Fill Out Your Utah Tc 941D Form

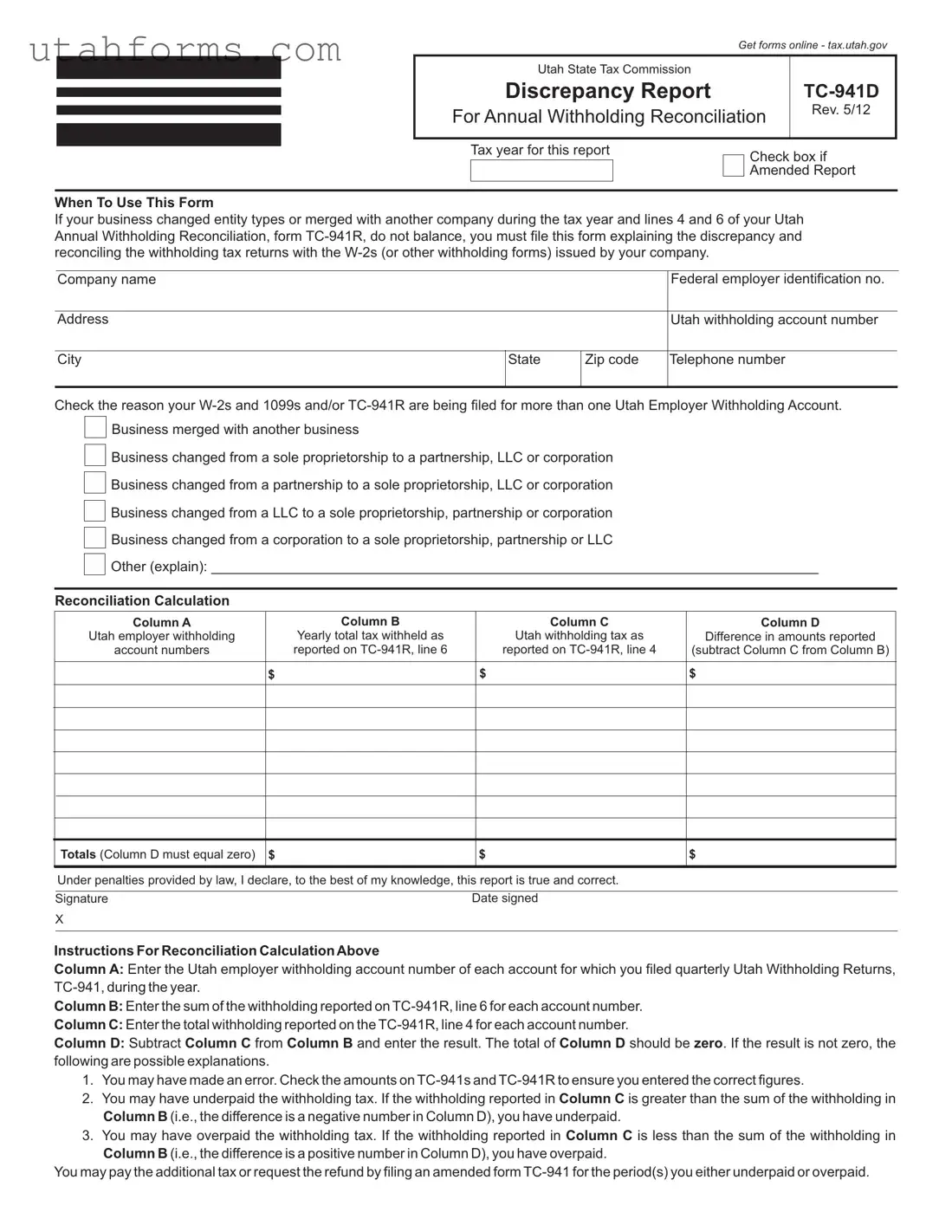

Navigating the complexities of Utah's tax system, especially when it comes to annual withholding reconciliations, can be a daunting task for businesses. One crucial document in this process is the Utah State Tax Commission Discrepancy Report, also known as form TC-941D. This form plays an essential role when discrepancies arise between the Utah Annual Withholding Reconciliation, form TC-941R, and the W-2s or other withholding documents issued by a company. Typically required when a business undergoes changes in entity types, mergers, or other organizational shifts, the TC-941D form helps in clarifying and rectifying discrepancies. It contains detailed sections for the reconciliation calculation, requiring information on Utah employer withholding account numbers, yearly total tax withheld, and the Utah withholding tax as reported on the TC-941R. Completeness and accuracy are paramount when filling out this form, ensuring that the totals of calculated discrepancies should ideally reconcile to zero. Additionally, the form serves as a declarative statement by the company, under penalty of law, affirming the correctness and truth of the reported information. Beyond just a formality, the TC-941D is a critical component in maintaining compliance with Utah's tax laws, streamlining the reconciliation process, and potentially resolving financial discrepancies that could affect a business's tax liabilities.

Preview - Utah Tc 941D Form

Get forms online - tax.utah.gov

Utah State Tax Commission

Discrepancy Report

For Annual Withholding Reconciliation

Rev. 5/12

Tax year for this report

Check box if Amended Report

When To Use This Form

If your business changed entity types or merged with another company during the tax year and lines 4 and 6 of your Utah Annual Withholding Reconciliation, form

Company name

Federal employer identification no.

Address

Utah withholding account number

City

State

Zip code

Telephone number

Check the reason your

Business merged with another business

Business changed from a sole proprietorship to a partnership, LLC or corporation

Business changed from a partnership to a sole proprietorship, LLC or corporation

Business changed from a LLC to a sole proprietorship, partnership or corporation

Business changed from a corporation to a sole proprietorship, partnership or LLC

Other (explain): ______________________________________________________________________________

Reconciliation Calculation

Column A |

Column B |

Column C |

Column D |

Utah employer withholding |

Yearly total tax withheld as |

Utah withholding tax as |

Difference in amounts reported |

account numbers |

reported on |

reported on |

(subtract Column C from Column B) |

|

|

|

|

$ |

$ |

|

$ |

Totals (Column D must equal zero)

$

$

$

Under penalties provided by law, I declare, to the best of my knowledge, this report is true and correct.

Signature |

Date signed |

X |

|

|

|

Instructions For Reconciliation Calculation Above

Column A: Enter the Utah employer withholding account number of each account for which you filed quarterly Utah Withholding Returns,

Column B: Enter the sum of the withholding reported on

Column C: Enter the total withholding reported on the

Column D: Subtract Column C from Column B and enter the result. The total of Column D should be zero. If the result is not zero, the following are possible explanations.

1.You may have made an error. Check the amounts on

2.You may have underpaid the withholding tax. If the withholding reported in Column C is greater than the sum of the withholding in Column B (i.e., the difference is a negative number in Column D), you have underpaid.

3.You may have overpaid the withholding tax. If the withholding reported in Column C is less than the sum of the withholding in Column B (i.e., the difference is a positive number in Column D), you have overpaid.

You may pay the additional tax or request the refund by filing an amended form

File Specifications

| Fact | Detail |

|---|---|

| Form Purpose | The Utah TC-941D form is used to report discrepancies between the Utah Annual Withholding Reconciliation (form TC-941R) and the W-2s or other withholding forms issued by a company, especially after changes in the company's entity type or a merger. |

| When to Use | This form is necessary when the total tax withheld reported on lines 4 and 6 of the TC-941R does not match due to a company undergoing changes such as a merger, or a change in entity type within the tax year. |

| Reconciliation Process | The form requires the comparison of the year's total tax withheld to the Utah withholding tax as reported, with any discrepancies needing to be outlined and explained for proper reconciliation. |

| Governing Law | This form is governed by Utah state tax laws, as it pertains specifically to the reconciliation of withholding taxes reported to the Utah State Tax Commission. |

How to Write Utah Tc 941D

Filling out the Utah TC-941D form is a necessary step for businesses that have experienced changes such as entity type adjustments or mergers within the tax year, which have resulted in discrepancies between their annual withholding reconciliation and the W-2s or other withholding forms issued. This process ensures that your business complies with state tax obligations by accurately reporting and reconciling withholding taxes. Follow these steps to accurately complete the form:

- Access the form online at tax.utah.gov.

- Under "Tax year for this report," indicate the relevant tax year.

- If you are filing an amended report, check the box labeled "Amended Report."

- Write your "Company name."

- Enter your "Federal employer identification no."

- Fill in the company's "Address," including "City," "State," and "Zip code."

- Provide the "Utah withholding account number" and "Telephone number."

- Identify the reason for filing more than one Utah Employer Withholding Account by checking the appropriate box. If you select "Other," provide a specific explanation in the space provided.

- For the reconciliation calculation:

- In Column A, list each Utah employer withholding account number for which you filed quarterly Utah Withholding Returns, TC-941, during the year.

- In Column B, enter the sum of the withholding reported on TC-941R, line 6, for each account number mentioned.

- In Column C, document the total withholding reported on TC-941R, line 4, for each account number.

- In Column D, subtract Column C from Column B and write the result. Aim for the total of Column D to be zero, indicating no discrepancies.

- Review the possible explanations listed on the form if the totals don't match and take the necessary corrective actions as indicated.

- Sign and date the form at the bottom, thereby declaring, under penalties provided by law, that the report is true and correct to the best of your knowledge.

Once completed and reviewed for accuracy, submit the form as per the Utah State Tax Commission's instructions. This step is crucial for ensuring your business's compliance and may require additional documents or adjustments if discrepancies are found. Remember, accuracy in this process helps avoid potential penalties and ensures proper tax reporting and reconciliation.

Frequently Asked Questions

What is the purpose of the Utah TC-941D form?

The Utah TC-941D form is used when there's a discrepancy between the total annual withholding tax reported and the W-2s (or other withholding forms) issued by a company. This typically occurs if a business has changed entity types, merged with another company during the tax year, and the numbers on the Utah Annual Withholding Reconciliation (form TC-941R) lines 4 and 6 do not balance. The form helps in explaining and reconciling these figures.

When should a business file the Utah TC-941D form?

A business should file this form if it changed entity types or merged with another company during the tax year and there's a discrepancy between the figures reported on lines 4 and 6 of form TC-941R. It is essential to file the TC-941D to align the reported withholding tax returns with the issued W-2s or other withholding forms.

How do I complete the reconciliation calculation on the TC-941D form?

- Column A: Input the Utah employer withholding account number for each account where quarterly Utah Withholding Returns, TC-941, were filed throughout the year.

- Column B: Enter the total withholding tax reported on TC-941R, line 6 for each account number.

- Column C: Enter the total withholding tax reported on the TC-941R, line 4 for each account number.

- Column D: Subtract Column C from Column B and report the result. Ideally, Column D's total should be zero, indicating no discrepancy.

What should I do if the total in Column D is not zero?

If the total in Column D is not zero, indicating a discrepancy, you might have made an error, underpaid, or overpaid the withholding tax. Verify the amounts on TC-941s and TC-941R to ensure accuracy. If you discover you have underpaid, you must pay the additional tax. Similarly, if you have overpaid, you can request a refund by filing an amended form TC-941 for the relevant periods.

What reasons might lead to filing the TC-941D form for more than one Utah Employer Withholding Account?

Reasons include a business merger with another business or changes in the business's entity type, such as transitioning from a sole proprietorship to a partnership, LLC, or corporation, or vice versa. Other reasons necessitating the filing for multiple accounts should be specifically explained on the form.

How can I access the Utah TC-941D form?

You can access the form online at the Utah State Tax Commission's website tax.utah.gov. The site provides the most current version of the TC-941D form and detailed instructions for completion and submission.

What are the penalties for not accurately completing the TC-941D form?

Failure to accurately complete the TC-941D form can result in penalties under the law. The declaration at the end of the document underscores the legal requirement to ensure that information provided is true and correct to the best of one's knowledge. It's critical to review all entries and calculations for accuracy before submission to avoid potential penalties.

Common mistakes

Filling out the Utah TC-941D form, a crucial document for reconciling discrepancies in annual withholding reconciliation, often involves intricate details that require careful attention. Common errors can lead to processing delays or incorrect tax assessments. Here are nine frequent mistakes to avoid to ensure the form is filed accurately:

- Not checking the Amended Report box when filing a correction to a previously submitted report. This oversight can cause confusion and processing errors.

- Failing to accurately report changes in business entity types or mergers. This form is specifically designed for such circumstances, and overlooking this detail can result in discrepancies.

- Inaccurate reconciliation calculation between the Utah Annual Withholding Reconciliation form (TC-941R) lines 4 and 6, and the amounts reported on W-2s or other withholding forms. Precise matching is crucial for correct tax reporting.

- Omitting the Utah employer withholding account numbers in Column A. Each account number must be accurately listed to correlate the reported amounts properly.

- Incorrectly calculating the yearly total tax withheld in Column B. This column should accurately reflect the sum of withholding reported on TC-941R, line 6, for each account.

- Misreporting the total withholding tax reported in Column C. This figure must precisely match what was reported on TC-941R, line 4, for every account.

- Errors in the difference calculation in Column D, which involves subtracting Column C from Column B. This mistake can indicate either an overpayment or underpayment that needs addressing.

- Neglecting to explain the reason for discrepancies when the business structure changes or merges with another company. A clear, concise explanation aids in faster processing and resolution.

- Forgetting to sign and date the form. An unsigned or undated form is considered incomplete and can lead to its rejection.

Addressing these common pitfalls enhances the accuracy of your tax reporting. When the TC-941D is filled out correctly, it ensures that your business's tax responsibilities are met without unnecessary delays or corrections. Paying close attention to each detail on the form, double-checking calculations, and ensuring all required information is complete and accurate can streamline the reconciliation process.

- Always review the entire form before submission to catch any inaccuracies or omissions.

- Consult with a tax professional if there are uncertainties about how to accurately complete the form, especially regarding business structure changes or mergers.

- Keep copies of all documents and calculations used to fill out the form for your records and potential future reference.

By avoiding these common errors, businesses can facilitate a smoother interaction with the Utah State Tax Commission, ensuring that their tax obligations are accurately and efficiently met.

Documents used along the form

When handling the reconciliation of annual withholding for businesses in Utah, especially those encountering changes in their entity type or mergers, the Utah TC-941D form serves a significant role in rectifying discrepancies between withholding tax returns and W-2 or other withholding forms issued. This critical document ensures accurate tax reporting and compliance. Alongside the TC-941D, there are several other key forms and documents businesses may need to manage their tax responsibilities effectively.

- TC-941R (Utah Annual Withholding Reconciliation): This form is used to summarize annual employee withholding. It's an essential document for comparing total tax withheld from employees against what was reported and deposited throughout the tax year.

- W-2 (Wage and Tax Statement): Employers use this form to report annual wages and taxes withheld for each employee. It's crucial for reconciliation and ensuring employees' tax information is accurately reported to the IRS and the state.

- 1099 Forms: These documents are used to report various types of income other than wages, salaries, and tips. They are necessary for reconciling total payments made to non-employees and tax withholdings, if any.

- TC-941 (Utah Withholding Tax Return): Filed quarterly, this form reports the total income taxes withheld from employees' wages. It plays a key role in determining the figures entered into the annual reconciliation form, TC-941R, and the discrepancy form, TC-941D.

- Amended Forms: If errors are detected during the reconciliation process or after filing, businesses may need to submit amended forms for TC-941 or TC-941R. Accurate amendments ensure compliance and correct tax liabilities or refunds.

- Application for Change in Reporting Period: If a business undergoes significant changes affecting its tax reporting periods, this application is necessary to request adjustments in filing frequency or due dates, ensuring the correct alignment with tax obligations.

Utilizing these documents in coordination with the Utah TC-941D form allows businesses to maintain accurate tax records, comply with state regulations, and ensure the proper withholding and reporting of taxes. Proper management and submission of these forms are fundamental to a business's operational and financial health, streamlining the tax reconciliation process and avoiding potential penalties for discrepancies or non-compliance.

Similar forms

The Utah Annual Withholding Reconciliation, form TC-941R, shares similarities with the TC-941D in that it serves as a crucial component for businesses to report total tax withheld from employees' earnings. Both forms are integral to ensuring accurate tax reporting and reconciling discrepancies in withheld tax amounts. The TC-941R focuses on summarizing the total tax withheld throughout the year, which is necessary when discrepancies are identified and need to be explained through the TC-941D.

The Utah Quarterly Withholding Return, form TC-941, has a direct relation to the TC-941D as it provides the detailed quarterly tax withheld information. Businesses need to compile and reconcile these quarterly reports against the annual summary reported on form TC-941R and, by extension, the TC-941D if discrepancies arise. This form is a vital part of tracking and reporting withheld taxes to ensure they match the annual figures reported.

The W-2 form, or Wage and Tax Statement, plays a significant role alongside the TC-941D. It is the form employers give to their employees and the IRS at year's end, which details the employee's annual wages and the amount of taxes withheld. Discrepancies in the TC-941D often stem from variations in what's reported on the W-2s compared to what's been submitted through the business's withholding tax forms.

The 1099 form series, particularly the 1099-MISC for miscellaneous income, is relevant to the TC-941D as it involves reporting payments made to non-employees. Businesses that have discrepancies in their withholding tax reporting as outlined in TC-941D may need to review the 1099 forms they issued to ensure correct withholding and reporting of taxes for contractors or other non-employees.

Form TC-20, the Utah Corporation Franchise or Income Tax Return, is similar in concept to the TC-941D as it involves reconciling tax liabilities with payments made throughout the fiscal year for corporations. While TC-941D focuses specifically on reconciling discrepancies in withholding taxes, TC-20 addresses the broader gamut of corporate tax responsibilities.

The Amended Employer's Quarterly Federal Tax Return, Form 941-X, serves a similar purpose at the federal level to what the TC-941D does for Utah state taxes. When businesses identify mistakes in previously filed Form 941s, including those related to withholding taxes, they use Form 941-X to make corrections. The parallel process at the state level is handled through the TC-941D, where discrepancies between reported withholding taxes and actual figures are reconciled.

Form 940, the Federal Unemployment Tax Act (FUTA) Tax Return, while primarily focusing on unemployment tax, is part of the suite of payroll tax forms that includes forms W-2, 1099, and others relevant to the TC-941D. Though it deals with a different type of tax, the process of reconciling and ensuring accurate reporting is analogous to the scrutiny required for the TC-941D.

The Schedule K-1 (Form 1065), used by partnerships to report the share of income, deductions, and credits to partners, indirectly relates to the TC-941D. Discrepancies that might arise in withholding reporting on the TC-941D could stem from incorrect or incomplete reporting on Schedule K-1 forms, especially in businesses transitioning from partnerships as outlined in the TC-941D instructions.

The Change of Address or Responsible Party — Business, Form 8822-B, is connected to the TC-941D in the context of ensuring that all tax documents and correspondence are sent to the correct address following a change in business structure or merger. Accurate reporting and reconciliation of forms like the TC-941D rely on the IRS and state tax commission having current business information.

An Offer in Compromise, Form 656, involves proposing to the IRS to settle tax debts for less than the full amount owed. While not directly related to the process of reconciling withholding tax discrepancies as with TC-941D, it represents a resolution method for businesses facing significant tax discrepancies or underpayment identified through forms like TC-941D.

Dos and Don'ts

When completing the Utah TC-941D form, individuals and businesses need to take certain steps to ensure accuracy and compliance with the state's tax regulations. Below are lists of recommended actions to follow and pitfalls to avoid during the filing process.

Do's:

- Ensure accuracy: Double-check all filled information, especially the Utah employer withholding account numbers and the total tax withheld as reported on TC-941R, line 6, and line 4.

- Explain discrepancies: If there's a difference in the totals between Column B and Column C, provide a clear and detailed explanation for the discrepancy.

- Amend when necessary: If after submission, you discover errors or omissions, promptly file an amended report to correct the inaccuracies.

- Keep records: Maintain copies of the TC-941D form and all relevant documents for your records, as you may need to reference them in the future.

- Meet deadlines: Submit the form within the specified time frame to avoid possible penalties for late filing.

- Use the official website: Access forms and guidelines directly from tax.utah.gov to ensure you have the most current information and versions.

Don'ts:

- Guess on figures: Do not estimate or make guesses when filling out financial information; always use actual numbers obtained from your records.

- Overlook the reason for filing: Clearly check the appropriate box and/or provide a detailed explanation if your business underwent changes such as a merger or entity type change.

- Ignore instructions: The form comes with specific instructions for filling out each section; failing to follow these could lead to errors in your report.

- Postpone reconciliation: Do not delay the reconciliation process; discrepancies should be addressed and corrected before filing to ensure accurate reporting.

- Submit incomplete forms: Avoid submitting the form with missing information, as this could delay processing and potentially lead to penalties.

- Forget to sign and date: The form requires a signature and date to be considered valid. Filing without these may result in the report being rejected or considered incomplete.

Misconceptions

Understanding the Utah TC-941D form can be tricky, leading to common misconceptions. Let's clear up some of the confusion with accurate information.

Misconception: The TC-941D form is only for businesses that have made errors on their tax returns. Truth: While errors can prompt the use of this form, it's also required for businesses that have undergone entity changes or mergers, leading to discrepancies in their withholding tax reports.

Misconception: Any business can disregard this form if their numbers don't match. Truth: If there's a discrepancy between the annual withholding reconciliation (TC-941R) and the issued W-2s or other withholding documents, filing the TC-941D form is not optional; it's a requirement to explain and reconcile the differences.

Misconception: You only need to file this form at tax year-end. Truth: While the form is related to annual reconciliation, you should file it as soon as you recognize discrepancies or after entity changes that affect withholding accounts within the tax year.

Misconception: The TC-941D form is solely for reporting underpaid taxes. Truth: This form covers both underpaid and overpaid withholding tax situations. It's about reconciling discrepancies, regardless of whether they resulted in overpayment or underpayment.

Misconception: Filing this form is complicated and requires legal assistance. Truth: While getting professional advice is never a bad idea, the form is designed to be straightforward. It includes step-by-step instructions for reconciling your withholding tax returns.

Misconception: This form is a one-size-fits-all solution for any tax discrepancy. Truth: The TC-941D is specifically for reconciling discrepancies between the total yearly tax withheld and the Utah withholding tax as reported. It's not for correcting other types of tax errors or issues.

Misconception: You should wait for a notice from the Utah State Tax Commission before filing this form. Truth: Don't wait for the state to catch the discrepancy. Proactive filing can help avoid penalties and demonstrates good faith in maintaining accurate tax records.

Misconception: The "Amended Report" checkbox is for correcting filed TC-941D forms. Truth: While it's true that the checkbox is for amendments, it's specifically for amending previously filed reports due to newfound discrepancies or corrections, not just for errors on the TC-941D itself.

Misconception: There's no urgency in filing the TC-941D once a discrepancy is discovered. Truth: Timeliness is important. Delaying the filing of this form can lead to complications, potential audits, and penalties from the Tax Commission.

Misconception: This form negates the need for amendments to quarterly TC-941 forms. Truth: In some cases, amending quarterly TC-941 forms may still be necessary, in addition to filing the TC-941D, to ensure all your tax documents accurately reflect your withholding situation.

Understanding these points can help ensure that your dealings with the Utah State Tax Commission are accurate and compliant. Always ensure your business's changes, and discrepancies are properly documented and reconciled with the TC-941D form where applicable.

Key takeaways

For businesses operating in Utah, understanding how to properly fill out and use the TC-941D form is crucial. This form plays a key role in reconciling discrepancies in your annual withholding taxes, especially when changes occur in business structure or classifications. Here are seven key takeaways to ensure accuracy and compliance:

- Filing Requirement: You must file the Utah TC-941D form if your business underwent a change in entity type or merged with another company during the tax year, and as a result, the figures on lines 4 and 6 of your Utah Annual Withholding Reconciliation (TC-941R) do not match.

- Changes in Business Structure: This form is particularly applicable for businesses that have transitioned from one business structure to another, such as from a sole proprietorship to a corporation, LLC, or partnership, and vice versa.

- Explanation of Discrepancies: The TC-941D serves as a detailed report to explain any discrepancies between the total tax withheld reported on your TC-941R and the W-2s or other withholding documents your company has issued.

- Reconciliation Calculation: Carefully complete the Reconciliation Calculation section, which requires you to list Utah employer withholding account numbers, the yearly total tax withheld, and the Utah withholding tax as reported on the TC-941R. The ultimate goal is to ensure that the difference column (Column D) totals zero, indicating no discrepancy.

- Amended Reports: If you discover that you have either underpaid or overpaid your withholding tax, the TC-941D form allows for the submission of amended reports. This is crucial for correcting any previously reported figures.

- Detailed Record-Keeping: Keeping detailed and accurate records is imperative. Before submitting the TC-941D, verify the amounts reported on both TC-941s and TC-941R to ensure the figures entered are correct.

- Legal Declaration: The form contains a declaration that, under the penalties provided by law, states to the best of your knowledge, the information provided is true and correct. It’s a reminder of the importance of accuracy and the legal implications of the information being submitted.

In summary, the TC-941D form is an essential document for Utah businesses that need to reconcile discrepancies in their withholding tax reports due to changes in business structure or entity types. It’s not just about filling out the form but understanding the implications of the changes reported. Accurate completion and timely submission of this form help ensure compliance with Utah tax laws and can prevent potential legal and financial penalties.

Common PDF Templates

Utah State Withholding Form - The structured format of the TC-116 aids in preventing errors and omissions, facilitating a smoother refund process.

Utah State Withholding - Inclusion of signed declarations ensures accountability and the veracity of the information provided on the form.

Utah Title Application - Applicants can use the TC-55A for refunds on sales tax, registration fees, and other vehicle-related charges.