Fill Out Your Utah Tc 895 Form

Understanding the intricacies of tax forms can often feel overwhelming, especially when dealing with specialized documents like the Utah TC-895 form. This form plays a crucial role for taxpayers in Utah, facilitating the process of requesting tax credits for renewable energy systems. It's designed not just for individual filers but also for businesses aiming to make environmentally conscious upgrades to their operations. The form requires detailed information about the installation and expenses of qualifying renewable energy systems, ranging from solar panels to wind turbines. By accurately completing this form, taxpayers can significantly reduce their tax liability, encouraging the adoption of green energy solutions. The importance of this document extends beyond tax savings, as it reflects Utah's commitment to promoting sustainable energy practices. Through the Utah TC-895 form, the state incentivizes residents and businesses alike to invest in renewable sources, contributing to environmental preservation and energy independence.

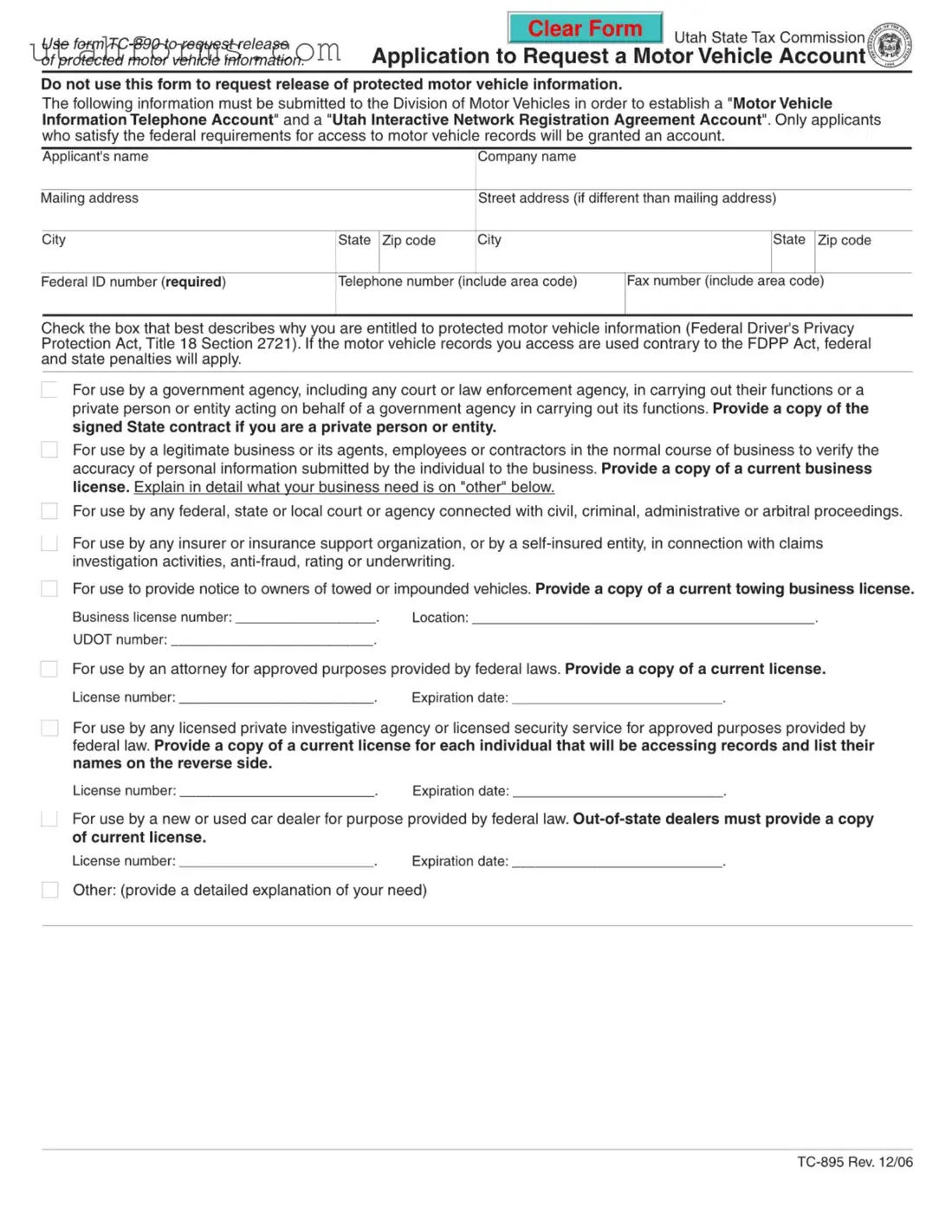

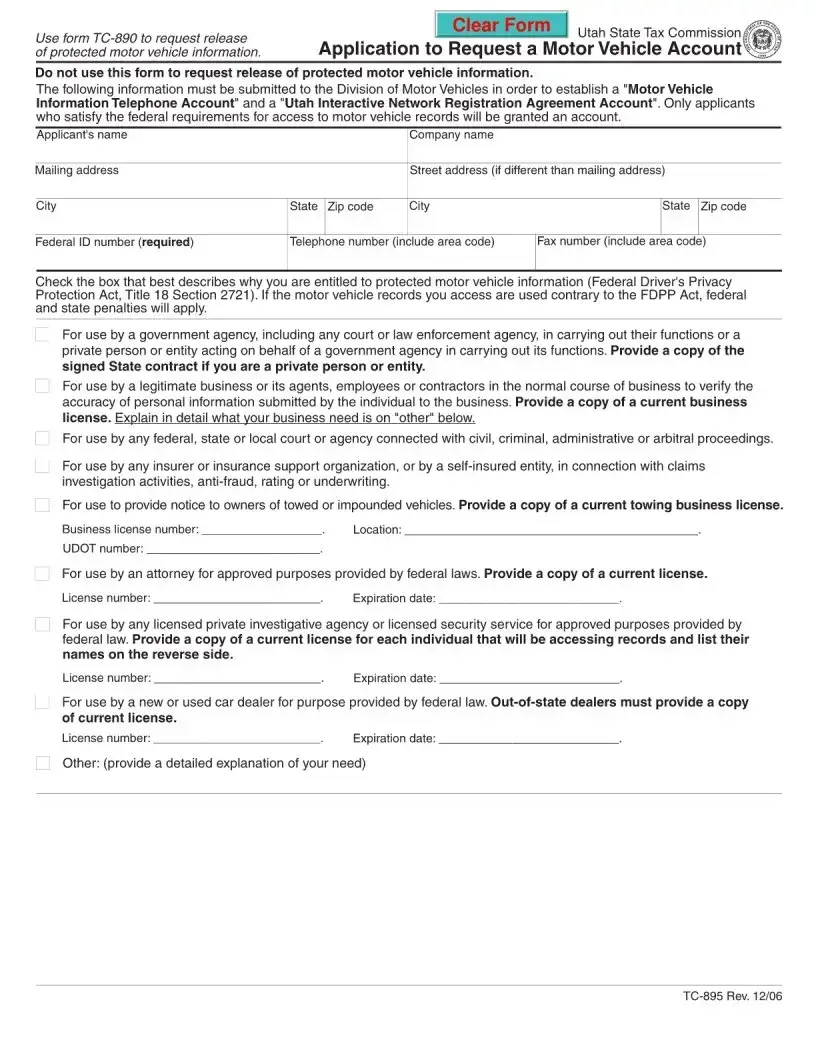

Preview - Utah Tc 895 Form

File Specifications

| Fact | Detail |

|---|---|

| Form Name | Utah TC-895 |

| Purpose | Used to request a tax credit for qualified clean fuel vehicle conversions, new purchases, or infrastructure. |

| Applicable Tax Years | Specified on the form, subject to legislative updates and extensions. |

| Governing Law | Utah Code, particularly sections related to environmental quality and tax incentives for clean fuel vehicles. |

| Eligibility | Residents, businesses, and entities in Utah that purchase or convert vehicles to clean fuels, or invest in clean fuel infrastructure. |

| Credit Amount | Varies based on the type of vehicle, conversion, or infrastructure, with specific caps and limitations defined by law. |

| Submission Deadline | Typically due with the tax return for the year in which the credit is claimed. |

| Where to File | Filed with the Utah State Tax Commission either electronically or in paper form, depending on the filer's preference and the Commission's requirements. |

How to Write Utah Tc 895

Filling out the Utah TC-895 form is a straightforward process that involves entering specific information to ensure completeness and accuracy. This document is designed to gather necessary details for processing. By following the steps below, individuals can efficiently complete the form and move on to the next phase of their task. Properly filled forms prevent delays and ensure that the submitted information is processed in a timely manner.

- Start by entering the current date at the top of the form, ensuring it is in the MM/DD/YYYY format.

- Provide the applicant's full legal name, including first, middle, and last names, in the designated section.

- Enter the applicant's complete address, including street name, city, state, and ZIP code.

- Fill in the applicant's telephone number, including the area code, in the space provided.

- Indicate the type of application by checking the appropriate box that corresponds to your situation.

- List all relevant license numbers or identifiers that pertain to the applicant's situation in the spaces provided.

- Describe the specific request or action needed in the section provided for detailed descriptions. Be concise yet thorough to avoid ambiguity.

- If applicable, specify the desired effective date for the action or request. Ensure this date is in the future but falls within a reasonable time frame.

- Sign and date the form at the bottom to authenticate the information provided. Ensure the signature is legible and matches the name provided at the beginning of the form.

- Finally, if any additional documentation is required, attach the documents securely to the form before submission. Check the instructions for a list of acceptable documents.

After completing these steps, the form should be reviewed for accuracy and completeness. Once verified, it can be submitted as per the guidance provided with the form, whether that be via mail, in person, or through an online submission portal. A timely submission ensures that your request or application will be processed without unnecessary delay.

Frequently Asked Questions

-

What is the Utah TC-895 form used for?

The Utah TC-895 form, officially known as the Request for Motor Vehicle Information, is a document utilized by individuals or entities seeking to obtain vehicle records or information from the Utah Division of Motor Vehicles (DMV). This form is primarily used to request details such as vehicle registration, title history, and owner information for purposes such as legal proceedings, research, and verification of ownership.

-

Who is eligible to submit a Utah TC-895 form?

Eligibility to submit the Utah TC-895 form is not granted to everyone due to the sensitive nature of the information being requested. Typically, eligibility is extended to individuals, legal entities, government agencies, or authorized businesses that have a legitimate or legal interest in obtaining the vehicle records. This may include law enforcement agencies, licensed private investigators, insurers, and lienholders. Applicants must also comply with the provisions of the Driver's Privacy Protection Act (DPPA) to ensure that the information obtained will not be used improperly.

-

How can one submit the Utah TC-895 form?

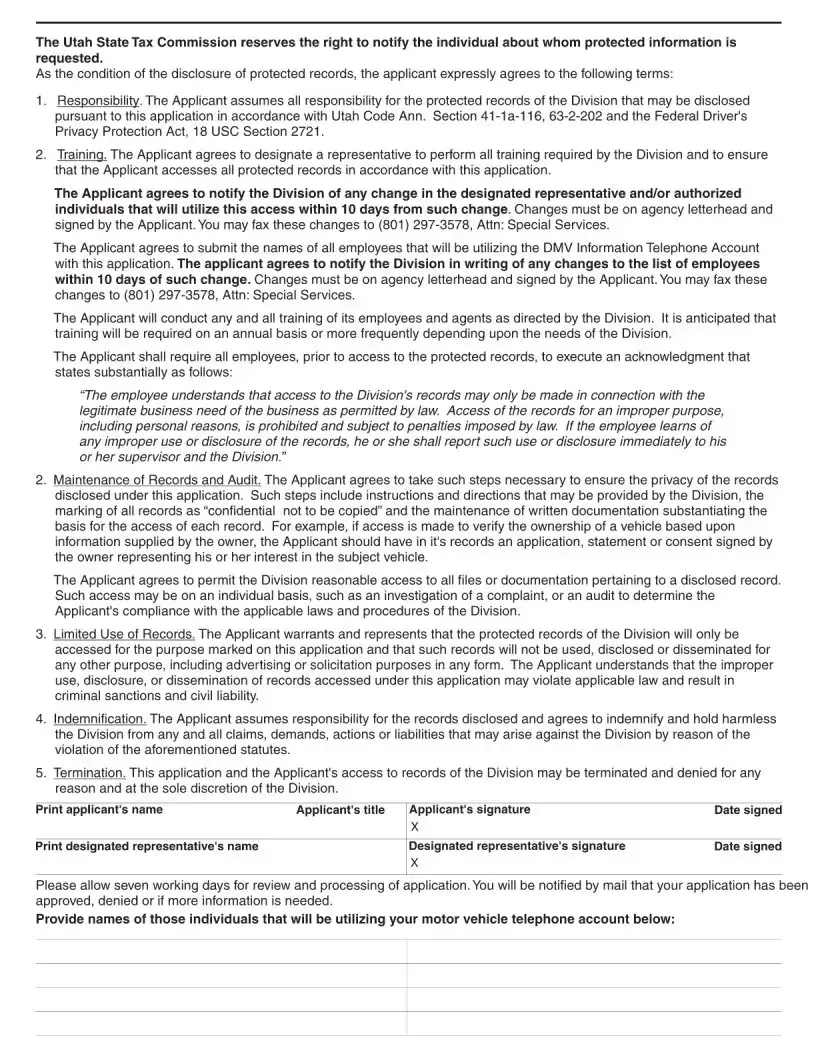

To submit the Utah TC-895 form, the requester must first complete the form with the necessary details, including specifying the type of records requested and the reason for the request. The completed form, along with any required documentation and the applicable fee, should be submitted to the Utah Division of Motor Vehicles. Submission can often be done via mail or in person at a DMV office, though it's advisable to check the latest submission methods and requirements on the Utah DMV's official website or by contacting them directly.

-

What information must be provided on the Utah TC-895 form?

When filling out the Utah TC-895 form, the requester must provide specific information to process the application effectively. This includes personal details of the applicant, such as name and contact information, the vehicle identification number (VIN) or license plate number of the vehicle in question, and the specific records or information being requested. Additionally, the applicant must provide a valid reason for the request, ensuring it aligns with the permissible uses under the DPPA. Proof of eligibility or authorization to access the requested information may also be required.

Common mistakes

When filling out the Utah TC-895 form, which facilitates the appeal of a decision related to a vehicle's registration, several common mistakes can arise. These errors can lead to delays in processing or even the outright denial of the appeal. Understanding these pitfalls can significantly streamline the appeal process.

The first mistake is incomplete information. The form requires detailed information about the vehicle, including its identification number, make, and year, as well as personal contact information. Leaving any section blank or partially filled can stall the process.

Another error involves incorrect information. Whether it's a typo in the vehicle identification number or an error in the contact details, incorrect information can mislead or confuse the reviewing authority, leading to unnecessary complications.

Many people also forget to attach necessary documents. The TC-895 form may require additional documentation, such as evidence of the vehicle's purchase or proof of a discrepancy in registration fees. Failing to include these documents can weaken an appeal.

Here are some of the mistakes often made:

- Not providing a detailed explanation for the appeal. Simply stating that one disagrees with a decision is not enough; a detailed reason highlighting the dispute is crucial.

- Not signing the form. An unsigned form is considered incomplete and will not be processed.

- Incorrectly calculating taxes or fees. Any discrepancy in the calculation must be clearly explained and supported with documentation.

- Ignoring deadlines. Timeliness is essential in filing an appeal, and missing the submission deadline can result in an automatic denial.

While these mistakes are common, they are also avoidable. Paying close attention to detail, thoroughly reviewing all provided information and documents before submission, and adhering to submission guidelines can drastically improve the chances of a successful appeal. Additionally, using the guidance provided in the instructions for the Utah TC-895 form can aid in ensuring that all requirements are met.

Remember, the process is designed to be fair and to ensure that any discrepancies in vehicle registration or related fees are appropriately addressed. Avoiding these common mistakes can lead to a more streamlined and efficient handling of appeals.

Documents used along the form

In Utah, navigating the waters of legal documents for tax matters requires careful attention and an understanding of the paperwork that often accompanies these processes. As we dive into the complexities of tax documents, it's crucial to highlight the role of the Utah TC-895 form, which is pivotal for individuals seeking tax-related approvals or submissions. The utilization of this form is just one step in a broader procedural landscape; thus, understanding the complementary documents that are frequently used alongside it can provide a holistic view of the tax documentation process in Utah.

- TC-20 Instructions: These instructions are vital for corporations filing a Utah Corporation Franchise or Income Tax Return. It provides detailed guidance on how to accurately fill out the TC-20 form, ensuring that businesses comply with Utah's tax laws and regulations.

- TC-40 Packet: This packet is essential for individual income tax filers in Utah. It includes the TC-40 form along with instructions and schedules necessary for completing an individual's state income tax return. Understanding and correctly utilizing the TC-40 packet is crucial for individuals to correctly report their income and calculate their tax responsibilities.

- TC-547: This form is a Property Tax Notice of Valuation and Tax Changes. It's sent to property owners to inform them of the valuation of their property and any tax changes. This document is closely related to tax documentation, as it impacts individuals' and businesses' property tax obligations.

- TC-161: This document is a Tax Payment Agreement Request. It's used when taxpayers find themselves unable to pay their taxes in full by the due date. By submitting a TC-161 form, individuals or businesses can negotiate terms for a payment plan, thus providing a structured way to address outstanding tax liabilities.

- TC-62S: The TC-62S form is a Sales and Use Tax Return for businesses. This document is essential for reporting the amount of sales and use tax collected from customers. Completing this form accurately is crucial for businesses to comply with state tax collection and reporting requirements.

Understanding and correctly utilizing these forms and documents in conjunction with the Utah TC-895 form create a comprehensive tax compliance framework. Whether one is dealing with corporate, individual, property, or sales tax matters, these documents together ensure that taxpayers can navigate Utah's tax system more effectively. Proper attention to each document's specific instructions and requirements significantly enhances the accuracy and efficiency of the tax reporting and payment process.

Similar forms

The Utah TC-895 form, utilized in the process of transferring ownership of a motor vehicle, bears similarities to various other documents required for legal or logistical purposes within different jurisdictions. One such document is the Vehicle/Vessel Transfer and Reassignment Form (REG 262) in California. This form, like the Utah TC-895, is crucial for properly documenting the transaction and transfer of ownership of a vehicle or boat. Both forms gather detailed information about the seller, the buyer, the vehicle, and ensure all required endorsements are captured to finalize the transfer, emphasizing legal compliance and the protection of all parties involved.

Similarly, the Bill of Sale form, widely used across different states, mirrors the function and objectives of the Utah TC-895 form. While the Bill of Sale is more versatile, applying to a range of personal property transactions beyond vehicles, it shares the core purpose of recording a transaction between a seller and a buyer, detailing the item sold, the sale amount, and the date of sale. This resemblance underscores their collective role in substantiating the terms of personal property sales, securing a legal basis for transferring ownership.

Another document akin to the Utah TC-895 form is the Texas Certificate of Title (Form 130-U). This form is central to the process of transferring vehicle ownership in Texas, encompassing sections for detailed information about the vehicle, the seller, and the buyer, similar to the Utah form. Both documents necessitate official endorsements from all parties involved and facilitate the legal transfer of the title, acting as a governmental record-keeping tool designed to prevent fraudulent transactions and ensure clear vehicle ownership.

The Notice of Transfer and Release of Liability (NRL) form, used in several states, shares objectives with the Utah TC-895 form, though it focuses on an aspect of the vehicle sale process. The NRL is submitted to the state’s department of motor vehicles to officially report the change of ownership and release the seller from future liability related to the vehicle. While concentrating on post-sale obligations, it complements the Utah TC-895 by playing a critical role in the transfer process, ensuring that the seller's responsibility ends with the sale, similar to how the TC-895 completes the legal transfer formalities.

Dos and Don'ts

The Utah TC-895 form, essential for certain types of tax credits in Utah, demands careful attention to detail. Here are six pivotal do's and don'ts to guide you through the process of filling it out accurately.

- Do thoroughly review the form's instructions before starting. Getting familiar with the form's requirements will ensure you understand the specifics of what's asked, leading to more accurate completion.

- Do use black ink or type directly into the form if it’s available in a fillable PDF format. This enhances readability and prevents any issues related to legibility.

- Do double-check your figures, especially when calculating tax credits. Mathematical errors can lead to processing delays or incorrect tax assessments.

- Don't leave any required fields blank. If a section doesn’t apply to you, it’s better to enter “N/A” (Not Applicable) instead of leaving it empty. This clarifies that you didn't overlook the field.

- Don't forget to sign and date the form. An unsigned form is considered incomplete and can lead to processing delays or even rejection.

- Don't send the form without making a copy for your records. Keeping a copy allows you to have a reference in case there are any questions or issues with your submission later on.

By adhering to these guidelines, you’ll be better positioned to complete the Utah TC-895 form accurately and efficiently, paving the way for a smoother processing of your tax credit claims.

Misconceptions

When dealing with legal forms, especially in specific states like Utah, it's essential to clear up common misconceptions. The Utah TC-895 form, which pertains to Non-Resident Tax Clearance, is no exception. Misunderstandings about its use, purpose, and requirements can lead to confusion and potentially costly mistakes. Below are several misconceptions about the Utah TC-895 form:

- It's only for businesses: A common misconception is that the Utah TC-895 form is exclusively for businesses. In reality, while it is often used by businesses to show they have no outstanding tax obligations in Utah, individuals who have conducted transactions or owned property in the state might also need to complete this form under certain circumstances.

- It clears all types of tax obligations: Some might believe that filing a TC-895 form absolves them from all types of taxes owed to the state of Utah. However, this form specifically relates to non-resident tax clearance, meaning it pertains to particular tax obligations and not necessarily all types of taxes that an individual or entity may owe.

- It can be filed anytime: Another common misconception is that there are no deadlines for filing the TC-895 form. Like many tax-related forms, there are specific deadlines that must be adhered to. Failing to file by these deadlines can result in penalties and interest charges.

- Filling out the form is complex: While tax forms can be intimidating, the Utah TC-895 is designed to be straight forward. Thorough instructions are provided to help filers complete the form accurately. Resources are also available through the Utah State Tax Commission for those who need additional help.

- Submission is always through mail: With the advancement of digital tools and the internet, the assumption that forms like the TC-895 must be submitted through mail is outdated. Utah offers electronic filing options for many of its tax forms, including the TC-895, facilitating quicker and more efficient submission processes.

- Approval is guaranteed: Completing and submitting the TC-895 form does not automatically ensure approval. The form must first be reviewed by the Utah State Tax Commission, which will verify the accuracy of the information provided and ensure that there are no outstanding tax obligations before granting clearance.

- No cost associated with filing: While filing the TC-895 form itself might not directly incur a fee, it is important to note that if taxes are owed, or if there are penalties and interest due to late filings, these will need to be paid. Thus, associated costs can arise in the process of obtaining tax clearance.

Understanding these misconceptions about the Utah TC-895 form is crucial for anyone engaging in relevant financial activities in Utah, especially for non-residents who have had dealings in the state. Whether an individual or a business entity, ensuring compliance with state tax laws and regulations is essential. Accurately completing and timely filing the TC-895 can help avoid potential legal and financial complications.

Key takeaways

Filling out and using the Utah TC-895 form, intended for vehicle titling and registration within the state, necessitates careful attention to detail and adherence to specific procedures. Here, we outline several crucial takeaways to ensure the process is completed smoothly and accurately.

Accurate Information: The first critical takeaway is the necessity of entering accurate personal and vehicle details on the form. This includes your full name, address, vehicle make, model, year, and VIN (Vehicle Identification Number). Inaccurate or incomplete information can lead to processing delays or complications in vehicle titling and registration.

Proof of Ownership: When submitting the Utah TC-895 form, applicants must provide proof of vehicle ownership. This typically entails including the vehicle title with the form. If the title is not available, other forms of ownership proof may be required. It is essential to verify with the Utah Division of Motor Vehicles (DMV) which documents are accepted as valid proof of ownership under your specific circumstances.

Payment of Fees: Titling and registration involve certain fees. The form requires applicants to calculate and remit the appropriate amount. Fee schedules are subject to change, and it's advised to consult the latest information from the Utah DMV website or contact them directly to ascertain the correct fees related to your vehicle's titling and registration.

Signature Requirements: A valid signature is needed to complete the Utah TC-895 form. This certifies that the information provided is true and accurate to the best of the applicant's knowledge. The signature also implies agreement to abide by Utah's vehicle registration and titling laws. It's important to sign the form in the designated area, as an unsigned form will not be processed and considered incomplete.

By adhering to these guidelines, individuals can navigate the complexities of vehicle titling and registration in Utah more efficiently. Ensuring all documentation is correct and submitted appropriately helps to expedite the process, allowing for a smoother transition to lawful vehicle ownership and use.

Common PDF Templates

Utah Title Application - Copies of sales agreements or lease buy-out agreements must accompany sales tax refund claims.

Cpe Ut - Medical conditions that prevent CPE completion may qualify for a waiver, subject to Board approval.