Fill Out Your Utah Tc 890 Form

In the realm of legal and financial documentation within Utah, the Utah TC 890 form represents a critical tool for facilitating specific types of transactions. This document is integral for individuals and entities alike, navigating the complexities of tax-related procedures or seeking to comply with regulatory mandates within the state. The form serves multiple purposes, including, but not limited to, the application for tax credits, reconciling certain financial accounts, or fulfilling statutory requirements under Utah law. As one ventures into the specifics of the Utah TC 890 form, it becomes evident that its proper completion and timely submission can have significant implications for the applicant's fiscal responsibilities and legal standing. Thus, understanding the comprehensive structure, intended use, and procedural context of this document is paramount for anyone looking to engage with Utah's financial or regulatory systems effectively.

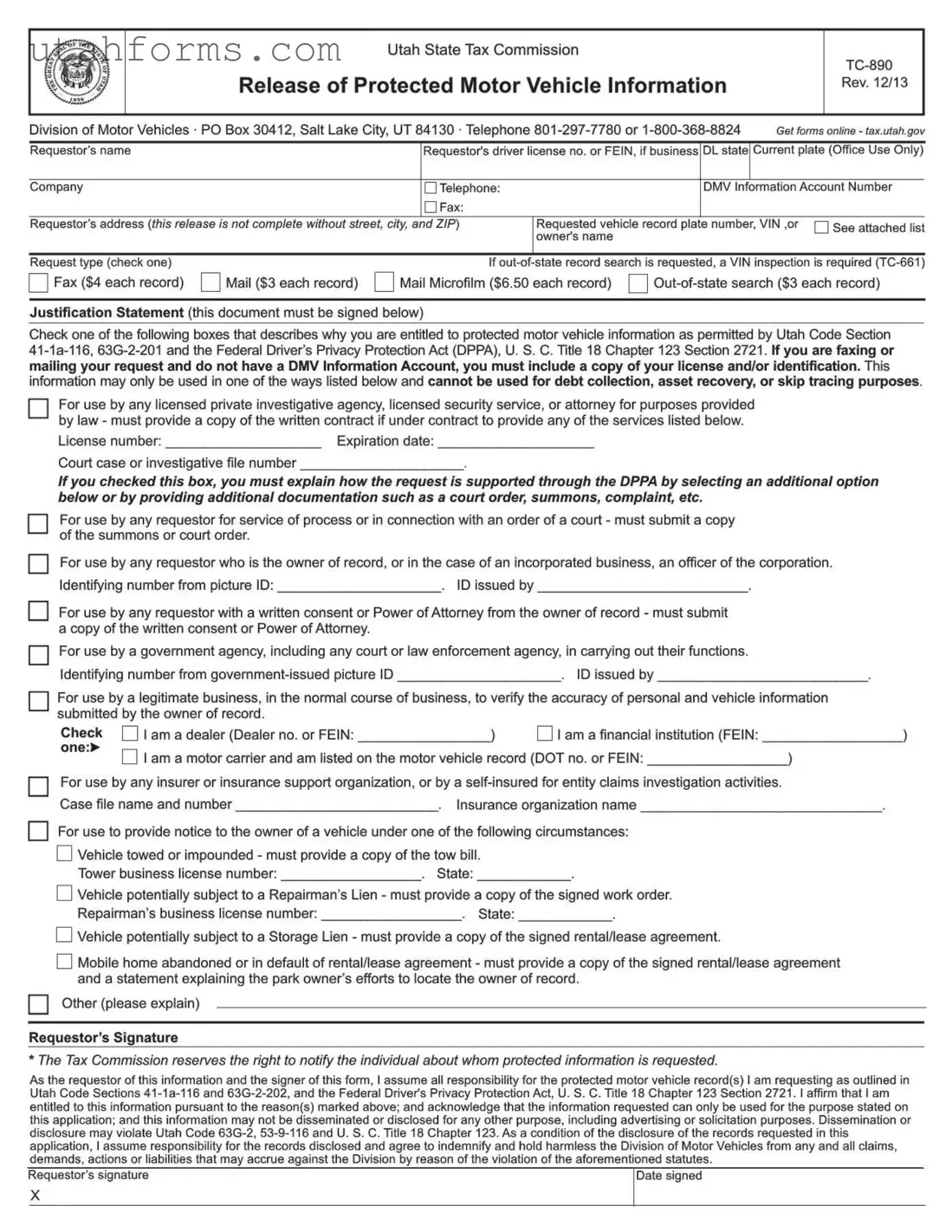

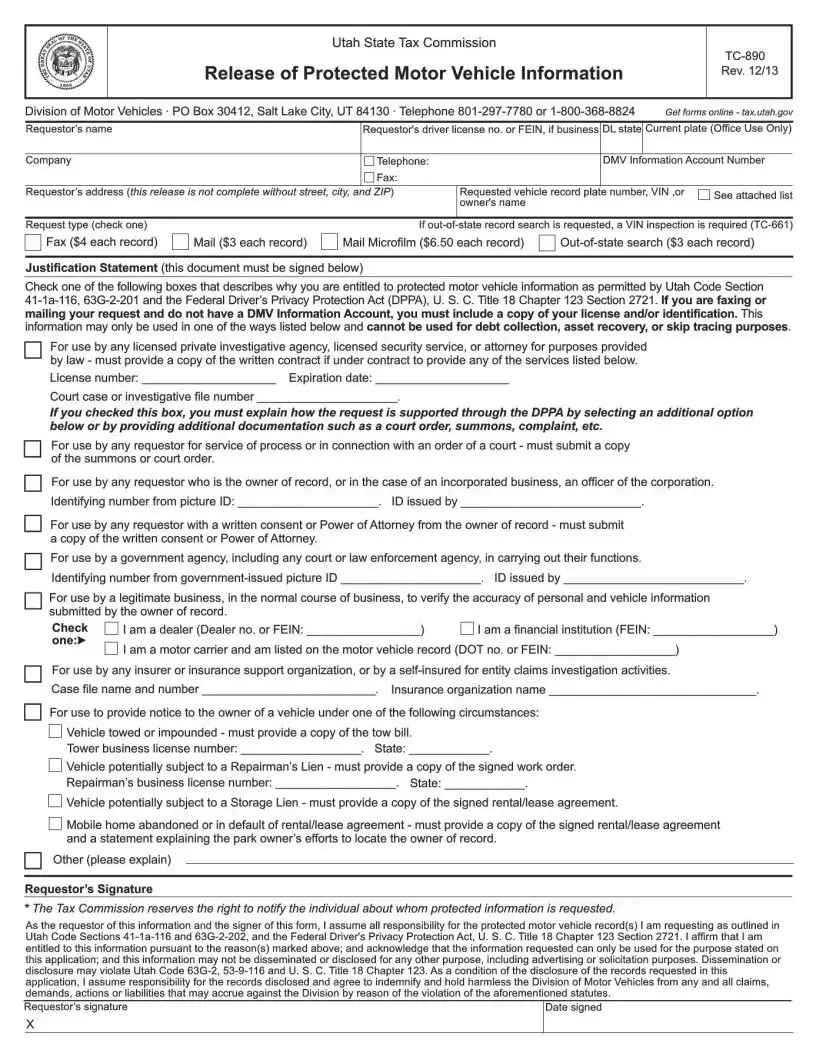

Preview - Utah Tc 890 Form

File Specifications

| Fact | Detail |

|---|---|

| 1. Purpose | The Utah TC-890 form is designed for requesting Motor Vehicle Enforcement Division (MVED) Office Action. |

| 2. Users | It is used by businesses needing licensure actions from the MVED, such as license renewal or update. |

| 3. Governing Law | This form is governed by the laws of Utah, specifically those related to motor vehicle dealership licensing and enforcement. |

| 4. Sections | The form is divided into sections for business information, action requested, and an affirmation by the business representative. |

| 5. Required Information | Businesses must provide their name, contact information, and specific details about the requested action. |

| 6. Submission Procedure | |

| 7. Fees | Depending on the action requested, certain fees may apply and must be paid upon submission of the form. |

| 8. Processing Time | Processing times can vary based on the complexity of the request and the current workload of the MVED. |

| 9. Validity | Actions taken by the MVED as a result of the form submission are effective for the period specified by Utah law or regulation. |

| 10. Contact Information | For assistance or further information, businesses can contact the Motor Vehicle Enforcement Division directly. |

How to Write Utah Tc 890

Filling out the Utah TC-890 form is a necessary step for individuals seeking certain types of tax-related requests or registrations in the state of Utah. This form requires careful attention to detail to ensure that all information is accurately represented. The process involves providing personal or business identity details, tax account information, and specific requests or declarations. It’s important to gather all relevant information and documents before starting to fill out the form to streamline the process and avoid delays.

To complete the Utah TC-890 form, follow these steps:

- Start by entering your full legal name or the legal name of your business. Ensure the name matches the one registered with the Utah State Tax Commission or other state agencies.

- Provide your Social Security Number (SSN) or Employer Identification Number (EIN). This will serve as a unique identifier for tax purposes.

- List your complete mailing address, including the street name and number, city, state, and ZIP code. This is important for any correspondence related to the form.

- Include your primary phone number and an alternate phone number if available. This will be used for any clarifications or additional information requests.

- Specify the type of request you are making with this form. Be clear and concise to avoid any processing delays.

- Provide detailed information related to your request. This may include account numbers, tax periods, and specific details about your inquiry or update.

- Sign and date the form. Your signature certifies that the information provided is true and accurate to the best of your knowledge.

- Review the form for accuracy. Double-check all the information to ensure there are no errors or omissions.

- Submit the completed form to the address provided by the Utah State Tax Commission. Depending on the instructions, it may be possible to submit the form electronically.

After submitting the Utah TC-890 form, the processing time can vary depending on the nature of your request and the current workload of the Tax Commission. You may be contacted for additional information or to clarify the details of your submission. It’s important to respond promptly to any inquiries to avoid further delays. Keep a copy of the form and any correspondence for your records.

Frequently Asked Questions

-

What is the purpose of the Utah TC-890 form?

The Utah TC-890 form is primarily used for requesting a waiver or an extension of time to pay certain taxes owed to the state. Individuals or businesses find it useful when they are unable to remit the full amount of taxes by the due date. Submitting this form allows the taxpayer to communicate with the Utah State Tax Commission to formally request additional time or a reduction in penalties associated with late payments.

-

Who is eligible to submit the Utah TC-890 form?

Eligibility to submit the Utah TC-890 form extends to both individuals and businesses registered to pay taxes in the state of Utah. Whether it's for personal income tax, sales tax, or any other state-imposed tax, applicants should demonstrate a genuine inability to pay by the deadline, alongside a reasonable plan or proposal for how and when they can settle their tax obligations.

-

How does one fill out and submit the Utah TC-890 form?

- Fill out the form with accurate personal or business information, including tax identification numbers and contact details.

- State the type of tax and the tax periods for which the waiver or extension is requested.

- Clearly explain the reasons for the inability to pay on time and propose a plan for payment including timelines.

- The finalized form can be submitted either electronically through the Utah State Tax Commission's website or by mail. It's important to retain a copy for personal records.

-

What happens after the Utah TC-890 form is submitted?

Upon submission, the form is reviewed by the Utah State Tax Commission. The review process involves evaluating the taxpayer's circumstances and the proposed payment plan. Applicants can expect a written response indicating whether their request is approved or denied. If granted, the taxpayer will receive specific terms under which the waiver or extension is provided, including any adjusted payment schedules or amounts. It is crucial to adhere to these terms to avoid further penalties.

Common mistakes

Filling out forms can sometimes feel overwhelming. It's important to approach them with attention to detail, especially when it comes to official documents like the Utah TC-890 form. Mistakes can lead to processing delays or other complications. Here are some common errors people make that are worth being mindful of:

- Not checking for the most current version of the form. The Utah TC-890 form, like many official documents, is subject to updates. Using an outdated version can result in the submission being rejected.

- Skipping sections. Every part of the form is there for a reason. If a section doesn't apply, it's better to mark it as "N/A" (not applicable) than to leave it blank.

- Entering incorrect information. This can range from typos in the name or address to errors in dates or identification numbers. Such mistakes can significantly delay processing.

- Omitting the signature and date. The form isn't considered valid without the applicant's signature and the date it was signed. This oversight can lead to automatic rejection.

- Using unofficial ink colors. Most forms require entries to be made in black or blue ink. Using other colors can cause issues with scanning and readability.

Along with these specific mistakes, there are some general tips that can help ensure the form is filled out correctly:

- Read all instructions carefully before starting to fill out the form. Understanding what's required can prevent many common mistakes.

- Have all necessary documents and information at hand. This preparation can help prevent pauses that might lead to partially completed sections being forgotten.

- Review the completed form for any errors or omissions. A second look can often catch mistakes that were initially overlooked.

- If unsure about how to complete a section, seek guidance. It's better to ask for help than to guess and potentially fill out a section incorrectly.

- Keep a copy of the completed form for personal records. Having a reference can be helpful if there are any questions or issues with the form after submission.

Approaching the Utah TC-890 form – or any official document – with thoroughness and care can help streamline the process for everyone involved. By being mindful of these common pitfalls, applicants can increase their chances of a smooth and timely processing of their forms.

Documents used along the form

When engaging in various transactions or regulatory processes in Utah, individuals and businesses may often find themselves working with the TC-890 form. This form is a pivotal document utilized primarily for requesting special processing or handling by the Utah State Tax Commission. However, it is not the only document that is necessary in completing these processes. There are other critical forms and documents that are frequently used alongside the Utah TC-890 form to ensure compliance and accuracy in submissions. These additional documents can range from verification of information to requests for specific tax considerations.

- TC-891, Special Request for Motor Vehicles: A companion document to the TC-890, the TC-891 form is specifically designed for requests related to motor vehicle registrations, titles, or other vehicle-specific considerations. It is often used by individuals and businesses involved in the purchase, sale, or transfer of vehicles in Utah.

- TC-922, Application for Tax Commission Account Number: Essential for new businesses or entities needing to register with the Utah State Tax Commission, this form is used to apply for a unique tax identification number necessary for tax filings and other government transactions.

- Form TC-20, Corporation Franchise or Income Tax Return: For corporations operating in Utah, this form is crucial for filing annual income tax returns. It details the income, deductions, and tax payable to the state for the fiscal year.

- Form TC-40, Individual Income Tax Return: Similar to the TC-20 but for individual residents, this form is used to file personal state income taxes. It encompasses earnings, tax credits, and deductions specific to Utah residents.

- TC-551, Property Tax Exemption Application: For properties that may be eligible for tax exemptions, this application is required. It outlines the criteria and documentation needed for property tax relief under various qualifying conditions.

- TC-62S, Sales and Use Tax Return: Retailers and businesses engaging in sales of goods and services in Utah must file this form. It is used to report and remate sales tax collected from customers, as per state regulations.

Each of these documents plays a crucial role in ensuring that transactions and tax-related activities are accurately recorded and processed by the Utah State Tax Commission. While the TC-890 form might be the starting point for requesting special handling or processing, the combination of additional forms ensures comprehensiveness and compliance across a wide range of transactions. Proper completion and submission of these documents are essential for smooth operations and compliance with state regulations. It is advisable for individuals and businesses to familiarize themselves with these forms and to seek guidance when necessary to ensure accurate and timely submissions.

Similar forms

The Utah TC 890 form, primarily used for revoking, updating, or reissuing various tax commissions or licenses, shares similarities with the IRS Form 8822, Change of Address. Like the Utah TC 894 but geared towards federal tax matters, the IRS Form 8822 serves the purpose of notifying the Internal Revenue Service about address changes. This is critical for maintaining accurate correspondence regarding federal tax filings, ensuring individuals or businesses receive timely updates and notifications about their federal tax status. Both forms facilitate essential administrative updates that help maintain legal and financial compliance.

Similarly, the Form W-9, Request for Taxpayer Identification Number and Certification, also mirrors the Utah TC 890 form in its role of collecting crucial taxpayer information, albeit for different reasons. While the W-9 form helps entities obtain information necessary for tax reporting to the IRS, the Utah TC 890 form might be used to update or verify taxpayer information for state-level tax purposes. Both forms serve as integral parts of the tax filing and reporting process, ensuring accurate tax identification and compliance with tax laws.

The form SS-4, Application for Employer Identification Number (EIN), issued by the IRS, parallels the Utah TC 890 form in its administrative function. The SS-4 form is vital for businesses to obtain an EIN necessary for tax filings, employment tax reporting, and opening a business bank account. Although serving different purposes, both forms are essential for the lawful operation of businesses within their respective jurisdictions, facilitating compliance with tax obligations and aiding in the smooth functioning of businesses’ financial operations.

Another document closely related to the Utah TC 890 form is the Business Tax Application in various states, such as the California Form BOE-400-SPA. This form serves a similar purpose in that it is used by businesses to apply for and update their tax accounts for state-level tax obligations, including sales and use taxes. Both documents are crucial for businesses to operate legally within their state, ensuring they are registered for the appropriate taxes and licenses needed to comply with state laws and regulations.

Lastly, the Vehicle Registration Application forms used by the Department of Motor Vehicles (DMV) in various states share a similar function to the Utah TC 890 form when it comes to updating information related to registration and licensing. Although one pertains to tax commission and the other to vehicle registration, both forms are key to updating governmental records and ensuring compliance with state regulations. This ensures that both individuals and businesses can operate within the legal framework, whether it’s for tax compliance or lawful operation of vehicles.

Dos and Don'ts

When completing the Utah TC 890 form, it's important to follow a set of guidelines to ensure the process is done correctly and efficiently. Below are some recommended do's and don'ts to help guide individuals through the process:

- Do read through the entire form before starting to understand all the required information.

- Do use black ink or type directly into the form if an electronic version is available to ensure clarity and legibility.

- Do double-check the taxpayer identification number to ensure it matches the number on your tax documents.

- Do provide accurate and complete information in every section to avoid delays or issues with processing.

- Do keep a copy of the completed form and any accompanying documents for your records.

- Don’t rush through filling out the form, as mistakes can lead to processing delays or a denial of the application.

- Don’t leave any required fields blank. If a section does not apply, mark it as 'N/A' (not applicable).

- Don’t use correction fluid or tape; if an error is made, it's best to start with a new form to ensure cleanliness and legibility.

- Don’t forget to sign and date the form, as an unsigned form is considered incomplete and will not be processed.

Misconceptions

The Utah TC-890 form, often associated with motor vehicle enforcement and regulation, is surrounded by misconceptions that can lead to confusion among vehicle owners and individuals dealing with vehicle regulations in Utah. Below are eight common misconceptions and clarifications about the form:

It's only for registering new vehicles: A common misconception is that the TC-890 form is exclusively used for the registration of new vehicles. In reality, it is also utilized for various other purposes such as bond title applications and to request a duplicate title, among others.

It replaces all other forms: Some people might think that the TC-890 is a universal form that replaces all other vehicle-related forms in Utah. However, it is just one of several forms required for different vehicle-related processes. Specific circumstances dictate the need for other forms in conjunction with or instead of the TC-890.

It can be filed online by anyone: While digital processing of forms has become more common, not everyone can file the TC-890 form online. The eligibility to file online depends on specific criteria, such as the nature of the request and the applicant's ability to provide required information electronically.

Immediate processing: There is an assumption that submissions of the TC-890 form are processed immediately. Processing times can vary based on the complexity of the application, current workload, and verification procedures that may be necessary.

No cost involved: Another misconception is that there are no fees associated with the processing of the TC-890 form. Depending on the transaction, there may be fees required, which are typically outlined in instructions accompanying the form.

It's only for personal vehicles: People might think the TC-890 form is only for personal vehicles. Commercial vehicles, trailers, and even off-highway vehicles might require the submission of a TC-890 form for certain transactions.

Available in English only: The assumption that the TC-890 form is available exclusively in English can deter some from seeking it out. Utah’s DMV makes efforts to provide forms in multiple languages to accommodate the state's diverse population.

Legal representation is required to file: There is a belief that legal help is necessary to correctly fill out and file the TC-890 form. While legal advice can be beneficial, especially in complex cases, many individuals successfully complete and submit the form without direct legal assistance.

Understanding the correct application and use of the Utah TC-890 form is crucial for individuals and entities involved in vehicle-related transactions, ensuring compliance with state regulations and facilitating smoother processes.

Key takeaways

The Utah TC-890 form serves a critical function in the management and application for refund of certain fees or taxes within the State of Utah. Understanding the correct way to fill out and utilize this form is vital for individuals and businesses alike to ensure compliance with state laws and to facilitate the efficient processing of refund requests. Below are seven key takeaways that can guide users through the correct completion and use of the Utah TC-890 form:

- Ensure accuracy in the provided information: It's imperative to double-check all the data entered on the form to prevent delays or denials due to inaccuracies. This includes the applicant's full name, address, and accurate calculation of the refund amount requested.

- Complete all required sections: The form requires specific details depending on the nature of the refund or credit requested. Leaving sections incomplete can result in processing delays or the rejection of the application.

- Attach supporting documentation: Any claim for a refund or credit must be substantiated with appropriate documentation. This includes receipts, invoices, or any relevant financial records that verify the claim.

- Understand the purpose of the refund: The TC-890 form is utilized for specific types of refunds related to fees or taxes. Applicants should ensure their request aligns with the purposes outlined for the use of this form.

- Deadline awareness: Submitting the form in a timely manner is crucial. Be aware of any deadlines that apply to the refund request to avoid forfeiture of the refund.

- Keep a copy of the completed form and all attachments: Retaining a copy for personal records is important for future reference and in case of any queries from the Utah State Tax Commission.

- Follow up if necessary: If a significant amount of time has passed without acknowledgment or response, reaching out to the Utah State Tax Commission for a status update is advisable. Keeping record of all communication can be helpful in tracking the progress of the refund request.

Following these guidelines can significantly increase the likelihood of a successful refund request using the Utah TC-890 form. It's essential for applicants to approach the process with attention to detail and an understanding of the state's requirements to ensure a smooth and efficient experience.

Common PDF Templates

Medical Power of Attorney Form Utah Pdf - Ensure your healthcare is handled according to your desires with Utah's directive, featuring agent selection and detailed care instructions.

Utah Dws Sds 305 - A comprehensive employment application provided by the Utah Department of Workforce Services, catering to various job openings within the state government.

Utah Sales License - Whether applying new for $56 or renewing for $31, the TC-303 form is your gateway to a career in vehicle sales in Utah.