Fill Out Your Utah Tc 824 Form

In navigating the complexities of vehicle ownership in Utah, the Utah Tc 824 form, officially known as the Motor Vehicle Defective Title or Insufficient Evidence of Ownership Bond (Surety Bond), plays a pivotal role. It's a crucial document designed to safeguard the rights and interests of individuals attempting to register or transfer a motor vehicle title under circumstances where the original title is missing, defective, or when there's insufficient evidence of ownership. This form, detailed in its layout and requirements, mandates comprehensive information including the bond number, principal's and surety's names, addresses, and specifics about the vehicle in question like make, model, and VIN. It ensures that anyone who can later prove legal ownership or interest in the vehicle is adequately compensated, making it an essential instrument for both the seller and buyer in the transaction process. Furthermore, it highlights the importance of attaching a power of attorney form if one is utilized, emphasizing the state's stringent policy against accepting photocopies of the bond. The completion and execution of this bond with precision not only facilitate smooth title transfers but also protect parties from potential legal disputes over vehicle ownership, underpinning its significance in Utah's vehicular regulatory framework.

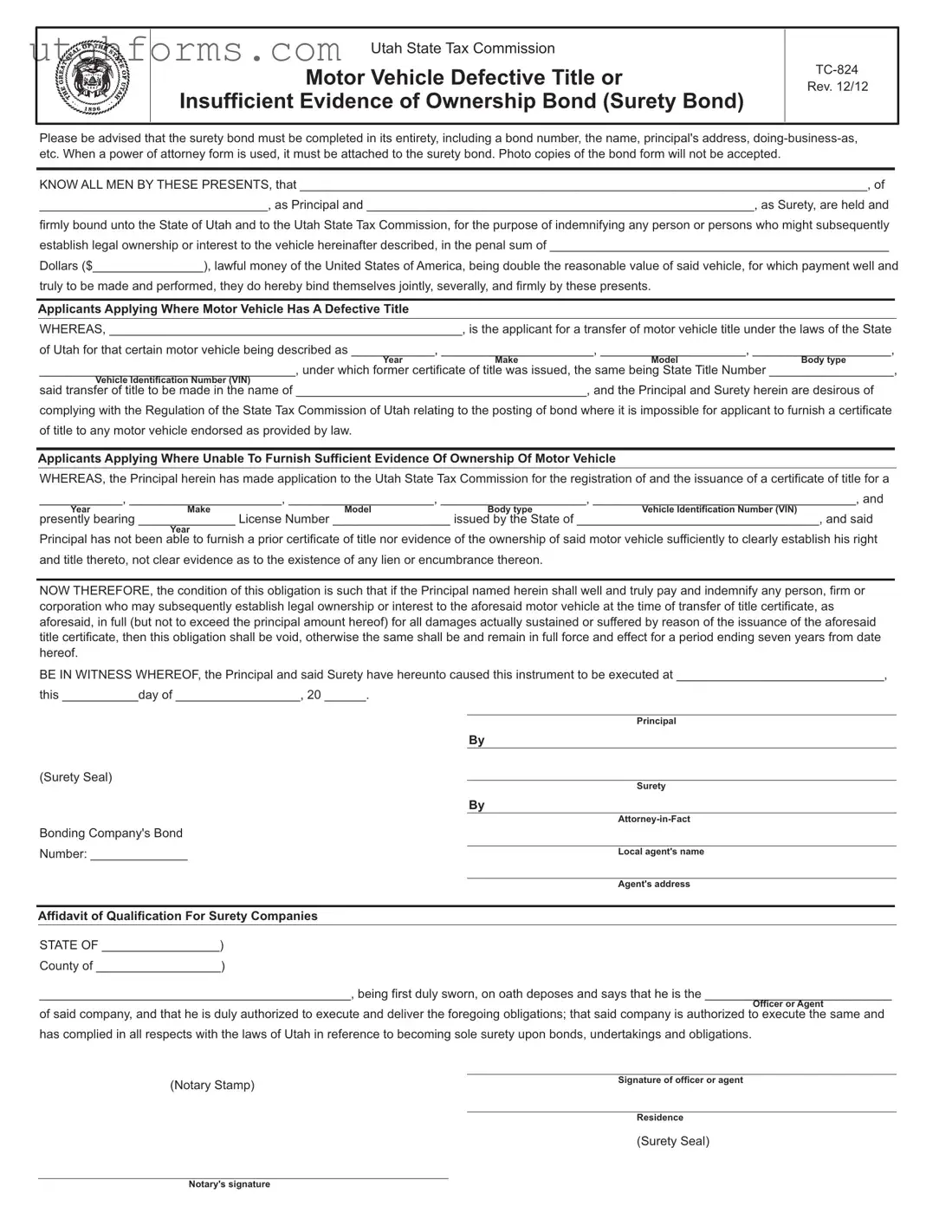

Preview - Utah Tc 824 Form

Utah State Tax Commission

Motor Vehicle Defective Title or

Insufficient Evidence of Ownership Bond (Surety Bond)

Rev. 12/12

Please be advised that the surety bond must be completed in its entirety, including a bond number, the name, principal's address,

KNOW ALL MEN BY THESE PRESENTS, that __________________________________________________________________________________, of

_________________________________, as Principal and ________________________________________________________, as Surety, are held and

firmly bound unto the State of Utah and to the Utah State Tax Commission, for the purpose of indemnifying any person or persons who might subsequently establish legal ownership or interest to the vehicle hereinafter described, in the penal sum of _________________________________________________

Dollars ($________________), lawful money of the United States of America, being double the reasonable value of said vehicle, for which payment well and

truly to be made and performed, they do hereby bind themselves jointly, severally, and firmly by these presents.

Applicants Applying Where Motor Vehicle Has A Defective Title

WHEREAS, ___________________________________________________, is the applicant for a transfer of motor vehicle title under the laws of the State

of Utah for that certain motor vehicle being described as ____________, ______________________, _____________________, ____________________,

YearMakeModelBody type

_____________________________________, under which former certificate of title was issued, the same being State Title Number __________________,

Vehicle Identification Number (VIN)

said transfer of title to be made in the name of __________________________________________, and the Principal and Surety herein are desirous of

complying with the Regulation of the State Tax Commission of Utah relating to the posting of bond where it is impossible for applicant to furnish a certificate

of title to any motor vehicle endorsed as provided by law.

Applicants Applying Where Unable To Furnish Sufficient Evidence Of Ownership Of Motor Vehicle

WHEREAS, the Principal herein has made application to the Utah State Tax Commission for the registration of and the issuance of a certificate of title for a

____________, ______________________, _____________________, _____________________, ______________________________________, and

YearMakeModelBody typeVehicle Identification Number (VIN)

presently bearing ______________ License Number _________________ issued by the State of ___________________________________, and said

Year

Principal has not been able to furnish a prior certificate of title nor evidence of the ownership of said motor vehicle sufficiently to clearly establish his right

and title thereto, not clear evidence as to the existence of any lien or encumbrance thereon.

NOW THEREFORE, the condition of this obligation is such that if the Principal named herein shall well and truly pay and indemnify any person, firm or corporation who may subsequently establish legal ownership or interest to the aforesaid motor vehicle at the time of transfer of title certificate, as aforesaid, in full (but not to exceed the principal amount hereof) for all damages actually sustained or suffered by reason of the issuance of the aforesaid title certificate, then this obligation shall be void, otherwise the same shall be and remain in full force and effect for a period ending seven years from date hereof.

BE IN WITNESS WHEREOF, the Principal and said Surety have hereunto caused this instrument to be executed at ______________________________,

this ___________day of __________________, 20 ______.

Principal

|

By |

|

(Surety Seal) |

|

|

Surety |

||

|

||

|

By |

|

|

||

Bonding Company's Bond |

|

|

|

|

|

Number: ______________ |

Local agent's name |

|

|

|

|

|

Agent's address |

Affidavit of Qualification For Surety Companies

STATE OF _________________)

County of __________________)

_____________________________________________, being first duly sworn, on oath deposes and says that he is the ___________________________

Officer or Agent

of said company, and that he is duly authorized to execute and deliver the foregoing obligations; that said company is authorized to execute the same and

has complied in all respects with the laws of Utah in reference to becoming sole surety upon bonds, undertakings and obligations.

(Notary Stamp) |

Signature of officer or agent |

|

|

|

|

|

Residence |

(Surety Seal)

Notary's signature

File Specifications

| Fact | Detail |

|---|---|

| Purpose | The Utah TC-824 form is used for the Utah State Tax Commission Motor Vehicle Defective Title or Insufficient Evidence of Ownership Bond (Surety Bond), aimed at indemnifying any subsequent legal owner(s) or interest holder(s) of the vehicle. |

| Monetary Requirement | The bond amount is set at double the reasonable value of the vehicle involved, ensuring coverage for any damages or claims made by individuals establishing legal ownership or interest. |

| Validity Period | This obligation remains valid and enforceable for a period ending seven years from the date of execution, providing ample time for any potential ownership disputes to surface and be resolved. |

| Governing Laws and Regulations | The form and the surety bond it represents adhere to the regulations of the State Tax Commission of Utah, specifically focusing on situations where a traditional certificate of title cannot be furnished by the applicant. |

How to Write Utah Tc 824

Filling out the Utah TC-824 form is necessary for situations involving a motor vehicle with a defective title or when there is insufficient evidence of ownership. This surety bond helps protect any future claims of ownership on the vehicle, ensuring that all parties are indemnified against potential legal challenges. To complete this form properly, careful attention must be given to each section to ensure accuracy and compliance with the Utah State Tax Commission requirements. Here are step-by-step instructions to guide you through the process:

- Read through the entire form to familiarize yourself with its requirements and information needed.

- Start by filling out the bond number provided by the bonding company at the top of the form.

- Enter the name of the principal (the person applying for the bond), including their full address and any doing-business-as (DBA) information, if applicable.

- Attach a power of attorney form if one is being used. This must be directly attached to the surety bond form.

- In the "Know all men by these presents" section, fill in the blanks with the principal's name, address, and the surety's name.

- Specify the penal sum of the bond in dollars, which should be double the reasonable value of the vehicle.

- For applicants with a defective title, provide the necessary vehicle description including year, make, model, body type, former state title number, and vehicle identification number (VIN).

- For those unable to furnish sufficient evidence of ownership, describe the vehicle and provide any licensing information and the state it was issued by, along with the vehicle identification number (VIN).

- Complete the section that applies to your situation—either defective title or insufficient evidence of ownership—with the name of the applicant and any other required details.

- At the end of the form, fill in the location and date where the bond is executed.

- Both the Principal and Surety need to sign the form. Ensure the Surety's seal is affixed.

- Fill in the bonding company's bond number, the local agent’s name, and address.

- The affidavit section at the bottom must be completed by an officer or agent of the Surety Company. They need to sign it in front of a notary, who will also sign and affix their seal.

Once all these steps are completed, review the form for accuracy and completeness. Remember, photocopies of the bond form will not be accepted, so ensure that all information is filled out on the original document. Submitting a properly completed form is crucial for the process to move forward without delays.

Frequently Asked Questions

-

What is the Utah TC-824 form?

The Utah TC-824 form, officially known as the Motor Vehicle Defective Title or Insufficient Evidence of Ownership Bond (Surety Bond), is a document used in the state of Utah. It serves to protect the interests of individuals who might later prove legal ownership or interest in a vehicle for which the title is defective or for which sufficient evidence of ownership cannot be provided. By completing this form, the principal and surety bond themselves to indemnify any future claimants.

-

Who needs to complete the TC-824 form?

This form must be completed by individuals or entities applying for the transfer of a motor vehicle title in Utah under circumstances where the current title is defective or where sufficient evidence of ownership is unavailable. It assures that any subsequent legal owners or claimants are compensated.

-

What information is required to fill out the TC-824 form?

To properly complete the TC-824 form, the following information is required: the name and address of the principal (the person requesting the new title), the name of the surety (the company acting as the bond), a complete description of the vehicle (including year, make, model, body type, and VIN), the bond number, and the amount of the bond (which must be double the vehicle’s value). An attached power of attorney form is necessary if one is being used.

-

Can photocopies of the TC-824 form be used?

No, photocopies of the TC-824 form are not accepted. The form must be the original document to ensure the authenticity and validity of the information provided and the signatures appended.

-

What does the bond amount on the TC-824 form represent?

The bond amount stated on the TC-824 form represents double the reasonable value of the vehicle concerned. This amount is set to ensure adequate funds are available to indemnify any subsequent claimants who establish legal ownership or interest in the vehicle.

-

What is the term of obligation for the TC-824 bond?

The obligation of the bond remains in effect for a period ending seven years from the date the bond is executed. If the principal named in the bond compensates any subsequent claimants as required, the obligation is considered void. Otherwise, it remains in full effect within this seven-year period.

-

How can one obtain a TC-824 form?

The TC-824 form can be obtained through the Utah State Tax Commission either by visiting their office in person or by accessing their official website. It is important to ensure the form is the latest version (Revision 12/12) to meet all current requirements.

-

Is a notary required for the TC-824 form?

Yes, the TC-824 form requires notarization. Specifically, the affidavit of qualification for surety companies must be signed by an officer or agent of the surety company and then notarized to confirm the surety company’s authorization to issue bonds and its compliance with Utah laws. The notary’s signature and seal are necessary to validate this affidavit.

Common mistakes

Filling out the Utah TC-824 form, which is required for obtaining a bond in case of a defective title or insufficient evidence of ownership of a motor vehicle, is a critical process that demands attention to detail. However, mistakes can occur, which might complicate or delay the resolution of title issues. Here are five common errors:

Not completing the form in its entirety: The form requires detailed information, including a bond number, the principal's name, address, and doing-business-as (DBA) name, if applicable. Skipping any section or providing incomplete information can result in the form's rejection.

Failure to attach a power of attorney form when necessary: If a power of attorney form is used in place of a personal signature, it must be attached to the surety bond. Ignoring this requirement can invalidate the submission.

Using photocopies of the form: Original forms are required for submission, as photocopies are not accepted. This is a common oversight that can easily be avoided by ensuring that the original document, with appropriate signatures and seals, is submitted to the Utah State Tax Commission.

Incorrectly calculating the bond amount: The bond amount must be double the reasonable value of the vehicle. Misunderstandings or miscalculations in determining the vehicle’s value can lead to incorrect bond amounts, which, if too low, might not satisfy the legal requirements.

Omitting critical vehicle information: Accurate and complete details regarding the motor vehicle, such as year, make, model, body type, Vehicle Identification Number (VIN), and, if applicable, license number must be included. Leaving out or inaccurately recording this information can compromise the bond's validity.

Each of these mistakes can delay the process of title resolution and may lead to additional complications or legal issues. It's important for applicants to carefully review all requirements and instructions detailed on the TC-824 form before submission. Ensuring accuracy and completeness of the application not only supports a smoother process but also helps in avoiding potential legal and financial consequences.

In summary, when dealing with a defective title or insufficient evidence of ownership in Utah, applicants should be diligent in completing the TC-824 form. Addressing these common mistakes proactively can help in achieving a successful outcome without unnecessary delays or issues.

Documents used along the form

When handling transactions involving the Utah TC-824 form, commonly known as the Motor Vehicle Defective Title or Insufficient Evidence of Ownership Bond, various documents and forms are often required to ensure compliance with state laws and regulations. The TC-824 form is crucial for those seeking to establish ownership over a vehicle when the title is missing, defective, or when there's insufficient evidence of ownership. Alongside this form, several other documents play integral roles in the process, helping individuals navigate the complexities of vehicle ownership and title transfer. Below is an informative list of these documents, each briefly described to shed light on their importance and usage.

- Application for Utah Title (Form TC-656): This form is necessary for transferring vehicle ownership, providing a detailed record of the vehicle, seller, and buyer.

- Vehicle Bill of Sale: Often accompanies the application for title, outlining the transaction details between the buyer and seller.

- Odometer Disclosure Statement (Form TC-891): Required for vehicles under ten years old, it certifies the vehicle's mileage at the time of sale.

- Emission Certificate: Necessary in certain Utah counties, it verifies the vehicle meets local emissions standards.

- Safety Inspection Certificate: Required for some vehicles, it ensures the vehicle meets safety requirements.

- Power of Attorney (Form TC-737): Allows a designated individual to act on behalf of another in dealings with the Utah State Tax Commission, essential when the form is submitted by someone other than the vehicle owner.

- Lien Release: If the vehicle was previously financed, this document from the lender confirms that the loan has been fully paid and the lien on the vehicle has been released.

- Vehicle Identification Number (VIN) Inspection Certificate (Form TC-661): Required for out-of-state vehicles or in cases where the VIN is in question, conducted by authorized personnel to verify the vehicle’s identity.

- Registration Application (Form TC-656V): Used to register the vehicle in Utah, providing a legal link between the vehicle and its owner.

Navigating vehicle ownership and the necessary legal steps can be complex, especially when dealing with inadequate evidence of ownership or defective titles. The documents listed above are commonly used in conjunction with the Utah TC-824 form to streamline the process, ensuring that all legal requirements are met. Each document serves a specific purpose, from verifying the vehicle's safety and emissions standards to legally transferring ownership and establishing a clear title. Understanding these documents and their roles can greatly simplify the process for all parties involved.

Similar forms

The Utah TC-824 form is closely akin to a Title Bond in other states, which provides assurance against claims on the ownership of a vehicle when the original title is lost, damaged, or otherwise unclear. Just like the TC-824 form, these Title Bonds aim to protect purchasers, sellers, and state agencies by ensuring that the rightful owner can claim their ownership or financial interest in the vehicle, significantly reducing the risk of legal disputes over vehicle ownership.

Similarly, Mechanics Lien Bonds operate on a comparable principle, where contractors, subcontractors, or workers who have not been paid for services rendered can secure their payment. Although it's focused on construction and property rather than vehicles, the underlying concept of providing a financial guarantee to protect the rights of unpaid parties is much like the intention behind the TC-824 form, highlighting the commonality of using bonds to secure legal or financial claims.

On the other hand, the Executor's or Administrator's Bond parallels the TC-824 form by ensuring the proper distribution of an estate's assets in accordance with a will or state law when an individual passes away without a will. Both types of bonds act as a safety net, ensuring that the obligations outlined, whether they involve transferring vehicle ownership without a proper title or distributing estate assets, are fulfilled accordingly.

Similarly, Lost Instrument Bonds share a common purpose with the TC-824 form, providing a safeguard for entities that have lost valuable documents, such as stock certificates or checks. Both forms of bonds offer a form of protection that compensates affected parties for any financial loss, ensuring that the person who finds or unlawfully holds the lost document can’t unjustly benefit from it, analogous to how the TC-824 protects against disputes over vehicle ownership.

The Importer Bond, required for companies importing goods into the United States, ensures compliance with all import regulations and payment of duties. While it pertains to goods rather than vehicles, the essence of safeguarding against potential financial losses or legal violations is a shared characteristic with the TC-824 form, reinforcing the common theme of risk management in various legal contexts.

Bail Bonds serve a fundamentally different purpose in the realm of criminal law, offering a financial guarantee that a Defendant will return for their court proceedings. Despite the differences, the similarity with the TC-824 form lies in the bond's role as a form of surety - one ensuring appearance in court, and the other ensuring rightful ownership or financial interest in a vehicle is respected.

The Fidelity Bond, which protects businesses from losses due to fraudulent acts committed by employees, parallels the TC-824 in its preventative nature. Although the TC-824 is more concerned with ownership rights and the Fidelity Bond with protecting financial assets, both serve to mitigate risks for those who might otherwise suffer from the dishonesty or wrongful actions of others.

Performance Bonds, typically used in construction projects, guarantee that the contracted work will be completed as agreed. This concept of guaranteeing an outcome under predefined conditions mirrors the TC-824 form’s goal of ensuring that rightful vehicle ownership claims are honored, thus preventing potential financial harm to any party involved in the vehicle’s sale or transfer.

Lastly, the License and Permit Bonds, required for various professionals to legally operate in their chosen field, share a similar protective function with the TC-824 form. While they are more focused on compliance with industry standards and regulations, both forms of bonds safeguard the public and state against malpractice or non-compliance, ensuring that only qualified individuals or entities can conduct their business or complete a transfer of vehicle ownership.

Dos and Don'ts

Filling out the Utah TC-824 form, a Motor Vehicle Defective Title or Insufficient Evidence of Ownership Bond, is a critical step in the process of titling a vehicle under special circumstances. Here's a friendly guide to help ensure that your form is completed accurately and effectively:

Do:

- Ensure that all the information you provide is accurate, including the bond number, your name, principal's address, and any doing-business-as names.

- Attach a power of attorney form if one is used in connection with the surety bond.

- Check that the bond amount is correctly calculated as double the reasonable value of the vehicle, as required by the form.

- Ensure that all the fields related to the vehicle description, including Year, Make, Model, Body type, and Vehicle Identification Number (VIN), are fully and accurately completed.

- Have the principal and the surety sign the form at the designated spots to confirm the bond is in effect from the stated date.

Don't:

- Attempt to submit photocopies of the bond form. Original, signed forms are required for processing.

- Leave any required fields blank, as incomplete forms may lead to processing delays or denials.

- Forget to include the surety bond number or to attach any required ancillary documents, like a power of attorney.

- Misstate the bond amount or miscalculate double the vehicle's reasonable value.

- Overlook having a notary public notarize the Surety's affidavit of qualification and the signature of the officer or agent of the bonding company.

By following these guidelines, you can help ensure the Utah TC-824 form is completed properly, which will facilitate the process of proving ownership or tackling issues related to a defective title or insufficient evidence of vehicle ownership.

Misconceptions

When dealing with the complexities of transferring vehicle ownership or registering a vehicle when the title is missing or defective in Utah, individuals are often required to complete a Utah TC-824 form. Misconceptions about this process can complicate what is already considered a daunting task for many. Below are four common misunderstandings about the Utah TC-824 form and clarifications to help dispel these inaccuracies:

- Photocopies of the form are acceptable: A significant misunderstanding is that photocopies of the TC-824 form can be submitted to the Utah State Tax Commission. The original document specifies that photocopies will not be accepted. This requirement ensures the authenticity and integrity of the document, which is crucial for a process that involves potential legal and financial implications.

- Any bonding company can issue the required surety bond: Not all bonding companies are qualified to issue the surety bond required by the TC-824 form. The bond must come from a company that has been authorized to operate in Utah and meets specific standards set by the state. This misconception can lead to delays if individuals procure a bond from a company that does not meet these prerequisites.

- The bond covers any ownership claim, regardless of value: While the bond amount is set to be double the reasonable value of the vehicle, it does not guarantee coverage for any claim that exceeds this amount. The bond serves as a form of insurance to protect against claims of ownership or liens that may arise after the vehicle is sold or transferred but is limited to the penal sum stated in the bond.

- Power of attorney is always required to attach: The necessity of attaching a power of attorney form to the surety bond is another area of confusion. This requirement depends on the circumstances under which the bond is executed. If an individual or entity acts on behalf of the bond's principal (the person requiring the bond), a power of attorney authorizing them to do so must be attached. It is not a blanket requirement but is contingent upon the specifics of the transaction.

Understanding these aspects of the Utah TC-824 form can significantly ease the burden of dealing with vehicle title issues. It emphasizes the importance of paying attention to the details and requirements set forth by the Utah State Tax Commission to prevent unnecessary setbacks in resolving ownership or registration challenges.

Key takeaways

When dealing with the Utah TC-824 form, which is crucial for situations involving a motor vehicle with a defective title or insufficient evidence of ownership, here are some important key takeages to consider:

- The Utah TC-824 form is a Surety Bond that must be filled out completely. This includes detailed information such as the bond number, principal's name and address, the business name if applicable, and any other required details to ensure the form is valid.

- If a power of attorney is utilized in the process, it is mandatory to attach the corresponding form to the Surety Bond. This ensures that the individual filling out the form has the legal right to do so on behalf of another person, if necessary.

- Photocopies of the bond form are not accepted. This emphasizes the importance of submitting the original, fully completed form to avoid delays or rejection. The requirement for original documents ensures the authenticity and seriousness of the bond.

- The Surety Bond serves a specific purpose: it is meant to indemnize any person who might later prove legal ownership or interest in the vehicle described in the bond. This includes covering damages up to two times the reasonable value of the vehicle, ensuring that potential ownership disputes can be resolved fairly and financially covered.

The completion and usage of the Utah TC-824 form are integral for individuals needing to navigate the complexities of vehicle ownership, especially when traditional proofs of ownership are missing or disputed. Understanding these key points can simplify the process and ensure compliance with Utah's regulations.

Common PDF Templates

Job Applications - Guided job application experience with prompts for employment history, designed to provide a clear timeline of an applicant's work background.

Survivorship Affidavit Utah - This form acts as the first step in appealing against your vehicle's impoundment by the authorities in Utah.