Fill Out Your Utah Tc 69 Form

Embarking on a business venture in Utah comes with its fair share of paperwork and compliance, and one key piece of the puzzle is the Utah TC-69 form, formally known as the Utah State Business and Tax Registration. Ideally crafted to streamline the process, this comprehensive form serves as a gateway for registering a wide array of business-related taxes and establishing a DBA (Doing Business As) if necessary. The TC-69 form simplifies the intricate task of tax registration by consolidating various tax licenses under one umbrella, from Employer Withholding and Sales and Use Tax License to more specific needs such as the Cigarette and Tobacco License. Following the guidelines is crucial; an ill-prepared form will be rejected, prolonging the setup of your business infrastructure. With processing times estimated at 15 business days—though faster online registration is available—planning ahead becomes invaluable. Moreover, this form doesn't exist in isolation; compliance with city or county business licensing requirements remains a prerequisite. The form also addresses specific stipulations for non-U.S. citizens and outlines the documentation needed to comply with federal laws. It's more than just a form; it's a navigational tool through the labyrinth of state tax compliance, ensuring your business starts on solid ground and avoids the pitfalls of penalties and delays.

Preview - Utah Tc 69 Form

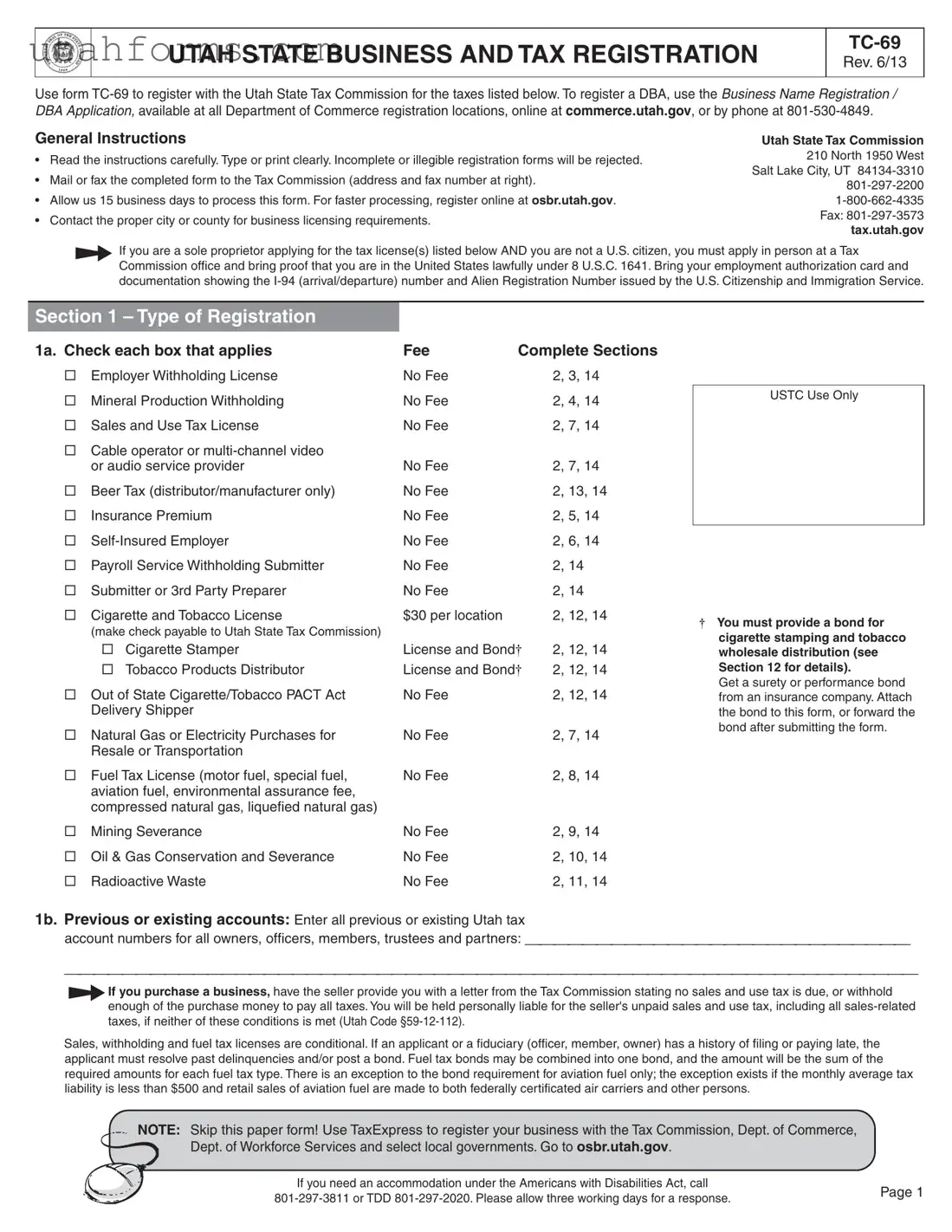

UTAH STATE BUSINESS AND TAX REGISTRATION

Rev. 6/13

Use form

General Instructions

•Read the instructions carefully. Type or print clearly. Incomplete or illegible registration forms will be rejected.

•Mail or fax the completed form to the Tax Commission (address and fax number at right).

•Allow us 15 business days to process this form. For faster processing, register online at osbr.utah.gov.

•Contact the proper city or county for business licensing requirements.

Utah State Tax Commission

210 North 1950 West

Salt Lake City, UT

Fax:

tax.utah.gov

If you are a sole proprietor applying for the tax license(s) listed below AND you are not a U.S. citizen, you must apply in person at a Tax Commission office and bring proof that you are in the United States lawfully under 8 U.S.C. 1641. Bring your employment authorization card and documentation showing the

Section 1 – Type of Registration

1a. Check each box that applies |

Fee |

Complete Sections |

|

|

Employer Withholding License |

No Fee |

2, 3, 14 |

|

Mineral Production Withholding |

No Fee |

2, 4, 14 |

Sales and Use Tax License |

No Fee |

2, 7, 14 |

|

Cable operator or

|

or audio service provider |

No Fee |

2, 7, 14 |

|

Beer Tax (distributor/manufacturer only) |

No Fee |

2, 13, 14 |

|

Insurance Premium |

No Fee |

2, 5, 14 |

|

No Fee |

2, 6, 14 |

|

|

Payroll Service Withholding Submitter |

No Fee |

2, 14 |

Submitter or 3rd Party Preparer |

No Fee |

2, 14 |

|

|

Cigarette and Tobacco License |

$30 per location |

2, 12, 14 |

|

(make check payable to Utah State Tax Commission) |

|

|

|

Cigarette Stamper |

License and Bond† |

2, 12, 14 |

|

Tobacco Products Distributor |

License and Bond† |

2, 12, 14 |

Out of State Cigarette/Tobacco PACT Act |

No Fee |

2, 12, 14 |

|

|

Delivery Shipper |

|

|

Natural Gas or Electricity Purchases for |

No Fee |

2, 7, 14 |

|

|

Resale or Transportation |

|

|

USTC Use Only

†You must provide a bond for cigarette stamping and tobacco wholesale distribution (see Section 12 for details).

Get a surety or performance bond from an insurance company. Attach the bond to this form, or forward the bond after submitting the form.

|

Fuel Tax License (motor fuel, special fuel, |

No Fee |

2, 8, 14 |

|

aviation fuel, environmental assurance fee, |

|

|

|

compressed natural gas, liquefied natural gas) |

|

|

|

Mining Severance |

No Fee |

2, 9, 14 |

|

Oil & Gas Conservation and Severance |

No Fee |

2, 10, 14 |

|

Radioactive Waste |

No Fee |

2, 11, 14 |

1b. |

Previous or existing accounts: Enter all previous or existing Utah tax |

|

|

|

account numbers for all owners, officers, members, trustees and partners: ___________________________ |

||

____________________________________________________________

If you purchase a business, have the seller provide you with a letter from the Tax Commission stating no sales and use tax is due, or withhold enough of the purchase money to pay all taxes. You will be held personally liable for the seller's unpaid sales and use tax, including all

If you purchase a business, have the seller provide you with a letter from the Tax Commission stating no sales and use tax is due, or withhold enough of the purchase money to pay all taxes. You will be held personally liable for the seller's unpaid sales and use tax, including all

Sales, withholding and fuel tax licenses are conditional. If an applicant or a fiduciary (officer, member, owner) has a history of filing or paying late, the applicant must resolve past delinquencies and/or post a bond. Fuel tax bonds may be combined into one bond, and the amount will be the sum of the required amounts for each fuel tax type. There is an exception to the bond requirement for aviation fuel only; the exception exists if the monthly average tax liability is less than $500 and retail sales of aviation fuel are made to both federally certificated air carriers and other persons.

NOTE: Skip this paper form! Use TaxExpress to register your business with the Tax Commission, Dept. of Commerce, Dept. of Workforce Services and select local governments. Go to osbr.utah.gov.

If you need an accommodation under the Americans with Disabilities Act, call |

Page 1 |

|

|

Section 2 – General Information

Required by all applicants.

2a. Organizational Structure Must check one.

Individual |

Government |

Corporation |

Partnership |

LLC/Trust |

|

Sole Proprietor |

Federal |

C Corp |

General |

LLC Low Profit LLC |

|

|

State |

S Corp |

Limited |

Check the return the LLC files with the IRS |

|

|

Tribal |

(Attach copy of |

Limited Liability |

Corp. |

Part. |

|

IRS approval letter) |

||||

|

|

|

|||

|

Political Subdivision |

|

|

Single Member LLC |

|

|

|

|

|

Check the return the LLC files with the IRS |

|

|

|

|

|

Indiv. Corp. Part. |

|

|

|

|

|

Trust |

|

|

|

|

|

Check the return the Trust files with the IRS |

|

|

|

|

|

Fiduc. |

Corp. Part. |

2b. Organization Date Enter the date of qualification or incorporation in Utah: ___________________

(Contact the Dept. of Commerce at

2c. Department of Commerce Entity Number Enter number issued by the Dept. of Commerce.

2d. Tax Year End Date: ___________

2e. Federal Identification Number

Every sole proprietor must provide a Social Security Number (SSN). A sole proprietor with employees must also provide an Employer Identification Number (EIN). All other organization types must provide an EIN.

|

|

Social Security Number (SSN) |

Federal Employer Identification Number (EIN) |

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2f. Name of Business Entity - PRINT If you are a sole proprietor, write your name here |

Daytime phone number |

|||

|

|

|

|

|

Owner's street address |

|

|

|

Cell phone number |

|

|

|

|

|

City |

County |

State |

Foreign country (if not U.S.) |

ZIP Code |

|

|

|

|

|

Business website address (URL) |

|

|

|

|

2g. DBA/Business Name Business or trade name at this physical location (for additional outlets, fill out form

Physical street address of business (P.O. Box not acceptable) |

|

Business phone number |

Fax number |

|

|

|

|

|

|

City |

County |

State |

Foreign country (if not U.S.) |

ZIP Code |

|

|

|

|

|

Required: Local Utah government issuing this location’s business license

Lodging services: Will you provide motel, hotel, trailer court, campground or other lodging services at this location?

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Cigarette/tobacco: Check all boxes that describe your cigarette/tobacco activities at this location (see section 12b for definitions): |

||||||||||

Retailer |

Stamper |

Distributor |

Importer |

PM Mfg |

NPM Mfg |

PACT Act shipper |

||||

|

|

|

|

|

|

|

|

|

||

2h. Business Mailing Address |

|

|

|

|

|

Email address |

|

|||

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

State |

ZIP Code |

|

Foreign country (if not U.S.) |

|

Contact phone number |

||

|

|

|

|

|

|

|

|

|

|

|

USTC Use Only

SIC Code

USTC SIC

NAICS

Section 2 continued on Page 3

Page 2

2i. Business Description Describe the nature of your business in detail (include the types of products sold)

Restaurant: If your business is a restaurant, check the box that best describes you: |

|

|

||

Fast food |

Family restaurant with liquor |

Theme with liquor |

White table cloth with liquor |

Specialty food |

2j. Officer/Owner Information

Enter the following information for each officer, general partner, managing member, trustee or enterprise owner. You must provide the SSN of each individual and the EIN of each entity listed (Tax Commission Rule

Name and Title - PRINT |

SSN and EIN |

Home Address and City/State/ZIP |

Phone Number |

SSN

EIN

SSN

EIN

Section 3 – Employer Withholding

3a. When will you start paying wages?

Month Day Year

3c. Annual Filing Option

3b. Estimate the amount of Utah wages you expect to pay in a calendar year:

$16,000 or less

$16,001 - $200,000

$200,001 or more

Will you file employment taxes on Schedule H of your federal income tax return (Form 1040)?

Yes No

Will you file form 944, Employer’s Annual Federal Tax Return?

Yes No

If yes, attach a copy of the IRS notification letter authorizing annual filing.

Section 4 – Mineral Production Withholding

4a. When did you start making mineral production payments?

Month Day Year

Section 5 – Insurance Premium

5a. Are you an admitted insurer who is required to pay tax on premiums received from direct business in Utah? If yes, when did you start writing insurance in Utah?

Month Day Year

Section 6 –

6a. Are you a

Month Day Year

Page 3

Section 7 – Sales and Use Tax

7a. When will you start selling or making purchases?

Month Day Year

7c. If you have a Streamlined Sales Tax (SST) number, enter it here:

7b. Estimate your annual net sales and purchases subject to tax.

$16,000 or less

$16,001 - $800,000

$800,001 - $1,500,000

$1,500,001 or more

Check this box to voluntarily file monthly:

7d. Are you a cable operator or

Yes No If yes, skip 7e.

7e. Sales and Use Tax

Check each box where your answer is "yes." Notify the Tax Commission if any of the information changes.

1.Will you sell goods or services from only one fixed Utah business location (includes vending machine operators and

2.Will you sell goods or services from more than one fixed Utah business location (includes vending machine operators and

•If yes, complete and attach form

3. Will you do one or both of the following:

a.sell goods or services that are shipped from outside Utah to a Utah customer(s)?

b.have goods or materials delivered from outside Utah to a location(s) in Utah other than your fixed place of business?

4. Will you do

•If yes, we will send you a Multilevel Marketing Agreement once we have reviewed and processed your application.

5. Will you charge admission or fees for any entertainment, recreation, exhibition, cultural or athletic activity

provided somewhere other than your business location?

6.Will you provide services (cleaning, washing, dry cleaning, repairing or renovating tangible personal property) at

7.Will you receive recurring payments for leases or rentals of tangible personal property or services?

8.Are you a seller with no physical or representational presence in Utah who is selling goods or services

shipped direct by U.S. mail or common carrier to Utah customers? See Pub 37, Business Activity and Nexus in Utah.

9.Will you sell grocery food? See Pub 25 for the definition of grocery food.

10.Will you sell motor vehicles, aircraft, watercraft, manufactured homes, modular homes or mobile homes in a city or town with the resort communities tax?

The resort communities tax applies to: Alta, Boulder, Brian Head, Bryce Canyon, Garden City, Green River, Independence, Kanab, Midway, Moab, Orderville, Panguitch, Park City, Park City East, Springdale and Tropic

11.Are you a utility providing telephone service, electricity or gas?

•If yes, complete and attach form

12.Will you have retail sales of new tires? This includes new tires sold as part of a vehicle sale, new tires bought

on or for rented vehicles, and new tires bought from anyone not collecting the Waste Tire Recycling Fee.

13.Will you provide motel, hotel, trailer court, campground or other lodging services for less than 30 consecutive days?

14.Are you a restaurant? See Pub 25 for the definition of restaurant.

15.Will you rent motor vehicles (12,000 pounds or less) to customers for 30 days or less?

16.Will you sell residential fuels (electricity, heat, gas, coal, fuel oil, firewood and other fuels for residential use)?

17.Will you purchase goods or services

in Utah? See Pub 25 for the definition of use tax.

18. Are you a municipality that generates your own taxable municipal energy,

19.If you did not mark question 18, will you sell taxable municipal energy?

20.Do you provide only the transportation component of taxable energy delivered to the point of sale or use?

21.Will you sell disposable cell phones or disposable cell phone minutes?

22.Will you be the first seller in Utah of lubricating oil in packages of less than 55 gallons?

23.Are you a cable operator or a

24.Are you a sexually explicit business (see Utah Code

25.Will you provide telecommunication services to end consumers?

26.Are you a telephone line provider (radio, land line, VOIP, etc.)?

USTC Use

Only

7d. CAS C/S SWT(VA)

2.A

3.J

4.J (M)

5.J (A)

6.J (S)

7.J (L)

8.J (N)

9.G

10.X

11.U

12.SWT(WT)

13.STR

14.SPF

15.STL

16.(R)

18.STE(ER)

19.STE(E)

20.STE(ET)

21.SWT(CP)

22.SWT(LT)

23.SWT(VA)

24.SWT(SX)

25.SMT

26.SEM

Page 4

Sales Tax Applicants...

NOTE: You must pay use tax on goods or services you |

Temporary Sales Tax License for Special Events |

|

purchase |

You must get a temporary sales tax license any time you |

|

and Use Tax Return. |

||

participate in a special event, even if you have a permanent sales |

||

|

||

Sales Tax Info |

tax license. |

|

See Pub 25, online at tax.utah.gov/forms, for sales tax |

A special event is a |

|

information. Find sales tax rates online at |

months or less where sales occur. |

|

tax.utah.gov/sales/rates. |

Examples include fairs, festivals, antique shows, gun shows, food |

|

|

||

|

shows, art shows, auctions, mall kiosks, swap meets, conventions, |

|

|

hobby shows, seasonal stands in malls, and similar events. |

|

|

See more information at tax.utah.gov/sales/specialevents, or |

|

|

call |

|

|

Section 8 – Fuel License

8a. Special Fuel Supplier Effective date (mm/dd/yy): _________

Qualifications: |

(Check all operations that apply to you. If none, you do not qualify.) |

|

Import diesel |

Produce, refine, manufacture |

Acquire diesel fuel (not previously |

|

or blend diesel fuel |

taxed) for distribution in Utah |

8b. Motor Fuel |

Effective date (mm/dd/yy): _________ |

|

Qualifications: |

(Check all operations that apply to you. If none, you do not qualify.) |

|

Import motor fuel for use, distribution or sale

Produce, refine, manufacture or compound motor fuel for use, distribution or sale

Purchase motor fuel for resale |

Blend |

in wholesale quantities to retail |

|

dealers inside or outside Utah |

|

(does not require a license if all |

|

Utah tax is paid to a Utah |

|

licensed distributor) |

|

8c. Aviation Fuel Effective date (mm/dd/yy): _________

Qualifications: (Check all operations that apply to you. If none, you do not qualify.)

Import aviation fuel for use, distribution or sale

Make aviation fuel retail sales to both federally certificated air carriers and other persons

Produce, refine, manufacture or compound aviation fuel for use, distribution or sale

Purchase aviation fuel for resale Blend in wholesale quantities to retail

dealers inside or outside Utah (does not require a license if all Utah tax is paid to a Utah licensed distributor)

8d. Environmental Assurance Fee Effective date (mm/dd/yy): _________

Qualifications: (Check all operations that apply to you. If none, you do not qualify.)

Import petroleum products for use, distribution or sale

Produce, refine, manufacture or compound petroleum products for use, distribution or sale

8e. Compressed Natural Gas Effective date (mm/dd/yy): _________

(For suppliers of CNG for highway use. A supplier is an owner or lessor of equipment used to compress natural gas.)

Qualifications: (Check all operations that apply to you. If none, you do not qualify.)

Owner of compression equipment Lessor of compression equipment

8f. Liquefied Natural Gas Effective date (mm/dd/yy): _________

(For suppliers of LNG for highway use. A supplier is an owner or lessor of equipment used for liquefied natural gas.)

Qualifications: (Check all operations that apply to you. If none, you do not qualify.)

Owner of equipment designed for the use/disbursement of LNG Lessor of equipment designed for the use/disbursement of LNG

Section 8 continued on Page 6

Page 5

8g. Estimate your monthly total taxable gallons for each fuel type you checked.

|

|

50,000 or less |

300,001 or more |

||

1. |

Aviation fuel |

|

|

|

|

2. |

Environmental assurance fee |

|

|

|

|

3. |

Motor fuel |

|

|

|

|

4. |

Special fuel |

|

|

|

|

5. |

Compressed Natural Gas* |

|

|

|

|

6. |

Liquefied Natural Gas* |

|

|

|

|

*Estimate taxable gallons in gasoline gallon equivalents (GGE = 120 cubic feet)

8h. General questions We may deny your license if you do not answer all questions that apply to you.

1. Provide the state, supplier and estimated monthly gallons of fuel imports (attach additional sheets if necessary):

a.Motor fuels

b.Diesel/biodiesel fuels

c.Aviation fuels

d.Other petroleum

State importing from:

State importing from:

State importing from:

State importing from:

_____ |

Supplier name: _____________ |

Est. gallons per month: ____ |

_____ |

Supplier name: _____________ |

Est. gallons per month: ____ |

_____ |

Supplier name: _____________ |

Est. gallons per month: ____ |

_____ |

Supplier name: _____________ |

Est. gallons per month: ____ |

2.How will you report motor, aviation and diesel fuel gallons?

(The basis you choose must stay the same for the calendar year. You may only change your election on January 1.)

Gross election – actual meter amount

Net election – converted to 60 degrees

Section 9 – Mining Severance

9a. When will you start operations in Utah?

Month Day Year

Section 10 – Oil & Gas Conservation and Severance

10a. When will you start operations in Utah?

Month Day Year

10b.DOGM Number

Issued by the Utah Department of Natural Resources:_____________

Section 11 – Radioactive Waste

11a.When will your Utah facility begin operation?

Month Day Year

USTC Use

Only

OGC

OGS

Page 6

Section 12 – Cigarette and Tobacco

12a. When will you start selling or making purchases?

Month Day Year

12b. Business Activities

Check each box where your answer is "yes." Notify the Tax

Commission if any of the information changes.

1. Will you purchase tobacco products (shisha; moist snuff; RYO, pipe and chewing tobacco; snus; etc.)

•Bond required. Check “Tobacco Products Distributor” on page 1 (1a) and attach bond.

The cash or surety bond value must equal your estimated quarterly tobacco products tax

($500 minimum). The Tax Commission may require you to increase your bond if your actual tax is greater than the estimated amount.

Estimate your tobacco products tax for a quarterly reporting period: $________

2.Will you purchase unstamped cigarettes and affix a Utah stamp prior to sale or distribution?

•Bond required. Check “Cigarette Stamper” on page 1 (1a) and attach bond. The minimum value of the cash or surety bond is $500.

Note: Unpaid cigarette stamp purchases may not exceed 90 percent of your bond value.

3.Will you make retail sales of cigarettes and/or tobacco products (RYO tobacco, shisha, moist snuff, etc.)?

•Signed & notorized affidavit required if:

a)you are not required to post a bond (see questions 1 and 2, above), AND

b)you will sell ONLY stamped cigarettes (no other tobacco products).

The affidavit must state that you will only sell stamped cigarettes.

4.Are you a Participating Manufacturer of cigarettes or RYO tobacco?

5.Are you a

6.Will you operate a cigarette rolling machine in Utah?

•Certification required. Attach form

USTC Use Only

1.distributor

2.stamper

3.retailer

4.PM mfg

5.NPM mfg

6.RMO

7.PACT

7. Are you subject to the PACT Act and will you ship cigarettes and/or tobacco products into Utah from another state or country?

Multiple Locations: If you will sell cigarettes and/or tobacco products (including vending machine sales) from more than one fixed Utah location, attach form

See Pub 65, Tax Information for Retailers, Distributors and Stampers of Cigarettes and Tobacco Products

Section 13 – Beer

Only complete section 13 if you are a business located in Utah. If you’re an

13a. When will you start manufacturing or distributing beer in Utah?

Month Day Year

13b. Business Type

Check all that apply.

1.Beer manufacturer

2.Beer distributor

Page 7

Section 14 – Authorized Signatures |

Required by all applicants. |

|

|

I understand the Tax Commission will review all officers/owners listed in Section 2j (page 3) for previous, unpaid tax debt and I may have to resolve tax issues or post a bond.

I understand any person (including employees, corporate directors, corporate officers, etc.) who has or will have the authority to direct accounting processes or who is required to collect, account for and pay any taxes and fails to do so will be liable for a penalty equal to the total amount of tax not collected, not accounted for or not paid (Utah Code

I understand I am required to notify the Tax Commission if I add or close a business location; or change the name, organizational structure, officer status or address of the business.

I also understand my signature confirms I have reviewed this section with all those named on this form.

Signature Requirements (for organizational structure checked on line 2a):

• Individual/Sole Proprietor |

Signature must match SSN provided in Section 2 (2e) |

|

(for example, a husband or wife may not sign on behalf of each other). |

• All Partnerships |

One general partner must sign. |

• Corporation / S Corporation |

An officer of the corporation authorized to sign on behalf of the corporation must sign. |

• Trust |

The grantor or a trustee must sign. |

• Limited Liability Company / Single Member LLC |

A member must sign. |

• Government |

A government official must sign. |

14a. Sole Proprietors Only

You must provide the following information if you are a sole proprietor applying for the tax license(s) shown in Section 1 of this application. Under state and federal law we cannot issue a license to any person who does not provide this information.

If you are a sole proprietor who is not a U.S. citizen, you must file this application IN PERSON at a Tax Commission office.

Check one (providing false information subjects the signer to penalties of perjury):

I am a U.S. citizen and have provided my Social Security Number in Section 2 (2e).

I qualify under 8 U.S.C. 1641 and I am present in the U.S. lawfully. |

Number*: |

___________________________ |

|

Alien Registration |

Number*: |

___________________________ |

|

Employment Authorization Card Number*: ___________________________

*The

Under penalty of perjury, I declare that I am a U.S. citizen OR that I qualify under 8 U.S.C. 1641 and am present in the United States lawfully.

Sole Proprietors Sign Here: __________________________________________ |

Title: |

__________________ |

Print Name: __________________________________________ |

Date: |

__________________ |

14b. All Applicants

Under penalty of perjury, I declare that, to the best of my knowledge, the information on this application is true, correct and complete.

ALL APPLICANTS Sign Here: __________________________________________ |

Title: __________________ |

|

Print Name: __________________________________________ |

Date: __________________ |

|

|

|

|

Reporting and Payment Guidelines |

|

|

Always file tax returns by the due date and pay taxes in full. You must file a return, even if no taxes are due. Enter zero tax, sign and date your return, and file by the due date.

You must file and pay timely, even if you do not receive a preprinted form. Get forms online at tax.utah.gov/forms, at all Tax Commission locations, or by calling the automated forms line at

If you do not file a return or pay taxes due, you will be sent a tax delinquency notice and/or contacted. If you disagree with an action taken by the Tax Commission, you may file an appeal within 30 days of receiving the notice. See Pub 2, Utah Taxpayer Bill of Rights.

For questions about EFT payments, see form

File Specifications

| Fact | Detail |

|---|---|

| Purpose | The Utah TC-69 form is used for business and tax registration with the Utah State Tax Commission. |

| Registration Types | It covers a range of tax licenses, including employer withholding, sales and use tax, and special fuel licenses, among others. |

| Processing Time | Applicants are advised to allow the Tax Commission 15 business days to process the form, with an option for faster online registration. |

| Governing Laws | Key regulations include compliance with 8 U.S.C. 1641 for non-citizens and potential bond requirements under specific circumstances, stated within various sections regarding tax liabilities and business operations in Utah. |

How to Write Utah Tc 69

Filling out the Utah TC-69 form is an important step for those looking to register their business for various tax purposes in the state of Utah. Whether you're starting a new venture or expanding an existing one, this form connects you with the necessary tax licenses and registrations. It's a straightforward document, but it requires attention to detail to complete it properly. Here are the steps you need to take to ensure your form is filled out accurately and entirely, increasing the likelihood of a smooth registration process.

- Begin by reading the General Instructions carefully to understand the form's requirements and recommendations for submission.

- Choose the type of registration(s) you are applying for under Section 1. Check all the boxes that apply to your situation.

- If applicable, enter any previous or existing Utah tax account numbers in Section 1b.

- In Section 2a, select your organizational structure by checking the appropriate box.

- Enter your business's organization date in 2b and the Department of Commerce Entity Number in 2c.

- Provide the Tax Year End Date in 2d and fill in your Federal Identification Number (EIN) or Social Security Number (SSN if a sole proprietor) in 2e.

- For Section 2f, if you are a sole proprietor, enter your name and provide the requested contact information. If your business is registered under a different structure, enter the business entity’s name and contact details.

- Detail your business name (DBA) and physical location in 2g. If relevant, answer the additional questions in this section.

- Provide a business mailing address and contact phone number in Section 2h.

- In Section 2i, describe the nature of your business. Check the appropriate box if your business is a restaurant.

- Section 2j requires information about any officer, owner, or relevant party, including Social Security or Employer Identification Numbers.

- Under Section 3, indicate when you will start paying wages and estimate the amount of Utah wages you expect to pay within a calendar year. Answer the other relevant questions about employment taxes.

- Complete Sections 4 through 8 as they apply to your business, providing dates, estimating sales or wages, and checking boxes relevant to your business activities.

- If applicable, provide additional information as required by the specific sections—for example, bonding information for cigarette and tobacco licenses.

- Review your completed form for accuracy and completeness. Incomplete or illegible forms will be rejected.

- Mail or fax your completed form to the Utah State Tax Commission using the address or fax number provided in the General Instructions. Alternatively, consider registering online for faster processing.

- Remember to contact your city or county to inquire about any local business licensing requirements.

After submitting your form, allow up to 15 business days for processing. If you have successfully filled out all necessary sections and provided accurate, legible information, you should be well on your way to registering your business with the Utah State Tax Commission. This registration is crucial for managing and complying with state tax obligations, helping ensure your business operates smoothly and legally within Utah.

Frequently Asked Questions

What is the purpose of the Utah TC-69 form?

The Utah TC-69 form is used for registering a business with the Utah State Tax Commission for various taxes. This includes, but is not limited to, sales and use tax, employer withholding, and fuel taxes. The form ensures businesses comply with state taxation requirements.

Can I submit the TC-69 form online, or do I have to mail it in?

For faster processing, businesses are encouraged to register online at osbr.utah.gov. However, if you prefer, you can also mail or fax the completed form to the Tax Commission. The choice offers flexibility based on your convenience or access to online services.

What if I am a sole proprietor and not a U.S. citizen?

Sole proprietors who are not U.S. citizens must apply in person at a Tax Commission office. You'll need to bring proof that you're lawfully in the United States, such as your employment authorization card and documents showing your I-94 number and Alien Registration Number.

Are there any fees associated with the TC-69 form?

Most registrations on the TC-69 form do not require a fee. However, there is a $30 fee per location for cigarette and tobacco licenses. Checks for this fee should be made payable to the Utah State Tax Commission.

What should I do if I purchase a business in Utah?

If you're buying a business, ask the seller to provide a letter from the Tax Commission stating no sales and use tax is due. Alternatively, withhold enough of the purchase price to cover all taxes. Failing to do so could make you personally liable for the seller's unpaid taxes.

What is the processing time for the TC-69 form?

Allow the Tax Commission 15 business days to process the form. Registering online can expedite this process, but always plan for some processing time to ensure compliance by your intended start date.

Common mistakes

Filling out the Utah TC-69 form, an essential step for many businesses to register for state taxes and licenses, can be tricky. Certain common mistakes can delay or disrupt this process. Understanding these pitfalls can help ensure a smoother registration experience with the Utah State Tax Commission.

One of the most frequent errors occurs when applicants provide incomplete or unclear information. The TC-69 form requires clarity and completeness; overlooking sections or providing vague details can result in the rejection of the application. This is particularly relevant in sections requiring detailed descriptions of the business or specific tax license selections.

Another common mistake involves the misclassification of the business's organizational structure. The form offers multiple options, such as Sole Proprietor, Corporation, LLC/Trust, among others. Accurately indicating your business structure is crucial because it determines the tax obligations and benefits your business will be subjected to. Misclassification can lead to improper tax filings and potential legal complications.

Incorrect or missing tax identification numbers also represent a significant issue. Sole proprietors might neglect to provide their Social Security Number (SSN) or, if applicable, their Employer Identification Number (EIN). Ensuring these numbers are correctly entered in the designated areas of the form is paramount. These identifiers are essential for tax purposes and are used by the state to track business tax filings and liabilities.

Lastly, failing to provide the proper bond for licenses requiring one, such as the cigarette and tobacco licenses, is a common oversight. The form specifies that a surety or performance bond must be submitted for certain types of registrations. Neglecting this requirement can delay the processing of your application or result in outright denial until the appropriate documentation is received.

Given these potential pitfalls, applicants should take the time to review their TC-69 form submissions thoroughly. Ensuring accuracy and completeness can not only expedite the registration process but also prevent future legal and financial issues related to state tax and business licensing requirements.

Documents used along the form

When businesses in Utah prepare to submit the TC-69 form for State Business and Tax Registration, it's not just about filling out that form and calling it a day. There are various other forms and documents that might be necessary to ensure a comprehensive approach to fulfilling state requirements. These documents are vital for different aspects of business operation and tax compliance. Let's delve into some of these essential forms and documents that are often used in conjunction with the TC-69 form.

- Form TC-69B (Multiple Location and Sales Use Tax Supplemental Schedule): If your business operates out of more than one location, this form helps you list each site. It's necessary for entities that have multiple branches or offices across Utah, ensuring that all locations are properly registered for sales and use tax purposes.

- Form TC-73 (Sales Tax Exemption Certificate): This form applies to businesses that purchase goods for resale, manufacture, or that are exempt from sales tax. It allows businesses to buy goods without paying sales tax upfront and is critical for retailers or wholesalers who buy products for resale.

- Form TC-160 (Credit Application): If your business has overpaid taxes or is eligible for certain tax credits, the TC-160 form is used to claim these credits or request a refund. This could be relevant after your initial registration if your business scenario warrants it.

- Employer Identification Number (EIN) Confirmation Letter (CP 575): Issued by the IRS, this document confirms your business’s EIN, which is necessary for tax filings and is requested on the TC-69 form. It's fundamental for all businesses as it identifies your business entity to the state and federal government.

- Articles of Incorporation/Organization: For corporations, LLCs, or other types of business structures, these documents establish your business’s legal existence. Submitted to the Utah Department of Commerce, they’re crucial to clarify your business structure and are referenced in your TC-69 submission.

- Professional Licensing: Depending on your business type, you might need professional licenses before registering your business. These documents prove your eligibility to offer certain services and are vital for compliance in regulated industries.

Together, these documents and forms complement the TC-69 form, facilitating a smooth registration process and ensuring your business meets all the legal and tax obligations in Utah. It's always advisable to consult with a professional to determine the specific needs of your business and ensure that you're not missing any crucial steps in your registration and setup process.

Similar forms

The Utah TC-69 form is closely related to the Business Name Registration / DBA Application. Both documents are essential for businesses looking to establish their legal presence in the state. While the TC-69 form focuses on tax and business registration with the Utah State Tax Commission, the Business Name Registration / DBA (Doing Business As) Application is more concentrated on the company's branding and legal identification. This is where a business can register a trade name it intends to use publicly, which is critical for marketing and ensuring that the business operates under a unique name.

Similarly, the Employer Identification Number (EIN) application with the IRS resonates with the TC-69 form's requirement. Both are foundational steps for any new business. The TC-69 form mandates the provision of an EIN for tax purposes. Simultaneously, acquiring an EIN from the IRS is a federal requirement for businesses to be identified for tax purposes. This number is used when reporting employment taxes and filing other tax documents, linking the two applications in their mutual goal of ensuring businesses meet their tax-related responsibilities.

The Sales and Use Tax License application shares similarities with the Utah TC-69 form, especially in the context of sales tax obligations. The TC-69 form encompasses the registration for various tax licenses, including the Sales and Use Tax License. This parallels the specific application process for obtaining a license to collect sales tax on taxable sales made within the state. Both processes aim at ensuring businesses comply with state tax laws by properly collecting and remitting sales tax.

The temporary Sales Tax License for Special Events found in Utah's tax guidelines can be compared to part of the TC-69 form's function. Businesses participating in temporary events like fairs or festivals are required to collect sales tax, similar to permanent retailers. This temporary license, while more short-term than the broader registrations covered by the TC-69, fulfills the same objective of tax compliance and accountability, ensuring all sales, even temporary ones, are appropriately taxed.

A Bond Requirement document is another related aspect, particularly for businesses that deal in regulated products like tobacco and alcohol. The TC-69 form outlines the need for a bond in specific licensure, indicating a financial security measure to ensure the business complies with tax laws. Similarly, securing a bond separate from the TC-69 form is a safeguard for the state, ensuring funds are available to cover any unpaid taxes or penalties, reflecting a shared emphasis on financial responsibility and compliance.

For businesses requiring environmental licenses, such as those involving the sale of fuels or dealing with environmental assurance fees, the similarity with the TC-69 form lies in the alignment of state compliance measures. The form includes registration for various environmental fees and taxes, paralleling separate environmental permits or licenses that ensure a business's operations do not harm Utah's ecosystem. Both sets of documentation require businesses to acknowledge and prepare for their environmental impact.

The Workforce Services Employer Registration parallels the TC-69 form in its aim to manage employment-related matters. While the TC-69 touches on employer withholding licenses amongst other tax responsibilities, the Workpower Services registration focuses more closely on unemployment insurance and job safety. Both registrations reflect the state’s broader goal of protecting workers and ensuring businesses contribute fairly to state services and benefits.

Dos and Don'ts

Filling out the Utah TC-69 form, the Utah State Business and Tax Registration form, is an important step for any business operating in Utah. This form helps businesses register for several tax licenses and fees without the hassle of completing multiple applications. Here are some dos and don'ts to consider when completing this form:

What You Should Do:

- Read the instructions carefully: Before you start filling out the form, take some time to read through the instructions provided. This will help you understand the requirements and ensure that you complete the form correctly.

- Type or print clearly: Ensure that all the information you provide on the form is legible. Incomplete or unclear information can result in the rejection of your application.

- Check the relevant boxes: The TC-69 form requires you to check boxes that apply to your business situation, such as the type of registration and the taxes for which you are registering. Make sure you check all that apply to your business.

- Provide accurate information: From the business name to the Federal Identification Number (EIN) and everything in between, make sure all the information you provide is accurate and current. Errors can delay the processing of your registration.

- Consider online registration: For faster processing, consider registering your business online at the provided Utah State Business Registration website. This can expedite the approval of your registration.

What You Shouldn't Do:

- Don’t skip sections: Even if a section seems not to apply, review it carefully to ensure that it truly doesn't pertain to your business. Skipping relevant sections can result in an incomplete application.

- Don’t use a P.O. Box for your business address: The form specifies that a physical street address of the business is required (P.O. Boxes are not acceptable). Ensure you comply with this requirement.

- Don’t forget the bond, if applicable: If you are applying for a Cigarette and Tobacco License, you must provide a surety or performance bond. Failing to attach the required bond to your application can result in delays or denial of your application.

- Don’t overlook the need for a local business license: In addition to state registration, most businesses will also need to obtain a local business license from the city or county in which they operate. Make sure to contact the proper local authorities to comply with all licensing requirements.

- Don’t ignore the special instructions if you are not a U.S. citizen: If you are a sole proprietor and not a U.S. citizen, you must apply in person at a Tax Commission office and bring certain documentation. Ensuring you follow these instructions is crucial for the successful processing of your registration.

Filling out the Utah TC-69 form accurately and completely is crucial for registering your business with the State of Utah. Paying attention to the dos and don'ts listed above can help streamline the process and avoid unnecessary delays or complications.

Misconceptions

One common misconception is that the TC-69 form is only for businesses that sell physical goods. In reality, this form is used to register a variety of businesses with the Utah State Tax Commission for several types of taxes and licenses, including service providers, mineral production, and more.

Many believe that submitting the form guarantees immediate business operation. However, it usually takes up to 15 business days to process the form, and additional time may be needed for certain types of registrations or if additional information is required.

There's a misconception that you must go in person to submit the TC-69 form. While in-person submission is an option, Utah encourages online registration through osbr.utah.gov for faster processing, or the form can be mailed or faxed as well.

Some think that the TC-69 form is all you need to start a business in Utah. This form is just one part of the process. Business owners also need to check city or county requirements for additional business licensing.

It's mistakenly believed that there are fees for all registrations on the TC-69 form. Many of the registrations listed, such as the Sales and Use Tax License, require no fee. However, certain licenses, like the Cigarette and Tobacco License, do have a fee.

There’s a false belief that a sole proprietor without employees does not need to provide an Employer Identification Number (EIN). If a sole proprietor hires employees, they must provide an EIN on the form in addition to their Social Security Number.

Some people are under the impression that only US citizens can complete the TC-69 form. Non-citizens can apply as well, but sole proprietors who are not U.S. citizens must apply in person and provide documentation proving they are in the United States lawfully.

Another misconception is that you only need to fill out the TC-69 form once for any business. If there are significant changes in your business, like adding a new type of service or a change in organizational structure, you may need to update your registration or submit a new form.

Finally, some business owners believe that the TC-69 form covers all tax registrations needed at the state level. Depending on the nature of your business, you may also need to register for other state taxes or fees not covered by the TC-69.

Key takeaways

- To initiate business and tax registrations with the Utah State Tax Commission, use the TC-69 form, ensuring all listed taxes and registrations are applied for accordingly.

- For those wishing to register a DBA (Doing Business As), a separate Business Name Registration / DBA Application is required, available both online and through contact with the Department of Commerce.

- Accuracy and completeness are crucial when filling out the form; incomplete or illegible forms will be rejected, potentially delaying the registration process.

- Businesses can expedite their registration process by opting for online registration at osbr.utah.gov, rather than mailing or faxing the form.

- It’s essential to consult with local city or county authorities regarding additional business licensing requirements which may not be covered by the state registration process.

- Sole proprietors who are not U.S. citizens must apply in person and provide proof of lawful presence in the United States, including an employment authorization card and documentation of their I-94 number and Alien Registration Number.

- A variety of tax licenses and registrations are available at no fee, indicating the state’s support for easy business setup; however, there are exceptions, such as the Cigarette and Tobacco License which has a cost associated per location.

- When purchasing an existing business, obtaining a letter from the Tax Commission stating no sales and use tax is due is crucial to avoid personal liability for the seller's unpaid taxes.

- Businesses involved in certain activities may be required to post a bond to cover potential tax liabilities, especially if there is a history of late filings or payments.

- The form requires detailed information about the business, including organizational structure, tax identification numbers, and detailed descriptions of the business’s activities.

- Registering for specific taxes, such as sales and use tax, involves estimating annual net sales and deciding whether to voluntarily file monthly, highlighting the need for accurate financial forecasting.

Common PDF Templates

Utah State Withholding - Applicants can request for the Letter of Good Standing to be faxed to them by providing a fax number on the form.

Tc 738 Utah - Key document for accessing the appeals unit's expertise in resolving complex tax issues within the state of Utah.