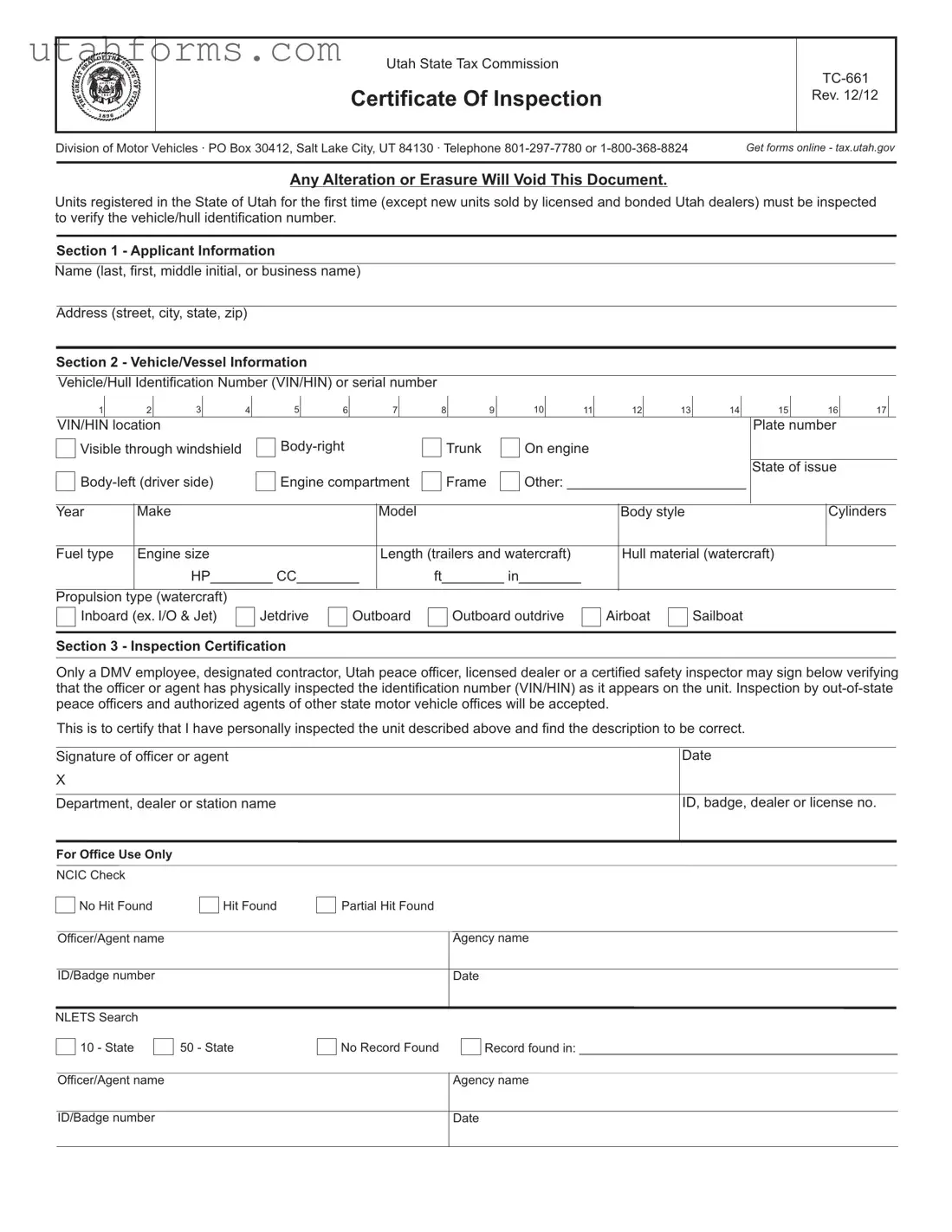

Fill Out Your Utah Tc 661 Form

Navigating the requirements for vehicle registration in Utah involves understanding various forms, one of which is the pivotal Utah State Tax Commission Certificate Of Inspection, known as TC-661. This form plays a crucial role, especially for vehicles that are being registered in the state for the first time and are not brand new units sold by licensed and bonded dealers within Utah. Essentially, the TC-661 form ensures that a thorough inspection has been conducted to verify the vehicle or hull identification number (VIN/HIN), guaranteeing the authenticity and legality of the vehicle or vessel. The form is divided into distinct sections including applicant information, detailed vehicle/vessel specifics, and inspection certification, the latter of which can only be completed by authorized personnel such as DMV employees, designated contractors, Utah peace officers, licensed dealers, or certified safety inspectors. Additionally, it is important to note that any alterations or erasures to the form will render it void, underlining the importance of accuracy and completeness in its completion. Compliance with these requirements not only facilitates the registration process but also ensures that all vehicles meet the state's standards for safety and identification.

Preview - Utah Tc 661 Form

Utah State Tax Commission

Certificate Of Inspection

Rev. 12/12

Division of Motor Vehicles · PO Box 30412, Salt Lake City, UT 84130 · Telephone |

Get forms online - tax.utah.gov |

|

|

Any Alteration or Erasure Will Void This Document.

Units registered in the State of Utah for the first time (except new units sold by licensed and bonded Utah dealers) must be inspected to verify the vehicle/hull identification number.

Section 1 - Applicant Information

Name (last, first, middle initial, or business name)

Address (street, city, state, zip)

Section 2 - Vehicle/Vessel Information

Vehicle/Hull Identification Number (VIN/HIN) or serial number

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

VIN/HIN location |

|

|

|

|

|

Plate number |

||

Visible through windshield |

|

Trunk |

On engine |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State of issue |

|

Engine compartment |

Frame |

Other: _______________________ |

|

|

||||

|

|

|

|

|

|

|

|

|

Year |

Make |

|

Model |

|

|

Body style |

|

Cylinders |

|

|

|

|

|

|

|||

Fuel type |

Engine size |

|

Length (trailers and watercraft) |

Hull material (watercraft) |

||||

|

HP________ CC________ |

|

ft________ in________ |

|

|

|

||

|

|

|

|

|

|

|

|

|

Propulsion type (watercraft)

INBOARD (EX. I/O & JET)

JETDRIVE

OUTBOARD

OUTBOARD OUTDRIVE

AIRBOAT

SAILBOAT

Section 3 - Inspection Certification

Only a DMV employee, designated contractor, Utah peace officer, licensed dealer or a certified safety inspector may sign below verifying that the officer or agent has physically inspected the identification number (VIN/HIN) as it appears on the unit. Inspection by

This is to certify that I have personally inspected the unit described above and find the description to be correct.

Signature of officer or agent |

|

|

|

|

|

Date |

|

|||||

X |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

Department, dealer or station name |

|

|

|

|

|

ID, badge, dealer or license no. |

||||||

For Office Use Only |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|||

NCIC Check |

|

|

|

|

|

|

|

|

|

|

||

|

No Hit Found |

|

|

Hit Found |

|

Partial Hit Found |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Officer/Agent name |

|

|

|

|

|

Agency name |

||||||

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

||

ID/Badge number |

|

|

|

|

|

Date |

||||||

NLETS Search |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|||

|

10 - State |

|

50 - State |

|

No Record Found |

|

|

Record found in: ______________________________________________ |

||||

|

|

|

|

|

||||||||

Officer/Agent name |

|

|

|

|

|

Agency name |

||||||

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

||

ID/Badge number |

|

|

|

|

|

Date |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

File Specifications

| Fact | Detail |

|---|---|

| Purpose of the Form | The Utah TC-661 form is used for the inspection of vehicles or vessels that are being registered in the State of Utah for the first time, not including new units sold by licensed and bonded Utah dealers. |

| Who Can Perform the Inspection | The inspection can be performed by a DMV employee, designated contractor, Utah peace officer, licensed dealer, or a certified safety inspector. Inspections by out-of-state peace officers and authorized agents of other state motor vehicle offices are also accepted. |

| Information Required on the Form | The form requires applicant information, vehicle/vessel identification details including VIN/HIN, and the certification of the inspection by the authorized inspector, including their signature, ID, and agency or dealership details. |

| Alterations to the Form | Any alteration or erasure on the TC-661 form will render it void, emphasizing the importance of accuracy while filling out the form. |

| Governing Law(s) | The process and requirements stipulated in the TC-661 form are governed by Utah state laws relevant to the registration and inspection of motor vehicles and vessels. These laws ensure the safety and proper identification of vehicles and vessels in the state. |

How to Write Utah Tc 661

Before embarking on the process of filling out the Utah TC-661 form, it's essential to understand the purpose and requirements that accompany this document. This form serves as a certificate of inspection for vehicles or vessels being registered in Utah for the first time, excluding those purchased new from licensed and bonded dealers within the state. All necessary inspections conducted through this form aim to verify the vehicle or hull identification number (VIN/HIN), ensuring the reliability and legality of the vehicle or vessel in question. With careful attention to detail and accuracy, one can successfully navigate the completion of this form by following the steps outlined below.

- Section 1 - Applicant Information:

- Enter the name of the applicant. This can be the last name, first name, and middle initial for individuals or the business name for companies.

- Provide the complete address of the applicant, including street, city, state, and zip code.

- Section 2 - Vehicle/Vessel Information:

- Record the Vehicle/Hull Identification Number (VIN/HIN) or serial number in the designated space.

- Specify the location of the VIN/HIN from the options provided or write a specific location if it is not listed.

- Fill in the plate number and state of issue, if applicable.

- Provide detailed information about the vehicle or vessel, including year, make, model, body style, cylinders, and fuel type.

- For vehicles, include engine size. For trailers and watercraft, include length, hull material, and propulsion type.

- Section 3 - Inspection Certification:

- This section must be completed by a DMV employee, designated contractor, Utah peace officer, licensed dealer, or a certified safety inspector.

- The inspector will verify the VIN/HIN as it appears on the unit and sign to certify that the description provided is correct.

- Include the inspector's signature, date of inspection, department, dealer or station name, and their ID, badge, dealer, or license number.

- For Office Use Only:

- This section is reserved for official use by the Utah State Tax Commission and will be completed by the office staff based on the information provided and any necessary checks or searches conducted.

Once all sections of the Utah TC-661 form have been filled out thoroughly and accurately, it is crucial to review the document for any errors or omissions. Any alterations or erasures may invalidate the form, necessitating a careful and precise approach throughout the completion process. After ensuring all information is correct and the form is duly signed by an authorized inspector, the applicant should submit the form as directed by the Utah State Tax Commission to proceed with the vehicle or vessel registration.

Frequently Asked Questions

- What is the purpose of the Utah TC-661 Certificate of Inspection form?

- Who needs to complete the Utah TC-661 form?

- Who is authorized to conduct the inspection and sign the Utah TC-661 form?

- What information is required on the TC-661 form?

- Applicant information including name and address

- Vehicle or vessel information such as VIN/HIN or serial number, plate number, year, make, model, body style, and, for watercraft, details like hull material and propulsion type

- The signature of the officer or agent who inspected the vehicle/vessel, along with their department, station name, and ID or badge number

- What happens if there are alterations or erasures on the form?

- Can the inspection be done by an out-of-state officer?

- Where can one obtain the Utah TC-661 form?

- Is there a fee associated with the inspection or the form?

- What should I do after the inspection is complete and the form is signed?

The Utah TC-661 Certificate of Inspection form is used to document the inspection of a vehicle or vessel's identification number (VIN/HIN) when it is being registered in the State of Utah for the first time, except for new units sold by licensed and bonded Utah dealers. This inspection ensures that the identification number on the vehicle or vessel matches the records, helping to prevent fraud and theft.

This form needs to be completed by individuals or businesses that are registering a vehicle or vessel in Utah for the first time that is not a new unit purchased from a licensed and bonded Utah dealer. It serves as evidence that a proper inspection of the vehicle or vessel’s identification number has been conducted.

Inspections can be conducted and the form can be signed by a DMV employee, a designated contractor, a Utah peace officer, a licensed dealer, or a certified safety inspector. Additionally, inspections by out-of-state peace officers and authorized agents of other state motor vehicle offices are also accepted.

The TC-661 form requires:

Any alterations or erasures will void the document. It is crucial to ensure that all information is accurate and complete before submission to avoid the need for corrections, which would necessitate a new inspection and a new form.

Yes, the inspection can be conducted by an out-of-state peace officer or an authorized agent of another state's motor vehicle office. However, it is still necessary for the inspector to verify the identification number (VIN/HIN) as it appears on the unit and sign the form to validate the inspection.

The form can be obtained online at the official website of the Utah State Tax Commission (tax.utah.gov) or directly from a Utah Division of Motor Vehicles (DMV) office. It is recommended to download it directly from the website to ensure that you have the most current version.

The text provided does not specify if there is a fee for the inspection or for obtaining the form. Typically, fees may apply for the inspection service, but this can vary depending on who conducts the inspection. It is advised to contact the local DMV or inspection site directly for specific fee information.

Once the inspection is completed and the form is signed by an authorized inspector, the form should be submitted to the Utah Division of Motor Vehicles as part of the vehicle or vessel registration process. It is important to keep a copy of the form for your records and ensure all other registration requirements are met.

Common mistakes

When individuals attempt to complete the Utah Tc 661 form, there are several common mistakes that can create delays and potentially void the document. Understanding these mistakes is essential for ensuring that the process of vehicle registration moves smoothly and efficiently.

One frequent mistake involves the mishandling of the applicant information section. Applicants often inadvertently enter incomplete or incorrect data regarding their names, addresses, or business information. This section requires meticulous attention to detail since it forms the basis of the identity verification process. The correct input of the applicant’s last, first, and middle initial, alongside a precise business name if applicable, and a complete address including the street, city, state, and zip code, is crucial for the form’s validity.

In the Vehicle/Vessel Information section, errors are commonly made in detailing the Vehicle/Hull Identification Number (VIN/HAP) or serial number. This critical section is often compromised by either transposing numbers, omitting characters, or incorrectly identifying the VIN/HIN location. Such inaccuracies can lead to significant issues in the vehicle identification process, which is a mandatory step for registration.

Misidentifications or vague descriptions of the vehicle’s specifications, including year, make, model, body style, and engine details, are also problematic. The precision of this information assists in the accurate identification and registration of the vehicle. Furthermore, for trailers and watercraft, the specifics regarding length, hull material, and propulsion type are sometimes overlooked or improperly entered, further complicating the registration process.

- Not double-checking the completeness and accuracy of applicant information, which is foundational for the entire process.

- Entering incorrect or incomplete Vehicle/Vessel Identification Numbers (VIN/HIN), a critical error that can nullify the document.

- Failing to specify the VIN/HIN location accurately, leading to potential verification issues during the inspection process.

- Providing inaccurate vehicle details, such as the year, make, model, and specifications, which are essential for the accurate identification and registration of the vehicle.

- Omitting or incorrectly entering information related to trailers and watercraft, such as length, hull material, and propulsion type, which are necessary for correct identification and registration.

Another oversight happens within the Inspection Certification section. Applicants often forget that only specific individuals are authorized to perform and sign off on the inspection, including DMV employees, designated contractors, Utah peace officers, licensed dealers, or certified safety inspectors. Acceptance of inspections carried out by out-of-state peace officers requires an understanding that these should also be conducted by authorized agents, adhering strictly to the guidelines stipulated by the Utah State Tax Commission. Ensuring the correct authorization and documentation of the inspection certification is paramount to avoid the invalidation of the application.

To mitigate these common errors, it is recommended that applicants thoroughly review each section of the TC-661 form before submission, paying special attention to the accuracy and completeness of all entered information. Utilizing the guidance provided by the Utah State Tax Commission can also be invaluable in avoiding these pitfalls.

Documents used along the form

When dealing with vehicle registration and verification in Utah, particularly involving the Utah State Tax Commission Certificate of Inspection TC-661 form, there are often several other forms and documents that may be required or useful in the process. Each of these documents supports a specific part of the registration or inspection process, whether it’s verifying ownership, insurance, or compliance with state regulations.

- Title Application Form (TC-656): This form is used to apply for a vehicle title in Utah. It’s necessary when owning a vehicle for the first time or when transferring ownership. It verifies the legal ownership of the vehicle.

- Bill of Sale (TC-843): This document provides proof of purchase. It’s important for both buyer and seller in private vehicle sales. It lists detailed information about the vehicle, sale price, and both parties' information.

- Odometer Disclosure Statement (TC-891): Required for transactions involving vehicles less than ten years old. This statement ensures that the mileage of a vehicle is accurately reported at the time of sale or transfer of ownership.

- Application for Duplicate Title (TC-123): This form is necessary when the original vehicle title is lost, stolen, or damaged. It’s required to issue a new title under the vehicle owner’s name.

- VIN/HIN Inspection Form: Specific form used by authorized personnel to document the inspection of the vehicle or vessel’s VIN/HIN. This can be a part of or separate from the TC-661 certification depending on context.

- Proof of Insurance: Not a form, but essential documentation. Utah requires proof of insurance to register a vehicle. The information must be current and show that the vehicle meets the state’s minimum insurance requirements.

- Emission Inspection Certificate: In certain Utah counties, vehicles must pass an emission test to be registered. The certificate from this test must be submitted to prove the vehicle meets environmental standards.

Each of these forms and documents plays a crucial role in ensuring that vehicles are properly registered, safe for operation, and compliant with Utah’s state laws. The TC-661 form, alongside these additional documents, ensures a thorough and legal process for vehicle owners and operators within the state.

Similar forms

The Utah TC 661 Certificate of Inspection form shares similarities with the Vehicle Inspection Report (VIR), often required when registering or renewing a vehicle's registration. Both documents serve as a confirmation of the vehicle's condition and compliance with safety standards. The main similarity lies in their purpose: to ensure that the vehicle meets the state's safety and emission requirements. The TC 662 form focuses specifically on verifying the vehicle identification number (VIN) and other physical attributes of the vehicle, while the VIR encompasses a broader range of inspection criteria, including emissions testing and safety feature checks.

Another related document is the Application for Title or Registration, used in various states. Like the TC 661, this form requires detailed information about the vehicle or vessel, such as make, model, and VIN. Both forms are integral in the process of legally recognizing ownership and the right to operate the vehicle within the state. The key similarity lies in gathering critical information to ensure the vehicle's identification is accurately recorded in state databases, thereby preventing fraud and theft.

The Bill of Sale is another document that shares common ground with the TC 661. It provides proof of a transaction between a seller and a buyer, detailing the exchange of vehicle ownership. While the Bill of Sale focuses on the commercial aspect – selling and buying – the TC 661 emphasizes compliance with state regulations. However, both are crucial for the vehicle registration process, serving as legal documents that support ownership and identification verification.

The Odometer Disclosure Statement, required during the sale and purchase of a vehicle, parallels the TC 661 form in its contribution to preventing fraudulent activities. It records the vehicle's mileage at the time of sale, providing transparency and honesty in transactions. Similarly, the TC 661 form’s role in verifying the VIN and ensuring the vehicle's identity plays a pivotal part in maintaining the integrity of the vehicle registration system.

Similarly, the Salvage Certificate, issued for a vehicle that has been declared a total loss, shares common purposes with the TC 661. While the Salvage Certificate identifies vehicles that have sustained significant damage, the TC 661 form certifies the legitimacy and identification of a vehicle before it is registered. Both documents are essential in the lifecycle of a vehicle’s operation and legal status within the state.

The Emissions Testing Report is closely related to the Utah TC 661 form, particularly for vehicles in areas requiring emissions testing for registration renewal or initial registration. While the TC 661 form focuses on the physical inspection and verification of the vehicle's identification number, the Emissions Testing Report ensures that the vehicle meets environmental standards set by the state. Both inspections are vital for maintaining public safety and health standards.

The Lien Release document also correlates with the TC 661 in the broader context of vehicle ownership and registration. When a vehicle loan is fully paid off, a Lien Release is issued to remove the lender’s claim on the vehicle as collateral. This process is complementary to the inspection and verification aims of the TC 661, ensuring that all legal and regulatory hurdles are cleared for a vehicle's operation and ownership transfer.

Finally, the Dealer Reassignment Form is akin to the TC 661 form in the context of vehicle transactions. This form is used by dealers to document the transfer of a vehicle to another dealer or purchaser when the title lacks space for such information. It complements the TC 661 by further ensuring that vehicle identification and ownership details are thoroughly documented and legitimate, facilitating a transparent chain of ownership and compliance with state regulations.

Dos and Don'ts

When completing the Utah TC-661 Certificate of Inspection form, it's important to follow specific guidelines to ensure the process goes smoothly. Here are some dos and don'ts to keep in mind:

Do:- Read through the entire form before starting to fill it out, making sure you understand each section.

- Use blue or black ink to ensure legibility and to meet the standards required for official documents.

- Provide accurate and complete information in the Applicant Information section, including your full legal name or business name and your current address.

- Verify the Vehicle/Vessel Information thoroughly, including the VIN/HIN or serial number, to ensure all details are correct.

- Have the inspection carried out by a qualified individual, such as a DMV employee, designated contractor, Utah peace officer, licensed dealer, or a certified safety inspector as specified in Section 3 of the form.

- Ensure that the officer or agent conducting the inspection signs and dates the form, verifying the accuracy of the vehicle identification.

- Check the vehicle against the NCIC database, if applicable, to ensure no issues will prevent registration.

- Keep a copy of the completed form for your records before submitting it to the Utah State Tax Commission.

- Submit the form in a timely manner, according to the instructions provided by the Utah State Tax Commission.

- Contact the Utah State Tax Commission directly if you have any questions or need clarification on filling out the form.

- Attempt to fill out the form without having all the necessary information about the vehicle or vessel handy.

- Use a pencil or non-permanent writing instrument, as these can be altered easily, which might void the document.

- Provide false or incomplete information, as this could result in delays in processing or penalties.

- Forget to specify the location of the VIN/HIN on the vehicle or vessel, as this is crucial for identification purposes.

- Let someone unqualified conduct the inspection, as this could invalidate the certification section of the form.

- Sign the form without verifying all details against the actual vehicle or vessel to ensure accuracy.

- Ignore instructions for an NCIC check if required, as overlooking this step can lead to registration issues.

- Misplace the form before submission, as this could delay the entire process.

- Procrastinate in submitting the completed form, as there may be deadlines that need to be met.

- Hesitate to seek assistance from the Utah State Tax Commission if you encounter any issues or have doubts about how to properly fill out the form.

Misconceptions

When it comes to the Utah TC-661 Certificate of Inspection form, confusion often arises about its purpose, requirements, and the process involved. Clearance of misconceptions can streamline the registration process for many. Here are nine common misconceptions and the truths behind them:

- Misconception 1: The form is only for cars and trucks.

This is incorrect. The Utah TC-661 form is not just for cars and trucks but also applicable to boats, trailers, and any other vehicle types requiring a verification of their VIN or HIN (Hull Identification Number) before registration.

- Misconception 2: Only Utah residents need to complete this form.

While primarily for vehicles being registered in Utah, out-of-state vehicles coming into Utah for registration must also complete this form, ensuring that their identification numbers are verified as per Utah's requirements.

- Misconception 3: Any mechanic or individual can conduct the inspection.

In fact, inspections must be carried out by authorized personnel only. This includes DMV employees, designated contractors, Utah peace officers, licensed dealers, or certified safety inspectors. Out-of-state officers and authorized agents of other state motor vehicle offices are also accepted.

- Misconception 4: The form is valid even with alterations or erasures.

Any alteration or erasure on the document will void it. Accuracy and clarity are paramount while filling out the form, ensuring that all information is correct and legible.

- Misconception 5: The inspection only verifies the VIN/HIN.

While the primary purpose is to verify the VIN or HIN, the inspection may also include checks on the vehicle's year, make, model, body style, and other distinguishing features to ensure the identification number matches the actual vehicle.

- Misconception 6: The form can only be submitted in person.

Depending on the situation, there may be multiple submission options including mail, in person, or possibly online submission to the Utah State Tax Commission or DMV, though it's crucial to verify the most current process with state authorities.

- Misconception 7: It's not necessary for new vehicles sold by licensed Utah dealers.

That's accurate. New units sold by licensed and bonded Utah dealers are exempt from this requirement, as the dealership typically handles the necessary inspection and documentation for the first-time registration.

- Misconception 8: The inspection certificate is the only document needed for registration.

In addition to the TC-661 form, vehicle owners may need to provide additional documentation such as proof of ownership, a valid photo ID, and possibly proof of insurance, among others, to complete the registration process.

- Misconception 9: There's no need to check for theft or liens during this inspection.

The inspection certification section implies a check against the NCIC (National Crime Information Center) to see if the vehicle is stolen and may also involve checking for any outstanding liens. This ensures the vehicle is legally clear for registration.

Understanding these aspects of the Utah TC-661 Certificate of Inspection can significantly simplify the process for vehicle owners and ensure compliance with the state's regulations. Clearing up misconceptions ensures individuals are better prepared, with accurate expectations, as they navigate the registration or inspection process.

Key takeaways

Understanding how to properly fill out and use the Utah State Tax Commission Certificate of Inspection, known as the TC-661 form, is crucial for anyone aiming to register a vehicle in Utah for the first time. Here are seven key takeaways that can help simplify the process:

- Specific Purpose: The TC-661 form is essential for the inspection and verification of a vehicle’s or hull’s identification number (VIN/HIN) for units being registered in Utah for the first time, excluding those sold by licensed and bonded Utah dealers.

- Complete Applicant Information: Section 1 requires the complete details of the applicant, including the full name (or business name) and address. Make sure this information is accurate to avoid any processing delays.

- Detailed Vehicle/Vessel Information: It’s important to provide a detailed description of the vehicle or vessel in Section 2. This includes the VIN/HIN, plate number, year, make, model, and specific characteristics like body style, engine size, or hull material for watercraft.

- Inspection Certification: Section 3 must be completed by an authorized individual. Only a DMV employee, designated contractor, Utah peace officer, licensed dealer, or a certified safety inspector can verify the VIN/HIN and sign off on the inspection. Inspections by out-of-state peace officers or agents from other states’ motor vehicle offices are also accepted.

- Accuracy is Critical: Any alteration or erasure on the form will void the document. It’s paramount to double-check all entries for accuracy before submission to ensure the integrity of the inspection certification.

- Follow Up on NCIC and NLETS Searches: The form includes sections for office use only, mentioning NCIC and NLETS searches regarding the vehicle or vessel’s record. While these sections are for internal use, being aware that these checks are part of the process can offer insights into potential delays or issues.

- Availability: This form, along with additional resources, can be obtained online at the Utah State Tax Commission's official website, making it convenient to access and review the form before going through the actual inspection process.

Properly completing the TC-659 form is a straightforward process once you understand its components and requirements. Ensuring that all sections are filled out correctly and that the document’s integrity is maintained by avoiding alterations are critical steps toward successful vehicle or vessel registration in Utah.

Common PDF Templates

Cpe Ut - Completing the form accurately protects licensees from penalties and supports the public's trust in accounting services.

Income Tax Calculator Utah - A section is included for paid preparers, requiring their signature, contact information, and identifying numbers.

Utah Contractor License Bond - Serves as a critical tool in maintaining professional integrity and public safety by ensuring only qualified individuals are granted the right to practice.