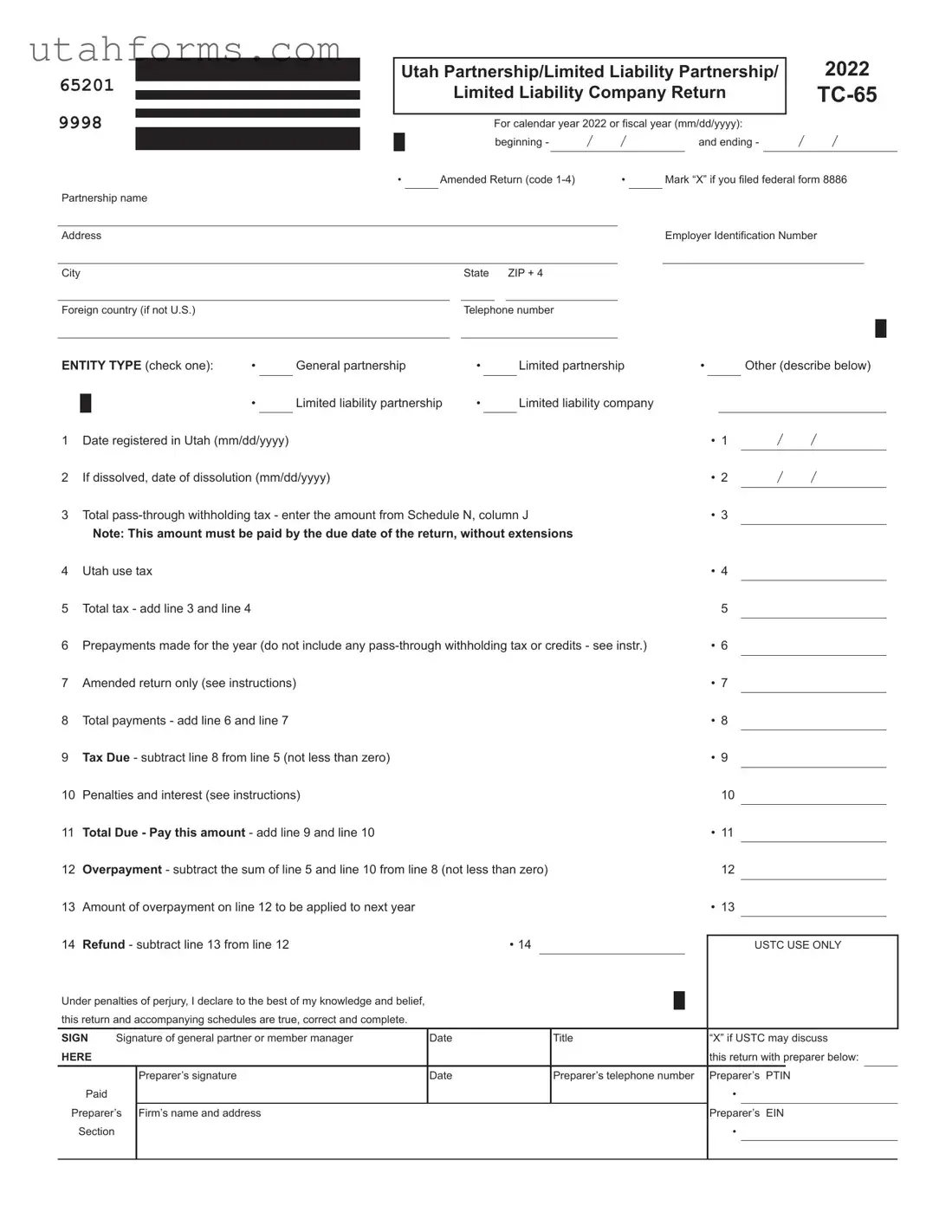

Fill Out Your Utah Tc 65 Form

The Utah TC-65 form is a document specifically designed for partnerships and limited liability companies (LLCs) that signals to the Utah State Tax Commission how these entities have operated financially within a tax year. It's a composite report that encompasses the fiscal performance, including income, deductions, and taxes owed or overpaid, offering a comprehensive view of an entity's financial status to the state. Both general partnerships, limited partnerships, limited liability partnerships, and LLCs must navigate through sections covering varied elements such as pass-through withholding tax, Utah use tax, and payments made throughout the year. Additionally, the form delineates instructions for amended returns, outlining a methodical approach to correcting previously submitted information. This mandatory submission plays a crucial role in ensuring compliance with Utah's tax laws, helping manage the state's tax framework efficiently. By including details about taxable income, partner contributions, foreign taxes, and Section 179 deductions, the TC-65 form serves as a vital tool for state tax assessment and enforcement, essentially streamlining the process for handling partnership and LLC tax obligations in Utah.

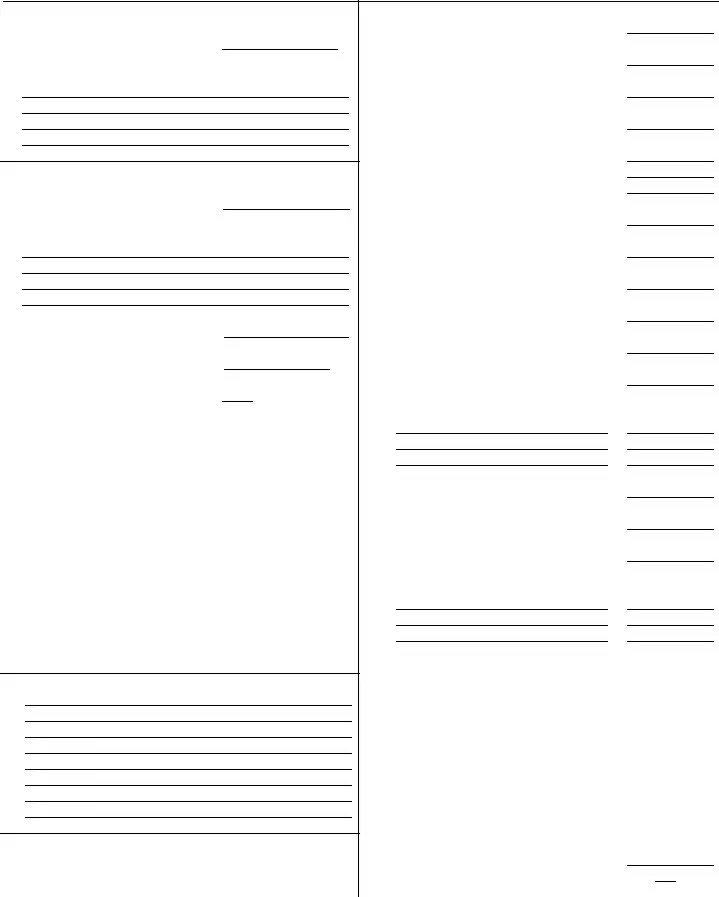

Preview - Utah Tc 65 Form

65201

9998

USTC ORIGINAL FORM

Partnership name

Address

City

Utah Partnership/Limited Liability Partnership/ |

|

2022 |

||||||||||

|

|

Limited Liability Company Return |

|

|||||||||

|

|

For calendar year 2022 or fiscal year (mm/dd/yyyy): |

|

|

|

|||||||

|

|

beginning - |

/ |

/ |

|

|

and ending - |

/ |

/ |

|

||

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

||

• |

|

Amended Return (code |

|

• |

Mark “X” if you filed federal form 8886 |

|||||||

|

|

|

|

|

|

|

Employer Identification Number |

|

|

|||

|

|

|

|

|

|

|

|

|

||||

|

|

State ZIP + 4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Foreign country (if not U.S.)Telephone number

ENTITY TYPE (check one): |

• |

General partnership |

• |

|

Limited partnership |

• |

|

Other (describe below) |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

Limited liability partnership |

• |

|

Limited liability company |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

Date registered in Utah (mm/dd/yyyy) |

|

|

|

|

|

|

• 1 |

/ |

/ |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

2 |

If dissolved, date of dissolution (mm/dd/yyyy) |

|

|

|

|

|

• 2 |

/ |

/ |

||||||

3 |

Total |

|

• 3 |

|

|

|

|||||||||

|

|

|

|

||||||||||||

|

|

Note: This amount must be paid by the due date of the return, without extensions |

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

||||||||

4 |

Utah use tax |

|

|

|

|

|

|

|

|

• 4 |

|

|

|

||

5 |

Total tax - add line 3 and line 4 |

|

|

|

|

|

|

|

5 |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

||||||

6 |

Prepayments made for the year (do not include any |

|

• 6 |

|

|

|

|||||||||

|

|

|

|

||||||||||||

7 |

Amended return only (see instructions) |

|

|

|

|

|

• 7 |

|

|

|

|||||

|

|

|

|

|

|

|

|

||||||||

8 |

Total payments - add line 6 and line 7 |

|

|

|

|

|

|

• 8 |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|||||||

9 |

Tax Due - subtract line 8 from line 5 (not less than zero) |

|

|

|

|

|

• 9 |

|

|

|

|||||

|

|

|

|

|

|

|

|

||||||||

10 |

Penalties and interest (see instructions) |

|

|

|

|

10 |

|

|

|

||||||

|

|

|

|

|

|

|

|||||||||

11 |

Total Due - Pay this amount - add line 9 and line 10 |

|

|

|

|

|

• 11 |

|

|

|

|||||

|

|

|

|

|

|

|

|

||||||||

12 |

Overpayment - subtract the sum of line 5 and line 10 from line 8 (not less than zero) |

12 |

|

|

|

||||||||||

|

|

|

|||||||||||||

13 |

Amount of overpayment on line 12 to be applied to next year |

|

|

|

|

|

• 13 |

|

|

|

|||||

|

|

|

|

|

|

|

|

||||||||

14 |

Refund - subtract line 13 from line 12 |

|

|

• 14 |

|

|

|

|

|

||||||

|

|

|

|

|

|

USTC USE ONLY |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Under penalties of perjury, I declare to the best of my knowledge and belief, |

|

|

|

|

|

|

|

|

|

||

this return and accompanying schedules are true, correct and complete. |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||||

SIGN |

Signature of general partner or member manager |

Date |

Title |

“X” if USTC may discuss |

|||||||

HERE |

|

|

|

|

|

|

this return with preparer below: |

||||

|

|

|

|

|

|

|

|

|

|

||

|

|

Preparer’s signature |

Date |

Preparer’s telephone number |

Preparer’s |

PTIN |

|||||

Paid |

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Preparer’s |

Firm’s name and address |

|

|

|

|

Preparer’s |

EIN |

||||

Section |

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

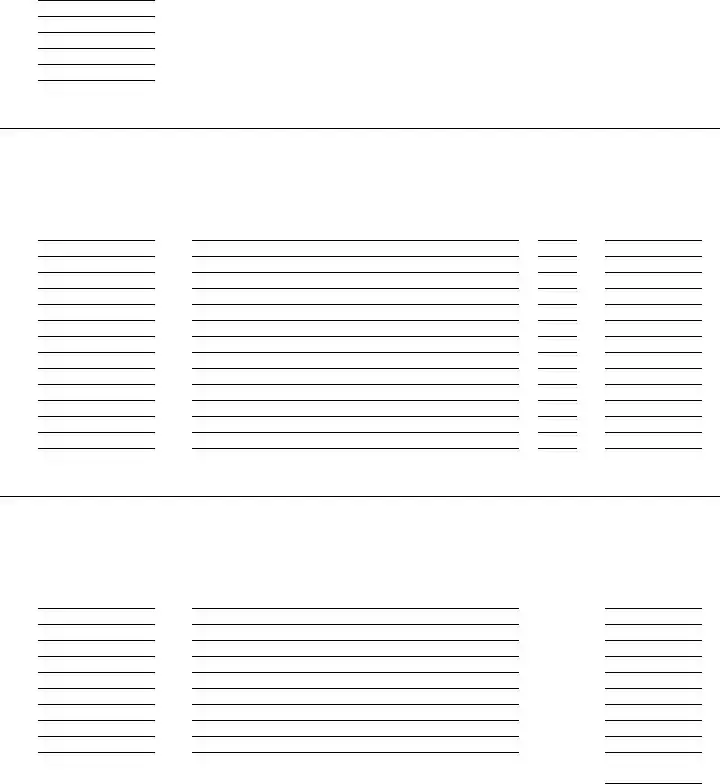

Schedule A - Utah Taxable Income for |

||||||

65202 |

EIN |

|

|

2022 |

|

|

||

USTC ORIGINAL FORM |

|

|

|

|

||||

1 |

Net income/loss from federal form 1065, Schedule K, Analysis of Net Income (Loss), line 1 |

• 1 |

||||||

|

|

|

|

|

|

|||

2 |

Contributions from federal form 1065, Schedule K, line 13a |

• 2 |

||||||

|

|

|

|

|

|

|||

3 |

Foreign taxes from federal form 1065, Schedule K, line 21 |

• 3 |

||||||

|

|

|

|

|

|

|||

4 |

Recapture of Section 179 deduction from all federal Schedules |

• 4 |

||||||

|

|

|

|

|

|

|||

5 |

Payroll Protection Program grant or loan addback (see instructions) |

• 5 |

||||||

|

|

|

|

|

|

|||

6 |

(Reserved, see instructions) |

• 6 |

||||||

7 |

Total income/loss - add lines 1 through 6 |

7 |

|

|

|

|||

|

|

|

||||||

|

|

|

|

|

|

|||

8 |

Total guaranteed payments to partners (see instructions) |

• 8 |

||||||

|

|

|

|

|

|

|||

9 |

Health insurance included in guaranteed payments on line 8 |

• 9 |

||||||

10 |

Net guaranteed payments to partners - subtract line 9 from line 8 |

10 |

|

|

|

|||

|

|

|

||||||

|

|

|

|

|

||||

11 |

Utah net nonbusiness income from |

• 11 |

||||||

|

|

|

|

|

|

|||

12 |

• 12 |

|||||||

13 |

Add lines 10 through 12 |

13 |

|

|

|

|||

|

|

|

||||||

|

|

|

|

|

||||

14 |

Apportionable income/loss - subtract line 13 from line 7 |

• 14 |

||||||

|

|

|

|

|

||||

15 |

Apportionment fraction - enter 1.000000, or |

• 15 |

||||||

|

|

|

|

|

|

|||

16 |

Utah apportioned business income/loss - multiply line 14 by line 15 |

• 16 |

||||||

|

|

|

|

|

||||

17 |

Total Utah income/loss allocated to |

• 17 |

||||||

|

|

|

|

|

|

|

|

|

Schedule H - Utah Nonbusiness Income Net of Expenses |

Pg. 1 |

|||||

20261 EIN |

|

|

|

|

2022 |

|

USTC ORIGINAL FORM |

|

|

(use with |

|

||

|

|

|

|

|

|

|

Note: Failure to complete this form may result in disallowance of the nonbusiness income. |

|

|

|

|

|||||||

Part 1 - Utah Nonbusiness Income (nonbusiness income allocated to Utah) |

|

|

|

|

|||||||

|

|

|

|

||||||||

|

|

|

|

||||||||

|

A |

B |

|

|

C |

D |

|

E |

|||

|

Type of Utah |

Acquisition Date of |

|

Beginning Value of Investment |

Ending Value of Investment |

|

Utah Nonbusiness Income |

||||

|

Nonbusiness Income |

Utah Nonbusiness |

|

Used to Produce Utah |

Used to Produce Utah |

|

|

|

|||

|

|

|

Asset(s) |

|

|

Nonbusiness Income |

Nonbusiness Income |

|

|

|

|

1a |

/ |

/ |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

1b |

/ |

/ |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

1c |

/ |

/ |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

1d |

/ |

/ |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

1e |

/ |

/ |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

2Total of column C and column D

3Total Utah nonbusiness income - add column E for lines 1a through 1e

|

Description of direct expenses related to: |

Amount of Direct Expense |

||

4a |

Line 1a above |

|

||

|

|

|

|

|

4b |

Line 1b above |

|

||

|

|

|

|

|

4c |

Line 1c above |

|

||

|

|

|

|

|

4d |

Line 1d above |

|

||

|

|

|

|

|

4e |

Line 1e above |

|

||

|

|

|

|

|

5Total direct related expenses - add lines 4a through 4e

6 |

Utah nonbusiness income net of direct related expenses - subtract line 5 from line 3 |

|

• |

||

|

|

Column A |

Column B |

||

|

Indirect Related Expenses for |

Total Assets Used to Produce |

Total Assets |

||

|

Utah Nonbusiness Income |

Utah Nonbusiness Income |

|

|

|

7 |

|

|

|

|

|

|

(enter in Column A the amount from line 2, col. C) |

|

|

|

|

|

|

|

|

|

|

8

(enter in Column A the amount from line 2, col. D)

9Sum of beginning and ending asset values (add line 7 and line 8)

10Average asset value - divide line 9 by 2

11Utah nonbusiness assets ratio - line 10, Column A, divided by line 10, Column B (to four decimal places)

12Interest expense deducted in computing Utah taxable income (see instructions)

13Indirect related expenses for Utah nonbusiness income - multiply line 11 by line 12

14 Total Utah nonbusiness income net of expenses - subtract line 13 from line 6 |

|

• |

|

Enter on: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Schedule H - |

Pg. 2 |

|||||

20262 EIN |

|

|

|

|

2022 |

|

USTC ORIGINAL FORM |

|

|

(use with |

|

||

|

|

|

|

|

|

|

Part 2 -

|

A |

B |

|

|

C |

D |

|

E |

||

|

Type of |

Acquisition Date of |

|

Beginning Value of Investment |

Ending Value of Investment |

|

||||

|

Nonbusiness Income |

|

|

Used to Produce |

Used to Produce |

|

Income |

|||

|

|

|

Nonbusiness Asset(s) |

|

Nonbusiness Income |

Nonbusiness Income |

|

|

||

15a |

/ |

/ |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

15b |

/ |

/ |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

15c |

/ |

/ |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

15d |

/ |

/ |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

15e |

/ |

/ |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

16Total of column C and column D

17Total

|

Description of direct expenses related to: |

|

|

|

|

|

Amount of Direct Expense |

|

18a |

Line 15a above |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18b |

Line 15b above |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18c |

Line 15c above |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18d |

Line 15d above |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18e |

Line 15e above |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19 |

Total direct related expenses - add lines 18a through 18e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

20 |

• |

|||||||

|

|

|

Column A |

Column B |

|

|

||

|

|

|

|

|

||||

|

Indirect Related Expenses for |

Total Assets Used to Produce |

Total Assets |

|

|

|||

|

|

|

|

|

||||

21 |

|

|

|

|

|

|

||

|

(enter in Column A the amount from line 16, col. C) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

22 |

|

|

|

|

|

|

||

|

(enter in Column A the amount from line 16, col. D) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

23Sum of beginning and ending asset values (add line 21 and line 22)

24Average asset value - divide line 23 by 2

25

26Interest expense deducted in computing

27Indirect related expenses for

28 Total |

• |

|

Enter on: |

|

|

|

|

|

|

|

|

Schedule J - Apportionment Schedule |

Pg. 1 |

|||||

20263 EIN |

|

|

|

|

2022 |

|

USTC ORIGINAL FORM |

|

|

(use with |

|

||

|

|

|

|

|

|

|

Note: Use this schedule only if the entity does business in Utah and one or more other states and income must be apportioned to Utah.

Briefly describe the nature and location(s) of your Utah business activities:

Apportionable Income Factors

|

|

|

|

|

Column A |

|

Column B |

|||

1 |

Property Factor |

|

|

Inside Utah |

|

Inside and Outside Utah |

||||

|

a |

Land |

• 1a |

• |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

b |

Depreciable assets |

• 1b |

• |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

c |

Inventory and supplies |

• 1c |

• |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

d |

Rented property |

• 1d |

• |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

e |

Other allowable property (see instructions) |

• 1e |

• |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

f |

Total tangible property - add lines 1a through 1e |

• 1f |

• |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||

2 |

Property factor - divide line 1f, Column A, by line 1f, Column B (to six decimal places) |

• |

2 |

|

|

|

||||

3 |

Payroll Factor |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

a |

Total wages, salaries, commissions and other compensation |

• 3a |

• |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||

4 |

Payroll factor - divide line 3a, Column A, by line 3a, Column B (to six decimal places) |

• |

4 |

|

|

|

||||

5 |

Sales Factor |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

a |

Total sales (gross receipts less returns and allowances) |

|

|

|

• |

5a |

|||

|

b |

Sales delivered or shipped to Utah buyers from outside Utah |

• 5b |

|

|

|

|

|

||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

c |

Sales delivered or shipped to Utah buyers from within Utah |

• 5c |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

d |

Sales shipped from Utah to the United States government |

• 5d |

|

|

|

|

|

||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

e |

Sales shipped from Utah to buyers in states where the corp. |

• 5e |

|

|

|

|

|

||

|

|

has no nexus (corporation not taxable in buyer’s state) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

f |

Rent and royalty income |

• 5f |

• |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

g |

Services and other allowable sales (see instructions) |

• 5g |

• |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

h |

Total sales (add lines 5a through 5g) |

• 5h |

• |

|

|

|

|

||

|

|

|

|

|

|

|

||||

6 Sales factor - line 5h, Column A, divided by line 5h, Column B (to six decimals) |

• |

6 |

|

|

|

|||||

|

|

Continued on page 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Schedule J - Apportionment Schedule |

Pg. 2 |

|||||

20264 EIN |

|

|

2022 |

|

|

|

||

USTC ORIGINAL FORM |

(use with |

|

|

|||||

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

7 All entities - enter your NAICS code here (see instructions) |

• 7 |

|

|

||||

Apportionment Fraction |

|

|

|

|

||||

|

|

|

|

|||||

|

Optional apportionment taxpayers (see instructions) complete Part 1 or Part 2. |

|

|

|

|

|||

|

Sales factor weighted taxpayers (see instructions) complete Part 2. |

|

|

|

|

|||

Part 1:

8 |

Total factors - add lines 2, 4 and 6 |

|

8 |

9 |

Calculate the Apportionment Fraction to SIX DECIMALS |

• |

9 |

|

Divide line 8 by 3 (or the number of factors present) |

|

|

Part 2: Sales Factor Formula (see instructions for those who qualify) |

|

|

|

10 |

Apportionment Fraction - enter the |

• |

10 |

Enter the fraction from line 9 or line 10, above, as follows:

Schedule K - Partners’ Distribution Share Items |

|

|

|||

65203 EIN |

|

|

2022 |

||

USTC ORIGINAL FORM |

|

|

|

||

Number of Schedules |

• |

||||

|

|

|

|

|

|

Income/Loss

Deductions

Utah Credits

Federal Amount |

Utah Amount |

1Ordinary business income/loss

2Net rental real estate income/loss

3 Other net rental income/loss

4 Guaranteed payments

5a U.S. government interest income

5b Municipal bond interest income

5c Other interest income

6Ordinary dividends

7 Royalties

8 Net

9 Net

10 Net Section 1231 gain/loss

11 Recapture of Section 179 deduction

12 Other income/loss (describe)

13Section 179 deduction

14Contributions

15Foreign taxes paid or accrued

16Other deductions (describe)

17 Utah nonrefundable credits - enter the name of the Utah credit |

Code |

|

Credit Amount |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18 Utah refundable credits - enter the name of the Utah credit |

Code |

|

Credit Amount |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19 Total Utah tax withheld on behalf of all partners from Schedule N, column J

|

Schedule |

|

65204 |

of Utah Income, Deductions and Credits |

2022 |

USTC ORIGINAL FORM

Partnership Information

APartnership’s EIN:

BPartnership’s name, address, city, state, and ZIP code

Partner Information

C Partner’s SSN or EIN:

D Partner’s name, address, city, state, and ZIP code

EPartner’s phone number

F Percent of ownership

G Enter “X” if limited partner or member

H Entity code from list below: |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I = Individual |

|

|

P = Gen’l Partnership |

|

|

||||||

|

C = Corporation |

|

L = Limited Partnership |

|

|

|||||||

|

Codes |

|

|

|

||||||||

|

S = S Corporation |

|

B = LLC |

|

|

|

|

R = LLP |

||||

|

N = Nonprofit Corp. |

|

T = Trust |

|

|

|

|

O = Other |

||||

|

|

|

|

|

|

|

||||||

I |

Enter date: |

|

/ |

/ |

/ |

/ |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

affiliated |

|

|

|

|

withdrawn |

|||

|

|

|

|

|

|

|

|

|

||||

Partner’s Share of Apportionment Factors |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

Utah |

|

|

|

|

|

Total |

|

J |

Property |

$ |

|

|

$ |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

||

K |

Payroll |

$ |

|

|

$ |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

L |

Sales |

|

$ |

|

|

$ |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Information

Note: To complete lines 1 through 16:

*Utah residents, enter the amounts from federal Schedule

*Utah nonresidents, see instructions to calculate amounts.

All filers complete lines 17 through 19, if applicable.

Partner’s Share of Utah Income, Deductions and Credits

1Utah ordinary business income/loss

2Utah net rental real estate income/loss

3 Utah other net rental income/loss

4 Utah guaranteed payments

5a Utah U.S. government interest income

5b Utah municipal bond interest income

5c Utah other interest income

6Utah ordinary dividends

7 Utah royalties

8 Utah net

9 Utah net

10 Utah net Section 1231 gain/loss

11 Utah recapture of Section 179 deduction

12 Utah other income/loss (describe)

13Utah Section 179 deduction

14Contributions

15Foreign taxes paid or accrued

16Utah other deductions (describe)

17Utah nonrefundable credits:

Name of Credit |

Code |

Credit Amount |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18 Utah refundable credits:

Name of Credit |

Code |

Credit Amount |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19Utah tax withheld on behalf of partner “X” if withholding waiver applied for

Schedule N - |

|

|||

65205 EIN |

|

|

|

2022 |

USTC ORIGINAL FORM

A partnership with nonresident individual partners, resident/nonresident business partners, or resident/nonresident trust or estate partners must complete the information below to calculate the Utah withholding tax for these partners. See instructions for column G, column H and column I.

WITHHOLDING WAIVER CLAIMED under |

|

• |

|||||||||||||||||||||||||||

Enter "1" to claim a waiver for ALL partners (enter "X" in column B and "0" in column F for all partners) |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

Enter "2" to claim a waiver for SOME partners (enter "X" in column B and "0" in column F for those partners claimed) |

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

||||||||||||||||||||||||

|

See Schedule N instructions for liability responsibilities when claiming a waiver. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

A |

Name of partner |

|

|

|

|

E |

Income/loss |

F |

4.85% of income - |

G |

Mineral production |

J Withholding tax |

|||||||||||||||||

B |

Withholding waiver for this partner |

|

|

attributable to Utah |

|

|

E times .0485 |

|

|

|

withholding credit |

|

to be paid by |

||||||||||||||||

|

(enter “X” in column B and “0” in column F) |

|

|

plus Utah source |

|

|

(not less than zero) H |

|

this partnership |

||||||||||||||||||||

C |

SSN or EIN of partner |

|

|

|

|

|

|

guaranteed pymts |

|

|

|

|

|

|

|

through withholding |

|

F less G, H and I |

|||||||||||

D |

Partner’s % of income or ownership |

|

|

(see instructions) |

|

|

|

|

I Tax paid by PTE |

|

(not less than 0) |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

#1 |

A |

|

|

|

|

|

E |

|

|

|

|

F |

|

|

G |

|

|

J |

|||||||||||

• |

B |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

H |

|

|

|

|

|

|

|

|

|

|||

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

D |

|

|

|

|

|

|

|

|

|

|

I |

|

|

|

|

|

|

|

|

|||||||||

#2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

A |

|

|

|

|

|

E |

|

|

|

|

F |

|

|

G |

|

|

J |

||||||||||||

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

B |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

H |

|

|

|

|

|

|

|

|

|||||

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

C |

D |

|

|

|

|

|

|

|

|

|

|

I |

|

|

|

|

|

|

|

|

|||||||||

#3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

A |

|

|

|

|

|

E |

|

|

|

|

F |

|

|

G |

|

|

J |

||||||||||||

• |

B |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

H |

|

|

|

|

|

|

|

|

|

|||

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

C |

D |

|

|

|

|

|

|

|

|

|

|

I |

|

|

|

|

|

|

|

|

|||||||||

#4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

A |

|

|

|

|

|

E |

|

|

|

|

F |

|

|

G |

|

|

J |

||||||||||||

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

B |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

H |

|

|

|

|

|

|

|

|

|||||

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

C |

D |

|

|

|

|

|

|

|

|

|

|

I |

|

|

|

|

|

|

|

|

|||||||||

#5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

A |

|

|

|

|

|

E |

|

|

|

|

F |

|

|

G |

|

|

J |

||||||||||||

• |

B |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

H |

|

|

|

|

|

|

|

|

|

|||

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

C |

D |

|

|

|

|

|

|

|

|

|

|

I |

|

|

|

|

|

|

|

|

|||||||||

#6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

A |

|

|

|

|

|

E |

|

|

|

|

F |

|

|

G |

|

|

J |

||||||||||||

• |

B |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

H |

|

|

|

|

|

|

|

|

|

|||

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

C |

D |

|

|

|

|

|

|

|

|

|

|

I |

|

|

|

|

|

|

|

|

|||||||||

#7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

A |

|

|

|

|

|

E |

|

|

|

|

F |

|

|

G |

|

|

J |

||||||||||||

• |

B |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

H |

|

|

|

|

|

|

|

|

|

|||

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

D |

|

|

|

|

|

|

|

|

|

|

I |

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Report the partner’s |

|

|

|

|

Total Utah withholding tax to be paid by this partnership: |

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

tax from column J on Schedule |

|

|

|

|

Enter on |

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

Credits Received from |

|||

25201 and Mineral Production Withholding Tax Credit on |

2022 |

||

EIN |

|

|

(use with |

USTC ORIGINAL FORM

Part 1 - Utah Nonrefundable Credits Received from

1

2

3

4

5

6

|

|

|

|

UT nonrefundable |

Name of |

|

Credit |

credit from |

|

from Utah Schedule |

|

Code |

Utah Sch. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enter these credits on Utah

Part 2 - Utah Refundable Credits Received from

Name of |

Credit |

UT refundable credit |

from Utah Schedule |

Code |

from Utah Sch. |

1

2

3

4

5

6

7

8

9

10

11

12

13

14

Enter these credits on Utah

Part 3 - Utah Mineral Production Withholding Tax Credit Received on

|

|

Mineral production |

Producer EIN from |

|

withholding from |

Producer’s name from |

1

2

3

4

5

6

7

8

9

10

Total Utah mineral production withholding tax credit received on

Enter total credit on Utah

File Specifications

| Fact | Detail |

|---|---|

| Form Type | Utah TC-65 Form |

| Applicability | For Partnerships and Limited Liability Companies (LLCs) |

| Year | 2020 |

| Entity Types Covered | General Partnership, Limited Partnership, Limited Liability Partnership, Limited Liability Company |

| Key Features | Includes sections for reporting Utah taxable income, pass-through withholding tax, Utah use tax, and total payments made. |

| Amended Return Option | Provides option to mark an amended return with specific codes (1-4). |

| Attachments | Requires attachment of federal forms such as 8886, Schedule A from Utah Taxable Income for Pass-through Entity Taxpayers, Schedule H for Utah and Non-Utah Nonbusiness Income Net of Expenses, and Schedule J for Apportionment Schedule. |

| Governing Law | Regulated under Utah state law |

| Due Date | Must be filed for the calendar year 2020 or fiscal year beginning and ending specified by the filer |

How to Write Utah Tc 65

After gathering all the necessary information and documents related to your partnership or limited liability company, the next step is to complete the Utah TC-65 form. This document is essential for reporting your entity's income, deductions, and taxes for either the calendar year 2020 or a fiscal year starting and ending on specified dates. It's important to review each part carefully and provide accurate information to avoid any potential issues with your return.

- Start by writing the name of the partnership and the address, including city, state, and ZIP+4 code at the top of the TC-65 form.

- Enter the Employer Identification Number (EIN) and the full telephone number.

- Specify the entity type by checking the appropriate box: General Partnership, Limited Partnership, Limited Liability Partnership, Limited Liability Company, or Other (with a brief description).

- Fill in the registration date in Utah using the format (mm/dd/yyyy).

- If applicable, enter the date of dissolution in Utah using the same date format.

- Under the section titled "Utah Tax Due," enter the total pass-through withholding tax from Schedule N, column I, in line 3.

- Calculate and enter the Utah use tax on line 4.

- Add lines 3 and 4 to determine the total tax due and enter this amount on line 5.

- Enter any prepayments made during the year on line 6, ensuring not to include pass-through withholding tax or credits.

- If filing an amended return, follow the specific instructions and enter applicable amounts on line 7.

- Add lines 6 and 7 to calculate the total payments and write this amount on line 8.

- Subtract line 8 from line 5 to determine the tax due and enter this on line 9. If less than zero, write "0".

- Consult the instructions to calculate any penalties and interest, then enter those amounts on line 10.

- Add lines 9 and 10 to calculate the total amount due and enter this on line 11.

- Determine the overpayment amount by subtracting the sum of line 5 and line 10 from line 8. Enter the result on line 12.

- Decide how much of the overpayment on line 12 to apply to next year's taxes and enter that amount on line 13.

- To calculate the refund, subtract line 13 from line 12 and enter the result on line 14.

- Complete the signature section at the bottom of the form. It must be signed by a general partner or member manager, including their title and date. Provide contact information for the preparer, if applicable.

After completing all necessary sections and reviewing for accuracy, your next steps will involve attaching any required schedules, making a copy of the completed form for your records, and submitting the original form to the Utah State Tax Commission by the due date. If you owe any tax, be prepared to make the payment through the appropriate channels specified by the state tax commission.

Frequently Asked Questions

What is the purpose of Utah TC-65 Form?

The Utah TC-65 Form is the tax return form used by partnerships, limited partnerships, limited liability partnerships, and limited liability companies that do business in Utah. It gathers information on income, deductions, and credits, which helps in determining the amount of state tax liability for these entities.

Who needs to file the Utah TC-65 Form?

Any partnership or limited liability company (LLC) that engages in business in Utah or earns income from Utah sources is required to file the TC-65 Form.

When is the Utah TC-65 Form due?

The due date for filing the TC-65 Form is the 15th day of the 4th month following the end of the fiscal year. For entities operating on a calendar year basis, this means the form is due by April 15th of the following year.

What are the penalties for submitting the Utah TC-65 late?

Penalties for late submission of the Utah TC-65 Form can be assessed in the form of late filing fees and interest on any taxes due. These penalties increase the longer the delay in filing.

How can an entity amend a previously filed Utah TC-65 Form?

To amend a previously filed TC-65, select the "Amended Return" option on the form and provide the corrected information. Be sure to include an explanation for the amendments.

Is electronic filing an option for the Utah TC-65 Form?

Yes, electronic filing is available and encouraged for the TC-65 Form. Filing electronically can expedite the processing of returns and refunds.

What attachments are required with the Utah TC-65 Form?

Attachments typically include a copy of the federal return, Schedule K-1s for each partner or member, and any other required schedules such as Schedule A for Utah Taxable Income and Schedule H for nonbusiness income, among others.

How is total tax on the Utah TC-65 calculated?

Total tax is calculated by combining the total pass-through withholding tax from Schedule N and Utah use tax. Additional credits or prepayments are then subtracted to determine the final tax due or refund.

Can the TC-65 be used for bulk filing for multiple entities?

Bulk filing is not directly facilitated through the TC-65 Form itself. However, tax professionals or entities managing multiple partnerships or LLCs should check with the Utah State Tax Commission for possible electronic bulk filing options.

Common mistakes

Filling out tax forms can be a complex task, often leading to common mistakes. The Utah TC-65 form, used by partnerships and limited liability companies to report income, is no exception. Here are several errors to avoid for a smoother process:

- Incorrect Entity Type Selection: Not checking the correct entity type box at the beginning of the form can lead to confusion and incorrect processing of the form. It is crucial to accurately identify whether the entity is a General Partnership, Limited Partnership, Limited Liability Partnership, or Limited Liability Company.

- Registration and Dissolution Dates: Missing or incorrect dates for when the entity was registered in Utah or dissolved (if applicable) can affect the accuracy of the return. These dates are essential for understanding the entity's status during the tax year.

- Pass-through Withholding Tax Errors: Some entities incorrectly calculate the total pass-through withholding tax or fail to enter it on line 3. This figure must include all relevant withholding taxes and be paid by the return’s due date, without any extension.

- Utah Use Tax Oversight: Neglecting to report Utah use tax on line 4 is a common oversight. Entities often overlook or miscalculate this tax, which pertures to the use, consumption, or storage of goods and services in Utah for which sales tax has not been paid.

- Incorrect Total Payments Calculation: Combining pass-through withholding tax or credits with prepayments on line 6 causes errors in the total payments calculation. It’s important to include only the prepayments made for the year, excluding any pass-through withholding tax or credits.

- Failing to Sign the Form: An unsigned form is one of the most straightforward yet frequent mistakes. The form requires signatures from a general partner or member manager to certify its accuracy under penalties of perjury. Not signing the form can result in it being returned or not processed.

- Forgetting to Check the Amended Return Box: If filing an amended return, it’s crucial to mark the “X” in the designated box for amended returns and to include the appropriate code. Failing to do so can lead to the amended return not being recognized as such, potentially causing confusion and delays.

In conclusion, paying close attention to details and thoroughly reviewing the Utah TC-65 form before submitting it can significantly reduce the risk of errors. By avoiding these common mistakes, entities can ensure their tax processing goes as smoothly as possible.

Documents used along the form

When preparing and submitting the Utah TC-65 form, which is the return document for partnerships, limited liability partnerships, and limited liability companies, it's crucial to gather and complete several other documents. These documents ensure that your filing is accurate and compliant with Utah tax laws. Here's a rundown of other forms and documents that are often used alongside the TC-65 form, providing a comprehensive approach to your tax preparation needs.

- Federal Form 1065: This is the U.S. Return of Partnership Income form. It's essential for providing the federal tax information of the partnership, including income, gains, losses, deductions, and credits.

- Schedule K-1 (Form 1065): This schedule is used to report each partner's share of the partnership's earnings, losses, deductions, and credits. It must be filed with the federal form 1065.

- TC-20: If the entity also files as a corporation in Utah, the TC-20, Utah Corporation Franchise or Income Tax Return, may be necessary. It details the corporation's income, deductions, and tax liability.

- TC-20S: This form is the Utah S Corporation Return Form, required for S corporations operating within the state. It captures the income, deductions, and credits of the S corporation.

- Schedule H: Both Utah Nonbusiness and Non-Utah Nonbusiness Income Net of Expenses Schedules are vital for calculating nonbusiness income allocated within and outside of Utah.

- Schedule A: Utah Taxable Income for Pass-through Entity Taxpayers. This schedule is specifically designed for detailing the income adjustments and tax calculations for pass-through entities.

- Schedule J: This is the Apportionment Schedule, used if the entity does business in Utah and other states. It helps in distributing income and deductions based on the business activity in Utah.

- Form 8886: Reportable Transaction Disclosure Statement, which might be necessary if the partnership is involved in certain types of transactions that need to be disclosed to the IRS.

- UT Form W-2: Wage and Tax Statements for employees, if the partnership has any. Although not directly part of the TC-65, they're crucial for complete tax reporting.

- UT Form 1099: This includes various types of 1099 forms relevant for reporting non-employee compensation, interest, dividends, and other sources of income.

These complementary documents play a significant role in the accurate filing of the Utah TC-65 form. By ensuring that each of these forms is appropriately completed and filed, partnerships, limited liability partnerships, and limited liability companies can maintain compliance with both federal and state tax obligations. Remember, this list is not exhaustive, and depending on your specific business activities, additional forms may be required. Always consult with a tax professional to ensure complete and accurate tax filing.

Similar forms

The Utah TC-65 form is notably similar to the Federal Form 1065, known as the U.S. Return of Partnership Income. Both forms are used by partnerships to report their financial activities for the year. They detail income, gains, losses, deductions, and credits of the partnership, aiming to ensure proper tax reporting at the entity level before income is passed on to the partners. Where the TC-65 form focuses on the specifics required by Utah state law, the Federal Form 1065 provides the broader strokes required by the IRS, ensuring partnerships comply with federal tax obligations.

Another document akin to the Utah TC-65 is the Schedule K-1, which is an attachment to both the federal Form 1065 and the TC-65. This document breaks down each partner’s share of the partnership's earnings, deductions, and credits. While the TC-65 compiles the total financial picture of the partnership at the state level, the Schedule K-1 offers a detailed report on how each piece of the partnership's financial puzzle affects the individual partner's tax obligations.

The California Form 565, Partnership Return of Income, shares similarities with the Utah TC-65 in that both are state-specific forms used by partnerships to report income, deductions, and tax liabilities. However, each caters to the tax laws and requirements specific to its respective state. They ensure that partnerships accurately report their operating results and meet their state tax obligations, thereby serving as the state-level counterparts to the federal Form 1065.

The New York Form IT-204, Partnership’s Return of Income, is another document that bears resemblance to the Utah TC-65 form. Used by partnerships operating within New York State, it requires similar information about the partnership's income, deductions, and tax calculations specific to New York State tax law. Both forms are essential for state tax compliance, facilitating accurate tax reporting by partnerships based on geographic operations.

The Texas Franchise Tax Report, while distinct in its function as it relates to the franchise tax rather than income tax, shares a conceptual similarity with the Utah TC-65. Partnerships in Texas use this report to detail earnings and calculate the franchise tax owed to the state. Although the tax basis differs, both documents require comprehensive financial reporting by partnerships, emphasizing the importance of accurate financial disclosure for tax purposes.

The Schedule H and Schedule J components of the Utah TC-65 form, which detail nonbusiness and apportioned business incomes respectively, share purposes with similar schedules in other state and federal tax forms. These schedules are crucial for calculating how much income is taxable within the state by distinguishing between different income types and sources. This differentiation allows for precise tax responsibilities to be determined, paralleling the functionality of similar schedules in other tax reporting frameworks.

Lastly, the TC-20 Instructions booklet, while not a form itself, is related to the Utah TC-65 in providing necessary guidance and clarification on completing the form. It addresses specific line items, definitions, and requirements, much like instruction booklets for other state and federal tax forms. This authoritative source ensures that taxpayers accurately complete their filings in compliance with Utah’s tax laws and regulations.

Dos and Don'ts

When dealing with the Utah TC-65 Form, which is vital for partnerships, limited liability partnerships, and limited liability companies to accurately report their income and taxes, there are several practices you should follow to ensure the form is completed properly and common errors to avoid. Here is a curated list of dos and don'ts:

Do:- Double-check the Employer Identification Number (EIN) to make sure it matches the federal records.

- Ensure the correct entity type is checked to reflect your organization’s status accurately.

- Mark the “Amended Return” box only if you're submitting an amended return.

- Report the total pass-through withholding tax accurately, as it is required to be paid by the due date without extensions.

- Include Utah use tax if applicable to your business activities within the state.

- Accurately calculate and report the total payments made during the year, excluding pass-through withholding tax or credits.

- Seek professional help if unsure about any part of the form. Having a preparer’s information filled out can be helpful if the Utah State Tax Commission has questions.

- Verify all dates, especially the fiscal year start and end dates, if not filing for the calendar year.

- Sign and date the return. Unsigned forms are considered invalid and may result in penalties.

- Attach all required schedules or documents, such as Schedule A - Utah Taxable Income for Pass-through Entity Taxpayers.

- Forget to check the amended return box if this submission corrects a previously filed TC-65. Remember to include the amendment code.

- Use pencil or any erasable ink to complete the form. All entries should be made in permanent ink or typed.

- Misreport the partnership’s name or address, ensuring it matches the records held by the state and IRS.

- Ignore the instructions for specific lines, such as those related to deductions, income, and exemptions.

- Leave required fields blank. If a section does not apply, enter a “0” or “N/A” as appropriate to indicate the question was not overlooked.

- Miss the deadline. Late submissions can lead to penalties, interest charges, and potentially more serious consequences.

- Overlook the declaration statement at the end of the return; it's under the penalties of perjury.

- Mix up schedules from different tax years. Be sure the schedules correspond to the 2020 tax year or the fiscal year you’re reporting.

- Rush through filling out the form without reviewing it for errors or omissions.

- Assume that the instructions haven’t changed from the previous year. Always review the current year’s instructions for updates or changes in tax law.

Misconceptions

Understanding tax forms can sometimes feel like navigating through a maze, especially with forms like the Utah TC-65, a required filing for partnerships, limited liability partnerships, and limited liability companies in Utah. Common misconceptions about this form can lead to confusion or even errors in filing. Let's debunk some of these myths:

Myth 1: "The TC-65 form is only for businesses physically located in Utah." This isn't the case. The form is also required for businesses operating or generating income in Utah, even if they're not physically based in the state. This ensures that all entities pay their fair share of taxes on income earned within Utah.

Myth 2: "Filing a TC-65 automatically covers your individual tax obligations." While the TC-65 does relay partnership or LLC financial activities, partners and LLC members must still report and pay individual taxes on their share of the income through their personal tax returns.

Myth 3: "You only need to file the TC-65 if you owe taxes." Actually, this form serves as an annual return, documenting income, deductions, and credits, whether you owe taxes or not. It's important for maintaining compliance and ensuring accurate records are kept.

Myth 4: "There's no need to mark the amended return box if you've filed an amendment with the IRS." This is incorrect. If you're amending a previously filed TC-65 due to changes in your federal return or for any other reason, you must indicate this by marking the amended return box and providing the necessary documentation.

Myth 5: "You can file the TC-65 form without an Employer Identification Number (EIN)." Every entity filing this form must have an EIN. It's a unique identifier for the IRS and state tax agencies to track tax filings. Without it, the form cannot be correctly processed.

Myth 6: "A limited liability company (LLC) cannot file the TC-65 form." This is a common misconception. LLCs, depending on their tax treatment elections, may indeed be required to file Form TC-65, especially if they're treated as a partnership for tax purposes.

Myth 7: "The due date for filing the TC-65 is the same every year." The due date can vary, especially when it falls on a weekend or holiday. Additionally, entities operating on a fiscal year basis will have different due dates from those operating on a calendar year. Always check the current year's deadlines to avoid penalties.

Myth 8: "Electronic filing is optional for the TC-65." While paper filing may still be acceptable, Utah encourages (and in some cases requires) electronic filing for faster processing and more secure handling of tax information. It's advisable to file electronically for convenience and efficiency.

Dispelling these myths aims to clear up confusion and ensure that entities can file their Utah TC-65 forms accurately and on time. Remember, when in doubt, consulting with a tax professional can help navigate the specifics of your tax obligations.

Key takeaways

When filling out and using the Utah TC-65 form, there are several key aspects to keep in mind:

- Identify the correct tax year: Ensure you're filing for the correct calendar year or fiscal year, noting the start and end dates.

- Select the appropriate entity type: It's crucial to check the box that corresponds with your specific entity type, such as a general partnership, limited partnership, limited liability partnership, or limited liability company.

- Report accurate financial information: Include total income, deductions, and taxes due, ensuring all amounts are correctly calculated from attached schedules and forms.

- Understand the requirement for pass-through withholding tax: Any pass-through withholding tax must be paid by the due date of the return, without extensions. This is critical to avoid penalties.

- Sign and date the form: The form requires a signature from a general partner or member manager to declare that the information provided is accurate. If you're working with a preparer, they also need to sign the form, providing their contact information and PTIN.

It's also very important to complete all relevant schedules and attachments, like Schedule A for Utah Taxable Income for Pass-Through Entity Taxpayers and Schedule H for Utah Nonbusiness Income Net of Expenses, to provide a full picture of your financial situation. Consulting a professional for complex situations is often advisable to ensure compliance and accuracy.

Common PDF Templates

Utah State Tax Form for Employees - Specifies how to compute the apportionment fraction and apportioned income.

Utah Contractor License Bond - By mandating this application, Utah enforces a rigorous vetting process, underlining its commitment to professional excellence and ethical practice.