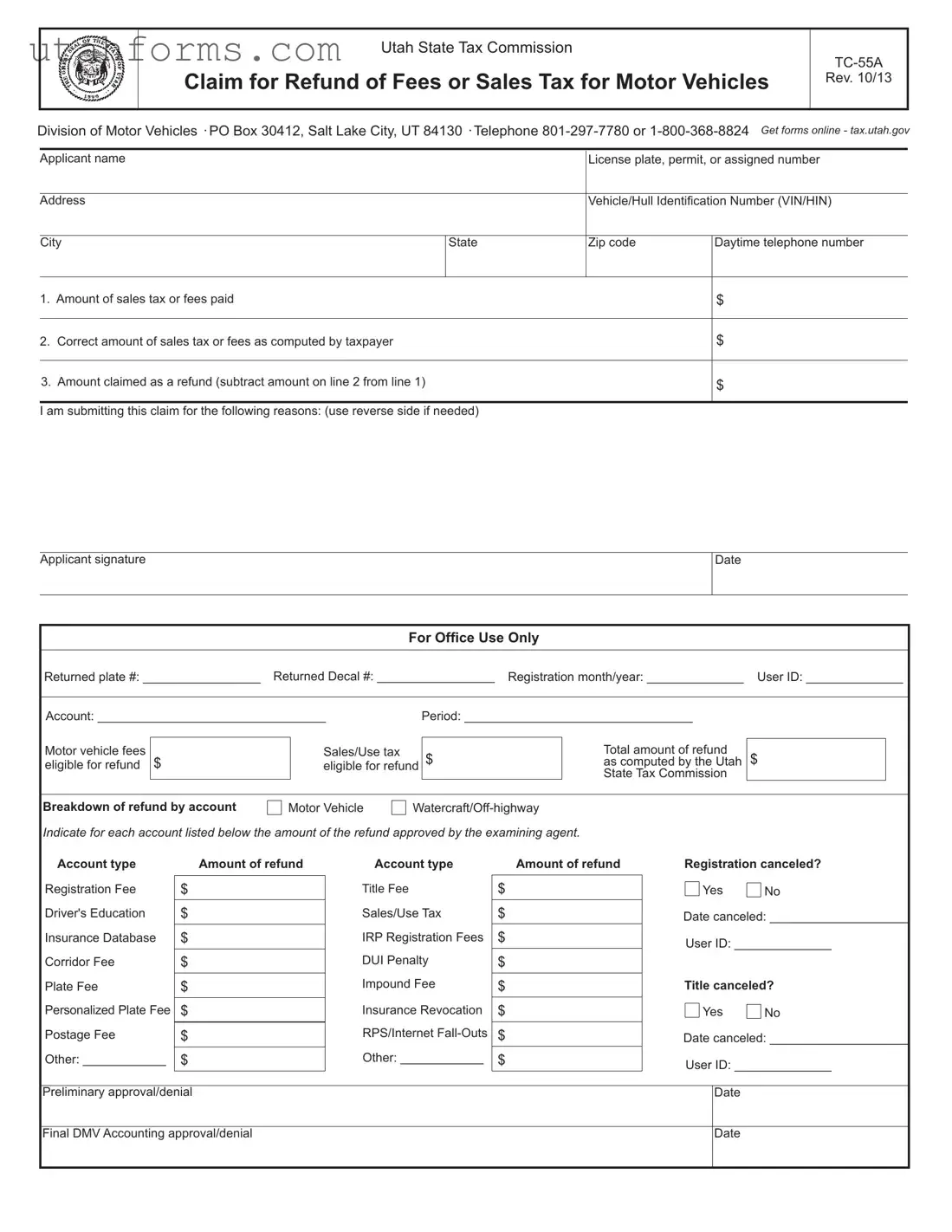

Fill Out Your Utah Tc 55A Form

In the realm of motor vehicle transactions within Utah, the TC-55A form plays a crucial part in the financial transactions between vehicle owners and the state's tax system. Essentially, this document enables individuals to claim refunds on fees or sales tax paid on motor vehicles. Endorsed by the Utah State Tax Commission, specifically under the division of Motor Vehicles, the form facilitates claims for money back that potentially were overpaid or inaccurately charged due to various reasons. Vehicle owners are required to fill in comprehensive details including their name, license plate or assigned number, and the unique Vehicle/Hull Identification Number (VIN/HIN), alongside other pertinent information to validate their claim. The form clearly delineates the process for claiming refunds - from the amount paid versus the correct amount figured by the taxpayer, to the specific reasons for the claim. It mandates the return of all registration materials as part of the refund claim process and necessitates the provision of supporting documents such as receipts, canceled checks, or any proof of sale or trade-in documentation where applicable. With the submission deadline firmly set within six months post the original payment date, the TC-55A form underscores the Utah State Tax Commission's structured approach to ensuring fairness and accuracy in vehicle-related tax levies and fees. Importantly, it also provides guidelines on the scenarios where registration fees can be refunded, highlighting the exceptions and necessary conditions under which claims may be deemed valid or invalid.

Preview - Utah Tc 55A Form

Utah State Tax Commission

Claim for Refund of Fees or Sales Tax for Motor Vehicles

Rev. 10/13

Division of Motor Vehicles · PO Box 30412, Salt Lake City, UT 84130 · Telephone

Applicant name |

|

License plate, permit, or assigned number |

||

|

|

|

|

|

Address |

|

Vehicle/Hull Identification Number (VIN/HIN) |

||

|

|

|

|

|

City |

State |

Zip code |

Daytime telephone number |

|

|

|

|

|

|

1. |

Amount of sales tax or fees paid |

|

|

$ |

|

|

|

|

|

2. |

Correct amount of sales tax or fees as computed by taxpayer |

|

|

$ |

|

|

|

|

|

3. Amount claimed as a refund (subtract amount on line 2 from line 1) |

|

|

$ |

|

|

|

|

|

|

I am submitting this claim for the following reasons: (use reverse side if needed)

Applicant signature

Date

For Office Use Only

Returned plate #: _________________ |

Returned Decal #: _________________ |

Registration month/year: ______________ |

User ID: ______________ |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Account: _________________________________ |

|

|

Period: _________________________________ |

|

|

|

|||||||||||||||

Motor vehicle fees |

|

|

|

|

Sales/Use tax |

|

|

|

Total amount of refund |

|

|

|

|||||||||

|

|

|

|

$ |

|

|

$ |

|

|

||||||||||||

eligible for refund |

$ |

|

|

|

eligible for refund |

|

|

as computed by the Utah |

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

State Tax Commission |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Breakdown of refund by account |

|

Motor Vehicle |

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Indicate for each account listed below the amount of the refund approved by the examining agent. |

|

|

|

|

|

|

|

|

|||||||||||||

Account type |

Amount of refund |

Account type |

Amount of refund |

Registration canceled? |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Registration Fee |

$ |

|

|

|

Title Fee |

|

$ |

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

Yes |

|

|

No |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Driver's Education |

$ |

|

|

|

Sales/Use Tax |

|

$ |

|

Date canceled: ____________________ |

||||||||||||

Insurance Database |

$ |

|

|

|

IRP Registration Fees |

|

$ |

|

|

User ID: ______________ |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Corridor Fee |

$ |

|

|

|

DUI Penalty |

|

$ |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

Impound Fee |

|

|

|

|

|

|

|

|

|

|

|

||||

Plate Fee |

$ |

|

|

|

|

$ |

|

Title canceled? |

|||||||||||||

Personalized Plate Fee |

|

|

|

|

Insurance Revocation |

|

|

|

|

|

|

|

|

|

|

|

|||||

$ |

|

|

|

|

$ |

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

Yes |

|

|

No |

|||||||||||

|

|

|

|

|

|

RPS/Internet |

|

|

|

|

|

|

|

|

|

|

|

||||

Postage Fee |

$ |

|

|

|

|

$ |

|

Date canceled: ____________________ |

|||||||||||||

Other: ____________ |

$ |

|

|

|

Other: ____________ |

|

$ |

|

|

User ID: ______________ |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preliminary approval/denial |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Final DMV Accounting approval/denial |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Instructions

Important:

•You must apply to your local county assessor for refunds of property tax.

•Pursuant to Utah Code Section

•Registration fees are refundable in very limited circumstances. The following example provides common circumstances under which registration fees may or may not be refundable:

ºIf your registration expires in January (as an example), and you pay your renewal fees prior to the expiration date (January 31st), your refund may be approved if you make a request January 31st or prior.

ºIf your registration expires in August (as an example), and you pay your renewal fees prior to the expiration date (August 31st), your refund may be approved if you provide proof that the vehicle was sold,

ºIf the vehicle is in use when the new registration period begins (February 1st in the first example and September 1st in the second example), the fees would not be refundable.

1.You must return all registration materials that pertain to the refund request (i.e. decals, registrations, plates, etc).

2.Attach a copy of all receipts or a copy of your canceled check(s) (both front and back).

3.If you paid through the internet, you must provide a copy of your statement which shows the date and amount of the payment.

4.Provide copies of all documents which support your reason for requesting a refund.

•If the vehicle has been sold or traded in: Attach documentation which includes the VIN/HIN, date of the transaction, and signatures of both the seller and the purchaser.

•Lease

•For Sales Tax Only: If the purchased vehicle was returned to the seller and the sale canceled, attach a copy of the canceled sale documentation which includes the VIN/HIN and signatures of both the seller and the purchaser.

5.Mail refund claim and all supporting documentation to DMV

Keep a copy of the refund claim and all documentation for your records.

Statement Continuation

File Specifications

| Fact | Detail |

|---|---|

| Form Purpose | Claim for Refund of Fees or Sales Tax for Motor Vehicles |

| Form Number | TC-55A |

| Revision Date | October 2013 |

| Associated Division | Division of Motor Vehicles, Utah State Tax Commission |

| Contact Information | Telephone 801-297-7780 or 1-800-368-8824 |

| Governing Law | Utah Code Section 41-1a-1203 |

| Refund Timeframe | Application must be made within six months after the original date of payment |

| Supporting Documents Required | Receipts or canceled check(s), documentation supporting the refund request, and all registration materials related to the refund request |

How to Write Utah Tc 55A

Filling out the Utah TC-55A form is a straightforward process if you're looking to claim a refund for vehicle sales tax or fees in Utah. This process is essential for individuals who have encountered circumstances where they’ve overpaid or are eligible for a refund on taxes or fees related to motor vehicles. By carefully following the steps below, you'll be able to submit your claim accurately and efficiently.

- Start by entering the Applicant Name at the top of the form. This should be the name of the person requesting the refund.

- Fill in the License Plate, Permit, or Assigned Number related to the vehicle or hull in question.

- Provide the Address, including the city, state, and zip code where the applicant can be contacted.

- Enter the Vehicle/Hull Identification Number (VIN/HIN) to identify the specific vehicle or vessel associated with the refund.

- Fill in the Daytime Telephone Number to allow for any necessary follow-up communication.

- Under the financial section, enter the Amount of Sales Tax or Fees Paid initially.

- Calculate and enter the Correct Amount of Sales Tax or Fees as determined by you, the taxpayer. This amount should reflect what you believe to be the accurate obligation.

- Determine and enter the Amount Claimed as a Refund, which involves subtracting the amount on line 2 from the amount on line 1.

- Provide a clear explanation for your claim in the designated section. If needed, use the reverse side of the form for additional space.

- Sign and date the form at the bottom to certify your claim.

- If applicable, complete the For Office Use Only section, which includes returned plate and decal numbers, registration month/year, User ID, Account, and Period, although this part is often left for office personnel.

- Finally, gather and attach any required supporting documents outlined in the instructions, such as copies of receipts, canceled checks, sale or trade-in documentation, lease buy-out agreements, or canceled sale documentation for sales tax claims.

- Mail your completed TC-55A form along with all supporting documentation to the address provided in the form instructions: DMV Accounting-4th Floor at the Utah State Tax Commission, PO Box 30412, Salt Lake City, UT 84130.

Remember, the key to a successful refund claim is ensuring that all information provided is accurate and complete, and that all supporting documents are included with your submission. Keep a copy of the entire package for your records. If you have any questions while filling out the form or gathering your documents, don't hesitate to contact the Utah State Tax Commission for assistance.

Frequently Asked Questions

What is the TC-55A form used for in Utah?

The TC-55A form is specifically designed for individuals looking to claim a refund on certain fees or sales tax paid on motor vehicles in Utah. This might include overpaid amounts due to miscalculation, changes in vehicle ownership, or situations where a vehicle is no longer operable or has been sold.

Who needs to complete the TC-55A form?

Any individual seeking a refund for overpaid fees or taxes on a motor vehicle should complete the TC-55A form. This includes taxes paid during a vehicle purchase, fees for vehicle registration, or any other applicable motor vehicle fees where a refund is sought.

Where can I find the TC-55A form?

You can access the TC-55A form online through the Utah State Tax Commission’s website at tax.utah.gov. The form is also available at local Division of Motor Vehicles (DMV) offices across Utah.

What documents are required to accompany the TC-55A form?

- All relevant registration materials (decals, registrations, plates, etc.)

- Receipts or a copy of your canceled check(s) showing payment

- If applicable, internet payment statements

- Supporting documentation for the refund request (including sale documentation, lease buy-out agreements, or canceled sale documents)

How is the refund amount calculated on the TC-55A form?

The refund amount is determined by subtracting the correct amount of sales tax or fees (as computed by the taxpayer) from the amount of sales tax or fees initially paid. This calculation should reflect the overpaid amount for which the refund is being claimed.

What are some common reasons for submitting a TC-55A form?

Refunds are commonly requested due to the sale or trade-in of a vehicle, a vehicle being returned to the seller with the sale canceled, or in situations where a vehicle becomes inoperable. Other reasons might include the discovery of a miscalculation of the fees or taxes initially paid.

How long does it take to process a TC-55A form?

While specific processing times can vary, it’s important to submit all required documents and accurately filled-out forms to facilitate a smoother process. Generally, it may take several weeks for the Division of Motor Vehicles to process a refund claim once all required documentation is received.

Can I submit the TC-55A form online?

Currently, the TC-55A form along with all the necessary documentation must be mailed to the address provided by the Utah State Tax Commission. While the form can be accessed online, physical submission is required for the refund claim.

What if my application for a refund is denied?

If your refund claim is denied, you will receive a notification explaining the reason for the denial. If you believe the denial was based on incorrect information or an error, you may contact the provided telephone number for the Utah State Tax Commission or DMV Accounting to inquire further about the possibility of re-evaluation or to provide additional information.

Common mistakes

Filling out the Utah TC-55A form, also known as the Claim for Refund of Fees or Sales Tax for Motor Vehicles, is a process that demands attention to detail. Mistakes during this process can lead to delays or denials of the refund claim. Here is an explanation of four common pitfalls to avoid:

- Not including all required documents: Applicants often forget to attach all necessary documentation supporting their refund claim. As stated, one needs to return all registration materials associated with the refund request, including decals, registrations, plates, etc. Additionally, a copy of all receipts, a copy of the cancelled check (both front and back), or a copy of the statement showing the payment for internet payments is required. Documents supporting the reason for the refund, such as proof of sale, trade-in documentation, or a cancelled sale document in case of returned vehicles, are crucial. Failure to include these may result in the rejection of the application.

- Miscalculating the refund amount: A common mistake is incorrectly calculating the refund amount. It requires accurately subtracting the correct amount of sales tax or fees as computed by the taxpayer from the amount of sales tax or fees originally paid. Mistakes here could lead to claims being questioned or delayed.

- Applying after the deadline: According to the instructions, the application for a refund must be made within six months after the original date of payment. Missing this deadline is a frequent error that leads to the immediate denial of the refund claim, irrespective of its validity.

- Failing to keep copies for personal records: It's advised to keep a copy of the refund claim and all documentation for one's records. Applicants often overlook this step, which makes it difficult for them to follow up on their claim or provide additional information if any document gets lost or misplaced during the processing of their claim.

These mistakes can be avoided by thoroughly reading the instructions included with the TC-55A form and carefully preparing the claim package. Ensuring that all documentation is complete, calculations are accurate, deadlines are met, and copies are retained will significantly increase the likelihood of a successful refund claim.

Documents used along the form

When applying for a refund of fees or sales tax for motor vehicles using the Utah TC-55A form, individuals might need to include additional forms and documents to support their claims. These documents can vary depending on the specific circumstances of each case, but generally, they provide evidence to substantiate the reasons for requesting a refund. Understanding what these documents are and how they relate to the refund process can significantly streamline the application.

- Copy of the Vehicle Registration: This document provides proof of the registration associated with the vehicle in question, indicating the fees that were paid.

- Original Receipts of Payment: These are needed to prove the amount of fees or sales tax paid. Both the front and back of canceled checks, or a copy of the transaction record if payment was made electronically, should be included.

- Bill of Sale: In cases where the vehicle has been sold or traded in, this document serves as evidence of the transaction, showing the date it occurred and the details of the parties involved.

- Lease Buy-out Agreement: For individuals who have purchased their leased vehicle, a copy of the lease buy-out agreement is necessary. This document should outline the terms of the purchase, including the transaction's date.

- Canceled Sale Documentation: If the vehicle was returned to the seller and the sale was canceled, documentation proving the cancellation should be attached. It must include the VIN/HIN and signatures from both the seller and the buyer.

- Proof of Vehicle Inoperability: If claiming a refund due to the vehicle being inoperable, documentation verifying the vehicle's condition during the time of the registration period claimed for a refund should be provided.

- Insurance Cancellation or Change Documents: When requesting a refund due to changes in insurance that affect registration fees or taxes paid, documentation from the insurance provider detailing the cancellation or change is required.

- Death Certificate: In the event of the vehicle owner's death, a copy of the death certificate may be necessary to process a refund to the estate or next of kin.

- Power of Attorney: If someone other than the vehicle owner is applying for the refund, a Power of Attorney document may be required to authorize them to act on the owner's behalf.

The process of applying for a refund requires careful documentation and attention to detail. By ensuring that all necessary forms and documents accompany the Utah TC-55A form, applicants can help facilitate a smoother and more efficient review process. It's always advisable to keep copies of all submissions for personal records. For any queries or assistance, contacting the Utah State Tax Commission directly is recommended.

Similar forms

The California Application for Refund of Vehicle License Fees (Form REG 65) bears similarity to the Utah TC-55A form primarily in the type of refund it addresses. Both forms are designed for vehicle owners seeking a refund on fees or taxes erroneously paid during vehicle transactions. Where the Utah form focuses on a broad array of taxes and fees, the California counterpart specifically narrows down to vehicle license fees, emphasizing the state’s own procedures and requirements for claiming such refunds. Each form mandates the submission of evidence supporting the claim, such as receipts and documentation of the vehicle transaction.

The Texas Application for Motor Vehicle Tax Refund (Form 14-202) is another document that echoes the purpose of the Utah TC-55A form. Both solicit a refund for taxes paid, but the Texas form zeroes in on motor vehicle tax. Claimants in both states are required to present just cause for their refund request through documented evidence of overpayment or eligibility for exemption. These forms serve as a nexus between state tax authorities and taxpayers, illustrating the varying fiscal policies across states regarding vehicle transactions.

The Virginia Application for Vehicle Sales and Use Tax Refund (Form SUT-4) closely aligns with the Utah form in that it provides a pathway for individuals to reclaim excess sales and use taxes. However, the Virginia form is specifically tailored towards situations involving sales and use tax, such as erroneous computation or vehicle returns. Like the Utah TC-55A, applicants must furnish detailed information about the vehicle and transaction, alongside substantiating documentation, to initiate the refund process.

Similarly, the Florida Application for Refund - Motor Vehicle/Vessel Fees (Form DR-26S) offers a mechanism for reclaiming various vehicle-related fees, including registration and titling fees, akin to the scope of the Utah TC-55A form. The Florida document, however, expands to include vessel transactions, illustrating the diverse range of refundable fees across different types of ownership. Both forms underscore the necessity of providing transactional evidence and detail the conditions under which refunds may be granted.

The New York Application for Sales Tax Refund (Form AU-11) parallels the Utah TC-55A form in its facilitation of sales tax refunds for vehicle owners. While the New York form can apply to a broader range of sales tax refunds beyond vehicles, its inclusion of vehicle-related transactions captures a similar audience. Each form highlights the importance of returning plates, registrations, or decals, and requires detailed financial information to support the refund claim. This underscores the rigorous documentation standards states maintain for tax refunds.

Michigan's Application for Refund - Motor Vehicle Sales Tax (Form 426) is designed with a focus on motor vehicle sales tax refunds, sharing commonality with the Utah form in serving individuals seeking to recover funds from vehicle transactions. Applicants are prompted to provide comprehensive vehicle information and reasons for the refund, underscoring the procedural parallels in navigating tax refunds across state lines. Both documents reflect the intricate nature of tax laws as they apply to vehicle ownership and transactions.

The Illinois Vehicle Transaction Tax Refund Request (Form RUT-50) offers another counterpart to the Utah TC-55A, focusing on transactions where tax refunds are sought due to overpayment or exemption eligibility. Both forms necessitate detailed transaction information and substantiation through documentation, encapsulating the shared goal of returning undue payments to taxpayers. This alignment reinforces the critical role documentation plays in tax refund applications.

The Colorado Application for Refund of Motor Vehicle Tax (DR 0137) likewise facilitates refunds for vehicle owners, echoing the Utah form’s premise but within Colorado’s tax framework. This document highlights the varied reasons why a motor vehicle tax refund might be warranted, from overpayment to tax-exempt status, mirroring the multifaceted nature of tax refunds seen in the Utah TC-55A form. Both states require thorough documentation to process such refunds, emphasizing the importance of precision in tax-related matters.

The Oregon Application for Vehicle Registration Refund (Form 735- refund) also correlates with the Utah TC-55A, focusing on refunds of vehicle registration fees. While the Oregon form specializes in registration fees as opposed to the broader tax and fee scope of the Utah form, the essence of seeking restitution for undue payments is a common thread. Applicants are guided to submit detailed evidence of their transaction and payment, underlining the unified principle of substantiating claims with concrete documentation.

Dos and Don'ts

When completing the Utah TC-55A form for a claim of refund of fees or sales tax for motor vehicles, it is crucial to adhere to specific guidelines to ensure the process is smooth and effective. Attention to detail can prevent delays in processing your claim. Below are the recommended dos and don'ts:

Dos:

Ensure all required sections of the form are completed accurately. Providing precise applicant information, including name, address, and Vehicle/Hull Identification Number (VIN/HIN), is essential.

Attach all necessary documents as specified in the instructions, including copies of receipts or canceled checks, supporting documents for the reason for the refund, and any documentation that pertains to the vehicle's sale, lease buy-out, or return.

Calculate the correct amount of sales tax or fees due meticulously to determine the amount eligible for a refund. Any error in calculation can affect the refund amount.

Sign and date the application to validate the request. An unsigned form may be deemed incomplete and could result in a delay.

Mail the completed form along with all the supporting documents to the appropriate address as given in the instructions. This ensures the application reaches the correct department for processing.

Keep copies of the completed form and all documents you submit. This is important for your records and can be helpful if there are any questions or issues with your claim.

Don'ts:

Do not leave any relevant sections of the form blank. Incomplete forms may result in processing delays or denial of the refund claim.

Do not submit the claim without all the required documentation. The absence of necessary documents can lead to the rejection of your refund request.

Avoid making errors in the calculation of the refund amount. Inaccuracies can negatively impact the refund process.

Do not forget to sign and date the form. An unsigned form may not be processed.

Do not mail the form and documents to the wrong address. Sending your claim to the incorrect location can delay processing time significantly.

Do not discard your copies of the submitted form and documentation. Keeping these records is crucial for reference and follow-up, if necessary.

By following these guidelines, applicants can navigate the procedures more efficiently and increase the likelihood of a successful refund claim.

Misconceptions

Misconceptions about the Utah TC-55A form can lead to confusion and mistakes in the refund claim process. Here are five common myths debunked:

- Any time is a good time to apply for a refund. Actually, the application for a refund of registration fees must be made within six months after the original date of payment. Timing is crucial when submitting a TC-55A form.

- All vehicle fees are refundable. This isn't correct. Registration fees are only refundable under very limited circumstances. For instance, if a vehicle is sold, traded-in, or becomes inoperable before the start of a new registration period, a refund may be approved. However, if the vehicle is in use when the new registration period begins, fees typically cannot be refunded.

- You only need to submit the TC-55A form. The process requires more than just the form. Applicants must return all registration materials related to the refund request, such as decals, registrations, plates, etc. Additionally, copies of all receipts or a copy of a canceled check, internet payment confirmation, and documents supporting the refund request reason must be provided.

- The refund process is immediate. After submitting the TC-55A form and all necessary documentation, the request undergoes a review process by the Utah State Tax Commission. This includes preliminary approval or denial, followed by a final accounting approval or denial. The process takes time and is not immediate.

- Refunds for property tax are claimed using this form. This is incorrect. The form is specifically for claiming refunds of fees or sales tax for motor vehicles. Refunds of property tax must be applied for through your local county assessor.

Understanding these misconceptions can help applicants navigate the refund process more effectively and set the right expectations when applying for a refund using the Utah TC-55A form.

Key takeaways

Understanding the process for requesting refunds on motor vehicle fees or sales tax in Utah is vital for anyone looking to navigate their financial responsibilities effectively. The Utah TC-55A form serves as a crucial document for this purpose. Here are several key takeaways to ensure the process is as smooth as possible:

- Eligibility and Timing: It’s important to note that requests for a refund of registration fees must be submitted within six months following the original date of payment. This is a firm deadline set by the Utah State Tax Commission, and your submission date matters greatly in determining your eligibility for a refund.

- Documentation Is Key: When filling out and submitting your Utah TC-55A form, attaching all relevant documentation is a must. This includes a copy of your lease buy-out agreement if applicable, documentation of the vehicle being sold or traded, and any receipts or canceled checks related to the fees paid. These documents support your refund claim and are necessary for processing.

- Refund Specifics: Understand that registration fees can only be refunded under particular circumstances outlined by the state. For example, if a vehicle is sold, traded in, or becomes inoperable before the expiration of the registration period, and you have proof of such, you may be eligible for a refund. Awareness of your situation in relation to these rules is essential.

- Contact Information and Submission: For any questions or additional assistance, the Utah State Tax Commission has made resources available both online and via telephone. All refund claims along with the supporting documentation should be mailed to the specified address for the DMV Accounting-4th Floor. Keeping a copy of the refund claim and all submitted documents is advised for your records.

By keeping these key takeaways in mind, you can navigate the refund process for motor vehicle fees or sales tax with greater confidence and efficiency. Remember, preparation and attention to detail are your best tools in ensuring a successful refund claim.

Common PDF Templates

Cpe Ut - There are provisions for carrying forward extra CPE hours, up to 40, to the next reporting period.

Utah Payroll Taxes - Completing the TC-941D form is a step towards resolving tax discrepancies resulting from modifications in business structure or ownership.

Utah Rental Agreement - Mediation for dispute resolution is encouraged, promoting a collaborative approach to address disagreements.