Fill Out Your Utah Tc 559 Form

Navigating the complexities of corporate and partnership tax obligations in Utah necessitates familiarity with various forms and procedures, among which the Utah TC-559 form plays a crucial role. This form, issued by the Utah State Tax Commission, serves as a multifunctional payment coupon designed to facilitate different types of tax payments, including estimated tax payments, extension payments, and return payments for corporations and partnerships. Businesses are required to meticulously mark the appropriate circle on the coupon to indicate the specific nature of the payment they are making. The form underscores the importance of adherence to payment deadlines and accuracy in payment amounts to avoid penalties and interest charges. For corporations, the form outlines that if the tax payments fall short of the lesser of 90 percent of the current year's tax liability or 100 percent of the previous year's liability, penalties will ensue. Furthermore, the form stipulates quarterly estimated tax payment requirements for corporations with tax liabilities surpassing $3,000 in the current or previous tax year, and delineates the conditions under which these payments must be made. It also provides guidance on making extension payments, highlighting the necessity of meeting the minimum payment thresholds to avoid additional fees. The instructions include specific details about payment submission, emphasizing the option for electronic payment, which modernizes and simplifies the process. By shedding light on these facets, the TC-559 form is an essential tool in the array of resources available to Utah corporations and partnerships striving to fulfill their tax payment obligations.

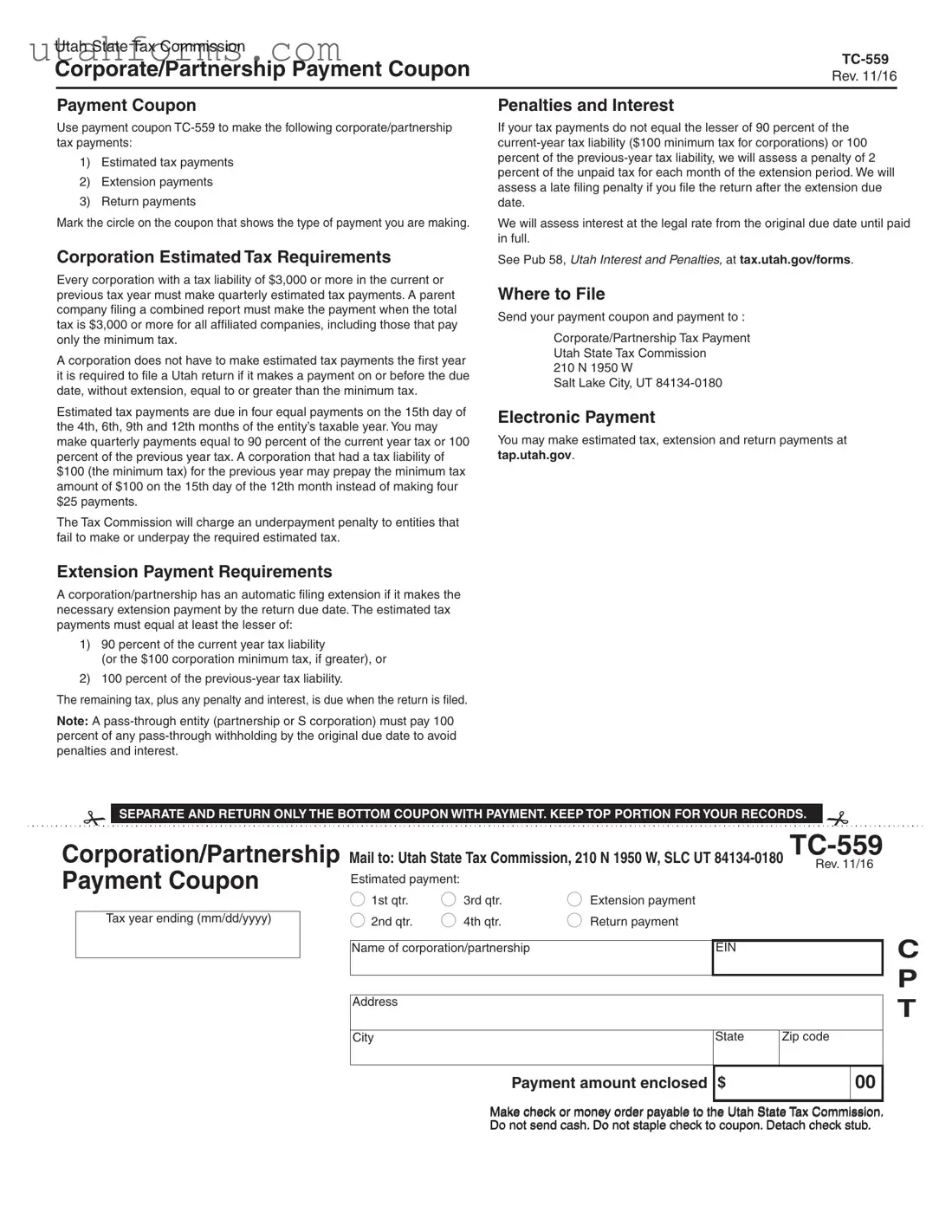

Preview - Utah Tc 559 Form

Utah State Tax Commission

Corporate/Partnership Payment Coupon |

|

Rev. 11/16 |

|

|

|

Payment Coupon |

Penalties and Interest |

Use payment coupon

1)Estimated tax payments

2)Extension payments

3)Return payments

Mark the circle on the coupon that shows the type of payment you are making.

If your tax payments do not equal the lesser of 90 percent of the

We will assess interest at the legal rate from the original due date until paid in full.

Corporation Estimated Tax Requirements

Every corporation with a tax liability of $3,000 or more in the current or previous tax year must make quarterly estimated tax payments. A parent company filing a combined report must make the payment when the total tax is $3,000 or more for all affiliated companies, including those that pay only the minimum tax.

A corporation does not have to make estimated tax payments the first year it is required to file a Utah return if it makes a payment on or before the due date, without extension, equal to or greater than the minimum tax.

Estimated tax payments are due in four equal payments on the 15th day of the 4th, 6th, 9th and 12th months of the entity’s taxable year. You may make quarterly payments equal to 90 percent of the current year tax or 100 percent of the previous year tax. A corporation that had a tax liability of $100 (the minimum tax) for the previous year may prepay the minimum tax amount of $100 on the 15th day of the 12th month instead of making four $25 payments.

The Tax Commission will charge an underpayment penalty to entities that fail to make or underpay the required estimated tax.

Extension Payment Requirements

A corporation/partnership has an automatic filing extension if it makes the necessary extension payment by the return due date. The estimated tax payments must equal at least the lesser of:

1)90 percent of the current year tax liability

(or the $100 corporation minimum tax, if greater), or

2)100 percent of the

The remaining tax, plus any penalty and interest, is due when the return is filed.

Note: A

See Pub 58, UTAH INTEREST AND PENALTIES, at tax.utah.gov/forms.

Where to File

Send your payment coupon and payment to :

Corporate/Partnership Tax Payment

Utah State Tax Commission

210 N 1950 W

Salt Lake City, UT

Electronic Payment

You may make estimated tax, extension and return payments at tap.utah.gov.

SEPARATE AND RETURN ONLY THE BOTTOM COUPON WITH PAYMENT. KEEP TOP PORTION FOR YOUR RECORDS.

Corporation/Partnership Mail to: Utah State Tax Commission, 210 N 1950 W, SLC UT |

||||||||

Rev. 11/16 |

||||||||

Payment Coupon |

|

Estimated payment: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1st qtr. |

3rd qtr. |

Extension payment |

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax year ending (mm/dd/yyyy) |

|

2nd qtr. |

4th qtr. |

Return payment |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

Name of corporation/partnership |

|

EIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

State |

Zip code |

|

|

|

|

|

|

|

|

|

|

C P T

Payment amount enclosed

$

00

Make check or money order payable to the Utah State Tax Commission. Do not send cash. Do not staple check to coupon. Detach check stub.

File Specifications

| Fact | Detail |

|---|---|

| Form Number | TC-559 |

| Revision Date | November 2016 |

| Purpose | Used for making corporate/partnership tax payments such as estimated tax payments, extension payments, and return payments. |

| Penalty for Underpayment | A 2 percent penalty per month on unpaid tax during the extension period. |

| Minimum Corporate Tax | $100 |

| Estimated Tax Payment Requirement | Corporations with a tax liability of $3,000 or more in the current or previous tax year must make quarterly estimated tax payments. |

| Payment Schedule for Estimated Taxes | Due on the 15th day of the 4th, 6th, 9th, and 12th months of the entity's taxable year. |

| Extension Payment Requirement | Automatic filing extension with necessary payment by the return due date, which must be at least the lesser of 90 percent of the current year's tax liability or 100 percent of the previous year's tax liability. |

| Where to File | Payments should be sent to: Corporate/Partnership Tax Payment, Utah State Tax Commission, 210 N 1950 W, Salt Lake City, UT 84134-0180. |

| Electronic Payment Option | Payments can also be made electronically at tap.utah.gov. |

How to Write Utah Tc 559

Filling out the Utah TC-559 form is a necessary step for corporations and partnerships in Utah to make their tax payments, whether these are estimated payments, payments for an extension, or payments along with their return. This document ensures that the taxes are processed correctly and efficiently by the Utah State Tax Commission. By following these steps closely, taxpayers can ensure their payments are attributed to the right account and for the correct tax period, thereby avoiding possible penalties and interest for underpayment or late payments.

- Identify the type of payment you are making by marking the circle next to the correct option: Estimated tax payments, Extension payments, or Return payments.

- For the "Tax year ending" field, enter the last day of your fiscal year in a mm/dd/yyyy format. This clarifies the tax period for which you are making the payment.

- Write the Name of the corporation or partnership making the tax payment. This should match the legal name registered with the State.

- Enter the Employer Identification Number (EIN) of your corporation or partnership in the designated field.

- Fill in the Address, City, State, and Zip code fields with the correct mailing address of your corporation or partnership. This ensures any correspondence related to your payment can be delivered accurately.

- In the section marked "Payment amount enclosed," write the total amount of the payment you are sending. Ensure the amount is accurate to avoid underpayment penalties.

- Determine the method of payment. If you are paying by check or money order, make it payable to the Utah State Tax Commission. Do not send cash for obvious security reasons, and avoid stapling the check to the coupon to ensure smooth processing.

- Detach the bottom coupon from any top portion designed to be kept for your records. This bottom part is what you will mail in along with your payment.

- Finally, send the completed payment coupon and your check or money order to the Utah State Tax Commission at 210 N 1950 W, Salt Lake City, UT 84134-0180. Alternatively, you may opt for electronic payment at tap.utah.gov, following the site's instructions for payment submission.

By executing these steps meticulously, you will successfully complete and submit your Utah TC-559 form. Timely and correct filing not only keeps your business compliant but also prevents unnecessary financial setbacks through penalties and interest. Moreover, it assures that your business maintains a solid standing with the Utah State Tax Commission.

Frequently Asked Questions

- What is the purpose of the Utah TC-559 form?

This form is utilized by corporations and partnerships in Utah for the payment of various taxes. Its main purpose is to facilitate the payment of estimated tax payments, extension payments, and return payments to the Utah State Tax Commission. By marking the specific type of payment on the coupon, entities ensure that their payments are accurately processed for the appropriate tax obligation.

- Are there penalties for not making or underpaying estimated tax payments?

Yes, failure to make or underpaying the required estimated tax results in a penalty. Specifically, if your tax payments are less than either 90% of the current year’s tax liability ($100 minimum tax for corporations) or 100% of the prior year’s tax liability, the Utah State Tax Commission imposes a 2% penalty for each month of the extension period on the unpaid tax.

- What are the estimated tax payment requirements for a corporation?

A corporation with a tax liability of $3,000 or more in the current or previous tax year is required to make quarterly estimated tax payments. These payments must be equal to 90% of the current year's tax liability or 100% of the prior year's tax liability and are due on the 15th day of the 4th, 6th, 9th, and 12th months of the entity’s taxable year. However, a corporation can opt to prepay a minimum tax of $100 by the 15th day of the 12th month instead of making four $25 payments if the previous year's tax liability was $100.

- How does a corporation or partnership obtain an automatic filing extension?

An automatic filing extension is granted to a corporation or partnership when it makes the necessary extension payment by the due return date. This payment must be at least the lesser of 90% of the current year's tax liability (or the $100 corporation minimum tax, if greater) or 100% of the last year's tax liability. The remaining tax, along with any penalty and interest accrued, is due upon filing the return.

- What steps should be taken to avoid penalties and interest for a pass-through entity?

To avoid penalties and interest, a pass-through entity, such as a partnership or S corporation, must pay 100% of any pass-through withholding by the original due date of the tax return. Detailed information can be found in Pub 58, "UTAH INTEREST AND PENALTIES," available on the Utah State Tax Commission’s website.

- Where should payments using the TC-559 form be sent?

Payments accompanied by the TC-559 payment coupon should be mailed to: Corporate/Partnership Tax Payment, Utah State Tax Commission, 210 N 1950 W, Salt Lake City, UT 84134-0180. It is essential to send only the bottom portion of the coupon with the payment and retain the top portion for your records.

- Is electronic payment an option for the TC-559 form?

Yes, estimated tax payments, extension payments, and return payments can be made electronically through the Taxpayer Access Point at tap.utah.gov. This offers a convenient and secure way to fulfill tax obligations without the need for mailing physical coupons.

- What should be done to correctly submit a payment using the TC-559 form?

To submit a payment correctly, ensure that the correct type of payment is marked on the coupon, fill out all required fields, including the tax year ending date, entity name, Employer Identification Number (EIN), and contact details. Additionally, make the check or money order payable to the Utah State Tax Commission. Remember not to send cash or staple the check to the coupon. Detach the check stub before mailing.

Common mistakes

Filling out the Utah TC-559 form, essential for corporate and partnership tax payments, can be tricky. Even small mistakes can lead to penalties, interest, or processing delays. Let's explore seven common errors people make with this form to help ensure your next tax payment goes smoothly.

- Incorrectly marking the type of payment - The TC-559 form allows for three different types of payments: estimated tax payments, extension payments, and return payments. One common mistake is not correctly indicating which type of payment is being made. It's crucial to select the right option to ensure the payment is processed correctly and applied to the correct tax period.

- Underestimating tax payments - For both corporations and partnerships, failure to pay at least 90% of the current year's tax liability or 100% of the previous year's liability can result in penalties. An easy pitfall is underestimating these amounts, especially if not accounting for changes in income or tax laws that could affect liability.

- Missing estimated tax payments - Corporations with a tax liability of $3,000 or more are required to make quarterly estimated tax payments. Neglecting to make these payments, or not making them by the due dates, can attract underpayment penalties. It’s essential to stay on top of these deadlines to avoid unnecessary costs.

- Failing to make the extension payment - If taking advantage of the automatic filing extension, the necessary extension payment must still be made by the return's original due date. Forgetting this payment can lead to penalties and interest accruing from the original payment due date.

- Incorrect payment amount - This can happen by either overestimating or underestimating the taxes due. Both can cause issues: overestimation leaves money unnecessarily tied up until possibly refunded, while underestimation results in penalties and interest on the unpaid amount.

- Sending to the wrong address - Though it might seem straightforward, another common mistake is sending the payment and coupon to an incorrect address. This error can delay processing times or, worse, result in lost payments. Always double-check the current mailing information as it may change.

- Choosing the wrong payment method - Payments can be made electronically or by mail, but some choose to send cash despite recommendations against it, or they may staple checks to the coupon which can complicate processing. Adhering to the guidelines for payment ensures that it is processed efficiently and correctly.

Understanding and avoiding these common mistakes on the Utah TC-559 form can save businesses time, money, and headaches. It's about being accurate, timely, and in compliance with the Utah State Tax Commission's requirements. Always review your form thoroughly before submitting and consult with a tax professional if you're unsure about your tax obligations.

Documents used along the form

When dealing with corporate or partnership financial matters, specifically in the context of tax obligations for entities in Utah, one form you might regularly encounter is the Utah TC-559 form. This form is specifically designed for corporations or partnerships to make various types of tax payments including estimated tax payments, extension payments, and return payments. To ensure compliance and proper handling of tax liabilities, several other forms and documents may often accompany or be required along with the Utah TC-559 form. Let’s explore some of these crucial forms and documents.

- TC-20: The Utah Corporation Franchise or Income Tax Return form is used by corporations to file their annual income tax return. This form is where most of the details from the estimated payments made with the TC-559 would be finalized and reported.

- TC-20S: Similar to the TC-20, this form is the Utah S Corporation Franchise or Income Tax Return, tailored for S corporations, detailing their annual income tax responsibilities.

- TC-65: This form is the Partnership or LLC Return of Income. It's applicable for partnerships and certain LLCs for reporting their income, deductions, gains, and losses.

- Form 1041: For entities acting as trusts or estates that have tax obligations in Utah, Form 1041, the U.S. Income Tax Return for Estates and Trusts, may be required alongside the TC-559 for certain payments or declarations.

- UT Form 33H: This is the Holding Company Tax Return for the state of Utah and is particularly relevant for holding companies that need to file a state-specific return.

- Pub 58: This publication, titled "Utah Interest and Penalties," offers comprehensive information about how interest and penalties are assessed, including on late payments or underpayment of estimated taxes, providing essential guidance for entities looking to avoid these charges.

- Sch K-1: This schedule, part of the TC-65 form, details the share of profits, losses, and other deductions for each partner or LLC member, which is critical for assessing individual tax liabilities.

- TC-546: The Individual Income Tax Prepayment Coupon is used by individuals, but in the context of partnerships, individual partners might use it to make prepayments on their expected tax liability from pass-through income.

- TC-40: Utah Individual Income Tax Return form, which might be required for individual members of a partnership or S corporation to report their share of the income and calculate their tax dues accordingly.

- TC-941: The Utah Employer's Quarterly Withholding Tax Return, used by businesses to report and pay withholding taxes on employee salaries. Although not directly related to the TC-559, corporations and partnerships with employees must stay compliant with payroll tax obligations.

Each of these documents plays a vital role in ensuring that corporations and partnerships are fulfilling their tax responsibilities accurately and effectively in Utah. They cover a broad spectrum of tax-related declarations, from income and franchise taxes to partner allocations and beyond. Understanding and correctly utilizing these forms, along with the Utah TC-559, help entities navigate the complexities of tax compliance, enabling them to focus more on their operations and less on their tax obligations.

Similar forms

The IRS Form 1040-ES, "Estimated Tax for Individuals," shares similarities with the Utah TC-559 form as it is also designed for the payment of estimated taxes. While the IRS form is for individuals, both forms serve a similar purpose: allowing filers to make payments towards their expected tax liability for the year. These payments help avoid underpayment penalties by ensuring taxpayers pay as they earn or receive income throughout the year. The structure of quarterly payments is a common feature, aiming to spread the tax burden evenly across the year.

Form 7004, "Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns," mirrors the Utah TC-559 form in providing an avenue for businesses to request an extension for filing tax returns. Both forms do not extend the time for payment of taxes due but focus on granting more time to file the necessary documentation. This pivotal feature underlines the importance of meeting payment deadlines to avoid penalties, even when additional time for filing has been granted.

The California Form 3522, "LLC Tax Voucher," is another document that resembles the Utah TC-559 form as it pertains to a specific entity, in this case, limited liability companies (LLCs), making tax payments. Similar to the TC-559, it is a payment coupon used for submitting annual tax payments, emphasizing the parallel process of entities across different jurisdictions making regular tax payments to comply with state laws and avoid penalties for late or insufficient payments.

The Form 1065, "U.S. Return of Partnership Income," though primarily a return filing document, shares a connection with the TC-559 through its extension and estimated tax payment components for partnerships. Both documents facilitate partnerships in managing their tax obligations, specifically in relation to paying taxes due in a timely manner and filing for extensions when necessary. This showcases the coordinated effort across different forms and entities to ensure tax compliance.

The New York IT-2105, "Estimated Tax Payment Voucher for Individuals," parallels the TC-559 form in serving individuals within a specific state, emphasizing the universal need for taxpayers, regardless of jurisdiction, to prepay their estimated tax liabilities. This prepayment reduces the risk of accruing interest and penalties due to underpayment, indicating how various tax authorities manage estimated tax payments in a similar manner.

Form 1120-W, "Estimated Tax for Corporations," is directly comparable to the Utah TC-559 as both target corporations' estimated tax payments. Each form guides corporations through the process of calculating and paying their estimated taxes, aiming to prevent underpayment penalties. This underlying purpose reinforces the significance of estimated payments as a financial management tool for corporations to evenly distribute their tax liabilities over the fiscal year.

The "Electronic Federal Tax Payment System (EFTPS)" voucher, though not a physical form, offers an electronic equivalent to the TC-559's functionality for paying various types of taxes electronically. Like the TC-559, users can specify the payment type, such as estimated taxes or return payments. This digital approach facilitates timely and secure tax payments, highlighting the shift towards accommodating modern payment methods while serving the same fundamental purpose of tax compliance.

Form 4868, "Application for Automatic Extension of Time to File U.S. Individual Income Tax Return," provides individual taxpayers with a method to request a filing extension, akin to the extension payment feature of the Utah TC-559 for corporations and partnerships. Both forms acknowledge situations where taxpayers require more time to gather necessary information, allowing them to avoid penalties associated with late filing, albeit keeping the obligation to pay estimated taxes by the original due date.

The Form 1041-ES, "Estimated Income Tax for Estates and Trusts," offers a process similar to the TC-559, but for estates and trusts to make estimated tax payments. It highlights the broader application of estimated tax payments across different types of entities, including individuals, corporations, and non-corporate entities like trusts and estates. This diversity underscores the importance of estimated tax payments in the overall framework of tax administration.

Lastly, the Pennsylvania REV-857, "Estimated Tax Payment," serves a similar function for businesses within Pennsylvania, making it akin to Utah's TC-559 form. Both provide a structured method for entities to comply with state tax obligations through pre-determined payment schedules. This parallel signifies a common approach adopted by state tax authorities to facilitate regular tax payments, aiding in the smooth operation of state taxation systems and ensuring entities meet their tax responsibilities promptly.

Dos and Don'ts

Filling out the Utah TC-559 form accurately and timely is crucial for corporations and partnerships to avoid penalties and interest. Here's a list of dos and don'ts that can help ensure that you complete the form correctly.

Do:- Clearly mark the circle on the coupon that indicates the type of payment you are making: estimated tax payments, extension payments, or return payments.

- Ensure the tax payments meet at least the lesser of 90 percent of the current-year tax liability or 100 percent of the previous-year tax liability to avoid penalties.

- Make quarterly estimated tax payments if the corporation's tax liability was $3,000 or more in the current or previous tax year.

- Send the payment coupon and payment to the correct address provided by the Utah State Tax Commission.

- Consider making electronic payments via tap.utah.gov for convenience and confirmation of receipt.

- Forget to detach the check stub if paying by check or money order. This is a common oversight that can lead to processing delays.

- Staple the check to the coupon. This could damage the document and interfere with processing.

- Underestimate the importance of meeting the estimated tax payment requirements to avoid underpayment penalties.

By following these guidelines, you can help ensure that your corporation or partnership complies with Utah's tax payment requirements, avoiding unnecessary penalties and interest. Keep a copy of the TC-559 form and all related correspondence for your records, maintaining accurate and complete financial documentation.

Misconceptions

Understanding the Utah TC-559 form is crucial for businesses operating within the state, yet there are several misconceptions that often lead to confusion. Dispelling these myths can help ensure that companies comply with tax regulations effectively and avoid unnecessary penalties.

Misconception 1: The TC-559 form is only for corporations. While it's true that corporations are required to use the TC-559 form for certain tax payments, partnerships also need to utilize this form. It serves both entities for estimated tax payments, extension payments, and return payments, ensuring that both corporations and partnerships adhere to state tax obligations.

Misconception 2: Estimated tax payments are optional. Some businesses mistakenly believe that making estimated tax payments is optional. However, for corporations with a tax liability of $3,000 or more in the current or previous tax year, quarterly estimated tax payments are mandatory. Failing to do so can lead to underpayment penalties, emphasizing the importance of adhering to this requirement.

Misconception 3: The form cannot be filed electronically. In today’s digital world, it is still commonly believed that tax forms can only be submitted in paper form. Contrary to this belief, the Utah TC-559 form, along with the related payment, can be submitted electronically through the state's tax website. This option simplifies the process, saving time and resources for businesses.

Misconception 4: Late filing is the only reason for penalties. While late filing is a common reason for penalties, underpayment of the required estimated tax can also trigger penalties. If tax payments do not meet the specified criteria, a penalty of 2 percent of the unpaid tax for each month of the extension period is assessed, underlining the importance of accurate and timely payments.

Misconception 5: First-year corporations are exempt from estimated tax payments. It's often thought that newly established corporations are exempt from making estimated tax payments in their first year. While somewhat true, the exemption is conditional; a new corporation does not have to make estimated tax payments in the first year if it makes a payment equal to or greater than the minimum tax by the due date, without extension. This nuanced requirement can catch new business owners off guard.

Misconception 6: Any method of payment is accepted with the form. Some might assume that any payment method can be used when submitting the TC-559 form. However, payments must be made via check, money order, or electronically through the specified state tax website. Cash payments are explicitly not accepted, and checks should not be stapled to the coupon, ensuring the processing of payments goes smoothly.

Clarifying these misconceptions about the Utah TC-559 form can aid corporations and partnerships in navigating their tax responsibilities more effectively. By understanding and adhering to the specific requirements, businesses can avoid common pitfalls and ensure they remain in good standing with the Utah State Tax Commission.

Key takeaways

When filling out the Utah TC-559 form, businesses must carefully indicate the type of payment they are making by marking the appropriate circle on the coupon. This categorization is critical for ensuring the payment is processed correctly for either estimated tax payments, extension payments, or return payments.

Corporations with a tax liability of $3,000 or more in either the current or previous tax year are required to make quarterly estimated tax payments. This requirement also applies to a parent company filing a combined report for all affiliated companies, provided the total tax exceeds $3,000. These payments are due on the 15th day of the 4th, 6th, 9th, and 12th months of the entity's taxable year.

Entities making estimated tax payments have the option to base their payments on 90 percent of the current year's tax liability or 100 percent of the previous year's tax liability. This flexibility can aid in managing cash flow and tax liability effectively throughout the year.

A unique provision exists for corporations that had a tax liability of only the minimum $100 in the previous year; these entities may opt to prepay this amount in full instead of making quarterly payments.

Failure to make the required estimated tax payments, or underpaying these amounts, results in a penalty. The Tax Commission imposes a 2 percent penalty on the unpaid tax for each month of the extension period if payments don’t meet the stipulated thresholds.

For extension payments, the Tax Commission grants an automatic extension to file provided the necessary payment is made by the return due date. The payment must be at least the lesser of 90 percent of the current year's tax liability or 100 percent of the previous year's tax liability.

All payments, whether for estimated taxes, extensions, or return payments, should be directed to the Utah State Tax Commission at the address provided on the form. This ensures payments are processed efficiently and accurately.

Electronic payments offer a convenient alternative to mailing checks. Businesses can make their estimated tax, extension, and return payments online at tap.utah.gov, simplifying the process and saving time.

Common PDF Templates

Income Tax Calculator Utah - For nonresident estates or trusts, specific calculations are required to determine federal taxable income derived from Utah sources.

Utah Real Estate Purchase Contract - Allows for adjustments to financing, closing dates, or sale conditions, reflecting the dynamic nature of real estate transactions.

Drivers Handbook Utah - A comprehensive form for applying for a Utah driver's license, including personal, contact, and residency details.