Fill Out Your Utah Tc 42 Form

Navigating the corporate landscape in Utah, especially when it involves reinstating a corporation with the Department of Commerce, requires a thorough understanding of specific documentation, such as the Utah TC-42 form. This essential form, directly associated with the Utah State Tax Commission, serves a pivotal role for corporations and S-corporations keen on regaining their good standing status. Unlike limited liability companies (LLCs), which are exempt from this requirement, these entities must ensure that they are current with all tax filing and payment obligations as mandated by the Commission. The form itself demands a detailed compilation of corporate information, including the current address, Commerce number/entity number, and the Federal Identification Number, among other data. A Letter of Good Standing Certificate, obtainable through the submission of this form, affirms that the corporation has met its tax obligations. This process, which can take between five to ten days, also includes provisions for cases where tax responsibilities have not been fulfilled, outlining steps for compliance. With the Utah State Tax Commission offering assistance via phone for any arising queries, the form represents a critical step for corporations aiming to navigate their administrative reinstatement efficiently.

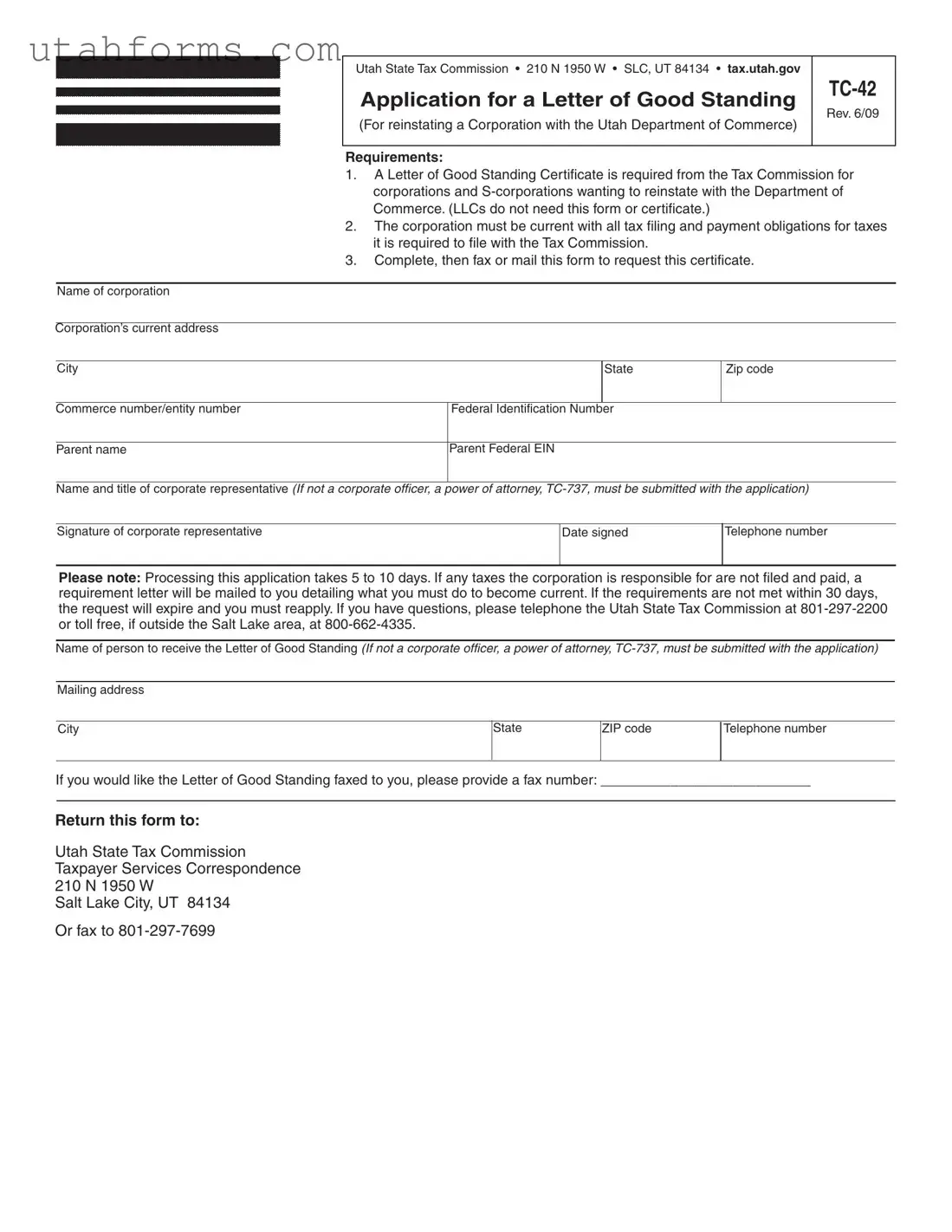

Preview - Utah Tc 42 Form

Utah State Tax Commission • 210 N 1950 W • SLC, UT 84134 • tax.utah.gov

Application for a Letter of Good Standing

(For reinstating a Corporation with the Utah Department of Commerce)

Rev. 6/09

Requirements:

1.A Letter of Good Standing Certificate is required from the Tax Commission for corporations and

2.The corporation must be current with all tax filing and payment obligations for taxes it is required to file with the Tax Commission.

3.Complete, then fax or mail this form to request this certificate.

Name of corporation

Corporation’s current address

City |

|

State |

Zip code |

|

|

|

|

Commerce number/entity number |

Federal Identification Number |

|

|

|

|

|

|

Parent name |

Parent Federal EIN |

|

|

|

|

|

|

Name and title of corporate representative (If not a corporate officer, a power of attorney,

Signature of corporate representative

Date signed

Telephone number

Please note: Processing this application takes 5 to 10 days. If any taxes the corporation is responsible for are not filed and paid, a requirement letter will be mailed to you detailing what you must do to become current. If the requirements are not met within 30 days, the request will expire and you must reapply. If you have questions, please telephone the Utah State Tax Commission at

Name of person to receive the Letter of Good Standing (If not a corporate officer, a power of attorney,

Mailing address

City

State

ZIP code

Telephone number

If you would like the Letter of Good Standing faxed to you, please provide a fax number: ___________________________

Return this form to:

Utah State Tax Commission

Taxpayer Services Correspondence

210 N 1950 W

Salt Lake City, UT 84134

Or fax to

File Specifications

| Fact | Detail |

|---|---|

| Form Purpose | Application for a Letter of Good Standing for corporations and S-corporations seeking reinstatement with the Utah Department of Commerce. |

| Exclusions | LLCs do not need this form or certificate to reinstate with the Department of Commerce. |

| Tax Compliance Requirement | The corporation must be current with all tax filing and payment obligations with the Tax Commission. |

| Submission Options | The form can be submitted via fax or mail to the Utah State Tax Commission. |

| Processing Time | Application processing takes between 5 to 10 days. |

| Expiration of Application | If tax obligations are not fulfilled within 30 days after a requirement letter is sent, the request for a Letter of Good Standing expires. |

| Governing Law | This application is regulated by the Utah State Tax Commission and pertains to tax compliance and corporate reinstatement laws in Utah. |

How to Write Utah Tc 42

Filling out the Utah TC-42 form is a crucial step for corporations and S-corporations aiming to reinstate with the Utah Department of Commerce. This process requires attention to detail to ensure every piece of information is accurately provided. It not only signifies compliance with state tax obligations but also paves the way for successful reinstatement. The following steps are designed to provide a clear, straightforward guide to complete the form accurately. After submission, processing may take between 5 to 10 days. It's important to note that failure to meet all tax obligations could result in delays or the need to reapply, so ensuring all tax responsibilities are fulfilled before submitting this form is essential.

- Begin by entering the Name of the corporation at the top of the form.

- Fill in the Corporation’s current address, including the city, state, and zip code.

- Provide the Commerce number/entity number associated with your corporation.

- Enter the Federal Identification Number (EIN) of the corporation.

- If applicable, list the Parent name and Parent Federal EIN.

- Identify the Name and title of the corporate representative who is filling out the form. If this person is not a corporate officer, attach a power of attorney, TC-737.

- Signature of the corporate representative is required. Therefore, have the designated individual sign the form.

- Indicate the Date when the form was signed next to the signature.

- Provide a Telephone number where the representative or corporation can be reached.

- Specify the Name of the person to receive the Letter of Good Standing. If this individual is not a corporate officer, a power of attorney, TC-737, must be included with the application.

- Fill in the Mailing address, including city, state, and ZIP code, for where the Letter of Good Standing should be sent.

- Enter a Telephone number for the person receiving the Letter of Good Standing.

- If you prefer to receive the Letter of Good Standing via fax, provide a fax number.

- Once the form is completed, review it carefully to ensure all information is accurate and complete. Then, return this form to the Utah State Tax Commission either through mail at Taxpayer Services Correspondence, 210 N 1950 W, Salt Lake City, UT 84134 or fax it to 801-297-7699.

Ensuring that all information provided is accurate and current is paramount for a smooth process. Once the form is submitted, anticipatory steps include waiting for the processing period to conclude. Keep in mind, if your corporation has unmet tax obligations, you will be notified and given 30 days to become current. Failure to satisfy these requirements within the given timeframe could necessitate starting the process anew. For any queries or clarification throughout this procedure, reaching out to the Utah State Tax Commission directly can provide additional guidance.

Frequently Asked Questions

What is the purpose of the Utah TC-42 form?

The Utah TC-42 form is designed to facilitate corporations and S-corporations in obtaining a Letter of Good Standing from the Utah State Tax Commission. This certificate is essential for these entities to reinstate their status with the Department of Commerce. Importantly, this form and certificate are not required for LLCs. The Letter of Good Standing verifies that a corporation is current with all its tax filing and payment obligations to the Commission.

Who needs to complete the Utah TC-42 form?

Corporations and S-corporations seeking to reinstate with the Utah Department of Commerce must complete the Utah TC-42 form. This is a mandatory step in verifying that the entity has fulfilled all tax-related requirements with the Utah State Tax Commission. It is important to note that LLCs are exempt from this requirement.

What are the requirements to receive a Letter of Good Standing?

- The corporation must ensure that it is up-to-date with all tax filings and payments for taxes due to the Commission.

- A completed Utah TC-42 form must be submitted, either by fax or mail, to make the request for a Letter of Good Standing.

How long does it take to process the Utah TC-42 form?

Processing of the Utah TC-42 form typically takes between 5 to 10 days. It is during this time that the Tax Commission reviews the corporation’s compliance with its tax obligations. Should there be any outstanding taxes, a requirement letter will be dispatched, outlining the necessary actions to become current. If these requirements are not satisfied within 30 days, the request will expire, necessitating a reapplication.

What happens if the corporation is not current with its tax obligations?

If the corporation has not fulfilled its tax obligations, the Utah State Tax Commission will issue a requirement letter to the corporation. This letter details the specific actions the corporation must take to become current. Failure to meet these requirements within 30 days results in the expiration of the request. In such cases, entities must reapply for the Letter of Good Standing, ensuring that all tax obligations are settled beforehand.

How can questions regarding the Utah TC-42 form be addressed?

For any inquiries or further clarification on the Utah TC-42 form, individuals are encouraged to contact the Utah State Tax Commission directly. Assistance can be sought by calling their main line at 801-297-2200 or toll-free for those outside the Salt Lake area at 800-662-4335. The Tax Commission staff is prepared to offer guidance on completing the form and understanding the requirements for obtaining a Letter of Good Standing.

Common mistakes

Completing the Utah TC-42 form, which is the application for a Letter of Good Standing, requires attention to detail and a clear understanding of the form's requirements. However, individuals often make mistakes during this process that can lead to delays or the rejection of their application. Highlighting the most common errors can assist individuals and corporations in successfully navigating this process.

One common mistake is overlooking the requirement that only corporations and S-corporations need to apply for a Letter of Good Standing. Limited Liability Companies (LLCs) do not require this form, yet some LLC representatives mistakenly complete and submit it, wasting time and resources.

Another common error involves failing to ensure all tax filings and payments are up to date before submitting the form. The application requires the entity to be current with all tax obligations. Submitting the form without being current on these obligations will result in a requirement letter being sent to the applicant, detailing what needs to be addressed to become current. This can significantly delay the process.

Incorrectly filling out the contact information is also a frequent mistake. Applicants often provide outdated or incorrect mailing addresses, telephone numbers, or fax numbers. This mistake can lead to the Letter of Good Standing being sent to the wrong address or the inability of the Tax Commission to contact the applicant if further information is needed, thus delaying the entire process.

Submitting incomplete or incorrect corporate information is another common error that can be easily avoided. Applicants sometimes fail to provide the full legal name of the corporation, the correct Commerce number/Entity number, or the Federal Identification Number. Such inaccuracies can lead to the rejection of the application.

Failing to include a power of attorney form (TC-737) when the application is submitted by someone who is not a corporate officer is a significant mistake that many applicants make. This oversight can invalidate the application, as the Utah State Tax Commission requires proper authorization for individuals acting on behalf of the corporation who are not corporate officers.

To avoid these mistakes, applicants should carefully review the requirements listed on the TC-42 form and ensure all provided information is accurate and complete. Paying attention to detail and adhering to the specified requirements can streamline the process of obtaining a Letter of Good Standing.

The following is a summary of the mistakes to avoid:

- Submitting the form for an LLC, which is not required.

- Not being current with all tax obligations before applying.

- Providing incorrect or outdated contact information.

- Submitting incomplete or inaccurate corporate information.

- Omitting a power of attorney form when necessary.

Documents used along the form

When dealing with the process of reinstating a corporation with the Utah Department of Commerce using the Utah TC-42 form, several other documents are often required to successfully navigate the process. These documents play vital roles in ensuring the corporation meets all legal and procedural requirements for reinstatement and continued operation within the state. Below is a list of documents often used in tandem with the TC-42 form, each serving a unique purpose in the reinstatement process.

- TC-737: Power of Attorney and Declaration of Representative form allows a designated individual to act on behalf of the corporation. This is necessary if the TC-42 form is not being submitted by a corporate officer.

- Articles of Incorporation: The original Articles of Incorporation or Restated Articles of Incorporation, including any amendments, verify the corporation's legal formation and any changes to its structure or name over time.

- Certificate of Existence: Also known as a Certificate of Good Standing from the state where the corporation was originally incorporated, it proves the corporation is legally recognized and has met all state requirements up to date.

- Annual Reports: These reports provide a yearly snapshot of the corporation’s financial health and operational status, often required to ensure compliance with state regulations.

- Tax Clearance: A document that verifies the corporation has no outstanding tax liabilities. While similar to the Letter of Good Standing in concept, it specifically relates to tax obligations.

- Articles of Amendment: Filed if the corporation has undergone changes such as a name change or changes to its corporate structure, these amendments must be filed with the state.

- Articles of Dissolution: If the corporation was previously dissolved, the Articles of Dissolution must be provided to clarify the terms and conditions of the dissolution.

- Operating Agreement: Though typically associated with LLCs, corporations may also have an operating agreement that outlines the operational procedures and guidelines for the corporation’s governance.

- Corporate Bylaws: This document outlines the rules by which the corporation operates and is governed. While not always required for reinstatement, it is fundamental for the internal management of the company.

- Shareholder Agreement: Relevant to corporations with multiple shareholders, this agreement details the rights and obligations of the shareholders and can play a role in the reinstatement process.

The above documents, when used in conjunction with the TC-42 form, create a comprehensive package for the Utah State Tax Commission and the Utah Department of Commerce, facilitating the efficient processing of a corporation’s reinstatement. Corporations looking to operate within Utah must provide accurate and current documentation, ensuring compliance with state laws and regulations. This careful attention to detail not only aids in the reinstatement process but also helps in maintaining good standing in the future.

Similar forms

The Certificate of Good Standing from the Delaware Division of Corporations is similar to Utah's TC-42 form in its core function. Both documents verify a corporation's compliance with state requirements, including tax filings and payments. This verification is essential for businesses seeking reinstatement or to prove their legitimacy for transactions and business activities in their respective states. While the TC-42 is specific to Utah, the Certificate of Good Standing serves a parallel purpose in Delaware, where a large number of businesses are incorporated due to favorable corporate laws.

California's Statement of Information (Form SI-550) shares similarities with the TC-42 form, although it encompasses broader informational reporting requirements for corporations, including details about corporate officers and directors. While the TC-42 focuses on tax compliance for the purpose of obtaining a Letter of Good Standing, the Statement of Information ensures corporations are current with the California Secretary of State's office on annual or biennial bases, depending on the entity type. Both forms serve as critical compliance documents within their state's business regulatory framework.

The Application for Certificate of Authority from the Texas Comptroller of Public Accounts mirrors the TC-42's objective in assisting out-of-state corporations to operate legally within another jurisdiction. While the TC-42 form is a precondition for reinstatement in Utah, the Texas application enables foreign corporations to transact business in Texas legally. Both forms require adherence to tax obligations and are foundational for corporations’ operational legitimacy in their respective states.

New York's Application for Authority, administered by the Department of State, is akin to the Utah TC-42 form in facilitating a corporation's legal operation within the state. Though the TC-42 is specifically for tax compliance and reinstatement, New York's application allows out-of-state corporations to do business in New York by registering and complying with state regulations, including tax obligations. The underlying similarity lies in ensuring corporations meet state-specific legal and tax requirements.

Florida’s Application for Certificate of Authority closely aligns with the intentions behind the TC-42 form, guiding out-of-state corporations to obtain the legal right to conduct business in Florida. Similar to the TC-42's role in reinstatement with the Utah Department of Commerce, Florida's application requires corporations to be in good standing in their home state, including being current on all tax obligations, to operate within Florida boundaries legally.

The Pennsylvania Department of State's Request for Certificate of Good Standing carries out a similar function as Utah's TC-42, confirming a corporation's compliance with state tax and legal requirements. This affirmation, crucial for various business needs such as financing or registration in another state, is similarly sought through the TC-42 form in Utah, highlighting the importance of maintaining clean tax and legal records for corporations in any jurisdiction.

The Annual Report filing with the Washington Secretary of State shares a procedural resemblance with the TC-42, despite serving a broader purpose. The annual report updates entity information and compliance status, whereas the TC-42 specifically addresses tax compliance for reinstatement. Both documents are integral to maintaining a corporation's good standing and accurate records within their respective states.

Oregon's Application for Authority to Transact Business is another document similar to the TC-42 form, aimed at out-of-state or foreign corporations seeking to legally operate in Oregon. Like the TC-42, which facilitates a corporation's reinstatement in Utah by verifying tax compliance, Oregon's application ensures that corporations entering Oregon are compliant with state regulations, including tax obligations, thereby safeguarding the state's business environment.

The Certificate of Existence from the Alabama Secretary of State functions parallel to the TC-42 form by verifying a corporation's legal and tax standing within the state. Required for various corporate activities, including loans and business agreements, this certificate, like Utah’s Letter of Good Standing obtained through the TC-42, certifies a corporation's compliance with state-imposed requirements.

Lastly, the Michigan Annual Statement and report submission process resembles the TC-42 form. While focused on annual informational updates and compliance verification, Michigan's requirement emphasizes the necessity for corporations to remain in good standing, much like the TC-42’s purpose of reinstating corporations with the Utah Department of Commerce through tax compliance certification. Both documents are essential for transparency and regulatory adherence within their respective states.

Dos and Don'ts

When filling out the Utah TC-42 form, an Application for a Letter of Good Standing, there are several important do's and don'ts to keep in mind. These guidelines will help ensure the application process is smooth and successful.

Do's:- Ensure the corporation is up-to-date on all tax filings and payments before submitting the TC-42 form. Being current with tax obligations is a prerequisite for obtaining a Letter of Good Standing.

- Complete the application in full, providing accurate and comprehensive information in every field to avoid delays or rejections.

- Include the corporation’s correct current address, city, state, and zip code to ensure any correspondence can be promptly and correctly delivered.

- If the corporate representative signing the form is not a corporate officer, attach a power of attorney form (TC-737).

- Provide a valid contact telephone number and an optional fax number, if you prefer to receive the Letter of Good Standing by fax.

- Review the application for errors or omissions before submission.

- Don’t overlook the requirement for S-corporations and corporations to have this form when reinstating with the Department of Commerce. Note that LLCs are not required to submit this form.

- Don’t forget to sign and date the application form. The signature of the corporate representative is necessary to process the application.

- Avoid delays in responding to any requirement letters from the Tax Commission if your corporation is found not current with its tax responsibilities. Failing to comply within 30 days will result in the expiration of your request.

- Do not underestimate the processing time. Keep in mind that processing the application can take 5 to 10 days, so plan accordingly.

Following these guidelines when filling out the Utah TC-42 form will help to streamline the process of obtaining a Letter of Good Standing, thereby facilitating a smoother reinstatement with the Department of Commerce for corporations and S-corporations.

Misconceptions

When it comes to the Utah TC-42 form, there are several misconceptions that can lead to confusion for businesses seeking to reinstate their corporation with the Utah Department of Commerce. Understanding these misconceptions is crucial for a smooth reinstatement process. Here are four common misconceptions and the truths behind them:

- All business entities need to submit a TC-42 form to reinstate. This is not accurate. The TC-42 form, or Application for a Letter of Good Standing, is specifically required for corporations and S-corporations that are looking to reinstate with the Department of Commerce. Limited Liability Companies (LLCs) do not need this form or certificate for reinstatement purposes.

- Submitting the form is all that's required to obtain a Letter of Good Standing. Merely submitting the TC-42 form is not enough. The corporation must be current with all tax filing and payment obligations it is required to file with the Tax Commission. If any taxes are unpaid or filings are incomplete, a Letter of Good Standing will not be issued until these obligations are met.

- Processing of the TC-42 form is immediate. It's important to plan ahead because processing the application for a Letter of Good Standing takes 5 to 10 days. This timeframe should be taken into consideration when planning the reinstatement of a corporation with the Department of Commerce.

- If the requirements aren't met initially, the application process starts over automatically. If the Tax Commission identifies that there are outstanding requirements after the TC-42 form is submitted, they will notify the applicant. The applicant then has 30 days to meet these requirements. If not met within this timeframe, the request expires, and the process does not start over automatically. Instead, the corporation must reapply and submit a new TC-42 form.

Understanding and addressing these misconceptions about the Utah TC-42 form is essential for corporations and S-corporations aiming to smoothly reinstate with the Utah Department of Commerce. Being well-informed about these aspects can help avoid unnecessary delays or complications in obtaining a Letter of Good Standing.

Key takeaways

Understanding the process and requirements for applying for a Letter of Good Standing in Utah is critical for corporations and S-corporations looking to reinstate with the Department of Commerce. Here are key takeaways about filling out and using the Utah TC-42 form.

- Eligibility Is Specific: The TC-42 form is explicitly required for corporations and S-corporations that hope to reinstate their status with the Utah Department of Commerce. Limited Liability Companies (LLCs) are not required to fill out this form or obtain the certificate.

- Stay Current on Taxes: A fundamental requirement for obtaining a Letter of Good Standing is that the corporation must be up to date with all tax filings and payments for taxes due to the Utah State Tax Commission.

- Submission Information: Complete the TC-42 form with the necessary corporation details and then submit it through fax or mail. This includes providing information such as the corporation’s name, current address, Commerce number/entity number, Federal Identification Number, and the contact details of a corporate representative.

- Processing Time: Applicants should allow for a processing time of 5 to 10 days after submitting their application. It's important to plan accordingly to ensure the reinstatement process with the Department of Commerce can proceed without delays.

- Follow-Up and Compliance: If there are any outstanding taxes owed by the corporation, a requirement letter will be sent out detailing steps to become current on these obligations. It is crucial to address these requirements within 30 days. Failure to do so will result in the application expiring, necessitating a new application.

If applicants have any questions or need further clarification, they are encouraged to contact the Utah State Tax Commission directly through the provided phone numbers. Ensuring all required information is accurately provided and understanding the process can streamline the application for a Letter of Good Standing.

Common PDF Templates

Workers' Compensation Utah Phone Number - This form is an essential component of Utah's commitment to workplace health and safety, enforcing a standardized injury and illness reporting procedure.

Utah Tc-40 Instructions - The Utah 24 06 37 form not only aids in operational aspects but also in the strategic planning of construction endeavors.