Fill Out Your Utah Tc 40V Form

In an effort to promote environmentally friendly transportation solutions, Utah offers a tax incentive for individuals and businesses investing in cleaner burning fuel vehicles. The Utah State Tax Commission's TC-40V form is a crucial document for those seeking to claim the Clean Fuel Vehicle Tax Credit, a nonrefundable credit against individual, corporation, or fiduciary taxes. This form must be meticulously completed for each qualifying vehicle, whether purchased or converted, to utilize cleaner fuel options such as electricity, propane, or natural gas. The credit, which is only available once per vehicle and must be certified in the taxable year of purchase or conversion, can significantly offset the cost of cleaner transportation. Moreover, if the credit amount surpasses that year's tax liability, it can be carried forward to any of the next five taxable years, ensuring that taxpayers fully benefit from their eco-friendly investment. This form also involves the Utah Division of Air Quality, which plays a pivotal role in certifying that the vehicle meets the necessary clean-air and fuel-economy standards. The instructions provided with the TC-40V form offer a step-by-step guide on calculating the tax credit and properly documenting and filing for the credit, though it's important to note that the form itself should not be sent with the return but kept for records.

Preview - Utah Tc 40V Form

Utah State Tax Commission |

|

||

Clean Fuel Vehicle Tax Credit |

Get forms online - tax.utah.gov |

Rev. 7/12 |

|

|

|

|

|

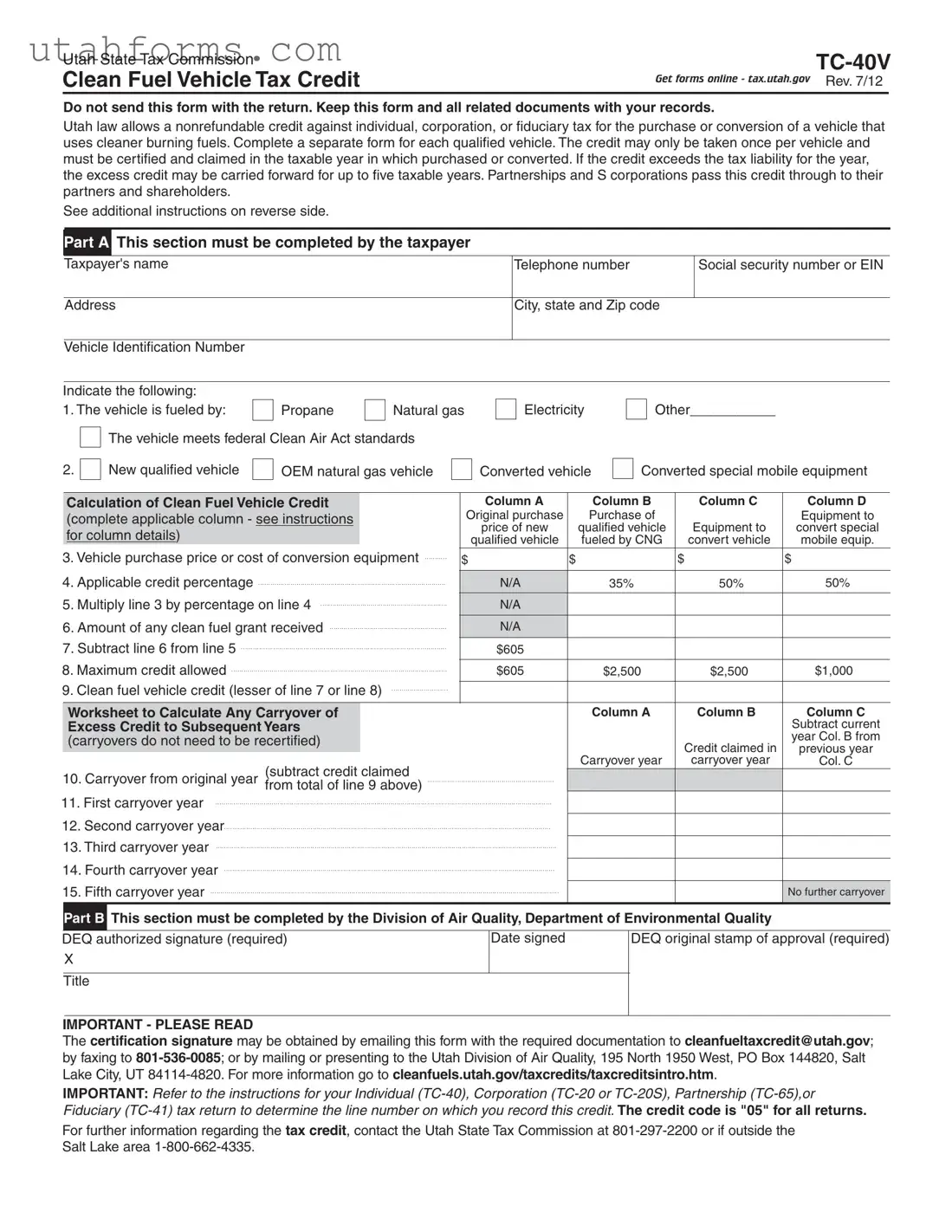

Do not send this form with the return. Keep this form and all related documents with your records.

Utah law allows a nonrefundable credit against individual, corporation, or fiduciary tax for the purchase or conversion of a vehicle that uses cleaner burning fuels. Complete a separate form for each qualified vehicle. The credit may only be taken once per vehicle and must be certified and claimed in the taxable year in which purchased or converted. If the credit exceeds the tax liability for the year, the excess credit may be carried forward for up to five taxable years. Partnerships and S corporations pass this credit through to their partners and shareholders.

See additional instructions on reverse side.

Part A This section must be completed by the taxpayer

Taxpayer's name

Telephone number

Social security number or EIN

Address

City, state and Zip code

Vehicle Identification Number

Indicate the following: |

|

|

1. The vehicle is fueled by: |

Propane |

Natural gas |

The vehicle meets federal Clean Air Act standards

Electricity

Other___________

2.

New qualified vehicle

OEM natural gas vehicle

Converted vehicle

Converted special mobile equipment

|

Calculation of Clean Fuel Vehicle Credit |

|

Column A |

Column B |

Column C |

Column D |

|

(complete applicable column - see instructions |

|

Original purchase |

Purchase of |

Equipment to |

Equipment to |

|

|

price of new |

qualified vehicle |

convert special |

||

|

for column details) |

|

||||

|

|

qualified vehicle |

fueled by CNG |

convert vehicle |

mobile equip. |

|

3. Vehicle purchase price or cost of conversion equipment |

|

|

|

|

||

$ |

$ |

$ |

$ |

|||

4. Applicable credit percentage |

|

|

|

|

||

N/A |

35% |

50% |

50% |

|||

5. Multiply line 3 by percentage on line 4 |

N/A |

|

|

|

||

6. Amount of any clean fuel grant received |

N/A |

|

|

|

||

7. Subtract line 6 from line 5 |

$605 |

|

|

|

||

8. Maximum credit allowed |

|

|

|

|

||

$605 |

$2,500 |

$2,500 |

$1,000 |

|||

9. Clean fuel vehicle credit (lesser of line 7 or line 8) |

|

|

|

|

||

|

|

|

|

|||

|

|

|

|

|

|

|

|

Worksheet to Calculate Any Carryover of |

|

|

Column A |

Column B |

Column C |

|

Excess Credit to Subsequent Years |

|

|

|

|

Subtract current |

|

(carryovers do not need to be recertified) |

|

|

|

Credit claimed in |

year Col. B from |

|

|

|

|

previous year |

||

|

|

|

|

|

||

|

(subtract credit claimed |

|

Carryover year |

carryover year |

Col. C |

|

|

|

|

|

|

||

10. Carryover from original year from total of line 9 above) |

|

|

|

|

||

11. First carryover year |

|

|

|

|

||

12. Second carryover year |

|

|

|

|

||

|

|

|

|

|||

13. Third carryover year |

|

|

|

|

||

|

|

|

|

|||

14. Fourth carryover year |

|

|

|

|

||

|

|

|

|

|||

15. Fifth carryover year |

|

|

|

|

||

|

|

|

No further carryover |

|||

|

|

|

|

|

|

|

Part B This section must be completed by the Division of Air Quality, Department of Environmental Quality

DEQ authorized signature (required) |

Date signed |

X

Title

DEQ original stamp of approval (required)

IMPORTANT - PLEASE READ

The certification signature may be obtained by emailing this form with the required documentation to cleanfueltaxcredit@utah.gov; by faxing to

IMPORTANT: Refer to the instructions for your Individual

For further information regarding the tax credit, contact the Utah State Tax Commission at

Instructions for the Clean Fuel Vehicle Tax Credit -

Taxpayers may claim a nonrefundable tax credit against Utah individual income tax, corporate franchise tax or fiduciary tax. (See Utah Code sections

The credit may only be taken once per vehicle. It must be certified and claimed in the taxable year in which the item is purchased or converted.

Column A - New Vehicle Meeting Air Quality and Fuel Economy Standards for Combined City and Highway, and Not Fueled by Compressed Natural Gas

A qualified vehicle is an original purchase, registered and titled for the first time in Utah, and having less than 7,500 miles. The vehicle must be certified by the Utah Department of Environmental Quality and meet both of the following standards:

1.Fuel Economy Standards for Combined City and Highway

a.at least 31 miles per gallon for

b.at least 36 miles per gallon for

c.at least 19 miles per gallon for vehicles fueled by a blend of 85% ethanol and 15% gasoline;

d.at least 19 miles per gallon for liquified petroleum

e.meet standards consistent with 40 C.F.R.

2.Air quality standards which are equal to or cleaner than the standards established in bin 2 in Table

The credit amount is $605.

Column B - OEM Vehicle Fueled by Compressed Natural Gas

A qualified vehicle is one fueled by compressed natural gas, and is registered in Utah.

The credit is the lesser of 35% of the purchase price of the vehicle less any clean fuel grant received, or $2,500.

Column C - Equipment to Convert Vehicle to Run on Propane, Natural Gas, Electricity, or Other Approved Fuel

A qualified vehicle must be registered in Utah and meet one of the following conditions:

1.It converts the engine to be fueled by propane, compressed natural gas, or electricity;

2.It converts the engine to be fueled by another fuel determined by the Air Quality Board to be as effective as the above listed fuels, or

3.It converts the vehicle to meet the

The credit is the lesser of 50% of the cost of the conversion equipment less any clean fuel grant received, or $2,500.

Column D - Equipment to Convert Special Mobile Engine to Operate on Propane, Natural Gas, Electricity, or Other Approved Fuel

A qualified vehicle must meet one of the following conditions:

1.It converts the engine to be fueled by propane, compressed natural gas, or electricity;

2.It converts the engine to be fueled by another fuel determined by the Air Quality Board to be as effective as the above listed fuels, or

3.It converts the engine to be substantially more effective in reducing air pollution than the fuel for which the engine was originally designed.

The credit is the lesser of 50% of the cost of the conversion equipment less any clean fuel grant received, or $1,000.

Procedures

1.If you have purchased a qualifying vehicle or converted a vehicle or special mobile equipment engine, submit the required documentation with a completed form

2.The taxpayer must receive certification from the Utah Division of Air Quality. The credit is not valid unless both an authorized signature and certification stamp are present.

3.Complete the calculation of the credit in Part A. Carryover credits may be recorded on lines 10 through 15. Carryover credits do not need to be recertified by the Utah Division of Air Quality.

4.Refer to the return instructions to determine the line number on which to record this credit. The credit code is "05" for all returns.

5.Do not send this form with your return. Keep this form and all related documents with your records.

File Specifications

| Fact | Detail |

|---|---|

| Form Type | Utah State Tax Commission TC-40V - Clean Fuel Vehicle Tax Credit |

| Purpose | To claim a nonrefundable tax credit for the purchase or conversion of vehicles to cleaner burning fuels. |

| Eligibility | Individuals, corporations, or fiduciaries purchasing or converting qualifying vehicles. |

| Qualifying Vehicles | Vehicles that are fueled by propane, natural gas, electricity, or meet federal Clean Air Act standards. |

| Credit Amount | Varies; up to $605 for new vehicles, $2,500 for OEM natural gas vehicles or conversion equipment, and $1,000 for special mobile equipment conversion. |

| Carryover Provision | Excess credit may be carried forward for up to five taxable years. |

| Documentation Retention | Keep the form and all related documents with your tax records; do not send with the tax return. |

| Required Certification | Must be certified by the Utah Division of Air Quality to be valid. |

| Governing Law(s) | Utah Code Sections 59-7-605 and 59-10-1009 |

How to Write Utah Tc 40V

Completing the Utah TC-40V form is an essential step for taxpayers seeking to claim the Clean Fuel Vehicle Tax Credit for qualifying vehicles. This process ensures that individuals and entities receive the appropriate credit for their investment in cleaner transportation options, aligning with Utah’s commitment to environmental quality. The steps outlined below guide through the paperwork, helping to streamline the certification and claiming process.

- Gather all necessary documents that prove the purchase or conversion of the qualified vehicle into a clean fuel vehicle. This includes receipts, certificates, or any official documentation.

- Enter the taxpayer's name, telephone number, social security number or EIN, address including city, state, and Zip code in the designated areas of Part A.

- Specify the Vehicle Identification Number (VIN) in the appropriate space.

- Check the correct box to indicate the fuel type that the vehicle uses: Propane, Natural Gas, Electricity, or Other, ensuring the vehicle meets federal Clean Air Act standards.

- For Column A (if applying to new qualified vehicles), B (OEM natural gas vehicles), or C/D (converted vehicles or special mobile equipment), fill in the original purchase price or cost of conversion equipment.

- Determine the applicable credit percentage for the type of vehicle or conversion, which could be based on the specified percentages in the form instructions.

- Calculate the credit by multiplying the cost (line 3) by the applicable percentage (line 4).

- If applicable, subtract any clean fuel grant received from the total calculated credit to find the eligible amount.

- Note the maximum credit allowed and determine the actual clean fuel vehicle credit, which is the lesser of line 7 or the maximum credit.

- In Worksheet to Calculate Any Carryover of Excess Credit to Subsequent Years section, fill in the carryovers as instructed, ensuring to note any credit claimed in the current year and subtract from the original carryover.

- For Part B, await the completion by the Division of Air Quality, Department of Environmental Quality, which includes an authorized signature and original stamp of approval.

- Keep the completed TC-40V form and all related documents with your financial records. Do not send this form with your return.

- When filing your return, refer to the provided instructions to determine the appropriate line to record the credit, using credit code "05".

After these steps have been meticulously followed, the taxpayer will have efficiently prepared their TC-40V form. This preparation not only adheres to the compliance requirements but also ensures the rightful claim of the clean fuel vehicle tax credit. For any ambiguities or further information, contacting the Utah State Tax Commission or visiting their official website can offer additional guidance.

Frequently Asked Questions

-

What is the Utah TC-40V form used for?

The Utah TC-40V form is used to claim a nonrefundable tax credit for individuals, corporations, or fiduciaries who have either purchased or converted a vehicle to use cleaner burning fuels. This form helps in documenting the purchase or conversion and calculating the available credit.

-

Can the tax credit be carried forward if it exceeds the tax liability for the year?

Yes, if the clean fuel vehicle tax credit exceeds the tax liability for the year, the excess amount can be carried forward for up to five taxable years, ensuring taxpayers can benefit from the full amount of the credit over time.

-

Who can claim the credit?

The credit can be claimed by individuals, corporations, or fiduciary taxpayers in Utah for the purchase or conversion of qualified vehicles. Additionally, partnerships and S corporations can pass this credit through to their partners and shareholders.

-

Are there specific vehicles that qualify for the tax credit?

Yes, vehicles that qualify for the tax credit include new vehicles meeting certain fuel economy and air quality standards, vehicles fueled by compressed natural gas, and those converted to run on propane, natural gas, electricity, or other approved clean fuels. The vehicle must be registered in Utah and meet specific criteria as outlined in the form's instructions.

-

How is the credit amount determined?

The credit amount is determined based on the type of vehicle and the costs associated with purchasing a new qualified vehicle or converting a vehicle. It considers the purchase price, the cost of conversion equipment, and the applicable credit percentage, which varies by the type of fuel used and conversion type. The maximum credit allowed is also capped depending on the vehicle category.

-

What documentation is required to claim the tax credit?

To claim the tax credit, taxpayers must submit the required documentation along with the completed TC-40V form to the Utah Division of Air Quality. This documentation may include proof of purchase or conversion, as well as certification of meeting clean fuel and air quality standards.

-

How can I get the certification signature?

The certification signature, which is necessary for the tax credit to be valid, can be obtained by emailing the required documentation to cleanfueltaxcredit@utah.gov, faxing to 801-536-0085, or mailing or presenting the documents to the Utah Division of Air Quality.

-

Should I attach the TC-40V form to my tax return?

No, you should not send the TC-40V form with your tax return. Instead, keep the form and all related documentation with your records. Refer to your specific tax return instructions to determine the line number on which to record the credit.

-

Where can I find more information or get further assistance?

For more information on the clean fuel vehicle tax credit or for assistance with the TC-40V form, contact the Utah State Tax Commission at 801-297-2200 or 1-800-662-4335 for those outside the Salt Lake area. Additional information can also be found at the Utah Division of Air Quality's website.

Common mistakes

Filling out the Utah TC-40V form, which pertains to the Clean Fuel Vehicle Tax Credit, seems straightforward but can trip you up if you're not careful. This credit, aimed at promoting the use of cleaner-burning fuel vehicles, has specific steps and requirements that must be meticulously followed. Unfortunately, a few common mistakes often occur during the completion of this form, potentially leading to missed tax credit opportunities or processing delays. Let's dig into these pitfalls and how to avoid them.

One common mistake is not obtaining the necessary certification from the Utah Division of Air Quality. Remember, your tax credit isn't valid without both an authorized signature and a DEQ original stamp of approval on your form. To prevent this oversight, ensure that you submit your required documentation for certification promptly and keep a keen eye on the response from the Division of Air Quality.

Misunderstanding the eligible vehicles or conversion equipment categories leads to many errors. The TC-40V form clearly delineates different categories for new clean vehicles, OEM vehicles fueled by Compressed Natural Gas (CNG), vehicles converted to run on alternative fuels, and special mobile equipment conversions. Selecting the wrong category can not only invalidate your claim but also cause delays. Double-check the specific requirements for each category, focusing on fuel type and the vehicle or conversion equipment's eligibility criteria.

Another mistake is failing to accurately calculate the credit amount. This oversight is particularly common in sections dealing with the cost of conversion equipment and the subtraction of any clean fuel grants received. Ensure that you carefully follow the instructions for each column in the calculation section, paying close attention to applicable credit percentages and maximum credit allowed.

Ignoring carryover credit rules is also a frequent misstep. If the credit exceeds your tax liability for the year, the excess can be carried forward for up to five taxable years. However, applicants sometimes miss this detail and either fail to claim it in subsequent years or mistakenly attempt to claim more carryover than allowed. Keep meticulous records of your claimed credit and any carryover to avoid this error.

Lastly, a significant number of applicants inaccurately complete or overlook Part A of the form, which must be filled out by the taxpayer. This section requires personal and vehicle information, including the Taxpayer's name, Vehicle Identification Number (VIN), and details about the vehicle's fuel type and emissions standards compliance. An incomplete or inaccurately filled Part A can lead to the rejection of your application. Ensure all information is correct and complete before submission.

Correctly applying for the Clean Fuel Vehicle Tax Credit using the Utah TC-40V form involves understanding detailed requirements and following precise instructions. By avoiding these common mistakes—securing the right certifications, accurately categorizing your vehicle or equipment, precisely calculating your credit, adhering to carryover rules, and meticulously completing every section of the form—you'll improve your chances of claiming this beneficial tax credit without unnecessary delay.

Documents used along the form

When filing for the Clean Fuel Vehicle Tax Credit in Utah using form TC-40V, individuals and businesses often need additional forms to fully process their claims and comply with all requirements. Understanding these forms can help make the process smoother and ensure that you're taking full advantage of potential tax benefits. Below is a rundown of other commonly used documents alongside the TC-40V form.

- Utah Individual Income Tax Return (TC-40): This is the main tax return form for individuals in Utah. It's where you'll report your income, calculate your tax, and note any credits, including the Clean Fuel Vehicle Tax Credit.

- Utah Corporation Franchise or Income Tax Return (TC-20 or TC-20S): Corporations operating in Utah use these forms to file their taxes. Businesses that qualify for the Clean Fuel Vehicle Tax Credit will declare it as part of their total tax credits on these forms.

- Utah Partnership Return of Income (TC-65): Partnerships and their partners who are claiming the Clean Fuel Vehicle Tax Credit need to file this form to report their share of the income and credits, including any qualifying clean fuel vehicle credits.

- Utah Fiduciary Income Tax Return (TC-41): Fiduciaries of estates and trusts that have incurred expenses or made investments qualifying for the Clean Fuel Vehicle Tax Credit would use this form to file their taxes and include the credit.

- Vehicle Registration and Title: While not a tax form, registering your vehicle and having the title is crucial when applying for the Clean Fuel Vehicle Tax Credit. These documents prove the vehicle's eligibility based on its registration and titling in Utah.

Each of these forms plays a critical role in ensuring that individuals and businesses correctly claim the Clean Fuel Vehicle Tax Credit. Keeping detailed records and understanding the connections between these documents can lead to a more straightforward, error-free filing process. Remember, the specific form needed can vary based on your tax situation, so it's important to review your circumstances carefully or seek professional advice if needed.

Similar forms

The Utah TC-40V form, which offers a nonrefundable tax credit for the purchase or conversion of vehicles to cleaner fuels, shares similarities with several other tax-related documents. One such document is the Federal Electric Vehicle Tax Credit form. This federal document also supports the adoption of environmentally friendly vehicles by providing a tax credit to individuals who purchase new, eligible plug-in electric vehicles. The core similarity lies in encouraging the use of cleaner energy sources through financial incentives, although the federal form pertains to electric vehicles specifically, whereas the TC-40V includes various clean fuels.

Another document reminiscent of the TC-40V form is the Residential Energy Efficient Property Credit form. This form allows homeowners to claim a credit for making energy-efficient home improvements, such as solar electric and solar water heating systems. Both forms aim to promote environmental sustainability by offering tax credits, but they cater to different sectors: one focuses on vehicle-related expenses, while the other is dedicated to home improvements.

The Alternative Motor Vehicle Credit is yet another document that parallels the TC-40V form. It is designed for individuals who purchase vehicles that run on alternative energy sources, like hydrogen fuel cell cars. The similarity here revolves around the encouragement of using alternative fuels to reduce environmental impact. However, the Alternative Motor Vehicle Credit is more specialized in the type of vehicles it covers.

The Business Energy Investment Tax Credit (ITC) is also comparable to the Utah TC-40V form. The ITC benefits businesses that invest in various renewable energy resources, including solar and wind. While the focus of the ITC is broader, covering not only vehicles but also large-scale renewable energy projects, both forms serve the overarching goal of promoting cleaner energy solutions through tax incentives.

The Diesel Emissions Reduction Act (DERA) grant program, though not a tax form, operates with a similar objective to the TC-40V. It provides funding to reduce emissions from older, diesel-powered engines, including those in vehicles. Both initiatives work towards cleaner air quality and reduced pollution, albeit through different financial mechanisms—grants versus tax credits.

The Go Green Small Business Tax Credit, while not a federal document, represents another initiative aligned with the TC-40V’s objectives. It encourages small businesses to undertake environmentally friendly practices, including the use of clean vehicles. Both documents underscore governmental efforts to incentivize sustainable practices, though one targets individual and corporate taxpayers while the other focuses on small businesses.

Lastly, the Nonbusiness Energy Property Tax Credit, similar to the Residential Energy Efficient (REE) form, offers credits to taxpayers for making energy-efficient improvements to their homes, such as energy-saving windows and heating and cooling systems. While this credit is centered around residential property improvements and the TC-40V is vehicle-oriented, both encourage investments in energy efficiency to achieve environmental benefits.

Together, these documents illustrate a broad legislative effort to promote cleaner, more sustainable energy practices across different facets of life—from the vehicles we drive to the buildings we inhabit and the businesses we operate. Each document, including the Utah TC-40V form, plays a role in advancing environmental goals through financial incentives.

Dos and Don'ts

When filling out the Utah TC-40V form, it is important to follow specific guidelines to ensure that the process goes smoothly and accurately. Here are eight crucial dos and don'ts to keep in mind:

- Do complete a separate form for each qualified vehicle.

- Do not send the TC-40V form with your tax return. This form should be kept with your records.

- Do make sure that the vehicle meets all the necessary criteria for the clean fuel vehicle tax credit as outlined by Utah law.

- Do not attempt to claim the credit for a vehicle that has not been certified by the Utah Department of Environmental Quality or does not meet fuel economy and air quality standards.

- Do ensure that all sections of the form are filled out completely and accurately, including the taxpayer's information and the vehicle identification number (VIN).

- Do not forget to calculate the credit amount correctly, according to the instructions provided in the form, and ensure that any clean fuel grants received are deducted from the calculated credit.

- Do obtain the necessary certification signature and DEQ original stamp of approval for the tax credit to be valid.

- Do not overlook the carryover provisions if the tax credit exceeds your tax liability for the year. Remember, excess credit can be carried forward for up to five taxable years.

Adherence to these guidelines will help ensure that the process of claiming the clean fuel vehicle tax credit on the Utah TC-40V form is completed successfully and efficiently.

Misconceptions

Understanding the Utah TC-40V form, which covers the Clean Fuel Vehicle Tax Credit, is crucial for taxpayers looking to benefit from it. However, there are several misconceptions surrounding this form. Let's clear them up:

- Misconception 1: You need to send the TC-40V form with your tax return.

This is incorrect. The form should not be sent with your return. Instead, keep this form and all related documentation with your tax records. You only need to refer to it when completing your tax return to claim the credit.

- Misconception 2: The credit can be claimed multiple times for the same vehicle.

The credit may only be taken once per vehicle, and it must be certified and claimed in the taxable year the vehicle was purchased or converted.

- Misconception 3: Any vehicle qualifies for the tax credit.

Only vehicles that use cleaner burning fuels and meet certain criteria qualify for the credit. Specific conditions include being fueled by propane, natural gas, electricity, or meeting the requirements for new vehicles or converted vehicles as outlined in the form instructions.

- Misconception 4: The tax credit is refundable.

The clean fuel vehicle tax credit is nonrefundable. This means if the credit amount exceeds your tax liability, the excess cannot be refunded to you. However, you can carry the excess credit forward for up to five taxable years.

- Misconception 5: Partnerships and S corporations cannot pass the credit to partners or shareholders.

Contrary to this belief, partnerships and S corporations can pass this credit through to their partners and shareholders, allowing these individuals to claim their share of the credit on their personal tax returns.

- Misconception 6: You must calculate the credit on your own.

The form provides a worksheet to guide you in calculating your eligible credit amount, ensuring accuracy as long as you follow the instructions provided.

- Misconception 7: The maximum credit is always $605.

The $605 credit is specific to new vehicles that meet certain air quality and fuel economy standards. For other types of vehicles, such as those fueled by compressed natural gas or those that have been converted, the maximum credit varies and can be up to $2,500.

- Misconception 8: Obtaining certification is complicated.

To receive certification, you simply need to submit the required documentation along with a completed TC-40V form to the Utah Division of Air Quality. The process is straightforward, and instructions are readily available online and through the provided contact information.

By understanding the actual requirements and benefits of the Utah TC-40V form, taxpayers can more effectively navigate the process of claiming the Clean Fuel Vehicle Tax Credit, ensuring they maximize their potential savings while remaining compliant with state regulations.

Key takeaways

Filling out and using the Utah TC-40V form is essential for claiming a nonrefundable tax credit for cleaner fuel vehicles. This credit applies to individuals, corporations, or fiduciaries purchasing or converting vehicles to use cleaner burning fuels. Below are seven key takeaways to ensure proper use and compliance with the rules:

- The tax credit is available for a range of vehicles, including those fueled by propane, natural gas, electricity, or other cleaner burning fuels that meet federal Clean Air Act standards.

- Each qualified vehicle requires a separate form TC-40V to be completed, and the credit can only be claimed once per vehicle. The claim must be made in the taxable year the vehicle was purchased or converted.

- If the credit amount exceeds the tax liability for the year, the excess can be carried forward for up to five taxable years, facilitating future financial planning and benefits.

- Partnerships and S corporations can pass the credit through to their partners and shareholders, broadening the impact of the incentive to include a wider array of beneficiaries within a company structure.

- Certification by the Utah Division of Air Quality is mandatory for the credit to be valid. This involves obtaining both an authorized signature and a certification stamp on the form.

- Applicable credit percentages vary and can influence the total credit amount. These percentages depend on the type of fuel the vehicle uses and whether it is a new, converted, or specially modified vehicle for cleaner fuel use.

- It is critical not to send this form with your tax return. Instead, keep the TC-40V form and all related documentation with your records for reference and potential future audits.

Understanding these key points ensures compliance with Utah’s clean fuel vehicle tax credit requirements and enables taxpayers to gain maximum advantage from this incentive, supporting the transition to cleaner transportation options.

Common PDF Templates

Workers' Compensation Utah Phone Number - It includes sections for detailed employer information, including industry code and FEIN for accurate identification.

Utah Workforce Services - The form serves as a comprehensive employment application for various positions within the State of Utah's public employment services.