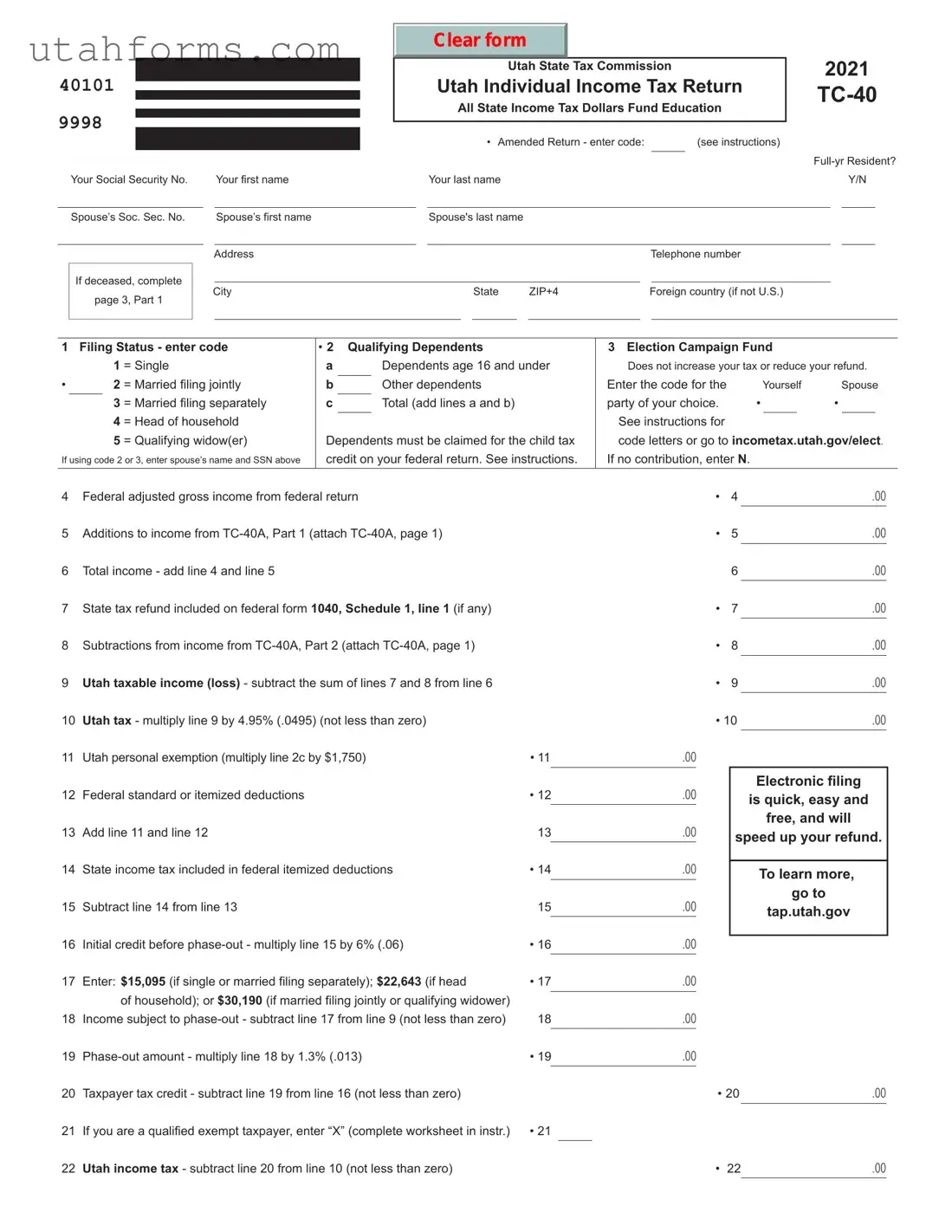

Fill Out Your Utah Tc 40 Form

The Utah TC-40 form, known officially as the Utah Individual Income Tax Return, is an essential document for state residents during tax season. This form, used for reporting annual income, calculating taxes owed, and claiming refunds, is vital for the accurate fulfillment of state tax obligations. It encompasses various sections including personal information, income details, deductions, tax credits, and refund or payment information. Features of the form such as the possibility to amend a previous return, options for direct deposit of refunds, and specific attachments for unique situations like deceased taxpayers or those making voluntary contributions, cater to a diverse range of taxpayer needs. The incorporation of elective options for contributing to public campaign financing and voluntary contributions to state funds reflects the state's encouragement of civic engagement through the tax process. Moreover, the form's design highlights Utah's commitment to funding education through state tax dollars, emphasizing the link between tax proceedings and community welfare. The TC-40 form also includes intricate details for adjustments to income, nonrefundable and refundable credits, emphasizing the state's nuances in tax calculations and qualifying criteria for various tax benefits. With electronic filing options, Utah facilitates an efficient and accessible way for residents to comply with their tax responsibilities, underscoring the blend of meticulous tax policy execution with user-friendly administrative processes.

Preview - Utah Tc 40 Form

Clearform

40101 |

|

|

|

|

|

|

|

|

|

|

|

|

Utah State Tax Commission |

|

|

|

|

|

|

2021 |

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

Utah Individual Income Tax Return |

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

9998 |

|

|

|

|

|

|

|

|

|

|

|

All State Income Tax Dollars Fund Education |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

• Amended Return - enter code: |

|

|

|

(see instructions) |

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

USTC ORIGINAL FORM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Your Social Security No. |

|

|

Your first name |

|

|

|

|

|

Your last name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Y/N |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s Soc. Sec. No. |

|

|

Spouse’s first name |

|

|

|

|

|

Spouse's last name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Telephone number |

|

|

|

|

|

|

|

|

||||||||

|

|

If deceased, complete |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

City |

|

|

|

|

|

|

|

State |

ZIP+4 |

|

|

Foreign country (if not U.S.) |

|

|

|

|

|

|||||||||||||||||||

|

|

page 3, Part 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

Filing Status - enter code |

• 2 |

Qualifying Dependents |

|

|

|

|

3 Election Campaign Fund |

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

1 = Single |

|

|

|

a |

|

|

Dependents age 16 and under |

Does not increase your tax or reduce your refund. |

|||||||||||||||||||||||||||

• |

|

2 = Married filing jointly |

b |

|

|

Other dependents |

|

|

|

|

Enter the code for the |

|

|

|

Yourself |

|

Spouse |

|||||||||||||||||||||

|

|

|

3 = Married filing separately |

c |

|

|

Total (add lines a and b) |

|

|

|

|

party of your choice. |

|

|

|

• |

|

• |

||||||||||||||||||||

|

|

|

4 = Head of household |

|

|

|

|

|

|

|

|

|

|

|

|

|

See instructions for |

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

5 = Qualifying widow(er) |

Dependents must be claimed for the child tax |

code letters or go to incometax.utah.gov/elect. |

|||||||||||||||||||||||||||||||||

If using code 2 or 3, enter spouse’s name and SSN above |

credit on your federal return. See instructions. |

If no contribution, enter N. |

|

|

|

|

|

|||||||||||||||||||||||||||||||

4 |

|

Federal adjusted gross income from federal return |

|

|

|

|

|

|

|

|

|

• |

4 |

|

|

|

|

.00 |

|

|||||||||||||||||||

5 |

|

Additions to income from |

|

|

|

|

|

|

|

|

|

• |

5 |

|

|

|

|

.00 |

|

|||||||||||||||||||

6 |

|

Total income - add line 4 and line 5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

|

|

|

|

.00 |

|

||||||||||

7 |

|

State tax refund included on federal form 1040, Schedule 1, line 1 (if any) |

|

|

|

|

|

|

|

|

|

• |

7 |

|

|

|

|

.00 |

|

|||||||||||||||||||

8 |

|

Subtractions from income from |

|

|

|

|

|

|

|

|

|

• |

8 |

|

|

|

|

.00 |

|

|||||||||||||||||||

9 |

|

Utah taxable income (loss) - subtract the sum of lines 7 and 8 from line 6 |

|

|

|

|

|

|

|

|

|

• |

9 |

|

|

|

|

.00 |

|

|||||||||||||||||||

10 |

Utah tax - multiply line 9 by 4.95% (.0495) (not less than zero) |

|

|

|

|

|

|

|

|

|

• 10 |

|

|

|

.00 |

|

||||||||||||||||||||||

11 |

Utah personal exemption (multiply line 2c by $1,750) |

• 11 |

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

12 |

Federal standard or itemized deductions |

|

|

|

|

|

|

|

|

|

• 12 |

|

|

.00 |

|

|

|

|

Electronic filing |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

is quick, easy and |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

free, and will |

||||||

13 |

Add line 11 and line 12 |

|

|

|

|

|

|

|

|

|

|

|

|

13 |

|

|

|

|

.00 |

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

speed up your refund. |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

14 |

State income tax included in federal itemized deductions |

• 14 |

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

To learn more, |

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

go to |

||||||

15 |

Subtract line 14 from line 13 |

|

|

|

|

|

|

|

|

|

15 |

|

|

|

|

.00 |

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

tap.utah.gov |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

16 |

Initial credit before |

• 16 |

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

17 |

Enter: $15,095 (if single or married filing separately); $22,643 (if head |

• 17 |

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

of household); or $30,190 (if married filing jointly or qualifying widower) |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

18 |

Income subject to |

18 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

19 |

• 19 |

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

20 |

Taxpayer tax credit - subtract line 19 from line 16 (not less than zero) |

|

|

|

|

|

|

|

|

|

• 20 |

|

|

|

.00 |

|

||||||||||||||||||||||

21 |

If you are a qualified exempt taxpayer, enter “X” (complete worksheet in instr.) |

• 21 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

22 |

Utah income tax - subtract line 20 from line 10 (not less than zero) |

|

|

|

|

|

|

|

|

|

• |

22 |

|

|

|

|

.00 |

|

||||||||||||||||||||

|

|

Utah Individual Income Tax Return (continued) |

|

|

|

|

|

|

Pg. 2 |

|||||||||||||||

40102 |

SSN |

|

|

|

Last name |

|

|

|

|

|

|

|

|

2021 |

|

|

|

|

|

|||||

USTC ORIGINAL FORM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

23 |

Enter tax from |

|

|

|

|

|

|

|

|

|

|

|

23 |

|

|

|

.00 |

|

||||||

24 |

Apportionable nonrefundable credits from |

|

|

• |

24 |

|

|

|

.00 |

|

||||||||||||||

25 |

|

|

|

|

|

|

• |

25 |

|

|

|

.00 |

|

|||||||||||

|

Non or |

|

|

|

|

|

|

|

.00 |

|

||||||||||||||

26 |

Nonapportionable nonrefundable credits from |

|

|

• |

26 |

|

|

|

|

|||||||||||||||

27 |

Subtract line 26 from line 25 (not less than zero) |

|

|

|

|

|

|

|

|

|

|

27 |

|

|

|

.00 |

|

|||||||

28 |

Voluntary contributions from |

|

|

• |

28 |

|

|

|

.00 |

|

||||||||||||||

29 |

AMENDED RETURN ONLY - previous refund |

|

|

|

|

|

|

|

|

|

|

• |

29 |

|

|

|

.00 |

|

||||||

30 |

Recapture of |

|

|

|

|

|

|

|

|

|

|

• |

30 |

|

|

|

.00 |

|

||||||

31 |

Utah use tax |

|

|

|

|

|

|

|

|

|

|

• |

31 |

|

|

|

.00 |

|

||||||

32 |

Total tax, use tax and additions to tax (add lines 27 through 31) |

|

|

|

|

|

|

|

32 |

|

|

|

.00 |

|

||||||||||

33 |

Utah income tax withheld shown on |

|

|

• |

33 |

|

|

|

.00 |

|

||||||||||||||

34 |

Credit for Utah income taxes prepaid from |

|

|

• |

34 |

|

|

|

.00 |

|

||||||||||||||

35 |

|

|

• |

35 |

|

|

|

.00 |

|

|||||||||||||||

36 |

Mineral production withholding tax shown on |

|

|

• |

36 |

|

|

|

.00 |

|

||||||||||||||

37 |

AMENDED RETURN ONLY - previous payments |

|

|

|

|

|

|

• |

37 |

|

|

|

.00 |

|

||||||||||

38 |

Refundable credits from |

|

|

|

|

|

|

• |

38 |

|

|

|

.00 |

|

||||||||||

39 |

Total withholding and refundable credits - add lines 33 through 38 |

|

|

|

|

|

|

|

39 |

|

|

|

.00 |

|

||||||||||

40 |

TAX DUE - subtract line 39 from line 32 (not less than zero) |

|

|

|

|

.00 |

• |

40 |

|

|

|

.00 |

|

|||||||||||

41 |

Penalty and interest (see instructions) |

|

|

|

|

41 |

|

|

|

|

|

.00 |

|

|||||||||||

42 |

TOTAL DUE - PAY THIS AMOUNT - add line 40 and line 41 |

|

|

|

|

|

|

• |

42 |

|

|

|

|

|||||||||||

43 |

REFUND - subtract line 32 from line 39 (not less than zero) |

|

|

|

|

|

|

• |

43 |

|

|

|

.00 |

|

||||||||||

44 |

Voluntary subtractions from refund (not greater than line 43) |

|

|

|

|

|

|

• |

44 |

|

|

|

.00 |

|

||||||||||

|

Enter the total from page 3, Part 5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

45 |

DIRECT DEPOSIT YOUR REMAINING REFUND - provide account information (see instructions for foreign accounts) |

checking |

|

savings |

||||||||||||||||||||

|

• Routing number |

• |

Account number |

|

|

|

|

Account type: • |

|

|

• |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Under penalties of perjury, I declare to the best of my knowledge and belief, this return and accompanying schedules are true, correct and complete. |

|

|

|

|

|

|||||||||||||||||||

SIGN Your signature |

|

Date |

|

Spouse’s signature (if filing jointly) |

|

|

|

|

|

|

|

Date |

||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||||

HERE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Third Party |

Name of designee (if any) you authorize to discuss this return |

|

|

Designee’s telephone number |

Designee PIN |

|

|

|

|

|

||||||||||||||

Designee |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

Preparer’s signature |

|

Date |

|

|

Preparer’s telephone number |

Preparer’s PTIN |

|

|

|

|||||||||||||

Paid |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

Preparer’s |

Firm’s name |

|

|

|

|

|

|

|

|

|

|

Preparer’s EIN |

|

|

|

|

|

|||||||

Section |

and address |

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Attach

|

|

|

Utah Individual Income Tax Return (continued) |

|

|

|

|

|

|

|

Pg. 3 |

|

||||||||

40103 |

SSN |

|

|

Last name |

|

|

|

|

|

|

2021 |

|

|

|

|

|

|

|

||

|

USTC ORIGINAL FORM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Part 1 - Deceased Taxpayer Information |

|

|

|

|

|

|

|

|

|

/ |

/ |

|

|

|

|||||

|

If the taxpayer shown on page 1 is deceased, enter the date of death here: |

|

|

|

|

|

• |

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

mm/dd/yy |

|

|

|||

|

If the spouse shown on page 1 is deceased, enter the date of death here: |

|

|

|

|

|

• |

/ |

/ |

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

mm/dd/yy |

|

|

|||

|

If you are claiming a refund for a deceased taxpayer and are not the surviving spouse, enter “X”: |

|

|

|

|

|

• |

|

|

|

|

|

|

|||||||

|

You must complete and attach form |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Part 2 - Fiscal Year Filer |

|

|

|

|

|

|

|

|

|

|

/ |

|

|

|

|

||||

|

If filing a fiscal year return (a year other than January 1 through December 31), enter the fiscal year end (mm/yy) |

• |

|

|

|

|

|

|||||||||||||

|

See instructions. |

|

|

|

|

|

|

|

|

|

mm/yy |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Part 3 - Federal Form 8886 filed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

If you filed federal form 8886, Reportable Transaction Disclosure Statement, enter “X”: |

|

|

|

|

|

• |

|

|

|

|

|

|

|||||||

|

Get form and instructions at irs.gov. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Part 4 - Voluntary Contributions (write the code and amount of each voluntary contribution) |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

See explanation of each contribution at incometax.utah.gov/contributions and/or the |

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sch Dist |

|

|||

02 |

Pamela Atkinson Homeless Account |

|

|

Code |

Amount |

|

Code |

|

||||||||||||

|

03 Kurt Oscarson Children’s Organ Transplant Account |

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

||||||

|

05 School District and Nonprofit School District Foundation - enter school district code |

• |

|

|

|

|

|

|

|

|

||||||||||

|

|

|

See instructions for school district codes, or get codes at |

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

||||

|

|

|

• |

|

|

|

|

|

|

|

|

|||||||||

15 |

Clean Air Fund |

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

||||

16 |

Governor’s Suicide Prevention Fund |

|

|

• |

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

• |

|

|

|

.00 |

|

|

|

|

|

|||

|

Total voluntary contributions (enter the total here and on |

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part 5 - Voluntary Subtractions from Refund |

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|||||

|

1. Enter the amount of your refund you want deposited into your my529 account(s): |

|

|

|

|

|

• 1 |

|

|

|

|

|||||||||

|

|

|

See instructions. Also see my529.org, or call |

|

|

|

|

|

|

|

|

.00 |

|

|

|

|||||

|

2. Enter the amount of your refund you want applied to your 2022 taxes: |

|

|

|

|

|

• 2 |

|

|

|

|

|||||||||

|

Total voluntary subtractions (enter the total here and on |

|

|

|

|

|

|

|

|

.00 |

|

|

|

|||||||

|

May not be greater than the amount on line 43. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Part 6 - Direct Deposit to Foreign Account |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

If you choose to direct deposit your refund to an account outside the United States and its territories, enter “X”: |

|

• |

|

|

|

|

|

|

|||||||||||

|

The Tax Commission cannot transfer a refund to an account outside the United States and its territories. |

|

|

|

|

|

|

|

|

|

||||||||||

|

By checking this box, your refund will not be direct deposited but will be sent to you by check. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Part 7 - Property Owner’s Residential Exemption Termination Declaration

If you are a Utah residential property owner and declare you no longer qualify to receive a residential exemption authorized under UC

•Enter “X”

•Enter code

Utah State Tax Commission |

Ź |

Utah State Tax Commission |

||

RETURNS WITH |

Ź 210 N 1950 W |

ALL OTHER |

210 N 1950 W |

|

PAYMENTS to: |

Salt Lake City, UT |

RETURNS to: |

|

Salt Lake City, UT |

Submit page ONLY if data entered.

Attach completed schedule to your Utah Income Tax return.

|

|

|

Income Tax Supplemental Schedule |

|

|

Pg. 1 |

||||||||||||||||||

|

40104 |

SSN |

|

|

|

|

|

|

|

|

|

Last name |

|

|

|

2021 |

|

|

|

|||||

|

USTC ORIGINAL FORM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Part 1 - Additions to Income (enter the code and amount of each addition to income) |

|

Code |

|

Amount |

.00 |

|

|

||||||||||||||||

|

See instructions or incometax.utah.gov for codes. |

|

|

|

|

|

• |

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

.00 |

|

|

|

|

|

Total additions to income (add all additions to income and enter total here and on |

|

|

|

|

.00 |

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part 2 - Subtractions from Income (enter the code and amount of each subtraction from income) |

|

Code |

|

Amount |

.00 |

|

|

||||||||||||||||

|

See instructions or incometax.utah.gov for codes. |

|

|

|

|

|

• |

|

|

|

|

|

||||||||||||

|

|

If using subtraction 77 (Native American Income), enter your enrollment |

• |

|

|

.00 |

|

|

||||||||||||||||

|

|

number and tribal code: |

Tribe |

|

|

|

|

|

|

|

|

|

.00 |

|

|

|||||||||

|

|

|

Enrollment Number |

Code |

|

|

|

|

|

• |

|

|

|

|

||||||||||

|

|

You |

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

||

|

|

Spouse |

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

.00 |

|

|

|

|

|

Total subtractions from income (add all subtractions from income and enter total here and on |

|

|

|

|

.00 |

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part 3 - Apportionable Nonrefundable Credits (enter the code and amount of each credit) |

|

Code |

|

Amount |

.00 |

|

|

||||||||||||||||

|

See instructions or incometax.utah.gov for codes. |

|

|

|

|

|

• |

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

.00 |

|

|

|

|

|

If you are using credit 18 (Retirement Credit), enter your birth date(s): |

|

|

|

|

|

|

|

|||||||||||||||

|

|

You • |

/ |

/ |

|

Spouse • |

/ |

/ |

|

|

• |

|

|

.00 |

|

|

||||||||

|

|

|

|

mm/dd/yy |

|

|

|

|

|

|

mm/dd/yy |

|

|

|

|

|

.00 |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

.00 |

|

|

|

|

Total apportionable nonrefundable credits (add all Part 3 credits and enter total here and on |

|

|

.00 |

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part 4 - Nonapportionable Nonrefundable Credits (enter the code and amount of each credit) |

|

Code |

|

Amount |

.00 |

|

|

||||||||||||||||

|

See instructions or incometax.utah.gov for codes. |

|

|

|

|

|

• |

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

.00 |

|

|

|

|

If you are using credit 02 (Qualified Sheltered Workshop), |

• |

|

|

.00 |

|

|

||||||||||||||||

|

|

enter the sheltered workshop’s name: |

|

|

|

|

|

|

|

|

|

.00 |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

.00 |

|

|

|

|

Total nonapportionable nonrefundable credits (add all Part 4 credits and enter total here and on |

|

|

.00 |

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Submit page ONLY if data entered.

Attach completed schedule to your Utah Income Tax Return.

Income Tax Supplemental Schedule |

|

Pg. 2 |

||||||||

40105 SSN |

|

|

Last name |

|

|

|

2021 |

|

|

|

USTC ORIGINAL FORM |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

Part 5 - Refundable Credits (enter the code and amount of each refundable credit) |

Code |

|

Amount |

.00 |

|

|||||

See instructions or incometax.utah.gov for codes. |

|

|

• |

|

|

|

|

|||

|

|

|

|

|

• |

|

|

|

.00 |

|

|

|

|

|

|

• |

|

|

|

.00 |

|

|

|

|

|

|

• |

|

|

|

.00 |

|

|

|

|

|

|

• |

|

|

|

.00 |

|

Total refundable credits (add all refundable credits and enter total here and on |

|

|

|

.00 |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

Submit page ONLY if data entered.

Attach completed schedule to your Utah Income Tax Return.

|

|

|

Non and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

40106 |

SSN |

|

|

|

Last name |

|

|

|

|

|

|

|

|

|

|

|

|

2021 |

|

|

|

|

|

|

||||||

|

USTC ORIGINAL FORM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

/ |

|

|

|

|

|

/ |

/ |

|

|

||||

Residency Status: • |

|

Nonresident: Home state abbreviation: |

• |

|

|

to |

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

mm/dd/yy |

|

|

|

|

mm/dd/yy |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Col. A - UTAH |

|

|

|

|

Col. B - TOTAL |

|

||||||||

1 |

Wages, salaries, tips, etc. (1040 line 1) |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

|||||||||||

2 |

Taxable interest income (1040 line 2b) |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

|||||||||||

3 |

Ordinary dividends (1040 line 3b) |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

|||||||||||

4 |

IRAs, pensions and annuities - taxable amount (1040 lines 4b and 5b) |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

|||||||||||

5 |

Social Security benefits - taxable amount (1040 line 6b) |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

|||||||||||

6 |

Taxable refunds/credits/offsets of state/local income taxes (1040, Schedule 1, line 1) |

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

||||||||||||||

7 |

Alimony received (1040, Schedule 1, line 2a) |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

|||||||||||

8 |

Business income or (loss) (1040, Schedule 1, line 3) |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

|||||||||||

9 |

Capital gain or (loss) (1040, line 7) |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

|||||||||||

10 |

Other gains or (losses) (1040, Schedule 1, line 4) |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

|||||||||||

11 |

Rental real estate, royalties, partnerships, S corps, trusts, etc. (1040, Schd 1, line 5) |

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

||||||||||||||

12 |

Farm income or (loss) (1040, Schedule 1, line 6) |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

|||||||||||

13 |

Unemployment compensation (1040, Schedule 1, line 7) |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

|||||||||||

14 |

Other income (1040, Schedule 1, line 9) |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

|||||||||||

15 |

Additions to income from |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

|||||||||||

16 |

Reserved |

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

|||||

17 |

Reserved |

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

|||||

18 |

Total income (loss) - add lines 1 through 17 for both columns A and B |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Adjustments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Col. A - UTAH |

|

|

|

|

Col. B - TOTAL |

|

||||||||

19 |

Educator expenses (1040, Schedule 1, line 11) |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

|||||||||||

20 |

Certain bus. expenses of reservists, performing artists, etc. (1040, Schd 1, line 12) |

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

||||||||||||||

21 |

Health savings account deduction (1040, Schedule 1, line 13) |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

|||||||||||

22 |

Moving expenses (1040, Schedule 1, line 14) - col. A only expenses moving into Utah |

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

||||||||||||||

23 |

Deductible part of |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

|||||||||||

24 |

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

|||||||||||||||

25 |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

||||||||||||

26 |

Penalty on early withdrawal of savings (1040, Schedule 1, line 18) |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

|||||||||||

27 |

Alimony paid (1040, Schedule 1, line 19a) |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

|||||||||||

28 |

IRA deduction (1040, Schedule 1, line 20) |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

|||||||||||

29 |

Student loan interest deduction (1040, Schedule 1, line 21) |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

|||||||||||

30 |

Reserved |

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

|||||

31 |

Reserved |

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

|||||

32 |

Taxable refunds/credits/offsets of state and local income taxes (1040, Schd 1, line 1) |

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

||||||||||||||

33 |

Subtractions from income from |

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

||||||||||||||

34 |

Reserved |

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

|||||

35 |

Reserved |

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

|||||

36 |

(see instructions): |

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

||||

37 |

Total adjustments - add lines 19 through 36 for both columns A and B |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

38 |

Subtract line 37 from line 18 for both columns A and B |

|

|

|

• |

.00 |

|

• |

|

|

|

|

|

.00 |

|

|

||||||||||||||

|

|

Line 38, column B must equal |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Non or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

39 |

Divide line 38 column A by line 38 column B (to 4 decimal places, not more than 1.0000 or less than 0.0000) |

|

39 |

|

|

|

|

|

|

|

|

|

||||||||||||||||||

40 |

Subtract |

|

|

|

40 |

|

|

|

|

|

|

.00 |

|

|

||||||||||||||||

41 |

UTAH TAX - Multiply line 40 by the decimal on line 39. Enter on |

|

|

• |

41 |

|

|

|

|

|

|

.00 |

|

|

||||||||||||||||

Submit this page ONLY if data entered.

Attach completed schedule to your Utah Income Tax Return.

Credit for Income Tax Paid to Another State |

||||

40108 SSN |

|

Last name |

|

2021 |

NOTE:

FIRST STATE |

|

.00 |

|

|

|

|||

1 |

Enter federal adjusted gross income taxed by both Utah and state of: |

|

|

1 |

|

|

|

|

2 |

Federal adjusted gross income from |

2 |

.00 |

|

|

|

||

3 |

Divide line 1 by line 2; round to 4 decimal places. Do not enter a number greater than 1.0000. |

3 |

|

|

||||

4 |

Utah income tax from |

4 |

.00 |

|

|

|

||

5 |

Credit limitation - multiply line 4 by decimal on line 3 |

5 |

.00 |

|

|

|

||

6 |

Actual income tax paid to state shown on line 1 |

6 |

.00 |

|

|

|

||

|

|

|

|

|

|

|||

|

to the portion of actual taxes paid to the other state on income shown on line 1. |

|

|

|

|

|

||

7 |

Credit for tax paid another state - lesser of line 5 or line 6 |

|

|

7 |

|||

SECOND STATE |

|

|

.00 |

|

|||

|

|

|

|||||

1 |

Enter federal adjusted gross income taxed by both Utah and state of: |

|

|

1 |

|

|

|

2 |

Federal adjusted gross income from |

2 |

|

.00 |

|

||

3 |

Divide line 1 by line 2; round to 4 decimal places. Do not enter a number greater than 1.0000. |

3 |

|||||

4 |

Utah income tax from |

4 |

|

.00 |

|

||

5 |

Credit limitation - multiply line 4 by decimal on line 3 |

5 |

|

.00 |

|

||

6 |

Actual income tax paid to state shown on line 1 |

6 |

|

.00 |

|

||

|

|

|

|

|

|||

|

to the portion of actual taxes paid to the other state on income shown on line 1. |

|

|

|

|

||

7 |

Credit for tax paid another state - lesser of line 5 or line 6 |

|

|

7 |

|||

THIRD STATE |

|

|

.00 |

|

|||

|

|

|

|||||

1 |

Enter federal adjusted gross income taxed by both Utah and state of: |

|

|

1 |

|

|

|

2 |

Federal adjusted gross income from |

2 |

|

.00 |

|

||

3 |

Divide line 1 by line 2; round to 4 decimal places. Do not enter a number greater than 1.0000. |

3 |

|||||

4 |

Utah income tax from |

4 |

|

.00 |

|

||

5 |

Credit limitation - multiply line 4 by decimal on line 3 |

5 |

|

.00 |

|

||

6 |

Actual income tax paid to state shown on line 1 |

6 |

|

.00 |

|

||

|

|

|

|

|

|||

|

to the portion of actual taxes paid to the other state on income shown on line 1. |

|

|

|

|

||

7 |

Credit for tax paid another state - lesser of line 5 or line 6 |

|

|

7 |

|||

Use additional forms

Enter the total of all amounts shown on line 7 above on

Submit page ONLY if data entered.

Attach completed schedule to your Utah Income Tax Return.

.00

.00

.00

|

Part 1 - Utah Withholding Tax Schedule |

|

|

|

Pg. 1 |

|||||||

40109 SSN |

|

|

Last name |

|

|

|

|

2021 |

|

|

||

USTC ORIGINAL FORM |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Line Explanations |

|

|

IMPORTANT |

|

|

|

||||||

1 |

Employer/payer ID number from |

Do not send your |

|

|

||||||||

2 |

Utah withholding ID number from |

|

|

|||||||||

|

(14 characters, ending in WTH, no hyphens) |

|

|

on the form. |

|

|

|

|||||

3 |

Employer/payer name and address from |

|

|

|

|

|

|

|||||

4 |

Enter “X” if reporting Utah withholding from form 1099 |

Use additional forms |

||||||||||

5 |

Employee’s Social Security number from |

1099s with Utah withholding tax. |

|

|

|

|||||||

6 |

Utah wages or income from |

|

|

|

|

|

|

|

|

|||

7 |

Utah withholding tax from |

|

|

Enter mineral production withholding from |

||||||||

|

|

|

|

|

|

|

enter |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

First |

|

|

Second |

|

|

|

||||||

1 |

|

|

|

|

|

|

1 |

|

|

|

|

|

2 |

|

|

(14 characters, no hyphens) |

2 |

|

|

(14 characters, no hyphens) |

|||||

3 |

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

4 |

|

|

|

|

|

|

5 |

|

|

|

|

|

5 |

|

|

|

|

|

|

6 |

|

|

.00 |

|

|

6 |

|

|

.00 |

|

|

|

7 |

|

|

.00 |

|

|

7 |

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Third |

|

|

|

Fourth |

|

|

|

|

||||

1 |

|

|

|

|

|

1 |

|

|

|

|

|

|

2 |

|

|

|

|

(14 characters, no hyphens) |

2 |

|

|

|

|

(14 characters, no hyphens) |

|

3 |

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

4 |

|

|

|

|

|

5 |

|

|

5 |

|

|

|

|

|

6 |

.00 |

6 |

.00 |

|

|

|

||

7 |

.00 |

7 |

.00 |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Enter total Utah withholding tax from all lines 7 here and on |

.00 |

|

|||

Submit page ONLY if data entered.

Attach completed schedule to your Utah Income Tax Return.

Do not attach

Mineral Production and |

Pg. 2 |

||||

40110 SSN |

|

Last name |

|

2021 |

|

USTC ORIGINAL FORM

Part 2

Do not send

Line Explanations

1Producer’s EIN from box “2” of

2Producer’s name from box “1” of

3Producer’s Utah withholding number from box “3” of

4

5Utah mineral production withholding tax from box”6” of

First |

|

|

Second |

|

|

|

|

|||||

1 |

|

|

|

|

1 |

|

|

|

|

|

|

|

2 |

|

|

|

|

2 |

|

|

|

|

|

|

|

3 |

|

|

(14 characters, no hyphens) |

3 |

|

|

|

(14 characters, no hyphens) |

||||

4 |

|

|

|

|

4 |

|

|

|

|

|

|

|

5 |

.00 |

|

|

|

5 |

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Third |

|

|

Fourth |

|

|

|

|

|||||

1 |

|

|

|

|

1 |

|

|

|

|

|

|

|

2 |

|

|

|

|

2 |

|

|

|

|

|

|

|

3 |

|

|

(14 characters, no hyphens) |

3 |

|

|

|

(14 characters, no hyphens) |

||||

4 |

|

|

|

|

4 |

|

|

|

|

|

|

|

5 |

.00 |

|

|

|

5 |

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enter total mineral production withholding tax from all lines 5 here and on |

|

.00 |

|

||||||||

Part 3

Do not send Utah Schedule(s)

Line Explanations

1

2Name of

3Utah withholding tax paid by

First Utah Schedule |

|

|

|

|

Second Utah Schedule |

|||||

1 |

|

|

|

|

|

1 |

|

|

|

|

2 |

|

|

|

|

|

2 |

|

|

|

|

3 |

|

.00 |

|

|

|

3 |

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Third Utah Schedule |

|

|

|

|

Fourth Utah Schedule |

|||||

1 |

|

|

|

|

|

1 |

|

|

|

|

2 |

|

|

|

|

|

2 |

|

|

|

|

3 |

|

.00 |

|

|

|

3 |

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enter total |

.00 |

Submit page ONLY if data entered.

Attach completed schedule to your Utah Income Tax Return.

File Specifications

| Fact | Detail |

|---|---|

| Form Type | Utah Individual Income Tax Return |

| Form Number | TC-40 |

| Tax Year | 2021 |

| Purpose | To report individual income tax to the Utah State Tax Commission |

| Filing Options | Electronic filing is available and recommended for quicker refunds. |

| Governing Laws | Guided by the Utah State Tax Code and regulations |

| Notable Sections | Includes sections for income adjustments, tax calculations, credits, and refund or amount owed. |

How to Write Utah Tc 40

Filling out the Utah TC-40 form, the state individual income tax return, is an important task that Utah residents need to complete to comply with state laws regarding income tax. This process involves reporting your income, calculating tax owed or refund due, and claiming any eligible credits or deductions. The steps outlined below will guide you through the process to ensure accuracy and compliance.

- Start with your basic information. Enter your full name, Social Security Number (SSN), and address in the designated areas at the top of the form.

- Indicate your filing status by entering the corresponding code (1 for Single, 2 for Married Filing Jointly, etc.) in the Filing Status section.

- For Qualifying Dependents, list dependents under 16 years of age in section 2a and other dependents in section 2b. Calculate the total number of dependents and enter it in section 2c.

- Choose whether to contribute to the Election Campaign Fund by entering the code for your choice, or mark 'N' if you choose not to contribute.

- Enter your Federal Adjusted Gross Income (AGI) from your federal tax return on line 4.

- Attach and summarize any additions to income from Schedule TC-40A, Part 1, on line 5.

- Add lines 4 and 5 to get your Total Income and enter it on line 6.

- Report any State Tax Refund you included on your federal return on line 7.

- Detail and total your subtractions from income from Schedule TC-40A, Part 2, on line 8.

- Calculate your Utah Taxable Income on line 9 by subtracting lines 7 and 8 from line 6.

- Compute your Utah Tax owed by multiplying line 9 by 4.95% and enter on line 10.

- Multiply the total number of exemptions by $1,750 and enter this amount on line 11.

- Enter your Federal Standard or Itemized Deductions on line 12.

- Add line 11 and line 12 amounts to get your total deductions and enter this on line 13.

- Subtract any state income tax included in your federal itemized deductions on line 14 from your total deductions on line 13, and enter this on line 15.

- Calculate your Initial Credit Before Phase-Out on line 16 by multiplying line 15 by 6%.

- Follow the instructions for calculating the phase-out amount, if applicable, and enter the Taxpayer Tax Credit on line 20.

- Subtract your Taxpayer Tax Credit from the Utah tax owed to find your Utah Income Tax on line 22.

- Complete the remaining sections of the form, including any Credits, Prepayments, and withholding, and calculate either your Tax Due or Refund.

- Sign and date the form at the bottom, and include your spouse’s signature if filing jointly.

- Attach all required documentation, including any schedules, W-2 forms, and 1099 forms.

- Review the entire form for accuracy before submitting to the Utah State Tax Commission either by mail or electronically via the state’s e-filing system.

Finishing up your Utah TC-40 form is a big step towards fulfilling your tax obligations. Once completed, you're ready for the next steps, whether that’s planning for next year's taxes, addressing any potential tax liabilities, or simply waiting for your refund. Remember, the more accurate and complete your form, the smoother the process will be. If you have questions or encounter difficulties, don't hesitate to seek professional advice or assistance.

Frequently Asked Questions

Frequently Asked Questions about the Utah TC-40 Form

- What is the Utah TC-40 form?

- Who needs to file a Utah TC-40 form?

- Can I file an amended Utah TC-40 form?

- What are the filing statuses available on the Utah TC-40 form?

- How do I claim deductions on the Utah TC-40?

- What tax credits are available on the Utah TC-40 form?

- Nonrefundable credits for various state taxes and contributions.

- Refundable credits, including those for certain withholdings and payments.

- Apportionable and nonapportionable nonrefundable credits that apply to specific tax situations or contributions to state funds.

- How can I receive my Utah tax refund?

- Where do I find more information or get help filing the Utah TC-40?

The Utah TC-40 form is the primary document used by full-year, part-year, or nonresident individuals to file their state income tax return in Utah. It encompasses information on income, tax calculations, tax credits, deductions, and any refund or payment due to or from the taxpayer.

Any full-year resident, part-year resident, or nonresident who has earned income in Utah over the tax year is required to file the Utah TC-40 form if they meet the state's income filing threshold.

Yes, if you need to make corrections or if there have been changes to your income tax situation after submitting your original return, you can file an amended return using the same TC-40 form. You should indicate that your filing is an amended return and follow the specific instructions provided for amending a return.

The Utah TC-40 form offers several filing statuses to match federal options: Single, Married Filing Jointly, Married Filing Separately, Head of Household, and Qualifying Widower(er). Your choice of filing status influences your tax rates and allowable deductions.

Deductions on the Utah TC-40 are claimed in several areas, including adjustments to income on Schedule TC-40A, Part 2 and the personal exemption section. The form also allows for federal standard or itemized deductions to be considered in calculating the Utah state taxable income.

Each class of credits offers different benefits, depending on the taxpayer’s eligibility and filing status.

If you're entitled to a refund, you can choose to receive it via direct deposit or a paper check. To opt for direct deposit, you'll need to provide your banking information on the TC-40 form, ensuring a quicker and more secure method of receiving your refund.

For more information or assistance with the Utah TC-40 form, you can visit the Utah State Tax Commission's website at incometax.utah.gov. Here, you'll find detailed instructions, resources for taxpayers, and contact information for direct support.

Common mistakes

Filling out the Utah TC-40 form, also known as the Utah Individual Income Tax Return, is an important task that requires attention to detail. Unfortunately, there are common mistakes that people often make when completing the form. Understanding these errors can help ensure that you submit your tax return correctly, possibly speeding up your refund process and avoiding unnecessary delays or complications.

One of the first mistakes is incorrectly choosing the filing status on the form. This section is crucial because it influences the tax calculation. Another frequent error involves individuals forgetting to include their Social Security Number or that of their spouse if filing jointly. This identifier is essential for the Utah State Tax Commission to process the return.

When it comes to dependents, some people either leave out their information or input incorrect details. It's important to fill in the correct names and Social Security Numbers for all dependents to claim the appropriate deductions and credits. Moreover, inaccuracies in reporting income or adjustments can lead to discrepancies. These variables directly impact the calculated tax liability or refund.

Calculating deductions and tax credits is a step where errors often occur. This includes missing out on deductions or credits that one is eligible for, or conversely, claiming those without eligibility. Additionally, the section dealing with Utah income tax withheld, credits for Utah income taxes prepaid, and refundable credits, is filled out improperly at times. These amounts directly influence the final tax due or refund amount and should be entered with precision.

Last but not least, people sometimes overlook supplemental schedules such as the TC-40A, essential for adding detailed information to the tax return. Ignoring this can lead to an incomplete submission. Others fail to sign the return before mailing it, which is a simple but critical oversight. Finally, inaccuracies in banking details for direct deposit lead to refund delays.

Here's a summarized list of common mistakes:

- Inaccurately choosing the filing status.

- Omitting or miswriting Social Security Numbers.

- Incorrect details for dependents.

- Inaccuracies in reporting income or adjustments.

- Miscalculating deductions and tax credits.

- Errors in sections dealing with withholdings and credits.

- Overlooking necessary supplemental schedules.

- Failure to sign the tax return.

- Providing incorrect banking details for refunds.

To avoid these pitfalls, it's advisable to take your time when filling out the TC-40 form, double-check all information, and consult the instructions provided by the Utah State Tax Commission. This approach can help ensure your tax return is accurate and processed without delay.

Documents used along the form

Filing your Utah TC-40 Individual Income Tax Return is a critical step in meeting your tax obligations, but it often requires additional forms and documents to accurately report your financial situation for the year. Understanding these supplementary documents can help ensure that you’re filing your taxes thoroughly and taking advantage of all deductions and credits available to you.