Fill Out Your Utah Tc 301 Form

In the landscape of Utah's motor vehicle industry, the TC-301 form plays a pivotal role by serving as the Bonded Motor Vehicle Business Application, a document vital for those seeking to enter into or expand their presence in the state's motor vehicle dealership, manufacturing, dismantling, or related business sectors. Located in Salt Lake City, the Motor Vehicle Enforcement Division requires this comprehensive form for various licensure types, including new and used motor vehicle dealers, motorcycle and trailer dealers, transporters, manufacturers, body shops, dismantlers, and crushers, among others. Each applicant must provide detailed information, including but not limited to, business identification, organizational structure, and specific licensure sought, along with the mandatory submission of a non-refundable fee corresponding to the license type. Additionally, applicants need to navigate through a series of requirements such as providing a Utah sales tax number, ensuring all forms are completed in full and legible, and adhering to city or county business licensing prerequisites. Compulsory disclosures extend to personal information of owners or corporate officers, employment history, legal history—including any misdemeanors or felonies—and current compliance with state and federal laws. Further complexity is added for non-U.S. citizens and entities applying for licenses, who must present proof of lawful presence in the United States. With requisite sections covering employment history, criminal background checks, and specific disclosures pertaining to franchise dealers, the form also demands acknowledgment of the Motor Vehicle Business Act's regulations, underscoring the applicant's commitment to ethical conduct and regulatory compliance within Utah's motor vehicle industry.

Preview - Utah Tc 301 Form

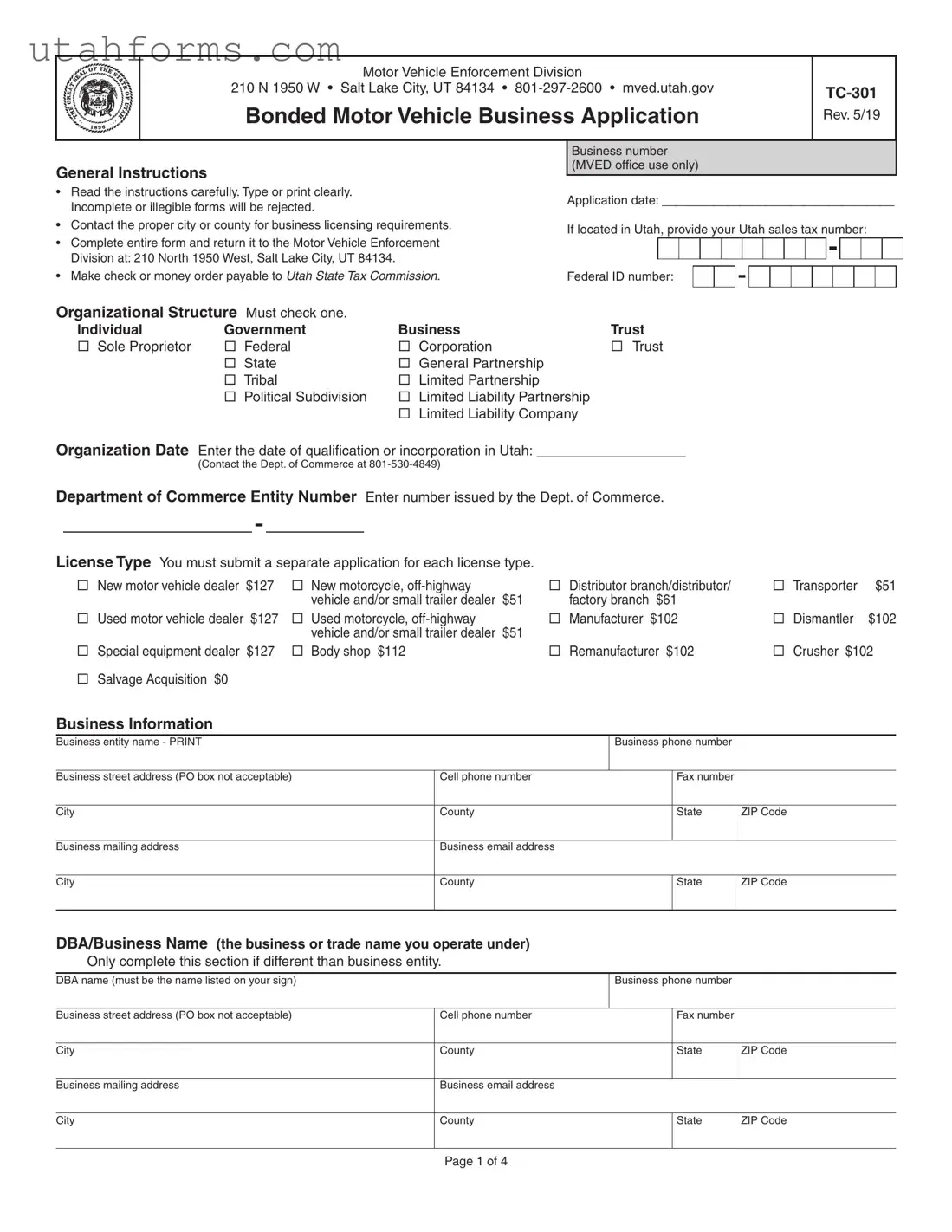

Motor Vehicle Enforcement Division

210 N 1950 W • Salt Lake City, UT 84134 •

Bonded Motor Vehicle Business Application

Rev. 5/19

General Instructions

Business number (MVED office use only)

•Read the instructions carefully. Type or print clearly. Incomplete or illegible forms will be rejected.

•Contact the proper city or county for business licensing requirements.

•Complete entire form and return it to the Motor Vehicle Enforcement Division at: 210 North 1950 West, Salt Lake City, UT 84134.

Application date: __________________

If located in Utah, provide your Utah sales tax number:

• Make check or money order payable to Utah State Tax Commission.Federal ID number:

Organizational Structure Must check one.

Individual |

Government |

Business |

Trust |

Sole Proprietor |

Federal |

Corporation |

Trust |

|

State |

General Partnership |

|

|

Tribal |

Limited Partnership |

|

|

Political Subdivision |

Limited Liability Partnership |

|

|

|

Limited Liability Company |

|

Organization Date |

Enter the date of qualification or incorporation in Utah: ___________________ |

||

|

(Contact the Dept. of Commerce at |

|

|

Department of Commerce Entity Number Enter number issued by the Dept. of Commerce.

License Type You must submit a separate application for each license type. |

|

|

|

|

|

|

|||||

New motor vehicle dealer |

$127 |

New motorcycle, |

|

Distributor branch/distributor/ |

Transporter |

$51 |

|||||

|

|

|

vehicle and/or small trailer dealer |

$51 |

factory branch |

$61 |

|

|

|||

Used motor vehicle dealer |

$127 |

Used motorcycle, |

|

Manufacturer |

$102 |

Dismantler |

$102 |

||||

|

|

|

vehicle and/or small trailer dealer |

$51 |

|

|

|

|

|

|

|

Special equipment dealer $127 |

Body shop $112 |

|

Remanufacturer $102 |

Crusher $102 |

|||||||

Salvage Acquisition $0 |

|

|

|

|

|

|

|

|

|

|

|

Business Information |

|

|

|

|

|

|

|

|

|

|

|

Business entity name - PRINT |

|

|

|

|

|

|

Business phone number |

|

|

||

|

|

|

|

|

|

|

|

|

|||

Business street address (PO box not acceptable) |

|

Cell phone number |

|

|

|

Fax number |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

County |

|

|

|

|

State |

ZIP Code |

|

|

|

|

|

|

|

|

|

|

|

||

Business mailing address |

|

|

|

Business email address |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

County |

|

|

|

|

State |

ZIP Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

DBA/Business Name (the business or trade name you operate under)

Only complete this section if different than business entity.

DBA name (must be the name listed on your sign) |

|

Business phone number |

|

|

|

|

|

|

|

Business street address (PO box not acceptable) |

Cell phone number |

|

Fax number |

|

|

|

|

|

|

City |

County |

|

State |

ZIP Code |

|

|

|

|

|

Business mailing address |

Business email address |

|

|

|

City

County

State

ZIP Code

Page 1 of 4

Owner(s), partner(s) or corporate officers information Attach additional sheet(s) if necessary.

You must apply in person at MVED (210 N 1950 W, Salt Lake City, Utah) if:

1.you are applying for dealer license as any entity type and any of the owners are not U.S. citizens; or

2.you are a sole proprietor who is not a U.S. citizen and you are applying for any of the following licenses: body shop, crusher, distributor, dismantler, manufacturer, factory branch, distributor branch, remanufacturer or transporter.

Bring proof that you and/or any of the owners who are not U.S. citizens are in the United States lawfully under 8 USC 1641. Also bring your/their employment authorization card(s) and documentation showing the

|

|

|

|

|

|

|

Owner #1 name |

|

|

Title |

Home phone |

|

|

Home address (physical address, not PO box) |

|

Social Security Number |

Driver license number and state of issue |

|||

|

|

|

|

|

|

|

City |

|

State |

|

ZIP Code |

Date of birth |

|

|

|

|

|

|

|

|

Hair color |

Eye color |

Height |

|

Weight |

Gender |

|

|

|

|

|

|

Male |

Female |

|

|

|

|

|

|

|

Place of birth |

|

Citizenship |

|

|

Race |

|

|

|

|

|

|

|

|

Under state and federal law we cannot issue a license to any person who does not provide the following information.

Check one (Providing false information subjects the signer to the penalties of perjury.):

I am a U.S. citizen. |

SSN: _______________________ |

|

|

|

||||

I qualify under 8 U.S.C. 1641 and I am present in the U.S. lawfully. |

||||||||

Alien #*: _______________________ |

Employment authorization card #*: _______________________ |

|||||||

|

|

|

|

|

|

|

|

|

Ow ner #2 name |

|

|

|

Title |

|

Home phone |

|

|

Home address (physical address, not PO box) |

|

|

Social Security Number |

|

Driver license number and state of issue |

|||

|

|

|

|

|

|

|

|

|

City |

|

State |

|

|

ZIP Code |

|

Date of birth |

|

|

|

|

|

|

|

|

|

|

Hair color |

Eye color |

Height |

|

|

Weight |

|

Gender |

|

|

|

|

|

|

|

|

Male |

Female |

|

|

|

|

|

|

|

|

|

Place of birth |

|

Citizenship |

|

Race |

|

|||

|

|

|

|

|

|

|

|

|

Under state and federal law we cannot issue a license to any person who does not provide the following information.

Check one (Providing false information subjects the signer to the penalties of perjury.):

I am a U.S. citizen. |

SSN: _______________________ |

|

|

|

||||

I qualify under 8 U.S.C. 1641 and I am present in the U.S. lawfully. |

||||||||

Alien #*: _______________________ |

Employment authorization card #*: _______________________ |

|||||||

|

|

|

|

|

|

|

|

|

Owner #3 name |

|

|

|

Title |

|

Home phone |

|

|

Home address (physical address, not PO box) |

|

|

Social Security Number |

|

Driver license number and state of issue |

|||

|

|

|

|

|

|

|

|

|

City |

|

State |

|

|

ZIP Code |

|

Date of birth |

|

|

|

|

|

|

|

|

|

|

Hair color |

Eye color |

Height |

|

|

Weight |

|

Gender |

|

|

|

|

|

|

|

|

Male |

Female |

|

|

|

|

|

|

|

|

|

Place of birth |

|

Citizenship |

|

Race |

|

|||

|

|

|

|

|

|

|

|

|

Under state and federal law we cannot issue a license to any person who does not provide the following information.

Check one (Providing false information subjects the signer to the penalties of perjury.): |

|

I am a U.S. citizen. SSN: _______________________ |

|

I qualify under 8 U.S.C. 1641 and I am present in the U.S. lawfully. |

Alien #*: _______________________ Employment authorization card #*: _______________________

* The Alien Registration Number (A#),

1.List at least five years of employment history, including dates, for each owner. Also include any motor vehicle salesperson, dealer, dismantler or auction license you have held and if the license has ever been denied, suspended or revoked. Attach additional pages if needed.

Owner #1 |

Owner #2 |

Owner #3 |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2.During the past 10 years, have you been arrested, charged with, found in violation of, or convicted of any misdemeanors or felonies in Utah or in any other state? This includes any charges to which a “plea in abeyance,” or a guilty plea, are entered. You are not required to disclose simple traffic infractions.

Yes |

No |

Failure to disclose any of the requested information may result in suspension or revocation of this license. A charge, |

|

|

violation of, or criminal conviction for a motor vehicle or |

|

|

grounds for denial, suspension or revocation of your application or license, even if the plea is held in abeyance. Attach |

|

|

additional pages if needed. |

If yes, list each, including dates: (A copy of your criminal history, provided by BCI, may be attached.)

Owner #1 |

Owner #2 |

Owner #3 |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3.Are you currently on probation or parole, court supervision of any kind, or in a “plea in abeyance”?

Do you still owe restitution? |

Yes |

No |

Yes No If yes, state what type and from which event from your criminal history:

__________________________________________________________

Franchise Dealers

If you are a franchise dealer of new vehicles, RVs, motorcycles and/or trailers, report the information below and attach your franchise agreement to this application

Make

Name of manufacturer or distributor

Address of manufacturer or distributor

Utah license number

Make

Name of manufacturer or distributor

Address of manufacturer or distributor

Utah license number

Make

Name of manufacturer or distributor

Address of manufacturer or distributor

Utah license number

Make

Name of manufacturer or distributor

Address of manufacturer or distributor

Utah license number

|

|

|

|

|

|

||||

Special Plates & Decals |

|

|

|

||||||

|

|

|

|

|

|

|

|||

Manufacturer |

Transporter |

Dealer |

Dismantler |

|

|

|

|||

______ |

Dealer plates ($12.00 each) |

. . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . |

. . .$ |

__________ |

||||

______ |

Motorcycle plates ($12.00 each) . . . |

. . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . |

. . .$ |

__________ |

||||

______ |

Dismantler, manufacturer or transporter plates ($10.00 each) |

. . .$ |

__________ |

||||||

Basic handling fee |

. . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . |

. . .$ |

|

_2.50 |

|

||

Volume handling fee (add $1.00 if ordering more than 2 plates) |

. . . . . . . . . . . . . |

. . .$ |

__________ |

||||||

|

|

|

|

|

|

Total $ |

__________ |

||

Additional instructions: __________________________________________ |

|

|

|

||||||

Decal number (office use only): ______________________________________ |

|

|

|

||||||

Insurance company: _______________________________ |

Policy number: _______________ |

||||||||

Address: ____________________________________ |

Telephone number: _____________ |

||||||||

Note: You must submit a current copy of your plate insurance declaration every time you order or renew plates. Insurance must be issued in the name of the licensed business.

Signatures – All owners must sign

Owner #1

I am familiar with the motor vehicle dealer licensing laws and other laws of Utah governing the conduct of persons in the motor vehicle industry and will cooperate with the Utah State Tax Commission to eliminate abuse and unfair trade practices.

I certify under penalty of perjury that the above information is correct and complete. I further certify that my business, as reported on this application, is in compliance with the Motor Vehicle Business Act of the Utah Code.

____________________________________ _______________

Signature*Date

____________________________________

Signer’s printed name

Owner #2

I am familiar with the motor vehicle dealer licensing laws and other laws of Utah governing the conduct of persons in the motor vehicle industry and will cooperate with the Utah State Tax Commission to eliminate abuse and unfair trade practices.

I certify under penalty of perjury that the above information is correct and complete. I further certify that my business, as reported on this application, is in compliance with the Motor Vehicle Business Act of the Utah Code.

____________________________________ _______________

Signature*Date

____________________________________

Signer’s printed name

Owner #3

I am familiar with the motor vehicle dealer licensing laws and other laws of Utah governing the conduct of persons in the motor vehicle industry and will cooperate with the Utah State Tax Commission to eliminate abuse and unfair trade practices.

I certify under penalty of perjury that the above information is correct and complete. I further certify that my business, as reported on this application, is in compliance with the Motor Vehicle Business Act of the Utah Code.

____________________________________ _______________

Signature*Date

____________________________________

Signer’s printed name

* The signer(s) must be owner, partner or corporate officer, or have POA. Submit copy of POA if applicable.

File Specifications

| Fact | Detail |

|---|---|

| Governing Body | Utah State Tax Commission and Motor Vehicle Enforcement Division |

| Purpose | Application for Bonded Motor Vehicle Business License |

| Application Location | Motor Vehicle Enforcement Division, 210 N 1950 W, Salt Lake City, UT 84134 |

| Application Requirement | Applicants must provide accurate personal and business information, including a detailed employment history and any criminal history. |

| Key Features | Specifies license types for various motor vehicle businesses and includes spaces for detailed owner information and business details. |

How to Write Utah Tc 301

Ready to start your application for a bonded motor vehicle business in Utah? The Utah TC-301 form is your first step to becoming a licensed dealer. This form helps the Motor Vehicle Enforcement Division understand your business, ensuring all laws and regulations are met. The steps below will guide you through the process from beginning to end, making sure your submission is clear, complete, and compliant. Whether you're applying for a dealer, distributor, or transporter license, following these steps carefully will help you avoid common pitfalls and get your application processed smoothly.

- Begin by securing a Utah sales tax number if your business is located in Utah, as this will be required on the form.

- Choose your check or money order payable to the Utah State Tax Commission for the necessary fee, depending on the license type you're applying for.

- Select your business’s organizational structure by checking the appropriate box: Individual, Government, Business Trust, Sole Proprietor, Corporation, General Partnership, Limited Partnership, Limited Liability Partnership, Limited Liability Company, Federal, State, Tribal, or Political Subdivision.

- Fill in the date your business qualified or incorporated in Utah.

- Enter your Department of Commerce Entity Number, which can be obtained from the Utah Department of Commerce.

- Indicate the license type you are applying for by checking the corresponding box. Remember, a separate application is required for each license type.

- Complete the Business Information section by providing your Business Entity Name, phone number, street address (P.O. Boxes are not accepted), cell phone number, fax number, city, county, state, ZIP code, business mailing address, and business email address. If your DBA/Business Name is different from your Business Entity Name, fill that section accordingly with the DBA name, phone number, street address, cell phone number, fax number, city, county, state, ZIP code, business mailing address, and business email address.

- For the Owners, Partners, or Corporate Officers section, fill in the necessary personal information for each individual. This includes name, title, home phone, home address, social security number, driver’s license number and state, city, state, ZIP code, date of birth, hair color, eye color, height, weight, gender, place of birth, and citizenship. Ensure to provide the required declaration regarding citizenship or legal presence in the U.S. under federal and state law.

- List at least five years of employment history for each owner, including any motor vehicle salesperson, dealer, dismantler, or auction licenses held, and disclose if any such license has ever been denied, suspended, or revoked.

- Answer questions regarding past criminal charges, convictions, probation, parole, or court supervisions for each owner. Include any motor vehicle or drug-related crimes, fraud, or registered sex offenses.

- If you are a franchise dealer, report the manufacturer or distributor information and attach your franchise agreement to the application.

- If ordering special plates or decals, indicate the type and quantity needed and calculate the total fees including the handling fee.

- Provide the required insurance information, ensuring it's issued in the name of the licensed business. You must submit a current copy of your plate insurance declaration with the application.

- Ensure all owners, partners, or corporate officers sign and date the form, certifying familiarity with motor vehicle dealer licensing laws and compliance with the Motor Vehicle Business Act of the Utah Code.

- Finally, submit the completed form, along with any attachments and necessary fees, in person or by mail to the Motor Vehicle Enforcement Division at the address provided.

Once submitted, your application will undergo a review process. It is essential to ensure that all information provided is accurate and truthful to avoid delays or potential denial. Congratulations on taking this significant step towards starting your bonded motor vehicle business in Utah!

Frequently Asked Questions

- What is the purpose of the Utah TC-301 form?

- Who needs to fill out the Utah TC-301 form?

- What information do you need to provide on the TC-301 form?

- Business entity name, address, phone, and email

- DBA/Business Name if applicable

- Ownership information including details about the owners, partners, or corporate officers

- Five years of employment history for each owner and disclosure of any past criminal convictions

- Details about the make and address of the manufacturer or distributor if you're a franchise dealer

- Vehicle insurance information, including insurance company name and policy number

- Signature of all owners certifying the accuracy and completeness of the provided information

- Where should the completed TC-301 form be submitted?

- Is there a fee associated with the TC-301 form?

- Can non-U.S. citizens apply for a license with the TC-301 form?

- What happens if the information provided in the TC-301 form is not accurate?

- Are additional documents required when submitting the TC-301 form?

The Utah TC-301 form serves as an application for businesses involved in vehicle-related services to register with the Motor Vehicle Enforcement Division. This includes dealerships for new or used vehicles, motorcycle, off-highway vehicles, small trailers, as well as for distributors, manufacturers, body shops, dismantlers, remanufacturers, crushers, and transporters. The purpose is to ensure compliance with Utah's regulatory standards and to assist in maintaining a legitimate automotive market.

Any business entity seeking to obtain a license in Utah for conducting activities as a motor vehicle dealer (new or used), distributor, manufacturer, body shop, dismantler, crusher, remanufacturer, transporter, or special equipment dealer is required to complete the TC-301 form. This includes both individual and corporate applicants.

Applicants need to provide comprehensive business information, including:

The completed TC-301 form should be returned to the Motor Vehicle Enforcement Division at 210 North 1950 West, Salt Lake City, UT 84134. It's crucial to ensure that the form is filled out completely and legibly to avoid rejection.

Yes, there are different license types each with associated fees listed on the TC-301 form, ranging from $51 for transporter licenses to $127 for new or used motor vehicle dealer licenses. Additional fees may apply for license plates and decals. Make sure to include the correct amount with your application, payable to the Utah State Tax Commission.

Non-U.S. citizens can apply using the TC-301 form but must apply in person if they are applying for a dealer license as any entity type and one or more of the owners are not U.S. citizens. Similarly, sole proprietors who are not U.S. citizens need to apply in person for licenses like body shop, crusher, etc. They must bring proof of lawful presence in the U.S. as per 8 USC 1641, including employment authorization card(s) and documentation showing the I-94 (arrival/departure) number(s) and Alien Registration Number(s).

Providing false information on the TC-301 form subjects the signer to penalties of perjury. Furthermore, inaccuracies can lead to the suspension or revocation of the applied license. It is imperative that all information provided on the form is accurate and complete.

Yes, depending on the type of license being applied for, additional documents may be required. For instance, franchise dealers need to attach their franchise agreement. Additionally, proof of insurance must accompany the application, and non-U.S. citizens must provide specific identification and legal presence documentation. It is recommended to check with the Motor Vehicle Enforcement Division for a comprehensive list of required documents.

Common mistakes

Filling out the Utah TC-301 form, which is needed for bonding motor vehicle businesses, can be a bit tricky. Below are the five common mistakes to watch out for to ensure your application goes through smoothly:

- Not providing complete details: One of the main obstacles is leaving certain fields blank or not offering enough information. Make sure every required section is filled out. This is vital as incomplete or vague information can lead to the rejection of your application.

- Using a P.O. Box for the business address: The form clearly states that a physical street address is necessary, not a P.O. Box. This is crucial for verifying the location of your business.

- Forgetting to sign the form: It might seem straightforward, but it’s an easy step to miss. Remember, all owners, partners, or corporate officers must sign the form. Any application missing these signatures will not be processed.

- Incorrect payment: The application comes with specific fees based on the type of license you are applying for. Making a check or money order payable to the Utah State Tax Commission in the wrong amount, or forgetting it altogether, will stall your application.

- Not attaching required additional documents: Depending on your circumstances, you might need to attach extra documents, such as proof of lawful presence in the U.S., employment authorization cards, or documentation of your criminal history. Failing to include these can cause significant delays.

Apart from these errors, it’s also essential to ensure that the form is legible. If you’re filling it out by hand, make sure your handwriting is easy to read. A better approach might be to type the information if you have the means. Also, take care to check the department of commerce entity number and the Utah sales tax number for accuracy – mixing up these numbers can also lead to processing issues.

In summary, when preparing your application, double-check each section for completeness and clarity, make sure the financial details are correct, and attach all necessary additional documents. Taking these steps will help avoid the common pitfalls and get your application processed more efficiently.

Documents used along the form

When applying for a Bonded Motor Vehicle Business License in Utah with the TC-301 form, applicants often need to submit additional documents to ensure compliance with the state requirements. These documents are pivotal for a smooth application process and help in establishing the legitimacy and operational scope of the business.

- Proof of Identity and Legal Status: Each owner, partner, or corporate officer must provide proof of identity and legal status in the U.S. This could include a driver's license, passport, and documentation proving lawful presence in the U.S., such as a Green Card or Visa documentation.

- Business License: Proof of a city or county business license is required to show that the business is allowed to operate within the local jurisdiction. This document is crucial for verifying that the business complies with local laws and regulations.

- Articles of Incorporation/Organization: Depending on the business structure (e.g., corporation, LLC), articles of incorporation or organization are necessary to demonstrate the legal formation of the business. This includes details like the business name, purpose, duration, and information about the incorporators or organizers.

- Zoning Verification: Applicants must provide documentation proving that their business location meets local zoning requirements for operating a bonded motor vehicle business. This often comes from the city or county zoning office.

Apart from these documents, it's important for applicants to ensure that all information provided is accurate and up to date. Incomplete or inaccurate documents can delay the licensing process. An overview of these supplementary documents illustrates the comprehensive nature of the regulatory framework, guiding applicants effectively through the process of licensing a bonded motor vehicle business in Utah.

Similar forms

The Utah TC-301 Bonded Motor Vehicle Business Application is particular to entities looking to conduct motor vehicle-related business within the state. However, this kind of regulatory control is not unique to motor vehicle businesses. Similar documentation exists for various other industries and purposes, each designed to ensure compliance with governmental regulations and safeguard public interests. One such document is the Business License Application used in many states for businesses to officially operate within a particular municipality or state. While the business license application might be broader in scope, covering a range of businesses, both applications serve as gateways for businesses to enter the formal market, ensuring that they meet local and state regulations.

An Alcohol Beverage License Application is another instance showcasing regulatory parallels. This application is crucial for businesses intending to sell alcoholic beverages. Much like the TC-301 form, the Alcohol Beverage License includes scrutiny of the business’s eligibility, background checks on owners, and specific operational information. Both forms require detailed information about the business and its principals to ensure that only qualified entities are allowed to conduct potentially sensitive activities.

Food Establishment Permit Applications are similarly structured to ensure that restaurants, food trucks, and other food vendors meet health and sanitation standards before operating. Just like the TC-301 form demands details pertaining to the motor vehicle industry's unique requirements, the Food Establishment Permit Application focuses on the specifics of safe food preparation, storage, and sales practices. These measures protect public health, emphasizing the provider’s responsibility to operate within established guidelines.

The Real Estate Broker License Application echoes the TC-301 form’s function in the real estate sector. It scrutinizes applicants’ backgrounds, education, and experience to ensure they are fit to responsibly guide clients in real estate transactions. Both applications ultimately serve to maintain professionalism and ethical standards within their respective industries, requiring detailed submissions and regular renewals or updates.

For construction-related businesses, the Contractor’s License Application presents a similar framework, requiring detailed information about the business, including proof of insurance and bonding, much like the TC-301 form. This application ensures that contractors have the necessary skills, knowledge, and financial safeguards to properly serve their clients and protect the public from potential harm or fraud.

The Pharmacy License Application parallels the TC-301 form in the pharmaceutical sector, requiring pharmacies to meet stringent guidelines before dispensing medication. Both licenses aim to protect consumers by ensuring that only qualified and compliant businesses can operate, thus safeguarding public health and safety.

In the field of education, the Private School License Application resembles the TC-301 document as it necessitates detailed information about the school's ownership, location, and the programs offered. This ensures that private educational institutions provide high-quality education in compliance with state educational standards.

The Firearms Dealer License Application, much like the TC-301, requires applicants to provide extensive background information, ensuring that only responsible and qualified entities are involved in the sale of firearms. This represents a focus on public safety and responsible business practices within both the automotive and firearm industries.

Environmental Permits, while broad in category, share the TC-301 form's goal of ensuring businesses operate within regulatory standards to protect the environment. These permits might be necessary for businesses that emit pollutants, manage waste, or use natural resources, underscoring the importance of regulatory compliance across diverse sectors.

The Pawnbroker License Application also requires thorough vetting of applicants, including background checks and proof of a secure facility, illustrating a common theme across industries: the need to regulate businesses closely to protect consumers and maintain fairness in the marketplace. The structure and intent behind this form show clear parallels to the TC-301 document, despite the differences in industry focus.

Through these examples, it’s evident that the Utah TC-301 Bonded Motor Vehicle Business Application is part of a broader ecosystem of regulatory documents designed to ensure businesses across various sectors operate ethically, safely, and in accordance with state and federal guidelines. While each document is tailored to its specific industry, the underlying purposes of regulation, consumer protection, and quality assurance are universally shared.

Dos and Don'ts

When it comes to filling out the Utah TC-301 form, a vital document for anyone looking to establish a bonded motor vehicle business, there are specific dos and don’ts that applicants should be mindful of to ensure a smooth application process. Here’s a straightforward guide to help you navigate through the application:

- Do read the instructions carefully before starting to fill out the form. They contain important details necessary for completing the form accurately.

- Do contact the appropriate local authority for business licensing requirements. These requirements may vary by city or county, and it's essential to comply with all local laws in addition to state regulations.

- Do complete the entire form. Leaving sections incomplete can lead to your application being rejected, which could delay your business operations.

- Do print or type clearly. Illegible forms are subject to rejection, which means you would have to spend additional time correcting and resubmitting them.

- Do make your check or money order payable to Utah State Tax Commission. This is crucial for the processing of your application fee.

While there are important steps to take, there are also pitfalls to avoid:

- Don’t submit the TC-301 form without checking for accuracy and completeness. Errors or omissions can lead to unnecessary delays.

- Don’t forget to include your Federal ID number and, if applicable, your Utah sales tax number. These are critical details for the processing of your application.

- <ß>Don’t overlook the need to attach additional documents if necessary. For instance, if you have to provide details about the business's owners, partners, or corporate officers, ensure all required documentation is included.

- Don’t ignore the section requiring disclosure of criminal history. Failure to disclose relevant information could have serious consequences for the approval of your application.

- Don’t send the form to the wrong address. Ensure it is sent to the Motor Vehicle Enforcement Division at the address specified on the form to avoid delays.

By following these guidelines and carefully preparing your TC-301 application, you'll increase your chances of a smooth process, allowing you to focus on building your bonded motor vehicle business with the proper authorization from the Utah State Tax Commission.

Misconceptions

When dealing with the Utah TC-301 form, required for bonded motor vehicle business applications, there are several misconceptions that might confuse applicants. Clearing up these misunderstandings ensures a smoother application process for those looking to operate within this sector in Utah.

It's only for car dealerships: While car dealerships are prominent applicants, the TC-301 form is also necessary for motorcycles, off-highway vehicles, small trailers, body shops, dismantlers, manufacturers, remanufacturers, transporters, and crusher businesses.

Personal information isn’t important: Every owner, partner, or corporate officer must provide detailed personal information, including citizenship status, to comply with state and federal laws. This data is crucial for background checks and ensuring lawful operation.

One form fits all license types: Businesses must submit a separate application for each license type they are applying for. The form clearly outlines different sections for different licenses, indicating that one application does not cover multiple licenses.

A P.O. Box is an acceptable business address: The form specifically requires a physical business street address. A P.O. Box can only be used for the mailing address, not the principal place of business.

The application is complete once submitted: Submission is just the beginning. Applicants must also comply with city or county business licensing requirements, and they might need to submit further documentation or corrections if the initial form is incomplete or contains errors.

Applying doesn't require personal presence: If an applicant, especially a non-U.S. citizen or a sole proprietor who is not a U.S. citizen, is applying for certain licenses, they must apply in person at the Motor Vehicle Enforcement Division.

All criminal history is disqualifying: Applicants must disclose their criminal history, but not all offences are automatically disqualifying. The form requires information on misdemeanors, felonies, and certain other legal circumstances within the past ten years, but the impact on licensing depends on the nature of the offenses.

Insurance details are optional: Providing current insurance details, specifically issued in the name of the licensed business, is essential. This includes submitting a copy of the plate insurance declaration every time plates are ordered or renewed.

Understanding these misconceptions about the Utah TC-301 form is vital for any business aiming to operate within the bonded motor vehicle industry in Utah. Clear and accurate completion of this application helps facilitate legal compliance and contributes to a smoother licensing process.

Key takeaways

Understanding how to correctly complete and use the Utah TC-301 form, a Bonded Motor Vehicle Business Application, is essential for operating within the legal framework of motor vehicle businesses in Utah. Here are seven key takeaways to ensure compliance and successful navigation of the process:

- Ensure full completion and legibility: It is imperative to read the instructions carefully before filling out the form. Any incomplete or illegible applications will be rejected. Type or print clearly to avoid any misunderstandings or processing delays.

- Understand licensing requirements: Each city or county in Utah might have different business licensing requirements. It is the applicant's responsibility to contact the appropriate local authority to comply with these requirements fully.

- Payment method: Any fees associated with the application should be paid via check or money order made payable to the Utah State Tax Commission. Ensuring the correct payment method helps in avoiding application processing delays.

- Select the correct license type: The form requires the applicant to submit a separate application for each license type they are applying for, which includes options ranging from new motor vehicle dealer to crusher. It’s important to accurately identify and apply for the license that aligns with the business operations.

- Provide correct business and personal information: Accurate business information, including the physical business address (PO Boxes are not accepted) and contact details, should be included. Additionally, owner, partner, or corporate officer information is required, emphasizing the need for transparency and truthfulness in the application.

- Legal eligibility and background disclosure: Applicants must disclose their citizenship status and any criminal history as part of the application process. Failure to disclose such information, or providing false information, subjects the signer to penalties for perjury and could result in the suspension or revocation of the license.

- Insurance requirements: A current copy of the plate insurance declaration must be submitted every time plates are ordered or renewed. Insurance must be issued in the name of the licensed business, ensuring that it’s adequately covered as per state requirements.

- Signatures are required: All owners, partners, or corporate officers must sign the form, certifying under penalty of perjury that the information provided is correct and complete. This certification also confirms that the business complies with the Motor Vehicle Business Act of the Utah Code.

By diligently following these guidelines, applicants can navigate the bureaucracy efficiently, ensuring that their motor vehicle business operates legally and without unnecessary delays in the state of Utah.

Common PDF Templates

Utah Tax Forms - For corporate tax compliance in Utah, the TC-559 coupon is an essential form for estimated and extension payments.

Medical Power of Attorney Form Utah - The directive encourages individuals to have discussions with potential agents about their health care wishes, fostering open communication about these important decisions.