Fill Out Your Utah Tc 20 Form

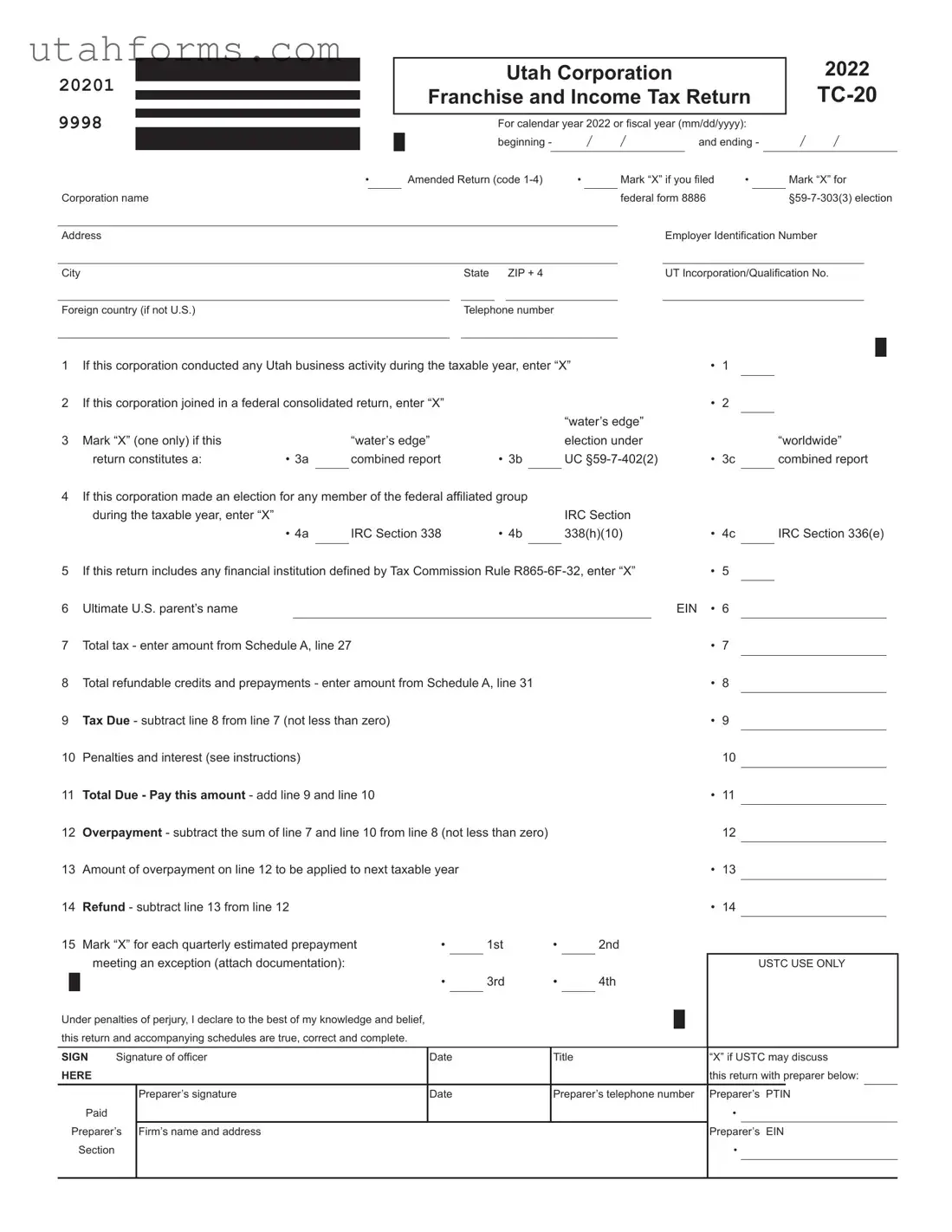

As the landscape of business and taxation continues to evolve, understanding the complexities of tax forms becomes pivotal for corporations. Among these, the Utah TC-20 form stands out as a critical document for any corporation operating within the state of Utah for the tax year 2020. This form, serving as the Franchise and Income Tax Return, demands meticulous attention from businesses as it encompasses a wide array of information, ranging from basic corporate details to intricate financial statements. It is designed to capture the complete financial essence of a corporation, including income, deductions, taxable income adjustments, and various tax credits. The form not only caters to native Utah corporations but also extends its applicability to those engaging in business activities within the state, making it a substantial document for both local and foreign entities. Aside from the primary focus on income and franchise tax calculations, the TC-20 form intricately links to a corporation's federal tax obligations, hence requires disclosures related to consolidated returns, affiliate transactions, and other significant election choices made under the Internal Revenue Code. By providing detailed schedules for net taxable income calculations and tax payments, along with specific sections for amendments and adjustments based on federal audit findings, the form acts as a comprehensive tax reporting tool. It is imperative for businesses to navigate through each section with precision to ensure compliance and optimize their tax positions, making it essential for corporations and their tax preparers to fully understand every aspect of the UT TC-20 form.

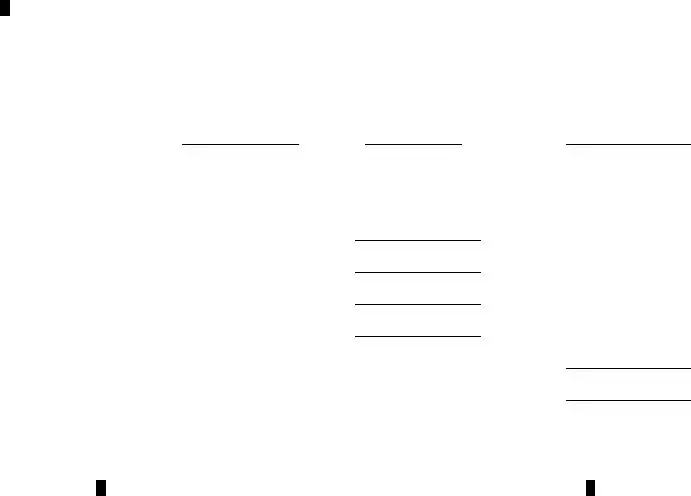

Preview - Utah Tc 20 Form

20201 |

|

|

|

|

Utah Corporation |

|

|

||||

|

|

|

|

Franchise and Income Tax Return |

|||||||

9998 |

|

|

|

|

|||||||

|

|

|

|

||||||||

|

|

|

|

For calendar year 2022 or fiscal year (mm/dd/yyyy): |

|||||||

|

|

|

|

||||||||

|

|

|

|

|

beginning - |

/ |

/ |

and ending - |

|||

USTC ORIGINAL FORM |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

||||

|

|

• |

|

Amended Return (code |

• |

Mark “X” if you filed • |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

Corporation name |

|

|

|

|

|

federal form 8886 |

|||||

2022

/ /

Mark “X” for

Address |

|

|

|

|

Employer Identification Number |

|

|

|

|

|

|

|

|

City |

State |

|

ZIP + 4 |

|

UT Incorporation/Qualification No. |

|

|

|

|

|

|

|

|

Foreign country (if not U.S.) |

Telephone number |

|

|

|||

1 |

If this corporation conducted any Utah business activity during the taxable year, enter “X” |

• |

1 |

|

|

||||||

2 |

If this corporation joined in a federal consolidated return, enter “X” |

|

|

|

• |

2 |

|

|

|||

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

“water’s edge” |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

Mark “X” (one only) if this |

|

|

“water’s edge” |

|

|

election under |

|

|

|

“worldwide” |

|

return constitutes a: |

• 3a |

|

combined report |

• 3b |

|

UC |

• |

3c |

|

combined report |

|

|

|

|

|

|

|

|

|

|

|

|

4If this corporation made an election for any member of the federal affiliated group

|

during the taxable year, enter “X” |

|

|

|

|

IRC Section |

|

|

|

|

|

|

• 4a |

|

IRC Section 338 |

• 4b |

338(h)(10) |

• |

4c |

|

IRC Section 336(e) |

||

|

|

|

|

|

|

|

|

|

|

||

5 |

If this return includes any financial institution defined by Tax Commission Rule |

• |

5 |

|

|

||||||

6 |

Ultimate U.S. parent’s name |

|

|

|

|

|

EIN • |

6 |

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

7 |

Total tax - enter amount from Schedule A, line 27 |

|

|

|

• |

7 |

|

|

|||

8 |

Total refundable credits and prepayments - enter amount from Schedule A, line 31 |

|

• |

8 |

|

|

|||||

|

|

|

|||||||||

9 |

Tax Due - subtract line 8 from line 7 (not less than zero) |

|

|

|

• |

9 |

|

|

|||

|

|

|

|

|

|||||||

10 |

Penalties and interest (see instructions) |

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

|

|

|

|

||||

11 |

Total Due - Pay this amount - add line 9 and line 10 |

|

|

|

• |

11 |

|

|

|||

|

|

|

|

|

|||||||

12 |

Overpayment - subtract the sum of line 7 and line 10 from line 8 (not less than zero) |

|

|

12 |

|

|

|||||

|

|

|

|

||||||||

13 |

Amount of overpayment on line 12 to be applied to next taxable year |

|

|

|

• |

13 |

|

|

|||

|

|

|

|

|

|||||||

14 |

Refund - subtract line 13 from line 12 |

|

|

|

|

|

• |

14 |

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

15 Mark “X” for each quarterly estimated prepayment |

• |

1st |

• |

2nd |

|

|

|

||||||||||

|

|

meeting an exception (attach documentation): |

|

|

|

|

|

|

|

|

|

USTC USE ONLY |

|||||

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

• |

3rd |

• |

4th |

|

|

|

||||||

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Under penalties of perjury, I declare to the best of my knowledge and belief, |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

this return and accompanying schedules are true, correct and complete. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

SIGN |

Signature of officer |

Date |

|

Title |

|

|

|

“X” if USTC may discuss |

|||||||||

HERE |

|

|

|

|

|

|

|

|

|

|

this return with preparer below: |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

Preparer’s signature |

Date |

|

Preparer’s telephone number |

Preparer’s |

PTIN |

||||||||

|

|

Paid |

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Preparer’s |

Firm’s name and address |

|

|

|

|

|

|

|

|

Preparer’s |

EIN |

|||||

|

Section |

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

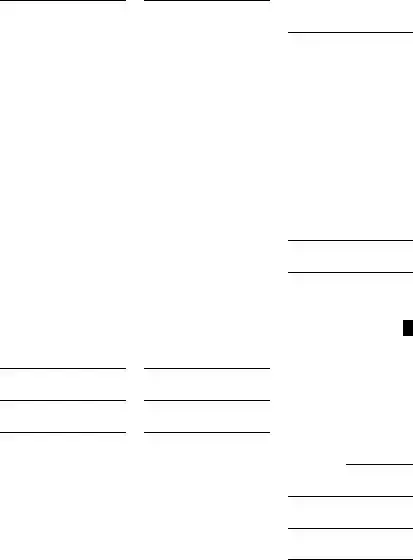

Supplemental information to be Supplied by All Corporations |

Pg. 2 |

||||||||

20202 EIN |

|

|

|

|

|

2022 |

|

|

|

|

USTC ORIGINAL FORM |

|

|

|

|

|

|

|

|

||

|

1 Date of incorporation: |

/ / |

|

State or country in which incorporated: |

|

|

|

|

||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

mm/dd/yyyy

2If this corporation is dissolved or withdrawn, see Dissolution or Withdrawal in the General Instructions.

3If this corporation at any time during its tax year owned more than 50 percent of the voting stock of another corporation(s), provide the following for each corporation so owned. Attach additional pages if needed.

Name of corporation:

Address:

City, State, ZIP Code:

Percent of stock owned: |

% |

Date stock acquired: |

/ |

/ |

|

|

|

|

|

|

|

mm/dd/yyyy

4If more than 50 percent of the voting stock of this corporation is owned by another corporation, provide the following information about the other corporation.

Name of corporation:

Address:

City, State, ZIP Code:

Percent of stock owned: |

% |

|

|

|

|

5Check here if this corporation or its subsidiary(ies) had a change in control or ownership or acquired control or ownership of any other legal entity this year.

6Enter the location where the corporate books and records are maintained:

7Enter the state or country of commercial domicile:

• 8 Enter the |

/ |

/ |

|

|

|

mm/dd/yyyy

Under separate cover, send a summary and supporting schedules for all federal adjustments and the federal tax liability for each year for which federal audit adjustments have not been reported to the Tax Commission. Include the date of final determination. Send the information to:

Auditing Division, Utah State Tax Commission, 210 North 1950 West, Salt Lake City, UT

•9 Enter the

/ / |

/ / |

/ / |

/ / |

|||

|

|

|

|

|

|

|

mm/dd/yyyy |

|

mm/dd/yyyy |

|

mm/dd/yyyy |

|

mm/dd/yyyy |

•10 Enter the

/ / |

/ / |

/ / |

/ / |

|||

|

|

|

|

|

|

|

mm/dd/yyyy |

|

mm/dd/yyyy |

|

mm/dd/yyyy |

|

mm/dd/yyyy |

Note: Utah Code

|

|

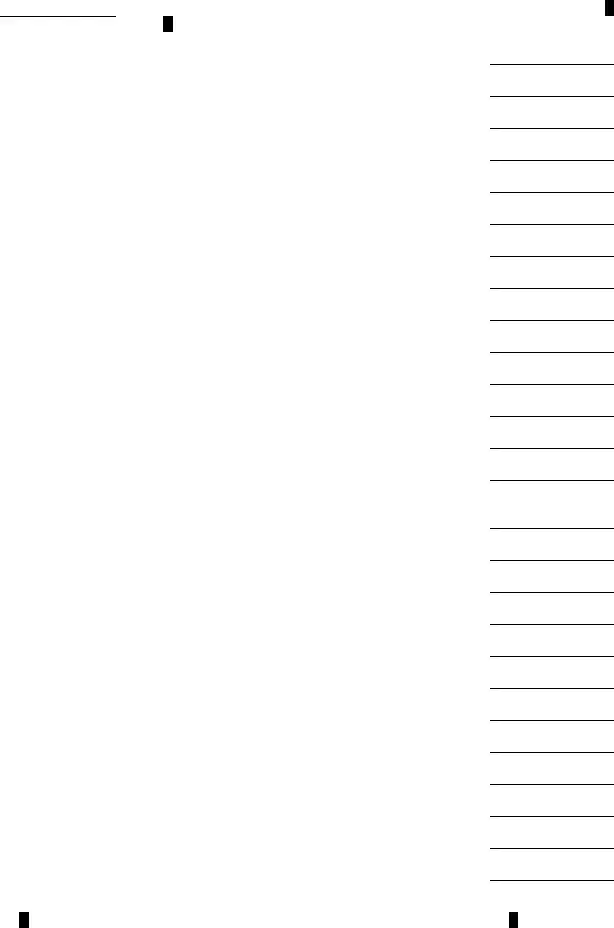

Schedule A - Utah Net Taxable Income and Tax Calculation |

Pg. 1 |

||||||||||

20203 |

EIN |

|

|

|

|

|

|

2022 |

|

|

|

||

USTC ORIGINAL FORM |

|

|

|

|

|

|

|

|

|

||||

1 |

Unadjusted income/loss before NOL and special deductions from federal form 1120, line 28 |

• 1 |

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|||||

2 |

Additions to unadjusted income from Schedule B, line 19 |

|

|

• 2 |

|

|

|

||||||

3 |

Add line 1 and line 2 |

|

|

3 |

|

|

|

|

|||||

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|||||

4 |

Subtractions from unadjusted income from Schedule C, line 21 |

|

|

• 4 |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|||||

5 |

Adjusted income/loss - subtract line 4 from line 3 |

|

|

• 5 |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|||||

6 |

Utah net nonbusiness income from Schedule H, line 14 |

|

|

• 6 |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|||||

7 |

|

|

• 7 |

|

|

|

|||||||

8 |

Total nonbusiness income net of expenses - add line 6 and line 7 |

|

|

8 |

|

|

|

|

|||||

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

||||||

9 |

Apportionable income/loss before contributions deduction - subtract line 8 from line 5 |

• 9 |

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|||||

10 |

Utah contributions deduction from Schedule D, line 6 |

|

|

• 10 |

|

|

|

||||||

11 |

Apportionable income/loss - subtract line 10 from line 9 |

|

|

11 |

|

|

|

|

|||||

|

|

|

|

|

|

||||||||

12 |

Apportionment fraction - enter 1.000000, or Schedule J, line 9 or 10, if applicable |

12 |

|

|

|

|

|||||||

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|||||

13 |

Apportioned income/loss - multiply line 11 by line 12 |

|

|

• 13 |

|

|

|

||||||

14 |

Utah net nonbusiness income (from line 6 above) |

|

|

14 |

|

|

|

|

|||||

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|||||

15 |

Utah income/loss before Utah net loss deduction - add line 13 and line 14 |

|

|

• 15 |

|

|

|

||||||

|

|

|

|

|

|

|

|

||||||

16 |

Utah net loss carried forward from prior years (see instructions and attach documentation) |

• 16 |

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|||||

17 |

Net Utah taxable income/loss - subtract line 16 from line 15 |

|

|

• 17 |

|

|

|

||||||

18 |

Calculation of tax (see instructions): |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|||||||

|

a Multiply line 17 by 4.85% (.0485) (not less than zero) |

18a |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|||||

|

b Minimum tax - enter $100 or amount from Schedule M, line b |

• 18b |

|

|

|

|

|

||||||

|

Tax amount - enter the greater of line 18a or line 18b |

|

|

• 18 |

|

|

|

||||||

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|||||

19 |

Interest on installment sales |

|

|

• 19 |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|||||

20 |

IRC 965(a) deferred foreign income installment amount |

|

|

• 20 |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|||||

21 |

Recapture of |

|

|

• 21 |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|||||

22 |

Total tax - add lines 18 through 21 |

|

|

• 22 |

|

|

|

||||||

|

Carry to Schedule A, page 2, line 23 |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

||||||

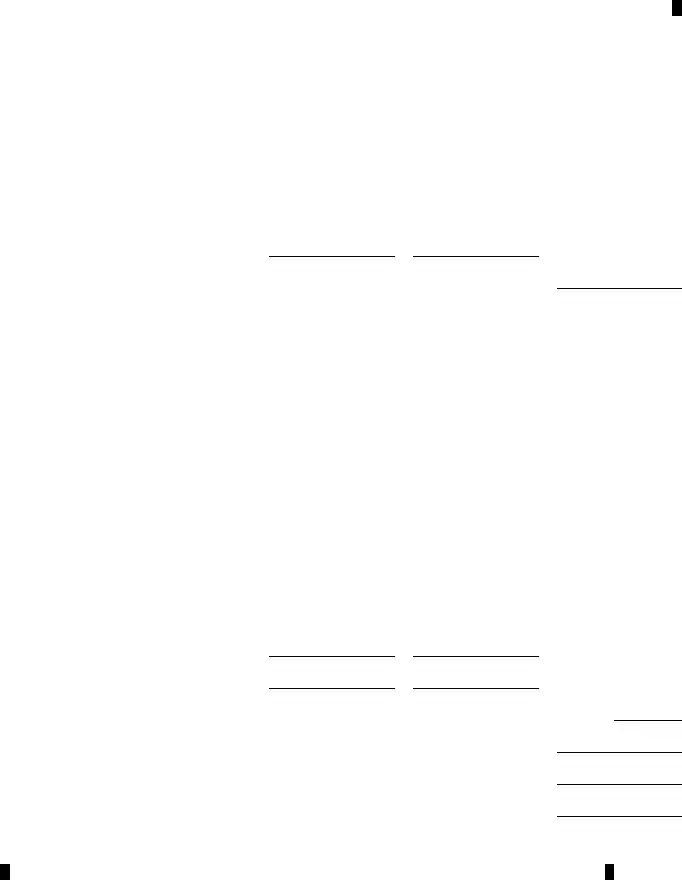

|

Schedule A - Utah Net Taxable Income and Tax Calculation |

Pg. 2 |

|||||||||||||||

20204 EIN |

|

|

|

|

|

|

|

|

|

|

2022 |

|

|

||||

USTC ORIGINAL FORM |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

23 |

Enter tax from Schedule A, page 1, line 22 |

|

|

|

|

|

23 |

|

|

|

|||||||

24 |

Nonrefundable credits (see instructions or incometax.utah.gov/credits for codes) |

|

|

|

|

||||||||||||

|

|

|

|

||||||||||||||

|

|

|

Code |

Amount |

|

Code |

Amount |

|

|

|

|

||||||

|

• 24a |

|

|

|

|

• 24b |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• 24c |

|

|

|

|

• 24d |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• 24e |

|

|

|

|

• 24f |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Total nonrefundable credits - add lines 24a through 24f |

|

|

|

|

|

• 24 |

|

|

||||||||

|

|

|

|

|

|

||||||||||||

25 |

Net tax - subtract line 24 from line 23 (cannot be less than line 18b or less than zero) |

• 25 |

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

26 |

Utah use tax |

|

|

|

|

|

|

|

|

|

• 26 |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|||||||

27 |

Total tax - add line 25 and line 26 |

|

|

|

|

|

• 27 |

|

|

||||||||

|

Enter here and on |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

||||||||

28 |

Refundable credits (see instructions or incometax.utah.gov/credits for codes) |

|

|

|

|

|

|||||||||||

|

|

|

Code |

Amount |

|

Code |

Amount |

|

|

|

|

||||||

|

• 28a |

|

|

|

|

• 28b |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• 28c |

|

|

|

|

• 28d |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Total refundable credits - add lines 28a through 28d |

|

|

|

|

|

• 28 |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||

29 |

Prepayments from Schedule E, line 4 |

|

|

|

|

|

• 29 |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||

30 |

Amended return only (see instructions) |

|

|

|

|

|

• 30 |

|

|

||||||||

|

|

|

|

|

|

|

|||||||||||

31 |

Total refundable credits and prepayments - add lines 28 through 30 |

|

• 31 |

|

|

||||||||||||

|

Enter here and on |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

Schedule B - Additions to Unadjusted Income |

|||||||

20205 |

EIN |

|

|

2022 |

|

||||

USTC ORIGINAL FORM |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

1 |

Interest from state obligations |

• 1 |

|||||||

|

|

|

|

|

|

|

|||

2 |

a Income taxes paid to any state |

• 2a |

|||||||

|

|

|

|

|

|||||

|

b Franchise or privilege taxes paid to any state |

• 2b |

|||||||

|

|

|

|

|

|||||

|

c Corporate stock taxes paid to any state |

• 2c |

|||||||

|

|

|

|

|

|||||

|

d Any income, franchise or capital stock taxes imposed by a foreign country |

• 2d |

|||||||

|

|

|

|

|

|||||

|

e Business and occupation taxes paid to any state |

• 2e |

|||||||

|

|

|

|

|

|||||

3 |

Safe harbor lease adjustments |

• 3 |

|||||||

|

|

|

|

|

|||||

4 |

Capital loss carryover |

• 4 |

|||||||

|

|

|

|

|

|||||

5 |

Federal deductions taken previously on a Utah return |

• 5 |

|||||||

|

|

|

|

|

|||||

6 |

Federal charitable contributions from federal form 1120, line 19 |

• 6 |

|||||||

|

|

|

|

|

|||||

7 |

Gain/loss on IRC Sections 338(h)(10) or 336(e) |

• 7 |

|||||||

|

|

|

|

|

|||||

8 |

Adjustments due to basis difference |

• 8 |

|||||||

|

|

|

|

|

|||||

9 |

Expenses attributable to 50 percent unitary foreign dividend exclusion |

• 9 |

|||||||

|

|

|

|

|

|||||

10 |

Installment sales income previously reported for federal but not Utah purposes |

• 10 |

|||||||

|

|

|

|

|

|||||

11 |

Nonqualified withdrawal from my529 |

• 11 |

|||||||

|

|

|

|

|

|||||

12 |

Income/loss from IRC Section 936 corporations |

• 12 |

|||||||

|

|

|

|

|

|||||

13 |

Foreign income/loss for worldwide combined filers |

• 13 |

|||||||

|

|

|

|

|

|||||

14 |

Income/loss of unitary corporations not included in federal consolidated return |

• 14 |

|||||||

|

|

|

|

|

|||||

15 |

Deductions for a royalty or other expense paid to an entity related by common ownership (see instructions) |

• 15 |

|||||||

|

|

|

|

|

|||||

16 |

Payroll Protection Program grant or loan addback (see instructions) |

• 16 |

|||||||

|

|

|

|

|

|||||

17 |

(Reserved, see instructions) |

• 17 |

|||||||

|

|

|

|

|

|||||

18 |

(Reserved, see instructions) |

• 18 |

|||||||

|

|

|

|

|

|||||

19 |

Total additions - add lines 1 through 18 |

• 19 |

|||||||

|

Enter here and on Schedule A, line 2 |

|

|

|

|||||

|

|

|

|

||||||

Schedule C - Subtractions from Unadjusted Income

20206 EIN

USTC ORIGINAL FORM

1Intercompany dividend elimination (see instructions)

2 Foreign dividend

3 Net capital loss

4a Federal jobs credit salary reduction

b Federal research and development credit expense reduction

c Federal orphan drug credit clinical testing expense reduction

d Expense reduction for other federal credits (attach schedule)

e.Federal qualified tax credit bond credit, income increase

f.Federal qualified zone academy bond credit, income increase

5 Safe harbor lease adjustments

6 Federal income previously taxed by Utah

7 Fifty percent exclusion for dividends from unitary foreign subsidiaries

8 Fifty percent exclusion for foreign operating company income/loss

9Gain/loss on stock sale not recognized for federal purposes (but included in taxable income) when IRC Section 338(h)(10) or 336(e) has been elected

10Basis adjustments

11Interest expense not deducted on federal return under IRC Section 265(b) or 291(e)

12Dividends received from admitted insurance company subsidiaries exempt under UC

13Contributions to my529 account(s)

14(Reserved, see instructions)

15Dividends received or deemed received by a member of the unitary group from a captive REIT

16IRC Section 857(b)(2)(E) deduction from a captive REIT

17FDIC Premiums disallowed as a deduction for federal income tax purposes

18

19(Reserved, see instructions)

20(Reserved, see instructions)

21Total subtractions - add lines 1 through 20

Enter here and on Schedule A, line 4

•1

•2

•3

•4a

•4b

•4c

•4d

•4e

•4f

•5

•6

•7

•8

•9

•10

•11

•12

•13

•14

•15

•16

•17

•18

•19

•20

•21

|

Schedule D - Utah Contributions Deduction |

|

|

||||||

20207 EIN |

|

|

2022 |

|

|

||||

USTC ORIGINAL FORM |

|

|

|

|

|

|

|||

1 |

Apportionable income before contributions deduction from Schedule A, line 9 |

|

|

• 1 |

|||||

|

If a loss, no contribution deduction is allowed |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|||

2 |

Utah contribution limitation - multiply line 1 by 10% (.10) (not less than zero) |

2 |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

3 |

Current year contributions |

|

|

• 3 |

|||||

|

|

|

|

|

|

|

|

||

4 |

Utah contributions carryforward (attach schedule) |

|

|

• 4 |

|||||

5 |

Total contributions available - add line 3 and line 4 |

5 |

|

|

|

||||

|

|

|

|||||||

|

|

|

|

|

|

|

|

||

6 |

Utah contributions deduction - lesser of line 2 or line 5 |

|

|

• 6 |

|||||

|

Enter here and on Schedule A, line 10 |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|||

7 |

Contribution carryover to next year - subtract line 6 from line 5 |

• 7 |

|||||||

|

|

|

|

|

|

|

|

|

|

|

Schedule E - Prepayments of Any Type |

|

||||

1 |

Overpayment applied from prior year |

|

|

1 |

|

|

2 |

Extension prepayment |

Date: |

/ / |

Check no.: |

2 |

|

|

||||||

Enter the date and amount of any extension prepayment. If paid by check, enter the check number.

3Other prepayments (attach additional pages if necessary)

Enter the date and amount of any prepayment for the filing period. If paid by check, enter the check number.

a Date: |

/ |

/ |

Check no.: |

|

3a |

|

|

|

|

|

|

b Date: |

/ |

/ |

Check no.: |

|

3b |

|

|

|

|

|

|

c Date: |

/ |

/ |

Check no.: |

|

3c |

|

|

|

|

|

|

d Date: |

/ |

/ |

Check no.: |

|

3d |

|

|

|

|

|

|

Total of all prepayments - add lines 3a through 3d |

3 |

4 Total prepayments - add lines 1 through 3 |

4 |

Enter here and on Schedule A, line 29 |

|

Schedule H - Utah Nonbusiness Income Net of Expenses |

Pg. 1 |

|||||

20261 EIN |

|

|

|

|

2022 |

|

USTC ORIGINAL FORM |

|

|

(use with |

|

||

|

|

|

|

|

|

|

Note: Failure to complete this form may result in disallowance of the nonbusiness income. |

|

|

|

|

|||||||

Part 1 - Utah Nonbusiness Income (nonbusiness income allocated to Utah) |

|

|

|

|

|||||||

|

|

|

|

||||||||

|

|

|

|

||||||||

|

A |

B |

|

|

C |

D |

|

E |

|||

|

Type of Utah |

Acquisition Date of |

|

Beginning Value of Investment |

Ending Value of Investment |

|

Utah Nonbusiness Income |

||||

|

Nonbusiness Income |

Utah Nonbusiness |

|

Used to Produce Utah |

Used to Produce Utah |

|

|

|

|||

|

|

|

Asset(s) |

|

|

Nonbusiness Income |

Nonbusiness Income |

|

|

|

|

1a |

/ |

/ |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

1b |

/ |

/ |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

1c |

/ |

/ |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

1d |

/ |

/ |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

1e |

/ |

/ |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

2Total of column C and column D

3Total Utah nonbusiness income - add column E for lines 1a through 1e

|

Description of direct expenses related to: |

Amount of Direct Expense |

||

4a |

Line 1a above |

|

||

|

|

|

|

|

4b |

Line 1b above |

|

||

|

|

|

|

|

4c |

Line 1c above |

|

||

|

|

|

|

|

4d |

Line 1d above |

|

||

|

|

|

|

|

4e |

Line 1e above |

|

||

|

|

|

|

|

5Total direct related expenses - add lines 4a through 4e

6 |

Utah nonbusiness income net of direct related expenses - subtract line 5 from line 3 |

|

• |

||

|

|

Column A |

Column B |

||

|

Indirect Related Expenses for |

Total Assets Used to Produce |

Total Assets |

||

|

Utah Nonbusiness Income |

Utah Nonbusiness Income |

|

|

|

7 |

|

|

|

|

|

|

(enter in Column A the amount from line 2, col. C) |

|

|

|

|

|

|

|

|

|

|

8

(enter in Column A the amount from line 2, col. D)

9Sum of beginning and ending asset values (add line 7 and line 8)

10Average asset value - divide line 9 by 2

11Utah nonbusiness assets ratio - line 10, Column A, divided by line 10, Column B (to four decimal places)

12Interest expense deducted in computing Utah taxable income (see instructions)

13Indirect related expenses for Utah nonbusiness income - multiply line 11 by line 12

14 Total Utah nonbusiness income net of expenses - subtract line 13 from line 6 |

|

• |

|

Enter on: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Schedule H - |

Pg. 2 |

|||||

20262 EIN |

|

|

|

|

2022 |

|

USTC ORIGINAL FORM |

|

|

(use with |

|

||

|

|

|

|

|

|

|

Part 2 -

|

A |

B |

|

|

C |

D |

|

E |

||

|

Type of |

Acquisition Date of |

|

Beginning Value of Investment |

Ending Value of Investment |

|

||||

|

Nonbusiness Income |

|

|

Used to Produce |

Used to Produce |

|

Income |

|||

|

|

|

Nonbusiness Asset(s) |

|

Nonbusiness Income |

Nonbusiness Income |

|

|

||

15a |

/ |

/ |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

15b |

/ |

/ |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

15c |

/ |

/ |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

15d |

/ |

/ |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

15e |

/ |

/ |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

16Total of column C and column D

17Total

|

Description of direct expenses related to: |

|

|

|

|

|

Amount of Direct Expense |

|

18a |

Line 15a above |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18b |

Line 15b above |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18c |

Line 15c above |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18d |

Line 15d above |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18e |

Line 15e above |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19 |

Total direct related expenses - add lines 18a through 18e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

20 |

• |

|||||||

|

|

|

Column A |

Column B |

|

|

||

|

|

|

|

|

||||

|

Indirect Related Expenses for |

Total Assets Used to Produce |

Total Assets |

|

|

|||

|

|

|

|

|

||||

21 |

|

|

|

|

|

|

||

|

(enter in Column A the amount from line 16, col. C) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

22 |

|

|

|

|

|

|

||

|

(enter in Column A the amount from line 16, col. D) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

23Sum of beginning and ending asset values (add line 21 and line 22)

24Average asset value - divide line 23 by 2

25

26Interest expense deducted in computing

27Indirect related expenses for

28 Total |

• |

|

Enter on: |

|

|

|

|

|

|

|

|

Schedule J - Apportionment Schedule |

Pg. 1 |

|||||

20263 EIN |

|

|

|

|

2022 |

|

USTC ORIGINAL FORM |

|

|

(use with |

|

||

|

|

|

|

|

|

|

Note: Use this schedule only if the entity does business in Utah and one or more other states and income must be apportioned to Utah.

Briefly describe the nature and location(s) of your Utah business activities:

Apportionable Income Factors

|

|

|

|

|

Column A |

|

Column B |

|||

1 |

Property Factor |

|

|

Inside Utah |

|

Inside and Outside Utah |

||||

|

a |

Land |

• 1a |

• |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

b |

Depreciable assets |

• 1b |

• |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

c |

Inventory and supplies |

• 1c |

• |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

d |

Rented property |

• 1d |

• |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

e |

Other allowable property (see instructions) |

• 1e |

• |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

f |

Total tangible property - add lines 1a through 1e |

• 1f |

• |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||

2 |

Property factor - divide line 1f, Column A, by line 1f, Column B (to six decimal places) |

• |

2 |

|

|

|

||||

3 |

Payroll Factor |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

a |

Total wages, salaries, commissions and other compensation |

• 3a |

• |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||

4 |

Payroll factor - divide line 3a, Column A, by line 3a, Column B (to six decimal places) |

• |

4 |

|

|

|

||||

5 |

Sales Factor |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

a |

Total sales (gross receipts less returns and allowances) |

|

|

|

• |

5a |

|||

|

b |

Sales delivered or shipped to Utah buyers from outside Utah |

• 5b |

|

|

|

|

|

||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

c |

Sales delivered or shipped to Utah buyers from within Utah |

• 5c |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

d |

Sales shipped from Utah to the United States government |

• 5d |

|

|

|

|

|

||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

e |

Sales shipped from Utah to buyers in states where the corp. |

• 5e |

|

|

|

|

|

||

|

|

has no nexus (corporation not taxable in buyer’s state) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

f |

Rent and royalty income |

• 5f |

• |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

g |

Services and other allowable sales (see instructions) |

• 5g |

• |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

h |

Total sales (add lines 5a through 5g) |

• 5h |

• |

|

|

|

|

||

|

|

|

|

|

|

|

||||

6 Sales factor - line 5h, Column A, divided by line 5h, Column B (to six decimals) |

• |

6 |

|

|

|

|||||

|

|

Continued on page 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

File Specifications

| Fact | Detail |

|---|---|

| Form Designation | Utah Corporation Franchise and Income Tax Return TC-20 |

| Applicability | Used by corporations operating in Utah for reporting their annual franchise and income tax. |

| Options for Filing Period | Can be filed for a calendar year or a fiscal year, depending on the corporation's accounting period. |

| Governing Law | Governed by Utah Code §59-7-101 et seq., detailing corporation tax laws in Utah. |

How to Write Utah Tc 20

After gathering all the necessary information, including the corporate financial reports and the federal form 1120, you will be ready to start filling out the Utah TC-20 form for the Corporation Franchise and Income Tax Return. This task involves both entering specific financial data and making certain elections or declarations about your corporation's status and tax-related actions for the year in question. Ensuring accuracy in every detail is vital, as this affects the tax obligations and potential refund or credit for the corporation.

- Start by entering the full corporation name and address, including the ZIP + 4 code.

- Fill in the Employer Identification Number (EIN) and the Utah Incorporation/Qualification Number.

- If applicable, note the foreign country of incorporation.

- Provide the corporation’s telephone number.

- Indicate the tax year covered by marking either the calendar year 2020 or by specifying the fiscal year dates.

- Check the appropriate box if this is an Amended Return and enter the code (1-4).

- Mark “X” if the federal form 8886 was filed.

- If the corporation conducted any Utah business activity, mark "X" in item 1.

- If the corporation was part of a federal consolidated return, mark "X" in item 2.

- For the "water’s edge" election status, mark “X” in the appropriate box to declare it a combined report under specific Utah Code sections or indicate none applies.

- If an election was made for any member of the federal affiliated group, mark "X" in the corresponding IRC Section.

- Indicate if the return includes a financial institution as defined by the Tax Commission Rule.

- Enter the Ultimate U.S. parent’s name and EIN, if applicable.

- Calculate and enter the Total Tax from Schedule A, line 27.

- Determine and note the Total Refundable Credits and Prepayments from Schedule A, line 31.

- Calculate Tax Due by subtracting line 8 from line 7, ensuring it is not less than zero.

- List any Penalties and Interest observed.

- Compute the Total Due by adding line 9 (Tax Due) and line 10 (Penalties and Interest).

- If there is an Overpayment, subtract the sum of line 7 and line 10 from line 8, ensuring it is not less than zero.

- Determine the Amount of Overpayment to be Applied to the Next Taxable Year, if desired.

- Calculate the Refund by subtracting line 13 from line 12.

- Mark "X" for each Quarterly Estimated Prepayment box that applies and attach documentation for exceptions.

- Under the penalties of perjury declaration, have the officer sign and date the return and provide their title.

- Fill out the preparer’s section if applicable, including the signature, date, telephone number, PTIN, and EIN, along with the firm’s name and address.

- Complete the supplemental information on page 2 as necessary, focusing on incorporation details, ownership, and fiscal adjustments.

After successfully filling out the TC-20 form, review all the entered information for accuracy and completeness. Once confirmed, submit the form to the Utah State Tax Commission by the due date, along with any required payment for taxes due. Pay special attention to any sections that require additional documentation, making sure to provide all necessary schedules and supporting materials to ensure compliance and to facilitate the processing of your corporation’s tax return.

Frequently Asked Questions

- What is the Utah TC-20 form?

The Utah TC-20 form is the 2020 Franchise and Income Tax Return for corporations operating in Utah. It is required for reporting the corporation’s franchise and income taxes for either the calendar year 2020 or a fiscal year beginning and ending in the specified dates.

- Who needs to file the TC-20 form?

Any corporation that conducted business activity in Utah during the taxable year must file the TC-20 form. This includes corporations that have joined in a federal consolidated return.

- What are key sections in the TC-20 form?

The TC-20 form includes sections for reporting basic corporate information such as business name, address, and employer identification number; financial details like total tax, penalties, and interest, and specific elections like the “water’s edge” election.

- What is the 'water's edge' election?

The 'water's edge' election is a tax reporting option that limits the scope of income subject to apportionment to the income of affiliated corporations that have a significant economic presence in the United States. This option is available under specific code sections and must be indicated on the TC-20 form.

- How do corporations report changes in control or ownership?

Corporations or their subsidiaries that experienced a change in control or ownership during the tax year must check the relevant box on the form and may need to attach additional documentation detailing the change.

- How is the total tax calculated on the TC-20 form?

Total tax is calculated by adding adjustments to unadjusted income, deductions, and applying applicable tax rates and credits as detailed in the form's instructions and Schedule A.

- Can you amend a TC-20 form?

Yes, amendments to a previously filed TC-20 can be made. The form includes a section for indicating it is an amended return, and specific codes must be used to specify the type of amendment.

- What if a corporation paid taxes in other states or countries?

Corporations that have paid income taxes, franchise taxes, or similar taxes in other states or countries may need to make specific additions to their unadjusted income on the TC-20 form to account for these payments.

- How are tax credits and prepayments handled?

The form allows for the listing of refundable and nonrefundable tax credits, as well as any prepayments made during the taxable year. These amounts are factored into the calculation of the tax due or refundable.

- What is required for the signature section of the TC-20?

The TC-20 form must be signed by an authorized officer of the corporation, attesting under penalties of perjury that the return and accompanying schedules are true, correct, and complete. A paid preparer’s information can also be included.

Common mistakes

Filling out the Utah TC-20 form, which is essential for corporations to report their franchise and income tax, involves a careful process that can be prone to errors. Understanding and avoiding these common mistakes can ensure a smoother filing process and may prevent unnecessary delays or scrutiny from the Utah State Tax Commission.

-

Incorrectly entering dates. One common error is failing to correctly specify the fiscal or calendar year covered by the tax return. Corporations must accurately enter the start and end dates of the fiscal year if not operating on a calendar year basis. Mixing up the day and month in these fields due to differences in date formatting can lead to confusion and may require the submission of an amended return.

-

Failure to mark applicable checkboxes properly. The form includes several sections where a checkbox must be marked to indicate a specific tax situation, such as joining in a federal consolidated return or making a “water’s edge” election. Overlooking these boxes or marking the wrong one can lead to inaccuracies in how the corporation’s tax liabilities are calculated and reported.

-

Omitting information on affiliated corporations. If the corporation owns more than 50% of another corporation’s voting stock, or vice versa, detailed information about these affiliations must be provided. Failing to disclose such information or not providing complete details can lead to incomplete filings and potential penalties.

-

Miscalculating tax due and refundable credits. Accurately calculating the total tax due, including any refundable credits and prepayments, is critical. Common errors include mathematical mistakes, incorrect carryovers of amounts, and misunderstanding how certain credits can be applied. Such errors not only impact the financial accuracy of the return but can also affect the timeliness of refunds or assessments.

-

Incorrect or missing signatures and dates. The TC-20 form requires the signature of an authorized officer of the corporation and, if prepared by someone other than an employee of the corporation, the signature of the paid preparer. Failing to include these signatures or the corresponding dates can invalidate the filing, requiring resubmission and potentially leading to late filing penalties.

-

Companies should always verify their tax calculations against the current year's tax laws and rates to ensure accuracy.

-

Providing a complete and correct address, including the ZIP+4 code, is essential for any correspondence related to the tax return.

-

It is beneficial to double-check the corporation’s Employer Identification Number (E,IN) and the Incorporation/Qualification Number for consistency with previous filings to avoid mismatch errors.

To mitigate these common mistakes, corporations are encouraged to review their completed TC-20 form thoroughly before submission. Utilizing professional tax preparation services or software can also help identify and correct potential errors, ensuring compliance with Utah’s tax regulations.

Documents used along the form

When dealing with a Utah Corporation 2020 Franchise and Income Tax Return TC-20, several other documents and forms may be necessary to complete the filing process thoroughly. These documents support the information provided on the TC-20 form, ensuring compliance and accuracy in reporting. Here's a list of documents often used alongside the Utah TC-20 form and a brief description of each.

- Federal Form 1120: The U.S. Corporation Income Tax Return is essential for providing the federal tax information that the TC-20 form references, especially for unadjusted income and deductions.

- Federal Form 8886: Reportable Transaction Disclosure Statement, mentioned in the TC-20, must be filed if the corporation participated in certain transactions the IRS considers significant or reportable.

- Schedule A: Utah Net Taxable Income and Tax Calculation is a part of the TC-20 form packet and necessary for calculating the state tax owed.

- Schedule B: Additions to Unadjusted Income, also a part of the TC-20 form packet, helps calculate adjustments to the federal taxable income.

- Schedule H: Nonbusiness and Business Income, supplements the TC-20 by detailing sources of nonbusiness and business income specific to Utah.

- Schedule D: Contributions Deduction, helps calculate allowable contributions deductions on the Utah income tax.

- Schedule J: Apportionment Schedule, is required for multistate corporations to determine the portion of income subject to Utah taxes.

- Articles of Incorporation: Provides the date of incorporation and other basic information about the corporation that is necessary for the TC-20.

- Power of Attorney: Authorizes someone else, such as an accountant, to discuss and handle tax matters with the Utah Tax Commission on behalf of the corporation.

- Financial Statements: While not submitted with the TC-20, preparing financial statements helps provide the necessary financial information for the tax return.

- Documentation for Credits and Deductions: Detailed records supporting any claims for credits, deductions, and adjustments reported on the TC-20 and its schedules.

Understanding and gathering these documents in advance will streamline the tax filing process for your Utah corporation. Ensuring all relevant forms and supporting documentation are accurate and complete can aid in avoiding errors or potential audits, facilitating a more efficient handling of your corporation’s tax obligations.

Similar forms

The Utah TC-20 form is similar to the Federal Form 1120, which is the U.S. Corporation Income Tax Return. Both forms are used by corporations to report income, gains, losses, deductions, and credits to determine their federal or state income tax liability. The Utah TC-20 requires information from the federal return, such as unadjusted income before net operating losses (NOL) and special deductions, highlighting their interconnectedness. Additionally, both forms involve sections for calculating tax owed or refunds due, indicating a corporation's financial obligation to the government for the covered tax period.

Another document similar to the Utah TC-20 form is the Schedule K-1 (Form 1120S), which is used by S corporations to report each shareholder's share of income, deductions, and credits. Like the TC-20, which includes detailed reporting on modifications to income and tax calculations specific to Utah, the Schedule K-1 provides critical information to shareholders for use on their individual tax returns, reflecting their portion of the S corporation's income or losses. Both documents serve to allocate income and deductions down to an individual or entity level, ensuring accurate tax reporting and payment.

The form also shares similarities with the State of California Franchise Tax Board Form 100, the California Corporation Franchise or Income Tax Return. Like the Utah TC-20, California's Form 100 is tailored to the state's tax laws, requiring corporations to report income, calculate tax liability, and claim allowable credits specific to California. Both forms are essential for corporations operating within their respective states, providing a comprehensive framework for tax liability determination based on state-specific rules and regulations concerning corporate income.

Finally, the TC-20 resembles the New York State CT-3, Corporation Franchise Tax Return. This form, like the TC-20, is designed for corporations to report their income and calculate taxes owed under the specific franchise tax regulations of New York State. Both the TC-20 and the CT-3 include line items for adjustments based on state legislation, apportionment calculations for corporations operating in multiple states, and sections for various credits and deductions specific to the state. These forms ensure corporations meet their tax obligations in compliance with state-specific tax codes.

Dos and Don'ts

Filling out the Utah TC-20 form, which pertains to the 2020 Franchise and Income Tax Return for corporations, is a crucial process that requires careful attention to detail. There are key do’s and don’ts that can help ensure the process is completed accurately and efficiently.

- Do thoroughly review the form instructions before beginning. Understanding each section can prevent common mistakes.

- Do verify the accuracy of all the information, including the corporation name, Employer Identification Number (EIN), and address, to ensure they match records with the IRS.

- Do mark the appropriate checkboxes with an “X” to indicate your specific conditions or elections, such as if you filed federal form 8886 or if the return is amended.

- Do accurately calculate the total tax, refundable credits, and prepayments, utilizing Schedule A for guidance. This step is paramount to determining if you owe tax or are due a refund.

- Do sign and date the form. An unsigned form is considered incomplete and can result in processing delays or fines.

- Don’t rush through filling out the form. Take the time to double-check each line item against your financial records and the instructions provided.

- Don’t leave any required fields blank. If a specific line does not apply, consider entering “N/A” or “0,” as applicable, unless instructed otherwise.

- Don’t forget to attach necessary documentation or supplemental information, especially if noting exceptions or specific elections.

- Don’t delay in seeking help if needed. Whether it’s from a professional tax preparer or the Utah State Tax Commission’s resources, obtaining clarification on confusing items can prevent mistakes.

Adhering to these dos and don’ts will help ensure that your Utah TC-20 form is filled out accurately and completely, minimizing the risk of errors and the potential for subsequent penalties or audits. Always remember, when in doubt, seeking professional advice is in your best interest.

Misconceptions

When diving into the intricacies of the Utah TC-20 form, a corporate franchise and income tax return, it’s surprising to discover the breadth of misconceptions surrounding its completion and purpose. Here, we’ll unearth and clarify some of these common misunderstandings to ensure a smoother, more informed filing process.

“The TC-20 form is only for large corporations.” This is a misunderstanding. In reality, any corporation doing business in Utah, regardless of size, is required to file a TC-20 form if they have been active during the taxable year.

“Filing a federal consolidated return exempts a corporation from filing a TC-20 form.” This is incorrect. Even if a corporation files a consolidated return at the federal level, it must still complete and submit a TC-20 form if it conducts business in Utah.

“All corporations must pay the same tax amount.” Tax responsibilities vary. The amount owed is determined by the corporation's income, eligible deductions, and credits, not a flat rate applicable to all businesses.

“The form is too complicated to fill out without professional help.” While professional guidance can be beneficial, the TC-20 instructions are designed to be comprehensive and accessible for those willing to invest the time to understand them.

“Once the TC-20 form is submitted, amendments are not allowed.” Amendments can indeed be made if errors are found or financial adjustments are necessary. The appropriate box should be marked, indicating an amended return.

“Utah business activity is not clearly defined in the form.” Although “business activity” might seem vague, it encompasses any operation, transaction, or engagement carried out by a corporation that affects its financial status within Utah.

“Electronic filing is optional for all corporations.” While electronic filing is encouraged for its efficiency, certain corporations may be mandated to file electronically based on specific criteria, such as the amount of their payment.

“The TC-20 form doesn't account for multi-state operations.” Contrary to this belief, the form includes provisions and schedules specifically designed to calculate the tax obligations of corporations operating both within and outside of Utah, acknowledging their multi-state activities.

“There’s no need to report changes in control or ownership.” Any significant alteration in control or ownership within the corporation must be reported, as it can affect the tax implications and liabilities of the business.

“Estimated tax payments are optional.” Corporations are required to make estimated tax payments if they expect to owe $3,000 or more in taxes for the year. Neglecting this can lead to penalties.

Understanding these nuances helps corporations fulfill their tax obligations more accurately and efficiently. It’s crucial for businesses operating in Utah to dispel these misconceptions, ensuring compliance and avoiding potential pitfalls in their tax filing process.

Key takeaways

When dealing with the Utah TC-20 form, an understanding of the specifics can significantly impact the accuracy and compliance of a corporation's tax filing. Here are key takeaways for navigating through the form effectively:

- Identification of the Business: Information such as the corporation name, address, and Employer Identification Number (EIN) must be accurately provided to identify the business entity correctly.

- Tax Year: Corporations must clearly indicate whether the return is for a calendar year or a fiscal year, specifying the beginning and end dates of the tax period.

- Amended Returns: For amendments, one must identify the return as such by marking the designated checkbox and entering the appropriate amendment code.

- Utah Business Activity: Corporations need to disclose if they conducted business activities in Utah during the taxable year by marking the relevant box.

- Consolidated Returns: If the corporation participated in a federal consolidated return, this needs to be disclosed by marking the corresponding box.

- Special Elections: Indications of special elections made under various Internal Revenue Code (IRC) sections during the taxable year must be clearly marked, as this can affect tax computation.

- Financial Institution Declaration: Corporations defined as financial institutions under Tax Commission Rule R865-6F-32 are required to disclose this status on the form.

- Calculation of Tax and Credits: The form requires detailed calculations including total tax, refundable credits, prepayments, penalties, and interest, which determine the tax due or refund due amounts.

- Quarterly Estimated Tax Payments: Corporations that have made quarterly estimated tax payments should indicate this by marking the boxes corresponding to each payment.

- Documentation and Certification: All corporations must supply supplemental information including ownership percentages of other corporations, changes in control or ownership, and location where records are kept. Furthermore, the form must be signed under penalties of perjury, certifying its accuracy.

Ensuring precise and complete information on the Utah TC-20 form is essential for compliance with Utah's tax laws. Adherence to these key aspects can aid in avoiding common pitfalls and ensuring a smoother filing process.

Common PDF Templates

Survivorship Affidavit Utah - A procedural document that’s vital for those disputing vehicle impound decisions in Utah.

Utah Title Application - The form instructs on the return of registration materials related to the refund request.