Fill Out Your Utah Tc 142 Form

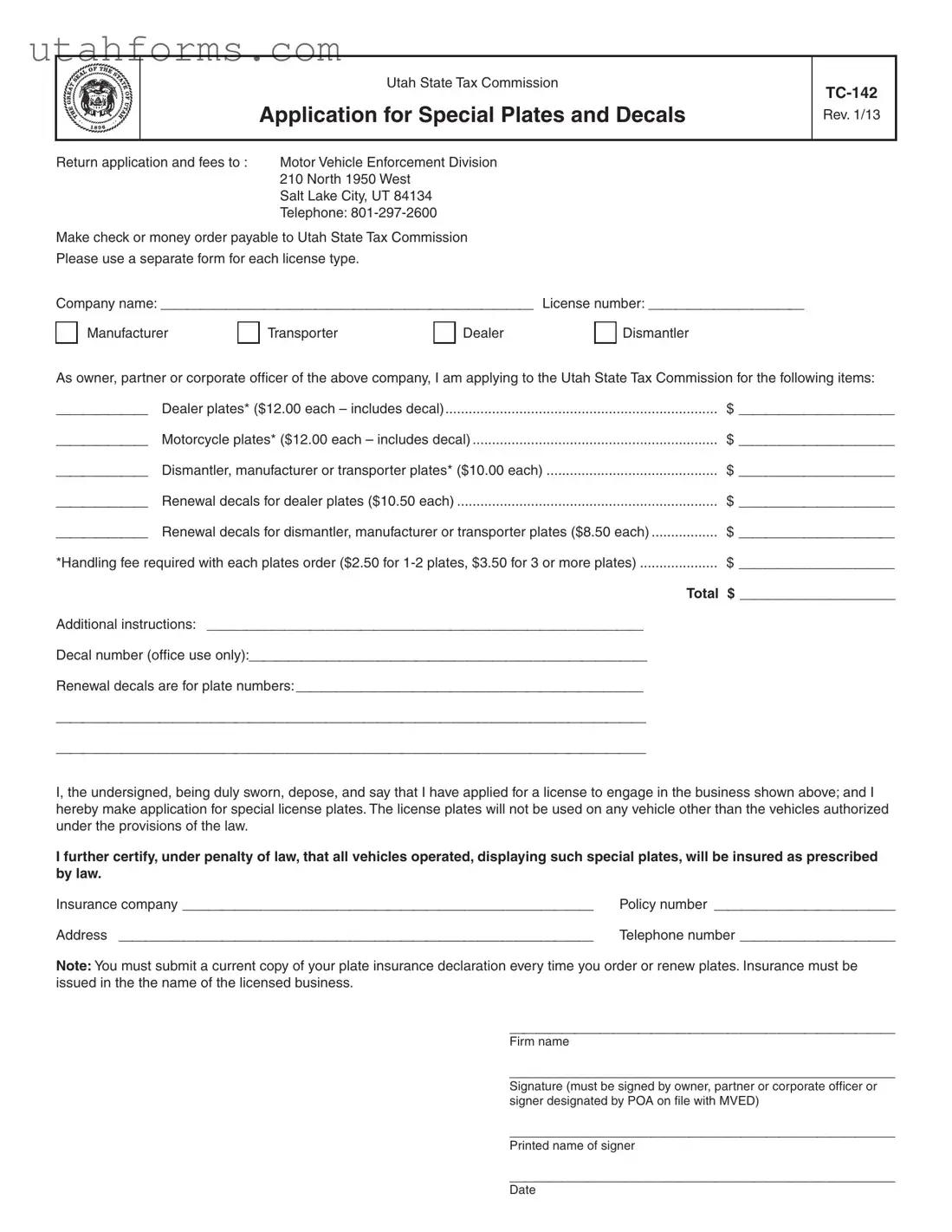

In the state of Utah, individuals or businesses involved in the automotive industry have the opportunity to apply for special license plates and decals through a specific application process. The Utah State Tax Commission facilitates this process via the Application for Special Plates and Decals, known as the TC-142 form. Revised in January 2013, the form requires applicants to provide detailed information about their business, including the company name and license number, and denotes the type of plates needed—whether for dealer, motorcycle, dismantler, manufacturer, or transporter purposes. The fees associated with these plates vary, with a handling fee also applicable depending on the quantity ordered. Applicants must affirm their eligibility under the law, ensuring that the plates will only be used on authorized vehicles and that each of these vehicles is insured according to state requirements. This obligation extends to submitting a current copy of the plate insurance declaration with each order or renewal. The TC-142 form underscores the serious nature of these applications by requiring a signature from the owner, partner, corporate officer, or a designated signer with Power of Attorney on file with the Motor Vehicle Enforcement Division. The form, thus, acts as a comprehensive tool for industry professionals to comply with Utah's regulations on specialty automotive plates and decals, blending legal requirements with procedural specifics to ensure a streamlined process for applicants.

Preview - Utah Tc 142 Form

Utah State Tax Commission

Application for Special Plates and Decals

Rev. 1/13

Return application and fees to : |

Motor Vehicle Enforcement Division |

|

210 North 1950 West |

|

Salt Lake City, UT 84134 |

|

Telephone: |

Make check or money order payable to Utah State Tax Commission

Please use a separate form for each license type.

Company name: _____________________________ License number: ____________

Manufacturer

Transporter

Dealer

Dismantler

As owner, partner or corporate officer of the above company, I am applying to the Utah State Tax Commission for the following items:

_______ |

Dealer plates* ($12.00 each – includes decal) |

$ ____________ |

_______ |

Motorcycle plates* ($12.00 each – includes decal) |

$ ____________ |

_______ |

Dismantler, manufacturer or transporter plates* ($10.00 each) |

$ ____________ |

_______ |

Renewal decals for dealer plates ($10.50 each) |

$ ____________ |

_______ |

Renewal decals for dismantler, manufacturer or transporter plates ($8.50 each) |

$ ____________ |

*Handling fee required with each plates order ($2.50 for |

$ ____________ |

|

|

|

Total $ ____________ |

Additional instructions: __________________________________

Decal number (office use only):_______________________________

Renewal decals are for plate numbers: ___________________________

______________________________________________

______________________________________________

I, the undersigned, being duly sworn, depose, and say that I have applied for a license to engage in the business shown above; and I hereby make application for special license plates. The license plates will not be used on any vehicle other than the vehicles authorized under the provisions of the law.

I further certify, under penalty of law, that all vehicles operated, displaying such special plates, will be insured as prescribed by law.

Insurance company ________________________________ |

Policy number ______________ |

Address _____________________________________ |

Telephone number ____________ |

Note: You must submit a current copy of your plate insurance declaration every time you order or renew plates. Insurance must be issued in the the name of the licensed business.

______________________________

Firm name

______________________________

Signature (must be signed by owner, partner or corporate officer or signer designated by POA on file with MVED)

______________________________

Printed name of signer

______________________________

Date

File Specifications

| Fact | Detail |

|---|---|

| Purpose of Form TC-142 | For applying for special license plates and decals for dealers, manufacturers, transporters, and dismantlers. |

| Application Submission Address | Motor Vehicle Enforcement Division, 210 North 1950 West, Salt Lake City, UT 84134. |

| Contact Information | Telephone number for inquiries: 801-297-2600. |

| Payment Method | Payments to be made via check or money order payable to the Utah State Tax Commission. |

| Separate Forms Requirement | A separate form is required for each license type requested. |

| Cost for Plates | Dealer and Motorcycle plates cost $12.00 each, including decals. Dismantler, manufacturer, or transporter plates cost $10.00 each. |

| Cost for Renewal Decals | Renewal decals for dealer plates are priced at $10.50 each, and for dismantler, manufacturer, or transporter plates at $8.50 each. |

| Handling Fee | A handling fee is required with each plates order: $2.50 for 1-2 plates, $3.50 for 3 or more plates. |

| Insurance Requirement | Applicants must certify that all vehicles operated with these special plates will be insured as required by law, and a current copy of the plate insurance declaration must be provided with each order or renewal. |

| Governing Law(s) | The application and issuance of special plates and decals are governed under the laws of the State of Utah pertaining to the operation and licensing of dealers, manufacturers, transporters, and dismantlers. |

How to Write Utah Tc 142

Ready to navigate the process of applying for Special Plates and Decals in Utah? This brief guide is here to make sure you correctly complete the TC-142 form, ensuring your application is processed without a hitch. Whether you're applying for dealer, motorcycle, dismantler, manufacturer, or transporter plates, or you're renewing your decals, accuracy and completeness are key. Remember, each license type requires a separate form, so organizing your information beforehand can save you time and effort.

To get started, let's walk through the steps you'll need to take:

- Gather relevant information, including your company name and license number, to begin the application process.

- Identify the type of license you are applying for: Dealer, Motorcycle, Dismantler, Manufacturer, or Transporter. Check the appropriate box on the form.

- Determine the quantity of plates and/or renewal decals you need. Enter the number next to the appropriate items, and calculate the fees according to the listed prices.

- Include the handling fee required with your plates order. This fee varies depending on the number of plates: $2.50 for 1-2 plates or $3.50 for 3 or more plates.

- Add up the total amount due for your order, including the cost of plates or decals and the handling fee, and enter this in the designated space on the form.

- If there are any additional instructions or specific details the Motor Vehicle Enforcement Division needs to know, include these in the "Additional instructions" section.

- Enter your insurance company details—name, policy number, address, and telephone number. Keep in mind, insurance must be issued in the name of the licensed business, and you'll need to submit a current copy of your plate insurance declaration with your order or renewal.

- Sign and date the form, confirming your application. Remember, the signature must come from an owner, partner, corporate officer, or an individual designated by Power of Attorney (POA) on file with the MVED.

- Review your application for completeness and accuracy before submission.

Now that you've filled out the form step by step, it's time to send it along with the appropriate fees to the Motor Vehicle Enforcement Division in Salt Lake City. Make sure your check or money order is payable to the Utah State Tax Commission. Submitting a complete and accurate application is crucial to avoid delays in processing. Double-checking your work can provide peace of mind and expedite the arrival of your special plates or decals. Good luck!

Frequently Asked Questions

Frequently Asked Questions about the Utah TC-142 Form

- What is the TC-142 form used for in Utah?

- Where should the completed TC-142 form be sent?

- How are the fees structured for the special plates and decals?

- Dealer plates: $12.00 each, including a decal

- Motorcycle dealer plates: $12.00 each, including a decal

- Dismantler, manufacturer, or transporter plates: $10.00 each

- Renewal decals for dealer plates: $10.50 each

- Renewal decals for dismantler, manufacturer, or transporter plates: $8.50 each

- Is insurance required for the special plates application?

- Can one application be used for multiple license types?

- Who is authorized to sign the TC-142 form?

The Utah TC-142 form is an application utilized by businesses to request special license plates and decals. These are specifically for vehicles associated with the business, including dealer, manufacturer, transporter, and dismantler plates. The form is required for both new applications and renewal of these special plates and decals.

The completed TC-142 form, along with the required fees, should be sent to the Motor Vehicle Enforcement Division at 210 North 1950 West, Salt Lake City, UT 84134. It's crucial to ensure that every section of the form is filled out accurately to avoid processing delays.

Fees for special plates and decals vary based on the type of license plate being applied for or renewed. The costs are outlined as follows:

Yes, proof of insurance is a mandatory requirement when applying for the special plates. The insurance must be in the name of the licensed business applying for the plates. Applicants must submit a current copy of their insurance declaration page with every order or renewal of plates.

No, separate TC-142 forms must be used for each license type you are applying for. This helps in correctly processing each application based on the distinct requirements and fees associated with dealer, manufacturer, transporter, and dismantler plates.

The TC-142 form must be signed by the owner, a partner, or a corporate officer of the company. If a representative is designated by a Power of Attorney (POA) on file with the Motor Vehicle Enforcement Division (MVED), that individual is also authorized to sign the form. Ensuring the correct individual signs the form is important for the validation of the application.

Common mistakes

Filling out governmental forms can often seem like traversing a minefield blindfolded. The Utah TC-142 form, an application for special plates and decals, is no exception. Familiarity with common pitfalls can transform a frustrating process into a straightforward task. Below are ten mistakes frequently made when completing this form.

- Not using a separate form for each license type. Though it might seem efficient to bundle several requests, the Utah State Tax Commission requires a distinct form for each license category.

- Forgetting to sign the form. A signature is essential, as the form will not be processed without the consent and confirmation of the applicant's identity and authority.

- Incorrectly calculating fees. This includes both the cost per plate or decal and the handling fee, which varies depending on the quantity ordered.

- Omitting the company name or license number, leaving the application incomplete and causing delays in processing.

- Not specifying the type of plates needed. Whether it’s dealer, dismantler, manufacturer, or transporter plates, clarity is key.

- Failing to include the renewal decal numbers for existing plates. This omission can lead to an unnecessary back-and-forth with the commission.

- Not providing a current copy of the plate insurance declaration. As insurance details are a mandate, forgetting this step can stall the application.

- Insufficient details about the insurance policy. Simply stating the insurance company name isn’t enough; policy number, address, and telephone number are also required.

- Using outdated information, whether it’s the company's address or the insurance details. Always double-check for the most current information.

- Assuming the form was received and processed without confirmation from the Motor Vehicle Enforcement Division. Following up is crucial to ensure the application is complete and under review.

While these mistakes are common, they are also entirely preventable with careful attention to detail. The following checklist can help ensure a hassle-free submission:

- Use one form per license type: This keeps applications organized and expedites processing.

- Complete all required fields: Skipping sections can lead to processing delays.

- Include accurate fee calculations: Check and double-check the math.

- Provide up-to-date insurance information: Remember, this must reflect the current status of the licensed business.

- Don't forget the signature: This is your attestation that all information provided is accurate and truthful.

Engagement with governmental forms like the Utah TC-142 requires a methodical approach. By avoiding these common mistakes, applicants can streamline their experience, ensuring a smoother path towards obtaining the needed special plates and decals.

Documents used along the form

Applying for special plates and decals in Utah, as outlined in the TC-142 form, signifies an important step for businesses and individuals in the automotive industry. The form is crucial for dealing in vehicles, whether you are a dealer, dismantler, manufacturer, or transporter. However, this process often requires additional documents to fully comply with the Utah State Tax Commission's regulations. Understanding these documents can streamline your application process and ensure you meet all necessary legal requirements.

- Certificate of Insurance: A document proving that the vehicle(s) in question are insured. It must match the business name on the TC-142 form.

- Business License: Proof that your business is licensed to operate in Utah. This confirms the legality of your operations.

- VIN Inspection Certificate: For certain vehicle transactions, a VIN (Vehicle Identification Number) inspection is mandatory. This certificate proves that the inspection has been completed.

- Sales and Use Tax License: This document shows your business is registered with the Utah State Tax Commission to collect and pay sales and use taxes.

- Title Application: When a vehicle's ownership is changing, a title application is necessary. This document complements the TC-142 if vehicles are being bought or sold.

- Odometer Disclosure Statement: Required for transactions involving vehicles less than ten years old, to prevent odometer tampering.

- Power of Attorney (POA): When submitting applications on behalf of another party, a POA document must be included, granting the submitter the legal right to act on the vehicle owner's behalf.

- Bill of Sale: Though not always required, having a bill of sale can provide proof of transaction for vehicles, which is helpful for record-keeping and legal protection.

Collecting and submitting these documents alongside the Utah TC-142 form can often seem daunting. However, understanding each document's purpose aids businesses and individuals in navigating the legal landscape of vehicle transactions more effectively. Each form plays a role in validating your operations, ensuring compliance with state laws, and protecting your business's and customers' interests.

Similar forms

The California Application for Special Interest License Plates (REG 17) is notably similar to the Utah TC-142 form, as both applications require the vehicle owner to apply for special or custom license plates. Both forms gather detailed information about the vehicle owner, such as company name and license number, and specify the types of plates requested. They also involve declaring the use of the plates strictly for vehicles authorized under specific provisions of the law.

New York's Application for Custom Plates (CP-30) shares similarities with Utah's TC-142 form in the process of requesting specialized vehicle plates. Each form encompasses sections for the type of special plates being requested and mandates the disclosure of the applicant's business details. Additionally, they both require fees for the processing and issuance of the plates, emphasizing adherence to respective state laws concerning vehicle operation and insurance coverage.

Texas Vehicle License Plate Renewal Form also has parallels with the Utah TC-142 since both involve the process of renewing license plates for various types of vehicles, including dealer, transporter, and motorcycle plates. These forms are crucial for ensuring the legality and registration compliance of the business's vehicle operations, alongside mandatory insurance verification for continued authorization to use the special plates.

Florida's Application for Personalized License Plate (HSMV 83043) functions similarly to the Utah TC-142 form, as both seek personalization or specialty options for vehicle plates but within different contexts. While Utah's form encompasses business operations including dealers and dismantlers, Florida's focuses more on personalization for individual vehicle owners. Yet, both necessitate specific information regarding the vehicle and applicant, alongside applicable fees.

Michigan's Application for Historical Vehicle License Plate parallels the Utah TC-142 form in its niche focus; however, it is tailored towards vehicles of historical significance rather than commercial or operational use. Despite this difference, both applications require the vehicle owner to provide specific details about the vehicle and owner, affirm legal compliance, and ensure all vehicles using these plates meet state insurance requirements.

The Oregon Application for Special Registration Plates shares the objective of acquiring special or customized plates with the Utah TC-142 form. It necessitates detailed information regarding the applicant and the classification of plates needed. Both forms entail a fee based on the number and type of plates or decals required, reflecting each state's regulation of vehicle registration and customization.

Virginia's Application for Special License Plates, like the Utah TC-142, accommodates requests for various special plates, including those for businesses such as dealers and transporters. Applicants must fill in comprehensive vehicle and business owner information, indicate the desired plates, pay the associated fees, and comply with insurance standards to ensure lawful vehicle operation.

The Colorado Application for Personalized Plates is structured to handle requests for personalized and special interest plates, akin to aspects of the Utah TC-142 form. Although one is more directed towards personal expression and the other towards commercial operation, both require applicants to submit specific vehicle and owner information, choose the type of plates, and satisfy state insurance requirements.

Washington's Special License Plate Application operates under a similar premise to Utah's TC-142 by offering specialty and personalized plates. Both forms demand detailed applicant and vehicle data, along with the submission of appropriate fees. They share a focus on legal compliance with state vehicle operation laws and the necessity of proper insurance coverage.

Pennsylvania's Application for Specialty License Plates rounds out this list, with a format that, like Utah's TC-142, requests special plates for various purposes including organizational, classic vehicle, and personalized plates. Each application enforces the need for comprehensive applicant information, the type and number of plates, adherence to state-specific operational laws, and current insurance verification.

Dos and Don'ts

When filling out the Utah TC-142 form, an application for special plates and decals, there are several important dos and don'ts to ensure your process is smooth and compliant. Here's a guide to assist you:

- Do ensure all the information you provide is accurate and up-to-date, to avoid any delays or issues with your application.

- Do make your check or money order payable to the Utah State Tax Commission, as specified on the form, to ensure your payment is processed correctly.

- Do use a separate form for each license type you are applying for. This helps in organizing and processing your application more efficiently.

- Do sign the form if you are the owner, partner, or a corporate officer of the company. The signature verifies your authority and the truthfulness of the application.

- Do submit a current copy of your plate insurance declaration every time you order or renew plates. This document is crucial for verifying that your insurance is valid and meets state requirements.

- Don't use the license plates on any vehicle other than those authorized under the law. Misuse can lead to severe penalties.

- Don't forget to calculate the total amount correctly, including the handling fee, which varies depending on the number of plates you're ordering.

- Don't neglect to fill out all required sections of the form. Incomplete forms can result in processing delays or rejection of your application.

- Don't overlook the need to update your insurance information. Insurance must be issued in the name of the licensed business and be current at the time of your application.

Adhering to these guidelines will help ensure that your application for special plates and decals through the Utah TC-142 form is completed correctly and processed in a timely manner. Always remember the importance of double-checking your form for accuracy before submission.

Misconceptions

When dealing with the Utah TC-142 form, several misconceptions can lead to confusion. Understanding the truth behind these common beliefs can streamline the process and ensure accurate completion of applications for special plates and decals. Here are seven misconceptions explained:

- It's only for personal vehicle plates. The TC-142 form is specifically designed for businesses such as dealers, dismantlers, manufacturers, and transporters to apply for special license plates and renewal decals, not for personal vehicle plates.

- One form fits all license types. Each license type requires a separate form. This ensures that the application is processed correctly according to the specific license type indicated, whether it's for a dealer, dismantler, manufacturer, or transporter.

- Renewal fees are the same for all plates. Renewal fees vary depending on the plate type. Dealer plates and motorcycle plates have a different renewal fee compared to dismantler, manufacturer, or transporter plates. This variance accounts for the different needs and regulations associated with each plate type.

- The handling fee is optional. A handling fee is mandatory with each plate order, and its cost varies depending on the number of plates ordered. This fee covers the processing of the plates and is required for all orders.

- Any form of payment is acceptable. Payments must be made via check or money order payable to the Utah State Tax Commission. This ensures secure transactions and proper accounting practices.

- You don't need to prove insurance. Applicants must submit a current copy of their plate insurance declaration with every order or renewal. The insurance must be issued in the name of the licensed business to comply with state laws.

- Plates can be used on any vehicle. Special license plates issued under this application can only be used on vehicles authorized under the law. Misuse of these plates on unauthorized vehicles could lead to penalties.

Understanding these points about the Utah TC-142 form can prevent mistakes and ensure that businesses comply with state regulations when applying for or renewing special license plates and decals. Keeping these misconceptions in mind will help clarify the process and requirements, making it easier for companies to fulfill their obligations.

Key takeaways

Filling out the Utah TC-142 form, which is an application for special plates and decals, involves important steps and considerations. Here are six key takeaways to ensure the process is done correctly and efficiently:

- It is mandatory to return the completed application along with the necessary fees to the Motor Vehicle Enforcement Division at the specified address. This ensures your application is processed without delays.

- The payment for applicable fees should be made through a check or money order, made payable to the Utah State Tax Commission. This is crucial for the financial transaction to be properly documented and processed.

- A separate form is required for each license type, including dealer, dismantler, manufacturer, and transporter licenses. This separation helps in the organization and processing of applications specific to each license category.

- The application must be signed by the owner, partner, corporate officer, or a person designated by Power of Attorney (POA) on file with the Motor Vehicle Enforcement Division (MVED). This ensures the legitimacy and authorization of the application.

- Applicants need to certify that the special license plates will only be used on vehicles authorized under the law and that all vehicles will be insured as required. This declaration is crucial for compliance with legal requirements.

- Renewal of decals and plates requires submitting a current copy of the plate insurance declaration each time. This ensures that all vehicles continue to meet the insurance requirements set forth by law.

Understanding and following these key points can significantly streamline the process of applying for special plates and decals in Utah through the TC-142 form, ensuring compliance with state requirements and contributing to a smoother application process.

Common PDF Templates

Job Applications - Facilitates detailed record of an applicant's educational qualifications, from high school through to higher education or vocational training.

Utah Vehicle Title Transfer - Streamlines the verification process for vehicle identities, making it more efficient for owners and regulatory bodies alike.

Utah Payroll Taxes - The form plays an essential role in ensuring that businesses accurately report their tax withholdings following significant organizational changes.