Fill Out Your Utah Tc 116 Form

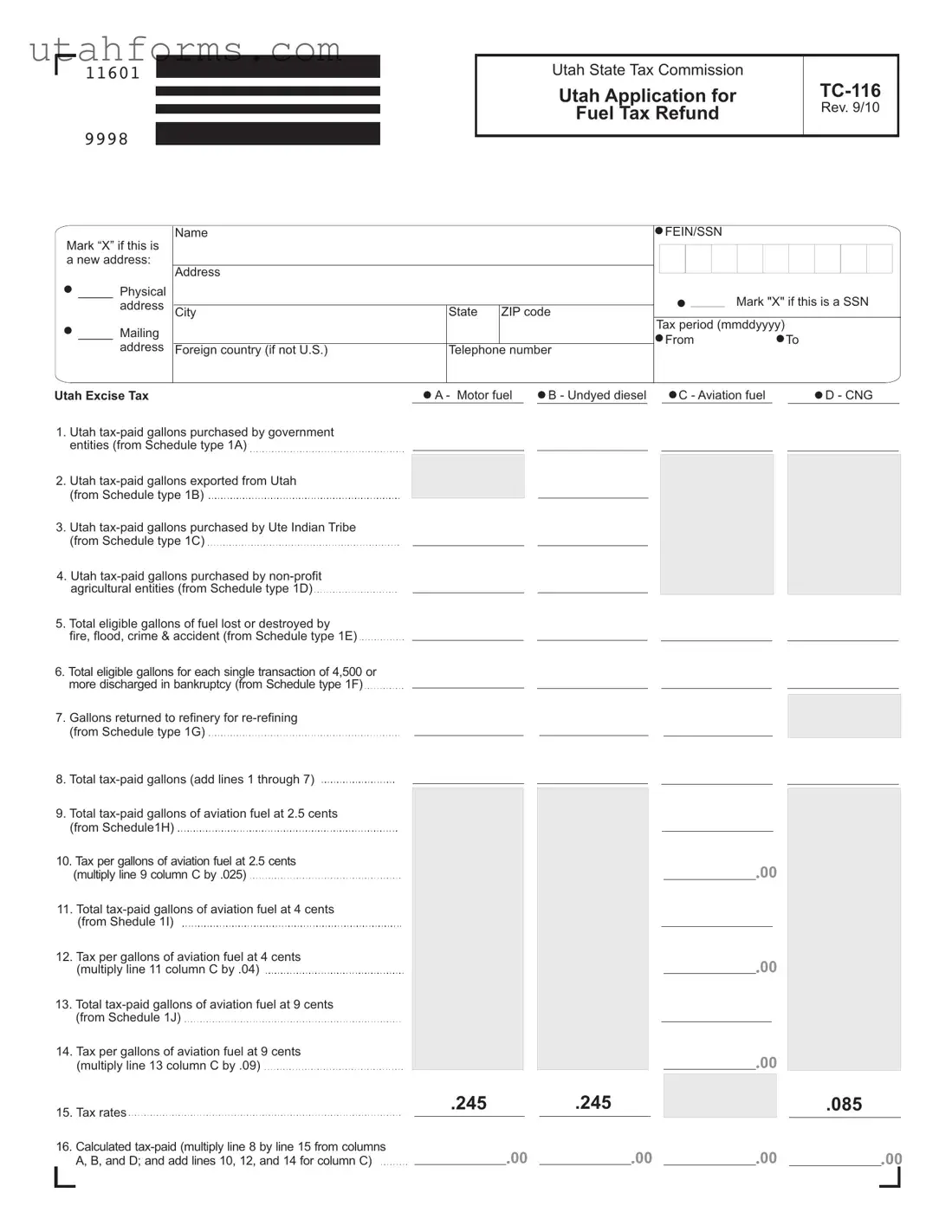

Amid the plethora of documentation and forms that navigate the complex terrain of tax obligations, the Utah TC-116 form stands out for entities seeking refunds on fuel taxes. This form, officially titled the Utah Application for Fuel Tax Refund, serves a critical function by offering a streamlined avenue for government entities, non-profit agricultural organizations, Ute Indian Tribes, and others to reclaim taxes paid on fuel under specific, qualified circumstances. Detailed within its sections are provisions for the refund of taxes paid on motor fuel, undyed diesel, aviation fuel, and compressed natural gas (CNG), catering to a broad spectrum of fuel types. Applicable scenarios that warrant a refund include tax-paid gallons purchased by eligible entities, gallons exported from Utah, fuel lost or destroyed due to unforeseen events such as fires or floods, and gallons discharged in bankruptcy, among others. Additionally, the form delves into the calculation of the Utah Environmental Assurance Fee and its associated refunds, further emphasizing the meticulous nature of tax accountability and environmental stewardship. The form also addresses refunds related to the Navajo Nation, underlining the nuanced considerations of fuel tax laws within and beyond Utah's borders. Through the inclusion of detailed schedules for each specific category of refund, the TC-116 form encapsulates the necessity for accuracy and thoroughness in navigating the intricacies of fuel tax exemptions and refunds, ensuring that eligible entities are duly compensated in accordance with Utah state tax laws.

Preview - Utah Tc 116 Form

11601

9998

Utah State Tax Commission

Utah Application for

Fuel Tax Refund

Rev. 9/10

|

|

Name |

|

|

|

Mark “X” if this is |

|

|

|

|

|

a new address: |

|

|

|

|

|

|

|

Address |

|

|

|

_____ |

Physical |

|

|

|

|

|

address |

City |

State |

ZIP code |

|

|

|

||||

_____ |

Mailing |

|

|

|

|

|

address |

Foreign country (if not U.S.) |

Telephone number |

||

|

|

||||

Utah Excise Tax |

|

A - Motor fuel |

B - Undyed diesel |

||

1.Utah

2.Utah

3.Utah

FEIN/SSN

FEIN/SSN

_____ Mark "X" if this is a SSN

Tax period (mmddyyyy) |

|

From |

To |

C - Aviation fuel |

D - CNG |

4.Utah

5.Total eligible gallons of fuel lost or destroyed by

fire, flood, crime & accident (from Schedule type 1E)

6.Total eligible gallons for each single transaction of 4,500 or more discharged in bankruptcy (from Schedule type 1F)

7.Gallons returned to refinery for

8.Total

9.Total

10.Tax per gallons of aviation fuel at 2.5 cents

(multiply line 9 column C by .025)

11.Total

12.Tax per gallons of aviation fuel at 4 cents (multiply line 11 column C by .04)

13.Total

14.Tax per gallons of aviation fuel at 9 cents (multiply line 13 column C by .09)

15.Tax rates

16.Calculated

00

00

.245

00

00

00

00

.245

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

.085

00

00

11602

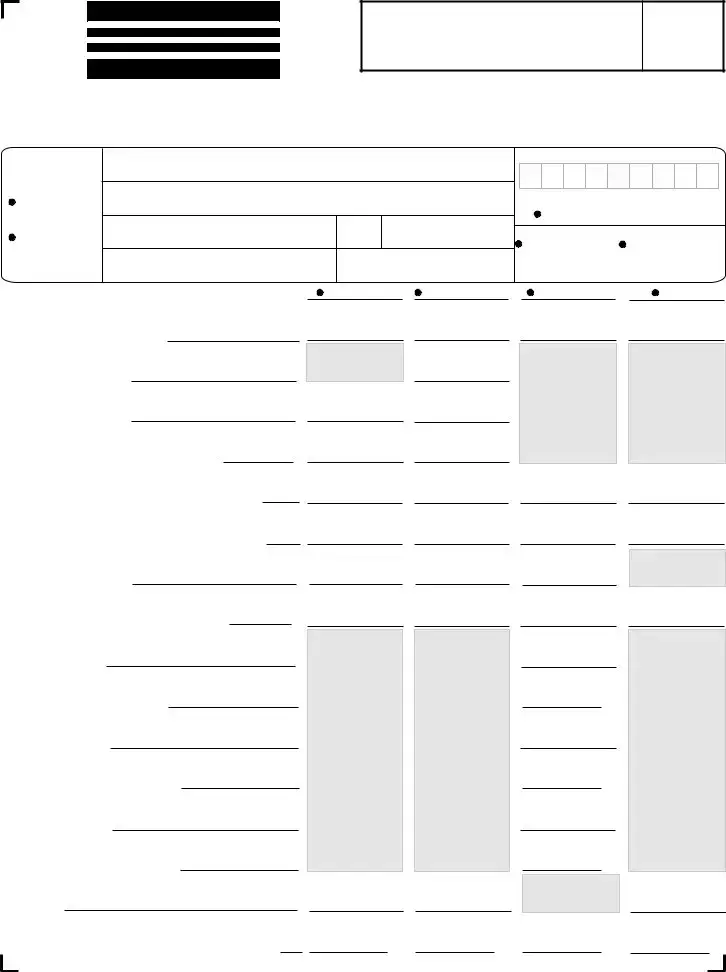

17. Total Utah exise tax (add line 16, columns A, B, C, and D) |

17 |

00 |

|

||

Utah Environmental Assurance Fee |

|

|

18. Utah Environmental Assurance Fee paid gallons |

18 |

|

exported from Utah (from Schedule type 2A) |

|

|

|

|

|

19. Utah Environmental Assurance Fee paid gallons placed |

19 |

|

in nonparticipating tanks (from Schedule type 2B) |

|

|

|

|

|

20. Utah Environmental Assurance Fee paid gallons for |

20 |

|

repackaged oil (from Schedule type 2C) |

|

|

|

21 |

|

21. Total Utah Environmental Assurance Fee paid gallons (add lines 18 through 20)

22.005

22. Tax rate

|

|

|

|

23 |

00 |

23. Calculated Environmental Assurance Fee (multiply line 21 by line 22) |

|

|

|||

|

|

A - Motor fuel |

|

B - Undyed diesel fuel |

|

|

|

65 |

|

160 |

|

Navajo Nation Refund |

|

|

|

|

|

24. Total taxable gallons reported to the Navajo Nation |

24 |

|

|

|

|

|

|

|

|

|

|

25. Gallons delivered to |

25 |

|

|

|

|

|

|

|

|

|

|

26. Total gallons subject to Utah fuel tax |

26 |

|

|

|

|

(subtract line 25 from line 24) |

|

|

|

|

|

27. Navajo 0.5% credit, if taken on Navajo Distributor |

27 |

|

|

|

|

Tax Return (multiply line 26 by .005) |

|

|

|

|

|

28. Net taxable gallons available for Utah fuel refund |

28 |

|

|

|

|

(subtract line 27 from line 26) |

|

|

|

|

|

29. Tax rate |

29 |

.18 |

|

.245 |

|

|

|

|

|

|

|

30. Navajo Nation fuel tax refund |

30 |

|

00 |

|

00 |

(multiply line 28 by line 29) |

|

|

|

||

|

|

|

|

31 |

00 |

31 Total Navajo Nation (add line 30, columns A and B) |

|

|

|

|

|

|

|

|

|

32 |

00 |

32. Total refund (add lines 17, 23, and 31) |

|

|

|

|

|

I certify that I meet all the conditions to qualify for this refund, I have examined this refund application, including any accompanying schedules, and certify that to the best of my knowledge it is true, correct and complete.

Print name of applicant

Applicant’s signature

|

|

|

11603 |

|

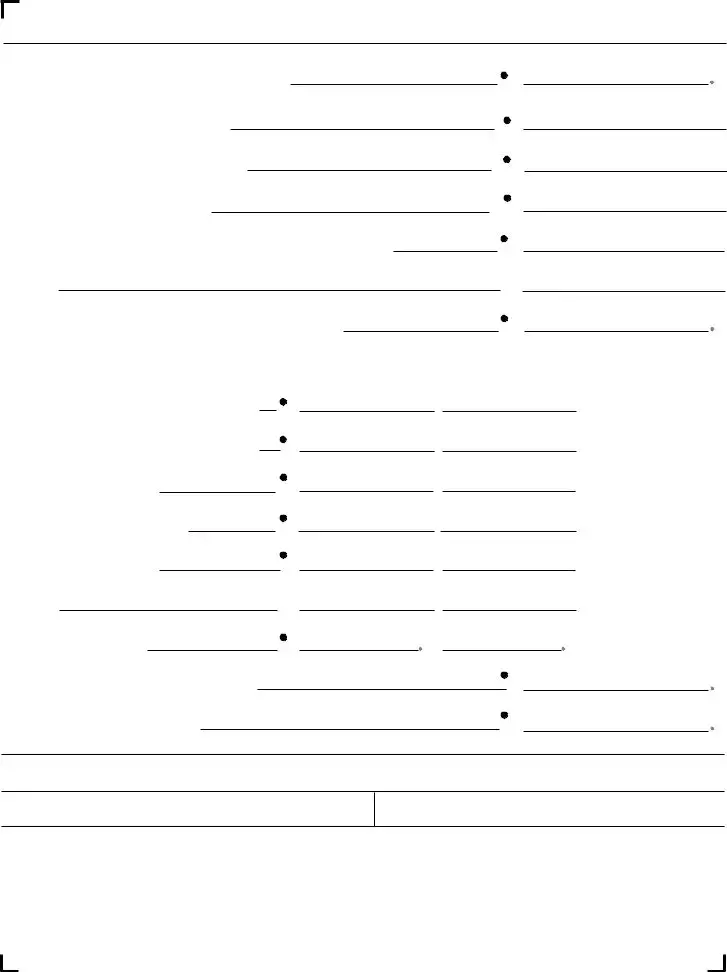

Utah Refund Application General Schedule |

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Company name |

|

|

|

|

|

|

|

|

FEIN/SSN |

Schedule type |

Product type |

Month/Year |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

From |

|

|

To |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Schedule type |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product type |

|

|

|

||||||

1A |

- Utah |

|

1H |

- Gallons of aviation fuel collected at 2.5 cent tax rate |

|

065 |

- Motor fuel |

228 - Diesel fuel (dyed) |

||||||||||||||||||

1B |

- Utah |

|

1I - |

Gallons of aviation fuel collected at 4 cent tax rate |

|

130 |

- Aviation fuel |

260 - Repackaged lube oil |

||||||||||||||||||

1C |

- Utah |

|

1J - Gallons of aviation fuel collected at 9 cent tax rate |

|

160 |

- Diesel fuel (undyed) |

|

|

|

|||||||||||||||||

1D |

- Utah |

2A |

- Utah Environmental Assurance Fee paid gallons exported from Utah |

224 |

- Compressed natural gas |

|

|

|

||||||||||||||||||

1E - Eligible gallons of fuel lost or destroyed by fire, flood, crime or accident |

2B |

- Utah Environmental Assurance Fee paid gallons placed in nonparticipating tanks |

|

|

|

|

|

|

|

|||||||||||||||||

1F - Eligible gallons for each single transaction discharged by bankruptcy |

2C |

- Utah Environmental Assurance Fee for repackaged |

|

|

|

|

|

|

|

|

||||||||||||||||

1G - Gallons returned to refinery for |

|

3A - Gallons of fuel delivered to Utah portion of Navajo Nation |

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

1 |

2 |

|

|

|

3 |

|

|

4 |

5 |

6 |

|

7 |

|

|

8 |

9 |

||||||||

|

|

Purchase date |

|

Invoice |

Manifest |

|

|

|

|

|

|

Facility/Terminal number |

Airport code |

|

|

Supplier’s |

|

|

||||||||

|

|

|

(mmddyyyy) |

|

number |

number |

|

|

Origin |

|

Destination |

|

(only for Sch. type 2A, 2B, 2C) |

(for prod. type 130) |

name |

|

|

gallons |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

File Specifications

| Fact | Description |

|---|---|

| Purpose | The Utah TC-116 form is used to apply for a fuel tax refund for certain entities and situations, including government entities, Ute Indian Tribe purchases, non-profit agricultural entities, and losses due to fire, flood, crime, or accidents. |

| Eligibility | Eligibility for a fuel tax refund includes government bodies, the Ute Indian Tribe, non-profit agricultural entities, and cases of fuel loss or destruction, as well as other specific conditions like fuel exported from Utah or sold to the Navajo Nation. |

| Content Details | The form requires detailed information such as the taxpayer's name, address, telephone number, the tax period, details on the type and amount of fuel for which a refund is sought, and a certification of truth and completeness signed by the applicant. |

| Governing Law | Refunds processed through the TC-116 form are governed by Utah state tax laws pertaining to fuel taxes. These laws define the eligibility criteria, refundable amounts, and the process for claiming refunds. |

How to Write Utah Tc 116

Filling out the Utah TC-116 form is a straightforward process designed to ensure entities can accurately claim their fuel tax refunds. From government entities to non-profit agricultural organizations, this form acts as a pathway to recoup taxes paid on fuel that qualifies under the stipulated conditions. The form may seem complex due to its comprehensive nature, covering various types of fuel and scenarios, but by following step-by-step instructions, an applicant can complete it efficiently. After submission, the Utah State Tax Commission will review the claim, a process that involves verifying the information against their records and applicable laws, ensuring that only eligible refunds are issued. This verification step is crucial in maintaining the integrity of the state's tax system.

- Start by entering the Name of the applicant at the top of the form.

- If this is for a new address, mark the "X" box.

- Fill in the Address details, including physical and mailing addresses if they differ.

- Provide a Telephone number where the applicant can be reached.

- Indicate whether this is for Motor fuel, Undyed diesel, Aviation fuel, CNG by marking "A," "B," "C," or "D."

- Enter the FEIN/SSN of the applicant and mark "X" if an SSN is being used.

- Specify the Tax period covered by this application by filling in the "From" and "To" dates.

- Under the ‘Utah Excise Tax’ sections, input the numbers from lines 1 through 7 based on the instructions provided for each line, specifying tax-paid gallons in various categories.

- Add lines 1 through 7 and input the total in line 8 for Total tax-paid gallons.

- Calculate the different rates for aviation fuel as instructed in lines 9 through 14, and input the totals.

- Follow the calculation instructions to find the Total Utah excise tax in line 17 by adding the calculated amounts in the previous step.

- Under the ‘Utah Environmental Assurance Fee’ section, compile the necessary gallon amounts for lines 18 through 20, add them, and calculate the fee based on the rate provided, entering this in line 23.

- If applicable, complete the ‘Navajo Nation Refund’ section by calculating the gallons subject to Utah fuel tax, the Navajo 0.5% credit, and net taxable gallons available for refund.

- Calculate the Navajo Nation fuel tax refund according to the instructions, and add this amount to lines 17 and 23 to get the Total refund in line 32.

- At the bottom of the form, ensure the applicant prints their name and provides their signature to certify the information’s accuracy.

By carefully following these steps, completing the Utah TC-116 form can be done accurately and efficiently. This process is crucial for entities looking to recover taxes paid on fuel, where applicable, through a structured and fair procedure established by the Utah State Tax Commission.

Frequently Asked Questions

What is the Utah TC-116 form used for?

The Utah TC-116 form serves as an application for a fuel tax refund. It is utilized by individuals or entities that qualify under specific conditions, such as government entities, tribes, non-profit agricultural entities, or situations involving lost, destroyed, or discharged fuel, to claim a refund on taxes paid on fuel within the state of Utah.

Who can apply for a fuel tax refund using the TC-116 form in Utah?

Entities that are eligible to apply for a fuel tax refund using the TC-116 form in Utah include government entities, the Ute Indian Tribe, non-profit agricultural organizations, and individuals or entities that have experienced fuel losses due to fire, flood, crimes, accidents, or bankruptcy. It is also applicable for fuel returned to refineries for re-refining and for exports outside of Utah.

How are the refundable gallons of fuel calculated on the TC-116 form?

Refundable gallons of fuel are calculated by totaling the tax-paid gallons purchased or acquired under the categories listed on the form. This includes fuel purchased by government entities, exported, purchased by the Ute Indian Tribe, non-profit agricultural entities, gallons lost or destroyed, discharged in bankruptcy, and gallons returned for re-refining. Specific schedules provide detailed information for each category, and the total from these schedules is summed to determine the refundable amount.

What types of fuel are eligible for a refund on the TC-116 form?

The TC-116 form accommodates requests for refunds on several types of fuel, including motor fuel, undyed diesel, aviation fuel, and compressed natural gas (CNG). Each type has its own tax rates and conditions for eligibility under the refund program.

Can you claim a fuel tax refund for aviation fuel on the TC-116 form?

Yes, aviation fuel is eligible for a tax refund under specific conditions outlined in the TC-116 form. There are separate sections for calculating the tax-paid gallons of aviation fuel at differing tax rates, allowing applicants to claim refunds on tax payments made for aviation fuel used under eligible circumstances.

What is the Utah Environmental Assurance Fee, and how is it related to the TC-116 form?

The Utah Environmental Assurance Fee is an additional fee applied to certain fuel transactions within the state. On the TC-116 form, there are sections dedicated to calculating the refund for this fee if paid on gallons that were exported from Utah, placed in nonparticipating tanks, or for repackaged oil. This fee is part of the overall calculation for determining the total refund amount on eligible fuel transactions.

How do you determine the tax rate for calculating your refund on the TC-116 form?

The tax rate for calculating your refund on the TC-116 form depends on the type of fuel and the specific use or situation that qualifies for the refund. The form includes predefined tax rates for different categories of fuel and purposes, such as motor fuel, undyed diesel, and aviation fuel at varying rates based on the schedule applicable to the refund claim.

What information do you need to complete Schedule types for the TC-116 form?

To complete the Schedule types for the TC-116 form, the applicant needs to provide detailed information including the purchase date, invoice number, facility or terminal number (if applicable), airport code (for aviation fuel), supplier's name, and the total tax-paid gallons. This information is essential to accurately calculate the refundable amount for each qualified transaction.

How does the Navajo Nation refund work on the TC-116 form?

The Navajo Nation refund section of the TC-116 form allows for reporting of gallons delivered to the non-Utah portion of the Navajo Nation that are subject to Utah fuel tax. Applicants can claim a refund for these gallons by subtracting the gallons delivered outside of Utah from the total taxable gallons reported, applying a specific credit rate, and calculating the net taxable gallons available for refund based on the appropriate tax rate.

What is the significance of certifying the TC-116 form?

Certifying the TC-116 form is a declaration by the applicant that all information provided on the form and accompanying schedules is accurate to the best of their knowledge. It confirms the applicant's eligibility for the refund claimed and acknowledges their understanding that providing false information may result in penalties, including denial of the refund request. This certification is a critical part of ensuring the integrity of the refund application process.

Common mistakes

Filling out the Utah TC-116 form, which is an application for a fuel tax refund, can sometimes be tricky. It's essential to pay close attention to detail to ensure the process goes smoothly. Here are five common mistakes people often make when completing this form:

- Incorrect or Incomplete Identification Information: At the top of the form, you are required to provide name, address, FEIN/SSN, and telephone number. A common misstep is not checking the box if the address provided is new or forgetting to include either the FEIN or SSN. This can delay processing as the tax commission must be able to accurately identify and contact the applicant.

- Misunderstanding the Type of Fuel Categories: The form differentiates between types of fuel such as motor fuel, undyed diesel, aviation fuel, and CNG. Applicants sometimes incorrectly categorize their fuel type, especially distinguishing between dyed and undyed diesel, which affects the refund calculation.

- Errors in Reporting Tax-Paid Gallons: Sections 1 through 8 require detailed information about tax-paid gallons in various categories, like gallons purchased by government entities or gallons lost due to accidents. Mistakes in this section often stem from oversight or misunderstanding of what qualifies under each category, leading to incorrect totals that can either inflate or reduce your expected refund.

- Miscalculating Taxes and Fees: The calculation of taxes owed and the environmental assurance fee in sections 17 and 23 respectively, is another common error area. The math might seem straightforward, but any previous error in the form can compound here, resulting in significant discrepancies in the total refund claimed.

- Failing to Properly Certify the Form: The final step requires the applicant's signature to certify that all conditions for the refund are met and that the information is accurate. Occasionally, applicants will skip this step, either by oversight or because they are awaiting additional information. Submission without this certification will result in the form being returned unprocessed.

When filling out the Utah TC-116 form, it's crucial to double-check each entry, ensure all required information is complete, and understand the details of your claim. Small mistakes can lead to delays or denials of the refund. Being meticulous and taking the time to review the form before submission goes a long way in ensuring a smooth refund process.

Documents used along the form

When handling the Utah Application for Fuel Tax Refund (TC-116), several other documents and forms are commonly used to streamline the refund process. These documents are integral for ensuring that all the necessary details are accurately reported and substantiated. They range from additional schedules that complement the TC-116 to proof of purchase and loss documents. Each plays a pivotal role in the refund application process.

- TC-116A - Utah Refund Application General Schedule: This schedule accompanies the main TC-116 form, providing detailed information about the tax-paid gallons eligible for a refund. It is used to report various types of fuel and situations, such as government purchases or losses due to accidents.

- Proof of Purchase Receipts: These are essential for demonstrating that the fuel was purchased and taxed in Utah. Applicants should keep all receipts related to their fuel purchases.

- Export Documentation: For fuel gallons exported out of Utah, export documentation will be necessary to prove that the fuel left the state, which qualifies for a refund on the paid taxes.

- Incident Reports: If claiming a refund for fuel losses due to fire, flood, crime, or accidents, relevant incident reports from appropriate authorities are required to support the claim.

- Detailed Inventory Records: These records help in accounting for all fuel transactions, including purchases, usage, and losses, providing a comprehensive audit trail.

- Navajo Nation Tax Return Forms: For fuel transactions involving the Navajo Nation, relevant tax returns must be supplied to confirm the amounts reported and the taxes paid.

- Bankruptcy Documents: If claiming a refund for fuel discharged in bankruptcy, the relevant court documents must be included with the application.

- Environmental Assurance Fee Documentation: This includes any reports or receipts relating to the environmental assurance fee, particularly for gallons exported from Utah or placed in nonparticipating tanks.

- Carrier and Delivery Documentation: For fuel deliveries, documents proving the delivery and receipt of the fuel, especially to locations like the Navajo Nation, are essential. This may include cargo manifests and delivery receipts.

Properly assembling and submitting these documents alongside the TC-116 form is crucial for a successful refund claim. They provide the necessary evidence and detail to the Utah State Tax Commission, ensuring that the application is processed efficiently and accurately. Applicants must ensure that all information is thoroughly documented and retained for verification purposes to facilitate a smooth refund process.

Similar forms

The Federal Excise Tax Return for Alcohol, Tobacco, and Firearms, commonly referred to as Form 720, shares similarities with Utah's TC-116 form. Both documents are designed to report and calculate taxes due on specific goods, with Form 720 focusing on federal excise taxes for a wide range of products including alcohol, tobacco, and firearms, while the TC-116 form concentrates on state-level fuel taxes in Utah. Each form requires detailed information about the quantity of taxable goods, calculates taxes owed based on specific rates, and includes sections for refunds or credits under certain conditions, such as goods lost due to disasters.

The Federal Heavy Highway Vehicle Use Tax Return, known as Form 2290, also shares parallels with the TC-116 form. Form 2290 is utilized by owners of heavy highway vehicles to calculate and pay the federal heavy highway vehicle use tax, while the TC-116 form is used within Utah to apply for fuel tax refunds. Both documents are structured to assess taxes related to vehicle operation and require detailed information about vehicle use or fuel consumption. Additionally, they offer provisions for claiming back taxes under specific circumstances, emphasizing the government's regulatory role in managing transportation and fuel use.

The IRS Form 8849, Claim for Refund of Excise Taxes, provides another point of comparison with the Utah TC-116 form. IRS Form 8849 is used to claim refunds for overpaid excise taxes on a federal level across various categories, including fuel taxes. Similar to Form TC-116, which allows entities in Utah to apply for refunds on state fuel taxes under specific conditions, Form 8849 accommodates a broad spectrum of claims for tax refunds. Both forms require detailed documentation of the tax overpayment situation and calculate the refund amount based on stringent criteria.

Lastly, the State Sales Tax Return forms, though varying by state, share a fundamental resemblance with Utah's TC-116 form in their purpose and structure. These forms are used by businesses to report and pay state sales taxes collected from customers, similar to how the TC-116 form is used for reporting state fuel tax refunds. Both types of documents necessitate detailed accounting of taxable transactions—fuel purchases in the case of the TC-116 and general sales for the Sales Tax Return forms. They also both play a crucial role in ensuring compliance with state tax laws and supporting the necessary financial infrastructure through taxes.

Dos and Don'ts

When filling out the Utah TC-116 form, which is an application for a fuel tax refund, it's essential to complete it accurately to ensure that your request is processed efficiently and correctly. Below are the things you should and shouldn't do when filling out this form:

- Do ensure that you fill in all required sections relevant to your refund request. Incomplete forms may delay processing.

- Do double-check the numbers you enter, especially in sections that require calculations. Mistakes in calculations can lead to incorrect refund amounts.

- Do provide accurate contact information, including your mailing address and telephone number, to facilitate communication regarding your application.

- Do mark the correct tax period and type of fuel for which you are claiming a refund, as this is crucial for determining eligibility.

- Do sign and date the form. An unsigned application is considered invalid and will not be processed.

- Don't forget to attach any required schedules or documentation that support your refund claim, such as purchase invoices or evidence of tax payment.

- Don't provide false or misleading information. Doing so may result in denial of your refund application or legal consequences.

Accurately and thoroughly completing the Utah TC-116 form is key to a smooth refund process. Attention to detail and providing complete and correct information will assist in promptly receiving any eligible refunds.

Misconceptions

Only for Gasoline and Diesel: A common misconception is that the Utah TC-116 form applies solely to refunds on gasoline and diesel fuel. In reality, the form also covers aviation fuel, CNG (Compressed Natural Gas), and other specified fuel types. This includes refund applications for aviation fuel at various tax rates and circumstances such as fuel lost due to disasters or fuel returned for re-refining.

Personal Use Only: Some might think the Utah TC-116 form is for personal use refunds exclusively. However, it also encompasses entities like government organizations, non-profit agricultural entities, and the Ute Indian Tribe, allowing them broad scope for fuel tax refunds under specific conditions.

Refunds Apply to Utah Residents Only: Another misconception is that only Utah residents can apply for fuel tax refunds using this form. Actually, the form can be used by anyone who meets the criteria, including businesses and tribes, regardless of their primary location, provided the fuel transactions meet Utah's eligibility requirements.

No Environmental Fees Considered: It's mistakenly believed that environmental assurance fees aren't part of the TC-116 form's refund calculation. In truth, the form includes sections to calculate and request refunds for these fees under specific circumstances, such as fuel exported from Utah or placed in nonparticipating tanks.

Complex and Inaccessible: People often think that the form is too complex and accessible only to tax professionals. While the form is detailed, it's designed to be comprehensive to ensure all eligible refund scenarios are covered. Instructions are available to guide applicants through the process, making it more accessible than it appears.

Exclusively for Fuel Purchases Within Utah: There's a misconception that the TC-116 form only applies to fuel purchased within Utah. The form actually includes provisions for fuel exported from Utah and special conditions for fuel transactions involving the Navajo Nation, highlighting its broader application.

Immediate Filing After Purchase: Some believe that the form must be filed immediately after fuel purchase to be valid. In fact, there's a timeframe to file for a refund, allowing applicants to gather necessary documentation and information to support their claim.

Single Use per Tax Period: A common misunderstanding is that the TC-116 form can be used only once per tax period. Entities or individuals with multiple qualifying transactions can file for refunds on all eligible instances within a single tax period, as long as each is properly documented.

No Documentation Required: It's incorrectly assumed that applicants don't need to provide documentation with their TC-116 form. Supporting documentation, such as purchase invoices and manifests, is crucial to substantiate claims and ensure the accuracy of the refund request.

Only Physical Submissions Accepted: Some might think the form can only be submitted in paper form. While the traditional mailing of documents is one submission method, options for electronic submission may be available, streamlining the process and making it more convenient for applicants.

Key takeaways

Understanding how to accurately complete the Utah TC-116 form is essential for entities seeking a fuel tax refund in Utah. Here are key takeaways to ensure the process is handled correctly:

- The Utah TC-116 form is used by government entities, non-profit agricultural organizations, and others eligible for a fuel tax refund for motor fuel, undyed diesel, aviation fuel, and compressed natural gas (CNG).

- Applicants must clearly indicate if a provided address is new to ensure all communications reach them promptly.

- The form requires detailed information about the tax-paid gallons of fuel, including gallons purchased, exported, lost, or destroyed, and gallons used by specific entities like the Ute Indian Tribe.

- Schedules accompanying the form must be selected based on the type of refund sought – these schedules detail the specific type of fuel and the circumstances of the purchase or loss.

- Calculations within the form must be carefully done, including total tax-paid gallons, applicable tax rates per gallon for different types of fuel, and overall refund amounts.

- The Utah Environmental Assurance Fee section needs to be completed if applicable, taking into account exported gallons, gallons placed in nonparticipating tanks, and liters for repackaged oil.

- For operations involving the Navajo Nation, the form facilitates claiming a refund for fuel taxes paid on gallons delivered to the non-Utah portion of the Navajo Nation, taking into account a specific credit.

- Finally, accuracy and honesty are crucial when completing the form. The applicant must certify that all information provided is true, correct, and complete to the best of their knowledge.

By keeping these key points in mind, applicants can navigate the process of claiming a fuel tax refund in Utah more smoothly, ensuring that they meet all requirements and provide all necessary information.

Common PDF Templates

Tc 738 Utah - Instructions indicate how to submit the petition via email, mail, or fax for convenience and efficiency.

Utah Tc-40 Instructions - Environmental compliance and safety measures can also be tracked and insured through the diligent use of the Utah 24 06 37 form.