Fill Out Your Utah Tax Exemption Form

In the state of Utah, businesses and institutions are privy to various tax exemptions, which can be claimed through the comprehensive Utah Tax Exemption Certificate (TC-721). Situated under the auspices of the Utah State Tax Commission, this form plays a pivotal role for purchasers seeking relief from sales, use, tourism, and motor vehicle rental taxes. Entities eligible for these exemptions include but are not limited to government departments, Native American tribes, public schools, religious and charitable institutions, and companies involved in manufacturing, mining, and other specified activities. The detailed provisions of the certificate enable qualifying purchasers to declare their exemption status for tangible personal property or services, construction materials for charitable or religious facilities, and specific items like fuels, machinery, and equipment vital to industrial operations. Furthermore, the exemption certificate encompasses a broad spectrum of use cases including pollution control, municipal energy sales, research and development of alternative energy technology, telecommunications equipment, and agricultural production, to showcase a few. Importantly, the document mandates that purchasers keep the certificate within their records for audit purposes, underscoring the need for meticulous tax compliance. With its extensive coverage, the Utah Tax Exemption Certificate underscores the state's commitment to fostering economic activity while ensuring a balanced approach to taxation. It’s essential for businesses and institutions in Utah to familiarize themselves with this form to fully leverage the tax exemptions available and maintain compliance with state tax laws.

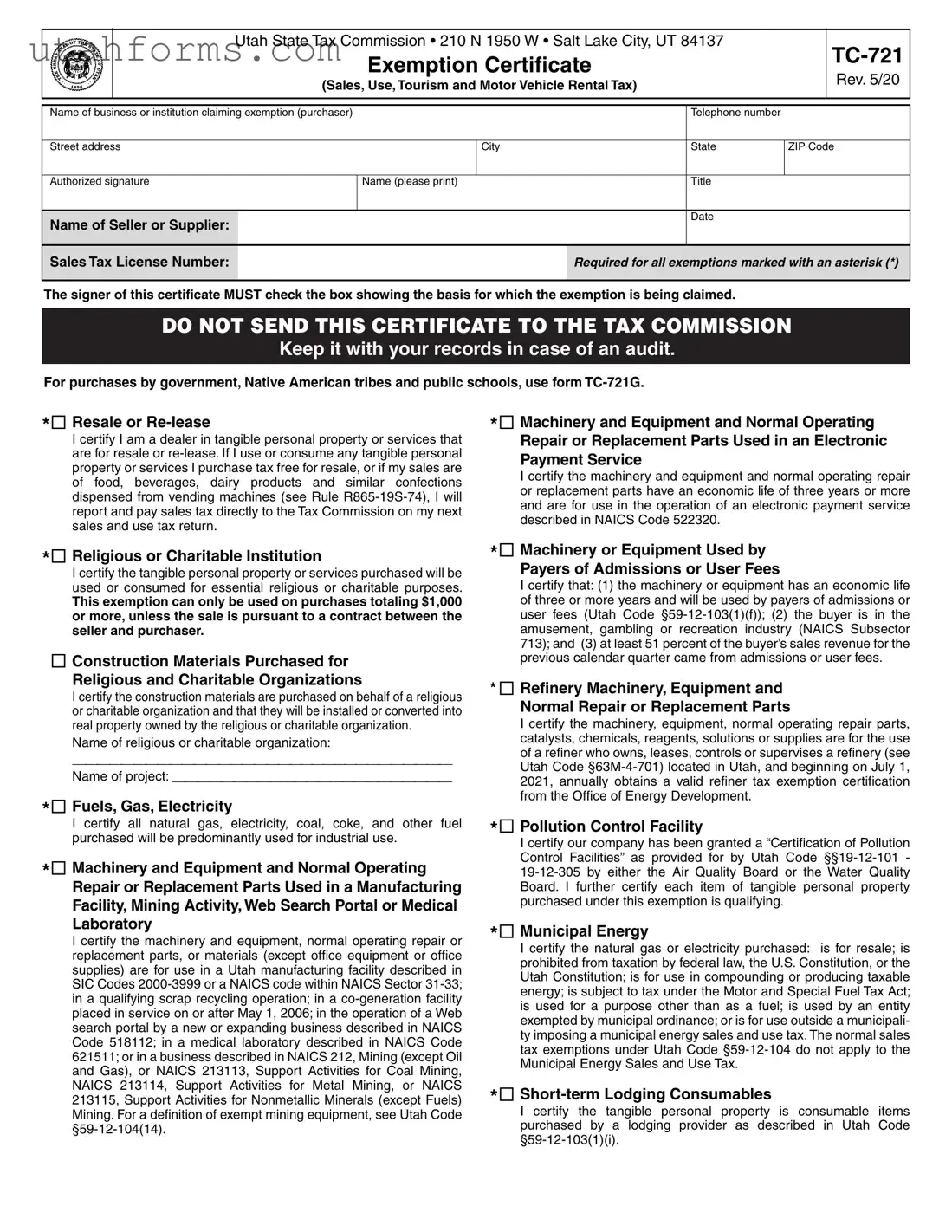

Preview - Utah Tax Exemption Form

Utah State Tax Commission • 210 N 1950 W • Salt Lake City, UT 84137

Exemption Certificate

(Sales, Use, Tourism and Motor Vehicle Rental Tax)

Rev. 5/20

Name of business or institution claiming exemption (purchaser) |

|

|

|

Telephone number |

|

|

|

|

|

|

|

|

|

Street address |

|

City |

|

State |

ZIP Code |

|

|

|

|

|

|

|

|

Authorized signature |

Name (please print) |

|

|

Title |

|

|

|

|

|

|

|

|

|

Name of Seller or Supplier: |

|

|

|

|

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales Tax License Number: |

|

|

|

Required for all exemptions marked with an asterisk (*) |

||

|

|

|

|

|

|

|

The signer of this certificate MUST check the box showing the basis for which the exemption is being claimed.

DO NOT SEND THIS CERTIFICATE TO THE TAX COMMISSION

Keep it with your records in case of an audit.

For purchases by government, Native American tribes and public schools, use form

* Resale or

I certify I am a dealer in tangible personal property or services that are for resale or

* Religious or Charitable Institution

I certify the tangible personal property or services purchased will be used or consumed for essential religious or charitable purposes.

This exemption can only be used on purchases totaling $1,000 or more, unless the sale is pursuant to a contract between the seller and purchaser.

Construction Materials Purchased for

Religious and Charitable Organizations

I certify the construction materials are purchased on behalf of a religious or charitable organization and that they will be installed or converted into real property owned by the religious or charitable organization.

Name of religious or charitable organization:

________________________________

Name of project: _______________________

* Fuels, Gas, Electricity

I certify all natural gas, electricity, coal, coke, and other fuel purchased will be predominantly used for industrial use.

* Machinery and Equipment and Normal Operating Repair or Replacement Parts Used in a Manufacturing Facility, Mining Activity, Web Search Portal or Medical Laboratory

I certify the machinery and equipment, normal operating repair or replacement parts, or materials (except office equipment or office supplies) are for use in a Utah manufacturing facility described in SIC Codes

* Machinery and Equipment and Normal Operating Repair or Replacement Parts Used in an Electronic Payment Service

I certify the machinery and equipment and normal operating repair or replacement parts have an economic life of three years or more and are for use in the operation of an electronic payment service described in NAICS Code 522320.

* Machinery or Equipment Used by Payers of Admissions or User Fees

I certify that: (1) the machinery or equipment has an economic life of three or more years and will be used by payers of admissions or user fees (Utah Code

* Refinery Machinery, Equipment and Normal Repair or Replacement Parts

I certify the machinery, equipment, normal operating repair parts, catalysts, chemicals, reagents, solutions or supplies are for the use of a refiner who owns, leases, controls or supervises a refinery (see Utah Code

* Pollution Control Facility

I certify our company has been granted a “Certification of Pollution Control Facilities” as provided for by Utah Code

* Municipal Energy

I certify the natural gas or electricity purchased: is for resale; is prohibited from taxation by federal law, the U.S. Constitution, or the Utah Constitution; is for use in compounding or producing taxable energy; is subject to tax under the Motor and Special Fuel Tax Act; is used for a purpose other than as a fuel; is used by an entity exempted by municipal ordinance; or is for use outside a municipali- ty imposing a municipal energy sales and use tax. The normal sales tax exemptions under Utah Code

*

I certify the tangible personal property is consumable items purchased by a lodging provider as described in Utah Code

* Direct Mail

I certify I will report and pay the sales tax for direct mail purchases

on my next Utah SALES AND USE TAX RETURN.

* Commercial Airlines

I certify the food and beverages purchased are by a commercial airline for

* Commercials, Films, Audio and Video Tapes

I certify that purchases of commercials, films, prerecorded video tapes, prerecorded audio program tapes or records are for sale or distribution to motion picture exhibitors, or commercial television or radio broadcasters. If I subsequently resell items to any other customer, or use or consume any of these items, I will report any tax liability directly to the Tax Commission.

* Alternative Energy

I certify the tangible personal property meets the requirements of UC

* Locomotive Fuel

I certify this fuel will be used by a railroad in a locomotive engine. Starting Jan. 1, 2021, all locomotive fuel is subject to a 4.85% state tax.

* Research and Development of Alternative Energy Technology

I certify the tangible personal property purchased will be used in research and development of alternative energy technology.

* Life Science Research and Development Facility

I certify that: (1) the machinery, equipment and normal operating repair or replacement parts purchased have an economic life of three or more years for use in performing qualified research in Utah; or (2) construction materials purchased are for use in the construc- tion of a new or expanding life science research and development facility in Utah.

* Mailing Lists

I certify the printed mailing lists or electronic databases are used to send printed material that is delivered by U.S. mail or other delivery service to a mass audience where the cost of the printed material is not billed directly to the recipients.

* Semiconductor Fabricating, Processing or Research and Development Material

I certify the fabricating, processing, or research and development materials purchased are for use in research or development, manufac- turing, or fabricating of semiconductors.

* Telecommunications Equipment, Machinery or Software

I certify these purchases or leases of equipment, machinery, or software, by or on behalf of a telephone service provider, have a useful economic life of one or more years and will be used to enable or facilitate telecommunications; to provide 911 service; to maintain or repair telecommunications equipment; to switch or route telecommunications service; or for sending, receiving, or transport- ing telecommunications service.

* Aircraft Maintenance, Repair and Overhaul Provider

I certify these sales are to or by an aircraft maintenance, repair and overhaul provider for the use in the maintenance, repair, overhaul or refurbishment in Utah of a

* Ski Resort

I certify the

* Qualifying Data Center

I certify that the machinery, equipment or normal operating repair or replacement parts are: (1) used in a qualifying data center as defined in Utah Code

Leasebacks

I certify the tangible personal property leased satisfies the following conditions: (1) the property is part of a

(2) sales or use tax was paid on the initial purchase of the property; and, (3) the leased property will be capitalized and the lease payments will be accounted for as payments made under a financ- ing arrangement.

Film, Television, Radio

I certify that purchases, leases or rentals of machinery or equip- ment will be used by a motion picture or video production company for the production of media for commercial distribution.

Prosthetic Devices

I certify the prosthetic device(s) is prescribed by a licensed physician for human use to replace a missing body part, to prevent or correct a physical deformity, or support a weak body part. This is also exempt if purchased by a hospital or medical facility. (Sales of corrective eyeglasses and contact lenses are taxable.)

I certify this tangible personal property, of which I am taking posses- sion in Utah, will be taken

Agricultural Producer

I certify the items purchased will be used primarily and directly in a commercial farming operation and qualify for the Utah sales and use tax exemption. This exemption does not apply to vehicles required to be registered.

Tourism/Motor Vehicle Rental

I certify the motor vehicle being leased or rented will be temporarily used to replace a motor vehicle that is being repaired pursuant to a repair or an insurance agreement; the lease will exceed 30 days; the motor vehicle being leased or rented is registered for a gross laden weight of 12,001 pounds or more; or, the motor vehicle is being rented or leased as a personal household goods moving van. This exemption applies only to the tourism tax (up to 7 percent) and the

Textbooks for Higher Education

I certify that textbooks purchased are required for a higher education course, for which I am enrolled at an institution of higher education, and qualify for this exemption. An institution of higher education means: the University of Utah, Utah State University, Utah State University Eastern, Weber State University, Southern Utah Universi- ty, Snow College, Dixie State University, Utah Valley University, Salt Lake Community College, or the Utah System of Technical Colleges.

*Purchaser must provide sales tax license number in the header on page 1.

NOTE TO PURCHASER: You must notify the seller of cancellation, modification, or limitation of the exemption you have claimed. Questions? Email taxmaster@utah.gov, or call

File Specifications

| Fact | Detail |

|---|---|

| Form Identifier | TC-721 Rev. 5/20 |

| Purpose | For claiming exemptions on Sales, Use, Tourism, and Motor Vehicle Rental Tax |

| Who Should Use | Businesses or institutions claiming tax exemption |

| Special Use | For government, Native American tribes, and public schools, a separate form TC-721G is used |

| Sales License Number | Required for all exemptions marked with an asterisk (*) |

| Record Keeping | Do not send the certificate to the Tax Commission; keep it for audit purposes |

| Governing Laws | Utah Code §59-12-104 for specific exemptions, among various specific sections for others |

| Auditing | The form must be retained by the purchaser for possible auditing |

How to Write Utah Tax Exemption

Filling out the Utah Tax Exemption form is a necessary step for entities that qualify for tax exemptions on purchases within the state. This document is crucial for ensuring that your business or institution can rightfully claim exemptions from sales, use, tourism, and motor vehicle rental tax. It's vital to accurately complete and maintain this form for record-keeping and audit purposes. Follow the steps below to properly fill out the form.

- Write the Name of the business or institution claiming exemption at the top of the form.

- Provide the Telephone number and Street address, including City, State, and ZIP Code of the purchaser.

- Under Name of Seller or Supplier, enter the name of the entity from which you are making exempt purchases.

- Provide the Date next to the seller information. This should be the date when the form is being filled out.

- If applicable, include the Sales Tax License Number in the space provided. Remember, this is required for all exemptions that are marked with an asterisk (*).

- In the section where the certificate signatory's details are required, print the Name of the authorized person, their Title, and have them sign under Authorized signature to validate the form.

- Choose and check the box that specifies the basis for which the exemption is being claimed. Ensure to read each exemption criteria carefully to select the one that accurately applies to your purchases.

- If selecting the exemption for Religious or Charitable Institution, Construction Materials, or any other specific category that requires further details, make sure to fill in the additional information such as the name of the organization or project.

- Review the entire form to ensure all the information provided is accurate and that the correct exemption box is checked.

- Keep the completed form with your financial records. Remember, DO NOT SEND THIS CERTIFICATE TO THE TAX COMMISSION. It must be kept on hand for audit purposes or in case of tax inquiries.

After filling out the form, you're set to proceed with making your tax-exempt purchases. It's recommended to regularly review the information on this certificate, especially if your institution's details or the nature of your tax-exempt purchases change. This form is a key component of managing your tax responsibilities correctly and benefiting from Utah's exemption provisions.

Frequently Asked Questions

- What is the Utah Tax Exemption form?

- Who needs to fill out the TC-721 form?

- Is a Sales Tax License Number always required?

- What should I do with the completed form?

- Can this form be used for government, Native American tribes, and public schools' purchases?

- What happens if I use or consume items I've purchased tax-free under the assumption of resale?

- Can I claim an exemption for all purchases made by a religious or charitable institution?

- Are there specific criteria for machinery and equipment to qualify for exemption?

- How can I determine if my purchase for pollution control qualifies for exemption?

- What if I have questions about filling out the form or my eligibility for an exemption?

This form, officially named TC-721, is provided by the Utah State Tax Commission. It's used by businesses, institutions, and certain individuals to claim exemption from sales, use, tourism, and motor vehicle rental taxes for qualifying purchases.

Any business or institution claiming tax exemption on purchases of tangible personal property or services for specific exempt purposes in Utah should complete this form. This includes dealers reselling items, religious or charitable institutions, manufacturers, miners, and others listed in the specific exemptions.

Yes, for all exemptions marked with an asterisk (*) on the form, providing a Sales Tax License Number is mandatory. This helps verify the entity claiming the exemption is registered with the Utah State Tax Commission for sales and use tax purposes.

Do not send the completed TC-721 form to the Tax Commission. Instead, keep it with your business records. You'll need to present it in case of an audit to prove your entitlement to the tax exemptions claimed.

For purchases by these entities, a different form, TC-721G, must be used. The TC-721 form isn't applicable for these purchasers.

If you end up using or consuming tangible personal property or services initially bought tax-free for resale, you must report and pay sales tax on these items on your next sales and use tax return.

No, the exemption for religious or charitable institutions generally applies only to purchases totaling $1,000 or more, unless the sale is pursuant to a specific contract between the seller and the purchaser. The exemption specifically covers items used or consumed for essential religious or charitable purposes.

Yes, for machinery and equipment to be exempt, they must be used in a qualifying manufacturing facility, mining operation, medical laboratory, or in certain other specified activities as listed on the form. The items should primarily be used in the operations that fit under designated SIC or NAICS codes.

Your company must have been granted a "Certification of Pollution Control Facilities" by either the Air Quality Board or the Water Quality Board according to Utah Code. Each item purchased under this exemption must qualify as equipment for pollution control.

If you have any questions or need clarification regarding the exemption form or your eligibility, you can email the Utah State Tax Commission at taxmaster@utah.gov, or call them at 801-297-2200 or 1-800-662-4335 for assistance.

Common mistakes

Filling out the Utah Tax Exemption form requires careful attention to detail. Mistakes can lead to audit issues or the denial of tax exemption status. Understanding common errors can help individuals and businesses avoid these pitfalls.

Here are eight common mistakes to watch out for:

- Not providing a sales tax license number: It is mandatory for all exemptions marked with an asterisk (*) to include a sales tax license number. Overlooking this requirement can invalidate the exemption claim.

- Incorrectly checking exemption boxes: Each box corresponds to a specific exemption type. Selecting the wrong exemption or checking multiple boxes that do not apply may cause confusion and lead to the rejection of the form.

- Failing to specify the exempted items: Just checking a box is not enough; the form requires specific information about the items or services claimed under the exemption. Vague descriptions can result in disqualification.

- Omitting the name of the business or institution: The form begins with a section for the name of the business or institution claiming the exemption. Failure to provide this information can immediately disqualify the application.

- Leaving the authorized signature blank: An authorized signature is necessary to validate the form. This oversight can suggest that the form is incomplete or not duly authorized.

- Not keeping a copy for records: The form instructions clearly state not to send the certificate to the Tax Commission but to keep it with one's records in case of an audit. Not having it on file can lead to complications during an audit.

- Using an outdated form: Tax laws and exemptions can change. Using an outdated version of the form that doesn’t reflect current tax codes can result in the application being invalid.

- Incorrect identification of the seller or supplier: It’s crucial to accurately provide the name and sales tax license number of the seller or supplier. Errors here can affect the exemption's validity, as it might not be clear who is claiming the exemption or for whom the goods are being purchased.

To ensure a smooth process, it’s essential to double-check the form before submission, making sure all the required information is accurate and complete. Taking the time to review each section carefully can save businesses from unwanted tax liabilities and ensure compliance with Utah's tax exemption regulations.

Documents used along the form

When managing tax responsibilities in Utah, especially regarding exemptions, the Utah Tax Exemption form is crucial. However, to navigate the complexities of tax law and ensure full compliance, other forms and documents are often necessary to accompany this form. Understanding these additional documents can make the process smoother and help avoid any legal issues.

- Form TC-721G: This specific form is for government entities, Native American tribes, and public schools, who must use it instead of the general exemption certificate when purchasing items exempt from sales tax. It ensures that these entities are correctly identified and receive their entitled exemptions.

- Utah Sales and Use Tax Return: Businesses must file this return periodically to report and pay taxes on sales, leases, and rentals of most goods, and some services. When an exemption is claimed using the Utah Tax Exemption form for certain items like direct mail, the taxpayer must report and pay any owed taxes through this return.

- Utah State Business and Tax Registration: Before applying for tax exemptions, a business must be properly registered with the state. This registration process involves obtaining a sales tax license number, which is a prerequisite for the Utah Tax Exemption form and must be included on the document.

- Exemption Certificate for Purchases by Electronic Payment Service Providers (Form TC-830): For those claiming exemptions on machinery and equipment used in electronic payment services, this form may be required to provide detailed information specific to the industry and exemption criteria.

- Refiner Tax Exemption Certification: Refineries in Utah seeking exemptions on certain machinery, equipment, and materials need a valid certification from the Office of Energy Development. This certificate is necessary to validate the exemption claim for refinery-specific equipment and operations.

Understanding and compiling the appropriate documentation is essential for businesses and institutions to take full advantage of Utah's sales tax exemptions. Not only do these documents support the exemption claims, but they also help keep records organized and prepared for any potential audits. Staying informed about the requirements and available exemptions can significantly benefit entities eligible for tax relief within Utah.

Similar forms

The Utah Tax Exemption form shares similarities with the Resale Certificate. Both documents allow businesses to make tax-free purchases of goods that are intended to be resold. The critical similarity lies in their purpose - to prevent double taxation of the same goods: first, when products are purchased for resale, and second, when they're sold to the final consumer. Each document requires the purchaser to provide proof of eligibility and understand that if the items are used in a way that disqualifies them from exemption, the tax must be paid.

Similar to the Exemption for Religious or Charitable Institutions form, both forms require certification that purchased goods are for use in activities considered exempt by law. They stand out by allowing organizations to buy goods or services without paying sales tax, provided these purchases are used for qualifying purposes. This similarity showcases the intent to support organizations that contribute to public welfare by easing their financial burdens associated with tax liabilities.

The Construction Materials Purchased for Religious and Charitable Organizations form aligns with the Utah Tax Exemption form in targeting specific beneficiary groups. These forms ensure that construction materials bought for charity or religious-based construction projects aren’t taxed, emphasizing support for such entities to invest more in their core missions without being heavily taxed.

The forms dealing with Exemption for Fuels, Gas, Electricity, and similar utilities parallel the Utah Tax Exemption form in their approach toward essential commodities. By exempting taxes on these critical supplies when used for qualifying purposes, such as industrial uses, both types of exemption forms aim at reducing operational costs for businesses engaging in substantial energy consumption, thereby fostering a more favorable economic environment.

The Machinery and Equipment Exemption form, much like the Utah Tax Exemption form, offers tax relief for purchases of machinery and equipment used in specific sectors, including manufacturing. These forms share the goal of encouraging investment in productivity-enhancing equipment and technology, recognizing the importance of modernization in maintaining competitive industries. They require detailed certification that the equipment or machinery will be used in eligible activities.

Similar to Direct Mail Tax Exemption forms, the Utah Tax Exemption form’s section on direct mail focuses on the exemption of taxes for purchases related to direct mailing services. This similarity underscores an understanding of the unique nature of direct mail advertising and the importance of offering tax relief to support businesses in executing marketing strategies efficiently.

The Exemption for Commercial Airlines form mirrors the Utah Tax Exemption form in its provision for the aviation industry. Both documents provide tax exemptions for purchases made by commercial airlines, such as food, beverages, and repair parts. This similarity points towards a broader legislative intent to support specific sectors by alleviating some financial burdens, acknowledging the industries' significance to economic and infrastructural development.

Also similar is the Alternative Energy form, echoing the Utah form’s focus on fostering environmentally sustainable investments. By offering tax exemptions for purchases related to alternative energy projects, both forms aim to promote green energy initiatives. This shared goal highlights a legislative intent to encourage cleaner energy production and technology development, demonstrating a commitment to environmental sustainability.

The Prosthetic Devices form shares a kinship with the Utah Tax Exemption form by offering tax relief for medical and health-related purchases. By exempting sales tax on prosthetic devices prescribed for human use, these forms alleviate the financial burden on individuals requiring such medical aids, reflecting a compassionate recognition of the essential nature of these devices for personal well-being.

Lastly, the Agricultural Producer Exemption Certificate parallels the Utah form in its focus on supporting the agricultural sector. Both documents allow for tax-free purchases of farming inputs and equipment, aimed at reducing operational costs for farmers. This shared approach demonstrates an understanding of the agricultural industry’s importance and the challenges it faces, thus aiming to promote agricultural productivity and sustainability.

Dos and Don'ts

When filling out the Utah Tax Exemption form, there are certain practices you should follow to ensure compliance and accuracy. Here is a list of things you should and shouldn't do:

- Do ensure that all the information you provide is accurate and current. This includes the name of the business or institution claiming the exemption, telephone number, street address, city, state, ZIP code, and the authorized signature.

- Do check the box that accurately shows the basis for which the exemption is being claimed, making sure that your claim fits within the specified categories.

- Do provide your Sales Tax License Number at the top of the form if your exemption claim requires one, marked by an asterisk (*).

- Do keep the certificate with your records for audit purposes. It's crucial not to send this certificate to the Tax Commission but to have it available in case it is requested.

- Don't claim exemptions for which you are not eligible. It is important to thoroughly review each exemption category to ensure your business or institution qualifies.

- Don't leave any required fields blank. Incomplete forms may result in the rejection of your exemption claim.

- Don't forget to sign and date the form. An unsigned form may be considered invalid.

- Don't hesitate to contact the Utah Tax Commission directly if you have any questions or if you are unsure about how to fill out the form accurately. They can be emailed at taxmaster@utah.gov, or called at 801-297-2200 or 1-800-662-4335.

Adhering to these guidelines will help ensure that your Tax Exemption form is filled out correctly, minimizing the risk of delays or issues with your exemption claim.

Misconceptions

Understanding tax exemption forms can be quite the endeavor, especially when it comes to the intricate details specific to a state like Utah. The Utah Tax Exemption form, officially known as TC-721, is a document designed to facilitate tax-exempt purchases by qualifying entities. However, myths and misunderstandings about this form are widespread, leading to common errors and misconceptions:

- All nonprofit organizations automatically qualify for an exemption. Not every nonprofit qualifies for a sales tax exemption in Utah. Organizations must meet specific criteria set by the Utah State Tax Commission and may have to provide documentation proving their eligibility, such as a tax-exempt status letter from the IRS.

- The exemption applies to all purchases made by eligible entities. The truth is that the exemption only applies to purchases that are directly related to the entity’s qualifying activities. For instance, office supplies for a qualifying nonprofit could be exempt, but personal items for staff or members likely wouldn't be.

- Once an entity is approved for exemption, it never has to apply again. This is incorrect. Entities must periodically renew their exemption status and maintain updated records with the Utah State Tax Commission to ensure their exemption remains valid.

- The exemption form is only for goods, not services. The TC-721 form actually covers both tangible personal property and services, provided these are used in an exempt manner by the purchasing entity.

- Government entities need to provide a tax exemption certificate. While many organizations must submit the TC-721 to prove their eligibility, government entities are generally recognized as exempt without needing to provide this specific form for each purchase.

- Only physical copies of the exemption certificate are accepted. In today’s digital age, many sellers accept a digital copy of the exemption certificate, though it's always recommended to check the seller's requirements ahead of time.

- Purchasers must send the completed exemption certificate to the Utah Tax Commission. The instruction clearly states that the certificate should not be sent to the Tax Commission but kept with the purchaser’s records for audit purposes.

- The exemption certificate covers sales tax only. Actually, the TC-721 form applies to several taxes, including sales, use, tourism, and motor vehicle rental tax, which demonstrates the form's versatility beyond just sales tax exemption.

- Every box checked on the form applies to a single transaction. The certificate could cover multiple transactions for the same type of exempt purchase, rather than needing a new form for each transaction, as long as the conditions for exemption are consistently met.

- There is no need to update the form once submitted to a vendor. If there are changes to the exemption status or applicability, it is the responsibility of the purchaser to inform the seller to ensure compliance with Utah tax laws.

Clearing up these misconceptions ensures that eligible entities correctly leverage the benefits of the Utah Tax Exemption form, maintaining compliance while optimizing their financial resources.

Key takeaways

Understanding the Utah Tax Exemption form is crucial for businesses and institutions seeking to navigate tax regulations effectively. Here are key takeaways to guide you:

- The form TC-721 is designed for claiming exemptions on sales, use, tourism, and motor vehicle rental tax. This allows entities to purchase goods and services without paying state tax, under qualifying conditions.

- Entities such as government organizations, non-profit religious and charitable institutions, and educational establishments often qualify for exemptions. However, they must accurately verify their eligibility.

- For exemptions requiring a sales tax license number, it's mandatory to provide this information on the form. Failure to do so could invalidate the exemption claim.

- It is important to retain the completed exemption certificate with financial records. In case of an audit, these documents must be readily accessible to justify the exemptions claimed.

- The exemption for resale or re-lease purposes stipulates that if the purchased goods or services are used instead of being resold or leased, the buyer is responsible for reporting and paying sales tax on those items.

- Sector-specific exemptions are available, such as for machinery and equipment used in manufacturing, mining, certain medical and research facilities, and for renewable energy projects. These exemptions require a clear understanding of the qualifying criteria, which are often detailed and specific.

Keep in mind: Misuse of this exemption can result in tax liabilities, penalties, and interest. It's important to claim only those exemptions for which you are fully eligible and to understand the specific requirements and limitations of each exemption class.

For further clarification or if there are questions regarding the exemption certificate, contacting the Utah State Tax Commission directly is advised. This ensures compliance and helps in avoiding any complications with tax obligations.

Common PDF Templates

Utah Real Estate Forms - The form addresses contingencies for late payments, establishing penalties and interest rates on overdue amounts, while allowing for prepayment without penalty.

Utah Payroll Taxes - The TC-941D form provides a pathway for businesses to explain and reconcile discrepancies in their withholding tax submissions.

Utah State Withholding Form - Government entities, the Ute Indian Tribe, and non-profit agricultural entities can use the TC-116 form to recover Utah tax-paid gallons purchased.