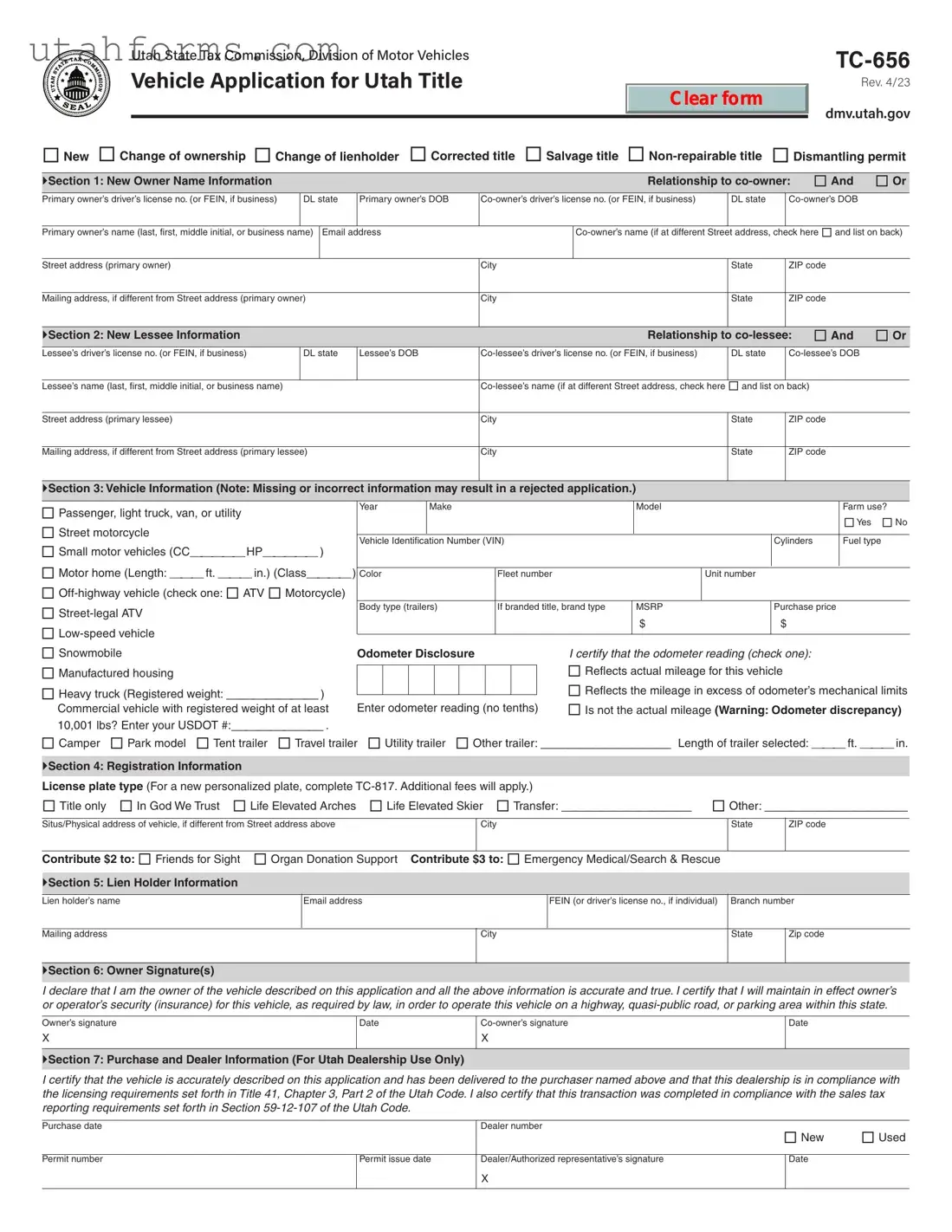

Fill Out Your Utah Dmv Tc 656 Form

When navigating the administrative pathways of vehicle ownership and registration in Utah, individuals and businesses alike will encounter the Utah DMV TC-656 form, a critical document designed to cater to a variety of needs. This form encompasses options for new registrations, changes of ownership, lienholder amendments, corrections to titles, and the assignment of salvage or non-repairable titles, in addition to permits for dismantling vehicles. It meticulously collects data ranging from owner name(s), relationship between co-owners, detailed lessee information, to thorough vehicle specifics. Furthermore, it plays a pivotal role in odometer disclosure, a crucial factor in the sale and purchase of vehicles. The form also facilitates the selection of license plate types while providing an opportunity for vehicle owners to contribute to community causes. With sections devoted to lienholder details and signatures from owners to affirm the accuracy and truthfulness of the information provided, the TC-656 form encapsulates a comprehensive process for vehicle transactions in Utah. Designed with both individual and commercial needs in mind, it underscores the state's stringent requirements for documentation, ensuring that all vehicles operated on its roads are rightfully owned, correctly registered, and adequately insured, thus safeguarding the interests of vehicle owners, potential buyers, and the community at large.

Preview - Utah Dmv Tc 656 Form

Clear form

New Change of ownership Change of lienholder Corrected title Salvage title

Section 1: New Owner Name Information |

Relationship to |

Primary owner’s driver’s license no. (or FEIN, if business)

DL state

Primary owner’s DOB

DL state

Primary owner’s name (last, first, middle initial, or business name) |

Email address |

|

|||||||

|

|

|

|

|

|

|

|

|

|

Street address (primary owner) |

|

|

|

City |

State |

ZIP code |

|

||

|

|

|

|

|

|

|

|

|

|

Mailing address, if different from Street address (primary owner) |

|

City |

State |

ZIP code |

|

||||

|

|

|

|

|

|

|

|

|

|

Section 2: New Lessee Information |

|

|

|

|

Relationship to |

And |

Or |

||

Lessee’s driver’s license no. (or FEIN, if business) |

DL state |

Lessee’s DOB |

DL state |

|

|||||

|

|

|

|

|

|

|

|

|

|

Lessee’s name (last, first, middle initial, or business name) |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

Street address (primary lessee) |

|

|

|

City |

State |

ZIP code |

|

||

|

|

|

|

|

|

|

|

|

|

Mailing address, if different from Street address (primary lessee) |

|

City |

State |

ZIP code |

|

||||

|

|

|

|

|

|

|

|

|

|

Section 3: Vehicle Information (Note: Missing or incorrect information may result in a rejected application.)

Passenger, light truck, van, or utility |

Year |

|

Make |

|

|

|

|

Model |

|

|

Farm use? |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes No |

||

Street motorcycle |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Vehicle Identification Number (VIN) |

|

|

|

|

Cylinders |

Fuel type |

|||||||||||||

Small motor vehicles (CC_____HP_____ ) |

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Motor home (Length: ___ ft. ___ in.) (Class____) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Color |

|

|

|

|

|

|

Fleet number |

|

|

Unit number |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Body type (trailers) |

If branded title, brand type |

MSRP |

Purchase price |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

$ |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Snowmobile |

Odometer Disclosure |

|

|

|

I certify that the odometer reading (check one): |

|

|||||||||||||

Manufactured housing |

|

|

|

|

|

|

|

|

|

|

|

Reflects actual mileage for this vehicle |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Heavy truck (Registered weight: _______ ) |

|

|

|

|

|

|

|

|

|

|

|

Reflects the mileage in excess of odometer’s mechanical limits |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Commercial vehicle with registered weight of at least |

Enter odometer reading (no tenths) |

Is not the actual mileage (Warning: Odometer discrepancy) |

|||||||||||||||||

10,001 lbs? Enter your USDOT #:_______ . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Camper |

Park model Tent trailer Travel trailer Utility trailer Other trailer: __________ Length of trailer selected: ___ ft. ___ in. |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Section 4: Registration Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

License plate type (For a new personalized plate, complete |

|

|

|

|

|

|

|

||||||||||||

Title only |

In God We Trust Life Elevated Arches |

Life Elevated Skier |

Transfer: __________ Other: ___________ |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Situs/Physical address of vehicle, if different from Street address above |

|

|

|

|

|

|

City |

|

|

|

State |

|

ZIP code |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Contribute $2 to: Friends for Sight Organ Donation Support |

Contribute $3 to: Emergency Medical/Search & Rescue |

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Section 5: Lien Holder Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lien holder’s name

Mailing address

Email address |

FEIN (or driver’s license no., if individual) Branch number |

|||

|

City |

State |

|

Zip code |

|

|

|||

|

|

|

|

|

Section 6: Owner Signature(s)

I declare that I am the owner of the vehicle described on this application and all the above information is accurate and true. I certify that I will maintain in effect owner’s or operator’s security (insurance) for this vehicle, as required by law, in order to operate this vehicle on a highway,

Owner’s signature

X

Date

X

Date

Section 7: Purchase and Dealer Information (For Utah Dealership Use Only)

I certify that the vehicle is accurately described on this application and has been delivered to the purchaser named above and that this dealership is in compliance with the licensing requirements set forth in Title 41, Chapter 3, Part 2 of the Utah Code. I also certify that this transaction was completed in compliance with the sales tax reporting requirements set forth in Section

Purchase date

Permit number

|

Dealer number |

New |

Used |

|

|

|

|||

Permit issue date |

Dealer/Authorized representative’s signature |

|

Date |

|

|

|

|||

|

X |

|

|

|

|

|

|

|

|

File Specifications

| Fact | Detail |

|---|---|

| Form Purpose | The Utah DMV TC-656 form is used for several purposes like registering new ownership, changing ownership or lienholder, correcting title information, and declaring the vehicle status as salvage, non-repairable, or for dismantling. |

| Sections on the Form | The form is divided into seven main sections including owner information, lessee information, vehicle information, registration information, lien holder information, owner signature(s), and purchase and dealer information. |

| Vehicle Types Covered | It covers a wide range of vehicles including passenger vehicles, motorcycles, motor homes, off-highway vehicles, trailers, and commercial vehicles. |

| Odometer Disclosure | Section 3 requires disclosure of the odometer reading, stating whether it reflects the actual mileage, exceeds mechanical limits, or is not the actual mileage. |

| Owner Identification | Owners must provide detailed personal information including a driver’s license number or FEIN for businesses, date of birth, and contact information. |

| Co-owner Options | It allows for co-ownership of the vehicle, where co-owners can be identified as "And" or "Or" in terms of titular relationship. |

| Charitable Contributions | Applicants can choose to contribute to either Friends for Sight or Organ Donation Support, and Emergency Medical/Search & Rescue through the form. |

| Insurance Requirement | By signing the form, the owner(s) certify that they will maintain necessary insurance for the vehicle as required by law. |

| Dealer Certification | For dealership use, the form ensures compliance with Utah Code Title 41, Chapter 3, Part 2, and sales tax reporting requirements as per Section 59-12-107 of the Utah Code. |

| Governing Law | The use and processing of the TC-656 form are governed by Utah state law, specifically mentioning compliance with sections of the Utah Code relevant to vehicle registration, dealership operations, and sales tax reporting. |

How to Write Utah Dmv Tc 656

Filling out the Utah DMV TC 656 form is key to handling your vehicle-related requests such as registering a new vehicle, changing ownership, or updating lienholder information, among other things. Before you begin, ensure you have all the necessary information regarding the vehicle and its ownership at hand to streamline the process.

- Start by identifying the purpose of your application. Check the appropriate box at the top of the form to indicate whether it's for a new registration, change of ownership, lienholder change, title correction, salvage title, non-repairable title, or a dismantling permit.

- Section 1: New Owner Name Information

- Fill in the primary owner's and co-owner's (if applicable) details, including driver's license numbers or FEIN (for businesses), states where the licenses were issued, and dates of birth.

- Enter the primary and co-owner's names, taking care to include last, first, and middle initial or business name where applicable.

- Provide the email address and street address for the primary owner, and check the box and list on the back if the co-owner's address is different.

- If the mailing address differs from the street address, furnish that information as well.

- Section 2: New Lessee Information (skip if not applicable)

- Specify the relationship of the lessee to the co-lessee by checking the appropriate 'And' or 'Or' box.

- Enter lessee and co-lessee's driving license details or FEIN, states of issue, and birth dates.

- Fill in the names and addresses for the lessee and co-lessee, marking the checkbox if the co-lessee resides at a different address.

- Section 3: Vehicle Information

- Check the type of vehicle you are registering and provide the year, make, and model.

- Indicate whether it's for farm use, and enter the Vehicle Identification Number (VIN).

- Provide details on cylinders, fuel type, body type, and if applicable, brand type for branded titles.

- Enter the MSRP, purchase price, and complete the odometer disclosure section according to the actual mileage situation of the vehicle.

- Section 4: Registration Information

- Choose the license plate type and fill in any additional registration information required.

- If the vehicle's physical address is different from the one above, provide the situs/physical address.

- Consider making contributions to the available funds if desired.

- Section 5: Lien Holder Information (if applicable)

- Fill in the lien holder's name, mailing address, email, FEIN or driver's license number (if individual), and branch number.

- Section 6: Owner Signature(s)

- Review the declaration statement, then sign and date as the owner and have any co-owner do the same to affirm that all information provided is accurate and true.

- Section 7: Purchase and Dealer Information (for dealership use only)

- This section will be completed by the dealer if the vehicle was purchased through a Utah dealership.

After you've meticulously filled out each section according to your situation, review the form to ensure all information is complete and accurate. Submit the completed form to the Utah DMV either through mail or in person, depending on their current protocols. This will initiate the process for your specific vehicle-related request, leading to an updated registration, a new title, or any other service you applied for.

Frequently Asked Questions

What is the purpose of the Utah DMV TC-656 form?

The Utah DMV TC-656 form is used for several purposes related to vehicle ownership and registration. It can be used for applying for a new title when you buy a vehicle or if the ownership structure changes, such as adding or removing an owner. It's also used to update the lienholder information, correct information on a current title, and apply for special types of titles like salvage or non-repairable titles. Additionally, if you need a dismantling permit for a vehicle, this form is required. Essentially, it serves as a comprehensive tool for managing the titling and registration details of a vehicle in Utah.

How do I indicate a change in ownership using the TC-656 form?

To indicate a change in ownership on the TC-656 form, you should select the "Change of ownership" box at the top of the form. You will need to provide the new owner name information in Section 1, including both primary and co-owner details if applicable. This includes personal details like driver's license numbers, dates of birth, and contact information, as well as specifying the ownership relationship (And/Or). Remember to sign the form in Section 6 to validate the change.

What information is required for the vehicle section of the TC-656 form?

The vehicle section of the TC-656 form, referred to as Section 3, requires detailed information about the vehicle being titled or registered. This includes specifying the type of vehicle, such as a passenger vehicle, light truck, motorcycle, etc., and the vehicle's year, make, model, VIN, fuel type, and body type. Additionally, you'll need to provide the odometer reading and certify its accuracy. For certain types of vehicles, like motor homes or commercial vehicles, additional details such as length, class, or USDOT number may be required. If the vehicle has a branded title, the type of brand should also be specified along with the MSRP and purchase price.

Can I use the TC-656 form to apply for personalized license plates?

No, the TC-656 form itself cannot be used to apply directly for personalized license plates. In Section 4, which covers registration information, there is an option to indicate a preference for a "Title only" or various standard plate themes, such as "In God We Trust" or "Life Elevated" plates. However, for personalized plates, you must complete a separate form, TC-817, and submit it along with any additional fees required for personalized plate applications. You can indicate your interest in a new personalized plate on the TC-656, but the actual application must be through the specific form for personalized plates.

What steps should I take if there is a lien on the vehicle?

If there is a lien on the vehicle, you must complete Section 5 of the TC-656 form to ensure the lienholder's information is accurately recorded. This section requires the lienholder's name, mailing address, email address, and FEIN (or driver's license number if the lienholder is an individual), along with the branch number. It's important that this information is accurately provided to register the lien against the vehicle correctly in the state records. This protects the lienholder's interest in the vehicle and is a crucial step in the titling process for vehicles with outstanding loans or financial obligations.

Common mistakes

Filling out the Utah DMV TC 656 form, a vital step in various vehicle transactions including title changes and registrations, often involves common mistakes that can delay processing. Understanding these errors can make the process smoother for individuals looking to navigate their vehicle documentation needs.

One frequently encountered error is the incorrect selection of the transaction type at the top of the form. With options like new, change of ownership, change of lienholder, corrected title, and others, it’s crucial to mark the appropriate box clearly. Mistaking this can lead to the wrong processing of the form.

Another common mistake involves the owner name information section. Applicants sometimes enter incomplete or incorrect details regarding the primary and co-owner's names, driver’s license numbers, or dates of birth. It's essential to provide accurate and full information, including middle initials and the correct state of the driver's license.

Address fields are often filled out incorrectly or left incomplete. Both the street address and mailing address, if different, need to be accurately provided for the primary owner, and co-owner if applicable. Ensuring the city, state, and ZIP code are correct is also vital.

In the vehicle information section, a frequent oversight is not providing or mistyping the Vehicle Identification Number (VIN). Given its importance for identifying the vehicle, any mistake here can lead to significant delays.

Odometer disclosure statements are mandatory and must reflect the true mileage of the vehicle. Selecting the wrong option or leaving this part blank can raise issues, especially since odometer reading impacts the vehicle’s value and legal documentation.

Details regarding the lien holder are often overlooked. For those with a financed vehicle, entering the correct lien holder's name, address, and identifying number is critical. Skipping or inaccurately filling this section can complicate future transactions.

The signature section also presents problems when missed or improperly executed. The form mandates the signatures of all owners, which serve as a declaration of the accuracy of the information provided and compliance with state law. Missing signatures can render the application invalid.

Lastly, owners sometimes neglect to check the appropriate boxes or fill in the sections related to fees and contributions toward public causes like organ donation or emergency medical services. Though not mandatory, this oversight can miss an opportunity to support state programs.

To avoid these common mistakes, applicants should meticulously review each section of the TC 656 form, ensure all information is complete and accurate, and double-check their entries before submission. Proper attention to detail can expedite the process and avoid unnecessary complications.

Documents used along the form

When individuals are engaging with the Utah Department of Motor Vehicles (DMV) to manage their vehicle-related matters, the TC-656 form becomes pivotal for a range of transactions, including acquiring a new title, transferring vehicle ownership, and updating lienholder information, among others. To ensure the smooth processing of the TC-656 form, various supplementary documents are often required to support the specific request being made. Understanding these additional requirements can significantly streamline the application process.

- Proof of Insurance: This document is essential as it verifies that the vehicle meets the minimum insurance coverage required by Utah law. Proof of insurance typically includes the insurer's name, the policy number, and expiration date of the policy. It ensures compliance with state regulations for operating a vehicle on public roads.

- Odomometer Disclosure Statement (Form TC-891): Required during the sale and transfer of ownership of a vehicle, this form records the mileage of the vehicle at the time of sale. It helps to keep an accurate history of the vehicle's use and aids in preventing odometer fraud.

- Emission Inspection Certificate: Depending on the county of registration and the age of the vehicle, an emission inspection may be necessary for the registration or renewal of a vehicle. This certificate proves that the vehicle has passed the required emissions testing, contributing to efforts to maintain air quality.

- Safety Inspection Certificate: While no longer universally required for all vehicles in Utah as of recent changes, a safety inspection might still be requested under certain conditions or for specific types of vehicles. The inspection ensures that the vehicle meets set safety standards, highlighting any potential issues that need to be addressed.

In addition to the main TC-656 form, these documents play a critical role in various vehicular transactions within the state of Utah. Together, they work to ensure that all vehicles on the road are safe, compliant with state laws, and properly documented. Applicants are encouraged to gather these documents in advance of their visit to the DMV or submission of the TC-656 form to ensure a smooth and efficient process.

Similar forms

The Vehicle Application for Title or Registration (Form REG 343) used in California shares similarities with the Utah DMV TC 656 form, chiefly in its purpose to establish or transfer vehicle ownership. Both forms collect detailed owner information, including names, addresses, and identifying numbers (e.g., driver's license or FEIN for businesses), and require details about the vehicle itself such as make, model, year, and vehicle identification number (VIN). These forms serve as integral documents for ensuring proper vehicle registration and title documentation in their respective states.

Another document resembling the Utah DMV TC 656 form is the Texas Application for Texas Title and/or Registration (Form 130-U). This form, like the TC 656, is vital for individuals looking to either register a new vehicle or transfer ownership in Texas. Sections regarding new owner information, vehicle specifics, and lien holder information are present in both documents. They are designed to ensure all necessary data is captured for the transaction to proceed in accordance with state regulations, emphasizing the importance of accurate and complete submissions for vehicle titling and registration processes.

The Application for Certificate of Title for a Motor Vehicle (Form MV-1) utilized in Pennsylvania also mirrors the Utah DMV TC 656 form in its functionality and data collection. Both forms necessitate new owner information alongside vehicle details, aiming to establish a legal title under the new owner’s name. Key sections include owner identification, vehicle identification number (VIN), and purchase details, which are critical for accurately reflecting the ownership and status of the vehicle in state records.

New York's Vehicle Registration/Title Application (Form MV-82) is analogous to the TC 656 form, focusing on registrants providing comprehensive owner and vehicle information. Each requires the declaration of vehicle type, including designations like passenger, commercial, or off-highway vehicles, and details such as the VIN, year, make, and model. These forms play a pivotal role in the legal acknowledgment of vehicle ownership and the accurate maintenance of vehicle registries within their states.

The Florida Vehicle Identification Number and Odometer Verification (Form HSMV 82042) has a partial overlap with the Utah DMV TC 656 form, particularly in verifying vehicle identification numbers (VINs) and odometer readings. While the Florida form concentrates on these specific verifications to prevent fraud and ensure the integrity of vehicle transactions, both documents are critical in the broader process of vehicle titling and registration, offering safeguards against inaccurate or deceptive information.

Lastly, the Motor Vehicle Title Application (Form TA-VT-04) employed in Vermont shares objectives with the Utah DMV’s TC 656 form. Establishing or modifying vehicle ownership, correcting titles, and dealing with salvage titles are actions facilitated by both documents. They require detailed entries about the vehicle and owner(s), including identification, vehicle specifics, and lien information if applicable, underscoring the forms’ roles in the proper governance and documentation of vehicle ownership transfers.

In conclusion, while each state in the U.S. uses distinct forms for vehicle registration, title applications, and ownership transfers, there’s a clear thread of similarity among them all, including the Utah DMV TC 656 form. Each document is designed to collect comprehensive information ensuring the lawful and accurate documentation of vehicle ownership and status, reflecting the shared aim of safeguarding both consumer and state interests in the realm of vehicle administration.

Dos and Don'ts

When filling out the Utah DMV TC 656 form, certain practices should be followed to ensure the process is carried out correctly and efficiently. Here are eight dos and don'ts to consider:

- Do double-check that all information entered on the form is accurate and matches your official documents.

- Don't leave any required fields blank. If a section doesn't apply, mark it as 'N/A' (not applicable) instead of leaving it empty.

- Do verify the vehicle identification number (VIN) on your vehicle to ensure it matches the VIN entered on the form.

- Don't sign the form until you are absolutely sure all the information is correct and you are in the presence of a notary, if required.

- Do select the correct title type that applies to your situation, such as 'New,' 'Change of ownership,' or another specified on the form.

- Don't guess on the odometer reading. Ensure the mileage entered reflects the current state of the vehicle accurately.

- Do use a black or blue pen when filling out the form. This ensures the form is legible and photocopies well.

- Don't overlook the lien holder information if your vehicle is financed or leased. This section is crucial for completing the registration process.

Following these guidelines can simplify the process of submitting the Utah DMV TC 656 form and help avoid delays or complications in registering your vehicle or transferring ownership. Always review each section carefully and consult the Utah DMV website or contact them directly for assistance with any uncertainties.

Misconceptions

Understanding the intricacies of vehicle documentation can sometimes be complex, and the Utah DMV TC 656 form is no exception. Misconceptions abound regarding its purpose, the information it entails, and how it should be filled out. By clarifying these misconceptions, individuals can navigate this process more effectively.

- Misconception 1: The TC 656 form is only for buying and selling cars.

This is a common misunderstanding. Beyond the purchase or sale of vehicles, the TC 656 form is multifaceted, covering changes in ownership, lienholder updates, corrections to titles, salvage titles, non-repairable titles, and dismantling permits. Its utility extends across a variety of circumstances beyond just the initial transaction of buying or selling.

- Misconception 2: Personal information is not required unless you're the primary owner.

Every section that demands personal details must be filled out by both the primary and co-owner, if applicable. This includes driver's license numbers, States of issuance, dates of birth (DOB), and addresses. It ensures thorough documentation and validation for all parties involved.

- Misconception 3: I can leave the lessee section blank if I own the vehicle.

While it might seem logical to skip the lessee information if you're the owner, this section becomes relevant if the vehicle is being leased. It's crucial for documenting the relationship between the lessee and co-lessee, which can have legal implications in terms of vehicle use and responsibility.

- Misconception 4: Vehicle information is optional if I have a clear title.

Even with a clear title, the vehicle information section is vital. It requires specifics such as year, make, model, VIN, and more to accurately identify and register the vehicle. Omission of this data can lead to application rejection.

- Misconception 5: The odometer reading only matters for new vehicles.

The odometer reading is a critical piece of information for all vehicles, new or used. It confirms the vehicle's mileage, which can affect its value, saleability, and historical record. Incorrect or fraudulent reporting can have serious legal consequences.

- Misconception 6: Only the owner's signature is needed.

This is not entirely true. Both the owner and co-owner (if applicable) must sign the form. This dual-signature requirement ensures mutual acknowledgment and agreement concerning the information provided and the legal responsibilities entailed.

- Misconception 7: Any corrections can be made directly on the form after submission.

Corrections to the form after submission are not so straightforward. Generally, erroneous or outdated information requires submitting a new form or specific correction documentation, as precise and accurate records are crucial for legal and registration purposes.

- Misconception 8: Dealer information is optional for private sales.

This section, while irrelevant for private transactions, is mandatory for dealership sales. It encompasses dealer certification that all information is accurate and that the vehicle has been duly delivered to the purchaser. It also confirms the dealership's compliance with Utah's legal and tax requirements.

By dispelling these misconceptions and providing clarity on the Utah DMV TC 656 form, individuals can ensure they are submitting accurate and complete information, facilitating a smoother and more compliant vehicle registration or title change process.

Key takeaways

When completing the Utah DMV TC-656 form, understanding the requirements and procedures is essential for a successful submission. Here are key takeaways to guide you through this process:

- Identify the Form’s Purpose: The TC-656 form serves multiple purposes, including new vehicle registration, change of ownership, change of lienholder, corrections to the title, and declarations for salvage or non-repairable titles. It's crucial to check the appropriate box at the top of the form to indicate your specific need.

- Section 1 - Ownership Details: Complete the new owner information accurately, specifying the relationship between co-owners, if applicable. Whether "And" or "Or" is selected can significantly impact legal ownership and rights to the vehicle.

- Driver’s License and DOB: Provide the primary and co-owner’s driver's license numbers and dates of birth. For businesses, a Federal Employer Identification Number (FEIN) is required instead.

- Email and Address Information: Ensure the email addresses and physical addresses for the primary and co-owners are current and accurate, as they are essential for communication and documentation purposes.

- Section 2 - Lessee Information: If the vehicle is leased, similar detailed information about the lessee and any co-lessee is required, following the format of Section 1.

- Vehicle Information: The vehicle section demands comprehensive details, including year, make, model, VIN, and other characteristics. This information is critical for accurately identifying and registering the vehicle.

- Odometer Disclosure: The odometer reading must be disclosed, indicating whether it reflects the actual mileage, exceeds the mechanical limits, or if the mileage is not accurate. Accurate disclosure is a legal requirement and essential for the buyer's protection.

- Registration and Lien Holder Information: If registering the vehicle, specify the license plate type and contribute to optional community support programs if desired. Additionally, provide lien holder information if the vehicle is financed.

- Owner and Dealer Signatures: The form must be signed by the owner(s) to declare the accuracy of the information and compliance with insurance requirements. For dealership sales, a section is dedicated to dealer certification, ensuring compliance with Utah laws.

- Preparation and Review: Before submitting the form, thoroughly review all sections for accuracy and completeness. Missing or incorrect information can lead to processing delays or rejection of the application.

By paying close attention to these guidelines, individuals and businesses can navigate the process of completing and submitting the Utah DMV TC-656 form with confidence, ensuring compliance with state requirements and facilitating a smooth transition of vehicle ownership or status.

Common PDF Templates

Utah State Withholding Form - This form is essential for recording a property sale in Utah, detailing the transaction to protect both buyer and seller interests.

Utah State Tax Form for Employees - Detailed instructions for reporting changes in control or ownership during the tax year.