Fill Out Your Utah Cpe Reporting Form

The Utah CPE Reporting Form plays a pivotal role in the professional lifecycle of Certified Public Accountants (CPAs) within the state, serving as both a testament to the fulfillment of continuing professional education (CPE) requirements and a prerequisite for license renewal. Administered by the State of Utah Department of Commerce's Division of Occupational and Professional Licensing, this form requires meticulous reporting of CPE activities undertaken by licensees over a two-year period, from January 1, 2010, to December 31, 2011, with a submission deadline set for January 31, 2012. The form is designed to not only capture completed CPE hours but also to ensure licensees meet the minimum requirement of 80 hours of qualifying education, subject to specific conditions for excess hours, interim licensure, and cases of non-compliance, including penalties for shortfall in required hours and provisions for medical waivers. Detailed submission instructions emphasize the importance of accuracy and timeliness in the reporting process, underscoring the state’s commitment to maintaining high standards of professional competency and ethical practice among its accounting professionals.

Preview - Utah Cpe Reporting Form

State of Utah

Department of Commerce

Division of Occupational and Professional Licensing

GARY R. HERBERT |

FRANCINE A. GIANI |

MARK B. STEINAGEL |

Governor |

Executive Director |

Division Director |

CPE Reporting and Renewal Certification Certified Public Accountant (For the reporting period January 1, 2010 through December 31, 2011)

The CPE report and the renewal certification on the reverse must be completed and returned to DOPL by January 31, 2012. Please complete the entire form and sign the certification at the bottom of the page. DOPL cannot guarantee the timely renewal of your license if the form is not received by January 31, 2012. Information for payment of your renewal fees will be mailed by August 2012. You may submit information on your own form provided it has all of the information requested including the certification of completion and your signature.

Licensees are required to complete 80 hours of qualifying continuing professional education every two years.

If you fail to complete the

(2009) Section

8)Other CPE requirements and failure to complete CPE requirements.

(a)Interim Licensure CPE requirements. Those individuals who become licensed or certified between renewal periods shall be required to complete CPE based upon ten hours per calendar quarter for the remaining quarters of the reporting period.

(b)Carry Forward Provision. A licensee who completes more than 80 hours of CPE during the two year reporting period may carry forward up to 40 hours to the next succeeding reporting period.

(c)Failure to comply with CPE requirements.

(i)Failure to meet the 80 hour requirement. An individual holding a current Utah license who fails to complete the required 80 hours of CPE by the reporting deadline will not be allowed to renew their license unless they complete and report to the division at least 30 days prior to their expiration date two times the number of CPE hours the license holder was short for the reporting period (penalty hours). The penalty hours shall not be considered to satisfy in whole or part any of the CPE hours required for subsequent renewal of the license.

(ii)

(iii)Waiver for Medical Reasons. A licensee may request the board to waive the requirements or grant an extension for continuing professional education on the basis that the licensee was not able to complete the continuing professional education due to medical or related conditions confirmed by a qualified health care provider. Such medical confirmation shall include the beginning and ending dates during which the medical condition would have prevented the licensee from completing the continuing professional education, the extent of the medical condition and the effect that the medical condition had upon the ability of the licensee to continue to engage in the practice of accountancy. The board in determining whether the waiver is appropriate shall consider whether or not the licensee continued to be engaged in the practice of accountancy practice on a full or part time basis during the period specified by the medical confirmation. Granting a waiver of meeting the minimum CPE hours shall not be construed as a waiver of a CPA being required to provide services in a competent manner with current knowledge, skill and ability. When medical or other conditions prevent the CPA from providing services in a competent manner, the CPA shall refrain from providing such services.

www.dopl.utah.gov • Heber M. Wells Building • 160 East 300 South • P.O. Box 146741, Salt Lake City, UT

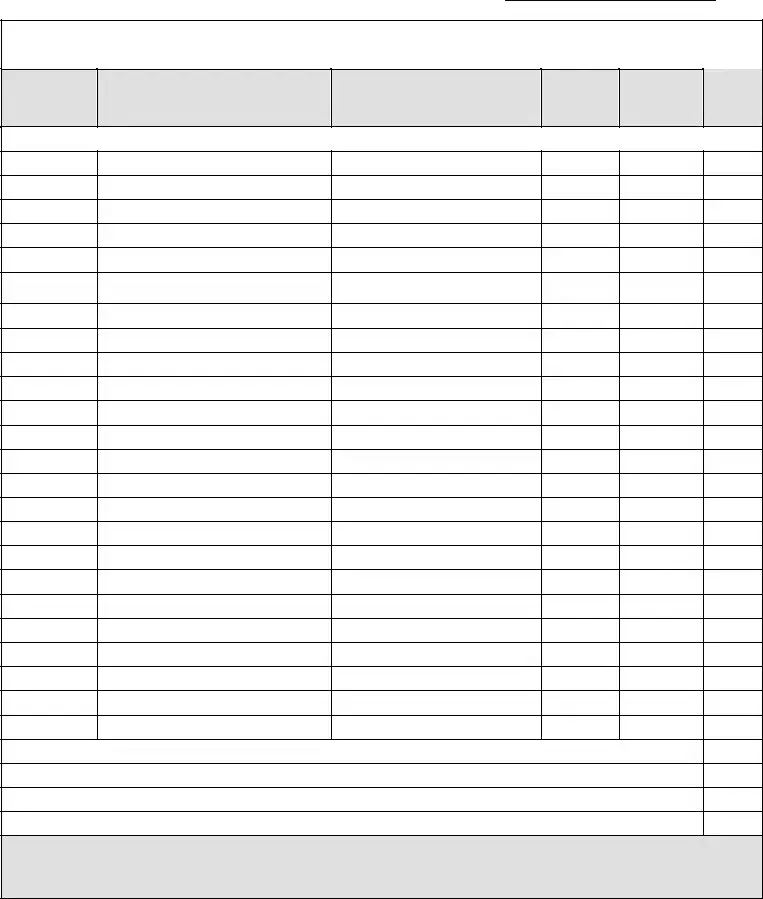

Licensee Name: |

|

License Number: |

Please complete the following schedule documenting satisfactory completion of the continuing professional education requirements. Type or print clearly; attach additional pages if necessary.

|

|

|

APPROVED |

INDICATE: |

|

|

DATE OF |

COURSE TITLE / DESCRIPTION |

SPONSOR |

COURSE |

Participant = P |

CPE |

|

NUMBER |

Instructor = I |

|||||

COURSE |

|

|

HOURS |

|||

|

|

(IF ANY) |

Author = A |

|||

|

|

|

|

|||

COURSES TAKEN JANUARY 1, 2010 – DECEMBER 31, 2011 |

|

|

|

|

||

TOTAL HOURS FOR REPORTING PERIOD

TOTAL HOURS

HOURS AVAILABLE FOR

I hereby certify that the information I have documented on this form is correct and true to the best of my knowledge.

SIGNED _____________________________________________________ DATE _______________

File Specifications

| Fact | Detail |

|---|---|

| Reporting Period | The reporting period for the Utah CPE (Continuing Professional Education) is a two-year span, from January 1, 2010, through December 31, 2011. |

| Submission Deadline | The CPE report and renewal certification must be completed and returned to the Division of Occupational and Professional Licensing (DOPL) by January 31, 2012. |

| Hour Requirement | Licensees are required to complete 80 hours of qualifying continuing professional education every two years. |

| Governing Law | The rules and requirements for the CPE are governed by the Utah Administrative Code (2009) Section R156-26a-303b(8). |

| Penalties and Provisions | Failure to meet the 80-hour requirement may lead to the inability to renew the license unless penalty hours are completed. The report also mentions provisions for carry-forward hours, qualification of CPE hours, and waivers for medical reasons. |

How to Write Utah Cpe Reporting

Filling out the Utah CPE (Continuing Professional Education) Reporting Form is a crucial step for Certified Public Accountants (CPAs) in Utah to maintain their licensing and ensure compliance with state requirements. This form is utilized to document and report the completed CPE hours over the designated two-year reporting period, which in this case is from January 1, 2010, through December 31, 2011. Ensure accuracy and completeness when documenting your CPE activities to avoid potential issues with license renewal. The following steps will guide you through the process of correctly completing the form.

- Start by entering your Licensee Name and License Number at the top of the form to correctly identify yourself to the Department of Commerce Division of Occupational and Professional Licensing.

- Document each CPE activity separately. For each course or activity, indicate the Date of Course, Course Title/Description, Sponsor, Course Number (if applicable), and whether you were a Participant (P), Instructor (I), or Author (A). This information is crucial for verifying the legitimacy and relevance of the CPE hours claimed.

- Under the "COURSE HOURS" column, accurately record the number of hours earned for each activity. Ensure these hours are qualifying based on the Utah Administrative Code and are within the reporting period.

- Add up all the CPE hours documented and enter the total in the TOTAL HOURS FOR REPORTING PERIOD section. This total should reflect all hours earned from January 1, 2010, to December 31, 2011.

- If you have completed more than the required 80 hours, document the number of hours you are allowed to carry over to the next reporting period in the CARRY-OVER HOURS ALLOWED FROM PRIOR PERIOD section (not to exceed 40 hours).

- Calculate and enter any remaining hours that will be available for carry-over to future periods. Remember, you cannot exceed 40 hours in the HOURS AVAILABLE FOR CARRY-OVER TO FUTURE PERIOD.

- After ensuring all information provided is accurate and true, sign and date the certification at the bottom of the form. Your signature is necessary to attest to the validity of the information reported.

Once completed, review the form to ensure all details are correct and that it is fully compliant with the CPE requirements and regulations set forth by the Utah Board of Accountancy. Submitting this form by the deadline, January 31, 2012, is essential for the timely renewal of your license. Late or incomplete submissions may result in delays or potential issues with your CPA license renewal. Remember, maintaining accurate and up-to-date CPE records is not only a regulatory requirement but also a testament to your commitment to professionalism and continuous learning in the field of accountancy.

Frequently Asked Questions

What is the purpose of the Utah CPE Reporting Form?

The Utah CPE Reporting Form is designed to document the completion of Continuing Professional Education (CPE) requirements by Certified Public Accountants (CPAs) in Utah for a specific two-year reporting period. This form ensures CPAs have met the education standards necessary to maintain their licensure and professionalism in the field of accounting.

When should the Utah CPE Reporting Form be submitted?

The form must be completed and returned to the Division of Occupational and Professional Licensing (DOPL) by January 31st of the year following the end of the reporting period. For instance, for the reporting period from January 1, 2010, to December 31, 2011, the form should have been submitted by January 31, 2012. Timely submission is crucial, as DOPL cannot guarantee the timely renewal of your license if the form is received after this deadline.

How many CPE hours are required for CPAs in Utah?

Licensees are required to complete 80 hours of qualifying CPE every two years. These hours ensure that CPAs maintain their knowledge and skills relevant to their professional responsibilities.

Can excess CPE hours be carried forward to the next reporting period?

Yes, a licensee who completes more than 80 hours of CPE during the two-year reporting period may carry forward up to 40 hours to the next succeeding reporting period. This provision encourages CPAs to engage in continuous learning beyond the minimum requirements.

What happens if I fail to meet the CPE requirements?

If a CPA fails to complete the required 80 hours by the reporting deadline, they must complete and report two times the number of CPE hours they were short at least 30 days prior to their license expiration date. These penalty hours cannot count towards any future CPE requirements.

In cases where non-qualifying hours are reported or hours are disqualified, the licensee must complete and report the relevant penalty hours within 60 days of receiving notification from DOPL.

Is it possible to get a waiver for CPE hours due to medical reasons?

Yes, a CPA may request a waiver of meeting the minimum CPE hours if they were unable to complete the CPE due to medical or related conditions, confirmed by a qualified health care provider. The request must include medical confirmation specifying the duration and extent of the condition and its impact on the licensee's ability to engage in the practice of accountancy. The board considers these requests carefully, especially in relation to the licensee's engagement in the practice during the specified period. However, granting a waiver does not absolve a CPA from the requirement to provide services competently.

Common mistakes

Filling out the Utah Continuing Professional Education (CPE) Reporting form is a critical step for Certified Public Accountants (CPAs) to maintain their licensing in the state of Utah. However, errors can occur during this process, which might hinder the timely renewal of a CPA license. Here are seven common mistakes made when completing the form:

- Not Completing the Entire Form: One of the primary errors is neglecting to fill out every section of the form. It's important to provide all the requested information to avoid processing delays.

- Incorrect Totals: Accuracy in reporting the total CPE hours is crucial. Miscounting or incorrectly totaling the hours can lead to compliance issues or even penalties.

- Failing to Account for Carry-Over Hours Properly: The form allows for up to 40 hours of CPE to be carried forward to the next reporting period. Failing to accurately report these carry-over hours can result in overstating or understating your compliance.

- Reporting Non-Qualifying Hours: Not all CPE hours fulfill the state’s requirements. Reporting non-qualifying hours as part of the minimum 80-hour requirement can lead to the need for corrective action and delaying license renewal.

- Omission of Signature: An unsigned form is one of the simplest yet most frequently overlooked mistakes. The signature certifies that the information provided is accurate to the best of the licensee's knowledge.

- Missing the Deadline: Submitting the form after the January 31, 2012 deadline can result in penalties or even non-renewal of a license. It's vital to submit the form on time to ensure continuous licensing.

- Not Using the Correct Form: Sometimes, individuals might inadvertently use an outdated form or a form intended for a different purpose. Ensuring you're filling out the correct, current form is essential.

To avoid these common pitfalls, CPAs should carefully review all entries on their Utah CPE Reporting form, ensuring accuracy and completeness. Double-checking the total hours, correctly identifying carry-over hours, and confirming the submission meets all requirements outlined by the Utah Division of Occupational and Professional Licensing will facilitate a smoother license renewal process. Always remember to sign the form, verify that all information is current and correct, and submit by the specified deadline to promote compliance and avoid potential issues with license renewal.

It's also advisable for CPAs to keep abreast of any changes in CPE requirements as outlined by the Utah Administrative Code and to maintain records of all CPE activities in case of audit. Adhering to these guidelines will support CPAs in fulfilling their professional responsibilities and maintaining their credentials effectively.