Fill Out Your Utah B10 Form

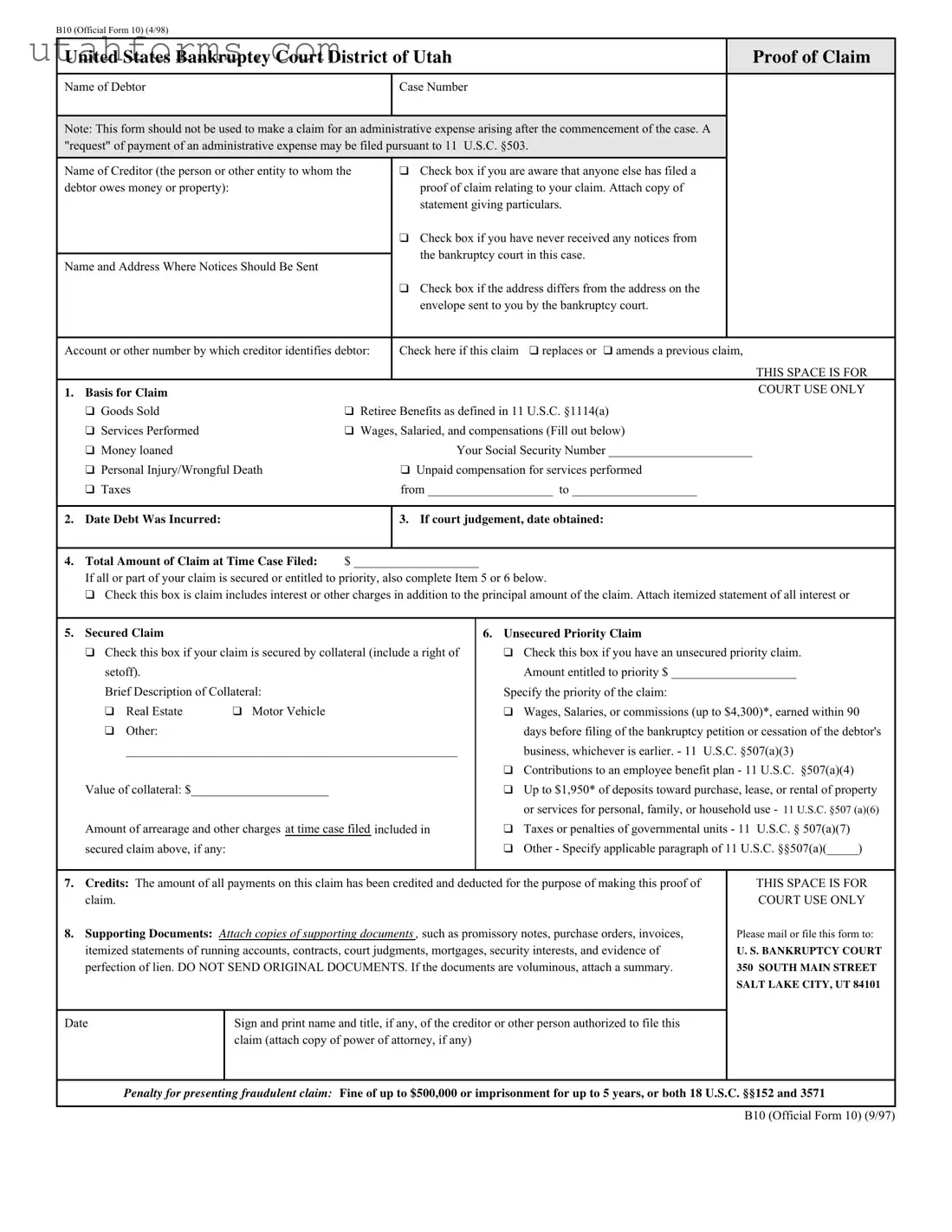

When individuals or entities need to file a claim in a bankruptcy case within the District of Utah, they use the Utah B10 form, officially known as the Proof of Claim. This form plays a crucial role in the bankruptcy process, enabling creditors to assert their right to receive a payment from the bankruptcy estate. It details the nature of the claim whether it's for goods sold, services rendered, wages owed, or any other basis for the claim. Importantly, it requires information such as the total amount of the claim at the time the bankruptcy case was filed and specifies whether the claim is secured or unsecured, with secured claims requiring further details about the collateral. The form also addresses priority claims, which could include unpaid wages or certain taxes, indicating distinct conditions under U.S. bankruptcy code sections that might affect the distribution order. Moreover, the form demands an itemization of any interest or additional charges included in the claim and outlines the requirement for attaching supporting documentation to substantiate the claim. Completing the B10 form accurately is paramount, as it affects the creditor's ability to recover funds from the debtor's estate. Furthermore, the admonition against filing fraudulent claims is spelled out clearly, underscoring the legal consequences of deceitful actions in the bankruptcy process.

Preview - Utah B10 Form

B10 (Official Form 10) (4/98)

United States Bankruptcy Court District of Utah |

|

|

|

Proof of Claim |

||||||||

|

|

|

|

|

|

|

|

|

|

|||

Name of Debtor |

|

|

Case Number |

|

|

|

|

|||||

|

|

|

|

|

||||||||

Note: This form should not be used to make a claim for an administrative expense arising after the commencement of the case. A |

|

|||||||||||

"request" of payment of an administrative expense may be filed pursuant to 11 U.S.C. §503. |

|

|

||||||||||

Name of Creditor (the person or other entity to whom the |

|

Check box if you are aware that anyone else has filed a |

|

|||||||||

debtor owes money or property): |

|

|

proof of claim relating to your claim. Attach copy of |

|

||||||||

|

|

|

|

|

|

|

statement giving particulars. |

|

|

|||

|

|

|

|

|

|

|

Check box if you have never received any notices from |

|

||||

|

|

|

|

|

|

the bankruptcy court in this case. |

|

|

||||

Name and Address Where Notices Should Be Sent |

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

Check box if the address differs from the address on the |

|

||||

|

|

|

|

|

|

|

envelope sent to you by the bankruptcy court. |

|

||||

|

|

|

|

|

|

|

||||||

Account or other number by which creditor identifies debtor: |

Check here if this claim |

replaces or |

amends a previous claim, |

|||||||||

|

|

|

|

|

|

|

|

|

|

THIS SPACE IS FOR |

||

1. |

Basis for Claim |

|

|

|

|

|

|

|

|

COURT USE ONLY |

||

|

|

|

|

|

|

|

|

|

||||

|

Goods Sold |

|

Retiree Benefits as defined in 11 U.S.C. §1114(a) |

|

||||||||

|

Services Performed |

|

Wages, Salaried, and compensations (Fill out below) |

|

||||||||

|

Money loaned |

|

|

|

Your Social Security Number _______________________ |

|||||||

|

Personal Injury/Wrongful Death |

|

Unpaid compensation for services performed |

|

||||||||

|

Taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

from ____________________ to ____________________ |

|

||||||

|

|

|

|

|

|

|

||||||

2. Date Debt Was Incurred: |

|

|

3. If court judgement, date obtained: |

|

||||||||

|

|

|

|

|

|

|

|

|

||||

4. Total Amount of Claim at Time Case Filed: |

$ ____________________ |

|

|

|

|

|||||||

|

If all or part of your claim is secured or entitled to priority, also complete Item 5 or 6 below. |

|

|

|||||||||

|

Check this box is claim includes interest or other charges in addition to the principal amount of the claim. Attach itemized statement of all interest or |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|||

5. |

Secured |

Claim |

|

|

|

|

6. |

Unsecured Priority Claim |

|

|||

|

Check this box if your claim is secured by collateral (include a right of |

|

|

Check this box if you have an unsecured priority claim. |

||||||||

|

setoff). |

|

|

|

|

|

|

Amount entitled to priority $ ____________________ |

||||

|

Brief Description of Collateral: |

|

|

|

|

Specify the priority of the claim: |

|

|||||

|

Real Estate |

Motor Vehicle |

|

|

|

|

|

Wages, Salaries, or commissions (up to $4,300)*, earned within 90 |

||||

|

Other: |

|

|

|

|

|

|

days before filing of the bankruptcy petition or cessation of the debtor's |

||||

|

_____________________________________________________ |

|

|

business, whichever is earlier. - 11 U.S.C. §507(a)(3) |

||||||||

|

|

|

|

|

|

|

|

|

|

Contributions to an employee benefit plan - 11 U.S.C. §507(a)(4) |

||

|

Value of collateral: $______________________ |

|

|

|

|

|

Up to $1,950* of deposits toward purchase, lease, or rental of property |

|||||

|

|

|

|

|

|

|

|

|

|

or services for personal, family, or household use - 11 U.S.C. §507 (a)(6) |

||

|

Amount of arrearage and other charges at time case filed included in |

|

|

Taxes or penalties of governmental units - 11 U.S.C. § 507(a)(7) |

||||||||

|

secured claim above, if any: |

|

|

|

|

|

Other - Specify applicable paragraph of 11 U.S.C. §§507(a)(_____) |

|||||

|

|

|

|

|

||||||||

7. |

Credits: The amount of all payments on this claim has been credited and deducted for the purpose of making this proof of |

THIS SPACE IS FOR |

||||||||||

|

claim. |

|

|

|

|

|

|

|

|

|

COURT USE ONLY |

|

8. |

Supporting Documents: Attach copies of supporting documents , such as promissory notes, purchase orders, invoices, |

Please mail or file this form to: |

||||||||||

|

itemized statements of running accounts, contracts, court judgments, mortgages, security interests, and evidence of |

U. S. BANKRUPTCY COURT |

||||||||||

|

perfection of lien. DO NOT SEND ORIGINAL DOCUMENTS. If the documents are voluminous, attach a summary. |

350 SOUTH MAIN STREET |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

SALT LAKE CITY, UT 84101 |

|

|

|

|

|

||||||||

Date |

|

|

Sign and print name and title, if any, of the creditor or other person authorized to file this |

|

||||||||

|

|

|

|

claim (attach copy of power of attorney, if any) |

|

|

|

|

||||

|

|

|

|

|||||||||

|

Penalty for presenting fraudulent claim: Fine of up to $500,000 or imprisonment for up to 5 years, or both 18 U.S.C. §§152 and 3571 |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

B10 (Official Form 10) (9/97)

File Specifications

| Fact | Detail |

|---|---|

| Form Name and Number | B10 (Official Form 10) |

| Purpose | Used to file a proof of claim in the United States Bankruptcy Court for the District of Utah |

| Exclusions | Not suitable for claims of administrative expense arising after the commencement of the case, which are filed under 11 U.S.C. §503 |

| Governing Law | Guided by 11 U.S.C. §§ 101-1532 (Bankruptcy Code), particularly sections related to proof of claim and administrative expenses |

How to Write Utah B10

Filing the Utah B10 form, or Proof of Claim, is a critical step for creditors in a bankruptcy case, enabling them to claim their right to a distribution from the bankruptcy estate. This form should be used carefully to detail the nature of the claim against the debtor, specifying whether it is secured or unsecured, among other details. The following steps provide a clear guide to completing the form accurately.

- Start by entering the Name of Debtor and the Case Number at the top of the form.

- In the Name of Creditor section, input your name or the name of the entity to whom the debtor owes money or property.

- If applicable, check the box to indicate whether another claim has been filed relating to your claim and attach any relevant statements.

- Check the box if you have never received any notices from the bankruptcy court for this case.

- Provide the Name and Address Where Notices Should Be Sent. Remember to check the box if this address is different from the one used by the bankruptcy court in their correspondence to you.

- Under the Account or other number section, include any identification number the creditor uses to reference the debtor’s account.

- Check the box if this claim replaces or amends a previous claim.

- Specify the Basis for Claim (e.g., Goods Sold, Services Performed, Money loaned, etc.) and fill out any required details such as the Social Security Number or the period for unpaid compensation.

- Indicate the Date Debt Was Incurred and, if relevant, the date a court judgment was obtained.

- Enter the Total Amount of Claim at Time Case Filed and check the box if the claim includes interest or other charges in addition to the principal amount.

- If part of your claim is secured or entitled to priority, complete Item 5 or 6, detailing the nature of the secured claim or unsecured priority claim, the value of collateral, and the specified priority of the claim.

- Under Credits, note any payments on this claim that have been credited and deducted.

- Attach copies of Supporting Documents (e.g., promissory notes, invoices) or a summary if the documents are voluminous. Do not send original documents.

- Sign and date the form, printing the name and title of the creditor or person authorized to file the claim. Attach a copy of the power of attorney if one is being used.

After completing the form, it should be mailed or filed with the U.S. Bankruptcy Court at 350 South Main Street, Salt Lake City, UT 84101. This step ensures that the creditor's claim is officially recognized and considered for any distributions made from the debtor's bankruptcy estate.

Frequently Asked Questions

What is the purpose of the Utah B10 form?

The Utah B10 form, officially known as the Proof of Claim, is a document used in bankruptcy cases within the District of Utah. Its main purpose is for creditors to formally assert claims against the bankruptcy estate of a debtor. This form records the details of the debtor's obligation to the creditor, including the nature and amount of the debt. It is essential for creditors who wish to receive payment from the proceedings of a bankruptcy case.

Who should file a Utah B10 form?

The form should be filed by creditors, which can be individuals or entities, to whom the debtor owes money or property. If a creditor believes they have a rightful claim to part of the bankruptcy estate due to unpaid debts, they should file this form to register their claim with the court.

Can the Utah B10 form be used for administrative expense claims?

No, the Utah B10 form should not be used for administrative expense claims that arise after the commencement of the bankruptcy case. Those types of claims must be made through a different process, specifically by filing a request for payment of an administrative expense pursuant to 11 U.S.C. §503.

What information is required on the Utah B10 form?

Creditors must provide several pieces of information when filling out the form, including:

- The name and case number of the debtor.

- The creditor's name and address for receiving notices.

- An account or other identification number that the creditor uses.

- The basis for the claim (e.g., goods sold, services performed, money loaned).

- The date the debt was incurred and, if applicable, the date of any court judgement.

- The total amount of the claim at the time the case was filed.

- Details on whether the claim is secured or has priority status.

- Any supporting documentation for the claim.

What should be done if a creditor has not received any notices from the bankruptcy court?

If a creditor has not received any notices from the bankruptcy court, they should check the appropriate box on the B10 form and ensure that their correct address is provided where notices should be sent. This will help in receiving future correspondences regarding the bankruptcy case.

How are secured claims and unsecured priority claims handled on the form?

For secured claims, creditors must indicate that the claim is secured by collateral and provide a brief description of the collateral, along with its value. For unsecured priority claims, creditors must specify the priority of the claim according to the categories listed under 11 U.S.C. §507, such as wages or taxes, and the amount entitled to priority.

What happens if a creditor's address differs from the one on the envelope sent by the bankruptcy court?

If the creditor's address differs from the one on the envelope sent by the bankruptcy court, the creditor must check the specified box on the B10 form and provide the correct address where notices should be sent. This ensures that the creditor receives all necessary information about the bankruptcy case.

Is it necessary to attach supporting documents to the Utah B10 form?

Yes, creditors are required to attach copies of supporting documents such as promissory notes, invoices, and contracts that substantiate the claim. These documents provide evidence of the debt owed by the debtor. If the documents are voluminous, a summary may be attached instead. Original documents should not be sent.

What are the consequences of presenting a fraudulent claim?

Presenting a fraudulent claim can lead to severe penalties, including a fine of up to $500,000 or imprisonment for up to 5 years, or both, under 18 U.S.C. §§152 and 3571. Therefore, it is crucial for creditors to ensure all information provided on the Utah B10 form is accurate and truthful.

Common mistakes

Filling out the Utah B10 form, an essential step in the bankruptcy claims process, can sometimes feel daunting. Yet, it's crucial for creditors to provide accurate and complete information to protect their rights to claim a debt owed by a debtor. Unfortunately, there are common mistakes that many people make when completing this form. Understanding and avoiding these errors can streamline the process and reinforce the credibility of the claim.

One frequent mistake is failure to attach supporting documents. The B10 form asks claimants to attach copies of any documents that support their claim, such as promissory notes, purchase orders, and itemized statements. Failing to do so can delay the review process or even result in the claim being disregarded because the court or the debtor might question the claim's validity without concrete evidence.

Another common error is incorrect calculation of the total amount of the claim. This includes both the principal amount owed and any additional interest or charges. Claimants must itemize these amounts and, if applicable, attach a detailed statement explaining the interest or other charges included in the claim. Misunderstanding the correct total can lead to disputes or adjustments down the line, complicating the claim process.

- Not updating contact information where required can lead to missed communications regarding the bankruptcy case. If the address where notices should be sent differs from the one on the court's envelope or if it has changed, it's imperative to check the appropriate box and update the address accordingly. This ensures that all notifications are received timely.

- Misunderstanding secured versus unsecured claims often leads to inaccuracies. A secured claim is backed by collateral, whereas an unsecured priority claim is not. Claimants need to accurately categorize their claim and provide the necessary details if it is secured, including a description of the collateral and its value.

- Failing to note any payments received that should be deducted from the total claim amount. All payments on the account prior to the filing should be deducted from the claimed amount. This oversight can lead to overstating the claim, which might cause delays or require additional documentation to rectify.

- Misidentifying the basis for the claim or the type of debt incurred. Claimants must specify whether the debt arises from goods sold, services performed, money loaned, etc., and provide the exact dates these debts were incurred as well as any court judgment dates if applicable.

- Omitting to sign the form or to include the title if filing on behalf of an entity. The form must be signed by the creditor or an authorized person to be considered valid. Failure to do so may lead to the form being returned, requiring resubmission and further delaying the claims process.

Avoiding these mistakes on the Utah B10 form not only facilitates a smoother bankruptcy process but also helps ensure that creditors' rights are fully protected. Taking the time to double-check the information provided, ensuring that all relevant documents are attached, and understanding the specific requirements can significantly impact the outcome of the claim.

Documents used along the form

Filing a claim in a bankruptcy case, like with the Utah B10 form, often involves more than just completing the Proof of Claim document. There are various forms and documents that creditors may need to use to ensure their claim is properly documented and secured. Understanding the purpose of each document can make the bankruptcy process more navigable.

- Voluntary Petition: This is the document that a debtor files to initiate bankruptcy proceedings. It includes basic information about the debtor, the type of bankruptcy being filed, and a statement of financial affairs.

- Schedules of Assets and Liabilities: Filed by the debtor, these schedules detail all assets, liabilities, income, and expenditures, providing a comprehensive financial overview to the court and creditors.

- Statement of Financial Affairs: This document complements the schedules by offering more detailed information about the debtor's financial transactions, including transfers of property, closed bank accounts, and lawsuits within certain time frames prior to filing.

- Creditor Matrix: The debtor must submit a list of names and addresses of all creditors, which the court uses to notify parties of the bankruptcy filing and other case developments.

- Proof of Service: When a creditor files a proof of claim or any other document in the bankruptcy case, they must also file a proof of service showing that copies have been served on required parties, such as the debtor and the debtor's attorney.

- Amendment to Proof of Claim: If a creditor needs to correct or update information in a previously filed claim, this document is used to make such amendments to ensure the claim reflects accurate information.

- Motion for Relief from Automatic Stay: Creditors who wish to proceed with collection efforts on secured debts, like foreclosing on a house or repossessing a vehicle, must request permission from the court through this motion.

- Reaffirmation Agreement: If a debtor wishes to exclude certain debts from discharge and continue paying them to retain the collateral (such as an automobile), both parties can enter into this agreement, which must be approved by the court.

- Notice of Appearance: This document is filed by creditors or their representatives who wish to participate in the case and receive all notices and documents filed in the case.

These documents work together to provide a framework for the fair treatment of creditors while protecting the rights of the debtor. Creditors should familiarize themselves with these documents to actively participate in the bankruptcy process, safeguard their rights, and maximize their potential for recovering owed debts.

Similar forms

The Official Form 10 (B10) used in United States Bankruptcy Court proceedings in Utah shares similarities with several other documents used in legal and financial contexts. For instance, the Form 1040 used for filing individual income tax returns involves declaring debts and assets, much like the B10 requires the declaration of claims against bankruptcy estates. Although tax-related, both forms necessitate accuracy in detailing financial positions and can lead to legal repercussions if improperly filed.

Uniform Commercial Code (UCC) financing statements, another comparable document, serve to notify interested parties of a security interest in collateral securing a debt. Much like the section in the B10 form that addresses secured claims and requires a description of collateral, UCC filings detail the collateral securing a creditor's interest, evidencing the secured status of the claim against a debtor.

W-2 Forms issued by employers to report employees' annual wages and taxes withheld closely resemble the portion of the B10 form outlining wages, salaries, or compensations. Both documents are pivotal for the correct reporting of earnings and pertinent to the resolution of claims related to employment in bankruptcy proceedings.

The Proof of Claim Form used in other bankruptcy cases across the U.S., not just Utah, also mirrors the B10 form in purpose and content. Each requires creditors to declare the nature of their claim, the amount owed, and any priority or security associated with the claim, facilitating the equitable distribution of a debtor's estate in bankruptcy proceedings.

Loan applications are similarly reflective of the B10 form in that both involve the declaration of financial information, albeit for opposing purposes. Where loan applications establish the ability to repay borrowed funds, the B10 form establishes the amount a creditor is owed, potentially influencing the recovery from a bankruptcy estate.

Mortgage applications, while primarily used for assessing a borrower's qualifications for a home loan, share attributes with the B10 form concerning the disclosure of financial obligations and collateral. The B10's sections on secured claims necessitate similar revelations about the debtor's property, highlighting parallels in financial disclosure requirements.

The Mechanic’s Lien claims, documents filed by contractors or suppliers to claim a security interest in a property to which they have supplied labor or materials, have similarities with the B10 form regarding secured claims. Both delineate claims secured by property, clarifying interested parties' rights in specific assets.

Finally, claim forms completed following an insurance event reveal congruities with the B10 form in terms of detailing amounts owed due to specific incidents, inclusive of itemized statements to substantiate the claim. Like insurance claims, the B10 form's attachments enumerate the basis and justification for the claim, reinforcing the demand for compensation.

Dos and Don'ts

Filing out the Utah B10 form, officially known as the Proof of Claim form, is an essential step in a bankruptcy case. It's how creditors tell the court how much the debtor owes them. To ensure your claim is processed smoothly and without delay, pay attention to the following dos and don'ts:

- Do provide accurate and complete information about your claim, including the amount owed and the basis for the claim.

- Do attach supporting documents to your form. These can include contracts, invoices, or court judgments. Remember, a summary is sufficient if there are too many documents.

- Do check the appropriate boxes if your claim is secured by collateral or if it's an unsecured priority claim, and provide detailed information as requested.

- Do deduct any payments that have already been made towards the debt from your claim amount.

- Do sign and print your name at the end of the form. If you're filing on behalf of another person or entity, attach a copy of your power of customer service is always available to answer any attorney, showing you're authorized to act on their behalf.

- Do check whether any other claims related to yours have been filed and if so, attach a statement giving particulars.

Additionally, here are things to avoid:

- Don't forget to provide your social security number or employer identification number, if applicable. This is crucial for identifying your claim.

- Don't send original documents with your form. Instead, attach copies and keep the originals for your records.

- Don't use this form to file a request for payment of an administrative expense. Such requests must be filed pursuant to 11 U.S.C. §503.

- Don't leave out any required details about collateral if your claim is secured. This includes the type of collateral and its value.

- Don't ignore the boxes that ask if your address is different from what the bankruptcy court has on file or if you haven't received any notices from the bankruptcy court.

- Don't attempt to file a fraudulent claim. Remember that there are severe penalties for doing so, including fines up to $500,000 and imprisonment for up to 5 years.

Following these guidelines will help ensure your Proof of Claim form is filled out accurately and completely, streamlining the bankruptcy process for all involved parties.

Misconceptions

There are several misconceptions about the Utah B10 form, officially known as the Proof of Claim form used in the United States Bankruptcy Court for the District of Utah. Clearing up these misconceptions is essential for creditors or entities wishing to file a claim in a bankruptcy case. Below are seven common misunderstandings and the truth behind each.

Only for Secured Claims: Many believe the B10 form is exclusively for secured claims. In reality, it's for submitting any claim, whether secured, unsecured, or priority, against a debtor's estate.

Necessity of Legal Representation to File: Some think legal representation is necessary to submit this form. However, creditors can file the form themselves, although consulting with a legal professional can help ensure accuracy and compliance with bankruptcy laws.

Submission of Original Documents Required: There’s a misconception that original documents must be submitted with the form. The form clearly instructs not to send original documents, but rather copies of supporting evidence like invoices, contracts, or judgments.

Claim Amount Limited to Principal Only: Another misunderstanding is that claims can only include the principal amount owed. The form allows for interest and other charges to be included in the total claim amount if applicable.

One-Time Filing: Some creditors believe once the form is filed, no amendments can be made. However, if new information comes to light or errors are found, the claim can be replaced or amended with a new submission.

Automatic Guarantee of Payment: Filing the B10 form doesn’t guarantee payment. It merely asserts the claim within the bankruptcy process. Payment is subject to the bankruptcy court's rulings and the debtor’s estate's ability to pay.

Applicable Only to Businesses: A common misconception is that only businesses can file a claim using the B10 form. In fact, any creditor, including individuals or entities, who has a claim against the debtor can use this form.

Understanding the purpose and proper use of the B10 form can significantly impact the outcome of a bankruptcy claim. Creditors should ensure they are familiar with the form’s requirements and consult legal professionals if necessary to navigate the process effectively.

Key takeaways

Filling out the Utah B10 form correctly is essential for individuals or entities looking to file a proof of claim in a bankruptcy case. This document is a formal statement that records a creditor’s claim against a debtor who has filed for bankruptcy. Here are four key takeaways for using the B10 form effectively:

- Complete Identification Information: It's crucial to provide complete and accurate information about the debtor and the creditor. This includes the debtor's name, case number, and the creditor's name and address. If the creditor's address has changed from what was previously known to the bankruptcy court, this should be highlighted.

- Specify the Nature and Basis of the Claim: Clearly indicate the basis for the claim, such as goods sold, services performed, wages owed, or money loaned. An itemized statement of the claim, including any interest or additional charges, should be attached. This helps the court understand the origin of the debt.

- Determine the Type of Claim: Identify if the claim is secured, unsecured, or entitled to priority. For secured claims, providing a description of the collateral (e.g., real estate, motor vehicle) and its value is required. For unsecured priority claims, specify the priority of the claim as outlined in the U.S. Code §507(a).

- Supporting Documentation: Attach copies of all relevant supporting documents, such as contracts, invoices, or court judgments, to substantiate the claim. It is advised not to send original documents. If the documentation is extensive, include a summary.

By thoroughly and accurately completing the B10 form, creditors can ensure that their claims are recognized and properly considered in the bankruptcy process. It is also important to note that providing false information can have serious legal repercussions, including fines or imprisonment.

Common PDF Templates

Job Applications - Empowers veterans by specifically asking about veteran status, providing opportunities for preference in hiring where applicable.

Utah State Withholding Form - Real estate agents frequently use the Utah 1 8 form to facilitate negotiations and agreements between buyers and sellers.

Utah Professional Licensing - Provides a structured format for businesses to formally request exemption from standard business disclosure obligations.