Fill Out Your Utah 1 8 Form

In the state of Utah, navigating the complexities of legal documentation is crucial for ensuring that legal procedures are executed correctly and efficiently. Among these documents, the Utah 1 8 form stands out as a significant requirement for certain legal proceedings. This document is fundamentally designed to streamline and standardize the process, ensuring that all necessary information is accurately collected and presented. It covers various aspects, including but not limited to, personal identification details, specifics of the legal matter at hand, and pertinent statements or declarations that may be required. By serving as a comprehensive tool, the Utah 1 8 form aids in the seamless facilitation of legal processes, making it easier for both legal professionals and individuals to navigate the often complex legal landscape of the state. Understanding the nuances and specific requirements of this form is essential, as it plays a pivotal role in the smooth execution of legal responsibilities and rights within Utah.

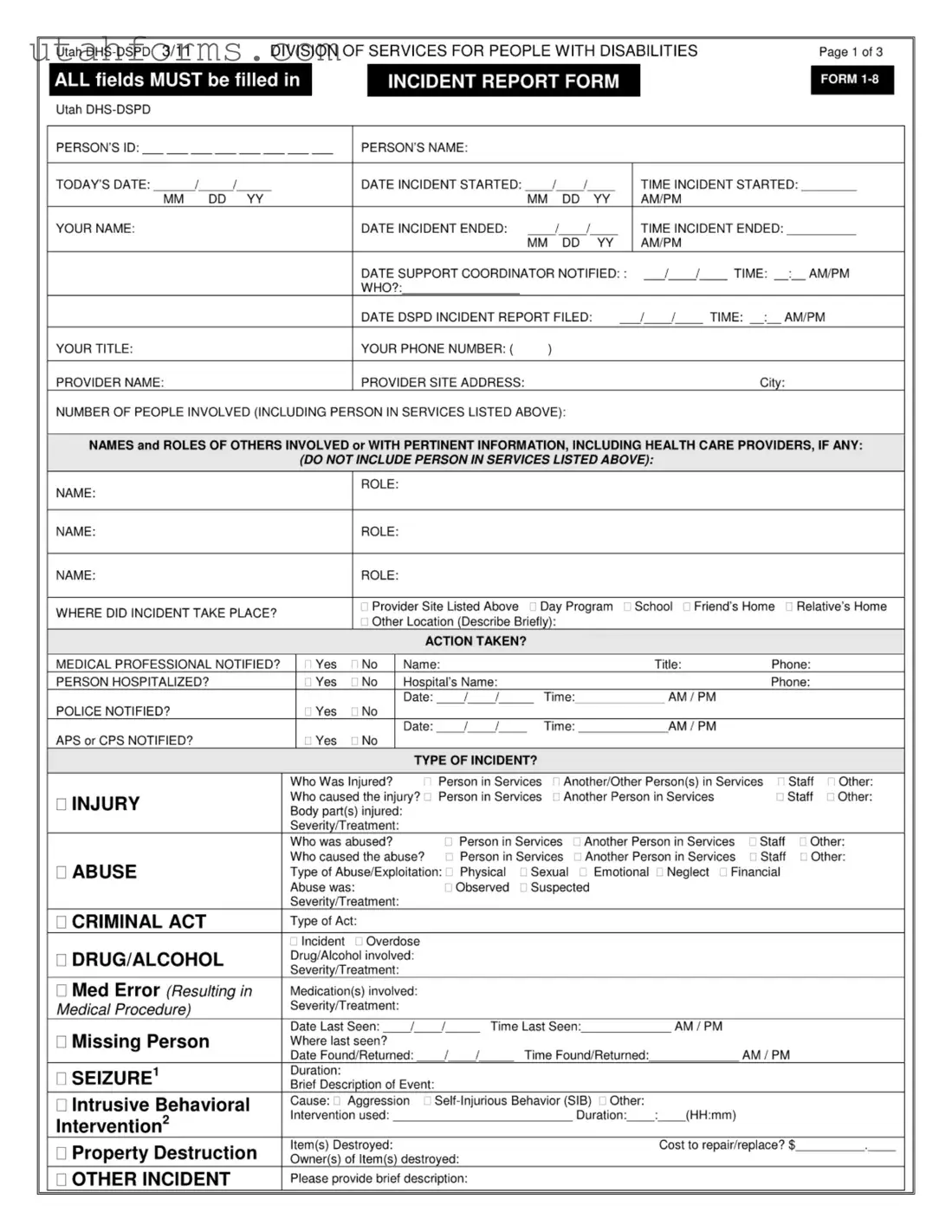

Preview - Utah 1 8 Form

File Specifications

| Fact | Detail |

|---|---|

| Purpose | The Utah 1 8 form is designed for the declaration of an individual's medical directive, serving as an advance healthcare directive in the state of Utah. |

| Governing Law | It is governed by the Utah Advance Health Care Directive Act found in Utah Code, Title 75, Chapter 2a. |

| Key Components | The form includes sections for the appointment of a healthcare agent, choice about life-sustaining treatment, and other special instructions regarding health care. |

| Validity Requirements | To be valid, the form must be either signed in the presence of a notary public or two adult witnesses who are not the healthcare agent or related to the declarant. |

| Usage | This form is used to communicate an individual's health care preferences, including end-of-life decisions, to healthcare providers and family members. |

How to Write Utah 1 8

Once you've decided to fill out the Utah 1 8 form, you're taking an important step that needs attention and accuracy. The process is straightforward, but it requires you to provide specific information accurately. Following these steps will ensure that the form is completed correctly and efficiently. Remember, this is an important document, and filling it out correctly is crucial for your next steps.

- Gather all necessary information before you start. This includes personal identification, relevant dates, and any other specific details asked for in the form.

- Begin by entering your full name (first, middle, last) in the designated area at the top of the form.

- Fill in your date of birth in the format MM/DD/YYYY.

- Next, provide your Social Security Number in the allocated space.

- Enter your full address, including street name and number, city, state, and ZIP code.

- Specify your contact details, such as your phone number and email address, to ensure you can be reached if there are questions or additional information is needed.

- If the form requests employment information, include your employer's name, address, and your role or position.

- Review the form thoroughly. Make sure all the information is correct and that no required fields are missed.

- Sign and date the form in the designated areas. Your signature is pivotal as it validates the information provided.

- Follow the instructions provided for submitting the form. This may involve mailing it to a specific address or submitting it online, depending on the form's requirements.

After you've completed and submitted the form, the process doesn't stop there. The information you provided will undergo evaluation, and you may be contacted for clarification or further details. Keep a copy of the form for your records and be prepared for the next steps. Patience and attention to detail are key throughout this process.

Frequently Asked Questions

-

What is the Utah 1 8 form used for?

The Utah 1 8 form is specifically designed for the purpose of reporting unclaimed property in the state of Utah. This form allows both businesses and individuals to report personal property that has been unclaimed for a period of time as defined by state law. It's a crucial step in ensuring that unclaimed assets are properly identified and can be returned to their rightful owners or the state after a certain period.

-

Who needs to file a Utah 1 8 form?

Any entity, whether it is a business, financial institution, or government body holding unclaimed property, is required to file a Utah 1 8 form. This includes properties such as forgotten bank accounts, unpaid wages, dividends, and customer overpayments. The duty to file this form arises when the property has gone unclaimed past the dormancy period set by Utah law.

-

What is the deadline for filing the Utah 1 8 form?

The Utah 1 8 form must be filed by November 1st of each year. This deadline applies to property considered unclaimed as of the preceding June 30th. It's important for holders of unclaimed property to adhere to this deadline to avoid possible penalties for late reporting.

-

What information must be included on the Utah 1 8 form?

- Holder information, including the name and contact details of the business or individual reporting the unclaimed property.

- Details of each unclaimed property item being reported, such as description, value, and the owner's last known address, if available.

- Date when the property became unclaimed.

- Relationship between the property and the owner.

-

Is there a minimum amount for property to be reportable on the Utah 1 8 form?

Yes, there is a minimum amount for property to be considered reportable on the Utah 1 8 form. Generally, unclaimed property with a value of $50 or more must be reported. However, it is recommended to review the most current guidelines provided by the Utah State Treasurer's office, as these thresholds may change.

-

How should the Utah 1 8 form be submitted?

The Utah 1 8 form should be submitted electronically through the Utah Unclaimed Property Division's online portal. This system allows for a more efficient processing and tracking of submitted forms. In certain cases, where electronic submission is not possible, the form may be allowed to be submitted in paper form, but this requires prior approval from the Unclaimed Property Division.

-

What happens if the property is reclaimed by the owner after the form is filed?

If an owner comes forward to claim the property after the form has been filed but before the property has been transferred to the state, the holder is generally responsible for removing the property from the report and resolving the claim directly with the owner. Detailed records of such transactions should be maintained by the holder in case of future audits or inquiries.

1 -

Are there penalties for not filing the Utah 1 8 form?

Yes, failing to file the Utah 1 8 form can result in penalties imposed by the state. These penalties can include fines and interest on the value of the unclaimed property that was not reported. It is critical for holders of unclaimed property to ensure compliance with the reporting requirements to avoid these penalties.

-

Where can I find more information and assistance with the Utah 1 8 form?

For more information and assistance with the Utah 1 8 form, it's best to consult the Utah State Treasurer's Unclaimed Property Division’s website. This site provides detailed guides, resources, and contact information for assistance with filing. Additionally, many professional services and legal advisors specialize in unclaimed property compliance and can provide guidance through the process.

Common mistakes

When completing the Utah 1-8 form, a common hurdle encountered by individuals involves oversight in providing complete and accurate personal information. People often neglect to double-check the form for errors, leading to discrepancies in details such as names, addresses, and identification numbers. Such inaccuracies can lead to delays or even the rejection of the form by authorities.

Another prevalent issue is the failure to thoroughly read the instructions before starting to fill out the form. This step is crucial as it provides guidance on the specific requirements for each section. By not following the instructions carefully, individuals might fill out sections inappropriately, use incorrect formats, or miss out on providing essential information.

The Utah 1-8 form requires specific documents to be attached as proof for certain sections. A frequent mistake is the omission of these required documents or the submission of documents that do not meet the criteria outlined in the form instructions. It is important to review the document requirements carefully and ensure that all submissions are complete and valid.

There are specific deadlines associated with the submission of the Utah 1-8 form. A common oversight is not adhering to these deadlines, which can result in the form being considered invalid. Timely submission is key to ensuring that the process moves forward without unnecessary delays.

In some cases, individuals forget to sign the form before submission. The signature is a vital component, as it signifies the individual's acknowledgment and agreement to the information provided on the form. An unsigned form is typically regarded as incomplete and is not processed until corrected.

Moreover, when it comes to filling out the form, here's an overview of the mistakes to avoid:

- Not verifying personal information for accuracy.

- Ignoring the detailed instructions provided for the form's completion.

- Overlooking the necessity to attach required supporting documents.

- Missing the set deadlines for submission.

- Failing to sign the form.

To mitigate these errors, individuals are encouraged to take a methodical approach to filling out the form. This includes reading all instructions carefully, adhering to specified formats, reviewing the form for completeness, and verifying all personal information. Additionally, individuals should familiarize themselves with the submission deadlines and ensure that all required documents are attached before submitting the form. By paying close attention to these details, the likelihood of errors can be significantly reduced, facilitating a smoother process.

Documents used along the form

In Utah, the 1-8 form is a crucial document, often encountered by individuals and professionals across various fields. As impactful as this form might be, its effectiveness and necessity are often maximized when accompanied by specific other documents. Each of these documents plays a unique role, ensuring comprehensive coverage, compliance with regulations, and facilitation of related processes. Here, we’ll explore five key documents often used in conjunction with the Utah 1-8 form.

- Release of Information Form: This document is essential as it authorizes the disclosure of personal information from one entity to another. It's particularly important in contexts where the Utah 1-8 form requires supplementary details that may be protected by privacy laws.

- Consent to Treat Form: In scenarios involving health or psychological assessments, this form is crucial. It grants professionals the authority to perform evaluations or treatments necessary for the processes the Utah 1-8 form is part of.

- Financial Disclosure Form: This document is often used to provide a comprehensive view of an individual's financial situation. When the Utah 1-8 form is used in contexts that require financial assessments, this document helps in presenting an accurate financial picture.

- Employment Verification Form: Employment details can be crucial in many processes involving the Utah 1-8 form. This document confirms an individual's employment status, job title, and other relevant details, ensuring that accurate employment information is available when needed.

- Property Declaration Form: When property details are relevant to the proceedings or applications involving the Utah 1-8 form, this document is key. It lists and describes owned properties, aiding in the assessment of assets and liabilities.

Utilizing the Utah 1-8 form alongside these documents ensures a thorough and compliant approach to various legal, financial, and personal processes. Each document serves to complement and complete the informational landscape the Utah 1-8 form operates within, making them indispensable tools in their respective realms.

Similar forms

The Utah 1-8 form, known for its role in real estate transactions, shares similarities with several key documents across different legal contexts. One of these is the Deed of Trust, used in many states to secure a real estate loan. Both the Utah 1-8 form and a Deed of Trust involve detailed descriptions of real property, establish certain rights and obligations related to the property, and require notarization to ensure authenticity. They serve to protect the interests of the parties involved in real estate transactions, albeit in slightly different manners.

Another document akin to the Utah 1-8 form is the Warranty Deed. Both documents are integral to the conveyance of property rights—the Warranty Deed guarantees clear title to the buyer, while the Utah 1-8 form might cover various other aspects of a real estate transaction, including stipulations specific to Utah's laws. Both require precise information about the property and the parties, and both are recorded with a local government entity to validate the transfer of ownership or interest in the property.

The Bill of Sale shares its purpose with the Utah 1-8 form in documenting the transfer of ownership, although the former is more commonly used for personal property, and the latter is for real estate. What makes them similar is their function as proof of an agreement between buyer and seller and the necessity for detailed descriptions of the property changing hands. They offer a written record that can be referred to in case of disputes or for tax purposes.

A Residential Lease Agreement, while primarily a document for renting property, shares key aspects with the Utah 1-8 form in terms of specifying details about the property, the parties involved, and the terms of the agreement. Both forms are legally binding and require the parties to adhere to the conditions set within them. They ensure that rights and responsibilities regarding a property are clear and agreed upon by all involved.

The Quitclaim Deed, often used to transfer interest in real property without a warranty of title, parallels the Utah 1-8 in its role in transferring certain rights or interests. While the Quitclaim Deed is more specific to title transfer without guarantee, both documents necessitate a legal description of the property and must be executed according to state-specific real estate laws, including notarization and recording requirements.

Loan Agreement forms share with the Utah 1-8 form the foundational aspect of detailing the terms of an agreement between two or more parties. In the case of Loan Agreement forms, the concern is money lending; for the Utah 1-8, it may involve various components of a real estate transaction. Both are vital for outlining the responsibilities and expectations of each party and ensuring there is a legally binding commitment.

The Power of Attorney, granting one party the authority to act on behalf of another, might not be primarily used in real estate like the Utah 1-8 form, but it shares the necessity for clear, legal documentation of the parties' identities and the scope of authority granted. This is crucial in situations where a party cannot personally attend to certain aspects of a transaction, necessitating a trusted individual to take legal actions on their behalf.

A Title Insurance Policy, while a product rather than a form per se, relates closely to the Utah 1-8's function in real estate transactions. Both aim to protect the parties' interests by ensuring clear property titles and helping manage the risks associated with defects in title or other legal impediments. The thorough examination of property history associated with obtaining title insurance reflects the rigorous attention to detail seen in the preparation of the Utah 1-8 form.

The Mortgage Agreement, essential for defining the terms under which a lender provides money to purchase real estate, has its intricacies reflected in the Utah 1-8 form. Both contain critical details regarding the property, the parties involved, and the conditions of the agreement, and serve to secure the interests of those entering into the transaction, especially concerning the rights to the property and the obligations of repayment.

Last but not least, the Promissory Note, primarily used in lending scenarios, overlaps with the Utah 1-8 form in its role of documenting an agreement. Though the Promissory Note focuses on the promise to repay a sum of money, and the Utah 1-8 deals with multiple aspects of real estate transactions, both are underpinned by legal requirements for precise terms, party information, and conditions under which the agreements can be altered or considered breached.

Dos and Don'ts

The Utah 1-8 form, a crucial document for various legal and administrative processes within the state, requires careful attention to detail. Ensuring accuracy and completeness is essential for a successful submission. Below are guidelines highlighting what you should and should not do when filling out this form.

Do:

Read all instructions carefully before beginning to fill out the form. Understanding each section thoroughly ensures that all necessary information is accurately provided.

Use black or blue ink if the form is to be filled out by hand. These colors are standard for legal documents and ensure legibility.

Provide accurate and current information. Double-check facts such as dates, names, and addresses to avoid any errors.

Sign and date the form where required. A missing signature can lead to the rejection of the document.

Don't:

Leave any required fields blank. If a section does not apply, write "N/A" (not applicable) to indicate that you have read and addressed every part of the form.

Use correction fluid or tape. Mistakes should be neatly crossed out, and the correct information should be printed clearly above or beside them.

Ignore the specified format for dates and other information. Adhering to the format guidelines ensures that the information is processed correctly.

Submit the form without reviewing it for completeness and accuracy. Taking the time to review can prevent delays caused by the need to correct or complete information later.

Misconceptions

Understanding the Utah 1-8 form is crucial for both legal professionals and the general public. Over time, several misconceptions have emerged about this document. Clarifying these misunderstandings can help ensure that individuals are better informed about its purpose and use.

Only for Criminal Matters: A common misconception is that the Utah 1-8 form is used solely for criminal matters. While it is often used in criminal proceedings, its application is not limited to these situations. It can also be relevant in certain civil contexts, providing critical information that supports various legal processes.

Public Access: Many believe that once filed, the Utah 1-8 form is publicly accessible. However, this is not always the case. The accessibility of these forms can be restricted, depending on the nature of the information contained within and the legal requirements respecting privacy and confidentiality.

Filled Out by Attorneys Only: Another widespread belief is that only attorneys can fill out the Utah 1-8 form. In reality, while it is advisable for legal professionals to complete or review the form to ensure accuracy and completeness, non-attorneys can fill out the form under certain circumstances, as long as they follow the provided instructions carefully.

Uniformity Across States: Some people mistakenly think the Utah 1-8 form is uniform across all states. Each state has its own forms and requirements, and the Utah 1-8 form is specific to Utah. It's important for individuals to understand the specific legal requirements and documents applicable in their state.

One-Time Use: It's often misconceived that the Utah 1-8 form is a one-time use document. In reality, the need for updating or resubmitting the form can arise as cases progress or if initial submissions contain errors or incomplete information.

Only Pertains to Adults: The belief that the Utah 1-8 form is only applicable to adults is incorrect. Depending on the case and its specific details, the form can be relevant to situations involving minors. It's critical to understand the scope of the form to recognize when it's applicable, regardless of age.

No Legal Impact: Some individuals are under the impression that the Utah 1-8 form does not have a significant legal impact. This is a false belief. The information provided in this form can have considerable implications for the legal process and outcome. It should be filled out with accuracy and seriousness, understanding its potential to influence legal decisions.

Dispelling these misconceptions is vital for anyone dealing with or interested in the legal process in Utah. An accurate understanding of the Utah 1-8 form ensures that it is used correctly, respecting its importance in the legal system.

Key takeaways

When it comes to completing and utilizing the Utah 1-8 form, it's essential to approach the task with attention to detail and a clear understanding of the process. The following key takeaways are designed to guide individuals through the steps effectively and ensure that they are making the most of the form's intended purpose.

- Accuracy is critical: Ensure all information provided on the form is accurate and current. Inaccuracies can lead to processing delays or issues with the application's acceptance.

- Read instructions carefully: Before filling out the form, thoroughly read through the instructions. Understanding each section's requirements can prevent mistakes.

- Use blue or black ink: Complete the form using either blue or black ink if completing it by hand. This ensures the form is legible and can be scanned or copied easily.

- Filling out digitally: If the option is available, consider filling out the form digitally to enhance legibility and reduce the risk of errors.

- Consult a professional if unsure: If any section of the form is confusing or unclear, consider seeking advice from a professional. A small consultation fee can prevent costly errors.

- Keep personal information secure: When submitting the form, especially online, ensure the platform is secure to protect personal information from unauthorized access.

- Confirm submission guidelines: Each organization may have specific guidelines for submitting the Utah 1-8 form. Confirm these guidelines to ensure the form is received and processed.

- Retain a copy: After submitting the form, keep a copy for personal records. This will be helpful for reference or if any disputes arise regarding the information provided.

- Timeliness matters: Be aware of any deadlines associated with the form and submit it within the required timeframe. Late submissions can result in penalties or processing delays.

By following these key takeaways, individuals can navigate the process of completing and using the Utah 1-8 form with confidence and efficiency. The aim is to simplify the process, minimize errors, and ensure the form serves its intended purpose without unnecessary complications.

Common PDF Templates

Utah Vehicle Title Transfer - Features a segment for office use only, including fields for NCIC and NLETS searches to check the vehicle’s legal status.

Utah Real Estate Contract - Contains a due-on-sale clause that may require the buyer to pay off the loan if the property is sold.

Utah State Withholding - Total wages and compensation paid to employees factor into the payroll consideration for apportioning income to Utah.