Free Transfer-on-Death Deed Form for Utah

Planning for the future, particularly when it concerns the smooth transition of property ownership after one's passing, often leads individuals to consider various legal instruments. Among these, the Utah Transfer-on-Death (TOD) Deed form stands out as a significant tool. It allows property owners in Utah to pass their real estate directly to a beneficiary without the need for the property to go through probate, which can be both time-consuming and costly. This form enables the property owner, referred to as the grantor, to retain full control over the property until their passing. The beneficiary has no legal right to the property until the death of the grantor, ensuring that the property owner's autonomy is preserved throughout their lifetime. The use of such a deed is especially appealing because it combines simplicity, efficiency, and the avoidance of unnecessary legal fees, making it an attractive option for many. Furthermore, the form itself requires particular information and formalities to be effective, including the need for proper execution, witnessing, and recording, underscoring the importance of understanding its requirements fully. Thus, the Utah TOD deed form embodies a thoughtful balance between ease of transfer and the safeguarding of the grantor's interests during their lifetime.

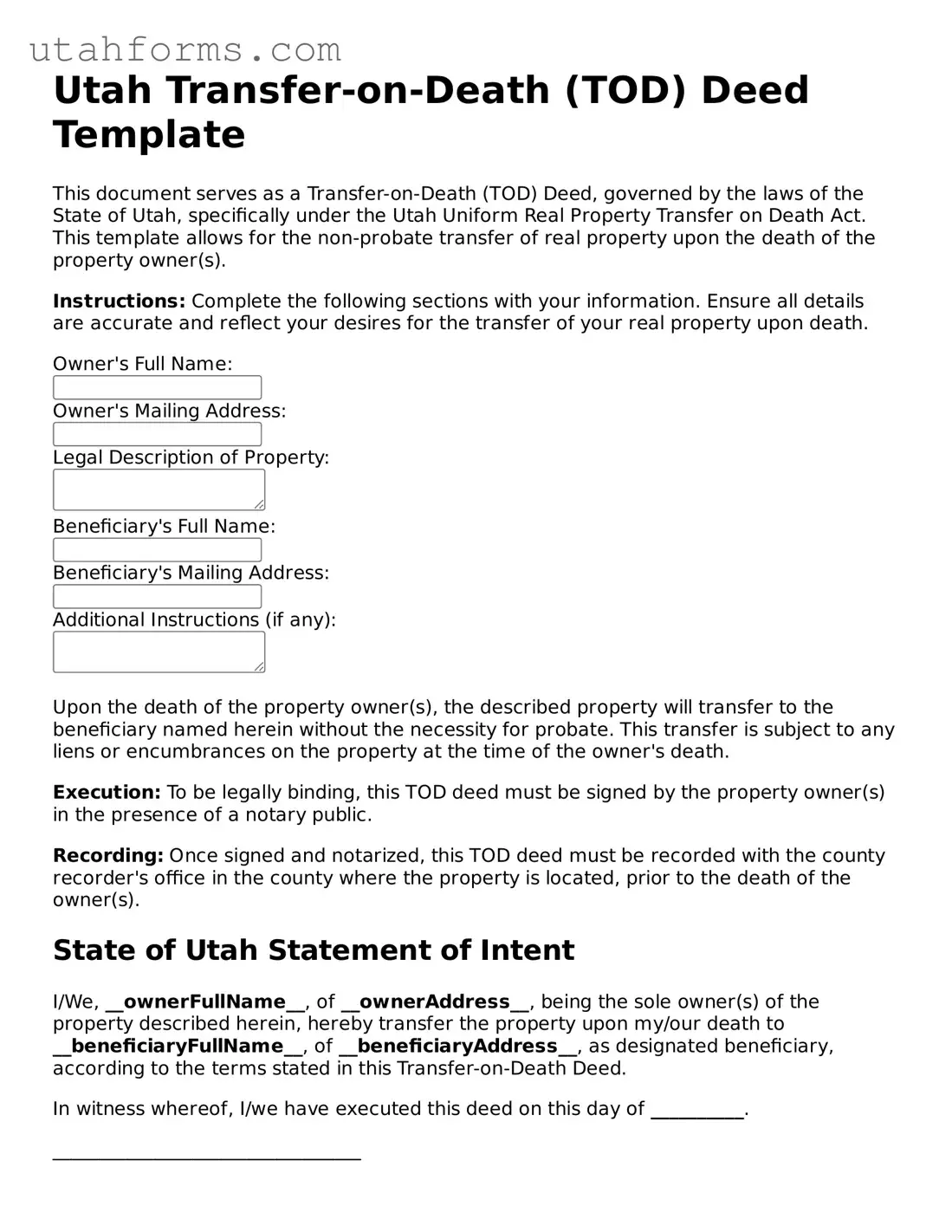

Preview - Utah Transfer-on-Death Deed Form

Utah Transfer-on-Death (TOD) Deed Template

This document serves as a Transfer-on-Death (TOD) Deed, governed by the laws of the State of Utah, specifically under the Utah Uniform Real Property Transfer on Death Act. This template allows for the non-probate transfer of real property upon the death of the property owner(s).

Instructions: Complete the following sections with your information. Ensure all details are accurate and reflect your desires for the transfer of your real property upon death.

Upon the death of the property owner(s), the described property will transfer to the beneficiary named herein without the necessity for probate. This transfer is subject to any liens or encumbrances on the property at the time of the owner's death.

Execution: To be legally binding, this TOD deed must be signed by the property owner(s) in the presence of a notary public.

Recording: Once signed and notarized, this TOD deed must be recorded with the county recorder's office in the county where the property is located, prior to the death of the owner(s).

State of Utah Statement of Intent

I/We, __ownerFullName__, of __ownerAddress__, being the sole owner(s) of the property described herein, hereby transfer the property upon my/our death to __beneficiaryFullName__, of __beneficiaryAddress__, as designated beneficiary, according to the terms stated in this Transfer-on-Death Deed.

In witness whereof, I/we have executed this deed on this day of __________.

_________________________________

Signature of Owner(s)

This document was acknowledged before me on __________ by __ownerFullName__.

_________________________________

Notary Public

My Commission Expires: __________

Document Properties

| Fact | Detail |

|---|---|

| Definition | The Utah Transfer-on-Death (TOD) Deed form allows property owners to pass their real estate to a beneficiary upon their death without the need for probate court proceedings. |

| Governing Law | Utah's Transfer-on-Death Deed is governed by the Utah Uniform Real Property Transfer on Death Act, found in Utah Code Title 75, Chapter 6, Part 4. |

| Revocability | The deed can be revoked by the property owner at any time before death, as long as the revocation is done in accordance with the law. |

How to Write Utah Transfer-on-Death Deed

Preparing a Transfer-on-Death (TOD) Deed in Utah is an important step for managing your estate. It allows you to name a beneficiary who will inherit your property without going through the probate process. After completing this form, you'll need to have it notarized and then record it with the county recorder's office where the property is located. Here are the steps to fill out the Utah TOD Deed form correctly and efficiently.

- Start by gathering all necessary information about the property, including its legal description and parcel number. This information is crucial for accurately filling out the form and can typically be found on your property deed or tax statements.

- Enter your full name as the current owner of the property in the designated section at the top of the form. It's important to use the same name that appears on the current deed of the property.

- Specify the full legal name(s) of the beneficiary(ies) whom you want to inherit the property. If you're naming more than one beneficiary, clarify how you would like them to take ownership, whether jointly, as tenants in common, or in any proportion you specify.

- Include the legal description of the property as indicated on the current deed or tax statement. This part is essential for clearly identifying the property in question.

- Add any specific conditions or stipulations regarding the transfer of the property if necessary. However, be aware that certain conditions might not be enforceably attached to a TOD Deed.

- Review the form thoroughly to ensure all information is accurate and complete. Mistakes could create complications for your beneficiary(ies) in the future.

- Sign and date the form in the presence of a notary public. The notarization is a critical step that validates the form legally.

- Finally, record the completed and notarized form with the county recorder's office where the property is located. There may be a recording fee, so it's wise to call ahead and find out the exact amount and acceptable payment methods.

After these steps are completed, the Transfer-on-Death Deed will be effective. It is a straightforward process, but it must be done properly to ensure that your property is transferred according to your wishes after your death. Remember, this deed can be revoked or changed at any time before your passing, as long as the changes are duly recorded. It's also wise to consult with a legal professional to understand fully how this deed fits into your estate planning strategy.

Frequently Asked Questions

-

What is a Transfer-on-Death Deed in Utah?

A Transfer-on-Death Deed (TODD) in Utah is a legal document that allows property owners to pass their real estate directly to a beneficiary upon their death without the need for probate court proceedings. This efficient tool helps in simplifying the transfer of property, ensuring that it goes directly to the intended person or persons.

-

Who can use a Transfer-on-Death Deed in Utah?

Any property owner in Utah can use a Transfer-on-Death Deed to designate a beneficiary for their real estate. This includes individual owners as well as those who hold the property in joint tenancy or as tenants by the entirety. It’s important that the property owner has the legal capacity to execute the deed.

-

How does one create a Transfer-on-Death Deed in Utah?

Creating a TODD in Utah requires drafting the deed document that includes the legal description of the property, the name of the beneficiary, and a statement that the transfer will occur at the owner’s death. The deed must be signed by the property owner in the presence of a notary public to be valid. Once notarized, the deed should be filed with the county recorder’s office in the county where the property is located.

-

Can a Transfer-on-Death Deed in Utah be revoked?

Yes, a Transfer-on-Death Deed in Utah can be revoked by the property owner at any time before their death. This can be done by executing a new TODD that expressly revokes the previous one or contradicts its terms, transferring the property to someone else, or by filing a formal revocation document with the county recorder’s office.

-

Is a Transfer-on-Death Deed in Utah subject to any taxes?

While a Transfer-on-Death Deed itself does not trigger any immediate taxes, the inherited property may be subject to federal estate tax or state inheritance tax, depending on the value of the estate and the tax laws in effect at the time of the property owner’s death. It is wise to consult with a tax advisor to understand any potential tax implications.

-

What happens to a mortgage on a property transferred by a Transfer-on-Death Deed in Utah?

When a property is transferred by a TODD, any existing mortgage on the property remains. The beneficiary who inherits the property will be responsible for continuing the mortgage payments if they wish to retain ownership of the property. It’s important for property owners to consider this when naming a beneficiary.

-

Can a property owner name multiple beneficiaries on a Transfer-on-Death Deed in Utah?

Yes, a property owner can name multiple beneficiaries on a TODD in Utah. The property owner can specify how the beneficiaries will hold the property, whether equally as tenants in common or in other proportions. Instructions should be clear to avoid confusion after the property owner's death.

-

Does a beneficiary need to take any action to accept the property transferred by a Transfer-on-Death Deed?

After the death of the property owner, the beneficiary or beneficiaries must file a death certificate and a notarized affidavit with the county recorder’s office to officially transfer the property into their names. These steps must be completed to recognize the transfer legally and to reflect the change in ownership in the public records.

-

How does a Transfer-on-Death Deed affect Medicaid eligibility in Utah?

Creating a TODD may have implications for Medicaid eligibility, as it could be considered an asset transfer. Utah’s Medicaid program may apply a penalty period for those who transfer assets below fair market value within a certain timeframe before applying for Medicaid. Individuals considering a TODD as part of their estate planning should consult with an attorney or a Medicaid planning professional to understand the potential impacts.

Common mistakes

When it comes to planning for the future, a Transfer-on-Death (TOD) Deed can be a valuable tool for seamlessly passing real estate to a beneficiary without the need for probate. However, when filling out the Utah Transfer-on-Death Deed form, it's crucial to avoid common mistakes that could potentially invalidate the document or lead to unintended consequences. Here are five errors individuals frequently make:

- Not providing specific details about the property. One of the most critical aspects of the TOD Deed is the description of the property. It is not sufficient to merely list an address; a legal description is required. This includes lot numbers, subdivision names, or any other details that appear on the property's deed. An inaccurate or incomplete description can lead to disputes or confusion about what property is actually being transferred.

- Failing to properly identify the beneficiary. Just as with the property, specificity is key when identifying the beneficiary. Simply putting down a first name or a nickname could lead to challenges in identifying the intended recipient of the property. It is wise to use full legal names and, if possible, include additional identifying information such as an address or relationship to you.

- Overlooking the need for witness signatures. Under Utah law, like in many states, a TOD Deed must be notarized to be valid. However, individuals often forget that the presence of witnesses may also be required when the deed is signed. Neglecting this step can render the document unenforceable.

- Assuming it overrides other estate planning documents. Some people incorrectly believe that the TOD Deed supersedes other estate planning documents, such as wills or trusts. However, this is not the case. If there are conflicting directives in different documents, it could lead to lengthy legal battles. It's important for all estate planning documents to be consistent and for a TOD Deed to be integrated into a broader estate plan.

- Omitting the revocation process when changing intentions. Life circumstances change, and there may come a time when you wish to revoke a TOD Deed or change the beneficiary. Failing to officially revoke or amend the deed according to Utah law will mean the original deed remains in effect. It's not enough to simply destroy the document or create a new one without following the proper legal procedures for revocation.

In summary, while a Transfer-on-Death Deed offers a straightforward method for transferring property, attention to detail is paramount. Ensuring that the property and beneficiary are correctly described, that all necessary signatures are obtained, and that the deed is properly integrated into your overall estate plan can help avoid complications after your passing. Always consider consulting with a legal professional to ensure that your estate planning documents accurately reflect your wishes and comply with current Utah law.

Documents used along the form

The Utah Transfer-on-Death (TOD) Deed form allows property owners to pass their real estate to a designated beneficiary without the need for a traditional will or going through probate court upon their passing. While this document is powerful and provides a smooth transition of property, it is often accompanied by several other documents to ensure that all aspects of the transfer are clear, lawful, and adequately planned. Here is a look at some of the other forms and documents frequently used together with the Utah Transfer-on-Death Deed form to complete a comprehensive estate plan.

- Revocable Living Trust Agreement: This document allows the creator to maintain control over their assets while alive but ensures these are transferred to designated beneficiaries upon death, often without the need for probate.

- Will: Even with a TOD Deed in place, having a will is crucial as it covers any property or assets not included in the TOD Deed. It is an essential backup document that speaks to the person's final wishes.

- Financial Power of Attorney: This form designates someone to make financial decisions on behalf of the person if they become incapacitated, ensuring that their financial matters are handled according to their wishes.

- Medical Power of Attorney: Similar to a Financial Power of Attorney, this document appoints someone to make healthcare decisions on behalf of the individual, in case they are unable to make these decisions themselves.

- Living Will: Also known as an advance healthcare directive, it outlines the person's wishes for medical treatment and life-sustaining measures in the event they are unable to communicate these wishes themselves.

- Designation of Beneficiary Forms: Often used for assets not covered by a TOD Deed or a trust, such as retirement accounts, these forms designate who will receive the assets upon the owner's death.

- Property Inventory: While not a legal document, keeping a detailed list of personal and real property can aid in the estate planning process, ensuring that nothing is overlooked when creating or updating estate documents.

Ensuring all these documents are part of your estate planning process, alongside the Utah Transfer-on-Dead Deed, will provide a comprehensive approach to managing and transferring assets. Each document plays a pivotal role in covering different aspects of your estate, making the process more efficient and less stressful for your loved ones. As with any legal document or process, consulting with a legal professional to understand the best course of action for your personal situation is always recommended.

Similar forms

The Utah Transfer-on-Death (TOD) Deed shares similarities with a Last Will and Testament, primarily in its function to distribute property upon death. Both documents allow individuals to specify how their assets should be passed on after they die, ensuring their wishes are respected. However, while a Last Will and Testament requires probate, a process that can be lengthy and costly, a Transfer-on-Death Deed bypasses this procedure, offering a smoother transition of real estate ownership directly to the named beneficiary.

Living Trusts bear a resemblance to the TOD Deed in that they both provide a mechanism for transferring assets upon the grantor's death without the need for probate. Living Trusts, however, are more comprehensive, allowing for the inclusion of various assets and providing detailed instructions for their management and distribution. In contrast, the TOD Deed is specific to real estate and does not cover other aspects of estate planning or asset distribution.

Joint Tenancy Agreements, particularly those with the right of survivorship, share common ground with TOD Deeds since they allow for the direct transfer of property to the surviving owner(s) upon one's death. Much like a TOD Deed, this arrangement avoids probate. However, while Joint Tenancy takes effect as soon as it is established, affecting ownership rights immediately, the Transfer-on-Death Deed only activates upon the death of the owner, allowing them full control over the property until that time.

The Beneficiary Deed, as it's known in some jurisdictions, is essentially identical to the Transfer-on-Death Deed. This document directly allows homeowners to name beneficiaries who will inherit their property upon death, bypassing the traditional probate process. The primary difference lies in terminology and specific legal nuances that might vary from one state to another, but the core purpose and function of the document remain consistent.

Lastly, the Payable-on-Death (POD) Accounts agreement, usually associated with bank accounts and other financial instruments, parallels the principle behind the TOD Deed. Both designate beneficiaries to receive assets upon the account holder or property owner's death, circumventing the probate process. While the POD applies to financial accounts and assets, the Transfer-on-Death Deed applies specifically to real estate property, both achieving similar goals through slightly different legal tools.

Dos and Don'ts

When it comes to ensuring your assets are smoothly transferred to your loved ones, the Utah Transfer-on-Death (TOD) Deed can be a valuable tool. However, proper completion of this form is essential for its effectiveness. Here are some critical dos and don'ts to keep in mind when filling out the Utah TOD Deed form:

- Do thoroughly read the instructions before you begin. Understanding the specifics can help avoid any mistakes that could invalidate the deed.

- Do ensure you have the legal description of the property. This is not just the address but the official description used in real estate documents.

- Do confirm the form is filled out completely. Incomplete forms may not be considered valid and can lead to complications later.

- Do sign the document in front of a notary public. This step is critical to authenticate the deed.

- Do file the deed with the county recorder’s office where the property is located. This makes the deed a matter of public record and is necessary for it to be enforceable.

- Don't forget to consider all your beneficiaries. It’s important to clearly identify everyone you wish to receive a stake in the property upon your passing.

- Don't ignore the need to revoke the deed if your circumstances change. Remember, as long as you are alive, you can adjust your plans. A new deed can be executed if you wish to change or nullify the previous one.

By following these guidelines, you ensure that the Transfer-on-Death Deed is filled out accurately, reflecting your intentions and making the transition as smooth as possible for your beneficiaries. Remember, although this document is powerful, it's just one part of a comprehensive estate plan. Consulting with a legal professional can provide you with tailored advice to suit your individual needs.

Misconceptions

When considering estate planning in Utah, many individuals have heard of the Transfer-on-Death (TOD) deed form. This document allows property owners to designate a beneficiary to inherit their real estate upon their death without the property having to go through probate. However, there are several misconceptions about the TOD deed form that need clarification:

It's not universally available: While Utah law allows the use of TOD deeds, they're not suitable for every type of property. Specific conditions must be met for the deed to be valid.

A TOD deed avoids probate for all your assets: This is incorrect. The TOD deed only avoids probate for the specific property named in the deed. Other assets not similarly designated will still go through probate.

There's no need for a will if you have a TOD deed: Even with a TOD deed in place for your real estate, having a will is crucial. A will covers assets not included in the TOD deed and can address other important issues like guardianship for minor children.

A TOD deed is irrevocable: Actually, one of the benefits of a TOD deed is that it's revocable. The property owner can change the beneficiary at any time before their death.

Creditors can't claim against the property transferred by a TOD deed: This is a misconception. Creditors may still have a claim against the inherited property, depending on the debts of the estate.

Setting up a TOD deed is complicated: Filing a TOD deed involves completing the form and recording it with the county recorder's office. While the process is straightforward, seeking professional advice to ensure it's done correctly is often beneficial.

Jointly owned property cannot pass through a TOD deed: Jointly owned property can indeed pass through a TOD deed, but the deed will only take effect after the death of the last surviving owner.

Beneficiaries of a TOD deed immediately take control of the property upon the owner's death: While the beneficiary has the right to the property, they must often take specific steps, like filing a death certificate, to finalize the transfer.

You can't cancel a TOD deed once it's created: Property owners have the right to revoke or change a TOD deed any time before their death as long as they follow the legal procedure to do so.

Understanding these misconceptions about the Utah Transfer-on-Death Deed can help individuals make informed decisions about their estate planning. It's always recommended to seek professional guidance when considering the use of a TOD deed to ensure that it aligns with one's overall estate planning goals.

Key takeaways

The Utah Transfer-on-Death (TOD) Deed form allows property owners to pass their real estate to a beneficiary without the need for probate court involvement after they die. Understanding how to properly fill out and use this form is crucial for ensuring that the transfer of property goes smoothly and according to the property owner's wishes. Here are some key takeaways to consider:

- Eligibility: The form can be used by individuals who hold the title to real property in Utah. This includes owners of homes, condos, and certain types of land.

- Choosing beneficiaries: A property owner can name one or more beneficiaries, including individuals, trusts, or organizations, to inherit the property upon their death.

- Notarization is required: For the Transfer-on-Death Deed to be legally valid, it must be signed in front of a notary public.

- Witnesses: Unlike some other estate planning documents, Utah does not require the TOD Deed to be signed by witnesses.

- Filing the deed: After it is signed and notarized, the deed must be filed with the county recorder’s office in the county where the property is located. This step is essential to make the deed effective.

- Revocability: The owner can revoke the TOD Deed at any time before death, as long as the revocation is done according to Utah law. This provides flexibility if circumstances or wishes change.

- Impact on property rights: The TOD Deed does not affect the owner’s rights to use, rent, sell, or mortgage the property during their lifetime.

- Does not override joint tenancy: If the property is owned as joint tenants with rights of survivorship, the TOD Deed will not take effect until the last surviving owner dies.

- Seek legal advice: Given the legal complexities and potential tax implications, consulting with a legal professional is strongly recommended to ensure that the deed aligns with the overall estate plan.

By carefully adhering to these guidelines, property owners can ensure their real estate is transferred directly to their named beneficiary with minimal legal hurdles, providing peace of mind to all parties involved.

Other Popular Utah Templates

Last Will and Testament Template Utah - The official instrument through which a person can express their wishes for the distribution of their estate and custody arrangements.

Free Living Will Form Utah - This document can be revised or revoked at any time, allowing for changes in medical preferences as circumstances evolve.

Creating an Operating Agreement - It can include provisions for admitting new members and handling the departure of existing members.