Free Tractor Bill of Sale Form for Utah

In the scenic landscapes of Utah, where agriculture plays a pivotal role in the local economy, buying or selling a tractor is a significant transaction that necessitates clear documentation. The Utah Tractor Bill of Sale form is an essential document that solidifies this transaction, offering peace of mind and legal clarity for both parties involved. It serves a dual purpose: not only does it act as a receipt for the transaction but also as a vital record reflecting the change of ownership. This form meticulously captures all the necessary details such as the make, model, year, and serial number of the tractor, alongside the personal information of both the seller and the buyer. Moreover, it underscores the importance of transparency by including the sale price, terms of the deal, and any warranties or representations made. For those engaged in the agricultural sector or in need of heavy machinery in Utah, understanding the nuances of this form is paramount to ensuring that the sale is recognized legally, safeguarding the interests of both parties involved.

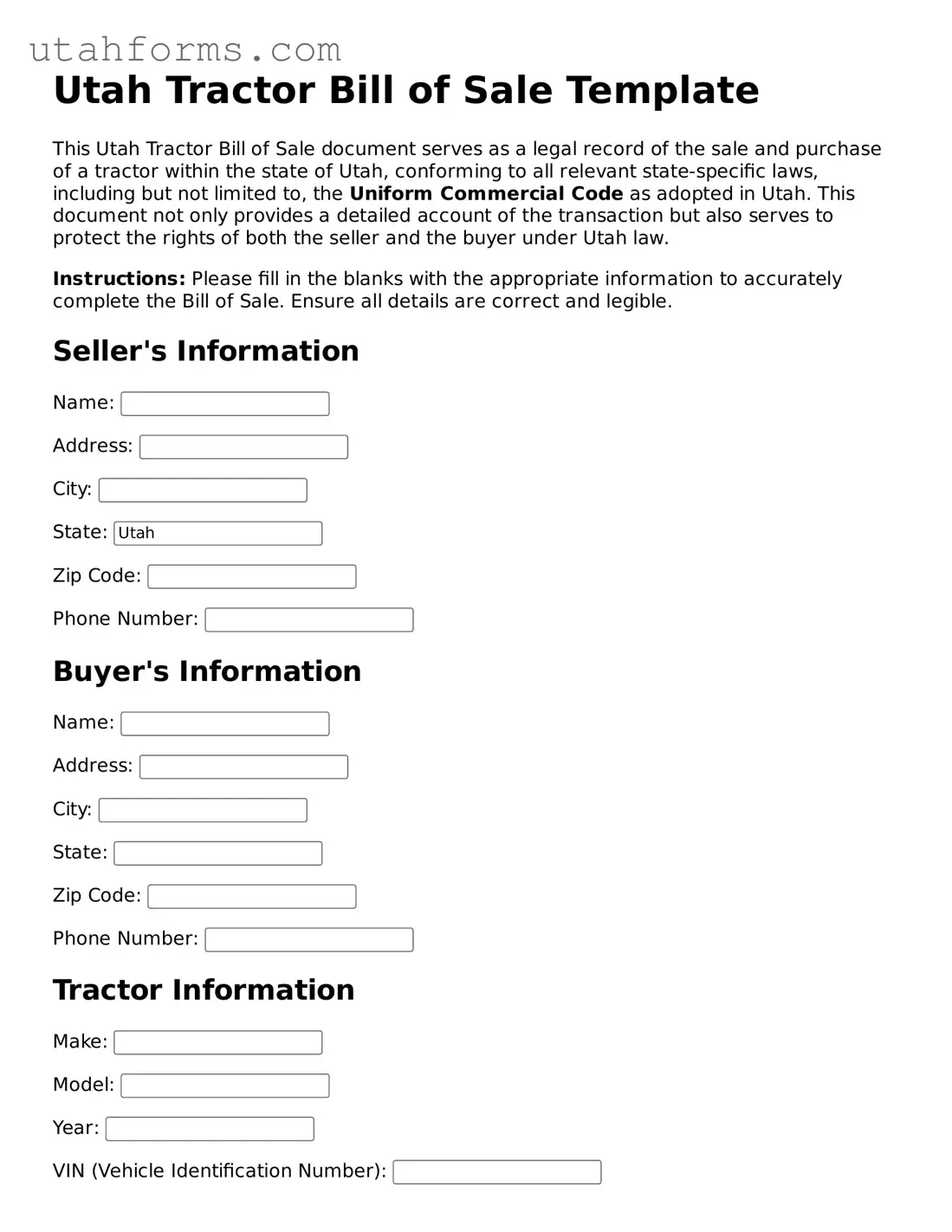

Preview - Utah Tractor Bill of Sale Form

Utah Tractor Bill of Sale Template

This Utah Tractor Bill of Sale document serves as a legal record of the sale and purchase of a tractor within the state of Utah, conforming to all relevant state-specific laws, including but not limited to, the Uniform Commercial Code as adopted in Utah. This document not only provides a detailed account of the transaction but also serves to protect the rights of both the seller and the buyer under Utah law.

Instructions: Please fill in the blanks with the appropriate information to accurately complete the Bill of Sale. Ensure all details are correct and legible.

Seller's Information

Name:

Address:

City:

State:

Zip Code:

Phone Number:

Buyer's Information

Name:

Address:

City:

State:

Zip Code:

Phone Number:

Tractor Information

Make:

Model:

Year:

VIN (Vehicle Identification Number):

Color:

Mileage:

Sale Information

Date of Sale:

Sale Amount ($):

Method of Payment:

- Cash

- Check

- Other:

Additional Terms and Conditions

Please detail any additional terms and conditions of the sale below:

Signatures

Both parties agree that all the information listed above is accurate and true to the best of their knowledge. This bill of sale will be considered valid and legally binding once signed by both the seller and the buyer.

Seller's Signature: __________________________________ Date: ___________

Buyer's Signature: __________________________________ Date: ___________

Note: It is highly recommended that both parties retain a copy of this document for their records and potential future needs such as registration or dispute resolution.

Document Properties

| Fact | Description |

|---|---|

| Purpose | This form serves as a legal document that evidences the sale and transfer of ownership of a tractor from the seller to the buyer in the state of Utah. |

| Key Information Included | It typically includes details such as the names and addresses of the buyer and seller, the sale date, the purchase price, a description of the tractor (make, model, year, and VIN), and any warranty information. |

| Governing Law | This form is governed by Utah state law, particularly the provisions relating to the sale of personal property and motor vehicles, which may include the Utah Uniform Commercial Code. |

| Notarization Requirement | While not always required, notarization of the bill of sale may be needed for the document to be used in certain legal or registration processes in Utah. |

| Benefit for Buyer and Seller | For the seller, it provides proof that the transaction has been completed and releases them from liability concerning the tractor. For the buyer, it is crucial for registering the tractor in their name and serves as proof of ownership. |

How to Write Utah Tractor Bill of Sale

When you're involved in buying or selling a tractor in Utah, it's essential to document the transaction formally. Completing a Tractor Bill of Sale form is a straightforward way to ensure that all the details of the sale are legally recorded. This procedure not only provides proof of purchase but also details the condition and exact terms of the sale. In essence, filling out this form diligently can help protect both parties involved in the transaction, should any disputes or misunderstandings arise later. Here are the steps necessary to accurately complete the Utah Tractor Bill of Sale form.

- Start by entering the date of the sale at the top of the form. Ensure that the date format follows the local convention (MM/DD/YYYY for Utah).

- Next, provide the full legal names of both the seller and the buyer. Include their complete addresses as well. This identifies the parties involved in the transaction.

- Describe the tractor in detail. Include its make, model, year, identification number, and any additional details that could help identify it, such as color or specific features. This aids in the accurate identification of the tractor being sold.

- Indicate the sale price of the tractor in the appropriate section. Write this amount in both words and numbers to ensure clarity.

- If applicable, outline any conditions or warranties that the seller is including with the sale. Be clear about what is being promised, if anything, to avoid future disputes.

- Both the seller and the buyer must sign the form. These signatures officially seal the agreement and indicate that both parties agree to the terms as described on the form.

- For added security and proof of the transaction, it's recommended to have the signatures witnessed or notarized. While not always a legal requirement, this step can provide additional verification of the document's authenticity.

Once the form is fully completed and signed, both the seller and the buyer should keep a copy for their records. This document will serve as a receipt for the buyer, showing proof of ownership, and for the seller, it can be an important record for tax and liability reasons. Additionally, should any legal issues arise related to the sale of the tractor, having this bill of sale can be invaluable in resolving those disputes. By following these steps carefully, you can ensure that your tractor sale in Utah is properly documented, providing peace of mind to both seller and buyer.

Frequently Asked Questions

-

What is a Tractor Bill of Sale form in Utah?

A Tractor Bill of Sale form in Utah is a legal document that records the sale and transfer of ownership of a tractor from a seller to a buyer. It serves as proof of purchase and documents the specific details of the transaction, including the parties involved, the date of sale, and the tractor's description.

-

Why is it important to have a Tractor Bill of Sale in Utah?

Having a Tractor Bill of Sale is important for several reasons. It provides legal protection for both the buyer and the seller by documenting the transaction's specifics. For the buyer, it serves as proof of ownership, which is necessary for registration and insurance. For the seller, it releases them from future liability concerning the tractor.

-

What information should be included in the Tractor Bill of Sale?

- The date of the sale

- Full names and addresses of the seller and the buyer

- A detailed description of the tractor (make, model, year, serial number)

- The sale price

- Any warranties or "as-is" condition statements

- Signatures of both the seller and the buyer

- Notarization, if required

-

Do you need to notarize the Tractor Bill of Sale in Utah?

While notarization is not a requirement for a Tractor Bill of Sale in Utah, having the document notarized can add an extra layer of legal protection. Notarization confirms the identity of the parties and the authenticity of their signatures.

-

How does a Tractor Bill of Sale protect the buyer?

The document protects the buyer by providing evidence of the transfer of ownership. Should any disputes or claims arise regarding the tractor's ownership or condition after the sale, the Bill of Sale can be used as evidence in legal proceedings.

-

How does a Tractor Bill of Sale protect the seller?

For the seller, the Bill of Sale serves as a record that they have fulfilled their obligation by transferring ownership of the tractor to the buyer. It helps avoid future legal issues or liability related to the tractor's use or condition after the sale.

-

Is a Bill of Sale the same as a title?

No, a Bill of Sale is not the same as a title. The Bill of Sale documents the transaction between the buyer and the seller, while the title is a legal document that officially records the ownership of the tractor. In Utah, a title transfer should accompany the Bill of Sale to complete the change of ownership.

-

Can I create my own Tractor Bill of Sale template?

Yes, individuals in Utah can create their own Tractor Bill of Sale template. However, it is important to ensure that the document includes all the necessary information to be legally valid. Seeking guidance from a legal professional or using a state-provided template is recommended to avoid any issues.

-

Where can I obtain a Tractor Bill of Sale form in Utah?

Tractor Bill of Sale forms in Utah can be obtained online through legal document providers or state government websites. Additionally, individuals may seek assistance from legal professionals who can provide a template or help create a customized Bill of Sale that meets all legal requirements.

Common mistakes

When completing the Utah Tractor Bill of Sale form, several common mistakes can lead to unnecessary complications. Ensuring accuracy and thoroughness when filling out this document is crucial for both the seller and the buyer. Doing so will help to avoid potential legal issues or misunderstandings in the future.

One frequent error is not providing detailed descriptions of the tractor. It's important to include all relevant details such as the make, model, year, and any identifying features or modifications. This specificity ensures the tractor is easily identifiable and helps to prevent disputes regarding the vehicle’s condition or specifications.

Another mistake is failing to verify the accuracy of both parties' personal information. This includes the full names, addresses, and contact information of the seller and buyer. Accurate records are vital for any future communications or legal necessities. Misinformation can lead to significant delays or complications in the transaction process.

Omitting the date of sale is also a common oversight. This date is crucial because it marks the official transfer of ownership. It can affect warranty periods, liability, and other time-sensitive issues. Remembering to include this can prevent legal uncertainties related to the timing of the sale.

Forgetting to include the purchase price is another error that occurs frequently. Both parties need clarification on the agreed price, as it is essential for tax purposes and in case of any future disagreements about payment terms.

Lastly, not obtaining or providing a signature from both parties can invalidate the whole document. A signature legally binds the agreement, confirming that both the buyer and seller agree to the terms. Skipping this step can lead to the sale being legally unenforceable.

Addressing these mistakes before completing the Utah Tractor Bill of Sale form can smooth the process for everyone involved. By focusing on accuracy, legality, and clarity, you can lay a solid foundation for a smooth transaction. This care not only protects both parties but also ensures that the transfer of ownership complies with all applicable laws and regulations.

Documents used along the form

When handling the transfer of ownership for a tractor in Utah, it's common to focus primarily on the Bill of Sale. However, it’s equally important to be familiar with several other forms and documents that often accompany this key document in the process. These additional documents help ensure a smooth and legally compliant transaction, providing clear evidence of the transfer and safeguarding the interests of both buyer and seller.

- Proof of Ownership Document: This is essential for verifying the seller's right to sell the tractor. It could be an original purchase receipt, a manufacturer's statement of origin, or a prior title document if applicable.

- Title Application: Required for the buyer to legally register the tractor under their name, assuming the tractor is of a type that needs titling. This application is submitted to the local DMV (Department of Motor Vehicles) or similar authority. UT

- Tractor Insurance Proof: Some buyers might need to submit evidence of insurance to the DMV, especially if the tractor is intended for use that could impact public safety or infrastructure.

- Odometer Disclosure Statement: Although more commonly associated with motor vehicles, for certain types of tractors, especially those that are road-used, disclosing the odometer reading might be a legal requirement to ensure accurate mileage is reported.

- Sales Tax Certificate: Depending on the sale's specifics and local laws, either the buyer or seller may need to submit proof that sales tax has been paid or report the transaction for tax assessment purposes.

- Release of Liability or Notice of Transfer: This document, submitted to the DMV by the seller, officially releases them from responsibility for the tractor after the sale. It is a crucial step to protect the seller from potential liabilities.

- Inspection Certificates: For certain classes of tractors, particularly those used commercially or on roads, an inspection certificate proving the tractor meets safety and environmental standards may be required.

While navigating the complexities of a tractor sale in Utah, it’s pivotal to approach the process with a comprehensive understanding of all the requisite documentation. Doing so not only ensures compliance with state regulations but also provides peace of mind to both parties involved in the transaction. These documents collectively support the Bill of Sale, creating a robust framework that upholds the legality and integrity of the transfer.

Similar forms

The Utah Tractor Bill of Sale form shares similarities with a Vehicle Bill of Sale, often used when buying or selling a car, truck, or motorcycle. Both documents serve as legal proof of a transaction, detailing the transfer of ownership from the seller to the buyer. They typically include the sale date, purchase price, and specifics about the item sold, such as make, model, and identification number. These forms are crucial for registration, tax, and legal purposes, ensuring that all parties have a record of the sale.

Similar to a Boat Bill of Sale, the Utah Tractor Bill of Sale form documents the sale of a specific item — in this case, a tractor, whereas for the boat form, a watercraft. Each form includes pertinent details like the vessel's or tractor's description, the sale amount, and the parties' information. Both documents are essential for recording the transfer of ownership and can be necessary for registration with the respective state authorities, protecting both buyer and seller interests.

A Firearms Bill of Sale closely mirrors the structure and function of the Utah Tractor Bill of Sale form. This document is used in the transfer of ownership of a firearm from one party to another. It provides a detailed record of the transaction, including personal details of the buyer and seller, firearm specifics, and the sale price. Similar to the tractor bill of sale, a firearms bill of sale helps ensure legal compliance and serves as proof of ownership and transaction validity.

Another similar document is the Equipment Bill of Sale, which is used for the sale and purchase of machinery and equipment other than tractors. Like the tractor bill of sale, it outlines the transaction details, including the equipment description, parties' information, and sale conditions. This form is vital for business transactions, providing a legal record of the ownership transfer of valuable equipment assets.

The Pet Bill of Sale is an agreement documenting the sale of animals, including pets. While considerably different in what it sells, this form functions similarly to the tractor bill of sale by detailing the exchange between seller and buyer, including the animal's description and the sale's terms and conditions. Both forms formalize the agreement in writing, providing legal evidence of the transaction.

The Aircraft Bill of Sale resembles the tractor bill of sale in that it documents the sale of a high-value asset — in this case, an aircraft versus a tractor. Both forms include comprehensive details about the asset sold, identification numbers, sale price, and the parties involved. They are crucial for registration purposes with the appropriate government agencies, serving as legal proof of the ownership transfer.

The Business Bill of Sale is used when an entire business, or a portion of its assets, is being sold, akin to the singular focus of a tractor in the tractor bill of sale. Both documents record the details of the transaction, including descriptions of what's being sold (whether a business or a tractor), the agreed-upon price, and the identities of the transaction parties. This facilitates a smoother transition of ownership and helps in legal and tax documentation.

Real Estate Sale Contracts, while covering the sale of real property rather than movable assets like tractors, share the purpose of formally documenting the details of a transaction. Both this contract and the tractor bill of sale include specific information about the item being sold, the agreed price, and party information, ensuring that the transfer of ownership is legally recorded.

The General Bill of Sale is a broad document that can be used for various items, including tractors, vehicles, equipment, and more, making it inherently similar to the tractor bill of sale. It serves as a catch-all document to prove the sale and transfer of ownership of personal property. The general form includes transaction details such as the description of the sold item, sale price, and participant identities, providing a legal safeguard for both buyer and seller.

Finally, the Livestock Bill of Sale parallels the tractor bill of sale when it comes to the sale of farm-related assets, except it focuses on animals rather than equipment. It contains specifics about the livestock sold, the parties involved, and the sale conditions. Both forms are pivotal for farmers and ranchers, ensuring that the sale is legally documented and the transfer of ownership is clearly established for registration, tax, and personal record-keeping purposes.

Dos and Don'ts

When dealing with the Utah Tractor Bill of Sale form, it's crucial to handle the document properly to ensure a smooth transaction and protect both buyer and seller. Below are some key do's and don'ts to consider:

Do:

- Verify the accuracy of all information. Make sure the details like the tractor’s make, model, year, and serial number match the actual machine.

- Include clear contact information for both the buyer and seller, such as full names, addresses, and phone numbers, to ensure easy communication.

- Ensure the sale price is clearly stated and agreed upon by both parties, to avoid future disputes.

- Sign and date the bill of sale in the presence of a notary, if required by Utah law or local statute, to add a layer of legal protection and authenticity.

- Keep a copy of the completed bill of sale for both the buyer and seller’s records, providing proof of transaction and ownership transfer.

Don't:

- Leave any sections of the form blank. An incomplete bill of sale can lead to misunderstandings or legal issues down the line.

- Forget to check if additional documentation is required by Utah law. Sometimes, titles or other transfer documents must accompany the bill of sale.

By following these guidelines, you can ensure a valid and enforceable Utah Tractor Bill of Sale that protects all parties involved in the transaction. Always remember, when in doubt, consulting with a legal professional can provide clarity and confidence throughout the process.

Misconceptions

When it comes to transferring ownership of a tractor in Utah, the Tractor Bill of Sale form is an essential document. However, there are several misconceptions surrounding its use and requirements. Understanding these can help ensure a smoother transaction process for both buyers and sellers. Here are nine common misconceptions about the Utah Tractor Bill of Sale form:

- It's the same as a car bill of sale. While both serve to document the sale and transfer of ownership, the Tractor Bill of Sale is specifically tailored for transactions involving tractors, addressing details pertinent to these types of vehicles.

- Notarization is always required. Not every transaction requires notarization. The necessity for notarization can depend on the county or the specifics of the transaction. However, getting the document notarized can add an extra layer of security and authenticity.

- It's only necessary for newer tractors. The age of the tractor does not exempt a seller or buyer from completing a bill of sale. Regardless of the tractor’s age, this document is crucial for legal ownership transfer.

- One needs a lawyer to prepare it. While consulting a lawyer can provide legal assurance, it’s not mandatory to have a lawyer prepare the document. A properly completed bill of sale form, available from various sources, often suffices.

- It's only used for tax purposes. Although the Tractor Bill of Sale is important for tax assessments, its primary function is to record the details of the transaction, serving as proof of purchase and ownership transfer.

- Personal information is not necessary. The inclusion of personal information of both the buyer and seller, such as addresses and contact details, is crucial for the validity of the bill of sale and future correspondence or legal matters.

- Any template can be used. It’s important to use a template or form that complies with the specific requirements of Utah state law to ensure its legality and effectiveness in transferring ownership.

- The selling price doesn’t need to be exact. The exact selling price should be clearly stated in the bill of sale. This information is critical for tax purposes and serves as a record of the transaction value.

- It guarantees the condition of the tractor. The Tractor Bill of Sale documents the sale and transfer of ownership but does not provide a guarantee or warranty regarding the condition of the tractor. Any such terms should be detailed in a separate agreement.

Clearing up these misconceptions ensures that individuals involved in the sale or purchase of a tractor in Utah approach the transaction with the right expectations and preparations. Correctly using the Tractor Bill of Sale form can help protect the interests of all parties involved.

Key takeaways

The Utah Tractor Bill of Sale form serves as a crucial document for the private sale of a tractor in Utah, acting as a legal record that evidences the transfer of ownership from seller to buyer. Understanding its importance and proper completion can ensure a smooth transaction process, providing protection for both parties involved. Here are ten key takeaways to keep in mind:

- Accurate Information: It’s essential that all information entered into the form is accurate and complete. This includes the names and addresses of both the seller and the buyer, as well as detailed information about the tractor (make, model, year, and VIN).

- Verification of Tractor Details: Before completing the sale, both parties should verify the tractor’s details to ensure they match the information on the form. This helps prevent any disputes about the condition or specifications of the tractor after the sale.

- Price and Payment Terms: Clearly state the sale price of the tractor and the agreed-upon payment terms. Include any deposit amount and the final payment date if applicable.

- Disclosure of Condition: The seller should disclose the condition of the tractor accurately, including any known faults or issues. This disclosure should be documented in the bill of sale to protect both parties.

- Signature Requirements: Both the seller and the buyer must sign the bill of sale. Their signatures confirm that they agree to the terms and conditions of the sale as outlined in the document.

- Date of Sale: The date when the bill of sale is signed is critical. It indicates when the ownership officially transfers from the seller to the buyer and can be important for warranty or service purposes.

- Witness or Notarization: While not always mandatory, having the bill of sale witnessed or notarized can add an extra layer of authenticity and may be required by some financial institutions or for registration purposes.

- Keep Copies: Both the seller and the buyer should keep a copy of the signed bill of sale for their records. This document serves as proof of purchase and ownership and may be needed for tax reporting or legal issues.

- Registration: The buyer should be aware that a bill of sale does not automatically register the tractor in their name. They will need to take the bill of sale to their local Department of Motor Vehicles (DMV) or similar agency to complete the registration process.

- Legal Protections: Completing and signing a bill of sale provides legal protections for both the seller and the buyer. It serves as evidence of the transaction and can be used in court if disputes arise regarding the sale's terms or the tractor's condition.

By keeping these key points in mind, both parties can ensure that the tractor sale process in Utah is conducted smoothly and with all necessary legal precautions in place.

Other Popular Utah Templates

How to Get Around a Non Compete - Offers companies peace of mind by legally binding employees to non-competition clauses, safeguarding business secrets.

Utah Dmv Report Sold Vehicle - It's necessary for registering the snowmobile in the buyer's name and proving ownership in some jurisdictions.

Last Will and Testament Template Utah - A binding document that captures the essence of an individual’s last wishes regarding their estate and familial obligations.