Fill Out Your Tc 8453 Utah Form

Understanding the intricacies of tax documentation is crucial for Utah residents aiming to navigate their financial responsibilities with ease. Among the plethora of forms required is the Tc 8453 Utah form, a key document designed for individuals who opt to file their state income tax returns electronically. This form serves as an electronic filing declaration, essentially acting as a taxpayer’s authorization to the state to process their electronic tax return. It also plays a vital role in verifying the taxpayer's identity and ensuring the accuracy of the information submitted digitally. The completion and submission of this form are pivotal steps in the electronic filing process, underscoring its importance in the efficient management of tax obligations in Utah. With various sections demanding precise details, from personal information to a breakdown of the tax return itself, the form embodies the shift towards more streamlined, digital tax services. Its proper completion is essential for a smooth tax filing experience, reinforcing the necessity for a thorough understanding of its components and requirements.

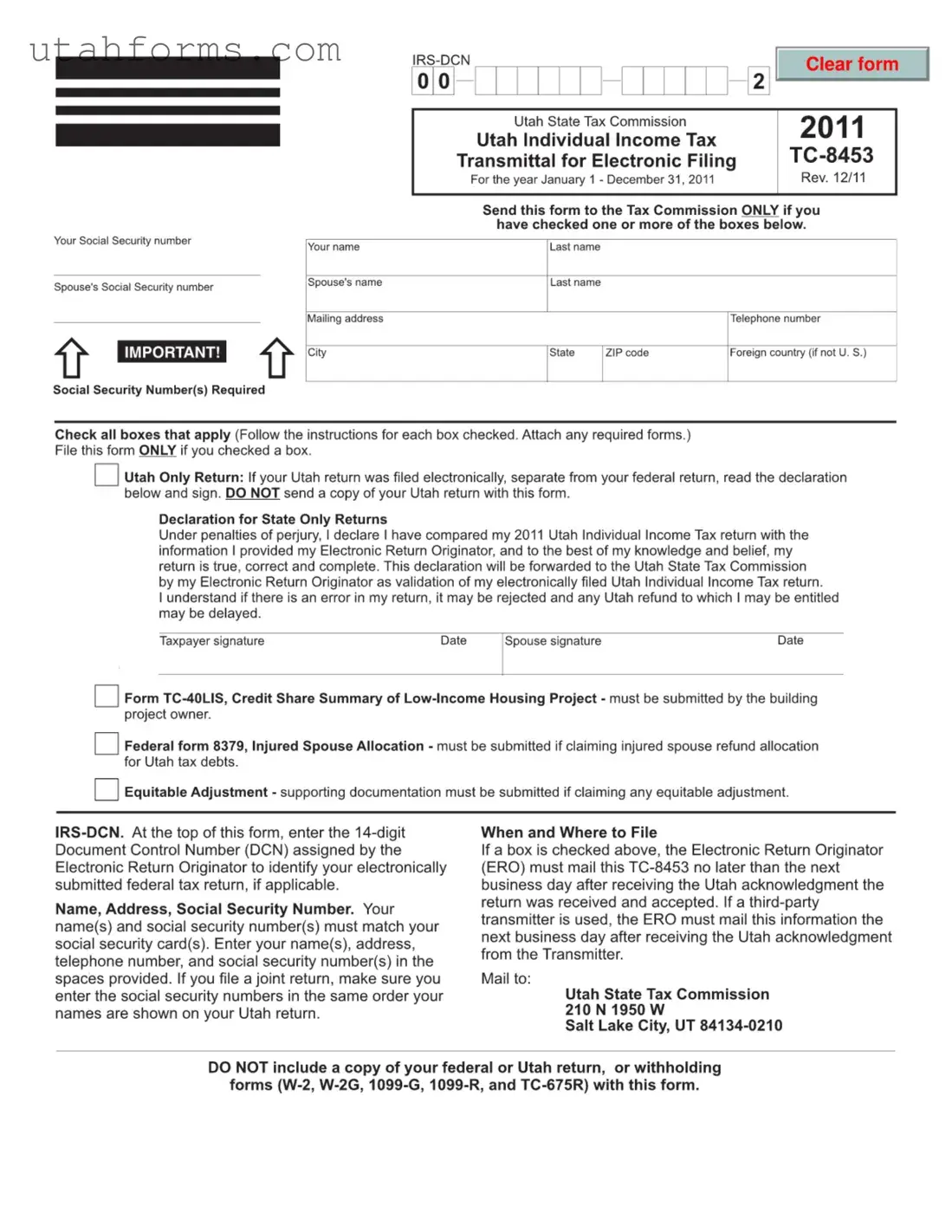

Preview - Tc 8453 Utah Form

File Specifications

| Fact | Detail |

|---|---|

| Form Name | TC-843, Bill of Sale |

| Purpose | To document the transfer of ownership of a vehicle from the seller to the buyer |

| Required Information | Vehicle information, seller's and buyer's information, sale price, and date of sale |

| Governing Law | Utah State Law |

| Where to File | Not filed with the state; retained by seller and buyer and may be required for registration or tax purposes |

How to Write Tc 8453 Utah

After completing the TC 8453 Utah form, it marks the beginning of processing your specific request with the state's relevant department. Handling it correctly is crucial as it ensures your information is correctly captured for future reference. The data presented in this form is processed to comply with certain state requirements, facilitating the efficient handling of your request. Here is a step-by-step guide to help you fill out the form accurately:

- Start with your personal information section. Here, you will need to provide your full name, including first, middle initial, and last name. If you're filing this form with a spouse or a partner, include their information in the designated spaces.

- Enter your Social Security Number (SSN) in the space provided. If this form is for joint filing, include your spouse's SSN as well.

- Fill out your current address thoroughly, including the street address, city, state, and ZIP code. Ensure this information is current as it will be used for any correspondence related to this form.

- Specify the tax year to which this form applies in the designated section. This is crucial for ensuring that your form is processed for the correct year.

- Look for the section regarding your filing status and select the option that applies to you. Options typically include single, married filing jointly, married filing separately, head of household, and qualifying widow(er) with dependent child.

- In the section provided for income, deductions, and credits, fill in the respective amounts accurately. These figures should match those filed with your federal return to avoid discrepancies.

- If applicable, enter the direct deposit information for receiving any refunds. This includes your bank’s routing number and your account number. Double check these numbers for accuracy to ensure prompt and correct payment.

- Review the form thoroughly for completeness and accuracy. Both you and your spouse (if filing jointly) need to sign and date the form in the designated areas at the bottom.

After completing and signing the form, submit it as directed by the accompanying instructions. Usually, this involves mailing it to the specified address, but electronic submission options may also be available. Following submission, the agency will process your form accordingly, which may include updates to your records or further steps you need to take.

Frequently Asked Questions

Understanding the TC-8453 Utah form can sometimes be confusing. Here are answers to some of the most frequently asked questions about this specific document to help guide you through the process of using it.

- What is the TC-8453 Utah Form?

The TC-8453 Utah Form, officially known as the Utah State Individual Income Tax Return Declaration for Electronic Filing, is a document used by Utah residents to authorize the electronic filing of their state tax return. It serves as a declaration that the information provided to the tax preparer and transmitted to the Utah State Tax Commission is accurate and complete. This form is particularly relevant in the process where taxpayers choose to file their returns electronically instead of sending paper documents through the mail.

- Who needs to file the TC-8453 Form?

Any Utah taxpayer who decides to file their state income tax return electronically is required to complete the TC-8453 Form. It is a necessary step in the e-filing process, ensuring that taxpayers agree with the information that has been submitted to the Utah State Tax Commission on their behalf.

- How do I fill out the TC-8453 Form?

Filling out the TC-8453 Form involves a few critical steps. Taxpayers must provide their personal information, including their full name, social security number, and address. Additionally, it requires the taxpayer to validate the accuracy of their tax return information. The form typically requires a signature from both the taxpayer and their spouse (if filing jointly) to confirm that they agree with all the information submitted.

- Is electronic filing preferred over traditional paper filing in Utah?

While both electronic and paper filing are accepted by the Utah State Tax Commission, electronic filing (e-filing) is generally preferred for several reasons. E-filing is faster, safer, and ensures quicker processing of returns and refunds. It also reduces the risk of errors that can occur with manual data entry from paper returns. By using the TC-8453 Form for e-filing, taxpayers can benefit from a streamlined and more efficient filing process.

- Where can I get the TC-8453 Form?

The TC-8453 Form can be obtained from several sources. It is available for download from the official Utah State Tax Commission website. Additionally, professional tax preparers and tax preparation software often provide the form and assistance in filling it out as part of their services. Ensuring access to the most current form is crucial, as tax laws and forms can change from year to year.

- What should I do if I make a mistake on the form?

If a mistake is made on the TC-8453 Form, it's essential to correct it as soon as possible. Depending on the nature of the mistake, you may be able to amend the form through your tax preparer or the software you used for filing. In some cases, contacting the Utah State Tax Commission directly for guidance on how to correct the error may be necessary. It's important to handle corrections promptly to avoid delays in processing your tax return.

- Can I file my federal and state taxes together with the TC-8453 Form?

Yes, when you e-file, you have the option to file your federal and state taxes together, and the TC-8453 Form facilitates the state portion of the filing for Utah residents. Tax preparation software often provides an integrated service that handles both federal and state tax filings, making the process convenient and efficient. However, the TC-8453 Form specifically applies to the state tax return, and a similar federal authorization form may be required for the federal return.

- What happens after I submit the TC-8453 Form?

After submitting the TC-8453 Form as part of your e-filed tax return, the Utah State Tax Commission will begin processing your return. Processing times can vary, but e-filed returns are typically processed faster than paper returns. Once processed, you will receive a notice regarding the status of your return, including any refunds due or additional taxes owed. It's advisable to keep a copy of your TC-8453 Form and all other tax documents for your records.

- Do I need to keep a copy of the TC-8453 Form after filing?

Yes, it's highly recommended to keep a copy of the TC-8453 Form and all tax-related documents for at least three years from the date of filing. These documents can be crucial for your records, allowing you to verify the information submitted to the Utah State Tax Commission should there be any questions or audits in the future.

- Is there a deadline for submitting the TC-8453 Form?

The deadline for submitting the TC-8453 Form coincides with the Utah state income tax filing deadline, which is typically April 15th, unless it falls on a weekend or holiday, in which case the deadline may be extended. To avoid penalties and interest, ensure that you complete and submit the form and your entire tax return by the deadline. For the most current deadline information, it's advisable to check the Utah State Tax Commission's website or consult with a tax professional.

Common mistakes

Filling out government forms can feel like navigating a maze. The Tc 8453 Utah form, required for certain tax filings, is no exception. It’s crucial to approach this document with care to avoid common pitfalls. Here are six mistakes that people frequently make:

- Not double-checking personal information. It may seem simple, but errors in your name, address, Social Security Number, or Tax ID can result in processing delays or even have your submission returned.

- Overlooking the signature and date fields. An unsigned or undated form might as well be incomplete. Both the taxpayer and the preparer must ensure their signatures and dates are present where required.

- Entering incorrect tax year. It’s an easy mistake to make, especially if you're rushing or multitasking. Ensure the tax year on the form matches the year for which you are filing.

- Misreporting income or deductions. Accuracy is paramount when reporting income and deductions. Mathematical errors or misinterpretations of what qualifies can lead to significant issues down the line.

- Sending the form to the wrong office or agency. The Tc 8453 must be sent to the correct Utah State Tax Commission office. Mailing it to the wrong place can lead to delays or even missed deadlines.

- Using outdated forms. Tax laws and form requirements can change from year to year. Using last year’s form by mistake can mean having to start over again with the correct version.

Avoiding these mistakes not only saves time but also helps ensure the processing of your tax submission without unnecessary delays. Always take the time to review the form in its entirety before sending it. Paying attention to the details can make a big difference in the long haul.

Remember, the goal is to get it right the first time. By being diligent and methodical in completing the Tc 8453 Utah form, you can avoid the common pitfalls that catch many people off guard. If in doubt, consulting with a professional can provide guidance and peace of mind during tax season.

Documents used along the form

When dealing with tax matters in Utah, especially in the case of electronic filing, the TC-8453 form, also known as the Utah Individual Income Tax Return Declaration for Electronic Filing, is a crucial document. This form serves as a declaration by the taxpayer to authorize their tax preparer to e-file their return. However, this form is often not the only document needed to fully complete the tax filing process. Several other forms and documents are commonly required to ensure that the tax filing is comprehensive, accurate, and in compliance with Utah state tax laws.

- W-2 Forms: These are Wage and Tax Statements that employers provide to their employees. They report annual wages and the amount of taxes withheld from paychecks. For any individual who has been employed during the tax year, this document is essential for filing taxes.

- 1099 Forms: Various 1099 forms exist, such as 1099-MISC, 1099-INT, and 1099-DIV, each for different types of income ranging from independent contractor work, interest earned, to dividends paid. These documents are necessary for taxpayers who have received income outside of traditional employment.

- Schedule 1 (Form 1040): This is a federal form used for reporting additional income or adjustments to income that can’t be entered directly on Form 1040. For individuals who need to report income or adjustments not covered by the standard 1040 form, Schedule 1 is required.

- Schedule A (Form 1040): Necessary for those who choose to itemize deductions instead of taking the standard deduction, Schedule A allows taxpayers to list deductible expenses such as medical, dental, taxes paid, and interest paid.

- Schedule EIC (Form 1040): The Earned Income Credit (EIC) is a tax credit for low to moderate-income working individuals and families, particularly those with children. The Schedule EIC must be filed alongside the tax return if the taxpayer is claiming the EIC.

In conclusion, while the TC-8453 form is a starting point for electronic tax filing in Utah, it's often just the tip of the iceberg. To ensure a thorough and law-abiding tax return process, taxpayers might need to include additional forms and documents like W-2s, various 1099s, and specific schedules from Form 1040. Navigating these requirements can seem daunting, but understanding the purpose of each form and how they contribute to a complete tax filing can simplify the process.

Similar forms

The TC-8453 Utah form, used for electronic filing of state tax returns, shares similarities with the IRS Form 8879, the e-file Signature Authorization form for federal tax returns. Both documents serve the role of authorizing electronic submission of tax returns by verifying the taxpayer's identity. They require the taxpayer's Social Security Number, the tax year, and an electronic signature, ensuring that the submission is valid and verified without needing a traditional wet signature.

Form W-2, the Wage and Tax Statement, is another document similar to the TC-8453, as it plays a crucial role in the tax filing process. While the TC-8453 concerns the electronic submission aspect, the W-2 provides the income and withheld tax information necessary for completing individual tax returns. Both forms are integral to the tax filing process, ensuring the accuracy and legitimacy of the information provided to the tax authorities.

The 1040 form, the U.S. Individual Income Tax Return, also shares similarities with the TC-8453. Both are essential components of the tax filing process, with the 1040 form being the primary document for reporting annual income, claiming deductions, and calculating federal tax liability. The TC-8453 facilitates the electronic submission of such tax returns in Utah, emphasizing their interconnected roles in tax administration.

The Schedule C form, used by sole proprietors to report profits and losses, parallels the TC-8453 by being another critical document in the tax filing framework. While the Schedule C focuses on the specifics of business income and expenses, the TC-8453 serves as a gateway for these detailed reports to be electronically filed, encapsulating the integration of various tax documents in the digital age.

Form 1099-MISC, the Miscellaneous Income form, while fundamentally different in purpose—reporting earned income not classified as salary, wages, or tips—connects with the TC-8453 through the tax reporting process. It provides essential income information that can affect the tax returns filed electronically via the TC-8453, underlining the interconnectedness of tax documentation.

The State Tax Withholding form, specific to each state, closely resembles the TC-8453 in its function for state-level tax dealings. This form dictates the amount of state tax withheld from an employee's paycheck, directly impacting the state tax return processed through the TC-8453. Both forms are pillars in ensuring accurate state tax reporting and compliance.

Form 4868, the Application for Automatic Extension of Time To File U.S. Individual Income Tax Return, while serving a different purpose—extending the deadline for filing tax returns—shares the procedural aspect with the TC-8453. Both are facilitated through electronic mechanisms, simplifying and streamlining the tax filing processes and deadlines for taxpayers.

The Form W-4, Employee’s Withholding Certificate, indirectly connects with the TC-8453 by influencing the initial stages of tax withholding and reporting. While W-4 determines the amount of taxes withheld from an employee's paycheck, the TC-8453 deals with the culmination of this process by enabling the electronic filing of the resulting tax documents, linking initial calculations to final submissions.

Form 1098, the Mortgage Interest Statement, provides taxpayers with the amount of interest paid on a mortgage during the year, which is essential for itemizing deductions on tax returns. Like the TC-8453, Form 1098 plays a critical role in the preparation and filing of taxes, providing necessary financial information that impacts the electronic submission of tax documents in Utah.

Lastly, the Direct Deposit Authorization form, used by tax filers to request direct deposit of refunds, shares a procedural similarity with the TC-8453. Both streamline financial transactions related to taxes—whether it's submitting tax returns or receiving refunds—highlighting the efficiency and integration of electronic processes in modern tax administration.

Dos and Don'ts

When filling out the TC 8453 Utah form, it is important to follow certain guidelines to ensure accuracy and compliance with tax regulations. Below are lists of things you should and shouldn't do when completing this form.

Things You Should Do

- Ensure all personal information is accurate and up-to-date, including your full name, address, and Social Security Number.

- Double-check all figures entered, especially those related to your income, tax deductions, and credits, to prevent any discrepancies.

- Sign and date the form in the designated areas to certify that the information provided is correct and complete.

- Attach any required documents, such as W-2s or 1099 forms, to support the income and tax deductions claimed.

- Keep a copy of the completed form and all attached documents for your records in case of any future inquiries or audits.

Things You Shouldn't Do

- Do not leave any required fields blank. If a particular section does not apply, ensure to mark it as "N/A" or "0," as appropriate.

- Do not guess or estimate figures. Use actual numbers from your financial documents to fill in your income and deductions.

- Avoid using correction fluid or tape; if you make an error, cleanly cross out the mistake and enter the correct information.

- Do not sign the form without reviewing all the information for accuracy and completeness to avoid potential issues with the tax authorities.

- Do not submit the form without ensuring all necessary supplementary documents are attached, as missing information can lead to processing delays.

Misconceptions

The TC 8453 Utah form, often required for specific tax filing purposes, is surrounded by a variety of misconceptions. Clear understanding is crucial for accurately completing and submitting this document. Below are nine common misunderstandings about the TC 8453 form that require clarification:

- It's for all tax filings: Many believe the TC 8453 form is necessary for all Utah tax filings. In reality, it's specifically used for electronic filings, acting as an authorization document for electronic submissions.

- Paper filing requires TC 8453: This misconception stems from confusion around electronic and paper filing requirements. The TC 8453 is not required for taxpayers who choose to file their returns via mail in paper form.

- Only individuals use it: While individuals do use the TC 8453 form, it is also applicable to estate and trust returns, showing its utility extends beyond just personal tax returns.

- It's a form for tax payment: Some people mistakenly think the TC 8453 is a form to make tax payments. However, its purpose is to authorize the electronic filing of a return, not to facilitate payment.

- No supporting documents needed: There's a belief that when you file electronically with the TC 8453, no other documents are necessary. But, taxpayers must still keep all relevant documentation for their records in case of an audit.

- Electronic signatures aren't secure: Concerns about the security of electronic signatures on the TC 8453 are prevalent. Nevertheless, strict protocols are in place to ensure that electronic filings are secure and signature authenticity is maintained.

- It's a complicated form: The myth that the TC 8453 form is complex and difficult to understand can deter people from filing electronically. In truth, the form is straightforward and designed to be user-friendly.

- Every section must be filled out: Not all parts of the TC 8453 apply to every taxpayer. Misunderstandings about which sections to complete can lead to unnecessary stress and errors in filing.

- Filing it results in faster refunds: While electronic filing can result in quicker processing times, the TC 8453 form itself doesn't guarantee a faster refund compared to other electronic filings not requiring this form.

Understanding the true purpose and requirements of the TC 8453 form can simplify the tax filing process and help avoid these common misconceptions. Always consult with a tax professional or refer to official state resources if in doubt about your tax filing obligations.

Key takeaways

Understanding the TC 8453 Utah form is essential for efficient and accurate tax filing. The form serves as an individual income tax declaration for electronic filing for residents of Utah. To simplify the process and ensure your form is correctly filled out and submitted, consider the following key takeaways:

- Accuracy is crucial: When filling out the TC 8453 form, it's important to double-check all the information you provide. This includes your name, address, Social Security number, and all the financial details pertaining to your tax return. Inaccuracies can lead to processing delays or questions from the Utah State Tax Commission.

- Signature requirement: After completing the TC 8453 form, you must sign and date it. This signifies that the information provided is accurate to the best of your knowledge. If filing jointly, both spouses are required to sign the form.

- Keep Records: Upon completing and submitting your TC 8453 form, retain a copy for your records. It's advisable to keep this copy along with the documents that support what's declared on your tax return, like W-2s, 1099s, and any deductions or credits claimed, for at least three years. This will be helpful in case the Utah State Tax Commission requests further information or if you need to reference past returns.

- Electronic Filing Pin: If you choose to file your taxes electronically, a Personal Identification Number (PIN) will be needed. The TC 8453 form serves as a way to authenticate your electronic submission, and your PIN acts as your electronic signature. Take care to remember this PIN for future reference and secure filing.

Common PDF Templates

Utah Dws Sds 305 - Through its detailed queries about machinery, equipment, and tools the applicant is proficient with, the form aids in identifying candidates with technical and specialized skills.

Utah Payroll Taxes - For businesses that have undergone changes affecting their withholding, the TC-941D provides a method to correct and clarify tax discrepancies.