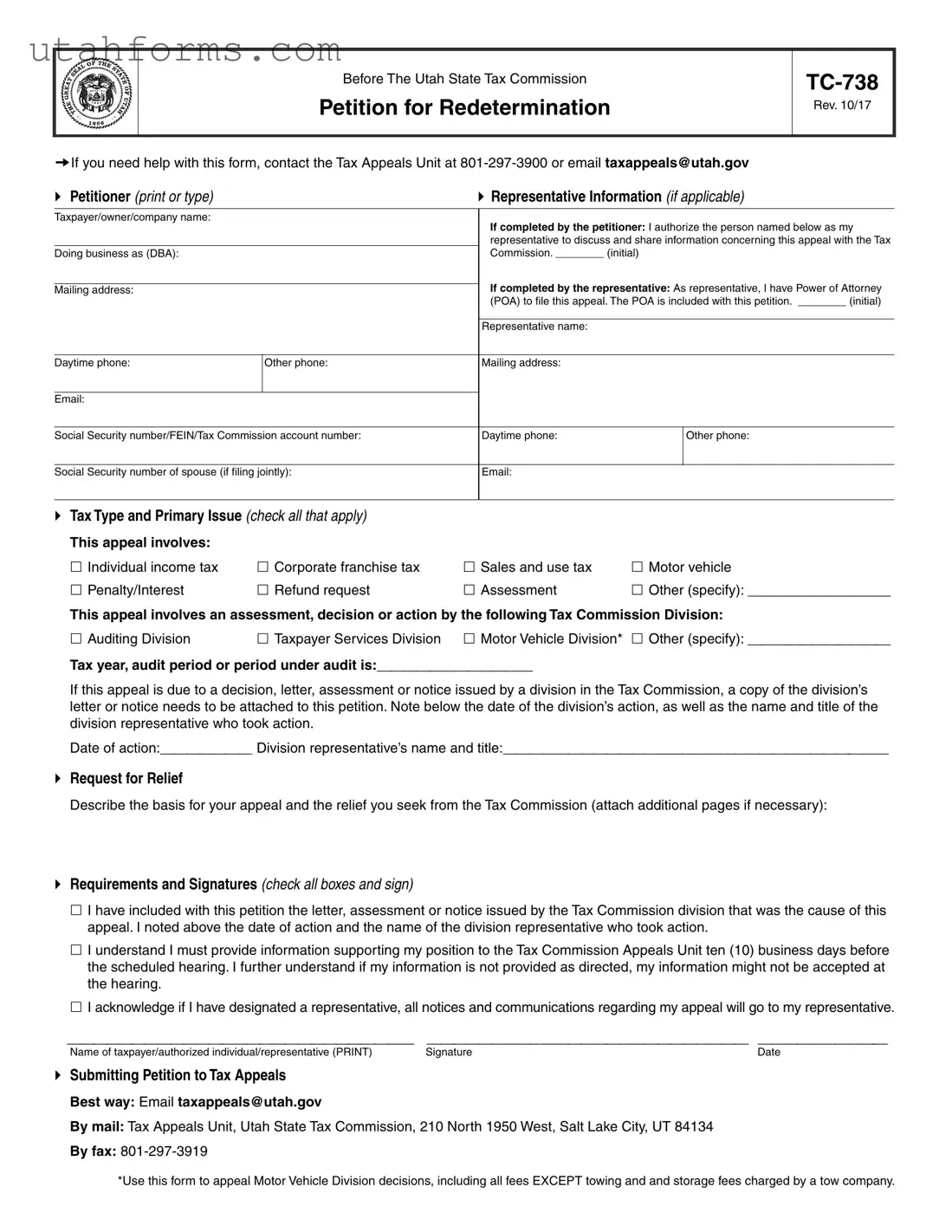

Fill Out Your Tc 738 Utah Form

When individuals or businesses in Utah disagree with a decision made by the State Tax Commission, they have a formal avenue to seek a reevaluation through the TC-738 Utah form. This document, officially titled "Petition for Redetermination," allows taxpayers to challenge various tax-related determinations including, but not limited to, individual income tax, corporate franchise tax, sales and use tax, and motor vehicle taxes. Whether it involves an assessment, a decision, or an action taken by any division within the Tax Commission, petitioners can clarify their position and request relief by providing a detailed explanation of their dispute and stating what outcome they desire. Importantly, the form requires that the taxpayer, whether acting independently or through a representative, submit any relevant notices or letters issued by the Tax Commission that prompted the appeal. Additionally, it mandates that all supporting documentation be furnished to the Tax Appeals Unit well ahead of the scheduled hearing. Completing and submitting the TC-738 form is a critical step for Utah taxpayers aiming to resolve tax disputes, making familiarization with its requirements and deadlines essential.

Preview - Tc 738 Utah Form

Before The Utah State Tax Commission

Petition for Redetermination

Rev. 10/17

If you need help with this form, contact the Tax Appeals Unit at

Petitioner (print or type) |

Representative Information (if applicable) |

Taxpayer/owner/company name:

Doing business as (DBA):

Mailing address:

If completed by the petitioner: I authorize the person named below as my representative to discuss and share information concerning this appeal with the Tax Commission. ________ (initial)

If completed by the representative: As representative, I have Power of Attorney (POA) to file this appeal. The POA is included with this petition. ________ (initial)

Representative name:

Daytime phone:

Other phone:

Mailing address:

Email:

Social Security number/FEIN/Tax Commission account number:

Daytime phone:

Other phone:

Social Security number of spouse (if filing jointly):

Email:

Tax Type and Primary Issue (check all that apply)

This appeal involves: |

|

|

|

Individual income tax |

Corporate franchise tax |

Sales and use tax |

Motor vehicle |

Penalty/Interest |

Refund request |

Assessment |

Other (specify): ___________ |

This appeal involves an assessment, decision or action by the following Tax Commission Division: |

|||

Auditing Division |

Taxpayer Services Division |

Motor Vehicle Division* Other (specify): ___________ |

|

Tax year, audit period or period under audit is:____________

If this appeal is due to a decision, letter, assessment or notice issued by a division in the Tax Commission, a copy of the division’s letter or notice needs to be attached to this petition. Note below the date of the division’s action, as well as the name and title of the division representative who took action.

Date of action:_______ Division representative’s name and title:______________________________

Request for Relief

Describe the basis for your appeal and the relief you seek from the Tax Commission (attach additional pages if necessary):

Requirements and Signatures (check all boxes and sign)

I have included with this petition the letter, assessment or notice issued by the Tax Commission division that was the cause of this appeal. I noted above the date of action and the name of the division representative who took action.

I understand I must provide information supporting my position to the Tax Commission Appeals Unit ten (10) business days before the scheduled hearing. I further understand if my information is not provided as directed, my information might not be accepted at the hearing.

I acknowledge if I have designated a representative, all notices and communications regarding my appeal will go to my representative.

___________________________ _________________________ __________

Name of taxpayer/authorized individual/representative (PRINT) |

Signature |

Date |

Submitting Petition to Tax Appeals

Best way: Email taxappeals@utah.gov

By mail: Tax Appeals Unit, Utah State Tax Commission, 210 North 1950 West, Salt Lake City, UT 84134

By fax:

*Use this form to appeal Motor Vehicle Division decisions, including all fees EXCEPT towing and and storage fees charged by a tow company.

File Specifications

| Fact | Detail |

|---|---|

| Form Name | Petition for Redetermination TC-738 |

| Revision Date | October 2017 |

| Contact Information | Tax Appeals Unit at 801-297-3900 or email taxappeals@utah.gov |

| Appeal Subject | Individual income tax, Corporate franchise tax, Sales and use tax, Motor vehicle, Penalty/Interest, Refund request, Assessment, Other |

| Governing Law | Utah State Tax Commission regulations |

| Authorization Requirements | Petitioners may authorize representatives to appeal on their behalf with initial authorization; representatives need Power of Attorney (POA) included with the petition. |

| Supporting Documentation | Must include any letter, assessment, or notice issued by the Tax Commission as the cause of the appeal along with the petition. |

| Information Submission Deadline | Supporting information must be provided to the Tax Commission Appeals Unit ten (10) business days before the scheduled hearing. |

| Communication Preference | If a representative is designated, all notices and communications regarding the appeal will be directed to the representative. |

| Submission Methods | Email to taxappeals@utah.gov, by mail to Tax Appeals Unit, Utah State Tax Commission, 210 North 1950 West, Salt Lake City, UT 84134, or by fax at 801-297-3919. |

How to Write Tc 738 Utah

Filling out the TC-738 form in Utah is a process that requires careful attention to detail to ensure that your petition for redetermination with the Utah State Tax Commission is completed accurately. Such forms are typically used when individuals or businesses believe there has been an error in tax assessment or when appealing a decision made by the Tax Commission. The information you supply on this form will be critical in reviewing your case. Here are straightforward steps to fill out the form successfully.

- Petitioner Information: Start by providing the required information about the petitioner. This includes the taxpayer/owner/company name, the business name if there's a different Doing Business As (DBA) name, and the mailing address.

- Authorization or Power of Attorney (POA): If you are the petitioner, initial the statement that authorizes your representative to discuss and share information about this appeal. If you are filling out the form as a representative with POA, initial the corresponding statement and ensure the POA document is attached to the petition.

- Representative Information: If applicable, fill in the representative’s name, daytime and other phone numbers, mailing address, and email. This section is only necessary if a representative is acting on behalf of the petitioner.

- Tax Information: Indicate the type of tax appeal you are filing by checking the appropriate box(es) for individual income tax, corporate franchise tax, sales and use tax, motor vehicle tax, etc. Also, specify the tax year, audit period, or period under audit.

- Details of Appeal: Specify the Tax Commission Division involved in the assessment, decision, or action being appealed. Include the date of the division's action and the name and title of the division representative who took the action. Attach a copy of the division’s letter, notice, or assessment that prompted this appeal.

- Request for Relief: Describe the basis for your appeal and the specific relief you are seeking. Attach additional pages if necessary to adequately explain your situation and the outcome you desire.

- Requirements and Signatures: Check all the boxes to confirm that you have included the required letter, assessment, or notice from the Tax Commission division, understand the requirements for providing supporting information, and acknowledge the communication protocol if a representative is designated. Finally, print the name of the taxpayer or authorized individual/representative, sign, and date the form.

- Submitting the Petition: Choose the best submission method for your situation. You can submit the petition via email to taxappeals@utah.gov, by mail to the Tax Appeals Unit at the address provided on the form, or by fax to 801-297-3919.

Once your petition is submitted, it will be reviewed by the Tax Appeals Unit of the Utah State Tax Commission. You should ensure all information is correct and complete to avoid delays in the processing of your appeal. Being thorough and detailed in your petition is key to a smoother review process.

Frequently Asked Questions

- What is the purpose of the TC-738 form in Utah?

The TC-738 form, issued by the Utah State Tax Commission, serves as a petition for redetermination. It is designed for individuals, companies, or representatives to formally contest an assessment, decision, or action made by a specific division within the Tax Commission. This form enables the petitioner to outline their case and request a review or reconsideration of the matter at hand.

- Who should file a TC-738 form?

This form should be filed by anyone who disagrees with a tax-related decision or action taken by the Utah State Tax Commission. This includes individuals disputing personal income taxes, companies challenging corporate franchise taxes or sales and use taxes, and other entities dealing with motor vehicle taxes, among others. It is also applicable to representatives authorized to act on behalf of such taxpayers, provided they have a Power of Attorney (POA).

- What information is required when completing the TC-738 form?

When completing the form, petitioners need to provide detailed information, including:

- The taxpayer, owner, or company's name and mailing address.

- Any Doing Business As (DBA) names.

- Contact information for the petitioner or the authorized representative, if applicable.

- The specific tax type and primary issue being appealed.

- Details of the Tax Commission division's decision or action being contested.

- A clear description of the relief sought and the basis for the appeal.

Furthermore, the form requires the petitioner to include a copy of the letter, assessment, or notice that prompted the appeal.

- Can a representative file the TC-738 form on behalf of a taxpayer?

Yes, an authorized representative can file the TC-738 form on behalf of a taxpayer. The representative must initially indicate they have the Power of Attorney to act in this capacity and attach the POA document with the petition. The representative's contact information and acknowledgment that they are authorized to discuss and share information concerning the appeal with the Tax Commission must also be provided.

- What tax types and issues can be appealed using the TC-738 form?

The form is versatile and permits appeals related to various tax types and issues, including but not limited to:

- Individual income tax

- Corporate franchise tax

- Sales and use tax

- Motor vehicle taxes (excluding towing and storage fees charged by a tow company)

- Penalties, interest, or requests for refunds

- Assessments or any other specific issues not listed explicitly on the form

- Is there a deadline for submitting supporting information for an appeal?

Yes, petitioners must provide all supporting information for their position to the Tax Commission Appeals Unit at least ten (10) business days before the scheduled hearing. Failure to comply with this requirement could result in the information not being accepted at the hearing. It's crucial to adhere to this timeline to ensure a fair and thorough review of the appeal.

- How can one submit the completed TC-738 form?

The completed form can be submitted to the Tax Appeals Unit in several ways:

- Email: taxappeals@utah.gov

- Mail: Tax Appeals Unit, Utah State Tax Commission, 210 North 1950 West, Salt Lake City, UT 84134

- Fax: 801-297-3919

Choosing the best submission method depends on the petitioner's convenience and preference. However, emailing is often the quickest and easiest way to ensure the form is delivered and received.

Common mistakes

Filling out the TC-738 Utah form, a petition for redetermination before the Utah State Tax Commission, is a critical step in disputing a decision regarding taxes. However, individuals often make mistakes that can affect the outcome of their appeal. By understanding and avoiding these common errors, petitioners can improve the chances of a favorable resolution.

Not including a copy of the division’s letter or notice. For the Tax Commission to consider an appeal, they require a copy of the initial decision, letter, assessment, or notice that prompted the appeal. Failing to attach this document can lead to immediate dismissal of the petition.

Failing to check the appropriate box under "Tax Type and Primary Issue." This section helps the Commission understand the nature of the appeal. When petitioners overlook this step, it can create confusion and delay the process as the Commission may need to request additional information to proceed.

Incomplete representative information. If a petitioner is utilizing a representative, such as a tax attorney, ensuring that all required fields are filled correctly is essential. This includes the initialing sections that authorize a representative to act on the petitioner's behalf and attaching a Power of Attorney (POA) if applicable. An incomplete section can hinder the representative's ability to communicate effectively with the Tax Commission.

Not providing a detailed basis for the appeal. A common oversight is providing insufficient details about why the appeal is being made and the relief sought. The "Request for Relief" section should be filled out with clear and comprehensive reasons for the dispute, along with any supporting evidence that strengthens the case. This is crucial for the Tax Commission to grasp the petitioner's argument fully.

Failure to comply with submission requirements and deadlines. It's of utmost importance that all necessary information supporting the position of the petitioner is submitted to the Tax Commission Appeals Unit ten business days before the scheduled hearing. Delays or omitting this step can result in the information not being accepted at the hearing, significantly impacting the petition's outcome.

By addressing these common mistakes before submission, individuals can ensure their petition is complete and correctly delivered to the Utah State Tax Commission. Attention to detail and adherence to the instructions on the TC-738 form can significantly contribute to a smoother appeals process.

Documents used along the form

When filing a Petition for Redetermination with the Utah State Tax Commission using the TC-738 form, it's common to include additional forms and documents to support the petition. These documents provide further details and evidence related to the appeal being made. They are critical for ensuring the Tax Commission has all the necessary information to make an informed decision on the appeal.

- Power of Attorney (POA) Form: Accompanies the TC-738 when a representative is filing on behalf of the taxpayer. It grants the representative the legal authority to discuss and share information concerning the appeal.

- Notice of Assessment or Decision: A copy of the original notice issued by the Tax Commission that is being appealed. It serves as the basis for the appeal, specifying the assessments, decisions, or actions taken by the Tax Commission.

- Financial Statements: May include recent tax returns, balance sheets, or other financial documents that provide context or evidence to support claims made in the appeal.

- Correspondence with the Utah State Tax Commission: Any previous correspondence related to the matter being appealed, including emails, letters, and notices, that could support the taxpayer's position.

- Evidence of Payment or Transaction Documents: Receipts, bank statements, or other documentation proving payments or transactions related to the tax issue under appeal.

- Schedule of Adjustments: If disputing specific adjustments made by the Tax Commission, a detailed list specifying each disputed item, the proposed adjustment, and the reasoning behind the adjustment request.

These documents, along with the TC-738 form, collectively form the packet that is reviewed during the appeal process. It's important for the taxpayer or their representative to ensure all information is accurate and complete before submitting to improve the chances of a favorable outcome. The Utah State Tax Commission provides guidelines and support for individuals needing assistance with appeals, ensuring the process is accessible and fair.

Similar forms

The Form 1040X (Amended U.S. Individual Income Tax Return) shares similarity with the UT TC-738 form as it's used to correct previously filed income tax returns. Both forms serve as a means to rectify errors or update information post-submission, providing taxpayers an opportunity to adjust their tax liability appropriately. They also require detailed explanations of the changes along with supporting documentation.

The IRS Form 656 (Offer in Compromise) is another document similar to the TC-738 form. This form is used by taxpayers to settle tax debts for less than the full amount owed, analogous to how the TC-738 form can involve requests for relief from tax liabilities assessed by the Utah Tax Commission. Both processes require the disclosure of personal financial information and a reasoned argument as to why the relief should be granted.

The Application for Change in Accounting Method (Form 3115) is used by taxpayers wanting to change how they calculate their income and deductions, similar to how the TC-738 form might be utilized to challenge or amend tax assessments or methodologies. Both forms entail a formal request to tax authorities and necessitate a thorough explanation of the reasons behind the request, accompanied by relevant documentation.

Form SS-4, the Application for Employer Identification Number (EIN), can be likened to the TC-738 in the sense that both are initial steps in formal tax procedures – the former for obtaining an EIN for tax purposes, and the latter for appealing tax-related decisions. Both forms gather identifying information and aim to establish a formal record with tax authorities.

The IRS Form 843 (Claim for Refund and Request for Abatement) is used to request a tax refund or request the abatement of certain taxes, penalties, fees, or interest, similar to the relief sought in a TC-738 appeal. Each of these forms allows taxpayers to present a case to rectify perceived overcharges or errors in tax collection or assessment.

Property Tax Appeal forms, used in various jurisdictions to contest the assessed value of property for tax purposes, share a purpose with the TC-738 form. Both provide a legal avenue for disputing tax decisions, requiring detailed reasoning, evidence to support the claim, and often involve a formal hearing process.

The Application for Taxpayer Identification Number for Pending U.S. Adoptions (Form W-7A) and the TC-738 share the procedural similarity of applying to tax authorities for recognition under specific circumstances. While the W-7A applies to adoption-related tax identification issues, the TC-738 addresses tax dispute resolutions, both necessitating detailed personal information and specific requests to the tax authority.

Bankruptcy forms related to tax obligations also parallel the TC-738 form, particularly where taxpayers seek relief from tax liabilities through bankruptcy proceedings. Both types of documents involve legal considerations of one's ability to meet tax obligations and may result in adjustments to how those obligations are fulfilled.

The Customs Declaration forms, used for declaring taxable items upon entering a country, similarly involve reporting to tax authorities, like the TC-738 does in the context of tax appeal. Although serving different functions, each necessitates accurate disclosure of information relevant to tax assessments.

Lastly, State Tax Exemption Forms, used by individuals and entities to claim exemption from certain state taxes, relate to the TC-738 form in their purpose to alter normal tax treatment based on specific criteria or situations. Both forms require sufficient justification and documentation to support the request for a deviation from standard tax rules.

Dos and Don'ts

When filling out the TC-738 Utah form for a Petition for Redetermination before the Utah State Tax Commission, it’s crucial to take careful steps to ensure accuracy and compliance. Below are lists of things you should and shouldn't do to help guide you through the process.

Things You Should Do

- Provide Complete and Accurate Information: Fill in all required sections with current and accurate information. This includes your name, address, Social Security number/Federal Employer Identification Number (FEIN), and any representative information if applicable.

- Include Power of Attorney (POA) if Applicable: If you are filling out the form as a representative, ensure that a POA document is included with the petition as proof of your authority to act on behalf of the petitioner.

- Check All Relevant Boxes: Carefully read through the Tax Type and Primary Issue section to ensure you are selecting all options that pertain to your appeal. This will help clarify the nature of your request to the Tax Appeals Unit.

- Attach Necessary Documentation: If your appeal is related to a specific decision, letter, assessment, or notice given by a Tax Commission Division, make sure to attach a copy of that document to your petition.

- Sign and Date the Form: Your signature and the date are essential for validating your petition. Check all the boxes in the Requirements and Signatures section before signing to acknowledge your understanding of the procedures.

Things You Shouldn't Do

- Leave Sections Blank: Avoid submitting an incomplete form. Missing information can delay the process or result in the rejection of your appeal.

- Forget to Include Supporting Documentation: Failing to attach the required letter, assessment, or notice from the Tax Commission Division can severely weaken your case. The same applies to not providing sufficient information supporting your position before the hearing.

- Misstate the Tax Year or Period Under Audit: Ensure that the tax year, audit period, or period under audit is correctly mentioned. Inaccuracies can lead to misunderstandings regarding your appeal.

- Assume Authorization Without Initialing: If someone is representing you, or if you’re a representative, the form requires initials to confirm this arrangement. Do not overlook this step.

- Send Incomplete Information: Remember, providing information to the Tax Commission Appeals Unit ten (10) business days before the scheduled hearing is mandatory. Incomplete information or documentation may not be accepted at the time of the hearing.

Approaching the TC-738 Utah form with diligence and attentiveness is key to ensuring your petition for redetermination is processed efficiently and effectively. Paying close attention to the dos and don'ts will assist in navigating this process smoothly.

Misconceptions

Understanding the TC-738 Utah form, specifically the Petition for Redetermination, can be a bit of a mind twister for many. It’s surrounded by misconceptions that can affect how you view and handle your tax appeal process. Let's debunk some of these myths and set the record straight.

- Myth #1: "I can only appeal if I owe a large amount." In truth, no matter the size of the tax issue, if you disagree with a decision made by the Utah State Tax Commission, you have the right to file an appeal using the TC-738 form.

- Myth #2: "The form is too complicated to fill out on my own." While it might look intimidating at first glance, assistance is available. You can contact the Tax Appeals Unit directly for help with filling out the form, ensuring you understand each part.

- Myth #3: "Filing an appeal will automatically lead to an audit." Filing an appeal does not increase your chances of being audited. The appeal is your right to dispute a decision and won’t flag your account for an audit.

- Myth #4: "I don’t need to attach any documentation." Actually, attaching the notice, letter, or assessment that prompted your appeal is crucial. The TC-738 form explicitly asks for this documentation as part of the submission process.

- Myth #5: "Any decisions made by the Commissioner can be appealed with this form." The form is designed for appealing specific tax-related decisions. It's essential to check that your appeal falls within the categories listed under the "Tax Type and Primary Issue" section of the form.

- Myth #6: "I can wait as long as I want to file an appeal." Like most legal processes, filing an appeal with the TC-738 form has deadlines. Acting swiftly is crucial, as waiting too long might forfeit your right to appeal.

- Myth #7: "All communication will come to me." If you designate a representative and provide their information on the form, all correspondence about the appeal will be directed to them. It’s essential to ensure your representative is reliable and keeps you in the loop.

- Myth #8: "Submitting the form is complicated." You have options for submitting your appeal: email, mail, and fax. Choose the method that’s most convenient for you. Ensure all parts of the form are completed and all necessary documentation is included.

Understanding these misconceptions and knowing the facts can significantly impact the appeal process's outcome. It’s about rights, responsibilities, and meeting requirements. With the right approach and understanding, navigating the appeal process can be a straightforward task.

Key takeaways

Understanding how to properly complete and use the TC-738 Utah form, which serves as a petition for redetermination before the Utah State Tax Commission, is crucial for individuals or entities wishing to appeal tax decisions. Below are nine key takeaways to guide you through this process.

- The form allows both individuals and businesses to challenge decisions regarding various tax types including individual income tax, corporate franchise tax, sales and use tax, and motor vehicle taxes, among others.

- If you are appointing a representative to handle your appeal, it's necessary to initial the form, indicating this authorization. The representative must also initial to confirm they have the power of attorney and that this documentation is included in the petition.

- Detailing the specific tax type and primary issue at the outset, by checking the applicable boxes, helps direct the appeal to the appropriate division within the Tax Commission.

- Should the appeal relate to a decision, notice, or assessment issued by a specific division of the Tax Commission, attaching a copy of the relevant document is mandatory.

- Clearly stating the basis of your appeal and the relief sought is essential. This includes attaching additional pages if the space provided is insufficient.

- It is critical to check all the boxes in the requirements and signature section to affirm that all necessary documentation and information have been included, and that you understand the conditions regarding submission and hearing procedures.

- All communication regarding the appeal will be directed to the authorized representative if one has been designated. This underscores the importance of ensuring your representative's contact information is accurate and up to date.

- The preferred method for submitting the petition is via email to taxappeals@utah.gov, though mailing or faxing the form are also viable options.

- This form is also applicable for appeals against decisions made by the Motor Vehicle Division of the Tax Commission, excluding disputes over towing and storage fees charged by tow companies.

Properly completing and submitting the TC-738 form is the first step in appealing a decision made by the Utah State Tax Commission. Ensuring that all sections are filled out accurately and that all necessary documentation is included can help streamline the appeal process.

Common PDF Templates

Survivorship Affidavit Utah - Enables disputing parties to bring their vehicle impound concerns before an official body in Utah.

Where Can I Find My State Tax Id Number - Utah TC-69 addresses tax registrations ranging from sales/use tax to specific licenses for fuel distributors.