Fill Out Your Tc 194 Utah Form

For businesses and individuals in Utah, navigating the complexities of tax compliance is an essential but often challenging task. Integral to this process is the Tc 194 Utah form, a critical document designed to streamline various tax-related procedures. Whether it's used for claiming tax credits, reporting specific tax information, or requesting tax exemptions, this form plays a pivotal role in ensuring that entities adhere to Utah's tax laws accurately and efficiently. It encompasses a broad spectrum of information, from personal identification details to specifics about the tax issue at hand, facilitating a smoother interaction between taxpayers and the state's tax collection agency. Understanding the structure, purpose, and correct way to fill out the Tc 194 form can significantly ease the burden of tax compliance, making it a topic of high relevance for anyone looking to maintain or establish tax responsibilities in the state of Utah.

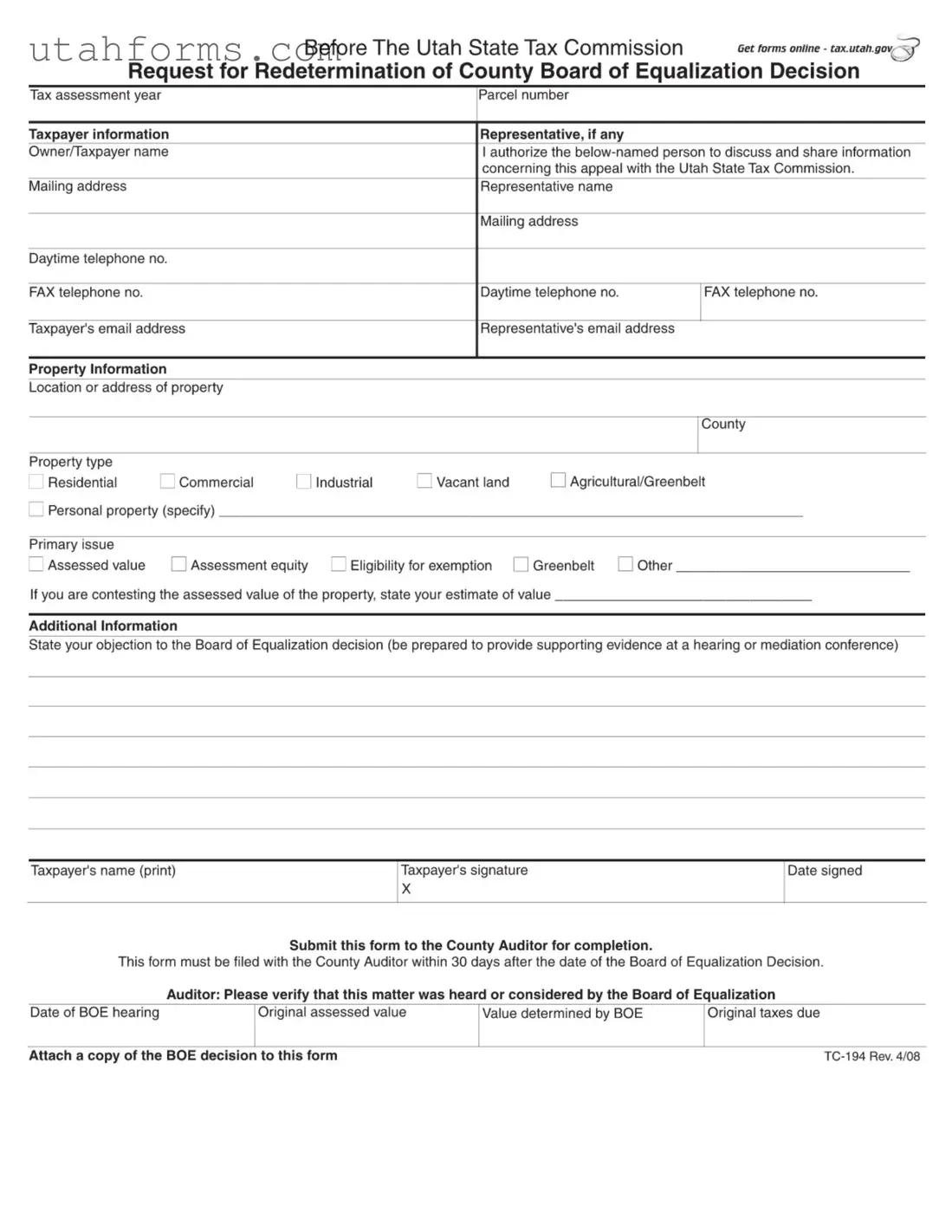

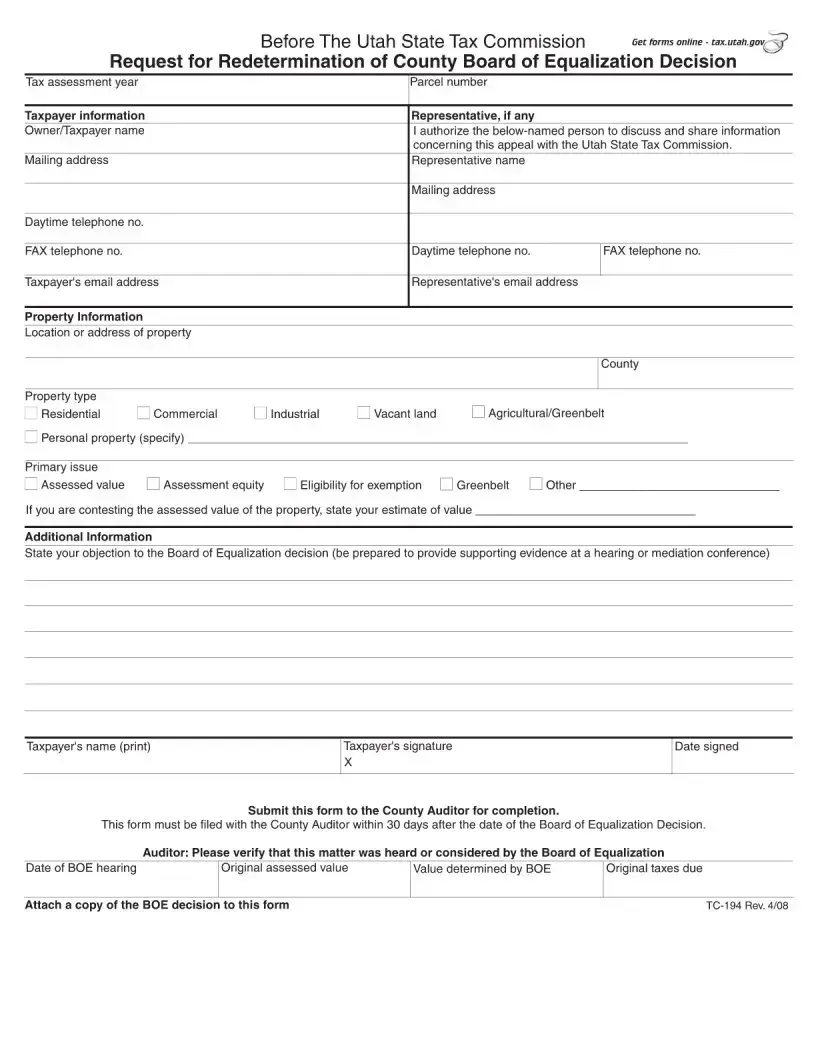

Preview - Tc 194 Utah Form

File Specifications

| Fact | Detail |

|---|---|

| Form Title | TC-194, Utah Motor Vehicle Dealer Bond |

| Purpose | Used to obtain a bonded license for motor vehicle dealership operations in Utah. |

| Requirement | Mandatory for all new and used motor vehicle dealers in Utah. |

| Authority | Utah State Tax Commission, Motor Vehicle Enforcement Division |

| Governing Laws | Utah Code, Title 41, Chapter 3, Motor Vehicle Business Regulation Act |

| Bond Amount | Varies; based on the type of dealership and number of vehicles sold. |

| Validity Period | Continuous; requires renewal to maintain an active dealer license in Utah. |

| Where to File | Submit to the Utah State Tax Commission, specifically to the Motor Vehicle Enforcement Division. |

How to Write Tc 194 Utah

When it comes time to filling out the TC-194 form in Utah, it's essential to approach the task with all the necessary information at hand. This particular form, used by residents for specific filings with state agencies, requires careful attention to detail to ensure accuracy and compliance with state regulations. Filling out this form correctly is paramount, as errors can lead to processing delays or complications. Below, you'll find a step-by-step guide designed to help navigate the completion of the TC-194 form smoothly and efficiently.

- Gather all required documentation and information before starting. This includes personal identification, relevant financial records, and any other specifics the form requires.

- Read through the entire form to understand the scope of information requested. This preemptive step will give you a clear view of the task ahead and help identify any areas where additional information may be needed.

- Begin by filling in your personal information. This typically includes your full name, date of birth, address, and contact details. Ensure all information is current and accurately reflects your legal documents.

- Move on to the section that requires the financial information or other specifics relevant to the form’s purpose. Input all details carefully, double-checking figures and other data for accuracy.

- If the form requests details about other individuals or entities (such as dependents, business partners, or affiliations), make sure you have the correct information on hand. Fill in these sections with the precise details required.

- Review the entire form once all sections are completed. Look for any errors, incomplete areas, or unclear responses. It's crucial that all information provided is clear, accurate, and legible.

- Sign the form in the designated area. Your signature is a certification that the information provided is truthful and accurate to the best of your knowledge. Depending on the specific requirements of the TC-194, additional signatures may be necessary.

- Follow the form's submission instructions carefully. This may involve mailing the form to a specific address, submitting it in person at a designated location, or possibly even filing online if such an option is available.

- Keep a copy of the completed form for your records. This copy will be valuable for reference or in case any issues arise with the form’s processing.

After completing and submitting the TC-194 form, the next steps will largely depend on the specifics of the form's purpose and the internal processes of the Utah department it was submitted to. It's common to receive a confirmation of receipt, followed by notifications regarding the status of your submission. Keeping track of these communications is crucial, as there might be requests for additional information or steps needed to complete the process. Patience is key, as processing times can vary significantly based on the form's nature and the workload of the processing office.

Frequently Asked Questions

-

What is the TC 194 Utah form used for?

The TC 194 form, specific to Utah, is utilized primarily for the purpose of applying for a refund on certain fees or taxes paid. This includes circumstances where an individual or entity believes they have overpaid or are entitled to a refund due to specific conditions outlined by Utah State Tax laws. Common scenarios include overpayment of taxes on fuel, incorrect tax assessments, or similar financial discrepancies that qualify for a refund request.

-

Who is eligible to file a TC 194 Utah form?

Eligibility to file the TC 194 form is generally determined by the nature of the overpayment or tax refund situation. Individuals, companies, or entities that have made tax payments to the state of Utah and have a legitimate reason to believe they have overpaid or are eligible for a refund under state tax law guidelines can file this form. It's essential to review the specific eligibility criteria as outlined in the instructions accompanying the form to ensure compliance.

-

What information is required to complete the form?

- Complete identification details, including the name and address of the applicant.

- Social Security Number (SSN) or Employer Identification Number (EIN) for identification purposes.

- Detailed information about the tax payment or transaction that is believed to have been overpaid.

- Documentation supporting the refund claim, such as receipts, tax returns, or other relevant financial statements.

- A clear explanation of the reason for the refund request, aligning with the eligibility criteria.

Accurate and comprehensive completion of the form, along with the required documentation, is crucial for the processing of the refund request.

-

How does one submit the TC 194 form?

The submission process for the TC 194 form can vary, but it generally involves either mailing the completed form along with any required documentation to the designated address provided by the Utah State Tax Commission or submitting it through their authorized online platform if available. It's important to verify the latest submission guidelines provided by the Utah State Tax Commission to ensure proper filing.

-

What happens after the form is submitted?

After the TC 194 form is submitted, the Utah State Tax Commission will review the refund request. This process involves verifying the information and documentation provided, assessing eligibility, and determining the validity of the refund claim. Applicants may be contacted for additional information or clarification during this time. Upon completion of the review, the applicant will be notified of the decision, and if the refund is approved, the appropriate amount will be refunded to the applicant. The duration of this process can vary, so patience is advised.

Common mistakes

Filling out forms for government or legal processes can often seem straightforward at first glance. However, the devil is in the details, particularly with forms like the TC-194 in Utah, used in specific legal contexts. Small, seemingly insignificant errors can lead to processing delays, rejections, or errors in documentation that could have broader implications. Here, we outline five common mistakes to watch for and avoid when completing this form.

-

Not double-checking for completeness: One of the most frequent mistakes is failing to ensure that every required field is filled out. It's easy to overlook a section, especially if the form is being filled out in a rush or if the applicant assumes certain parts do not apply to their situation. Every field in the TC-194 form has its purpose, and leaving a section blank can result in the form being returned or processing delays.

-

Misunderstanding the instructions: The TC-194 form, like many legal documents, comes with instructions that require careful reading to understand. Sometimes, individuals might make assumptions about what is expected without carefully reviewing these guidelines. This can lead to errors such as using incorrect formats for dates, misunderstanding the specific information requested in a field, or incorrectly identifying oneself in the context of the form.

-

Improper documentation: When filling out the TC-194, certain sections may require the inclusion of additional documents or specific pieces of evidence. Failure to include these required documents, or submitting them in an incorrect format, can obstruct the form's processing. It’s crucial to review the form's requirements carefully and ensure all necessary documentation is attached and clearly legible.

-

Handwriting legibility: While this may seem minor, completing the form in hard-to-read handwriting can lead to significant issues. Poor handwriting can result in misinterpretation of crucial information, such as names, addresses, or identification numbers. Whenever possible, filling out the form electronically is preferable to avoid this problem, but if handwriting is the only option, ensuring it is as clear as possible is essential.

-

Incorrect information: Sometimes, the rush to complete the form or a simple oversight can lead to the inclusion of inaccurate information. This could be anything from the misspelling of a name to incorrect numerical data. Such errors can have implications ranging from delays to the incorrect processing of the form. It's critical to review every piece of information on the TC-194 form for accuracy before submission.

To mitigate these mistakes, individuals should take their time to thoroughly review the TC-194 form before submission. Utilizing resources such as legal consultants or online guides can provide clarity and help avoid common pitfalls. Additionally, it's beneficial to:

- Complete the form in a quiet, distraction-free environment.

- Verify all attached documents for completeness and legibility.

- Review each section of the form carefully, ensuring understanding and accuracy.

- Consult the official instructions or seek professional advice if there’s any uncertainty.

By paying close attention to these areas, the process becomes smoother, and the likelihood of errors that can delay or complicate matters significantly reduces. It underscores the importance of diligence and accuracy in legal documentation and the potential consequences of oversight.

Documents used along the form

When dealing with the Tc 194 form in Utah, a comprehensive understanding is crucial for individuals and businesses aiming to comply with state regulations on motor vehicles. This form is commonly used in the state of Utah for motor vehicle registration, titling, and related matters. However, the Tc 194 form is often just one piece of the puzzle. To smoothly navigate the process, several other documents are typically required. The list below outlines key forms and documents that are frequently used in conjunction with the Tc 194 form, providing a brief description of each.

- Application for Utah Title (Form TC-656): This form is used to apply for a vehicle title in Utah. It's necessary for buying, selling, or transferring vehicle ownership.

- Vehicle Bill of Sale (Form TC-843): A document that records the sale of a vehicle between two parties. It proves the transfer of ownership and is often required for registration and titling.

- Emission Certificate: In certain Utah counties, vehicles must pass an emissions test. The certificate must be submitted to demonstrate compliance with the state's environmental standards.

- Safety Inspection Certificate: Some vehicles might be required to undergo a safety inspection. The resulting certificate is a prerequisite for registration in specific cases.

- Proof of Insurance: Utah law requires proof of automobile insurance when registering a vehicle. This document must show that the vehicle meets the state's minimum insurance requirements.

- Registration Fee: This is not a document but a necessary payment that accompanies the registration application. The amount varies depending on the vehicle type, age, and weight.

- Odometer Disclosure Statement (Form TC-891): This statement is required for all vehicles under ten years old at the time of sale or transfer. It declares the accurate mileage of the vehicle.

- Lien Release: If there was a lien on the vehicle, a lien release document is needed to prove that the lien has been satisfied and the vehicle is free of encumbrances.

- Non-Resident Proof of Tax Payment: For those who have paid sales tax on a vehicle in another state, this document is necessary to avoid double taxation.

- Power of Attorney (Form TC-737): If someone else is signing documents or making decisions on behalf of the vehicle owner, a power of attorney form may be required.

Navigating vehicle registration, titling, and related legal processes in Utah involves more than just submitting the TC-194 form. The documents listed above play a vital role in ensuring compliance with state laws and regulations. Whether you're buying a new car, selling an old one, or transferring ownership, preparing these documents in advance can streamline the process, ensuring that all requirements are met with minimal hassle. Always check the most current requirements on the Utah Division of Motor Vehicles website or consult with a professional to ensure you have all the necessary documentation.

Similar forms

The TC-194 Utah form, which is used in various business or tax-related processes within the state of Utah, shares similarities with other documents in terms of their usage and objectives. Understanding these documents can provide insight into the broader spectrum of tax and business documentation requirements in the United States.

One such document is Form W-9, Request for Taxpayer Identification Number and Certification. This form, utilized nationwide, is comparable to the TC-194 because both are used to collect taxpayer identification information for reporting purposes. However, the W-9 is primarily for individuals or entities to provide their taxpayer information to entities that will pay them income, emphasizing its role in federal tax compliance.

Another related document is the Sales and Use Tax Return, common in many states. Like the TC-194, this form is an essential tool for reporting and paying taxes—specifically, sales and use taxes. It emphasizes the responsibility of businesses to report their taxable sales and calculate the taxes owed to the state, underscoring the importance of compliance with state tax laws.

The Employer's Quarterly Federal Tax Return, Form 941, shares a purpose with the TC-194 in that both are integral to tax reporting and compliance. Form 941 is used by employers to report income taxes, social security tax, or Medicare tax withheld from employees' paychecks and is vital for reconciling employees' tax withholdings with the IRS.

The Application for Employer Identification Number, Form SS-4, is another document with similarities to the TC-194. This form is crucial for new businesses as it's used to apply for an Employer Identification Number (EIN). Like the TC-194, it serves as a foundational step in establishing a business's tax and legal identity.

The Annual Report and Tax Return for certain entities is also akin to the TC-194. Many states require these forms for entities like corporations and limited liability companies (LLCs) to report annual information and pay any owed taxes. They ensure that businesses maintain good standing with the state by keeping their registration information current and complying with tax obligations.

The Business Personal Property Statement, used in various localities, is akin to the TC-194 in its focus on reporting assets for tax purposes. This form requires businesses to list personal property (equipment, furniture, etc.) for tax assessment, emphasizing the importance of accurate reporting for fair taxation.

Form 1065, U.S. Return of Partnership Income, is another document related to the TC-194, designed for reporting the income, deductions, gains, and losses of a partnership. It highlights the requirement for partnerships to file and provide information necessary for taxing the partnership and its partners appropriately.

The Certificate of Registration or Licensing forms that businesses must file with state or local governments also share a purpose with the TC-194. These documents officially recognize a business's legal operation within a jurisdiction, underscoring the importance of meeting regulatory requirements for starting and operating a business.

Lastly, the Charitable Solicitation Registration forms, required in many states, are somewhat similar to the TC-194 in their regulatory intention. These forms are necessary for nonprofits seeking to solicit donations, ensuring they are registered and compliant with state laws governing charitable solicitations, reflecting an aspect of regulatory compliance and public trust.

Together, these documents play vital roles in the ecosystem of business and tax documentation. They emphasize the importance of compliance, accuracy, and timely reporting in maintaining a business's good standing and fulfilling its tax obligations.

Dos and Don'ts

When filling out the TC 194 Utah form, it's important to follow specific guidelines to ensure the process is completed correctly and efficiently. Below is a list of things you should do and things you should avoid to help you navigate the process:

- Do read the instructions carefully before beginning. The TC 194 form comes with detailed instructions meant to guide you through each step of the filling process.

- Do use blue or black ink if you are filling out the form by hand. These colors are generally required for legal documents because they stand out clearly when the document is copied or scanned.

- Do verify all the information for accuracy before submission. Double-check names, dates, and especially numbers, such as your Social Security number or account numbers, to ensure they are correct.

- Do make a copy of the completed form for your records. It's always wise to have a backup of important documents in case questions arise later or if the original is misplaced.

- Don't leave any required fields blank. If a section does not apply to you, it's generally advised to write "N/A" (not applicable) rather than leaving it empty. This indicates that you didn't overlook the section.

- Don't use correction fluid or tape. Mistakes should be neatly crossed out with a single line, and the correct information should be clearly written next to it or above it.

- Don't sign the form without reviewing it. The signature attests that all the information provided is accurate to the best of your knowledge, so it's crucial to ensure there are no mistakes.

- Don'T forget to include any required supporting documents. Many forms, including the TC 194, require additional documentation for processing. Failure to include these could result in delays or denial of your application.

Misconceptions

The TC-194 form in Utah, often surrounded by a cloud of misunderstandings, plays a crucial role in tax-related processes within the state. Addressing some of these misconceptions not only helps clarify their actual purpose and application but also assists individuals and businesses in navigating their tax responsibilities more efficiently. Here's a look at ten common misconceptions:

It's only for businesses: A common misconception is that the TC-194 form is exclusively for business use. In reality, while it is widely utilized by businesses, certain provisions also apply to individual taxpayers, especially those engaged in specific types of transactions or ownership.

Filing is optional: Some might think that filing this form is a matter of choice. However, compliance with TC-194 requirements is mandatory for those to whom it applies. Failing to file can result in penalties and interest charges, highlighting its importance within the legal framework of tax obligations in Utah.

It's complicated and inaccessible: The notion that the TC-194 form is overly complicated and difficult to access is another misconception. While tax forms can be intricate, the state provides resources, guides, and assistance for those who need help, making the process more approachable than it might seem at first glance.

It's the same as the federal tax form: Confusing state forms with federal forms is a common error. The TC-194 form is specific to Utah and deals with state tax obligations, separate from any federal tax forms or requirements. Understanding this distinction is crucial for proper compliance.

Once filed, it cannot be amended: The belief that once the TC-194 form is submitted, it cannot be amended, is incorrect. If errors are discovered or circumstances change, filers can submit amended forms. This process ensures that individuals and businesses can correct mistakes and remain compliant with state tax laws.

No penalties for late filing if no taxes are owed: Some individuals operate under the assumption that late filing penalties only apply if taxes are owed. However, penalties can also be assessed for late filing of the TC-194 form, regardless of the tax liability status. Prompt filing is always recommended.

Electronic filing is not available: Contrary to what some might believe, electronic filing is available and even encouraged for the TC-194 form. This method offers convenience and faster processing times, demonstrating the state’s commitment to using technology to facilitate taxpayer compliance.

Personal information is at high risk of being compromised: Concerns about personal information security are understandable in the digital age. However, the systems used for filing and processing the TC-194 form incorporate robust security measures to protect sensitive information, mitigating the risk of unauthorized access.

Only annual filing is required: The frequency of filing the TC-194 form can vary depending on specific circumstances or the nature of the transaction. It's not always an annual requirement; some scenarios may necessitate more frequent filings, emphasizing the need to understand the specific obligations related to this form.

All sections must be completed by all filers: Finally, the misconception that all sections of the TC-194 form must be filled out by anyone who files it overlooks the form's design to accommodate a variety of situations. Not all sections may be relevant to every filer, so it's important to carefully review the form and instructions to determine which parts apply to your specific situation.

Understanding these misconceptions surrounding the TC-194 form can significantly ease the tax filing process and ensure compliance with Utah's tax laws. With accurate information, taxpayers can navigate their obligations more confidently and efficiently.

Key takeaways

When tackling the task of filling out the TC 194 form in Utah, it's imperative to proceed with care and attention to detail. This document, although might seem straightforward at first glance, holds significant importance for those who use it. Here are four key takeaways to keep in mind to ensure the process goes smoothly and effectively:

- Understanding the Purpose: The TC 194 form is a vital document used in the state of Utah for specific legal or governmental transactions. Knowing exactly why and how it should be properly filled out is the first step. Each section should be reviewed to understand its requirements fully.

- Accuracy is Key: When completing the form, every piece of information should be double-checked for accuracy. Incorrect or misleading information can lead to delays or the rejection of the form. It's not just about filling in the blanks—it's about providing precise and correct details.

- Supporting Documents: In many cases, the TC 194 form requires accompanying documentation. This could include identification, evidence of eligibility, or other relevant records. Gathering all necessary documents before starting the form will save time and hassle.

- Submission Guidelines: Understanding where and how to submit the form is just as important as filling it out correctly. Depending on its purpose, the form might need to be submitted to a specific department or through a particular method (online, mail, or in person). Make sure to follow the stated guidelines to avoid any complications.

Filling out the TC 194 form does not have to be a daunting task. By keeping these key points in mind, individuals can navigate the process with more confidence and efficiency. Remember, the goal is to ensure that the submission is successful on the first try, so taking the time to do it right is well worth the effort.

Common PDF Templates

Survivorship Affidavit Utah - It serves as a formal request to the Utah State Tax Commission for a hearing concerning a towed vehicle.

Utah State Income Tax Forms 2022 - Detailed instructions for claiming the credit, including the certification process, are provided on the form.