Free Small Estate Affidavit Form for Utah

In the realm of probate law, the process of settling an estate after an individual's death can be daunting and complex, especially for those without a legal background. Utah, like many states, offers a streamlined method for handling smaller estates, significantly reducing the procedural hurdles typically associated with probate court. The Utah Small Estate Affidavit form emerges as a critical tool in this process, providing a simplified pathway for the transfer of assets from the deceased to their rightful heirs or beneficiaries. This form is applicable under specific circumstances, primarily based on the total value of the estate being below a certain threshold, thus exempting it from the full probate process. By utilizing this affidavit, eligible parties can expedite the transfer of assets, including personal property, bank accounts, and even vehicles, with considerably less time and expense. Its effectiveness, however, hinges on a clear understanding of its requirements, the types of assets it covers, and the legal obligations of the individuals involved. The utilization of the Utah Small Estate Afficavit form marks a significant departure from traditional probate proceedings, embodying a pragmatic approach to estate resolution that aligns with the needs of many Utah residents facing the challenging task of estate settlement.

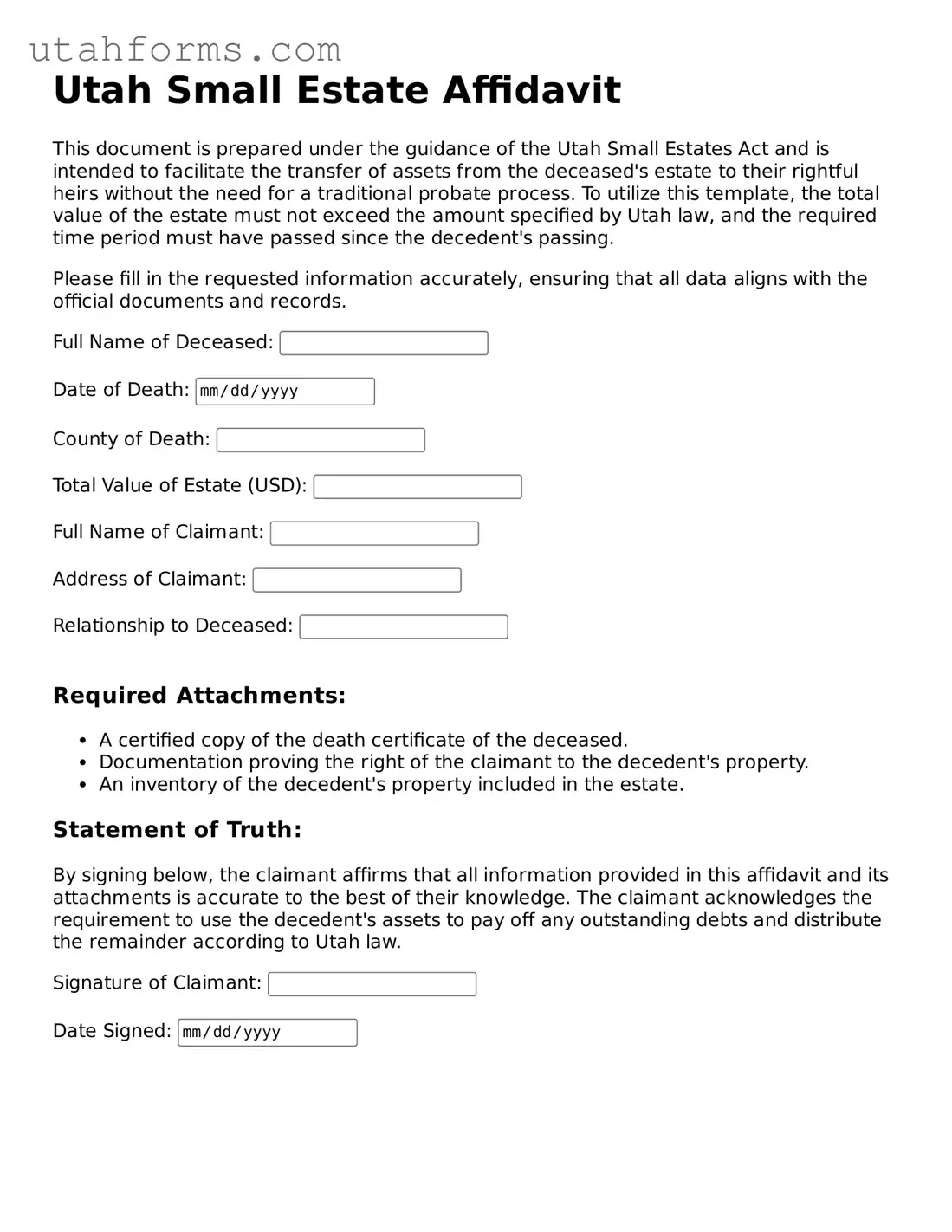

Preview - Utah Small Estate Affidavit Form

Utah Small Estate Affidavit

This document is prepared under the guidance of the Utah Small Estates Act and is intended to facilitate the transfer of assets from the deceased's estate to their rightful heirs without the need for a traditional probate process. To utilize this template, the total value of the estate must not exceed the amount specified by Utah law, and the required time period must have passed since the decedent's passing.

Please fill in the requested information accurately, ensuring that all data aligns with the official documents and records.

Document Properties

| Fact Number | Description |

|---|---|

| 1 | The Utah Small Estate Affidavit form is used to settle estates valued at $100,000 or less. |

| 2 | This form allows for the transfer of property without a formal probate process. |

| 3 | It is applicable to personal property such as bank accounts, stocks, and vehicles. |

| 4 | Real estate cannot be transferred using this form in Utah. |

| 5 | Governing laws for the form are found in Utah Code Section 75-3-1201. |

| 6 | A claim can be filed using this form only after 30 days have passed since the death. |

| 7 | The affidavit requires a detailed list of the assets and their values. |

| 8 | Debt obligations of the deceased must be disclosed and addressed. |

| 9 | Signing the form in front of a notary public is necessary to validate it. |

How to Write Utah Small Estate Affidavit

Dealing with the estate of a loved one who has passed away can be both an emotional and complex task. In Utah, if the estate is considered "small" by legal standards, you may have the option to utilize a Small Estate Affidavit to streamline the process. This document allows for the transfer of property without the need for a lengthy probate process. However, filling out this form correctly is crucial to avoid any potential legal issues. Here are the steps you'll need to follow to ensure the form is completed accurately.

- Determine eligibility: Before filling out the form, ensure that the estate meets Utah's requirements for being considered small. This typically involves the total value of the estate not exceeding a certain threshold.

- Gather necessary information: Collect all pertinent information such as the decedent's full name, date of death, and a detailed list of assets. You'll also need to know the legal names and addresses of any beneficiaries.

- Complete the affidavit: Start by filling in the decedent's details, including their full name as it appears on the death certificate and the date of death.

- Describe the assets: Clearly list all of the assets included in the estate. This should cover everything from bank accounts to personal property, along with their estimated values.

- Identify the beneficiaries: Provide the names, addresses, and relationship to the decedent of all individuals entitled to inherit the assets. If there are specific items bequeathed to particular beneficiaries, note this clearly.

- Sign before a notary: Once the affidavit is fully completed, it must be signed in the presence of a notary public. This adds a layer of legal verification to the document.

- File or present the affidavit: Depending on your local laws and the type of asset involved, you might need to submit the completed affidavit to a court or directly to the institution holding the asset (e.g., a bank).

After these steps are completed, the process of transferring assets can legally proceed. It’s worth noting that the actual experience may vary slightly based on the specific circumstances of the estate and the assets involved. In some situations, additional documentation or steps might be necessary. If at any point the process feels overwhelming, consulting with a legal professional who specializes in estate planning can be incredibly helpful.

Frequently Asked Questions

-

What is a Small Estate Affidavit in Utah?

A Small Estate Affidavit is a legal document used in Utah to manage and distribute the estate of a deceased person, known as the decedent, without a formal probate court process. It's applicable when the total value of the decedent’s assets falls below a specific threshold. This document allows the rightful heirs or designated people to claim property, manage bank accounts, and perform other tasks related to the estate's assets, simplifying the process significantly.

-

Who is eligible to file a Small Estate Affidavit in Utah?

In Utah, to be eligible to file a Small Estate Affidavit, an individual must be an heir or legally designated representative of the decedent's estate. This typically includes family members, such as spouses, children, or parents, or a person named in the will. It's important that the total value of the estate's assets qualifies under the state's threshold, which stands at $100,000 or less.

-

What is the threshold for a small estate in Utah?

For an estate to be considered small in Utah, the total value of the property left by the decedent, excluding liens and encumbrances, must not exceed $100,000. This calculation includes bank accounts, vehicles, and other personal property but does not take into account real estate owned by the decedent.

-

What documents are needed to file a Small Estate Affidavit in Utah?

To file a Small Estate Affidavit in Utah, you will need the following documents:

- A certified copy of the death certificate of the decedent.

- A completed Small Estate Affidavit form, accurately filled out and signed.

- Documents proving the heir’s entitlement to the property, such as a will, if available.

- An itemized list of the estate’s assets and their estimated value.

- Any other documents that might be required by the institution or entity transferring the assets.

-

How is the Small Estate Affidavit filed in Utah?

In Utah, the Small Estate Affidavit is typically not filed with the court. Instead, it is presented directly to the person or entity holding the assets of the estate, such as a bank or brokerage firm. The affidavit must be signed in the presence of a notary public before it's given to the asset holder. This process enables the transfer of assets without the need for formal probate proceedings.

-

Is there a waiting period to file a Small Estate Affidavit in Utah?

Yes, in Utah, there is a mandatory waiting period of 30 days after the decedent’s death before a Small Estate Affidavit can be legally filed or presented. This waiting period allows for the collection and valuation of the estate's assets and for potential creditors to make claims against the estate.

-

Can real estate be transferred with a Small Estate Affidavit in Utah?

No, real estate cannot be transferred using a Small Estate Affidavit in Utah. The affidavit process is designed only for personal property, such as bank accounts, stocks, and vehicles. If the decedent owned real estate, the estate might need to go through formal probate or use another legal process tailored for real estate, such as a Transfer on Death Deed, if it was prepared in advance.

-

What happens if the estate exceeds the small estate limit in Utah?

If the total value of the estate exceeds the $100,000 threshold in Utah, then it does not qualify as a small estate, and the Small Estate Affidavit cannot be used. Instead, the estate will likely need to undergo formal probate, where a court oversees the distribution of assets, payment of debts, and resolution of any disputes. This process is more time-consuming and may require the assistance of an attorney.

-

Can creditors make claims against assets transferred via a Small Estate Affidavit?

Yes, creditors may make claims against assets transferred through a Small Estate Affidavit. The heirs or recipients of the assets may be held liable for the decedent’s debts up to the value of the property they received. It's advisable to ensure that all debts and claims are satisfied, or adequately provided for, before distributing assets to avoid personal liability.

-

How can someone contest a Small Estate Affidavit in Utah?

To contest a Small Estate Affidavit in Utah, an interested party must typically present a written objection to the person or entity in possession of the estate's assets. This objection should clearly state the reasons for contesting the affidavit, backed by relevant laws or evidence. If disputes cannot be resolved through negotiation or mediation, litigation may be necessary, and it is advisable to seek legal counsel.

Common mistakes

Filling out legal forms can often seem straightforward, but errors can easily slip through. When it comes to the Utah Small Estate Affidavit form, several common mistakes could potentially derail the process or delay the distribution of assets. Understanding these mistakes can help ensure that the process goes smoothly.

Incorrect or Incomplete Information: One of the most frequent errors is entering incorrect or incomplete information. This could include misspelled names, wrong addresses, or incomplete descriptions of assets. Such mistakes can cause confusion or misidentification of estate assets, potentially leading to legal challenges or delays in the distribution process.

Not Meeting the Eligibility Requirements: Utah's Small Estate Affidavit procedure is designed for estates below a certain value threshold and with specific types of assets. Failing to verify that the estate meets these criteria before proceeding can lead to a waste of time and effort, as the affidavit would ultimately be rejected.

Failure to Properly Identify Heirs or Beneficiaries: Another common mistake is the failure to accurately list all rightful heirs or beneficiaries. This oversight can result in potential legal disputes among heirs or the inadvertent omission of rightful heirs from the distribution of assets.

Not Obtaining Required Signatures: The Small Estate Affidavit must be signed by all parties with a vested interest in the estate. Sometimes, individuals neglect to obtain all the necessary signatures, which can invalidate the document or at least delay the process until all signatures are gathered.

Lack of Adequate Documentation: Insufficient documentation supporting the assertions made in the affidavit, such as proof of ownership or valuation of assets, can also be problematic. This mistake can lead to questions regarding the legitimacy or accuracy of the affidavit, potentially causing legal complications or the need for additional documentation, thus prolonging the process.

Improper Filing or Submission: Finally, incorrectly filing the affidavit with the appropriate local court or failing to submit it within the requisite time frame can be a critical error. This could result in the document being returned for corrections or, in worse cases, being completely disregarded.

To navigate the process of completing the Utah Small Estate Affidavit form effectively, avoiding these common mistakes is crucial. Accurate and careful preparation can streamline the asset distribution process, ensuring that it is executed as efficiently and smoothly as possible. Whenever in doubt, consulting with a legal professional experienced with Utah's estate settlement laws can provide valuable guidance and help avoid potential pitfalls.

Documents used along the form

Alongside the Utah Small Estate Affidavit form, various other documents may be instrumental in administering an estate, especially in cases that do not necessitate a full probate process. These documents support the affidavit, either by providing evidence required to transfer property or by ensuring compliance with state laws. Below is a list of documents commonly used in conjunction with the Small Estate Affidavit form.

- Death Certificate: A certified copy of the death certificate is crucial for proving the death of the decedent to financial institutions and other entities.

- Will Copy: If the decedent left a will, a copy might be necessary to confirm the existence of a will and the intentions regarding the estate's distribution.

- Third-Party Affidavit: This form is used by third parties, like banks, acknowledging the affidavit's authority to collect the deceased's assets.

- Vehicle Title Transfer Forms: State-specific forms are required to transfer ownership of vehicles owned by the decedent.

- Real Estate Transfer Documents: If the estate includes real property, legal documents such as a Transfer on Death Deed or beneficiary deed might be required for its transfer.

- Bank Letters: Banks may require a specific form or letter to release funds to the person specified in the small estate affidavit.

- Stock Transfer Forms: If the decedent owned stocks or bonds, transfer forms from the brokerage or transfer agent might be necessary.

- Life Insurance Forms: To claim life insurance proceeds, the insurer may require completion of their specific claim forms.

- Personal Property Affidavit: For personal property without titles, such as jewelry or furniture, an affidavit may be required to distribute the items per the decedent’s wishes or according to the law.

Each document plays a specific role in the administration of a small estate, from establishing authority to transfer assets, to actual transfer or distribution of the assets in accordance with the decedent’s will or state laws. Using the correct forms ensures the process is conducted legally and efficiently, allowing for a smoother transition of the estate to heirs or designated beneficiaries.

Similar forms

The Utah Small Estate Affidavit form bears similarities to various legal documents designed to streamline or facilitate specific legal processes, particularly in the context of estate planning, transfer, and administration. These documents generally aim to simplify the procedures around asset distribution or certification in the absence of a will, or when dealing with small estates that do not require full probate proceedings. Each document, while serving a unique function, shares some fundamental similarities with the Utah Small Estate Affidavit in terms of purpose, structure, or the legal context in which it operates.

A General Affidavit is a written statement, sworn to be true, providing specific facts or information. Like the Small Estate Affidavit, it is used to assert facts in a legally binding manner, though its application is broader, not limited to estate matters. The similarity lies in the affidavit's nature, requiring the signatory to attest to the truthfulness of the stated facts under penalty of perjury, hence ensuring legal accountability.

A Transfer on Death Deed (TODD) allows property owners to name a beneficiary to whom the property will pass upon the owner’s death, bypassing traditional probate proceedings. This document aligns with the Small Estate Affidavit in its purpose to expedite the transfer of assets upon death. However, it is executed by the property owner before death, directly designating beneficiaries, thereby simplifying the post-death transfer process.

The Executor’s Deed serves to transfer property from an estate to a buyer, as authorized by the probate court. Analogous to the Small Estate Affidavit, it comes into play when managing a decedent's estate, specifically in transferring real estate under the executor's authority. Both documents are utilized in the context of estate administration, facilitating the transfer of assets from the deceased to living entities.

A Revocable Living Trust is a document that allows individuals to place assets within a trust for their benefit during their lifetime, with the remainder passing to designated beneficiaries upon death. Similarity with the Small Estate Affidavit lies in avoiding the often lengthy and costly probate process. Though more comprehensive, the living trust achieves a similar goal: the efficient transfer of assets upon death.

Letters Testamentary and Letters of Administration are documents issued by a probate court that authorize an executor or administrator to act on behalf of a deceased person’s estate. They share the essence of legal authority with the Small Estate Affidavit. While these letters typically pertain to larger estates requiring formal probate, they, like the affidavit, officially empower individuals to manage and dispose of estates' assets.

The Durable Power of Attorney for Finances is a document that authorizes someone to handle financial matters on another person's behalf, effective even if the principal becomes incapacitated. It is connected to the Small Estate Affidavit through its role in managing or transferring assets, albeit under different circumstances. Both documents involve delegating authority to manage assets, though the scope and conditions of this authority differ markedly.

A Beneficiary Designation is commonly used with retirement accounts and insurance policies to specify who will receive the assets upon the policyholder or account holder's death. This procedural similarity with the Small Estate Affidavit lies in the straightforward designation of beneficiaries, aiming to bypass the probate process for these particular assets. Both intend to ensure that certain assets are transferred smoothly and directly to beneficiaries.

A Payable on Death (POD) bank account designation allows account holders to specify beneficiaries for their accounts, who will then gain access to the funds upon the account holder's death, without going through probate. This concept mirrors the purpose behind the Small Estate Affidavit: enabling the direct transfer of assets to named individuals upon death, minimizing the need for judicial involvement.

The Joint Tenancy with Right of Survivorship is a form of co-ownership where property passes automatically to the surviving co-owner(s) upon one’s death. It shares the Small Estate Affidavit’s goal of avoiding probate for the transfer of assets. While structurally different, both arrangements facilitate a smoother transition of assets upon death, without entailing probate procedures.

Lastly, the Health Care Directive or Living Will is a document expressing an individual's preferences regarding medical treatment in the event they become unable to communicate their wishes. Though not directly related to asset transfer like the Small Estate Affidavit, it simplifies the process of decision-making in critical conditions, bearing the common theme of preparing for future inevitabilities through legally binding declarations.

Dos and Don'ts

When dealing with the Utah Small Estate Affidavit form, it's important to approach the process with care and attention. Understanding the do's and don'ts can make a significant difference in the efficacy and smoothness of the procedure. Below are key points, divided into what you should and shouldn't do, to help guide you through filling out the form accurately and compliantly.

Do:- Verify eligibility: Confirm that the estate in question qualifies as a "small estate" under Utah law. This typically means the total value of the estate meets the state's specified threshold.

- Gather accurate information: Before filling out the form, collect all necessary documents and accurate information about the deceased's assets, debts, and heirs.

- Review the form thoroughly: Understand every section of the form to ensure that all required information is provided and accurately reflects the estate's details.

- Sign in the presence of a notary public: Utah law requires the Small Estate Affidavit to be notarized. Ensure that all signatories are present before a notary public to validate the document.

- Make copies: After the form is completed and notarized, make several copies. You will need them for various institutions like banks, the DMV, and government agencies.

- File timely: Familiarize yourself with any timelines or deadlines for filing the Small Estate Affidavit within your local jurisdiction.

- Seek legal advice: If uncertain about any part of the process or if the estate has complex elements, consulting with a legal professional can provide clarity and ensure compliance.

- Guess on details: Avoid making assumptions about the value of assets or about legal heirs. Incorrect information can lead to delays and legal complications.

- Omit required information: Every field on the form is important. Leaving sections blank can result in the form being rejected.

- Rush the process: Take your time to accurately complete the form. Mistakes made in haste can be costly and time-consuming to correct.

- Ignore debts and obligations: Be sure to include all known debts and liabilities of the estate. Failing to account for these can create legal issues down the line.

- Attempt to hide assets: It's crucial to be transparent about all assets within the estate. Concealing assets is illegal and can result in severe penalties.

- Overlook tax implications: Some estates may have tax obligations. Ignoring potential taxes can lead to issues with the IRS or state taxing authorities.

- Assume you don't need professional help: While the Small Estate Affidavit process is designed to be straightforward, legal and financial complexities can arise. Professional guidance can help navigate these challenges effectively.

Misconceptions

When navigating the aftermath of a loved one's passing in Utah, dealing with their estate can seem daunting. The Utah Small Estate Affidavit is a tool designed to simplify this process for estates considered "small" by legal standards. However, there are several misconceptions regarding its use and applicability that can lead to confusion. Understanding these misconceptions is key to efficiently managing estate affairs.

- Anyone can file a Small Estate Affidavit immediately after a death. It's often thought that the Small Estate Affidavit can be filed immediately following a person’s passing. However, Utah law requires a waiting period of 30 days after the death before the affidavit can be submitted. This waiting period allows for a comprehensive identification of all potential claims and creditors against the estate.

- There is no value limit for using a Small Estate Affidavit. This is a common misunderstanding. In truth, Utah sets specific financial thresholds determining what constitutes a "small estate." As of the last update, an estate must not exceed $100,000 in value (excluding certain assets) to qualify for the small estate process. This limitation ensures that the process is only used for estates that can be resolved relatively simply.

- A Small Estate Affidavit transfers title to real estate. Another frequent misconception is that filing a Small Estate Affidavit allows for the transfer of real property (real estate) titles. In reality, the form is primarily used for personal property, such as bank accounts and vehicles. Real estate matters often require more formal probate proceedings to transfer titles legally.

- All assets can be transferred using a Small Estate Affidavit. Not all assets can be successfully transferred through the Small Estate Affidavit process. For example, assets that are owned jointly or designated to a beneficiary (such as life insurance policies or retirement accounts) normally pass to the surviving co-owner or named beneficiary directly, outside of the small estate process.

- The process eliminates the need for a lawyer. While the Small Estate Affidavit is designed to simplify estate resolution, assuming it negates the need for legal advice is a risk. Every estate is unique, and various complications can arise. Professional legal guidance can help navigate those complexities, ensuring all legal obligations are met and potentially avoiding costly mistakes.

Ultimately, the Small Estate Affidavit offers a streamlined alternative for handling small estates in Utah, but understanding its limitations and requirements is crucial. While it simplifies some aspects of estate resolution, it may not be a one-size-fits-all solution. Careful consideration and, often, professional guidance are necessary to ensure that the estate settlement process is conducted smoothly and in accordance with the law.

Key takeaways

The Utah Small Estate Affidavit form is an important document for those handling the estate of a deceased person without going through the formal probate process. It's essential to understand its use, requirements, and implications thoroughly. Here are key takeaways to consider:

- Eligibility for using the form hinges on the total value of the estate. It must fall below a certain threshold, determined by Utah state law, which is typically updated regularly.

- This form allows the transfer of property from the deceased to their heirs without the need for a lengthy court probate procedure.

- Only certain types of property can be transferred using the Small Estate Affidavit. These typically include personal property, bank accounts, and sometimes vehicles, but not real estate.

- Before filing the form, Utah law requires a waiting period from the date of death, ensuring all debts and claims against the estate can be accounted for.

- Accuracy is paramount when filling out the form. Errors or omissions can result in delays or legal complications.

- The affidavit must be signed in the presence of a notary public to ensure its validity.

- Detailing the deceased’s assets accurately is critical. This includes providing exact account numbers and descriptions of personal property.

- Filing the affidavit with the appropriate institution is necessary to transfer assets. For example, a bank would require this document to release funds to the heirs.

- There may be instances where multiple heirs are involved, necessitating clear communication and agreement on the distribution of assets as outlined in the affidavit.

- Obtaining legal advice can be beneficial, especially in situations where the estate’s distribution might be complex or disputed among heirs.

Handling the small estate of a loved person can be an emotionally taxing process. However, by using the Utah Small Estate Affidavit form correctly, beneficiaries can simplify the process, ensuring that assets are distributed according to the deceased’s wishes with minimal legal hurdles.

Other Popular Utah Templates

Is Utah a 50 50 Divorce State - A critical document for ensuring both spouses are on the same page regarding their separation terms and conditions.

How to Sell a Car Privately in Utah - Apart from the basic information, it might include special terms or conditions agreed upon by the buyer and seller.