Fill Out Your Seller Utah Form

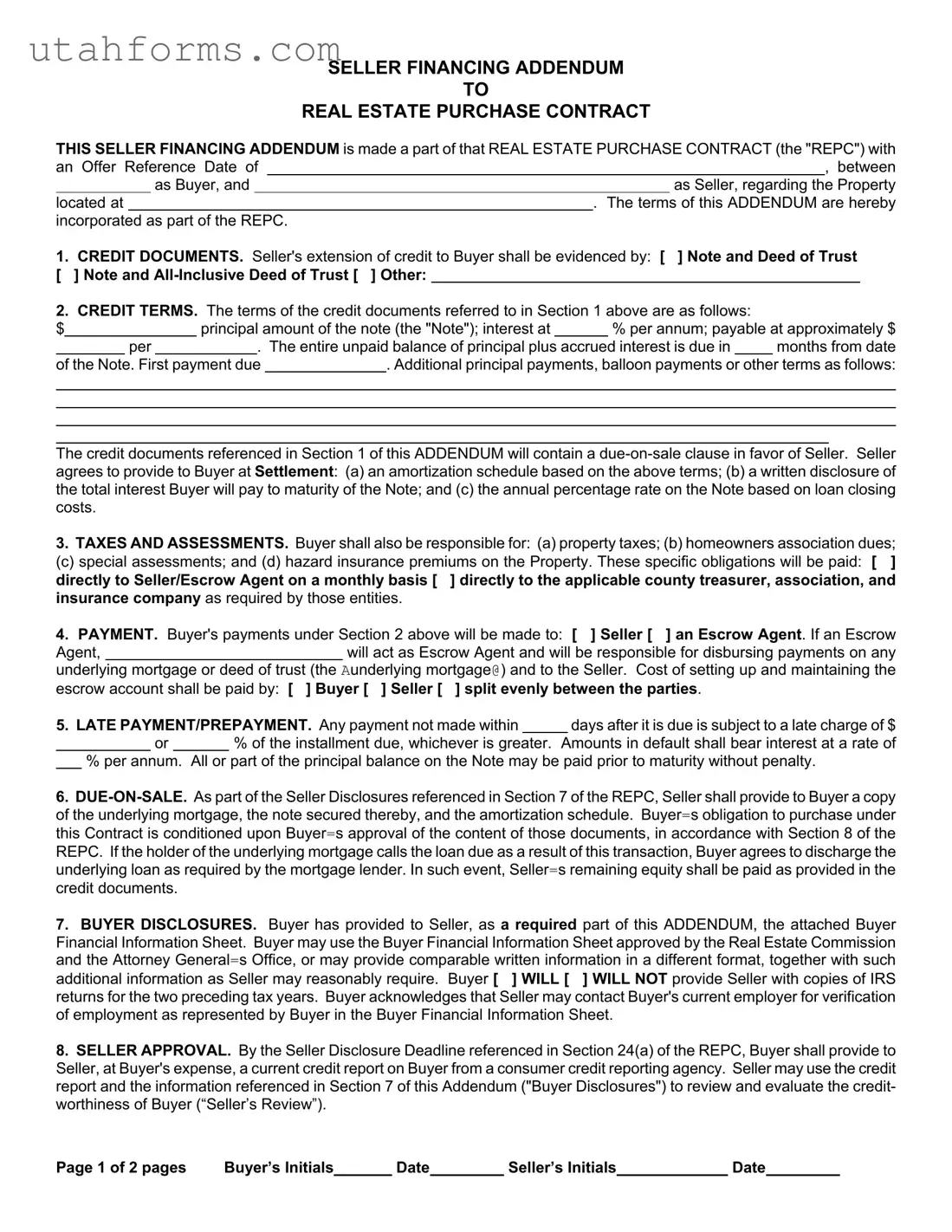

Engaging in a real estate transaction requires careful consideration, especially when seller financing is part of the agreement. The Seller Financing Addendum to Real Estate Purchase Contract, recognized within Utah real estate practices, plays a pivotal role for both buyers and sellers opting for this alternative financing method. It mandates a detailed framework by which the seller extends credit to the buyer beyond the traditional mortgage system. Key components such as the credit documents required, credit terms including interest rates and payment schedules, responsibilities for taxes, assessments, and insurance, payment processing, implications of late or prepayments, and conditions surrounding the due-on-sale clause are clearly outlined. Additionally, the form emphasizes the necessity of transparent disclosures by both parties, including Buyer Financial Information and Seller's approval based on the buyer's creditworthiness. This addendum not only adjusts the Real Estate Purchase Contract to accommodate seller financing specifics but also ensures that all parties have a clear understanding of the terms, safeguarding their interests throughout the transaction process.

Preview - Seller Utah Form

SELLER FINANCING ADDENDUM

TO

REAL ESTATE PURCHASE CONTRACT

THIS SELLER FINANCING ADDENDUM is made a part of that REAL ESTATE PURCHASE CONTRACT (the "REPC") with

an Offer Reference Date of |

|

|

|

, between |

|||

|

|

as Buyer, and |

|

|

as Seller, regarding the Property |

||

located at |

|

. The terms of this ADDENDUM are hereby |

|||||

incorporated as part of the REPC. |

|

|

|

||||

1. CREDIT DOCUMENTS. Seller's extension of credit to Buyer shall be evidenced by: [ ] Note and Deed of Trust [ ] Note and

2.CREDIT TERMS. The terms of the credit documents referred to in Section 1 above are as follows:

$ |

|

|

principal amount of the note (the "Note"); interest at |

|

% per annum; payable at approximately $ |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

per |

|

|

. The entire unpaid balance of principal plus accrued interest is due in |

|

months from date |

|||||

of the Note. First payment due |

|

. Additional principal payments, balloon payments or other terms as follows: |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The credit documents referenced in Section 1 of this ADDENDUM will contain a

3.TAXES AND ASSESSMENTS. Buyer shall also be responsible for: (a) property taxes; (b) homeowners association dues;

(c) special assessments; and (d) hazard insurance premiums on the Property. These specific obligations will be paid: [ ] directly to Seller/Escrow Agent on a monthly basis [ ] directly to the applicable county treasurer, association, and insurance company as required by those entities.

4. PAYMENT. Buyer's payments under Section 2 above will be made to: [ ] Seller [ ] an Escrow Agent. If an Escrow

Agent,will act as Escrow Agent and will be responsible for disbursing payments on any

underlying mortgage or deed of trust (the Aunderlying mortgage@) and to the Seller. Cost of setting up and maintaining the escrow account shall be paid by: [ ] Buyer [ ] Seller [ ] split evenly between the parties.

5. LATE PAYMENT/PREPAYMENT. Any payment not made within |

|

|

days after it is due is subject to a late charge of $ |

|||

|

or |

|

% of the installment due, whichever is greater. |

Amounts in default shall bear interest at a rate of |

||

%per annum. All or part of the principal balance on the Note may be paid prior to maturity without penalty.

6.

7.BUYER DISCLOSURES. Buyer has provided to Seller, as a required part of this ADDENDUM, the attached Buyer Financial Information Sheet. Buyer may use the Buyer Financial Information Sheet approved by the Real Estate Commission and the Attorney General=s Office, or may provide comparable written information in a different format, together with such

additional information as Seller may reasonably require. Buyer [ ] WILL [ ] WILL NOT provide Seller with copies of IRS returns for the two preceding tax years. Buyer acknowledges that Seller may contact Buyer's current employer for verification of employment as represented by Buyer in the Buyer Financial Information Sheet.

8.SELLER APPROVAL. By the Seller Disclosure Deadline referenced in Section 24(a) of the REPC, Buyer shall provide to Seller, at Buyer's expense, a current credit report on Buyer from a consumer credit reporting agency. Seller may use the credit report and the information referenced in Section 7 of this Addendum ("Buyer Disclosures") to review and evaluate the credit- worthiness of Buyer (“Seller’s Review”).

Page 1 of 2 pages |

Buyer’s Initials |

|

Date |

Seller’s Initials |

Date |

|||

|

|

|

|

|

|

|

|

|

8.1Seller Review. If Seller determines, in Seller’s sole discretion, that the results of the Seller’s Review are unacceptable, Seller may either: (a) no later than the Due Diligence Deadline referenced in Section 24(b) of the REPC, cancel the REPC by providing written notice to Buyer, whereupon the Earnest Money Deposit shall be released to Buyer without the requirement of further written authorization from Seller; or (b) no later than the Due Diligence Deadline referenced in Section 24(b), resolve in writing with Buyer any objections Seller has arising from Seller’s Review.

8.2Failure to Cancel or Resolve Objections. If Seller fails to cancel the REPC or resolve in writing any objections Seller has arising from Seller’s Review, as provided in Section 8.1 of this ADDENDUM, Seller shall be deemed to have waived the Seller=s Review.

9.TITLE INSURANCE. Buyer [ ] SHALL [ ] SHALL NOT provide to Seller a lender=s policy of title insurance in the amount of the indebtedness to the Seller, and shall pay for such policy at Settlement.

10.DISCLOSURE OF TAX IDENTIFICATION NUMBERS. By no later than Settlement, Buyer and Seller shall disclose to each other their respective Social Security Numbers or other applicable tax identification numbers so that they may comply with federal laws on reporting mortgage interest in filings with the Internal Revenue Service.

To the extent the terms of this ADDENDUM modify or conflict with any provisions of the REPC, including all prior addenda and counteroffers, these terms shall control. All other terms of the REPC, including all prior addenda and counteroffers, not

modified by this ADDENDUM shall remain the same. [ ] Seller [ ] Buyer shall have until |

|

[ ] AM [ ] PM |

||

Mountain Time on |

|

(Date), to accept the terms of this SELLER FINANCING ADDENDUM in |

||

accordance with Section 23 of the REPC. Unless so accepted, the offer as set forth in this SELLER FINANCING ADDENDUM shall lapse.

_________________________________________________________________________________________________

[ ] Buyer [ ] Seller Signature(Date) (Time)Social Security Number

_________________________________________________________________________________________________

[ ] Buyer [ ] Seller Signature |

(Date) (Time) |

Social Security Number |

ACCEPTANCE/COUNTEROFFER/REJECTION

CHECK ONE:

[ ]ACCEPTANCE: [ ] Seller [ ] Buyer hereby accepts these terms.

[]COUNTEROFFER: [ ] Seller [ ] Buyer presents as a counteroffer the terms set forth on the attached ADDENDUM NO.

______.

[]REJECTION: [ ] Seller [ ] Buyer rejects the foregoing SELLER FINANCING ADDENDUM.

(Signature) |

(Date) |

(Time) |

(Signature) |

(Date) |

(Time) |

|

|

|

|

|

|

(Signature) |

(Date) |

(Time) |

(Signature) |

(Date) |

(Time) |

THIS FORM APPROVED BY THE UTAH REAL ESTATE COMMISSION AND THE OFFICE OF THE UTAH ATTORNEY GENERAL,

EFFECTIVE AUGUST 27, 2008. AS OF JANUARY 1, 2009, IT WILL REPLACE AND SUPERSEDE THE PREVIOUSLY APPROVED VERSION OF THIS FORM.

Page 2 of 2 pages |

Buyer’s Initials |

|

Date |

Seller’s Initials |

Date |

|||

|

|

|

|

|

|

|

|

|

File Specifications

| Fact | Details |

|---|---|

| Purpose | Addendum for seller financing terms in a real estate purchase |

| Integration | Incorporated as part of the Real Estate Purchase Contract (REPC) |

| Credit Documents | Evidence of seller's credit extension to buyer (e.g., Note and Deed of Trust) |

| Credit Terms | Details of the note, interest, payments, and any balloon payments |

| Buyer Obligations | Property taxes, HOA dues, special assessments, hazard insurance premiums |

| Due-on-Sale Clause | Requirement for buyer to discharge the underlying loan if called due |

| Buyer Disclosures | Financial information and possibly IRS returns for the last two years |

| Seller Review | Seller's discretionary right to cancel or alter the REPC based on buyer's creditworthiness |

| Title Insurance | Buyer to provide a lender's policy of title insurance at Settlement |

| Governing Laws | Utah Real Estate Commission and the Office of the Utah Attorney General |

How to Write Seller Utah

After deciding to engage in a property sale with seller financing in Utah, completing the Seller Financing Addendum to the Real Estate Purchase Contract is required. This document outlines the financing terms agreed upon by both the buyer and seller. Care and attention should be given to fill out this form accurately, as it modifies and supplements the main Real Estate Purchase Contract with specific financial details and obligations. The steps outlined below guide through the process of completing the form, ensuring all necessary information is provided.

- Begin by entering the Offer Reference Date of the original Real Estate Purchase Contract (REPC) at the top of the form.

- Clearly print the names of the buyer and seller as they appear in the REPC.

- Specify the location of the property being sold under "Property located at."

- Choose the type of credit documentation (Note and Deed of Trust, Note and All-Inclusive Deed of Trust, or Other) by marking the appropriate box in Section 1.

- In Section 2, detail the credit terms including principal amount, interest rate, and monthly payment amount. Also specify the due date of the first payment and any special payment terms like balloon payments.

- For Section 3, indicate how taxes, assessments, homeowners association dues, and hazard insurance premiums will be paid by marking the appropriate box.

- Under Section 4, mark the appropriate box to indicate whether payments will be made directly to the seller or an Escrow Agent. Fill in the details of the Escrow Agent if applicable.

- In Section 5, enter the days after which a payment is considered late and specify the late charge.

- Detail the due-on-sale clause in Section 6, including the obligations of the buyer regarding the underlying mortgage, if applicable.

- Section 7 requires the buyer to attach a Buyer Financial Information Sheet and specify whether IRS returns will be provided.

- In Section 8, note that the buyer must provide a current credit report to the seller by a certain deadline and detail the outcomes based on the seller's review of the buyer's financial information.

- Confirm whether title insurance will be provided by marking the appropriate box in Section 9.

- Agree to disclose tax identification numbers to each other by the settlement date mentioned in Section 10.

- Ensure both the buyer and seller initial and date the bottom of each page to demonstrate agreement with the terms as stated.

- Sign and date the form at the end, ensuring both parties fully complete the acceptance, counteroffer, or rejection section accordingly.

After completing and signing the form, the next steps include submitting it as part of the closing documents and proceeding with the closing process. The filled-out addendum becomes a binding part of the Real Estate Purchase Contract, solidifying the agreed-upon seller financing terms. It is crucial to review all filled sections carefully before submission to avoid potential misunderstandings or disputes. Once submitted, parties should prepare for the next phases of the transaction, including settlement and transfer of ownership.

Frequently Asked Questions

What is the purpose of the Seller Financing Addendum in Utah?

How does seller financing work according to this addendum?

What are the specified credit terms under this addendum?

Who is responsible for property taxes and insurance according to the addendum?

What happens if a payment is late, according to the addendum?

What is the "due-on-sale" clause mentioned in the addendum?

What are the requirements for buyer disclosures?

How is seller approval of buyer credit determined?

The Seller Financing Addendum is designed to be an integral part of the Real Estate Purchase Contract (REPC), specifying the terms under which the seller will extend credit to the buyer for the purchase of property. Its primary purpose is to outline all credit-related details, such as the form of the credit agreement, the credit terms including interest rate, payment schedule, responsibilities for taxes, assessments, and insurance, as well as any conditions related to late payments or prepayment.

According to this addendum, seller financing operates by the seller extending credit directly to the buyer under specific terms outlined in the document. The extension of credit will be evidenced by a Note and Deed of Trust or an All-Inclusive Deed of Trust, among other potential credit documents. The buyer then repays the principal amount along with interest at the agreed upon rate, following the payment schedule specified in the credit terms.

The credit terms detailed in the addendum include the principal amount of the note, the interest rate per annum, the monthly payment amount, the total duration (in months) until the full amount plus interest is due, and the date the first payment is due. It may also outline conditions for additional principal payments, balloon payments, or other specific terms related to the credit arrangement.

Under the addendum, the buyer is responsible for paying property taxes, homeowners association dues, special assessments, and hazard insurance premiums. These payments can be made either directly to the seller or an escrow agent monthly or directly to the pertinent county treasurer, association, and insurance company as required by those entities.

If a payment is made after its due date, a late charge will apply, which is either a specified dollar amount or a percentage of the installment due, whichever is greater. In addition, amounts in default will accrue interest at an annually specified rate. The agreement also outlines that all or part of the principal balance can be paid off early without incurring any penalties.

The "due-on-sale" clause is a provision in favor of the seller that calls for the full repayment of the outstanding credit balance if the property is sold. This clause ensures that the seller can recover their equity in the property upon its sale by the buyer to another party.

Buyer disclosures, as required by this addendum, include providing the seller with a completed Buyer Financial Information Sheet, which may either follow the template approved by the Real Estate Commission and the Attorney General’s Office or provide comparable information in a different format. The buyer may also need to supply copies of IRS returns for the two preceding tax years and allow the seller to verify employment details presented in the Financial Information Sheet.

Seller approval of buyer credit is determined through a review process, where the seller evaluates the buyer's credit worthiness based on a current credit report and the financial information provided by the buyer. The seller has discretion to either cancel the REPC or resolve any objections in writing by specified deadlines if they find the results of their review unsatisfactory. Failure to cancel or resolve objections on the seller’s part is deemed a waiver of the seller’s review.

Common mistakes

When filling out the Seller Financing Addendum form, individuals often make errors that could be easily avoided with careful attention to detail and understanding of the document's requirements. These mistakes can lead to misunderstandings, delays, and potentially negative consequences for both the buyer and seller involved in a real estate transaction.

One common mistake is not specifying the type of credit documents under Section 1. The form provides options such as "Note and Deed of Trust," "Note and All-Inclusive Deed of Trust," and "Other." Accurately indicating the type of credit documents ensures that both parties have a clear understanding of the credit terms and legal instruments governing the transaction.

In Section 2, detailing the credit terms, individuals frequently fail to accurately record the principal amount of the note, the interest rate, and the payment schedule. These are crucial details that dictate the financial obligations of the buyer to the seller. Miscommunication or omission here can lead to significant discrepancies in expectations and legal obligations.

Failing to accurately indicate how taxes and assessments are to be paid, as outlined in Section 3. The form provides options for payments directly to the Seller/Escrow Agent or directly to the respective entities like the county treasurer. This section is crucial for managing the property's ongoing financial responsibilities and ensuring that taxes and dues do not become a point of contention.

Not properly identifying the party responsible for setting up and maintaining the escrow account in Section 4. This can lead to confusion about who bears the financial burden for these services, potentially causing disagreements or unexpected expenses for one party.

Omitting or incorrectly entering the due dates for the first payment under Section 2 and for resolving objections or cancelling the REPC as mentioned in Section 8.1. These dates are critical for ensuring that all parties adhere to the agreed timelines, and failing to specify them can lead to disputes and delays in the transaction.

Incomplete or inaccurate disclosure of tax identification numbers by the deadline, as required in Section 10. This information is essential for compliance with federal laws and failure to accurately disclose this can result in legal repercussions for both buyer and seller.

Overlooking the requirement under Section 9 for the buyer to provide a lender’s policy of title insurance, and who will bear the cost. This insurance protects the seller’s interest in the property and is a key component of a secure financial transaction. Misunderstandings in this area can lead to financial loss or legal complications.

Understanding each section and accurately completing the Seller Financing Addendum ensures a smoother, more transparent real estate transaction. By paying close attention to these details, buyers and sellers can avoid common pitfalls that complicate the process.

Documents used along the form

When engaging in real estate transactions that involve seller financing, like those outlined in the Seller Utah form, parties often need to prepare and consider additional documents to ensure a smooth and legally sound transaction. These documents play crucial roles in protecting both buyer and seller interests, clarifying the terms of the sale, and complying with legal requirements.

- Real Estate Purchase Contract (REPC): This is the primary agreement between the buyer and seller detailing the sale's terms, including the property price, closing date, contingencies, and other essential conditions. The Seller Financing Addendum complements this contract by specifying the financing terms provided by the seller.

- Amortization Schedule: This document outlines the breakdown of payments over the loan period. It shows how each payment contributes to paying off the interest and the principal amount. The schedule helps both parties understand the timeline of the financial obligations.

- Deed of Trust or Mortgage: Depending on the state, one of these documents secures the loan on the property. It gives the lender (the seller, in this case) a lien on the property as collateral for the loan, and it outlines what happens if the buyer fails to make the agreed payments.

- Title Insurance Policy: This ensures the buyer and lender that the title to the property is free from defects or encumbrances, except those listed as exceptions in the policy. It protects against financial loss from defects in title or from the enforcement of liens against the property.

In completing a real estate transaction with seller financing, it's crucial for all parties involved to thoroughly review and understand each document. This ensures that the terms are clear, rights and responsibilities are well-defined, and everyone is legally protected throughout the deal. Preparing these forms accurately and consulting with professionals when necessary can help prevent future disputes and complications.

Similar forms

The Real Estate Purchase Contract (REPC) is fundamentally similar to the Seller Financing Addendum as it sets forth the terms and conditions under which property is sold and purchased, albeit without the specific financing details. The REPC outlines the agreement between the buyer and the seller, including property details, offer price, and contingencies like inspections and financing. When the Seller Financing Addendum is made a part of the REPC, it specifically integrates the terms under which the seller will finance the purchase for the buyer, supplementing the basic agreement with detailed financing conditions.

The Note and Deed of Trust document shares similarities with the Seller Financing Addendum by detailing the financial obligation of the buyer to the seller (or lender) and securing it with the property as collateral. This document outlines the loan amount, interest rate, repayment schedule, and the legal steps the lender can take if the borrower fails to make payments. The Seller Financing Addendum refers to these financing instruments as means to detail the credit arrangement directly between buyer and seller, effectively making the seller the lender.

An All-Inclusive Deed of Trust (Wrap-Around Mortgage) is another financial document that bears resemblance to the Seller Financing Addendum. This type of deed of trust allows a buyer to assume the seller's existing mortgage while creating a new, larger loan. It’s similar because it directly involves seller-assisted financing, wrapping an existing loan with new financing terms, which the addendum may specify as part of the seller financing solution.

Amortization schedules, referenced in the Seller Financing Addendum, are also standalone documents. They lay out in detail the schedule of payments for a loan, showing how much of each payment goes towards the principal vs. interest over the life of the loan. This document is crucial in seller financing arrangements to clearly understand the repayment plan, aligning with the addendum’s provision to provide such a schedule to the buyer.

The Late Payment Policy document, mirroring aspects of the Seller Financing Addendum, outlines the consequences of late payments on a loan, including any late fees and the rate of interest on overdue amounts. Such policies are standard practice in lending to ensure borrowers are clearly aware of the repercussions of failing to make timely payments, a principle also encapsulated in the addendum’s terms.

A Due-on-Sale Clause Agreement, like the one contemplated in the Seller Financing Addendum, is a document or clause within a mortgage that requires the full loan balance to be paid if the property is sold. This clause protects the lender by preventing the loan from being assumed by another party without approval. The addendum’s inclusion of a due-on-sale clause ensures the seller retains this protective measure when providing financing.

The Buyer Financial Information Sheet, required by the Seller Financing Addendum, is akin to loan application documents used in standard mortgage processes. It collects the buyer's financial data, enabling the seller to assess the buyer’s creditworthiness. This documentation is part of the seller's due diligence in a seller-financed transaction, comparable to a lender’s review in a traditional mortgage application.

A Credit Report Authorization form is closely related to the credit review steps mentioned in the Seller Financing Addendum. It permits the seller to obtain and review the buyer’s credit report as part of evaluating the buyer's ability to fulfill the financial obligations outlined in the seller financing agreement. This step is common in both traditional and seller-financed transactions to ensure the financial risk is acceptable.

Title Insurance Commitment Letters are related to the Seller Financing Addendum in that they ensure the property being financed is free of liens or encumbrances that could affect the sale. The addendum mentions that the buyer should provide title insurance to protect the seller’s interest, ensuring that the title is clear and the seller’s security in the property is intact.

The IRS Form 1098 or Mortgage Interest Statement is a document required for reporting mortgage interest paid by a borrower during the year. It is related to the Seller Financing Addendum’s mention of the disclosure of Social Security Numbers or tax identification numbers for IRS reporting purposes. This document facilitates compliance with federal tax laws, underscoring the addendum’s alignment with legal reporting requirements.

Dos and Don'ts

When engaging in transactions involving the Seller Financing Addendum to Real Estate Purchase Contract in Utah, it is vital to navigate the process with care to ensure all legal and financial obligations are accurately met. Here are tips on what you should and shouldn't do when filling out the form:

Things You Should Do

- Review all sections carefully: Make sure to read and understand each section of the addendum before filling it out. This ensures that all terms of the sale, including the financing, are clear to both the buyer and seller.

- Accurately complete financial details: The principal amount, interest rate, payment schedule, and any terms related to balloon payments or additional principal payments must be accurately noted. This prevents confusion and ensures both parties are aware of the financial obligations.

- Check compliance with legal requirements: Verify that all disclosures regarding taxes, assessments, and insurance premiums are made according to state laws. Additionally, ensure that the social security numbers or tax identification numbers of both parties are properly disclosed for IRS compliance.

- Ensure mutual agreement and signatures: Both the buyer and seller must agree to the terms outlined in the addendum. Ensure that all required signatures and initials are present to validate the agreement.

Things You Shouldn't Do

- Omit buyer or seller information: Leaving out the names or addresses of the buyer or seller can lead to legal complications. All information should be provided to ensure clarity and legal standing.

- Ignore specific payment instructions: Do not gloss over how payments will be made, to whom they should be made, and who is responsible for setting up and maintaining any escrow accounts. This information is crucial for ensuring smooth financial transactions.

- Forget to include due-on-sale clause details: Failing to address or clearly state the existence of a due-on-sale clause can lead to misunderstandings or legal issues should the property be sold again in the future.

- Skip credit and employment verification steps: Both the buyer and seller should adhere to the stipulations requiring credit reports and employment verification. Skipping these steps can lead to issues based on misunderstanding a party's financial stability.

Filling out the Seller Financing Addendum with attention to detail and adherence to legal requirements ensures a smoother and more transparent transaction. It protects the interests of both the buyer and seller, providing a solid foundation for their real estate agreement.

Misconceptions

There are several misconceptions about the Seller Financing Addendum in real estate transactions in Utah. Understanding these misconceptions is crucial for both buyers and sellers to ensure that they are fully informed about the implications and requirements of seller financing. Here are five common misconceptions:

- It Replaces the Real Estate Purchase Contract (REPC): Some might believe that the Seller Financing Addendum replaces the original Real Estate Purchase Contract. However, this addendum is meant to be incorporated as part of the REPC, not to replace it. The terms outlined in the addendum modify or supplement those in the REPC regarding the financing provided by the seller.

- Interest Rates and Payments Are Non-Negotiable: Another misconception is that the interest rates and payment schedules outlined in the addendum are fixed and cannot be negotiated. In reality, these terms are subject to negotiation between the buyer and the seller before finalizing the addendum. Both parties must agree on the interest rate, payment schedule, and other financial terms.

- Seller Financing Eliminates the Need for Buyer Disclosures: Some may erroneously think that seller financing means buyer disclosures are unnecessary. However, section 7 of the addendum requires the buyer to provide financial information to the seller, including a financial information sheet and, optionally, copies of IRS returns for the previous two years. This requirement ensures that the seller can assess the buyer's creditworthiness.

- Seller Financing Does Not Require a Credit Check: Contrary to what some might assume, seller financing does not mean the buyer will not undergo a credit check. As indicated in section 8, the buyer is required to provide a current credit report at their expense. The seller uses this report and other disclosures to evaluate the buyer's creditworthiness before finalizing the financing terms.

- Due-on-Sale Clauses Are Automatically Voided: A common misunderstanding might be that entering into a seller financing agreement nullifies any due-on-sale clause associated with the property. In actuality, the addendum specifies that if the underlying mortgage's due-on-sale clause is triggered by the transaction, it is the buyer's responsibility to satisfy the its requirements. Therefore, both parties should be aware of and address any implications of a due-on-sale clause when entering into a seller financing agreement.

By clarifying these misconceptions, buyers and sellers can better navigate the complexities of seller financing arrangements in Utah, ensuring a smoother and more informed transaction process.

Key takeaways

When completing the Seller Financing Addendum as part of a Real Estate Purchase Contract (REPC) in Utah, it's important to understand several key points that ensure both parties are informed and agreement terms are clearly outlined. This knowledge assists in navigating the seller financing process effectively.

- The addendum should be made a part of the initial Real Estate Purchase Contract, integrating all its terms to ensure a cohesive agreement between the buyer and the seller regarding the property in question.

- Credit documentation specified in the addendum can include options like a Note and Deed of Trust, an All-Inclusive Deed of Trust, or other agreed-upon credit documents to evidence the seller's extension of credit to the buyer.

- Details regarding the credit terms such as the principal amount, interest rate, payment schedules, and conditions for balloon payments or additional principal payments should be explicitly stated to avoid future conflicts.

- The addendum outlines responsibilities for taxes, assessments, insurance premiums, and homeowners association dues, specifying how and to whom these payments should be made, ensuring transparency on financial obligations tied to the property.

- Payment methods and the responsible party for managing escrow accounts, if used for payment collection, are clarified within the addendum. This includes who bears the cost of setting up and maintaining the escrow account.

- Late payment penalties and prepayment conditions are determined to protect both buyer and seller interests, allowing for early repayment of the principal balance without penalty under specific conditions.

- Disclosure of the due-on-sale clause is required, informing the buyer about the circumstances under which the underlying loan can be called due, emphasizing the importance of buyer's approval of credit documents tied to the property.

- Buyer disclosures, including financial information and possibly IRS returns, are a prerequisite, enabling the seller to assess the buyer’s creditworthiness. The seller's approval of the buyer's creditworthiness is critical for the financing agreement to proceed.

- Title insurance and tax identification numbers must be disclosed by the settlement to comply with federal laws, ensuring that both parties adhere to legal requirements for reporting and insurance coverage.

Understanding these key takeaways helps both the buyer and the seller navigate seller financing arrangements more smoothly, highlighting the importance of clear communication and thorough documentation in real estate transactions.

Common PDF Templates

Utah State Withholding Form - The Utah TC-116 form is designed for entities seeking fuel tax refunds from the state, providing a process to claim back taxes on various fuels.

Utah Professional Licensing - A necessary procedure for businesses to officially register their exemption status with the Utah Department of Commerce.

Utah State Tax Form for Employees - Facilitates the reporting of financial institutions within the corporation's return.