Free Real Estate Purchase Agreement Form for Utah

When stepping into the world of property transactions in Utah, the Real Estate Purchase Agreement form plays a pivotal role, acting as the blueprint for the sale. This important document not only outlines the price agreed upon by both buyer and seller but also details the conditions under which the sale will proceed. Its comprehensiveness covers various aspects, from the closing date to the specifics of the property itself, ensuring a smooth transition of ownership. For those navigating their first real estate purchase or sale, understanding each component of this form can demystify the process, making it more accessible. It's not just a formality; it acts as a binding contract that ensures both parties adhere to their commitments, providing a safety net that covers contingencies, such as financing issues and inspections. Additionally, the agreement spells out who pays for what costs, from closing fees to home warranties, making the financial responsibilities clear from the start. This document is not to be taken lightly, as it lays the groundwork for one of the most significant financial decisions in a person's life.

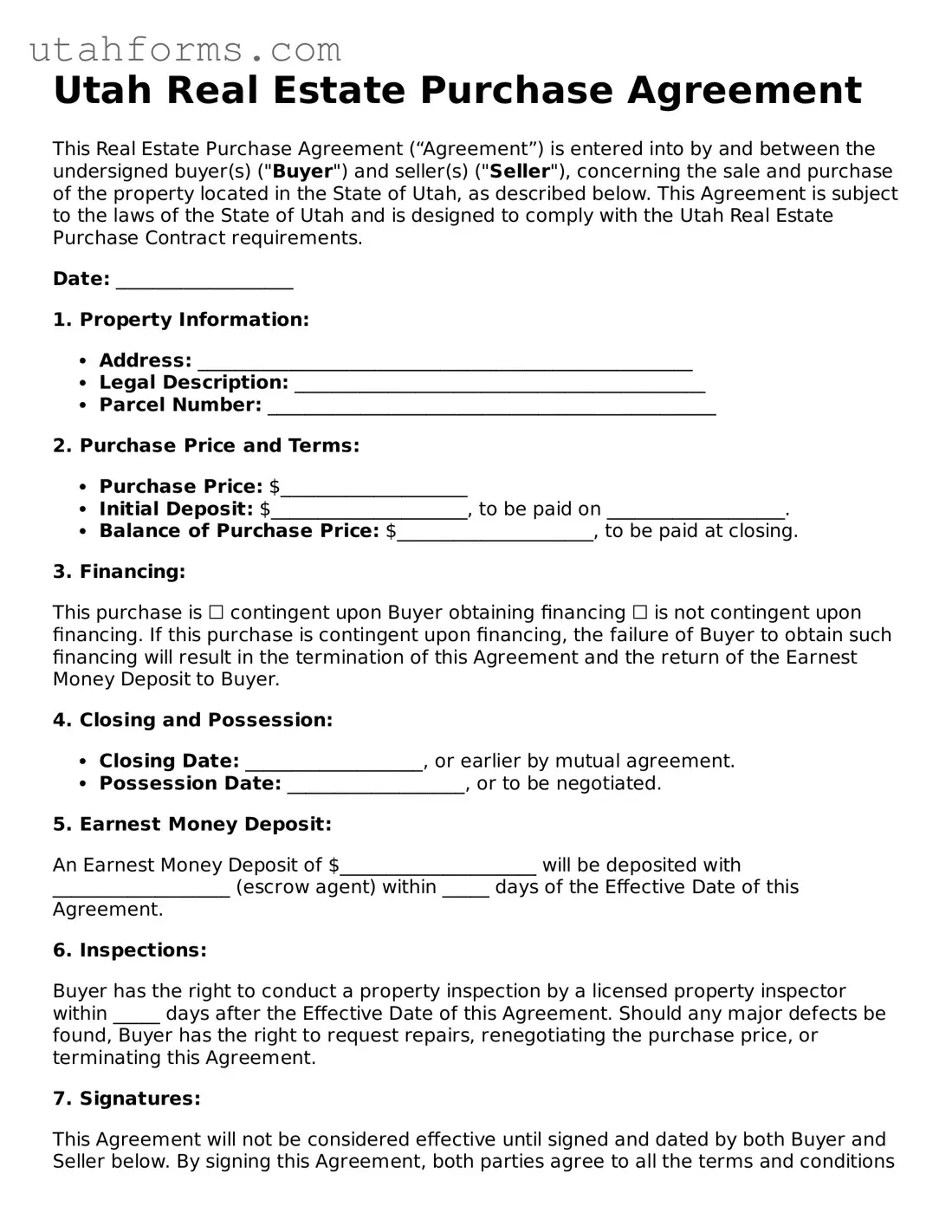

Preview - Utah Real Estate Purchase Agreement Form

Utah Real Estate Purchase Agreement

This Real Estate Purchase Agreement (“Agreement”) is entered into by and between the undersigned buyer(s) ("Buyer") and seller(s) ("Seller"), concerning the sale and purchase of the property located in the State of Utah, as described below. This Agreement is subject to the laws of the State of Utah and is designed to comply with the Utah Real Estate Purchase Contract requirements.

Date: ___________________

1. Property Information:

- Address: _____________________________________________________

- Legal Description: ____________________________________________

- Parcel Number: ________________________________________________

2. Purchase Price and Terms:

- Purchase Price: $____________________

- Initial Deposit: $_____________________, to be paid on ___________________.

- Balance of Purchase Price: $_____________________, to be paid at closing.

3. Financing:

This purchase is ☐ contingent upon Buyer obtaining financing ☐ is not contingent upon financing. If this purchase is contingent upon financing, the failure of Buyer to obtain such financing will result in the termination of this Agreement and the return of the Earnest Money Deposit to Buyer.

4. Closing and Possession:

- Closing Date: ___________________, or earlier by mutual agreement.

- Possession Date: ___________________, or to be negotiated.

5. Earnest Money Deposit:

An Earnest Money Deposit of $_____________________ will be deposited with ___________________ (escrow agent) within _____ days of the Effective Date of this Agreement.

6. Inspections:

Buyer has the right to conduct a property inspection by a licensed property inspector within _____ days after the Effective Date of this Agreement. Should any major defects be found, Buyer has the right to request repairs, renegotiating the purchase price, or terminating this Agreement.

7. Signatures:

This Agreement will not be considered effective until signed and dated by both Buyer and Seller below. By signing this Agreement, both parties agree to all the terms and conditions described herein.

Buyer's Signature: ___________________________

Date: ___________________

Seller's Signature: ___________________________

Date: ___________________

Document Properties

| # | Fact |

|---|---|

| 1 | The Utah Real Estate Purchase Agreement is a legally binding document used for the purchase and sale of real property in Utah. |

| 2 | This document outlines the terms and conditions agreed upon by both buyer and seller, including sale price, property description, and closing date. |

| 3 | Governing Law: The agreement is governed by the laws of the state of Utah. |

| 4 | Disclosures: Utah law requires sellers to provide buyers with a Property Condition Disclosure that outlines the condition of the property. |

| 5 | Financing Contingency: The contract often includes a contingency clause that makes the purchase conditional upon the buyer obtaining financing. |

| 6 | Inspection Contingency: Buyers are typically given a specified period to conduct a home inspection to ensure the property meets their expectations. |

| 7 | Closing Costs: The agreement specifies which party is responsible for covering closing costs, such as title insurance, taxes, and escrow fees. |

| 8 | Signatures: The agreement must be signed by both the buyer and seller to be considered valid and enforceable. |

| 9 | Amendments: Any changes to the original agreement must be made in writing and signed by both parties. |

| 10 | Escrow: The agreement often requires that earnest money be deposited into an escrow account to be held until the completion of the sale. |

How to Write Utah Real Estate Purchase Agreement

When you're ready to buy or sell property in Utah, the Real Estate Purchase Agreement form is a crucial step in the process. This document outlines the terms of the sale, including the price, the description of the property, and the responsibilities of each party. Filling it out correctly ensures that both buying and selling parties have a clear understanding of the agreement. Follow these steps to complete the form accurately and efficiently.

- Begin by entering the date of the agreement at the top of the form.

- Fill in the full legal names of the buyer(s) and seller(s) in the designated spaces.

- Provide a detailed description of the property being sold. This includes the address, legal description, and any other identifying information.

- Specify the purchase price in the section provided. Include both the numeric and written form of the amount.

- Detail the terms of the payment. Indicate whether the purchase will be made with cash, financing, or a combination of both. If financing is involved, provide the specifics of the loan.

- Include information about the earnest money deposit, such as the amount and the institution holding the deposit.

- Outline any items or fixtures that are included or excluded in the sale of the property.

- List all the contingencies that apply to the agreement, like financing approval, home inspections, and the sale of another property, if applicable.

- Indicate the closing date and location where the transaction will be completed.

- Specify who will be responsible for closing costs and how they will be divided.

- Provide information on any legal and regulatory requirements that must be met before the sale can be finalized.

- Both the buyer(s) and seller(s) must sign and date the form. Include the printed name of each party under their signature.

After you've completed the Utah Real Estate Purchase Agreement form, review it carefully to ensure all the information is accurate and complete. This form will serve as the legal record of your agreement and the outline of the sale. Proper completion helps protect both parties' interests and facilitates a smoother transaction process. Once signed, make sure both parties receive a copy for their records, paving the way for a successful real estate transaction.

Frequently Asked Questions

-

What is a Utah Real Estate Purchase Agreement?

A Utah Real Estate Purchase Agreement is a legally binding document used in the process of buying and selling real estate in the state of Utah. It outlines the terms and conditions agreed upon by both the buyer and the seller, including the purchase price, property description, contingencies, and closing details. This form is essential for protecting the interests of both parties involved and ensuring a smooth transaction.

-

Who needs to sign the Utah Real Estate Purchase Agreement?

Both the buyer(s) and seller(s) involved in the real estate transaction must sign the Utah Real Estate Purchase Agreement. If there are co-buyers or co-sellers, each party must provide their signature to validate the agreement. In some cases, real estate agents representing the parties may also sign the document, acknowledging that they have facilitated the transaction and provided the necessary disclosures.

-

Are there contingencies in the Utah Real Estate Purchase Agreement?

Yes, contingencies are common in Utah Real Estate Purchase Agreements. These conditions must be met for the transaction to proceed. Examples include financing contingencies, which allow the buyer to back out if they cannot secure a mortgage; inspection contingencies, giving the buyer the right to have the property inspected; and sale of the previous home contingencies, where the transaction depends on the buyer selling their current home. Both parties must agree to the specified contingencies.

-

What happens if either party wants to back out of the Utah Real Estate Purchase Agreement?

If either the buyer or seller wishes to terminate the agreement, the consequences will depend on the terms detailed within the contract and whether any contingencies allow for withdrawal without penalty. Typically, backing out without a valid reason or not adhering to agreed-upon contingencies can lead to legal and financial repercussions. For the buyer, this might mean forfeiting the earnest money deposit. Sellers, on the other hand, might face a breach of contract lawsuit.

-

How is the closing date determined in the Utah Real Estate Purchase Agreement?

The closing date, when the final transfer of property and funds occurs, is negotiated between the buyer and seller and detailed in the Utah Real Estate Purchase Agreement. This date is influenced by various factors, including the completion of agreed-upon contingencies and the readiness of both parties to finalize the transaction. Flexibility might be required from both sides if any unexpected delays arise.

Common mistakes

Filling out the Utah Real Estate Purchase Agreement form is a critical step in the process of buying or selling property. This document is legally binding and outlines the terms and conditions of the sale, making it imperative that both parties pay close attention to detail when completing it. However, many individuals make errors during this process, often due to a lack of understanding or oversight. Here are ten common mistakes made when filling out this form.

- Not Reading the Entire Form Carefully: Many people skim through the document without fully understanding every section. This oversight can lead to misunderstandings about the obligations and rights of each party.

- Incorrect Information: This might seem straightforward, but entering incorrect information, such as the wrong address or legal description of the property, can invalidate the agreement or cause significant delays.

- Omitting Important Details: Failing to include all relevant details, such as fixtures or appliances included in the sale, can lead to disputes later on.

- Neglecting to Specify Dates: Clear dates for actions, such as the closing date, contingency removals, and inspections, are essential. Vague timelines can cause confusion and complicate the transaction.

- Overlooking Contingencies: Buyers often forget to list conditions that must be met for the sale to proceed, such as financing approval or the sale of their current home.

- Not Clarifying Responsibilities: The agreement should specify who is responsible for certain costs, like closing costs, inspections, and repairs. An oversight here can lead to unexpected expenses.

- Failure to Include a Termination Clause: Without a clear termination clause that outlines the circumstances under which either party can withdraw from the agreement, ending the deal amicably can become complicated.

- Misunderstanding Deposit Rules: The terms concerning the earnest money deposit, including the amount, recipient, and conditions for refund, need to be explicit to avoid disputes.

- Using Ambiguous Language: Ambiguity in a legal document can lead to different interpretations and potentially result in legal battles. Precise and clear language is paramount.

- Not Securing Professional Advice: The complexity of real estate transactions often requires the input of a professional, such as a real estate agent or attorney. Attempting to navigate the process without this guidance is a risk.

Avoiding these mistakes requires attention to detail, a thorough understanding of the terms of the deal, and often, professional guidance. Given the legal and financial implications of a Real Estate Purchase Agreement, it's important that both buyers and sellers take the process seriously, review all documentation carefully, and ensure that everything is in order before signing.

Documents used along the form

The Utah Real Estate Purchase Agreement serves as a critical document in the process of buying or selling property, encapsulating the conditions of the sale. To ensure a comprehensive understanding and adherence to legal and procedural requirements, several other documents are often utilized together with this agreement. These documents play a pivotal role in providing clarity, ensuring compliance, and facilitating a smooth transaction.

- Disclosure Forms: Sellers are often required to fill out disclosure forms, which provide the buyer with important information about the property's condition, including any known defects or hazards. This can include a Lead-Based Paint Disclosure for homes built before 1978 and a Seller's Property Disclosure.

- Title Insurance Commitment: This document is issued by a title company and outlines the conditions under which a title insurance policy will be issued. It includes details on any encumbrances, liens, or defects in the property's title.

- Loan Estimate and Closing Disclosure: For transactions involving a mortgage, lenders must provide a Loan Estimate to the buyer within three days of receiving the application. The Closing Disclosure, which details the final transaction costs, must be provided at least three days before closing.

- Home Inspection Report: A comprehensive examination of the property's condition, a home inspection report is typically commissioned by the buyer. This report can influence negotiations, depending on what is uncovered about the property’s state.

- Appraisal Report: Lenders usually require an appraisal report to determine the property's fair market value. This ensures that the loan does not exceed the property’s actual worth.

- HOA Documents: For properties in a homeowners' association (HOA), relevant documents, including the HOA's rules and regulations, financial statements, and minutes of recent meetings, are crucial. These documents offer insight into the association's health and any potential restrictions or fees.

Together with the Utah Real Estate Purchase Agreement, these documents constitute a thorough vetting process, fostering transparency and trust between the parties involved. By meticulously assembling and reviewing these documents, both buyers and sellers can proceed with confidence, secure in their understanding of all aspects of the transaction.

Similar forms

The Residential Lease Agreement shares similarities with the Utah Real Estate Purchase Agreement as both lay out the terms and conditions governing the use of property. In the former, the focus lies on the rental arrangement between a landlord and a tenant, detailing responsibilities such as payments, duration of lease, and upkeep. Like the purchase agreement, it ensures both parties understand their commitments, although the lease pertains to renting rather than buying.

A Bill of Sale, much like the Utah Real Estate Purchase Agreement, serves as a documented proof of transfer of ownership, but it typically applies to personal property, such as cars or equipment, rather than real estate. Both documents include crucial details such as the identities of the buyer and seller, description of the property, and sale price. They play a pivotal role in legitimizing transactions and protecting both parties' rights.

The Warranty Deed is another document bearing resemblance to the Utah Real Estate Purchase Agreement, primarily because it guarantees the buyer's legal title to the property. This deed ensures that the property is free from liens or claims, mirroring the purchase agreement’s aim to safeguard the transaction. However, the Warranty Deed comes into play post-purchase, to confirm the transfer of clean title.

Similar to the Utah Real Estate Purchase Agreement, the Loan Agreement outlines the specifics of a financial arrangement, this time between a borrower and a lender. It details the loan amount, repayment schedule, interest rate, and collateral, if applicable. Though it concerns a borrowing relationship rather than a purchase, both documents formalize an agreement with legal obligations and rights for involved parties.

The Home Inspection Report, while not a contract like the Utah Real Estate Purchase Agreement, complements the buying process by providing a thorough evaluation of the property’s condition. It informs the buyer of potential issues that could impact the agreement's terms, such as repairs that may need to be addressed. Essentially, it aids in making an informed decision much like the purchase agreement outlines the terms based on the property’s state.

Finally, the Quitclaim Deed is closely related to the Utah Real Estate Purchase Agreement as it involves the transfer of property interest from one party to another. However, unlike the purchase agreement which specifies terms and conditions of sale, the Quitclaim Deed does not guarantee the seller’s title quality. It is primarily used between known parties, such as family members, to transfer property quickly without the formal guarantees of a sale.

Dos and Don'ts

When engaging in the process of purchasing real estate in Utah, parties often confront the task of filling out the Utah Real Estate Purchase Agreement form. This document, crucial to the process, serves as a binding contract between the buyer and seller, outlining the terms and conditions of the sale. To ensure the process is handled with due diligence and to avoid common pitfalls, here's a guide on what you should and shouldn't do.

Things You Should Do

- Review the form carefully: Before filling anything out, thoroughly review each section of the form to understand the information required and the terms being agreed to.

- Provide accurate details: When inputting details about the property, price, and terms, make sure all information is accurate and matches any prior agreements or discussions.

- Consult a real estate professional: Seek the guidance of a real estate agent or lawyer if there are any terms or clauses you do not understand. Their expertise can help navigate the complexities of real estate transactions.

- Include all necessary attachments: Often, additional documents such as disclosures or inspection reports need to be attached. Ensure all relevant documents are included to avoid delays or issues.

- Double-check before signing: Take the time to review the entire agreement and ensure all parties understand and agree to the terms before signing. Mistakes or misunderstandings can be difficult to correct later.

Things You Shouldn't Do

- Avoid leaving blank spaces: Any blank sections or unanswered questions can lead to misunderstandings or manipulation post-signature. If a section doesn't apply, consider writing “N/A” to signify as much.

- Don't rush through the process: Given the significance of the agreement, take your time to fill it out thoroughly and thoughtfully. Rushing can lead to mistakes or oversights.

- Don’t rely solely on verbal agreements: While verbal agreements may form part of the negotiation process, ensure all agreed-upon terms are documented in the agreement. Verbal agreements are difficult to enforce.

- Don't forget to specify contingencies: If the purchase is dependent on certain conditions, such as securing financing or a satisfactory home inspection, these should be clearly stated in the agreement.

- Don't sign without understanding every part: If there are terms or clauses you do not fully understand, avoid signing the document until you have sought clarification. Signing without full comprehension can lead to unforeseen commitments.

Filling out the Utah Real Estate Purchase Agreement form with attention to detail and careful consideration of the terms can lead to a smoother transaction process. By following these guidelines, parties can protect their interests and work towards a successful real estate purchase. Remember, when in doubt, consulting with a professional can provide clarity and direction.

Misconceptions

When navigating the process of buying or selling property in Utah, many people encounter misconceptions about the Real Estate Purchase Agreement (REPA). Understanding these can help parties avoid common pitfalls and make well-informed decisions. Here are six common misconceptions about the Utah Real Estate Purchase Agreement form:

- It's just a standard form. One common misconception is that the Utah Real Estate Purchase Agreement is a basic, one-size-fits-all document. In reality, while the form provides a standardized structure, it needs to be tailored to the specific transaction, including terms, contingencies, and other essential details relevant to both the buyer and seller.

- Verbal agreements are enforceable. Another misunderstanding is the belief that verbal agreements made during negotiations are binding. However, for a real estate transaction in Utah, the law requires all agreements to be in writing and included in the REPA to be legally enforceable.

- No attorney review is needed. Many people think that because the REPA is standardized, there's no need for legal review. This isn't true. It's advisable to have a real estate attorney or a qualified legal consultant review the agreement prior to signing, to ensure it accurately reflects the agreement and protects the client's interests.

- Any real estate agent can prepare the form. While real estate agents in Utah are trained in completing the REPA, their expertise may vary. It's crucial to work with an agent who is experienced and knowledgeable about the local market and specific legal requirements, ensuring that the agreement is completed correctly and fully serves the client's interests.

- The form covers everything. A common false belief is that the REPA automatically covers all aspects of the transaction. In reality, specific addenda and disclosures may be required, depending on the property type and the transaction's unique circumstances. These must be appropriately incorporated to make sure all legal and regulatory requirements are met.

- Signing the form locks in the deal. Finally, there's a misconception that once the REPA is signed, the transaction is final. However, the completion of the sale often depends on fulfilling contingencies listed in the agreement, such as financing approval, home inspections, and appraisals. Until these conditions are met, the deal can still be renegotiated or, in some cases, terminated.

Understanding these misconceptions about the Utah Real Estate Purchase Agreement can help buyers and sellers navigate their real estate transactions more effectively. It emphasizes the importance of careful consideration, legal review, and professional guidance in the process.

Key takeaways

When dealing with the Utah Real Estate Purchase Agreement form, it's essential to understand its significance and the best practices for completion. This document is crucial for the buying and selling of property in Utah, providing a clear and binding agreement between the parties involved. Here are key takeaways to keep in mind:

- Accuracy is paramount. Every detail in the agreement, from the names of the parties to the description of the property, must be precise to avoid any misunderstandings or legal issues down the line.

- The agreement should include all relevant financial details, such as the purchase price, earnest money deposit amounts, and the terms of financing. This clarity helps both parties understand their financial commitments.

- Condition disclosures are a critical part of the agreement. Sellers must disclose the property's condition truthfully, including any known defects or issues, to protect themselves from future liabilities.

- Contingencies are safeguards for the buyer and should be clearly outlined in the agreement. These can include financing approval, the completion of a satisfactory home inspection, and the ability to sell an existing home.

- Closing dates and possession details need to be explicit. The agreement should state when the property will change hands and the conditions of the handover.

- Legal compliance: The agreement must comply with all local, state, and federal regulations affecting real estate transactions to ensure its enforceability.

- Signatures are crucial. The agreement becomes legally binding once all parties have signed. Ensure that everyone who has a stake in the transaction reviews and signs the document.

- Professional advice can be invaluable. Considering the complexity and legal significance of the agreement, consulting with a real estate attorney or a professional realtor can provide clarity and ensure that the rights and interests of both parties are protected.

Remember, the Utah Real Estate Purchase Agreement is more than just a formality; it's a critical document that outlines the terms and conditions of a property transaction. Taking the time to ensure that it is filled out correctly and thoroughly can save a great deal of time and prevent potential legal issues in the future.

Other Popular Utah Templates

How to Sell a Car Privately in Utah - This document establishes a legally binding agreement, making any breach of its terms subject to legal consequences.

How to Avoid Probate in Utah - It represents a cost-effective solution for small asset distribution, offering a practical alternative to traditional probate processes.

How to Sell a Car Privately in Utah - By documenting the sale, it reduces the risk of fraud or disputes over the trailer's provenance or condition.