Free Promissory Note Form for Utah

In the realm of lending and borrowing in Utah, the Utah Promissory Note form emerges as a pivotal document, encapsulating the specifics of the agreement between the lender and the borrower. This form, tailored to comply with Utah's laws, ensures that all parties are aware of the amount borrowed, the interest rate applied, and the repayment schedule. It serves not only as a legal record but also as a clear guideline for how the loan should be repaid, including provisions for late fees and the consequences of default. Whether used for personal loans among friends and family or for more formal financial transactions, the Utah Promissory Note form offers a structured and secure approach to lending, safeguarding the interests of all involved. With its legal binding, the form plays a crucial role in maintaining trust and clarity, making it an essential tool for anyone engaging in lending or borrowing activities within the state.

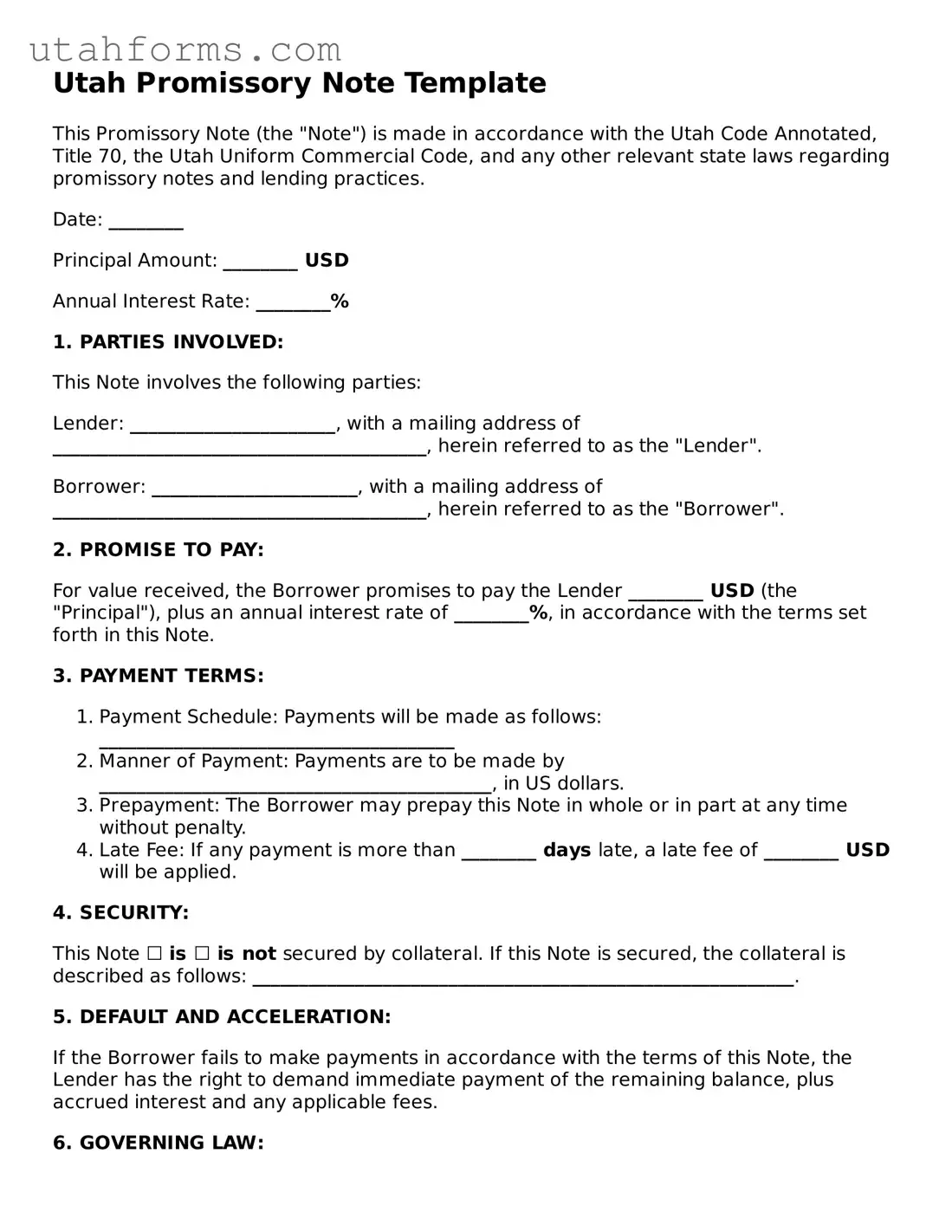

Preview - Utah Promissory Note Form

Utah Promissory Note Template

This Promissory Note (the "Note") is made in accordance with the Utah Code Annotated, Title 70, the Utah Uniform Commercial Code, and any other relevant state laws regarding promissory notes and lending practices.

Date: ________

Principal Amount: ________ USD

Annual Interest Rate: ________%

1. PARTIES INVOLVED:

This Note involves the following parties:

Lender: ______________________, with a mailing address of ________________________________________, herein referred to as the "Lender".

Borrower: ______________________, with a mailing address of ________________________________________, herein referred to as the "Borrower".

2. PROMISE TO PAY:

For value received, the Borrower promises to pay the Lender ________ USD (the "Principal"), plus an annual interest rate of ________%, in accordance with the terms set forth in this Note.

3. PAYMENT TERMS:

- Payment Schedule: Payments will be made as follows: ______________________________________

- Manner of Payment: Payments are to be made by __________________________________________, in US dollars.

- Prepayment: The Borrower may prepay this Note in whole or in part at any time without penalty.

- Late Fee: If any payment is more than ________ days late, a late fee of ________ USD will be applied.

4. SECURITY:

This Note ☐ is ☐ is not secured by collateral. If this Note is secured, the collateral is described as follows: __________________________________________________________.

5. DEFAULT AND ACCELERATION:

If the Borrower fails to make payments in accordance with the terms of this Note, the Lender has the right to demand immediate payment of the remaining balance, plus accrued interest and any applicable fees.

6. GOVERNING LAW:

This Note shall be governed by the laws of the State of Utah.

7. SIGNATURES:

This Note shall be considered valid and enforceable upon the signatures of both the Borrower and the Lender below.

Borrower's Signature: ______________________ Date: ________

Lender's Signature: ______________________ Date: ________

Document Properties

| Fact | Detail |

|---|---|

| 1. Purpose | Used to document and formalize a loan agreement between two parties. |

| 2. Parties Involved | Involves a borrower (promisor) and a lender (promisee). |

| 3. Payment Structure | Includes terms for repayment, such as the loan amount, interest rate, repayment schedule, and maturity date. |

| 4. Interest Rate | Must comply with Utah's usury laws to avoid illegal interest charges. |

| 5. Security | Can be secured or unsecured, indicating whether collateral is backing the loan. |

| 6. Legal Remedies | Details consequences for default, including potential legal action and remedies available to the lender. |

| 7. Governing Law | Governed by Utah law, including statutes related to interest rates, usury laws, and other relevant regulations. |

| 8. Co-signer Provision | May include provisions for a co-signer as additional security for the loan. |

| 9. Signatures | Must be signed by both parties to be legally binding, with witness or notary public signatures as optional depending on the agreement's nature. |

How to Write Utah Promissory Note

In Utah, drafting a Promissory Note is a straightforward but critical process that legally binds a borrower to repay a loan to a lender according to the agreed terms. This document is essential for defining the terms of the loan, including the repayment schedule, interest rates, and the consequences of failing to meet these obligations. It's a protective measure for both parties involved, ensuring there's a clear understanding and agreement on how the borrowed funds are to be repaid. The following steps are designed to guide individuals through the process of filling out a Utah Promissory Note, ensuring each party understands their rights and obligations.

- Identify the parties involved by writing the full legal names of both the lender and the borrower at the beginning of the document.

- Specify the principal amount of money being loaned. This is the initial amount the borrower receives before any interest.

- Detail the interest rate. Utah law restricts the amount of interest that can be charged, so ensure the rate complies with state regulations.

- Outline the repayment schedule. Include specific dates for repayments, whether the payments will be made monthly, weekly, etc., and the amount of each payment.

- Clarify the type of Promissory Note - whether it is secured or unsecured. A secured note means the borrower has backed the loan with collateral, which the lender can claim if the loan is not repaid. An unsecured note does not involve collateral.

- Include any co-signers if applicable. Co-signers agree to repay the loan if the primary borrower fails to do so. Their full legal names need to be documented.

- Describe the terms under which the loan must be repaid in full, covering conditions like default or acceleration clauses. This usually involves what happens if the borrower fails to make timely payments.

- Insert any governing law clauses that will apply to the agreement. While the agreement is under Utah law, any specific conditions or clauses related to Utah legislation should be noted here.

- Both parties, along with any co-signers, must sign and date the Promissory Note. Ensure this is done in the presence of a witness or notary public for additional legal validation.

Once these steps are meticulously followed and the document is signed by all parties, it becomes a binding agreement, enforceable under Utah law. It effectively outlines the expectations and obligations of the borrower and lender, providing a safeguard for both sides. It's recommended to keep multiple copies of the signed document for records and to prevent any potential disputes in the future.

Frequently Asked Questions

What is a Utah Promissory Note?

A Utah Promissory Note is a legal document that outlines a loan agreement between two parties in the state of Utah. It serves as a formal promise by the borrower to repay a specified amount of money to the lender under agreed-upon terms, which include payment schedule, interest rate, and what happens in case of a default. This document is beneficial for both parties as it clearly lays out the obligations and protects their interests.

Do I need a witness or notary for a Promissory Note in Utah?

In Utah, it is not mandatory to have a witness or notarize a Promissory Note for it to be considered legally binding. However, having the document notarized or witnessed can add a layer of authenticity and may help in the enforcement of the note, should any disputes arise. It's important to note that for real estate transactions, other legal requirements may necessitate notarization.

Can I charge any interest rate on a loan with a Promissory Note in Utah?

Utah law stipulates maximum interest rates that can be charged on loans. For personal loans documented with a Promissory Note, the interest rate cannot exceed the legal limit set by the state. As of the most recent update, this legal rate is 10% per annum if not specified. If an agreement between parties sets the rate above this without special authorization or under specific legal exceptions, it could be considered usurious and subject to penalties. Always check the current limitations on interest rates to ensure compliance with state law.;

How can I enforce a Promissory Note in Utah?

If a borrower fails to meet their obligations outlined in a Promissory Note in Utah, the lender has the right to pursue legal action to enforce repayment. This typically involves filing a lawsuit in the appropriate court. If the court rules in favor of the lender, it may issue a judgment against the borrower for the amount owed plus any additional fees and interest. The lender could then potentially garnish wages, place liens on property, or take other legal steps to collect the debt. It's advisable to seek legal guidance to navigate the enforcement process effectively.

Common mistakes

When filling out a Utah Promissory Note form, people often make mistakes that can lead to misunderstandings, disputes, or legal complications down the line. Avoiding these common errors can ensure that the agreement between the borrower and lender is clear and enforceable. Here are six frequent missteps to watch out for:

- Not specifying the loan amount in clear terms. It's critical to state the exact amount of money being loaned in clear, unambiguous terms. Sometimes, people either forget to include the amount or write it in a way that is open to interpretation, which can cause confusion or disagreements later.

- Omitting the interest rate. The interest rate on a loan is a pivotal detail that must be clearly mentioned in the Promissory Note. Failing to specify the interest rate, or not defining if it's simple or compounded interest, can lead to major issues and potential legal disputes.

- Forgetting to outline the repayment schedule. A detailed repayment schedule, including the due dates and the amount of each payment, is essential. This schedule helps both parties understand their obligations and avoids any ambiguity regarding payment deadlines.

- Ignoring penalty clauses for late payments or default. While no one likes to think about penalties, clearly defining the consequences of late payments or defaulting on the loan is crucial. Without this, enforcing penalties or taking legal action becomes more complicated.

- Failing to include the names and addresses of all parties. Each party involved in the loan agreement must be clearly identified by their full legal names and addresses. Sometimes, people overlook this detail or use nicknames, which can question the legal enforceability of the note.

- Skipping the signatures. The Promissory Note must be signed by both the borrower and the lender to be legally binding. Occasionally, individuals forget to sign the document, or they might neglect to have a witness or notary public sign, depending on the legal requirements of the state of Utah.

By paying close attention to these common pitfalls when completing a Utah Promissory Note form, individuals can ensure that their agreement is both clear and legally binding. This cautious approach can prevent misunderstandings and protect the interests of all parties involved in the loan agreement.

Documents used along the form

When dealing with loan transactions or agreements in Utah, the Utah Promissory Note form is a critical document that outlines the promise by a borrower to pay back a sum of money to a lender. However, this form doesn't exist in isolation; there's a suite of other documents that are often used alongside it to ensure clarity, compliance, and protection for all parties involved. These documents play various roles, from securing the loan to detailing the terms of agreement extensions. Below is an overview of these key documents that often accompany a Utah Promissory Note.

- Security Agreement: This document outlines the specifics of the collateral that the borrower agrees to put up to secure the loan. It details what happens to the collateral if the borrower fails to repay the promissory note.

- Guaranty: A guaranty is signed by a third party who agrees to repay the loan if the original borrower cannot. This adds an extra layer of security for the lender.

- Loan Agreement: While the promissory note signifies a promise to pay, the loan agreement details all the terms of the loan, including interest rates, repayment schedule, and the responsibilities of each party.

- Mortgage or Deed of Trust: For real estate transactions, a mortgage or deed of trust is used along with the promissory note to secure the loan with the property being purchased.

- Amendment Agreement: If the terms of the original loan or promissory note need to be modified, an amendment agreement is used to outline and agree upon these changes.

- Release of Promissory Note: Once the loan is fully repaid, this document is issued to formally release the borrower from their obligations under the promissory note.

- Notice of Default: This document alerts the borrower that they are in violation of the promissory note terms, detailing any actions that may follow if the default is not rectified.

- UCC-1 Financing Statement: Used to publicly disclose a secured transaction, this form is filed with the state to put others on notice of the lender's interest in the collateral.

Together, these documents provide a comprehensive framework for the lending and borrowing process, ensuring all parties are well-informed and legally protected. It’s important for borrowers and lenders alike to understand not just the commitment they are making with the promissory note but also the broader contractual and legal environment in which that note operates. By doing so, both parties can navigate the financial transaction with a clear understanding and proper due diligence.

Similar forms

A loan agreement is closely related to a Utah Promissory Note. Both documents are used to record the terms of a loan between two parties. The main difference lies in the level of detail and formality. While a promissory note will often briefly outline the repayment schedule, interest rate, and consequences of non-payment, a loan agreement tends to be more comprehensive, detailing the obligations of the borrower and the rights of the lender in greater depth, including warranties, covenants, and conditions of the loan. Both serve to provide legal protection and clarity regarding the loan terms but differ in their complexity and the breadth of the terms covered.

A mortgage agreement shares similarities with a Utah Promissory Note in that it is a binding agreement involving a loan. Specifically, a mortgage agreement secures a loan on a property, making the property collateral against the loan. While a promissory note records the promise to repay the borrowed amount, a mortgage agreement grants the lender a security interest in the property until the loan is fully repaid. If the borrower fails to fulfill the terms of the promissory note, the mortgage agreement provides the legal framework for the lender to enforce the sale of the collateral property to recover the loaned funds.

An IOU is another document similar to a Utah Promissory Note, albeit less formal. An IOU merely acknowledges that a debt exists and typically includes the basic information such as the amount owed and sometimes the debtor and creditor's names. Unlike a promissory note, it lacks detailed terms regarding repayment, interest, and due dates. IOUs serve as informal reminders of a debt and lack the legal robustness to specify repayment schedules and protections against default that a promissory note provides.

A bill of sale intersects with a Utah Promissory Note in its function of documenting an agreement between two parties. Where a promissory note details a promise to pay back a loan, a bill of sale confirms the transfer of ownership of an item from seller to buyer, often indicating the item sold and the agreed-upon price. While both are proof of an agreement and legally binding, a bill of sale centers on the sale and purchase of items rather than the terms of repaying borrowed money.

Student loan agreements are specialized forms of promissory notes targeted at financing education. They outline the conditions under which funds are lent and repaid, typically including specific terms related to deferment, interest accrual, and repayment plans. Comparatively, a standard Utah Promissory Note may cover any loaned amount for any purpose and lacks the specialized terms and protections afforded to students and lenders within the context of a student loan agreement.

A credit agreement can be likened to a Utah Promissory Note in its purpose of detailing the terms under which credit is extended from a lender to a borrower. This document outlines the size of the credit line, repayment schedule, interest rates, and other terms. Unlike a promissory note, which is typically used for a single loan transaction, a credit agreement can establish a revolving line of credit, offering ongoing access to funds up to a specified limit over a period of time. Each document serves to clarify the terms of lending and repayment for both parties involved.

An installment agreement parallels a Utah Promissory Note through its focus on repayment terms. These agreements specify how debt will be repaid in regular installments over time and include details such as the amount of each payment, due dates, and the total number of payments. While a promissory note also details repayment, installment agreements are often used for specific types of loans, like car loans or lease agreements, and typically include more detailed terms related to the collateral and repossession rights.

A lease agreement, while primarily used for the rental of property or equipment rather than a loan, shares the Utah Promissory Note’s characteristic of being a written agreement between two parties. It outlines the terms under which one party agrees to rent property owned by another party, including rent, maintenance, and duration of the lease. The core similarity lies in the formalization of terms and conditions agreed upon by the parties involved, providing a legal framework for their relationship and recourse in the event of disputes.

Dos and Don'ts

- Ensure that all information provided is accurate and complete. This includes the names of the borrower and lender, the loan amount, interest rate, and repayment schedule.

- Review Utah's legal interest rate limits and usury laws to make certain the interest rate on the note is compliant.

- Specify if the promissory note is secured or unsecured. A secured note means that the borrower has provided collateral for the loan.

- Clearly outline the consequences of late payments or default by the borrower, including any late fees or actions the lender can take.

- Both parties should sign and date the form in the presence of a witness or notary public, if required, to add legal validity to the document.

- Leave any sections of the form blank. If a section does not apply, write “N/A” (not applicable) rather than leaving it empty.

- Forget to provide a detailed repayment plan. The schedule should include payment amounts and due dates.

- Fail to check with a legal professional or financial advisor to ensure the promissory note complies with all federal and state laws, particularly if the terms are complex.

- Overlook the need to register or record the note, if necessary, according to Utah State law or county regulations.

- Ignore making copies of the signed document. Both the borrower and the lender should keep a copy for their records.

When filling out the Utah Promissory Note form, individuals should be mindful of the following dos and don'ts:

Do:

Don't:

Misconceptions

When dealing with a Utah Promissory Note form, it's important to have accurate information. Unfortunately, there are several misconceptions that can lead to misunderstanding or misuse of this legal document. Here are six common misconceptions explained:

All promissory notes are the same: This is not true. While promissory notes may share similarities, the details can vary significantly depending on the specific requirements in Utah. For example, the interest rates, repayment terms, and legal ramifications of non-payment might differ.

No legal document is needed for it to be valid: While a promissory note does not have to be notarized to be legally valid in Utah, having the document in writing is critical. A verbal agreement is much harder to enforce. A written promissory note provides clear terms and conditions that are acknowledged by both parties.

Interest rates can be as high as agreed upon: This is false. Utah, like other states, has usury laws that limit the maximum interest rate that can be charged. Charging an interest rate above this limit can render the note unenforceable and possibly subject the lender to legal penalties.

Only the borrower needs to sign the promissory note: While the borrower is the one who signs to agree to repay the debt, it is also advisable for the lender to sign the document. This action formally acknowledges the loan terms by both parties, adding another layer of legal protection.

A promissory note and a loan agreement are the same: Though they are related, they serve different purposes. A promissory note is a promise by the borrower to pay back the sum to the lender. A loan agreement, on the other hand, is more comprehensive and includes detailed terms and conditions of the loan, such as repayment schedule, collateral, and actions in case of default.

Legal advice is not necessary for creating a promissory note: While you can create a promissory note without legal advice, consulting an attorney is highly recommended, especially for large sums or complicated agreements. An attorney can ensure that the note complies with state laws and fully protects the interests of both parties.

Understanding these misconceptions about the Utah Promissory Note can help individuals and businesses create more accurate and enforceable agreements, ensuring that both lenders and borrowers are well-protected.

Key takeaways

Filling out and using the Utah Promissory Note form is a significant step in formalizing a loan agreement between two parties. This document serves as a legal record of the loan's terms and conditions, ensuring both the lender and borrower are clear on their obligations. Here are key takeaways to consider when dealing with this important financial instrument:

- The Utah Promissory Note requires detailed information about the loan, including the full names and addresses of both the lender and the borrower, to establish the identities of the parties involved.

- The loan amount, also known as the principal, must be clearly stated in U.S. dollars to avoid any confusion about the total sum being borrowed.

- Interest rates need to comply with Utah state laws to prevent the agreement from being considered usurious, which could render the note legally void.

- Repayment terms, including the schedule and method of repayment, should be explicitly outlined to ensure both parties understand when and how payments should be made.

- If the note includes collateral or a co-signer as security for the loan, these details must be recorded to legally bind all parties to their agreed-upon responsibilities.

- Ensure the note specifies the course of action or penalties in case of default by the borrower, providing a clear process for addressing missed payments or total failure to repay the loan.

- Both parties should carefully review all terms and conditions of the Utah Promissory Note before signing to guarantee their understanding and agreement with the document's contents.

- The promissory note must be signed by both the lender and the borrower, making it a legally binding document. Witnesses or a notary public may also need to sign, depending on the complexity of the loan or as required by Utah law.

By paying close attention to these key points, individuals can protect their interests and maintain a clear, enforceable agreement that upholds the integrity of their financial transaction.

Other Popular Utah Templates

Utah Power of Attorney - This document formalizes a temporary guardian's role in a child's life, including schooling and health care decisions.

Statement of Facts Utah - Designates a representative to make vehicle-related decisions, adhering to legal standards.