Free Operating Agreement Form for Utah

In the realm of business operations within Utah, the Operating Agreement form emerges as a pivotal document, instrumental in laying down the foundational structure and operational protocols for Limited Liability Companies (LLCs). Tailored to ensure that all members of an LLC are on the same page regarding the governance, financial arrangements, and procedural guidelines, this legal document takes on a paramount role. It not only furnishes a comprehensive blueprint, outlining the allocation of profits and losses among members but also navigates the intricacies of management authority and member duties. By establishing clear rules and expectations from the outset, the Utah Operating Agreement form acts as a safeguard against potential internal conflicts, thereby fortifying the LLC's operational resilience and legal standing. Moreover, while not mandated by state law, having this agreement in place is highly advisable, as it provides a layer of protection for the members' personal assets against the company's liabilities and debts, reinforcing the principle of limited liability. Beyond its protective measures, the form serves as a testament to the LLC's credibility and commitment to structured governance, proving invaluable in banking and financial negotiations.

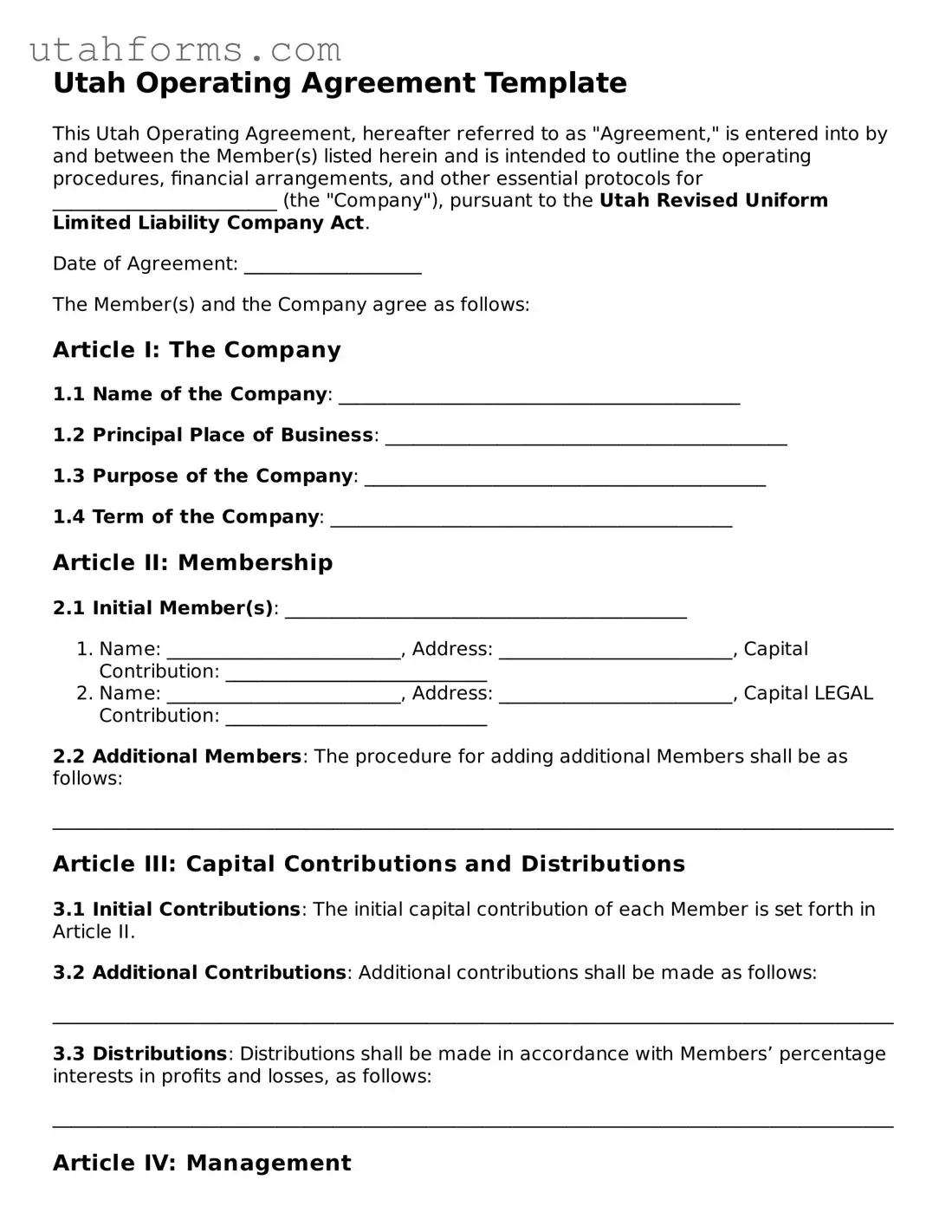

Preview - Utah Operating Agreement Form

Utah Operating Agreement Template

This Utah Operating Agreement, hereafter referred to as "Agreement," is entered into by and between the Member(s) listed herein and is intended to outline the operating procedures, financial arrangements, and other essential protocols for ________________________ (the "Company"), pursuant to the Utah Revised Uniform Limited Liability Company Act.

Date of Agreement: ___________________

The Member(s) and the Company agree as follows:

Article I: The Company

1.1 Name of the Company: ___________________________________________

1.2 Principal Place of Business: ___________________________________________

1.3 Purpose of the Company: ___________________________________________

1.4 Term of the Company: ___________________________________________

Article II: Membership

2.1 Initial Member(s): ___________________________________________

- Name: _________________________, Address: _________________________, Capital Contribution: ____________________________

- Name: _________________________, Address: _________________________, Capital LEGAL Contribution: ____________________________

2.2 Additional Members: The procedure for adding additional Members shall be as follows:

__________________________________________________________________________________________

Article III: Capital Contributions and Distributions

3.1 Initial Contributions: The initial capital contribution of each Member is set forth in Article II.

3.2 Additional Contributions: Additional contributions shall be made as follows:

__________________________________________________________________________________________

3.3 Distributions: Distributions shall be made in accordance with Members’ percentage interests in profits and losses, as follows:

__________________________________________________________________________________________

Article IV: Management

4.1 Management Structure: The Company shall be managed by:

- Member-Managed: ________________________________________________________________

- Manager-Managed: _______________________________________________________________

4.2 Powers and Duties of Managers: In a Manager-Managed company, the Managers shall have the power to:

__________________________________________________________________________________________

Article V: Voting

5.1 Voting Rights: Each Member’s voting rights are as follows:

__________________________________________________________________________________________

5.2 Matters Subject to Vote: Matters requiring a vote of the Members include:

__________________________________________________________________________________________

Article VI: Financial Matters

6.1 Fiscal Year: The fiscal year of the Company shall end on the last day of ______________________.

6.2 Financial Records: The Company shall maintain complete financial records and shall provide annual financial statements to all Members, prepared in accordance with _________________________ accounting principles.

Article VII: Dissolution

7.1 Dissolution Events: The Company may be dissolved upon the occurrence of any of the following events:

__________________________________________________________________________________________

7.2 Distribution of Assets: Upon dissolution, the assets of the Company shall be distributed as follows:

__________________________________________________________________________________________

IN WITNESS WHEREOF, the undersigned have executed this Operating Agreement as of the last date written below.

Member Signature: ______________________________ Date: ________________

Member Signature: ______________________________ Date: ________________

Document Properties

| # | Fact | Description |

|---|---|---|

| 1 | Definition | An Operating Agreement is a document used by LLCs in Utah to outline the business' financial and functional decisions. |

| 2 | Governing Law | Utah Code Title 48, Chapter 3a (Utah Revised Uniform Limited Liability Company Act) governs Operating Agreements in Utah. |

| 3 | Flexibility | The document allows significant flexibility in how a business is run, including management structure and profit distribution. |

| 4 | Not Mandatory, But Recommended | While not required by Utah state law, creating an Operating Agreement is highly recommended for all LLCs. |

| 5 | Protection | An Operating Agreement can help protect members' personal assets from the company's debts and obligations. |

| 6 | Customization | It can be tailored to fit the specific needs of your business, unlike the more rigid formalities of corporations. |

| 7 | Conflict Resolution | Includes provisions for resolving disputes among members, which can save time and resources in the future. |

| 8 | Confidentiality | Unlike articles of organization, the Operating Agreement is not filed with the state and can remain confidential amongst members. |

| 9 | Binding Document | Once signed by the members of the LLC, the Operating Agreement becomes a legally binding document. |

| 10 | Future Amendments | The agreement should include a process for future amendments, allowing the business to adapt over time. |

How to Write Utah Operating Agreement

Operating an LLC (Limited Liability Company) in Utah requires a clear outline of the business's structure, member roles, and financial decisions, among other important aspects. This foundation is encapsulated in a document known as the Operating Agreement. Although not submitted to any state agency, this internal document is vital for guiding the operations of the LLC, resolving disputes, and ensuring all members are on the same page regarding the company's management and financial arrangements. Drafting this agreement thoughtfully is crucial for the smooth running and governance of the LLC. Below are the steps to properly fill out a Utah Operating Agreement.

- Start by detailing the official name of the LLC exactly as it appears in your Articles of Organization filed with the state of Utah.

- Specify the effective date of the Operating Agreement. This is the date when the agreement takes legal effect, which may coincide with the filing date of the Articles of Organization.

- Enter the principal place of business. This should include the full street address, city, state, and zip code, where the primary operations of the LLC are located.

- List the names and addresses of all members. If the LLC is member-managed, this section acknowledges the individuals who will share in the decision-making and profits of the company.

- Outline the capital contributions of each member. This includes the amount of money, property, or services each member has contributed to start the LLC.

- Describe the allocation of profits and losses. Typically, this is divided among the members according to their percentage of ownership in the LLC.

- Detail the management structure of the LLC. Specify whether the LLC will be managed by the members (a more collective approach) or by designated managers (a more hierarchical approach).

- Set forth the rules for meetings and votes, including how often meetings will occur, how members will be notified, quorum requirements, and how votes are counted.

- Specify procedures for adding or removing members, including any buyout terms or other conditions that must be met for changes in membership.

- Include provisions for dissolving the LLC. This should cover conditions under which the LLC may be dissolved and how the assets will be distributed upon dissolution.

- Ensure all members sign and date the Operating Agreement, as this affirms their understanding and agreement to the terms outlined.

Once completed, each member should retain a copy of the Operating Agreement for their records. Although it's not filed with the state, it's a working document that might need periodic updates to reflect changes in the LLC's operational structure, the departure and addition of members, or modifications in member contributions. Keeping this document current and consulting it regularly can help ensure the longevity and success of the LLC.

Frequently Asked Questions

-

What is an Operating Agreement and why is it important for a Utah LLC?

An Operating Agreement is a legal document that outlines the ownership and member duties of a Limited Liability Company (LLC) in the state of Utah. It's crucial because it provides a clear framework for how the LLC will operate, helps to ensure that personal assets are protected from business liabilities, and reduces misunderstandings among members by setting out roles and responsibilities.

-

Is an Operating Agreement required for LLCs in Utah?

While Utah law does not require LLCs to have an Operating Agreement, it is highly recommended. Having one in place offers significant legal protections and clarity on the operation and structure of your business. Without it, the LLC will be governed by default state laws, which may not be to your advantage.

-

What topics should be included in a Utah LLC Operating Agreement?

A comprehensive Operating Agreement should cover various topics, including but not limited to: the structure of ownership, management, voting rights and procedures, profit and loss distribution, rules for meetings and decision-making, processes for adding or removing members, and procedures for dissolving the LLC.

-

Can I write my own Operating Agreement for my Utah LLC?

Yes, you can draft your own Operating Agreement. However, it's beneficial to consult with a legal professional to ensure that your document is thorough and complies with Utah state laws. They can also tailor the agreement to suit the unique needs of your business and help protect your interests.

-

How do I file an Operating Agreement in Utah?

In Utah, the Operating Agreement does not need to be filed with any state agency. It is an internal document that should be kept on record by the members of the LLC. Ensure each member has a copy and understands its contents. Although it's not filed, it's a crucial document in the operation of your LLC.

-

Can an Operating Agreement be changed?

Yes, an Operating Agreement can be modified if the members agree to the changes according to the procedures set out in the original agreement. It's important to update the document to reflect any significant decisions or changes in the operation or structure of the LLC to keep it current and relevant.

-

What happens if an LLC does not have an Operating Agreement?

Without an Operating Agreement, an LLC in Utah will be governed by the default state laws. This may lead to unintended or unfavorable management and financial arrangements among members. It can also complicate legal matters and financial disputes, making personal asset protection and business operations more challenging.

Common mistakes

When filling out the Utah Operating Agreement form, individuals often navigate through complex terrain without realizing where pitfalls lie. This document is a foundational stone for any Limited Liability Company (LLC) in Utah, guiding its operations, member roles, and financial decisions. Through careful observation and analysis, several common mistakes have surfaced, each providing critical learning opportunities for business owners.

Overlooking Customization Options: A significant misstep lies in not tailoring the Operating Agreement to the specific needs of the LLC. The default provisions may not always align with the members' visions for their business structure or operations. Individuals might miss the opportunity to specify unique profit distribution models, voting rights, or procedures for adding and removing members. Customization ensures the agreement serves the LLC's best interests rather than adhering to a one-size-fits-all approach.

Skipping Sections: It's not uncommon for individuals to skip sections of the form, often due to a lack of understanding or the assumption that certain parts do not apply to their situation. Each section, however, plays a critical role in defining the LLC's governance and operational structure. Ignoring sections can lead to ambiguities or lack of clarity in the future, potentially resulting in conflicts among members or with external parties.

Failing to Review and Update: The Operating Agreement is not a set-it-and-forget-it document. As the business evolves, so too should the agreement. Failing to periodically review and update the document to reflect changes in the business structure, membership, or operational strategy is a common mistake. This oversight can lead to discrepancies between how the LLC operates and what is outlined in the agreement, potentially causing legal complications.

Not Seeking Legal Advice: Perhaps the most critical oversight is the failure to consult with a legal professional. Many individuals believe they can navigate the complexities of the Operating Agreement on their own. However, without legal guidance, they might not fully understand the implications of certain provisions or the requirements under Utah law. Professional advice can help ensure the agreement is both compliant and optimized for the LLC's success.

In sum, these mistakes underscore the importance of approaching the Utah Operating Agreement form with diligence, attention to detail, and a willingness to seek expertise when needed. Avoiding these common pitfalls can help ensure the document fully reflects the intentions and strategies of the LLC's members, laying a solid foundation for the business's operation and governance.

Documents used along the form

When setting up a business structure in Utah, particularly a Limited Liability Company (LLC), the Operating Agreement is a crucial document that outlines the operational procedures and financial decisions of the business. Along with the Operating Agreement, several other forms and documents are commonly used to ensure the comprehensive establishment and smooth running of an LLC. These forms not only help in the legal formation of the company but also in its day-to-day operations, management of its affairs, and compliance with state regulations.

- Articles of Organization: This is the fundamental document required to officially form your LLC in Utah. It includes basic information about your LLC, such as the company name, principal address, registered agent information, and the duration of the LLC. It must be filed with the Utah Division of Corporations and Commercial Code.

- Employer Identification Number (EIN) Application: Often referred to as a Federal Tax Identification Number, an EIN is required for most businesses. It is used for tax purposes by the IRS and is necessary for hiring employees, opening business bank accounts, and filing company taxes.

- Business Licenses and Permits: Depending on the type of business and its location, your LLC may need to obtain various local, state, and federal licenses and permits to legally operate. These can include sales tax permits, professional licenses, and health department permits.

- Operating Agreement Amendment Form: If there are any changes in the membership, management, or operational procedures of the LLC, an Operating Agreement Amendment Form is used to officially document these changes. It ensures that the operating agreement stays current and reflective of the LLC's operations.

- Annual Report: Although not all states require LLCs to file annual reports, many do. This report typically updates the state on key information about your LLC, such as contact information and details about members and managers.

- Member and Manager Resolutions: These are formal documents that record significant decisions made by the LLC’s members or managers. They are essential for documenting the consent to major actions or changes within the company, such as entering into leases, loans, or other legal contracts.

Each of these documents plays a unique role in the life cycle of an LLC, from its creation to its daily operations, and ultimately its success. Proper filing and management of these documents help in maintaining the legal compliance of the LLC, minimizing liabilities, and ensuring that the business runs smoothly. Always consult with a legal advisor to ensure that you are meeting all the regulatory requirements for your LLC in Utah.

Similar forms

An operating agreement, essential for every LLC, outlines the governance and financial decisions of a business. It is akin to bylaws, which serve corporations. Bylaws establish the regulations under which a corporation operates, detailing the duties and responsibilities of the directors and officers, much like an operating agreement does for LLC members. Both documents are foundational, ensuring that all parties understand the rules governing their business entity.

Similar to a partnership agreement, an operating agreement for an LLC delineates the relationship among the owners. However, while a partnership agreement is used by general partnerships, an operating agreement is specific to LLCs. Both documents detail the distribution of profits and losses, management responsibilities, and what happens if a partner or member wants to exit the business, ensuring clarity and fairness in the operation of the businesses.

The shareholder agreement of a corporation shares similarities with an operating agreement, as both lay out the rights and obligations of the company's owners. Shareholder agreements go into detail about the sale of shares, dividend policies, and how decisions are made, much like operating agreements describe the financial and managerial rights and duties of LLC members.

The terms of service document, commonly found on websites and apps, is another document similar to an operating agreement. It outlines the rules that must be followed to use a service, including the rights and responsibilities of both parties. While terms of service govern the relationship between a service provider and its users, an operating agreement governs the relationship among business owners and their entity.

Employment contracts, which detail the duties and rights of employees and employers, also bear resemblance to operating agreements in their structure and intent. They ensure that both parties are aware of their commitments, performance expectations, and the grounds for termination. Likewise, an operating agreement ensures members know their responsibilities, contributions, and what is expected for the business's smooth operation.

A buy-sell agreement, often integrated within an operating agreement or established as a stand-alone document in partnerships and closely held corporations, stipulates how a member's share of a business may be reassigned if they leave the company. This agreement ensures the continuity of the business by outlining processes for transition, similar to how an operating agreement might include clauses for the addition or departure of members.

Franchise agreements, which define the relationship between franchisors and franchisees, share commonalities with operating agreements. Both lay out the roles, responsibilities, and financial arrangements between the parties. Franchise agreements, however, are for establishing the terms under which franchisees can operate under the franchisor's brand, unlike operating agreements, which detail the internal workings of an LLC.

A non-disclosure agreement (NDA) is designed to protect confidential information, similar to certain provisions that might be found in an operating agreement. NDAs ensure that secrets stay within the confines of a business arrangement, which is essential for maintaining competitive advantages. Though operating agreements usually deal with broader company governance, they can also include clauses to safeguard a company's proprietary information and trade secrets.

A loan agreement between a lender and a borrower specifies the terms of a loan, including repayment schedule, interest rates, and the consequences of non-payment. Elements of such an agreement can be mirrored in an operating agreement when detailing the financial contributions and profit distributions among members, ensuring that all parties understand the financial structuring within the LLC.

Lastly, property lease agreements, which set out the terms under which one party agrees to rent property from another, share the aspect of defining relationships and responsibilities. While these agreements focus on real estate transactions, operating agreements cover the broad operational and ownership aspects of an LLC, both establishing a framework within which parties interact and transact.

Dos and Don'ts

When tackling the Utah Operating Agreement form, it's crucial to proceed with caution and clarity. This document sets the foundation of how your business operates, distributes profits, and outlines the structure of management. Here is a curated list of do's and don'ts to guide you through this critical process:

Do:Review Utah's specific requirements for an Operating Agreement to ensure compliance.

Consult with all members involved in the LLC to discuss terms before filling out the form.

Provide detailed information regarding the distribution of profits, membership roles, and responsibilities.

Utilize clear, concise language to eliminate any potential ambiguity.

Update the Operating Agreement as your business grows or changes.

Have a legal professional review the document before finalizing it.

Don’t ignore state-specific clauses that may be unique to Utah, as this can cause compliance issues.

Don’t use vague terms that might lead to misinterpretation or conflict among members.

Don’t overlook the importance of outlining the process for adding or removing members.

Don’t forget to include a dissolution clause to address potential business closure conditions.

Don’t rush through filling out the form without reviewing each section for accuracy.

Don’t neglect to have every member sign the Operating Agreement, as this ensures mutual acknowledgment and understanding.

Remember, an Operating Agreement is not just a formality but a crucial document that governs your LLC. Approach it with the seriousness and thoroughness it deserves. The success and smooth operation of your business may very well depend on this document.

Misconceptions

Understanding the Utah Operating Agreement is crucial for business owners but is often surrounded by misconceptions. Clearing up these misunderstandings can help ensure that you're fully informed while making key decisions for your LLC. Let's take a closer look at some common misconceptions.

- All Utah LLCs are legally required to have an Operating Agreement. It's a common belief that an Operating Agreement is a legal necessity for every LLC in Utah. In reality, while it's highly recommended for clarifying the business structure and preventing disputes, Utah law does not strictly require LLCs to have one.

- An Operating Agreement needs to be filed with the Utah state government. Actually, the Operating Agreement is an internal document. You don't need to file it with the state; instead, you should keep it with your records, accessible to all members of the LLC.

- Templates found online "fit all" and are sufficient for your Utah LLC. Although online templates can provide a good starting point, they might not cover all the specifics or meet the unique needs of your LLC. Tailoring the document to your business is vital for full legal protection and functional operation.

- A single-member LLC doesn't need an Operating Agreement. Even if you're the sole owner of your LLC, having an agreement is beneficial. It helps demonstrate the separation between personal and business assets, provides proof of your business structure, and can offer extra protection for your personal assets.

- Once created, an Operating Agreement cannot be changed. This is not true. As your LLC grows and evolves, so too can your Operating Agreement. Amendments can be made as long as they follow the procedures outlined in the original agreement and are agreed upon by all members.

- Operating Agreements are only necessary if you plan to take legal action in the future. While an Operating Agreement can indeed be valuable in legal disputes, its purpose extends far beyond potential court cases. It also serves to outline daily operations, define responsibilities, and clarify financial arrangements among members.

- The state of Utah has a generic Operating Agreement format that all LLCs must follow. Utah does encourage LLCs to have an Operating Agreement but does not provide a "one-size-fits-all" format. The content and structure can be customized to suit the specific needs and preferences of your LLC, as long as it complies with state law.

- Verbal agreements between members are just as binding as a written Operating Agreement. While verbal agreements may hold some level of understanding between members, a written Operating Agreement is far more reliable and enforceable. It reduces the potential for misunderstandings and disputes by clearly laying out terms and conditions in writing.

Clearing up these misconceptions about the Utah Operating Agreement can help you better prepare for the successful management and operation of your LLC.

Key takeaways

When it comes to creating a successful business structure for your Utah LLC, utilizing an Operating Agreement is a crucial step. This formal document sets the groundwork for your business's financial and functional decisions. Understanding how to properly fill out and use the Utah Operating Agreement form can ensure your business operates smoothly and efficiently. Here are four key takeaways to consider:

- Personalize to Fit Your Business: Every LLC is unique, and your Operating Agreement should reflect that. While templates can provide a solid starting point, tailoring the content to match your specific business needs, structure, and goals is essential. This includes detailing the percentage of ownership, distribution of profits and losses, and the roles and responsibilities of each member.

- Ensure Compliance with Utah Laws: The Operating Agreement isn't just an internal document; it needs to align with Utah's legal requirements for LLCs. Although Utah does not require the Operating Agreement to be filed with a state agency, the document should comply with state regulations to avoid potential legal issues. It's advisable to review Utah's LLC Act or consult with a legal professional to ensure your agreement is compliant.

- Clarify Financial and Management Structure: A clear, well-structured Operating Agreement outlines how financial decisions are made, including details on fund allocation, handling of expenses, and distribution of profits and losses. Equally important is detailing the management structure, which includes decision-making processes and day-to-day operations. This clarity helps prevent conflicts among members.

- Review and Update Regularly: As your business evolves, your Operating Agreement should too. Regular reviews allow you to make adjustments that reflect growth changes, new state laws, or shifts in membership. Keeping your Operating Agreement current ensures it remains a useful tool for guiding your business's operations.

In conclusion, the Operating Agreement serves as a foundational document for your LLC in Utah. It's more than just a formality; it's a critical tool for defining your business's structure, rules, and expectations. By personalizing the agreement, ensuring it complies with state laws, clearly outlining financial and management structures, and keeping it updated, you set your business up for a smooth operation and long-term success.

Other Popular Utah Templates

Utah Real Estate Purchase Contract - Often requires acknowledgment or certification by a notary public to confirm the identity of the signatories.

Notary Bond Utah - Failure to obtain a Notary Acknowledgment when required can lead to a document being considered invalid or unenforceable.