Free Last Will and Testament Form for Utah

Embarking on the journey to draft a Last Will and Testament in Utah is a significant step towards ensuring one's wishes are honored after their passing. This pivotal document, tailored to the unique landscape of Utah's legal requirements, empowers individuals to dictate the distribution of their assets, appoint guardians for minor children, and specify their final wishes with clarity and precision. Its major aspects include the necessity for the testator—the person creating the will—to be of sound mind and at least 18 years old, the importance of having witnesses to validate the will, and the potential to nominate an executor who will oversee the will's execution. Furthermore, the form intricately navigates through Utah's nuances in estate law, offering a framework that can adapt to a diverse range of assets and personal situations. It underscores the value of foresight in estate planning, helping to minimize disputes among survivors and ensuring that the legacy left behind is in line with the testator’s desires. Though contemplating one's mortality may seem daunting, the process of crafting a Last Will and Testament in Utah can offer unmatched peace of mind, securing not just a person's assets, but also the well-being of their loved ones for the future.

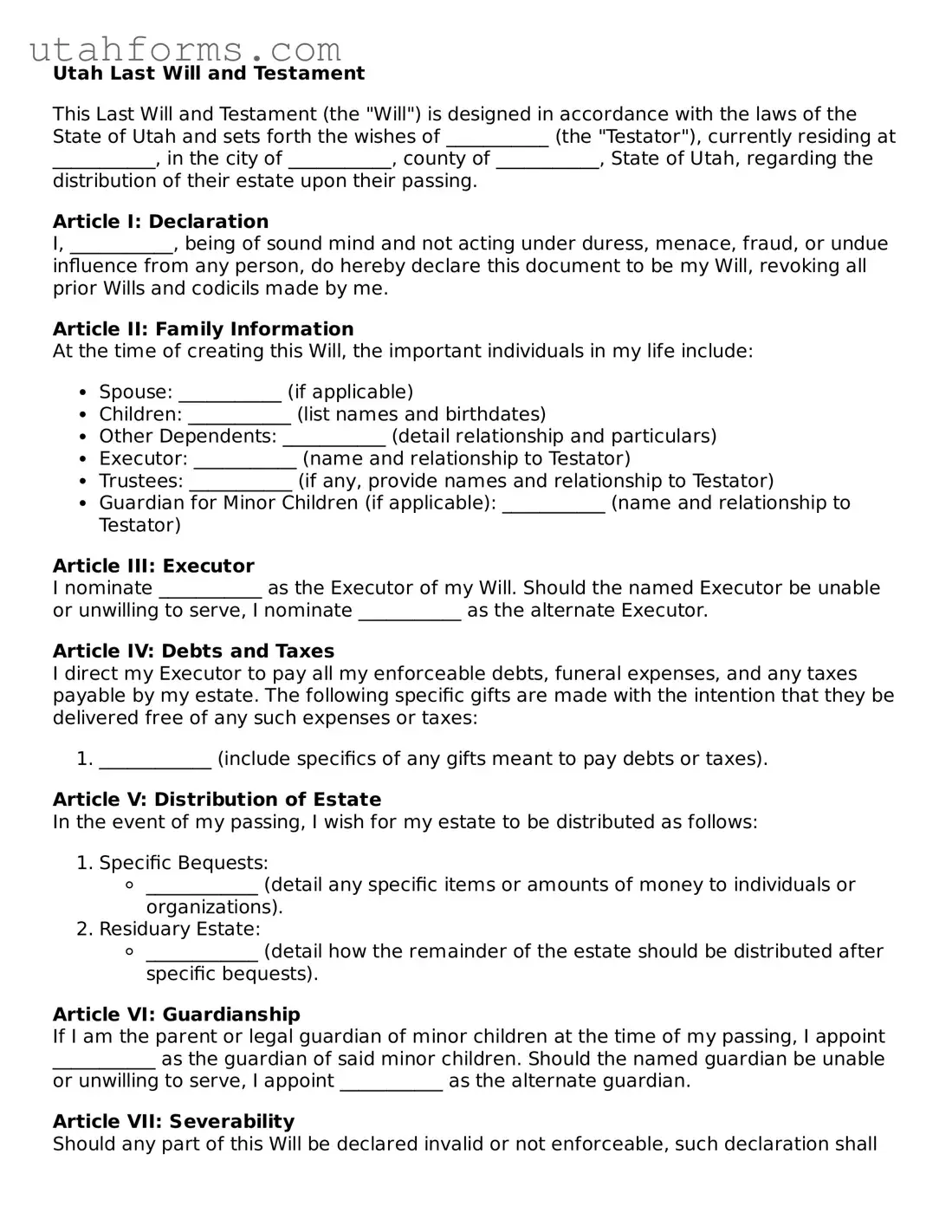

Preview - Utah Last Will and Testament Form

Utah Last Will and Testament

This Last Will and Testament (the "Will") is designed in accordance with the laws of the State of Utah and sets forth the wishes of ___________ (the "Testator"), currently residing at ___________, in the city of ___________, county of ___________, State of Utah, regarding the distribution of their estate upon their passing.

Article I: Declaration

I, ___________, being of sound mind and not acting under duress, menace, fraud, or undue influence from any person, do hereby declare this document to be my Will, revoking all prior Wills and codicils made by me.

Article II: Family Information

At the time of creating this Will, the important individuals in my life include:

- Spouse: ___________ (if applicable)

- Children: ___________ (list names and birthdates)

- Other Dependents: ___________ (detail relationship and particulars)

- Executor: ___________ (name and relationship to Testator)

- Trustees: ___________ (if any, provide names and relationship to Testator)

- Guardian for Minor Children (if applicable): ___________ (name and relationship to Testator)

Article III: Executor

I nominate ___________ as the Executor of my Will. Should the named Executor be unable or unwilling to serve, I nominate ___________ as the alternate Executor.

Article IV: Debts and Taxes

I direct my Executor to pay all my enforceable debts, funeral expenses, and any taxes payable by my estate. The following specific gifts are made with the intention that they be delivered free of any such expenses or taxes:

- ____________ (include specifics of any gifts meant to pay debts or taxes).

Article V: Distribution of Estate

In the event of my passing, I wish for my estate to be distributed as follows:

- Specific Bequests:

- ____________ (detail any specific items or amounts of money to individuals or organizations).

- Residuary Estate:

- ____________ (detail how the remainder of the estate should be distributed after specific bequests).

Article VI: Guardianship

If I am the parent or legal guardian of minor children at the time of my passing, I appoint ___________ as the guardian of said minor children. Should the named guardian be unable or unwilling to serve, I appoint ___________ as the alternate guardian.

Article VII: Severability

Should any part of this Will be declared invalid or not enforceable, such declaration shall not affect the validity and enforceability of any remaining part, which shall remain in full force and effect.

Article VIII: Declaration and Signatures

This Will was executed on the ___________ day of ___________, 20__, at ___________, in the State of Utah, as the free and voluntary act of the Testator, in the presence of two witnesses, neither of whom has any beneficial interest under this Will.

Testator's Signature: ___________

Witness #1 Name: ___________

Witness #1 Signature: ___________

Date: ___________

Witness #2 Name: ___________

Witness #2 Signature: ___________

Date: ___________

This document was prepared without any legal assistance and may not cover all individual circumstances or comply with specific state legal requirements beyond those listed. Professional legal advice is recommended for personalized guidance.

Document Properties

| Fact | Detail |

|---|---|

| Legal recognition | Utah recognizes a Last Will and Testament as legally binding if it meets state-specific requirements. |

| Governing law | Utah Probate Code, specifically sections 75-2-501 to 75-2-517. |

| Age requirement | The testator must be at least 18 years old. |

| Sound mind requirement | The testator must be of sound mind at the time of creating the will. |

| Witness requirement | A Utah Last Will and Testament must be signed in the presence of at least two witnesses. |

| Writing requirement | The will must be in writing to be recognized by Utah courts. |

| Holographic wills | Utah recognizes holographic (handwritten) wills if the material provisions and the signature are in the testator's handwriting. |

| Self-proving affidavit | Utah allows for the will to be accompanied by a self-proving affidavit, which can expedite the probate process. |

| Revocation | A Last Will and Testament in Utah can be revoked by creating a new will or by physically destroying the existing one. |

How to Write Utah Last Will and Testament

Creating a Last Will and Testament is an essential step in planning for the future. It not only outlines your wishes regarding the distribution of your assets, but also provides peace of mind for you and your loved ones. The process of filling out the Utah Last Will and Testament form requires attention to detail and precision. Follow these steps to ensure your will is legally compliant and reflects your intentions accurately.

- Begin with your full legal name and address to establish your identity. Include your city, county, and state to confirm your residence.

- Appoint an Executor by writing the full name and relationship of the person you trust to manage your estate. Ensure the individual is willing and able to perform the duties involved.

- Designate a Guardian for your minor children, if applicable. Include the guardian's full name and relationship to your children. Consider discussing this responsibility with them beforehand to confirm their willingness.

- List all your beneficiaries with their full names and relationships to you. Clearly specify what assets or portion of your estate each beneficiary will receive.

- Detail your assets and how you want them distributed among your beneficiaries. Be as specific as possible to avoid confusion or disputes.

- Sign the form in the presence of two witnesses who are not beneficiaries. Witnesses must be 18 years or older and of sound mind. Include the date of signing.

- Have your witnesses sign and date the form, acknowledging they witnessed your signature. Ensure they print their names and addresses for identification.

- If applicable, have the form notarized to add an extra layer of legal validation. This step is not mandatory in Utah but recommended for the probate process.

By carefully following these steps, you can complete the Utah Last Will and Testament form effectively. Remember, this legal document plays a critical role in ensuring your desires are respected and executed after your passing. Take your time to review all information for accuracy and completeness before finalizing your will.

Frequently Asked Questions

-

What is a Last Will and Testament?

A Last Will and Testament is a legal document that outlines a person's wishes regarding the distribution of their property and the care of any minor children upon their death. It allows individuals to ensure their final wishes are respected and followed by their heirs and beneficiaries.

-

Is a Last Will and Testament required to be notarized in Utah?

In Utah, a Last Will and Testament does not need to be notarized to be legally valid. However, it must be signed by the person creating the will (testator) in the presence of at least two witnesses, who must also sign the document attesting that they observed the testator's signature.

-

Can I write my own Last Will and Testament in Utah?

Yes, individuals in Utah can write their own Last Will and Testament. Despite this allowance, it's crucial to ensure that the document complies with Utah's legal requirements to be deemed valid. For clarity, accuracy, and to ensure that all legal bases are covered, consulting with a legal professional is recommended.

-

What happens if someone dies without a Last Will and Testament in Utah?

If a person dies without a Last Will and Testament in Utah, they are considered to have died "intestate." This means the distribution of their assets will be handled according to Utah's intestacy laws. Typically, the deceased person's property will be distributed to their closest relatives, starting with their spouse and children. If no relatives can be found, the property may escheat, or revert, to the state.

-

Can a Last Will and Testament be changed or revoked in Utah?

Yes, a Last Will and Testament can be changed or revoked at any time by the person who created it, as long as they are of sound mind. Changes can be made through a codicil, an amendment to the will, or by creating a new will. To revoke a will, it can be destroyed by the testator with the intention of revoking it or by creating a new will that states the previous will is revoked.

Common mistakes

Filling out a Utah Last Will and Testament is a significant step in ensuring one's wishes are honored after their passing. Yet, despite its importance, many individuals make critical errors during this process. These mistakes can lead to confusion, disputes among family members, and even the will being challenged or disregarded in court. Awareness and avoidance of common pitfalls are crucial during this delicate task.

One widespread mistake involves not properly adhering to the state's witnessing requirements. Utah law demands the presence of two witnesses when the will's creator, known as the testator, signs the document. These witnesses must be adults and should not stand to benefit from the will, to avoid conflicts of interest. Unfortunately, people often overlook this requirement, or choose witnesses who are not deemed legally acceptable, potentially rendering the will invalid.

- Inadequate Detail in Bequests: Individuals frequently err by not being specific enough in their bequests. Simply stating that assets should be divided among "my children" without further specification can result in disputes and legal complications. To avoid this, it's essential to clearly identify each beneficiary by their full legal name and specify the exact assets or portion of the estate they are to receive.

- Not Updating the Will: Many people fill out a Last Will and Testament and then forget about it. However, life's circumstances change—marriages, divorces, births, and deaths can all affect the relevance and functionality of a will. Neglecting to update a will to reflect these life changes can lead to unintended consequences and disputes among survivors.

- Choosing an Inappropriate Executor: The role of the executor, who is responsible for managing and distributing the estate according to the will, is critical. Selecting someone who lacks the skills, willingness, or integrity to perform these duties can result in mismanagement and conflict. It's vital to choose an executor who is both capable and trustworthy.

- Failing to Consider a Trust: For some individuals, a simple will may not be the most effective way to distribute their assets. In cases involving minor children, individuals with special needs, or the desire to avoid probate, establishing a trust in addition to the will might be advisable. Many overlook this option, which can offer more flexibility and protection for their assets and beneficiaries.

In the end, the process of creating a Last Will and Testament in Utah is not just about filling out a form. It requires careful consideration, proper legal guidance, and an understanding of state laws and personal circumstances. By avoiding these common mistakes, individuals can create a comprehensive and effective will that ensures their final wishes are respected and fulfilled.

Documents used along the form

When preparing a Last Will and Testament in Utah, several other forms and documents are often used alongside to ensure a comprehensive estate plan. These documents support the will by specifying preferences in situations not covered by a will, thus providing a full spectrum of directives for both end-of-life decisions and post-life arrangements. Here's a look at some of the key forms and documents frequently employed in conjunction with a Utah Last Will and Testament.

- Advance Health Care Directive - This document allows individuals to outline their healthcare preferences, including treatments they do or do not want, in case they are unable to communicate their wishes due to illness or incapacity.

- Financial Power of Attorney - This legal form designates a trusted person to manage the financial affairs of the individual, should they become incapacitated, ensuring that their financial responsibilities are taken care of.

- Living Will - Often included within an Advance Health Care Directive, a Living Will specifies desires regarding life-sustaining treatment if an individual becomes terminally ill or permanently unconscious.

- Trust Agreement - A Trust Agreement is used to create a trust, a legal arrangement that holds assets for beneficiaries, which can help avoid probate and manage estate taxes.

- Funeral Directive - This outlines an individual’s preferences for their funeral arrangements, including the type of service, burial or cremation, and even specifics like music and readings.

- Letter of Intent - While not legally binding, a Letter of Intent provides a personal touch, offering instructions or desires to loved ones or executors that aren’t covered within the will or other legal documents.

- Digital Assets Memorandum - Given the rise in digital assets, this document specifies what should happen to digital property (social media accounts, online banking, email accounts) after death.

- Property Deeds - Property deeds are crucial for ensuring the correct transfer of real estate properties as outlined in the will or trust. They may need to be re-titled or adjusted to conform with the estate plan.

Together, these documents work with a Last Will and Testament to create a protective web over one's final wishes and assets. They provide clarity, prevent disputes, and ensure that personal and financial affairs are handled according to the deceased's wishes. While the will itself is central to an estate plan, these supporting documents are invaluable for covering specifics that the will cannot, thus offering peace of mind to both the individual and their loved ones.

Similar forms

The Utah Living Will is a document that bears similarity to the Last Will and Testament, as both serve crucial roles in expressing an individual's preferences regarding their personal matters. A Living Will focuses specifically on healthcare decisions, providing instructions on life-prolonging treatments in the event that the individual cannot communicate their wishes due to a severe medical condition. This resemblance lies in their shared objective to ensure that the individual's preferences are respected and followed, albeit in different contexts.

The Durable Power of Attorney for Healthcare is another document closely related to the Utah Last Will and Testament. It enables an individual to appoint a trusted person to make healthcare decisions on their behalf should they become incapacitated. The similarity between these documents lies in their core purpose: to appoint representatives to act in the best interest of the individual, ensuring their specific wishes regarding personal care or health are executed when they are not in a position to do so themselves.

Similarly, the Financial Power of Attorney document parallels the Last Will and Testament in significant ways. It allows an individual to designate an agent to handle their financial affairs, ranging from managing investments to paying bills, in the event they are unable to manage their finances. This document reflects the Last Will and Testament’s aim of safeguarding an individual's assets and ensuring their distribution according to the person's wishes, though it operates while the individual is still alive rather than after their passing.

The Trust Agreement is akin to the Last Will and Testament as it encompasses the management and distribution of an individual’s assets. However, a Trust Agreement takes effect during an individual's lifetime and continues after their death. This document enables a precise control over when and how assets are distributed to beneficiaries, often providing the benefit of bypassing the lengthy probate process, a distinct yet complementary objective to that of a Last Will and Testament.

The Advance Healthcare Directive, much like the Utah Last Will and Testament, serves as a critical tool for end-of-life planning. This document combines elements found in both a Living Will and a Durable Power of Attorney for Healthcare, detailing an individual’s preferences for medical treatment and appointing a healthcare representative. The core similarity lies in their mutual goal to honor the individual's healthcare wishes during times when they are unable to communicate their desires.

Last but not least, the Funeral Planning Declaration form exhibits a fundamental resemblance to the Last Will and Testament. It focuses specifically on arrangements after an individual's death, such as burial or cremation preferences, and may include instructions for the memorial service. While the Last Will addresses the distribution of an individual’s estate and can include funeral instructions, a Funeral Planning Declaration provides a dedicated space to outline these details comprehensively, ensuring wishes related to one’s final arrangements are clear and respected.

Dos and Don'ts

Creating a Last Will and Testament is an important step in planning for the distribution of your estate - the assets you own upon your death - in Utah. It's critical that this document is filled out accurately to ensure that your wishes are carried out and to minimize potential disputes among heirs or beneficiaries. Below you'll find a list of things you should and shouldn't do when filling out the Utah Last Will and Testament form.

What You Should Do:

Clearly identify yourself in the document, including your full legal name and residence, to avoid any confusion about the will’s ownership.

Be specific about which assets go to which beneficiaries to prevent disagreements and ensure your wishes are followed accurately.

Choose an executor you trust to manage the estate. This person will be responsible for carrying out your will's instructions.

Sign the will in front of two witnesses who are not beneficiaries of the will. In Utah, the presence of these witnesses is crucial for the document's validity.

Consider appointing a guardian for any minor children or dependents to ensure their care and support in your absence.

Keep the document in a safe but accessible place and inform the executor or a trusted individual of its location.

What You Shouldn't Do:

Don't leave any sections blank. If a section doesn’t apply, it’s better to mark it as “N/A” (not applicable) than to leave it empty.

Avoid using vague language that could be open to interpretation. Be as clear and precise with your instructions as possible.

Don’t forget to update your will after major life events, such as marriage, divorce, the birth of children, or the death of a beneficiary.

Avoid choosing an executor who may not be willing or able to perform the duties required. Always have a conversation with your chosen executor to make sure they are willing and understand their responsibilities.

Don't neglect to review and adjust your beneficiaries on accounts or policies (like life insurance or retirement accounts) outside of the will, as these are not governed by the terms of your will and pass directly to the named beneficiaries.

Do not rely solely on a digital copy of your will. While having a digital backup is wise, an original signed document is necessary for the will to be legally binding in Utah.

Misconceptions

Understanding the Utah Last Will and Testament form is crucial for effectively planning one's estate. However, there are several misconceptions that can lead to confusion. Here are ten common misunderstandings and the realities behind them:

It's only for the wealthy: Many people believe that the Last Will and Testament is only necessary for those with substantial assets. The truth is, it is important for anyone who wishes to dictate how their possessions, regardless of their value, are distributed after their death.

Spouses inherit everything automatically: Another common misconception is that a surviving spouse will automatically inherit all of the deceased's estate. While spouses do have rights to the estate, a will can outline specific distributions and ensure certain property goes to other loved ones or organizations.

It's too complicated to create: The process of creating a Last Will and Testament in Utah can seem daunting, but it doesn't have to be. With the right guidance, individuals can draft a will that reflects their wishes without excessive complication.

It covers all types of property: Some people think that a Last Will and Testament covers all forms of property. However, certain kinds of assets, such as those held in joint tenancy or those with designated beneficiaries (like life insurance), typically pass outside of the will.

Only an attorney can draft it: While having an attorney can provide valuable advice and ensure the will meets all legal requirements, it's possible for individuals to draft their own wills, especially with the help of do-it-yourself kits or online resources.

It's expensive to create: The assumption that creating a will is inherently expensive can deter people from making one. In reality, costs can vary widely, and options exist for every budget, including affordable legal assistance and online services.

A Last Will doesn't need to be updated: Once a will is made, some might think it's set in stone. However, life changes such as marriage, divorce, the birth of children, or significant asset changes necessitate updates to the will to reflect current wishes.

It's only about distributing assets: While the distribution of assets is a major part of a will, it can also nominate guardians for minor children, dictate wishes for funeral arrangements, and leave instructions for the care of pets.

Oral wills are just as valid: In Utah, for a will to be legally valid, it generally must be written and meet certain formalities. Relying on oral promises or wishes can lead to disputes and complications.

It immediately takes effect upon death: It's a misconception that the instructions in a will take effect immediately after death. The will must go through the probate process, which can take time and involves the court validating the will and overseeing the estate's distribution.

Understanding these misconceptions about the Utah Last Will and Testament can lead to better estate planning and peace of mind. It's important to review and update your will as necessary to ensure it accurately reflects your desires and legal requirements.

Key takeaways

Filling out and using the Utah Last Will and Testament form involves several important considerations to ensure your final wishes are honored accurately and legally. Understanding these key takeaways can help guide individuals through the process smoothly.

- Legal Requirements Must Be Met: Utah law requires the person creating the will (testator) to be at least 18 years old and of sound mind. The document must be in writing and signed by the testator in the presence of at least two witnesses, who must also sign the will. Understanding these requirements is crucial to ensure the document is legally binding.

- Clearly Identify Your Beneficiaries: Clearly stating who your beneficiaries are, and what assets each beneficiary will receive, reduces the possibility of disputes among family members and ensures your assets are distributed according to your wishes.

- Appoint a Trustworthy Executor: The executor is responsible for managing the estate according to the will’s instructions. Choosing a reliable and competent individual is important, as the executor plays a pivotal role in the probate process and the distribution of assets.

- Consider a Guardian for Minor Children: If you have minor children, it's essential to appoint a guardian in your will. This ensures someone you trust is responsible for their care and upbringing, should something happen to both parents.

- Keep the Document in a Safe Place: Once your Utah Last Will and Testament is completed, sign it, have it witnessed, and then store it in a secure location. Important individuals, such as the executor or a trusted family member, should know where it is kept and how to access it when needed.

- Review and Update Regularily: Life events such as marriage, divorce, the birth of children, or the death of a beneficiary can impact your will. Reviewing and, if necessary, updating your will regularly ensures it always reflects your current wishes and circumstances.

By keeping these key takeaways in mind, individuals can navigate the process of completing a Utah Last Will and Testament with greater confidence, ensuring their final wishes are clearly communicated and legally recognized.

Other Popular Utah Templates

How to Sell a Car in Utah - Can be used in any state but should be customized to meet local legal requirements where necessary.

Creating an Operating Agreement - It provides a framework for decision-making processes within the LLC.