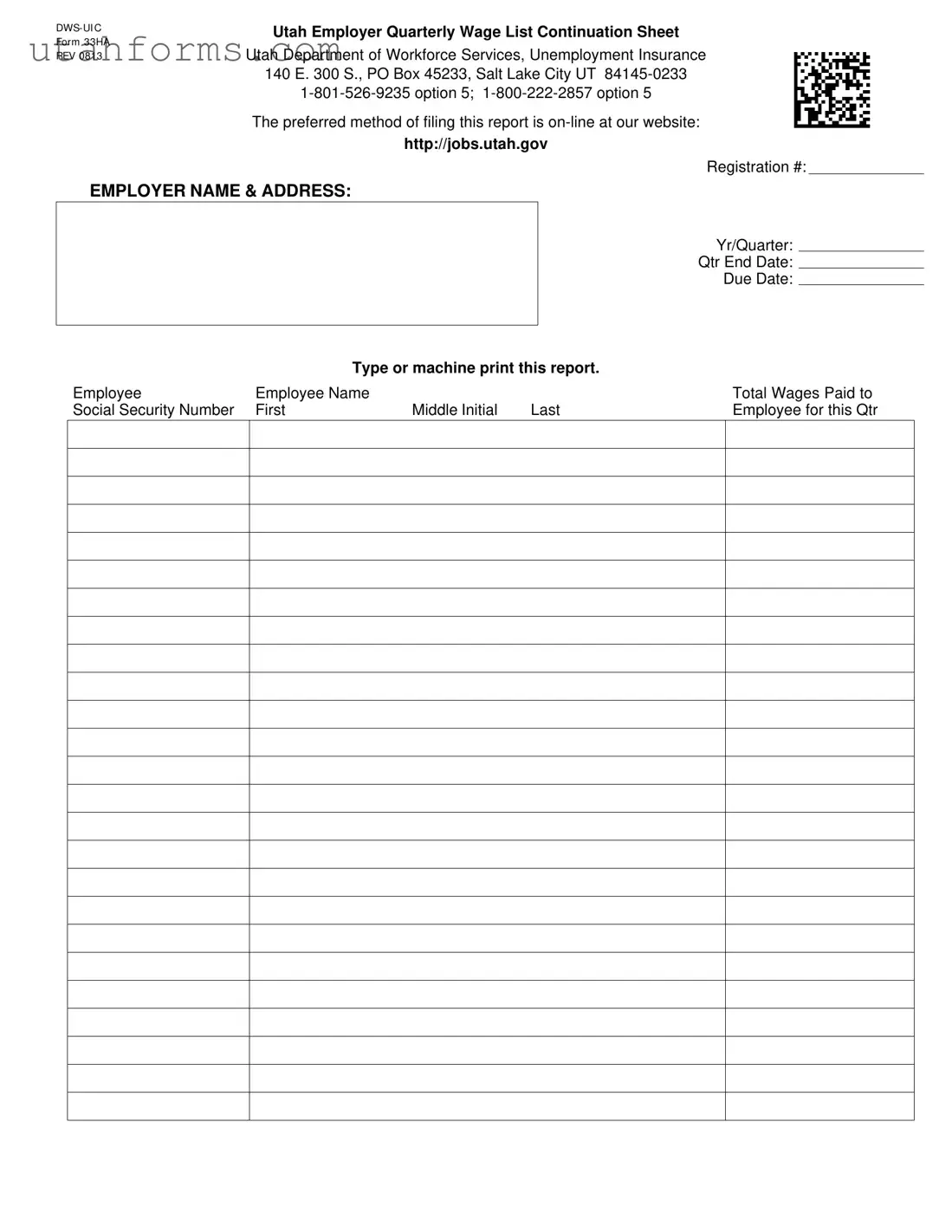

Fill Out Your Jobs Utah Gov Form

The Jobs Utah Gov form, designated as DWS-UI Form 33HA REV 0813, serves as a crucial tool for employers in Utah to submit their quarterly wage list to the Department of Workforce Services, specifically for Unemployment Insurance purposes. Housed in Salt Lake City, with the option for online submission, this document ensures that accurate wage data is reported for each employee, including details such as social security numbers and the total wages paid within the quarter. The form requires employers to type or print information neatly, emphasizing clarity and accuracy in reporting. It specifies essential information such as the employer's registration number, name, and address, along with the year and quarter of the report, and includes deadlines to encourage timely submissions. With options for submitting the form both online and via traditional mail, the DWS-UI Form 33HA aims to streamline the process for employers, ensuring compliance with Utah's unemployment insurance reporting requirements.

Preview - Jobs Utah Gov Form

Utah Employer Quarterly Wage List Continuation Sheet

Utah Department of Workforce Services, Unemployment Insurance

140 E. 300 S., PO Box 45233, Salt Lake City UT

The preferred method of filing this report is

http://jobs.utah.gov

Registration #:

EMPLOYER NAME & ADDRESS:

Yr/Quarter:

Qtr End Date:

Due Date:

|

|

Type or machine print this report. |

|

|

Employee |

Employee Name |

|

Total Wages Paid to |

|

Social Security Number |

First |

Middle Initial |

Last |

Employee for this Qtr |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

File Specifications

| Fact | Detail |

|---|---|

| Form Name | Utah Employer Quarterly Wage List Continuation Sheet |

| Form Number | DWS-UI Form 33HA |

| Revision Date | August 2013 (REV 0813) |

| Issuing Department | Utah Department of Workforce Services, Unemployment Insurance |

| Contact Information | 1-801-526-9235 option 5; 1-800-222-2857 option 5 |

| Preferred Filing Method | Online at http://jobs.utah.gov |

| Postal Address | 140 E. 300 S., PO Box 45233, Salt City Lake, UT 84145-0233 |

| Information Required | Registration Number, Employer Name & Address, Year/Quarter, Quarter End Date, Due Date, Employee Information (Name, Social Security Number, Total Wages Paid for the quarter) |

| Instructions | Type or machine print this report. |

| Governing Law(s) | Utah Unemployment Insurance laws |

How to Write Jobs Utah Gov

Filing the DWS-UI C Form 33HA, a Utah Employer Quarterly Wage List Continuation Sheet, is an important step for any employer in Utah needing to report wages paid to their employees for unemployment insurance purposes. The process is straightforward but requires attention to detail. Before diving into the form, it's vital to gather all necessary information, including employee names, social security numbers, and the total wages paid for the quarter. This will help ensure accuracy and compliance with the Utah Department of Workforce Services.

Step-by-Step Instructions for Filling Out the DWS-UI C Form 33HA:- Visit the official website provided to access the form: http://jobs.utah.gov.

- Locate the "Registration #" section at the top of the form and enter your employer registration number.

- In the "EMPLOYER NAME & ADDRESS" field, type or machine print your business's name and address details.

- Fill in the "Yr/Quarter" section by specifying the year and quarter to which the report pertains.

- Next, input the "Qtr End Date" and "Due Date" for the quarter being reported.

- For each employee, enter their full name (First, Middle Initial, Last) in the "Employee Name" column.

- In the "Social Security Number" column, provide the social security number of each employee.

- Finally, record the "Total Wages Paid to Employee for this Qtr." for every listed employee.

After carefully reviewing the accuracy of the information entered, make sure to submit the form before the specified due date to ensure compliance and avoid potential penalties. If you prefer, take advantage of the preferred online filing method through the website mentioned earlier, which can streamline the process and save time. Remember, maintaining accurate and timely wage reports is crucial for both your business and your employees' benefit eligibility.

Frequently Asked Questions

What is the DWS-UI Form 33HA for?

The DWS-UI Form 33HA, known as the Utah Employer Quarterly Wage List Continuation Sheet, is a document that businesses in Utah use to report wages paid to their employees for unemployment insurance purposes. Employers must fill out this form every quarter, listing each employee's name, social security number, and the total wages paid to them during that quarter. This form is submitted to the Utah Department of Workforce Services, Unemployment Insurance.

How can I file the DWS-UI Form 33HA?

Employers have the option to file the DWS-UI Form 33HA online, which is the preferred method. To file online, visit the website http://jobs.utah.gov. If you cannot file online, you may type or machine-print this report and mail it to the Utah Department of Workforce Services, Unemployment Insurance at the provided address. Before filing, make sure you have your registration number, and you can contact them through the provided phone numbers if you have questions or need guidance.

What information do I need to complete the form?

To correctly fill out the DWS-UI Form 33HA, you will need the following information:

- The employer's registration number.

- The name and address of the employer.

- The year/quarter for which wages are being reported.

- The quarter end date and the due date for the report.

- For each employee: their name (first, middle initial, and last), social security number, and the total wages paid to them for the quarter.

When is the DWS-UI Form 33HA due?

Employers must submit the DWS-UI Form 33HA by the due date specified for the quarter being reported. Generally, this form is due by the last day of the month following the end of a quarter. For example, wages for the first quarter (January to March) are usually due by the end of April. Keep in mind that failing to submit the form on time can result in penalties. It's important to refer to the specific quarter's end date mentioned in the form instructions or check the Utah Department of Workforce Services website for the most current deadlines.

Common mistakes

Filling out government forms can sometimes be a complex task. The DWS-UI C Form 33HA, a Utah Employer Quarterly Wage List Continuation Sheet, is one such form that requires attention to detail. Over the years, several common mistakes have been observed in the completion of this form that can lead to unnecessary delays or issues. Identifying these errors can help ensure the form is filled out correctly and efficiently.

One of the primary mistakes made involves the Registration #. It's crucial to enter this information correctly as it is used to identify the employer within the Utah Department of Workforce Services system. Similarly, the accuracy of the EMPLOYER NAME & ADDRESS cannot be overstated. Inaccuracies here can lead to miscommunication or misfiled documents. Another frequently seen error is incorrectly entering the Yr/Quarter and Qtr End Date. This date information helps to categorize the submission accurately over time, making errors here particularly problematic.

Moreover, when entering the Employee Name and Social Security Number, precision is essential. Misspelled names or incorrect numbers can lead to wrongful reporting of wages or confusion about employee identity. In the section for Total Wages Paid to Employee for this Qtr, mistakes often occur due to miscalculations or oversight, impacting the accuracy of reported wages. These areas are crucial for maintaining accurate employee records and ensuring correct unemployment insurance contributions.

To summarize, the ten most common mistakes observed on the DWS-UI C Form 33HA include:

- Failing to correctly enter the Registration Number.

- Miswriting the EMPLOYER NAME & ADDRESS.

- Incorrectly entering the Year/Quarter.

- Entering the wrong Quarter End Date.

- Mistyping Employee Names.

- Entering incorrect Social Security Numbers.

- Miscalculating the Total Wages Paid to Employee for this Quarter.

- Not using the preferred method of online filing despite its convenience.

- Overlooking the encouragement to type or machine print, leading to legibility issues.

- Failure to double-check the form for errors before submission.

By avoiding these common errors, employers can contribute to a smoother processing of their quarterly wage reports. It is always recommended to review the form thoroughly before submission and, if possible, to utilize the online filing system at http://jobs.utah.gov for a more streamlined and error-free process.

Documents used along the form

When businesses in Utah engage with employment and workforce-related filings, particularly with the Jobs Utah Gov form (DWS-UI Form 33HA), they often encounter a need to manage and submit additional documents. These forms and documents are vital for various aspects of employee management, tax reporting, and compliance with state and federal regulations. Understanding these companion documents can streamline the process and ensure thorough and compliant record-keeping and reporting.

- UT Form 33H: This is the primary quarterly wage and tax report form which employers must file along with the continuation sheet (Form 33HA). It provides a summary of total wages paid, taxes owed, and credits applied during the quarter.

- I-9 Employment Eligibility Verification: Required by the Department of Homeland Security, this form verifies an employee's legal right to work in the United States. It must be completed for each employee at the time of hire.

- W-4 Form: This IRS document is used by employees to indicate their tax withholdings. Employers use it to withhold the correct federal income tax from employees' paychecks.

- W-2 Form: Issued annually, this form reports total annual wages earned and taxes withheld from an employee's paycheck. It is crucial for employees' tax filings.

- W-9 Form: Request for Taxpayer Identification Number and Certification, used to provide the correct taxpayer identification number to entities that are required to file information returns with the IRS on the filer's behalf.

- Form UI-50A: Notice to Base Year Employer. This document is sent to employers for the purpose of verifying wages and employment periods for individuals filing for unemployment benefits.

- New Hire Reporting Form: Employers must report newly hired and re-hired employees to a state directory within 20 days of their hire date, to assist in child support enforcement efforts.

- Form 940: Employer's Annual Federal Unemployment (FUTA) Tax Return, used to report annual federal unemployment tax for employees.

- Form 941: Employer's Quarterly Federal Tax Return, filed quarterly, reports wages paid, tips employees received, federal income tax withheld, and both employer’s and employee’s share of social security and Medicare taxes.

- Workman’s Compensation Insurance Documentation: Proof of workman’s compensation insurance is required in most states, including Utah, providing benefits to employees who get injured or sick from their job.

Accurately completing and submitting the Jobs Utah Gov form along with these associated documents is critical for compliance with state and federal laws. These documents collectively ensure proper reporting and payment of taxes, verification of employment eligibility, and protection of employees’ rights. By familiarizing themselves with these forms, businesses can maintain good standing with regulatory entities and support their workforce more effectively.

Similar forms

The Federal Unemployment Tax Act (FUTA) Tax Return closely resembles the Jobs Utah Gov form in several ways. Both documents are essential for employers, as they detail the wages paid to employees within a specific period. FUTA forms are used at the federal level to report quarterly wages and calculate unemployment tax owed to the IRS. Similarly, the Jobs Utah Gov form serves to report employee earnings to the Utah Department of Workforce Services for unemployment insurance purposes. Each form collects employer information, including the total wages paid to each employee during the quarter.

The Quarterly Federal Tax Return, also known as Form 941, is another document sharing similarities with the Jobs Utah Gov form. Form 941 is used by employers to report income taxes, Social Security tax, or Medicare tax withheld from employees' paychecks. Additionally, it reports the employer's portion of Social Security or Medicare tax. Like the Jobs Utah Gov form, it is filed quarterly and requires detailed employee wage information, underscoring the documentation's integral role in tax and wage reporting.

State New Hire Reporting forms, which vary by state, also mirror the Jobs Utah Gov form in their function. These forms require employers to report new employees to a designated state agency shortly after hire, including employee names, addresses, and Social Security numbers, much like the wage list continuation sheet requires for unemployment insurance purposes. The main goal of both documents is to ensure compliance with employment regulations, though they serve different ends—unemployment insurance and child support enforcement.

Workers' Compensation First Report of Injury forms are submitted by employers following a workplace injury or illness. While focusing on incidents rather than quarterly wages, this form similarly collects detailed employee information, such as name and Social Security number, internalizing the importance of accurate record-keeping in both cases. The rationale behind both is to provide necessary benefits—unemployment or workers' compensation—to eligible employees.

The Employer's Quarterly Contribution and Wage Report, specific to state workforce agencies, shares a direct purpose with the Jobs Utah Gov form. It's designed to report wages paid, taxes owed, and contribute to the state's unemployment insurance fund. Both forms are crucial for maintaining the integrity of unemployment insurance programs, ensuring that benefits are available for individuals who may become unemployed.

The W-2 Form is annually filed and details the wages paid and taxes withheld for each employee. While it covers a year rather than a quarter and serves a slightly different purpose—informing employees about their annual earnings for their tax returns—it parallels the Jobs Utah Gov form in its emphasis on detailed employee wage reporting. Both documents play critical roles in the broader context of tax and income reporting.

The I-9 Employment Eligibility Verification form is distinctly different in its primary purpose—verifying an employee's legal authorization to work in the United States. However, like the Jobs Utah Gov form, the I-9 becomes a part of the employment compliance requirements, ensuring that all employees are documented and legally permitted to work, indirectly contributing to accurate and lawful wage reporting.

Payroll Processing forms, used by companies to manage and record employee wages, echo the utility of the Jobs Utah Gov form by tracking employee earnings and deductions extensively. Although these payroll documents are internal and vary by company, their meticulous collection of wage data supports the accurate completion of official documentation like the Jobs Utah Gov form, which relies on comprehensive payroll information for its filings.

The Business License Application forms, while generally focused on obtaining permission to operate a business within a certain jurisdiction, occasionally require information about employees for demographic or regulatory reasons, depending on the locale. This indirect collection of employee data shows a broader regulatory environment where businesses must regularly report detailed employment information, akin to the reporting on the Jobs Utah Gov form.

Finally, the Occupational Safety and Health Administration (OSHA) reporting forms, essential for documenting workplace illnesses and injuries, demand meticulous record-keeping about employees, similar to the Jobs Utah Gov form. Although they serve health and safety compliance rather than unemployment insurance, the premise of protecting employee welfare underscores the importance of accurate employee data collection in both instances.

Dos and Don'ts

When it comes to filling out the DWS-UI C Form 33HA for the Utah Department of Workforce Services, attention to detail is paramount. This form is essential for employers reporting quarterly wages, as it ensures employees receive appropriate unemployment insurance coverage and benefits. Below are eight vital dos and don'ts to guide you through this process:

- Do ensure that all information is accurate and up-to-date. It's essential to double-check the details such as the Registration #, Employer Name & Address, and the accurate calculation of Total Wages Paid to each employee for the quarter.

- Do type or machine print the report as instructed. This enhances readability and reduces the possibility of errors that can occur with handwritten entries.

- Don't forget to include the correct year/quarter and quarter end date as specified on the form. This is crucial for maintaining accurate and timely records.

- Do list each employee's Social Security Number, First Name, Middle Initial, and Last Name as requested. This data must be complete to ensure that employment records are accurately matched to the right individual.

- Don't estimate wages. You must report the exact wages paid to each employee for the specified quarter. Estimations can lead to discrepancies and potential issues with employees' unemployment benefits.

- Do use the preferred online filing method at the specified website if possible. Electronic submissions are often processed more quickly and efficiently, reducing the risk of errors and delays.

- Don't disregard the due date. Late submissions can result in penalties and complications with your employees' unemployment insurance coverage. Marking the due date on your calendar is a good practice.

- Do contact the Utah Department of Workforce Services directly if you encounter any issues or have questions. Utilize the provided phone numbers for assistance to ensure that your form is filled out correctly and submitted on time.

By following these guidelines, employers can fulfill their reporting obligations with greater confidence and precision. This not only aids in the smooth operation of Utah's unemployment insurance system but also supports the rightful administration of benefits to the state's workforce. Remember, accurate and timely reporting reflects well on your business and contributes to the well-being of the community.

Misconceptions

When it comes to submitting the DWS-UI C Form 33HA for quarterly wage reporting in Utah, there are several misconceptions that can lead to confusion for employers. Understanding these can save time and ensure the process goes smoothly. Below are seven common misunderstandings and clarifications on each.

- It's only possible to submit the form by mail. While the form includes an address for mailing, the Utah Department of Workforce Services actually prefers employers to file this report online via their website. This option is not only quicker but more environmentally friendly and efficient for processing.

- Personal computers are the only devices suitable for online filing. In reality, any device with internet access, including smartphones and tablets, can be used to file the report online. The online system is designed to be accessible and user-friendly across a range of devices.

- The form is complicated to fill out. The form requires basic information about the employer, such as registration number, name, address, and the wages paid to employees during the quarter. By gathering this information in advance, filling out the form can be straightforward and quick.

- Errors on the form are difficult to correct. Actually, making corrections is relatively simple, especially when filing online. The system allows for amendments, making it easier to correct any mistakes without having to start over from scratch.

- There's no need to report if no wages were paid during the quarter. Even if no wages were paid, the Utah Department of Workforce Services requires that this be reported. Filing with zero wages ensures the employer's account stays up to date and in good standing.

- Employee Social Security Numbers are not necessary. On the contrary, providing each employee's Social Security Number is a crucial requirement for this form. It ensures accurate recording and reporting of wages for unemployment insurance purposes.

- There's only one deadline for submission. While there is a primary due date each quarter, it's important to note that deadlines may shift due to holidays or weekends. Always verify the specific due date for the current quarter to avoid any late submission penalties.

Dispelling these misconceptions about the Utah Employer Quarterly Wage List Continuation Sheet can lead to a more efficient and stress-free filing process. Always refer to the official Utah Department of Workforce Services website for the most accurate and up-to-date information.

Key takeaways

Filling out and using the Jobs Utah Gov form, specifically the DWS-UI Form 33HA for employers, involves detailing quarterly wage information to the Utah Department of Workforce Services. Understanding how to properly complete and submit this form is essential for compliance and ensuring accurate unemployment insurance records. Below are key takeaways to guide you through this process:

- Online Submission is Preferred: Although the form presents an address for mailing, the Utah Department of Workforce Services strongly encourages employers to file this report online. This not only speeds up the processing time but also reduces the likelihood of errors associated with manual entry.

- Accurate Employee Information is Crucial: When filling out this form, provide complete and correct details for each employee. This includes the employee's full name (first, middle initial, and last), social security number, and the total wages paid during the quarter. Accurate information is vital for proper record-keeping and avoiding issues with unemployment insurance claims.

- Deadlines Matter: Pay special attention to the quarter end date and due date listed on the form. Submitting the form on time helps avoid penalties and ensures that your records are up to date. Late submissions can result in fines and complicate future filings.

- Use the Correct Form Version: Ensure you are using the most recent version of the form, as indicated by the revision date (e.g., REV 0813). State agencies periodically update forms, and using an outdated version can lead to processing delays or the need to resubmit using the correct form.

- Contact Information is Available for Assistance: For questions or clarification, the form lists contact numbers. Do not hesitate to use these resources if you encounter issues or have specific inquiries about filling out or submitting the form. Assistance is available to help employers navigate the process efficiently.

Properly completing and submitting the DWS-UI Form 33HA is an important responsibility for Utah employers. Keeping these key takeaways in mind can streamline the process, ensure compliance with state regulations, and maintain accurate employment records.

Common PDF Templates

Utah State Withholding Form - In Utah, the 1 8 form is a standardized contract that simplifies the process of real estate transactions, making it more straightforward for all involved.

Utah State Withholding Form - Through the TC-116 form, the state of Utah provides an equitable system for managing the complexities of fuel taxation and refunds.