Free Durable Power of Attorney Form for Utah

When individuals in Utah seek to secure their future and ensure their affairs are handled according to their wishes, particularly in times when they may not be able to speak for themselves due to mental or physical incapacity, the Utah Durable Power of Attorney form emerges as a vital legal tool. This form allows a person to designate another individual, known as an agent, to make significant financial, legal, and sometimes health-related decisions on their behalf. Its durability implies that the agent's authority remains in effect even if the principal, the person making the designation, becomes incapacitated. The flexibility of choosing an agent tailored to one’s personal trust level and the specificity with which one can delineate the agent’s powers make this document profoundly impactful. Additionally, understanding the protective measures and the legal obligations associated with creating a Durable Power of Attorney ensures that a person’s autonomy and preferences are upheld during unforeseen circumstances. It is key for those in Utah considering this precaution to recognize the form’s importance in comprehensive estate planning and the peace of mind it can provide both to them and to their families.

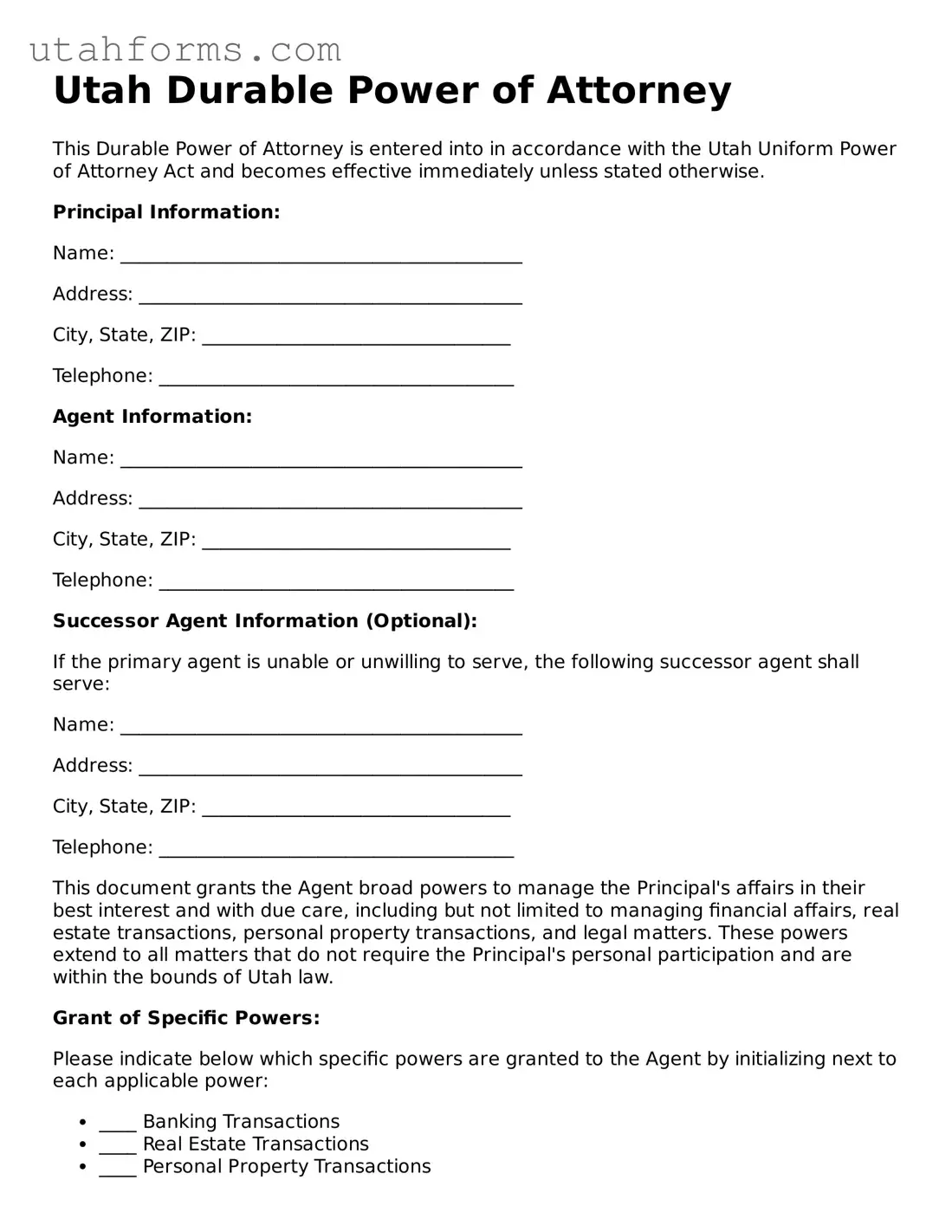

Preview - Utah Durable Power of Attorney Form

Utah Durable Power of Attorney

This Durable Power of Attorney is entered into in accordance with the Utah Uniform Power of Attorney Act and becomes effective immediately unless stated otherwise.

Principal Information:

Name: ___________________________________________

Address: _________________________________________

City, State, ZIP: _________________________________

Telephone: ______________________________________

Agent Information:

Name: ___________________________________________

Address: _________________________________________

City, State, ZIP: _________________________________

Telephone: ______________________________________

Successor Agent Information (Optional):

If the primary agent is unable or unwilling to serve, the following successor agent shall serve:

Name: ___________________________________________

Address: _________________________________________

City, State, ZIP: _________________________________

Telephone: ______________________________________

This document grants the Agent broad powers to manage the Principal's affairs in their best interest and with due care, including but not limited to managing financial affairs, real estate transactions, personal property transactions, and legal matters. These powers extend to all matters that do not require the Principal's personal participation and are within the bounds of Utah law.

Grant of Specific Powers:

Please indicate below which specific powers are granted to the Agent by initializing next to each applicable power:

- ____ Banking Transactions

- ____ Real Estate Transactions

- ____ Personal Property Transactions

- ____ Power to Borrow

- ____ Legal Actions and Proceedings

- ____ Tax Matters

Other powers or limitations on Agent's authority:

___________________________________________________________________________________

___________________________________________________________________________________

Effective Date and Duration:

This Power of Attorney is effective immediately upon execution unless a different effective date is specified here: ___________________________.

Unless otherwise revoked by the Principal, this Durable Power of Attorney will remain in effect indefinitely.

Signature of Principal:

______________________________________ Date: _______________

Signature of Agent:

______________________________________ Date: _______________

State of Utah)

County of ____________)

This document was acknowledged before me on _____(date) by __(name of principal)__.

______________________________

(Signature of Notarial Officer)

Notary Seal:

Place Notary Seal Here

Document Properties

| Fact | Detail |

|---|---|

| 1. Purpose | Allows an individual to appoint another person to manage their financial affairs. |

| 2. Durability | Remains in effect even if the principal becomes incapacitated. |

| 3. Governing Laws | Governed by the Utah Uniform Power of Attorney Act, primarily found in Sections 75-9-101 to 75-9-403 of the Utah Code. |

| 4. Agent's Authority | Can include managing real estate, financial accounts, and personal property, among others. |

| 5. Requirements for Validity | Must be signed by the principal, in the presence of a notary public. |

| 6. Revocation | The principal can revoke it at any time as long as they are mentally competent. |

| 7. Co-Agents | Allows for the appointment of co-agents, who can act together or separately. |

| 8. Successor Agents | Permits the designation of successor agents if the initial agent is unable or unwilling to serve. |

| 9. Recognition | Recognized and can be used across different states in the U.S., though it is specifically tailored to meet Utah's legal requirements. |

How to Write Utah Durable Power of Attorney

Completing the Utah Durable Power of Attorney form grants another individual the authority to act on one's behalf in legal and financial matters, ensuring decisions can be made even when one is not able to do so. The process for filling out this form involves a series of straightforward steps to appoint a trusted agent and delineate their powers. Accuracy and attention to detail are paramount in ensuring the document reflects the principal's wishes and complies with Utah law.

- Start by entering the date at the top of the form. This establishes when the document becomes effective.

- Write the full name and address of the individual granting power, known as the "principal". Ensure the information is accurate to confirm the identity of the person.

- Fill in the full name and address of the person being granted power, referred to as the "agent". It's crucial that this information is correct to avoid any confusion about who is authorized to act.

- Specify the powers granted to the agent. This involves checking the appropriate boxes or filling in the specific actions the agent is authorized to undertake on behalf of the principal. Be as detailed as necessary to cover the intended scope of authority.

- If applicable, designate any limitations on the agent's power. This is where the principal can note any actions or decisions that the agent is not authorized to make, providing clear boundaries for the agent's role.

- For added assurance of the document's validity, include the names and addresses of any alternate agents who can act if the primary agent is unable or unwilling to perform the duties.

- Have the principal sign and date the form in the presence of a notary public. The notary's role is to verify the identity of the principal and confirm that they are signing the document voluntarily.

- The notary should then complete their section of the form, including their stamp or seal, to notarize the Durable Power of Attorney, making it a legally binding document.

Once completed, the form should be stored in a secure yet accessible location, with copies provided to the agent, alternate agents, and possibly a legal advisor for safekeeping and reference. It's advisable to review and, if necessary, update the document periodically to ensure it continues to reflect current wishes and circumstances.

Frequently Asked Questions

-

What is a Utah Durable Power of Attorney form?

A Utah Durable Power of Attorney form is a legal document that allows an individual, known as the principal, to designate another person, known as the agent or attorney-in-fact, to manage their financial affairs. Unlike a general Power of Attorney, a Durable Power of Attorney remains in effect if the principal becomes incapacitated.

-

Who should have a Durable Power of Attorney?

It is recommended for any adult, especially those advancing in age or facing potential health issues, to have a Durable Power of Attorney. This ensures that someone they trust can handle their financial matters if they are unable to do so themselves due to illness or incapacity.

-

How can one create a Durable Power of Attorney in Utah?

To create a Durable Power of Attorney in Utah, the principal must complete the form, specifying the powers granted to the agent. The form must be signed by the principal, in the presence of a notary public or two adult witnesses, as required by Utah law. It’s recommended to consult with a legal professional to ensure the form meets all legal requirements and accurately reflects the principal's wishes.

-

What powers can be granted with a Durable Power of Attorney?

With a Durable Power of Attorney, a principal can grant the agent a wide range of powers, including handling financial transactions, managing property, dealing with government benefits, and making investment decisions. The principal can choose to grant broad authority or limit the powers to specific actions.

-

Can a Durable Power of Attorney be revoked?

Yes, as long as the principal is mentally competent, they can revoke a Durable Power of Attorney at any time. To revoke it, the principal should provide written notice to the agent and any institutions or parties that were aware of the original document. For added security, a revocation document should be notarized and distributed in the same manner as the original Power of Attorney.

Common mistakes

Filling out a Durable Power of Attorney (POA) form in Utah requires careful attention to legal and personal details. Despite the critical nature of this document, which grants another person the authority to act on your behalf, common mistakes can dilute its effectiveness or even render it invalid. Understanding these errors can ensure your intentions are accurately reflected and legally enforceable.

First, a frequent oversight is not specifying the scope of powers granted. Many individuals mistakenly believe that a generic description of powers is sufficient. However, the Utah Durable Power of Attorney form requires detailed enumeration of the agent's authorities. This might include making financial decisions, managing real estate transactions, or handling healthcare directives. Without clear boundaries, conflicts may arise over the agent's decisions, leading to legal challenges that could compromise your wishes.

Another critical mistake is selecting an inappropriate agent. The importance of choosing someone who is not only trustworthy but also capable of handling the responsibilities cannot be overstressed. Relatives or friends often get chosen based on emotional connections rather than their ability to manage finances or make healthcare decisions. A thorough evaluation of the potential agent's reliability, financial acumen, and willingness to act in your best interest is essential.

Incorrectly executing the document also leads to significant issues. The Utah Durable Power of Attorney form has specific signing requirements, including notarization and, in some cases, witnesses. Failure to follow these instructions precisely can invalidate the document. Even small oversights, such as missing signatures or improperly filled sections, can have far-reaching consequences.

Lastly, not updating the POA form is a common mistake with potentially serious implications. Life changes, such as marriages, divorces, the birth of children, or changes in the law, can affect the relevancy and efficacy of your POA. Regularly reviewing and, if necessary, amending your document ensures it reflects your current wishes and complies with existing laws.

- Not specifying the scope of powers granted.

- Selecting an inappropriate agent.

- Incorrectly executing the document.

- Not updating the POA form after life changes or changes in the law.

To prevent these common errors, individuals should thoroughly research, consider professional guidance, and meticulously review the Utah Durable Power of Attorney form before and after completion. Ensuring the accuracy and legal standing of this crucial document safeguards your interests and intentions, minimizing the risk of future complications.

Documents used along the form

When preparing for future financial and health-related decisions, it is crucial to have the right documents in place. In addition to the Utah Durable Power of Attorney form, which allows you to appoint someone to manage your financial affairs, several other documents should also be considered to ensure comprehensive coverage of your needs. These documents together create a safety net, enabling your wishes to be respected and followed precisely.

- Advance Health Care Directive - This document lets you outline your preferences for medical treatment and end-of-life care. It also allows you to appoint someone to make health care decisions on your behalf if you're unable to do so.

- Living Will - A specific form of advance directive, a living will enables you to express in detail your wishes regarding life-sustaining treatment if you become terminally ill or permanently unconscious.

- Will - This essential document allows you to specify how your assets and property are to be distributed after your death. It also lets you appoint an executor to oversee the process of distributing your assets according to your wishes.

- Designation of Health Care Surrogate - Similar to the advance health care directive, this document specifically appoints a surrogate to make health care decisions for you, emphasizing the surrogate's authority and your health care preferences.

- HIPAA Authorization Form - By signing this form, you grant designated individuals the ability to access your medical records. This facilitates better decision-making by those involved in your care or anyone you've appointed to make decisions on your behalf.

In conclusion, while the Utah Durable Power of Attorney form plays a critical role in managing your financial affairs, incorporating additional documents can provide a more comprehensive approach to planning. These documents ensure that both health care decisions and financial matters are taken care of according to your wishes, providing peace of mind for you and your loved ones.

Similar forms

The Utah Durable Power of Attorney (DPOA) shares similarities with the General Power of Attorney form. Both empower an individual, known as the "agent," to make decisions on the principal's behalf. While a DPOA is specifically designed to remain in effect even if the principal becomes incapacitated, the General Power of Attorney typically does not. The key difference lies in the durability feature which allows the DPOA to extend its effectiveness beyond the principal's incapacity, providing a broader scope of power in managing one's personal, financial, and health affairs.

Alike to the DPOa Living Will or Advance Health Care Directive is another document closely related to the Utah DPOA. This legal document allows an individual to outline their preferences concerning medical treatments and interventions in situations where they cannot communicate their decisions due to severe health conditions. While the DPOA can include provisions for health care decisions, a Living Will focuses exclusively on health care preferences, often working in tandem with a Health Care Power of Attorney that appoints an agent to make health-related decisions.

The Health Care Power of Attorney (HCPOA) also bears resemblance to the Utah DPOA, especially when the latter includes provisions for making health care decisions. An HCPOA specifically authorizes an agent to make medical decisions on behalf of the principal, aligning closely with the health care aspect of a DPOA. However, while a DPOA can encompass a broad range of powers beyond health care, an HCPOA is focused solely on medical decisions, often complementing a Living Will's directives.

The Financial Power of Attorney is another document similar to a segment of the Utah DPOA, specifically when it pertains to financial management. This document designates an agent to handle financial tasks, such as banking, investing, and managing real estate on behalf of the principal. Though a DPOA can include financial powers, a Financial Power of Attorney is purely concerned with financial affairs, lacking the durability aspect that characterizes a DPOA, unless it's explicitly stated otherwise.

A Springing Power of Attorney resembles the Utah DPOA in its trigger mechanism. It is designed to become effective only upon the occurrence of a specific event, typically the incapacity of the principal. Both documents ensure continued management of the principal's affairs despite their incapacity. However, the Springing Power of Emergency differs in that its power is dormant until activated by the defined condition, whereas a DPOA is effective immediately upon execution unless specified otherwise.

The Limited Power of Attorney is another type of legal document related to the Utah DPOA, albeit with a more narrowed focus. This document bestows authority upon an agent to perform specific acts or decisions on the principal's behalf, such as selling a car or handling a particular business transaction. Unlike the DPOA, which can grant broad or specific powers while maintaining durability, Limited Power of Attorney concentrates on a defined task without necessarily including provisions for the principal's incapacitation.

Last on the list, the Trust is a legal arrangement that, while different in structure, shares a fundamental goal with the Utah DPOA: managing and protecting assets. In a trust, a trustee manages assets for the benefit of a third party, the beneficiary. Trusts can be used for estate planning, similar to DPOAs, to ensure that an individual's affairs are managed according to their wishes. However, trusts offer a different legal framework compared to powers of attorney, focusing on asset distribution and management beyond the principal's life or capacity.

Dos and Don'ts

Filling out a Durable Power of Attorney (POA) form in Utah is an important step in managing your affairs. This document allows you to appoint someone to handle your legal and financial matters if you become unable to do so yourself. Here are some key dos and don'ts to keep in mind when completing this form:

- Do review the Utah laws regarding durable powers of attorney. Being familiar with state-specific regulations ensures that the document will be valid and effective.

- Do choose a trusted individual as your agent. This person will have significant authority over your affairs, so it’s crucial that they are reliable and have your best interests at heart.

- Do be clear about the powers you are granting. Specify which decisions your agent can make on your behalf to prevent any confusion or misuse of authority.

- Do include a durability clause. This ensures that the power of attorney remains in effect even if you become incapacitated.

- Do sign the form in the presence of a notary public. Utah law requires durable powers of attorney to be notarized to be legally binding.

- Don’t leave any sections incomplete. Failing to provide all the necessary information can lead to delays or the document being considered invalid.

- Don’t use vague or ambiguous language. Clearly articulate the extent of powers being granted to avoid potential disputes or legal challenges.

- Don’t forget to notify your financial institutions. Provide them with a copy of the POA to ensure your agent can act on your behalf when necessary.

- Don’t appoint an agent without discussing it with them first. It’s essential that they understand the responsibilities involved and agree to take on the role.

- Don’t neglect to keep a copy for your records. Safekeeping a copy of the signed and notarized document is crucial for reference or if disputes arise.

By following these guidelines, you can ensure that your Utah Durable Power of Attorney form is correctly filled out, legally compliant, and effectively conveys your wishes regarding the management of your affairs.

Misconceptions

Regarding the Utah Durable Power of Attorney (POA) form, there are widespread misconceptions. It is critical to address these to ensure individuals are fully informed about the implications and functionalities of such a legal document.

Misconception: A Durable Power of Attorney involves the loss of personal decision-making power. In reality, the person who creates the POA, known as the principal, retains their decision-making capacity unless deemed otherwise by a qualified medical professional.

Misconception: Only elderly individuals need a Durable Power of Attorney. This belief overlooks the fact that unexpected circumstances, such as accidents or sudden illness, can occur at any age, making a POA vital for adults of all ages.

Misconception: A Durable Power of Attorney is the same as a Last Will and Testament. These documents serve different purposes; a POA is effective during the principal's lifetime, particularly if they become incapacitated, while a Will takes effect after the principal's death.

Misconception: Creating a Durable Power of Attorney automatically means financial matters are the only concern. While financial management is a significant aspect, a POA can also encompass decisions about healthcare, real estate, and other personal matters.

Misconception: All Durable Power of Attorney documents are the same. The scope and powers granted can vary widely based on the principal's specific needs and wishes, making some POAs more comprehensive than others.

Misconception: A Durable Power of Attorney is difficult and expensive to create. With the right guidance and resources, individuals can prepare a POA effectively without excessive costs, though professional advice is recommended to ensure all legal bases are covered.

Misconception: Once executed, a Durable Power of Attorney cannot be changed or revoked. The principal has the right to amend or revoke their POA as long as they possess the mental capacity to do so, allowing for adjustments as circumstances change.

Understanding the realities of the Utah Durable Power of Attorney form allows individuals to make informed decisions that align with their personal and legal needs, emphasizing the importance of clear and accurate information.

Key takeaways

Filling out and properly using the Utah Durable Power of Attorney form is a critical process that grants another individual the authority to act on your behalf in financial matters. This responsibility shouldn't be taken lightly. To ensure you're on the right track, consider these key takeaways:

- Choose a trusted agent: The person you appoint as your agent should be someone you trust implicitly. This individual will have extensive power and control over your financial affairs. Therefore, it’s essential to make a choice based on reliability, honesty, and the ability to handle financial matters prudently.

- Be specific about powers granted: The Utah Durable Power of Attorney form allows you to specify exactly what financial powers your agent can exercise. This could range from managing bank accounts to handling real estate transactions. Clearly delineating these powers ensures your agent acts within the bounds of your wishes.

- Understand the durability aspect: A key feature of the durable power of attorney is its resilience in the face of the principal's incapacitation. Unlike other forms of power of attorney, it remains in effect if you become unable to make decisions for yourself. Recognizing the significance of this continuity helps in planning for unforeseen circumstances.

- Consult with a professional: Before completing the form, it might be beneficial to consult with a legal professional. This ensures that the document reflects your intentions accurately and is in compliance with Utah law. Legal advice can also help in understanding any implications related to the designation of your agent and the powers you are granting.

Correctly using the Utah Durable Power of Attorney form involves careful consideration and planning. By focusing on these key aspects, you're taking a significant step toward safeguarding your financial affairs and ensuring that your wishes are respected, even if you're not in a position to make decisions yourself.

Other Popular Utah Templates

Utah Real Estate Purchase Contract - Sets forth any escrow arrangements, ensuring funds and property titles are securely exchanged.

Utah Deed Requirements - Each type of deed form is tailored to specific transaction requirements, providing flexibility in property dealings.

Free Living Will Form Utah - In the absence of a Living Will, state laws will determine who makes healthcare decisions, which may not align with the person's wishes.