Free Bill of Sale Form for Utah

When engaging in the sale of a vehicle, boat, or other personal property in Utah, the Bill of Sale form emerges as a crucial document, effectively serving as a proof of the transaction between the buyer and seller. This important piece of paperwork not only verifies the transfer of ownership but also provides vital details about the sale, such as the date of the transaction, the price, and descriptions of the items being sold. It's designed to protect both parties involved, ensuring there's a solid record of the agreement should any disputes or questions arise later on. Whether you're navigating the sale of a car, a piece of artwork, or any valuable asset, understanding how to properly complete and use the Utah Bill of Sale form can make the process smoother and more secure, safeguarding your rights and interests every step of the way.

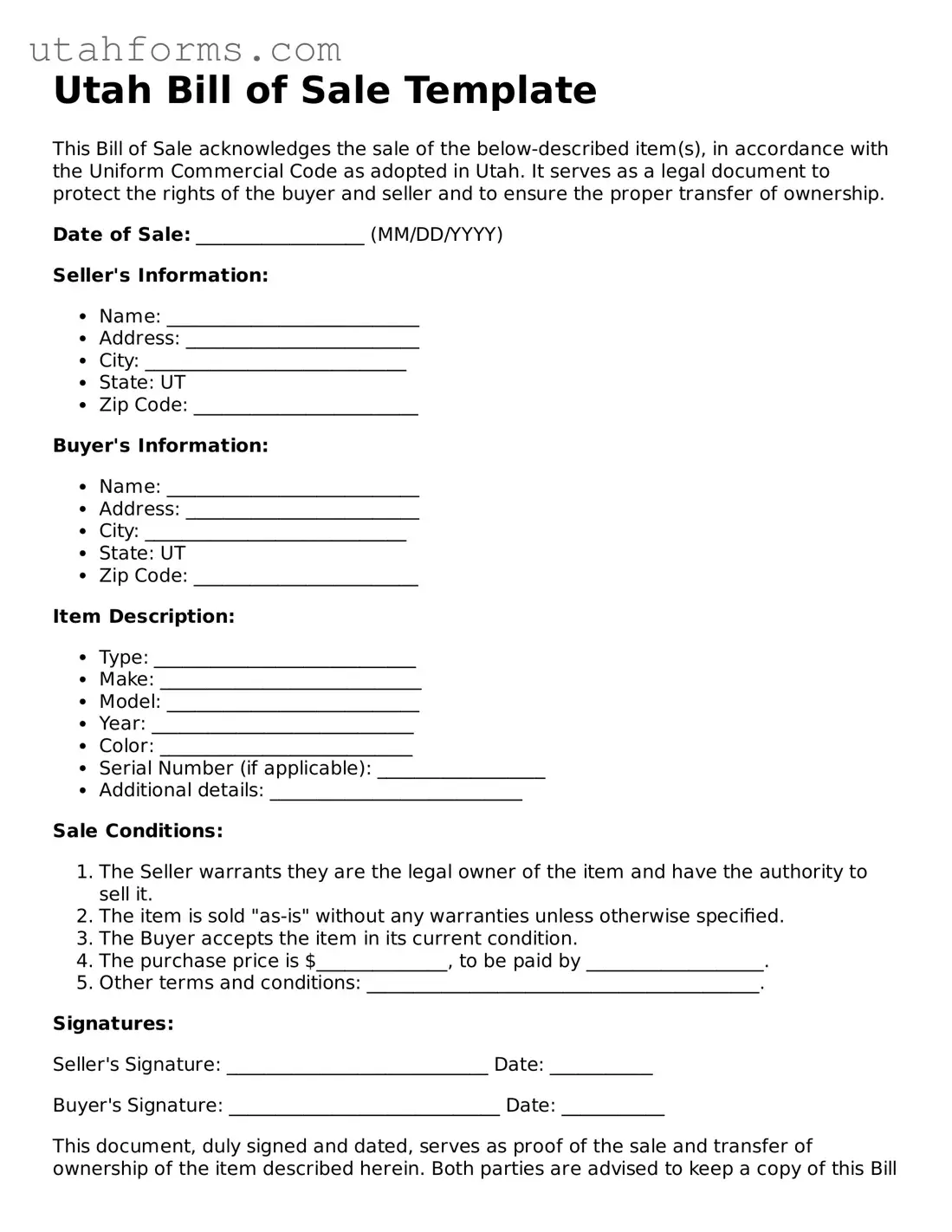

Preview - Utah Bill of Sale Form

Utah Bill of Sale Template

This Bill of Sale acknowledges the sale of the below-described item(s), in accordance with the Uniform Commercial Code as adopted in Utah. It serves as a legal document to protect the rights of the buyer and seller and to ensure the proper transfer of ownership.

Date of Sale: __________________ (MM/DD/YYYY)

Seller's Information:

- Name: ___________________________

- Address: _________________________

- City: ____________________________

- State: UT

- Zip Code: ________________________

Buyer's Information:

- Name: ___________________________

- Address: _________________________

- City: ____________________________

- State: UT

- Zip Code: ________________________

Item Description:

- Type: ____________________________

- Make: ____________________________

- Model: ___________________________

- Year: ____________________________

- Color: ___________________________

- Serial Number (if applicable): __________________

- Additional details: ___________________________

Sale Conditions:

- The Seller warrants they are the legal owner of the item and have the authority to sell it.

- The item is sold "as-is" without any warranties unless otherwise specified.

- The Buyer accepts the item in its current condition.

- The purchase price is $______________, to be paid by ___________________.

- Other terms and conditions: __________________________________________.

Signatures:

Seller's Signature: ____________________________ Date: ___________

Buyer's Signature: _____________________________ Date: ___________

This document, duly signed and dated, serves as proof of the sale and transfer of ownership of the item described herein. Both parties are advised to keep a copy of this Bill of Sale for their records.

Document Properties

| Fact Number | Fact Detail |

|---|---|

| 1 | Utah Bill of Sale form is a legal document used to transfer ownership of personal property from one person to another. |

| 2 | It is commonly used for the sale of vehicles, boats, motorcycles, and other personal property. |

| 3 | The form should include important information such as the description of the item being sold, sale price, and date of sale. |

| 4 | Both the buyer's and seller's contact information and signatures must be included on the form. |

| 5 | It serves as a receipt for the transaction and can be used for legal and tax purposes. |

| 6 | In some cases, Utah might require the Bill of Sale to be notarized, especially for motor vehicles. |

| 7 | Utah Code §41-1a-101 et seq. governs the requirements for a motor vehicle Bill of Sale in Utah. |

| 8 | Having a Bill of Sale can also be important for personal records, future disputes, or insurance claims. |

| 9 | Even though it's sometimes not required by law for other types of personal property, it's always recommended to have a Bill of Sale for any substantial transaction. |

How to Write Utah Bill of Sale

Completing the Utah Bill of Sale form is a necessary step when buying or selling a personal property item, such as a car or boat, in Utah. This document is crucial for both parties. It serves as a receipt for the transaction and helps to establish the transfer of ownership from the seller to the buyer. The process of filling out this form is straightforward, but it's essential to be thorough and ensure all information is accurate to avoid any potential disputes or problems in the future. Follow these steps to correctly fill out the form:

- Start by entering the date of the sale at the top of the form.

- Write the full name and address of the seller in the designated section.

- Next, include the full name and address of the buyer.

- Describe the item being sold. Include any identifying information, such as make, model, year, and serial number, if applicable.

- Enter the sale price of the item.

- Specify the form of payment. Indicate whether it is cash, check, or another form.

- If there are any additional terms and conditions of the sale, list them in the provided space.

- Both the buyer and the seller must sign and date the form. If there are co-sellers or co-buyers, make sure they also sign the form.

- Finally, it’s a good practice to make a copy of the signed form for each party for their records.

Once the Utah Bill of Sale form is fully completed and signed, the transaction is officially documented. The buyer should keep this document as proof of ownership, and it may be required for registration or other official purposes. The seller should also retain a copy to have a record of the sale. Remember, accuracy and completeness are key when filling out this form to ensure that both parties are protected and have a clear understanding of the sale's terms.

Frequently Asked Questions

-

What is a Utah Bill of Sale form?

A Utah Bill of Sale form is a legal document that records the transfer of ownership of an item from one person to another within the state of Utah. It serves as proof of purchase and verifies that a transaction has taken place. The form typically includes details about the item being sold, the sale price, and the names and signatures of the seller and buyer. It's often used for private sales of vehicles, boats, motorcycles, and other personal property.

-

Do I need a Utah Bill of Sale to register a vehicle?

Yes, when registering a vehicle in Utah, a Bill of Sale is required as part of the documentation. It proves that you have legally purchased the vehicle and outlines the specifics of the transaction. This form, along with a title transfer, is necessary to complete the registration process at your local Department of Motor Vehicles (DMV). It's important to keep a copy for your records as well, in case any ownership disputes arise in the future.

-

How do I write a Utah Bill of Sale?

Writing a Utah Bill of Sale involves including specific information to ensure the document is legally binding and valid. Essential details to include are:

- The date of the sale.

- A description of the item being sold, including make, model, year, and serial number, if applicable.

- The sale price of the item.

- The full names and addresses of the seller and the buyer.

- Signatures from both the seller and the buyer.

It's recommended to use a template or a form that complies with Utah law to ensure all necessary information is included.

-

Is a Utah Bill of Sale legally binding without a notary?

In most transactions, a Utah Bill of Sale does not need to be notarized to be considered legally binding. Both the buyer and seller's signatures are typically sufficient. However, having the document notarized can add an extra layer of authenticity and may be required in certain circumstances. Check with your local authorities or a legal professional to determine if notarization is necessary for your specific situation.

-

Can a Utah Bill of Sale be used for items other than vehicles?

Absolutely. Although commonly associated with the sale of vehicles, a Utah Bill of Sale can and should be used for transferring ownership of various types of personal property including boats, motorcycles, firearms, and more. Anytime a transaction occurs where personal property is exchanged for monetary value or even traded, a Bill of Sale can serve as a record of the agreement and transfer of ownership.

Common mistakes

When individuals engage in private sales of personal property, such as vehicles, in Utah, they often use a Bill of Sale to document the transaction. This legal document serves as proof of transfer of ownership. However, several common mistakes can lead to complications or even invalidate the document. Understanding and avoiding these errors can ensure a smooth and legally sound transaction.

Not including all necessary information: A common mistake is failing to include all required details. The Utah Bill of Sale form should contain the complete names and addresses of both the seller and buyer, a full description of the item sold (including make, model, year, and VIN for vehicles), the sale price, and the date of sale. Omitting any of these essentials can cause legal ambiguities.

Forgetting to sign and date the document: The Bill of Sale must be signed and dated by both parties. This action legally binds the agreement. Unfortunately, it's not uncommon for individuals to fill out the entire form and then overlook the necessity of signatures, rendering the document legally ineffective.

Ignoring the need for witnesses or a notary: Depending on the nature of the sale and local jurisdiction, a Bill of Sale might need to be witnessed or notarized to be considered legally binding. By neglecting this step, parties may inadvertently diminish the enforceability of the document.

Using unclear language: Ambiguity in the description of the sale item or terms can lead to disputes or legal issues down the line. It's essential to use clear, precise language that leaves no room for interpretation.

Failing to provide a copy to both parties: Both the buyer and seller should have a copy of the completed Bill of Sale for their records. This mistake often occurs due to oversight. A copy ensures that both parties have proof of the transaction and its terms.

Not verifying the information: It's crucial for both parties to verify all the information on the form before signing. Mistakes in the description of the item, miswritten names, or incorrect addresses can complicate future disputes or efforts to prove ownership.

By being mindful of these common pitfalls, individuals can better navigate the process of transferring ownership of personal property in Utah. A correctly filled out Bill of Sale not only provides legal protection but also peace of mind for both the buyer and seller.

Documents used along the form

When transferring ownership of an item in Utah, a Bill of Sale form is a crucial document that records the transaction details, ensuring both the buyer and seller have a record of the sale. However, to complete the transaction smoothly and comply fully with local laws, other documents are often required or recommended. These documents serve various purposes, from establishing the item's legal status to ensuring the transfer is recognized by relevant authorities. Here is a list of six additional forms and documents that are commonly used alongside the Utah Bill of Sale.

- Title Transfer Form: For vehicles, this form officially transfers the title from the seller to the buyer, crucial for legal ownership and registration purposes.

- Odometer Disclosure Statement: When selling a vehicle, federal law requires the seller to provide accurate mileage information to the buyer, ensuring transparency about the vehicle's condition.

- Registration Application: New owners must submit this form to the local Department of Motor Vehicles (DMV) to register the vehicle in their name, a step that often requires proof of sale.

- Warranty Documentation: If the item being sold comes with a warranty, providing the buyer with the warranty documents is important to transfer the benefits.

- Loan Payoff Letter: When selling an item with an outstanding loan, such as a car, this letter from the lender confirms the loan amount remaining and the payoff process. 7

- Release of Liability Form: This form protects the seller from being held liable for any accidents, damages, or legal actions involving the item after the sale.

Together with the Utah Bill of Sale, these documents form a comprehensive package that helps ensure the transaction is not only legally sound but also clear and transparent for all parties involved. Handling these documents properly offers peace of mind and protects the interests of both the buyer and the seller, facilitating a smooth transfer of ownership.

Similar forms

The Utah Bill of Sale form shares similarities with a Vehicle Title, primarily in its function to document the transfer of ownership. Like a title, the bill of sale confirms a transaction has occurred, detailing the seller and buyer's information, along with the specifics of the item sold, such as a car's make, model, and year. Both documents serve as proof of purchase and are vital for legal and registration purposes, though the title is the ultimate certification of ownership, while the bill of sale acts more as a transaction receipt.

Similar to a Warranty Deed in real estate transactions, the Utah Bill of Sale also serves to transfer ownership rights from one party to another. However, while a Warranty Deed is used specifically for real property (like land or buildings) and guarantees the property is free from liens or claims, a bill of sale is usually for personal property (like vehicles, electronics, or animals) and does not necessarily guarantee a clear title. Both documents provide a legal basis for the transfer and protect the rights of the buyer and seller.

A Sales Receipt, often provided after purchasing small-ticket items, resembles the Utah Bill of Sale in its role as proof of a transaction. Both outline the critical details of a sale, such as the date of transaction, a description of the item sold, and the sale amount. However, a bill of sale is more formal and legally binding, often required by law for the sale of high-value items and to facilitate changes in ownership, whereas a sales receipt serves more for personal record-keeping or warranty purposes.

The Promissory Note is another document sharing attributes with the Utah Bill of Sale, especially in recording an agreement between two parties. A Promissory Note is used for documenting a loan's terms, specifying the repayment schedule, interest rate, and what constitutes a default. While the Promissory Note is a debt instrument, a Bill of Sale is an ownership-transfer document. Both, though, are legally binding and essential for the effective documentation of agreements between parties.

Lastly, the Utah Bill of Sale is akin to a Gift Affidavit, where both document the transfer of property without the exchange of money. The main difference lies in their usage: a Gift Affidavit is used when something is given as a gift without consideration (payment or trade), essentially for tax purposes or to prove the intention of the gift, whereas a Bill of Sale involves a transaction, often with monetary exchange, and serves to record and prove the terms of the sale. Despite their differences in purpose, both play crucial roles in legal and financial records.

Dos and Don'ts

When filling out the Utah Bill of Sale form, there are several guidelines to follow for a smooth and legally sound process. The following lists provide essentials on what to do and what to avoid during this important step.

Do:

- Provide accurate details of both the buyer and seller, including their full names, addresses, and contact information. This ensures clear identification of the parties involved in the transaction.

- Include a detailed description of the item being sold. For vehicles, this means listing the make, model, year, VIN (Vehicle Identification Number), and odometer reading at the time of sale.

- State the exact sale price of the item, as well as the date of the transaction. This is crucial for tax and legal records.

- Ensure both the buyer and seller sign and date the Bill of Sale. These signatures legally bind the document, making it a valid record of the transaction.

- If possible, have the Bill of Sale notarized. Although not always required, notarization adds an extra layer of authenticity and can help protect against disputes.

- Keep a copy of the completed Bill of Sale for your records. Both the buyer and seller should retain a copy for their records to resolve any future disputes or for tax purposes.

Don't:

- Leave blank spaces on the form. Incomplete forms can lead to misunderstandings or legal challenges later on. If a section does not apply, clearly mark it as "N/A" (not applicable).

- Omit the date of sale. This date is important for legal and registration purposes, and forgetting it can lead to problems down the line.

- Falsify information on the Bill of Sale. All details provided must be truthful and accurate to ensure the legality of the document.

- Forget to research if your county in Utah requires specific forms or additional documentation. Rules can vary, and it’s important to comply with local regulations.

- Sign the document before all details are finalized and agreed upon. Once signed, the Bill of Sale is considered legally binding.

- Ignore any liens on the item being sold. Ensure all liens are cleared before completing the sale, as failing to do so can transfer the responsibility to the buyer.

Misconceptions

When it comes to completing and understanding the Utah Bill of Sale form, various misconceptions often arise. It's important to clarify these misunderstandings to ensure that transactions involving the sale of personal property are handled correctly and in accordance with Utah law.

All items require a Bill of Sale in Utah: This is a misconception. While a Bill of Sale is crucial for documenting the sale and transfer of ownership for various items, not all items legally require it. However, it's highly recommended for recording the details of the transaction, especially for items of significant value or those that are subject to registration, such as vehicles.

A Bill of Sale must be notarized in Utah: Many believe that for a Bill of Sale to be valid in Utah, it must be notarized. This is not always the case. While notarization can add an extra layer of legal protection, it is not a mandatory requirement for the Bill of Sale to be effective or for the transfer of ownership to be legally recognized.

Verbal agreements are just as binding as a Bill of Sale: Reliance on verbal agreements instead of a formal Bill of Sale can lead to misunderstandings and disputes. A verbal agreement might carry some weight, but without a written Bill of Sale, proving the terms of the sale or even the existence of the agreement becomes significantly more challenging.

The Bill of Sale is only for the buyer’s benefit: This misconception overlooks the seller's need for a Bill of Sale. This document serves as proof that the seller has legally transferred the ownership and is no longer responsible for the item sold. It protects both parties in case of future disputes.

A Bill of Sale does not need to include the price: Including the price of the item sold is essential for a comprehensive Bill of Sale. It not only provides proof of the transaction amount but can also be necessary for tax and registration purposes.

Any template will work for a Utah Bill of Sale: While there are many templates available, using one specifically designed to comply with Utah's requirements is important. A template that omits essential information or does not align with Utah statutes may not provide the intended legal protections.

Completing a Bill of Sale finalizes the transfer of ownership: Simply completing the Bill of Sale does not always finalize the transfer of ownership. For vehicles, for example, the transfer must be recorded with the Utah Division of Motor Vehicles, and applicable taxes must be paid. The Bill of Sale is a critical step in the process but may not be the final step.

Understanding these misconceptions about the Utah Bill of Sale form can help sellers and buyers alike ensure their transactions are conducted properly and are legally sound. For further guidance, consulting with a legal professional is advisable.

Key takeaways

When handling a Utah Bill of Sale form, it's crucial to understand its purpose and requirements to ensure a smooth transaction. This document serves as a legal record confirming the sale of personal property, such as a car, boat, or even livestock, from one party to another. Here are several key takeaways about completing and utilizing this form correctly.

- Accuracy Is Essential: Ensure all information provided on the form is accurate and complete. Mistakes or inaccuracies can invalidate the document or cause legal issues down the line.

- Details of the Property: Clearly describe the item being sold, including any identification numbers (like VIN for vehicles), make, model, year, and color. The more detailed the description, the better it serves as a record of what was sold.

- Payment Information: The form should include the sale price of the property and the payment method (e.g., cash, check, transfer). If there are any conditions to the sale, such as being sold "as is" or subject to any warranties, this should also be noted.

- Signatures: Both the buyer and the seller must sign the form. Their signatures legally bind the document, making the transaction official and recognized.

- Date of Sale: It's important to record the exact date when the sale takes place. This information can be crucial for both registration purposes and resolving any future disputes that may arise.

- Keep Copies: Both parties involved in the transaction should keep a copy of the signed Bill of Sale. It serves as a receipt for the buyer and proof of transfer of ownership for the seller.

- Notarization: While not always required, getting the bill of sale notarized can add an extra layer of legality and protection, confirming the authenticity of the signatures.

- Legal Requirements: Familiarize yourself with any specific legal requirements or provisions within Utah law regarding the sale of personal property. This may include specific forms or additional paperwork for registering the item with state or local authorities.

By adhering to these guidelines, both buyer and seller can ensure the transaction is conducted smoothly and that they are protected in case any disputes or questions about the sale arise in the future.

Other Popular Utah Templates

Rental Agreement Form Utah - Clarifies responsibilities for pest control and other environmental health factors.

How to Get Around a Non Compete - A contract that establishes a defined period during which an individual is prohibited from competing with their former employer’s business.

Free Rental Agreement Utah - This form can be customized to include anything else the landlord deems necessary to make an informed decision.