Free Articles of Incorporation Form for Utah

Taking the first step towards establishing a legal business entity in Utah involves navigating through the Articles of Incorporation, a crucial document that marks the beginning of a corporation's life under state law. This form not only cements an entity's existence but also serves as a formal declaration of a corporation’s fundamental aspects, including its name, purpose, type of corporation, registered agent, and the details of its incorporators, among other key elements. Approaching this document, prospective business owners are required to provide comprehensive and accurate information, as it lays down the groundwork for the corporation's legal standing, operational scope, and its adherence to state regulations. Filed with the Utah Division of Corporations, the Articles of Incorporation is more than just paperwork; it is a pivotal step in legitimizing a business, setting the stage for its future governance, fiscal health, and the legal protections it will enjoy. Understanding every facet of this form is essential for entrepreneurs who are eager to navigate the complexities of corporate formation with confidence and precision.

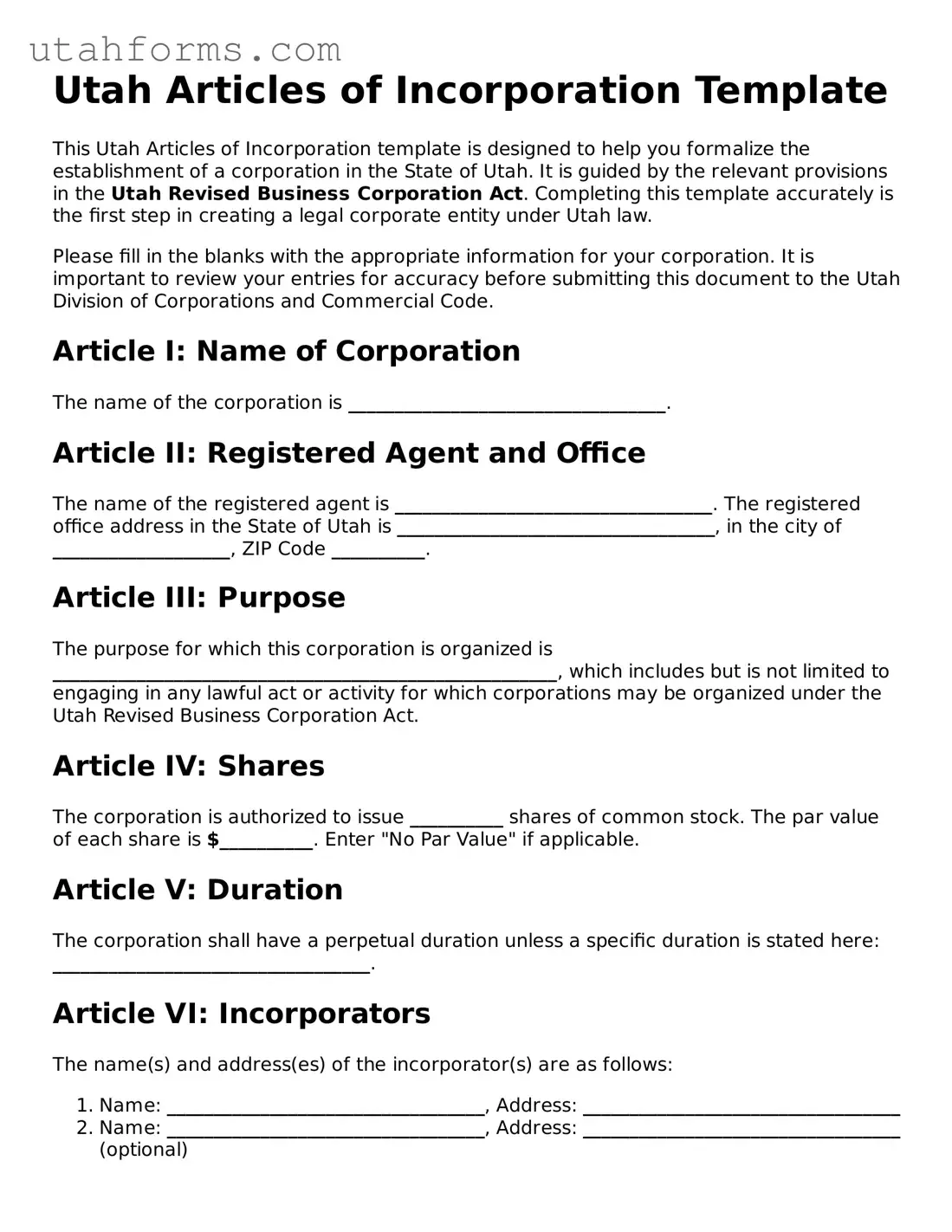

Preview - Utah Articles of Incorporation Form

Utah Articles of Incorporation Template

This Utah Articles of Incorporation template is designed to help you formalize the establishment of a corporation in the State of Utah. It is guided by the relevant provisions in the Utah Revised Business Corporation Act. Completing this template accurately is the first step in creating a legal corporate entity under Utah law.

Please fill in the blanks with the appropriate information for your corporation. It is important to review your entries for accuracy before submitting this document to the Utah Division of Corporations and Commercial Code.

Article I: Name of Corporation

The name of the corporation is __________________________________.

Article II: Registered Agent and Office

The name of the registered agent is __________________________________. The registered office address in the State of Utah is __________________________________, in the city of ___________________, ZIP Code __________.

Article III: Purpose

The purpose for which this corporation is organized is ______________________________________________________, which includes but is not limited to engaging in any lawful act or activity for which corporations may be organized under the Utah Revised Business Corporation Act.

Article IV: Shares

The corporation is authorized to issue __________ shares of common stock. The par value of each share is $__________. Enter "No Par Value" if applicable.

Article V: Duration

The corporation shall have a perpetual duration unless a specific duration is stated here: __________________________________.

Article VI: Incorporators

The name(s) and address(es) of the incorporator(s) are as follows:

- Name: __________________________________, Address: __________________________________

- Name: __________________________________, Address: __________________________________ (optional)

- Name:

___________________________ , Address: __________________________________ (optional)

Article VII: Board of Directors

The initial board of directors shall consist of __________ director(s). Their name(s) and address(es) are as follows:

- Name: __________________________________, Address: __________________________________

- Name: __________________________________, Address: __________________________________ (optional)

- Name: __________________________________, Address: __________________________________ (optional)

Article VIII: Indemnification

The corporation shall indemnify its directors, officers, employees, and agents to the fullest extent permitted by the Utah Revised Business Corporation Act and any other applicable law.

Article IX: Additional Provisions

Include any additional provisions here: ______________________________________________________________.

Conclusion

By completing this Utah Articles of Incorporation template, you are taking an important step towards establishing your corporation in Utah. Make sure to sign and date this document before filing it with the Utah Division of Corporations and Commercial Code.

Date: __________

Signature of Incorporator: __________________________________

Print Name: __________________________________

Document Properties

| Fact | Detail |

|---|---|

| 1. Governing Law | Utah Code Title 16, Chapter 6a - Utah Revised Business Corporation Act governs the filing of the Articles of Incorporation in Utah. |

| 2. Purpose of Form | The Articles of Incorporation form is used to legally establish a corporation in the State of Utah. |

| 3. Filing Entity | This form is designed for corporations; it cannot be used to establish LLCs, partnerships, or other types of business entities. |

| 4. Submission Method | The form can be submitted online through the Utah Division of Corporations and Commercial Code's website or via mail. |

| 5. Required Information | Information required includes the corporate name, principal office address, registered agent's name and address, incorporator information, and the number of shares the corporation is authorized to issue. |

| 6. Fees | There is a filing fee associated with the Articles of Incorporation, which must be paid when submitting the form. |

| 7. Corporate Name Requirements | The corporate name must be distinguishable from other business names on record with the Utah Division of Corporations and must include a corporate designator such as "Incorporated," "Corporation," "Company," or an abbreviation thereof. |

| 8. Registered Agent | The corporation must nominate a registered agent with a physical address in Utah to receive legal documents on behalf of the corporation. |

| 9. Duration | The Articles can specify the duration of the corporation's existence, which can be perpetual or for a set term. |

| 10. Additional Provisions | The form allows for the inclusion of additional provisions, which might cover areas such as the initial corporate officers, stockholder liability, and indemnification of officers and directors. |

How to Write Utah Articles of Incorporation

Filing Articles of Incorporation is a crucial step for forming a corporation in Utah. It's essentially a birth certificate for your corporation. This document needs to be filed with the Utah Division of Corporations and Commercial Code. It grants your business entity legal recognition by the state, allowing it to operate within Utah's jurisdiction. The process is straightforward but demands attention to detail. Follow these steps carefully to ensure your filing is successful and effectively establishes your corporation.

- Locate the official Utah Articles of Incorporation form on the Utah Division of Corporations and Commercial Code website.

- Read through the entire form before you start filling it out to ensure you understand all the requirements.

- Begin by providing the name of the corporation. The name must comply with Utah's naming requirements for a corporation, including the use of an appropriate corporate designator such as "Incorporated", "Corporation", "Company", or an abbreviation of these.

- Specify the principal office address where the official business records will be kept. This must be a physical address within Utah.

- Enter the name and physical Utah address of the registered agent. The registered agent is responsible for receiving legal documents on behalf of the corporation.

- Indicate the number of shares the corporation is authorized to issue. Remember, the shares represent ownership in the corporation.

- Include information about the incorporator(s) – these are the individual(s) who complete and file the Articles of Incorporation. Provide the name(s) and address(es).

- If the corporation will have a specific period of duration, specify this duration. Most corporations choose a perpetual duration, meaning they intend to exist indefinitely.

- Some corporations choose to appoint directors in their Articles of Incorporation. If this applies, list the names and addresses of the initial directors.

- Check for any additional provisions or articles that may apply to your specific corporation, such as indemnification of directors and officers. If applicable, include these provisions.

- Review the form thoroughly to ensure all information is accurate and complete.

- Sign and date the form. The incorporator(s) must sign the Articles of Incorporation.

- Pay the required filing fee. Check the Utah Division of Corporations and Commercial Code website for the current fee and acceptable forms of payment.

- Submit the completed form and payment to the Utah Division of Corporations and Commercial Code. This can typically be done by mail or online, depending on the current options offered.

After submitting the Articles of Incorporation, the process of legally establishing your corporation in Utah is almost complete. The state will review your submission, and if everything is in order, they'll officially file your corporation. You'll receive confirmation, which typically includes a certificate of incorporation. This document is essential for various business activities, including opening bank accounts and applying for business licenses. Keep it safe, as it represents your corporation's legal status and existence within Utah. Congratulations, you are well on your way to operating your newly formed corporation.

Frequently Asked Questions

-

What are the Utah Articles of Incorporation?

The Utah Articles of Incorporation are a legal document necessary for establishing a corporation within the state of Utah. This form outlines crucial information about the corporation, such as its name, purpose, duration, registered agent, and the number and type of authorized shares. Filing this document with the Utah Division of Corporations is a key step in creating a legally recognized corporate entity.

-

Who needs to file the Utah Articles of Incorporation?

Anyone looking to form a corporation in Utah must file the Articles of Incorporation. This form is essential for both profit and nonprofit entities intending to operate within the state. It’s an official start to ensuring that your corporation is legally recognized and authorized to conduct business in Utah.

-

What information is needed to complete the form?

To successfully complete the Utah Articles of Incorporation, you’ll need to provide a range of information, including:

- The name of the corporation.

- The purpose of the corporation.

- The duration of the corporation if it is not perpetual.

- The name and address of the corporation's registered agent in Utah.

- The number of shares the corporation is authorized to issue, and the classes of shares.

- Information regarding the incorporators.

- Principal office address.

-

How do you file the Articles of Incorporation in Utah?

To file the Articles of Incorporation in Utah, you can submit the form online through the Utah Division of Corporations and Commercial Code's website or mail a printed copy to their office. Filing fees are associated with this process, which must be paid at the time of submission. It’s advisable to check the current fees and any additional requirements directly on their website or by contacting their office, as these details may change.

-

What happens after the Articles of Incorporation are filed?

Once the Utah Articles of Incorporation are filed and the fee is paid, the state will review the submission for compliance with Utah corporation laws. If everything is in order, the state will officially register your corporation, making it a legal business entity. You’ll receive a confirmation, often along with a certificate of incorporation. Following incorporation, it’s important to adhere to any further compliance requirements, like annual reporting and tax obligations, to maintain your corporation’s good standing in Utah.

Common mistakes

Filling out the Utah Articles of Incorporation form is a critical step for anyone looking to establish a corporation in the state. It's a process that seems straightforward but is often fraught with nuanced mistakes that can delay or complicate the creation of a corporation. Understanding these mistakes can help ensure the process is completed efficiently and correctly.

Not checking name availability: One common mistake is not ensuring the chosen corporate name is available. Utah requires that a corporation's name be distinguishable from others already on file. Failing to verify name availability can result in a rejection of the filing.

Overlooking the required number of incorporators: Utah law mandates at least one incorporator to sign the Articles of Incorporation. Missing this requirement can invalidate the filing process, causing unnecessary delays.

Incorrectly stating the corporate purpose: While Utah doesn't require a detailed corporate purpose, it does need to be lawful. A vague or unlawful purpose can lead to the rejection of the articles.

Forgetting to designate a registered agent: A registered agent acts as the corporation's official contact for legal documents. Not designating a registered agent, or choosing one without a physical address in Utah, can result in the Articles of Incorporation being denied.

Not specifying stock information correctly: If the corporation will issue stock, the Articles must include details about the number and class of shares. This information is crucial for defining ownership and voting rights, and mistakes here can lead to significant issues down the line.

Ignoring attachment requirements: Sometimes, additional information is necessary, requiring attachments to the Articles of Incorporation. Failing to include necessary attachments can make the submission incomplete.

Lack of necessary signatures: The Articles of Incorporation need to be signed by the incorporator(s). Skipping or improperly executing this step can lead to the document being returned without being processed.

These mistakes, while common, are easily avoidable with attention to detail and a thorough understanding of the requirements. Incorporators should not hesitate to seek clarification on any aspects of the Articles of Incorporation that seem unclear. With the correct approach, the filing process can be smooth, paving the way for a successful corporate establishment in Utah.

Documents used along the form

Setting up a corporation in Utah requires more than submitting the Articles of Incorporation. The Articles of Incorporation serve as a foundational document, but various other forms and documents are often needed to properly establish and maintain a corporation. These documents ensure the corporation complies with state laws and supports its operational and legal needs. Let’s take a closer look at four other key forms and documents typically utilized alongside the Utah Articles of Incorporation.

- Corporate Bylaws: Although not filed with the state, Corporate Bylaws are crucial since they outline the operating rules for the corporation. Bylaws cover procedures for holding meetings, electing officers and directors, and other important governance practices. They serve as an internal document, guiding the corporation’s daily functions and management.

- Initial Report: This is often required shortly after a corporation is formed. The Initial Report, sometimes called a Statement of Information, helps the state maintain current records of the corporation’s affairs. It typically includes basic information such as the corporation’s name, address, and the names of its directors and officers.

- Registered Agent Acceptance Form: A registered agent acts as the corporation’s official point of contact for legal documents. In Utah, corporations must designate a registered agent and submit an acceptance form. This form confirms the agent’s willingness to serve in this capacity and to handle legal correspondence, including lawsuits and government notices.

- Business License Application: Depending on the nature of the business and its location, the corporation might need to obtain one or more business licenses to operate legally in Utah. The Business License Application is submitted to the relevant city or county, and the requirements can vary significantly depending on the specific business activities and the local jurisdiction.

Together, these documents complement the Articles of Incorporation, ensuring that the corporation is not only legally established but also well-prepared for operational success. Ensuring compliance with state requirements and adopting thorough internal governance practices from the outset can greatly contribute to the smooth operation and long-term resilience of the corporation.

Similar forms

The Utah Articles of Incorporation form shares similarities with the Articles of Organization used for forming a Limited Liability Company (LLC). Both documents serve as the foundational paperwork for registering a new business entity with the state. They require basic information about the business, such as the business name, principal address, and the name and address of the registered agent. However, the Articles of Incorporation are specifically used for incorporating a corporation, while the Articles of Organization are for establishing an LLC.

Another document akin to the Utah Articles of Incorporation is the Corporate Bylaws. While the Articles of Incorporation are used to legally form the corporation in the state, Corporate Bylaws outline the internal rules governing the management of the corporation. The Bylaws address issues like the frequency of board meetings, the process of electing officers, and the rights and responsibilities of the directors and shareholders. Although they serve different purposes, both documents are crucial for the operation and governance of a corporation.

Similarly, the Operating Agreement of an LLC parallels the Utah Articles of Incorporation. This document outlines the operational and financial decisions of a Limited Liability Company, including rules, procedures, and agreements among the members. Like the Articles of Incorporation establish a corporation's legal presence in Utah, an Operating Agreement provides the framework for how an LLC will run and sets forth the expectations and obligations of its members. Both documents are fundamental to the structured and legal operation of their respective business entities.

The Business Plan is another document that, while not legally required like the Utah Articles of Incorporation, shares a connection in its essential role in defining the business. A Business Plan outlines the company's objectives, strategies, target market, and financial forecasts. Although serving different functions—with the Articles of Incorporation required for legal formation and the Business Plan for strategic planning—both are critical at the early stages of a business for setting foundations and attracting investors or partners.

Finally, the Statement of Information, required annually or biennially in some jurisdictions, is somewhat akin to the Utah Articles of Incorporation. This document updates the state on vital information regarding the corporation's operations, such as current directors, officers, and the registered agent. While the Articles of Incorporation are filed once during the initial formation of the corporation, the Statement of Information keeps the state apprised of current details, ensuring that the public record remains accurate. Both documents are necessary to maintain the good standing and compliance of the corporation with state laws.

Dos and Don'ts

When filing the Utah Articles of Incorporation, certain practices ensure the process is smooth and compliant. Below are recommended actions to take and pitfalls to avoid:

Do:

- Check the availability of your desired business name to ensure it's not already in use or too similar to an existing name in Utah.

- Clearly specify the nature of the business to be undertaken, ensuring it adheres to Utah law.

- Include the complete and correct names and addresses of the incorporators and initial directors, if applicable.

- Accurately state the number of shares the corporation is authorized to issue, making sure it aligns with your business needs and growth plans.

- Appoint a registered agent with a physical address in Utah who is available during normal business hours.

- Review all entered information for accuracy and completeness before submitting the form.

Don't:

- Use a business name that is misleading or implies an association with government agencies or functions not approved by the Utah Department of Commerce.

- Omit the appointment of a registered agent, as this is crucial for legal and official correspondence.

- Forget to sign and date the form, as unsigned forms will not be processed.

- Overlook the specific filing fees and payment methods accepted by the Utah Division of Corporations and Commercial Code.

- Mix personal information with the corporation’s details, keeping the focus on the legal entity being created.

- Assume approval is immediate; understand and acknowledge the processing times that may apply.

Misconceptions

When it comes to filing the Utah Articles of Incorporation, there's a lot of information floating around that might not be entirely accurate. Let's bust some of these common misconceptions to give you a clearer path to starting your business right.

It's only for big businesses: A common misunderstanding is that the Articles of Incorporation are meant solely for large corporations. In reality, any company that wants to be recognized as a corporation, regardless of size, needs to file these documents.

You need a lawyer to file them: While legal advice can be beneficial, especially for complex cases, it's entirely possible to prepare and file the Articles of Incorporation on your own or with the help of a document preparation service.

The process is overly complicated: Filing the Articles of Incorporation in Utah is quite straightforward. The state provides a clear form and guidelines to help you through the process.

It's expensive to file: While there is a filing fee, the cost is not as prohibitive as some might think. It's an investment in your business's legal foundation.

You can't file online: Utah actually offers an online filing option, making it convenient to submit your Articles of Incorporation without having to send anything through the mail.

Filing instantly makes your business a corporation: While filing the Articles is a crucial step, your company isn't recognized as a corporation until the state processes and approves the submission.

The same form works for everyone: Although many businesses will use the standard form, there might be additional schedules or articles that specific types of corporations need to include. Tailoring the document to your business’s needs is important.

Once filed, no changes are necessary: If significant changes happen within your corporation, such as a change in address or directors, you'll likely need to file articles of amendment to keep your records current.

Any mistakes can be easily corrected: While it's true amendments can be filed, it's best to avoid errors in the original document. Mistakes can lead to delays or additional fees.

Personal information is always required:The Articles of Incorporation require information about your corporation, but you might not need to disclose as much personal information as you think. It’s more about the legal entity of the corporation rather than the personal details of its founders.

Understanding these misconceptions can make the process of incorporating in Utah less daunting. Ensure you're following the current guidelines and reach out to the appropriate state department with any questions. Doing so will set a firm legal foundation for your business to grow upon.

Key takeaways

Filing the Utah Articles of Incorporation is a pivotal step in establishing a corporation within the state. This document sets the foundation for your business's legal structure, rights, and responsibilities. The process requires attention to detail and an understanding of the following key takeaways:

- Details Matter: Complete accuracy is critical when filling out the form. Even minor errors or omissions can lead to processing delays or the rejection of your application. Ensure that all information, from the business name to the registered agent's details, is current and correct.

- Naming Your Business: The name of your corporation must comply with Utah's naming guidelines. It should be unique, not easily confused with existing entities in the state, and must include a corporate identifier such as "Corporation," "Incorporated," "Company," or an abbreviation of these. A preliminary name availability check on the Utah Division of Corporations website can save time and avoid issues.

- Designate a Registered Agent: Utah law requires every corporation to have a designated registered agent within the state. This agent acts as the official point of contact for legal documents and government communications. The agent must have a physical address in Utah and be available during normal business hours.

- Understanding Shares: When completing the Articles of Incorporation, you'll need to specify the number of shares the corporation is authorized to issue. This decision impacts your company’s structure, funding capabilities, and how ownership is distributed. It's advisable to consult with a legal or financial professional to make informed choices about share allocation and value.

Before submitting the form, review all entered information for accuracy and completeness. The Utah Division of Corporations offers resources and guidelines to help navigate the process. However, considering the legal and financial implications of incorporating, consulting with professionals can provide tailored advice and peace of mind. With careful preparation, the submission of your Articles of Incorporation marks an important milestone in your business journey.

Other Popular Utah Templates

How to Sell a Car in Utah - It can facilitate financing arrangements for the buyer, who may need to show proof of the purchase to lenders.

Creating an Operating Agreement - It sets forth the rules for allocation of profits and losses among the LLC's members.